Professional Documents

Culture Documents

QMB s13 PP Sup 1 Expected Value

Uploaded by

gators06Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QMB s13 PP Sup 1 Expected Value

Uploaded by

gators06Copyright:

Available Formats

Expected Value is what should happen, on average, per trial if there are many trials.

This is related to the Law of Large Numbers