Professional Documents

Culture Documents

Asset Allocation Strategy

Uploaded by

guidodasilvaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Allocation Strategy

Uploaded by

guidodasilvaCopyright:

Available Formats

Board Recommendations on Strategic Asset Allocation

Presenter: Aya El Ashi

Objectives and risk constraints

As a central bank, the main objective is capital preservation, liquidity, and the desire to achieve returns of at least 1% annually. Investment constraints:

1. 2.

Minimize the probability of negative returns over a 1-year horizon. Maximum allocation to credit sector is limited to 30% of total market value of the overall portfolio.

Eligible asset classes

The eligible asset class are the following: 1. US Treasury Bills. 2. UST 0-3 Index 3. UST 1-3 Index 4. UST 1-5 Index 5. US Agency 1-3 Index 6. US MBS Index 7. G7 1-3 Index hedge into USD 8. G7 1-5 Index hedge into USD

We used historical yields to calculate the betas using the Nelson Sieguel model in order to estimate the US, Euro, UK, and Japan yield curves. Then, using market consensus about expected yields after 1 year, we calculated the expected NS factors in order to estimate the forward yield curves through an exponential autoregressive model.

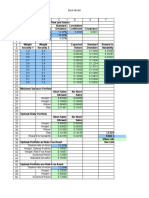

Risk and return characteristics of eligible asset classes

Based on the estimated yield curves at the end of the investment horizon (1 year) for each government index, as well as the 10 year swap spread for MBS index, and the 2 year agency spread for the US agency index; the model estimated the following risk/return characteristics for the eligible asset classes.

US 3mth US 0-1 Index US 0-3 Index 0.48% 0.62% 0.94% 0.25% 0.24% 0.66% 0.11% 0.23% -0.17% 0.06% 0.07% -0.59% 0.10% 0.20% 8.30% Consensus Expectations US 1-3 Index US 1-5 Index Agency 1-3 Index 1.01% 0.98% 1.69% 1.01% 1.73% 1.07% -0.65% -1.84% -0.03% -1.30% -2.79% -0.85% 16.50% 29.50% 5.40% US MBS 2.55% 1.73% -0.62% -2.01% 8.10% G7 1-3 Index 0.75% 0.44% 0.02% -0.24% 4.20% G7 1-5 Index 0.82% 0.82% -0.50% -1.05% 16.30%

Expected return Volatility VaR return (95%) VaR return (99%) Prob. of neg. returns

1. Optimal portfolio with 95% minimum return of 0%; only US Treasuries

2. Optimal portfolio with 95% minimum return of 0%; all asset classes, 30% constraint on non-government

3. Optimal portfolio with a target return of 1%; all assets, 30% constraint on non-government

4. Optimal portfolio with target return of 1%; all asset classes excluding MBS, 30% constraint on non-government

Asset Allocation of the Chosen Portfolios

Optimal Portfolio 1 Optimal Portfolio 2 Optimal Portfolio 3 Optimal Portfolio 4 Alternative 5 US 0-1 Index 25% 15% 73% 46% 0% US 0-3 Index 75% 55% 0% 24% 50% US Agnecy 1-3 Index 0% 0% 15% 30% 20% US MBS Index 0% 30% 12% 0% 10% G7 1-3 Index Hedged 0% 0% 0% 0% 20%

Risk and return statistics for optimal portfolios

Stress Test 1 Upward parallel shift of US curve, 100bps

Stress Test 1 Upward parallel shift of US curve, 100bps

Stress Test 2 Flattening of the US yield curve

Stress Test 2 Flattening of the US yield curve

Recommendation

We recommend to the Board the following portfolio (Optimal portfolio 3), which has the following composition:

73% 0-1 US Index 15% US Agency Index 1-3 12% US MBS Index

We chose this portfolio as it satisfies the two constraints imposed by the Board, and performs well under the applied stress-test scenarios

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Portfolio Optimization Techniques in Mutual Funds - Trends and IssuesDocument66 pagesPortfolio Optimization Techniques in Mutual Funds - Trends and Issuesjitendra jaushik83% (6)

- Linear Programming Applications in Marketing, Finance and Operations ManagementDocument12 pagesLinear Programming Applications in Marketing, Finance and Operations ManagementMarwa HassanNo ratings yet

- Financial Theory and Corporate PolicyDocument958 pagesFinancial Theory and Corporate PolicyDiego Ontaneda100% (1)

- Port Optimization TNDocument11 pagesPort Optimization TNTaiyuan PaiNo ratings yet

- Portfolio Optimisation in MatlabDocument9 pagesPortfolio Optimisation in MatlabStanley YongNo ratings yet

- Project ReportDocument24 pagesProject ReportAjay Kumar (M19MA002)No ratings yet

- Preliminary Problem Statement 2017Document8 pagesPreliminary Problem Statement 2017pallavi agarwalNo ratings yet

- 2022-01-Optimal Blending of Smart Beta and Multifactor PortfoliosDocument14 pages2022-01-Optimal Blending of Smart Beta and Multifactor PortfoliosZezhou XuNo ratings yet

- FIN302 Report PDFDocument22 pagesFIN302 Report PDFgaja babaNo ratings yet

- Dissertation On Project Portfolio ManagementDocument7 pagesDissertation On Project Portfolio ManagementPaperWriterServiceMinneapolis100% (1)

- Portfolio Optimization SoftwareDocument2 pagesPortfolio Optimization SoftwareAhamed IbrahimNo ratings yet

- Camm 4e Ch14 PPTDocument74 pagesCamm 4e Ch14 PPTMardonio Jr Mangaser AgustinNo ratings yet

- Parametric Models For Regression (Graded)Document6 pagesParametric Models For Regression (Graded)Wathek Al Zuaiby100% (2)

- LP ApplicationsDocument31 pagesLP ApplicationsRishabh MishraNo ratings yet

- Introduction of PortfoliosDocument10 pagesIntroduction of PortfoliosAbdul LathifNo ratings yet

- BKM 10e Ch07 Two Security ModelDocument2 pagesBKM 10e Ch07 Two Security ModelJoe IammarinoNo ratings yet

- Improved Covariance Matrix Estimation For Portfolio Risk Measurement: A ReviewDocument33 pagesImproved Covariance Matrix Estimation For Portfolio Risk Measurement: A ReviewTram NguyenNo ratings yet

- Kro CVaRDocument36 pagesKro CVaRmirah no eselNo ratings yet

- Portfolio Optimization With Conditional Value-at-Risk Objective and ConstraintsDocument26 pagesPortfolio Optimization With Conditional Value-at-Risk Objective and ConstraintsTrevor LittleNo ratings yet

- Project ReportDocument29 pagesProject ReportKallu Kallu100% (1)

- Bayesian Statistics and MCMC Methods For Portfolio SelectionDocument62 pagesBayesian Statistics and MCMC Methods For Portfolio SelectionJacopo PrimaveraNo ratings yet

- Free Sample of Portfolio OptimizationDocument37 pagesFree Sample of Portfolio Optimizationismailhasan85No ratings yet

- Maximum Product SubarrayDocument10 pagesMaximum Product SubarrayvedmilishiaNo ratings yet

- Practical Application of Modern Portfolio TheoryDocument69 pagesPractical Application of Modern Portfolio TheoryKeshav KhannaNo ratings yet

- Perry J. Kaufman - Trading Systems and Methods (Fifth Edition) - 15Document1 pagePerry J. Kaufman - Trading Systems and Methods (Fifth Edition) - 15juan.zgz.920% (1)

- MIE1622H OutlineDocument3 pagesMIE1622H OutlineGavrochNo ratings yet

- Statistics For Research: With A Guide To SPSSDocument20 pagesStatistics For Research: With A Guide To SPSSIgorNo ratings yet

- Optimal Portfolio SelectionDocument39 pagesOptimal Portfolio SelectionNeelam MadarapuNo ratings yet

- Fin661 - Lesson Plan - March2021Document2 pagesFin661 - Lesson Plan - March2021MOHAMAD ZAIM BIN IBRAHIM MoeNo ratings yet

- Application of GARCH-Copula Model in Portfolio Optimization: DOI: 10.5817/FAI2015-2-1 No. 2/2015Document14 pagesApplication of GARCH-Copula Model in Portfolio Optimization: DOI: 10.5817/FAI2015-2-1 No. 2/2015Julian GonzalezNo ratings yet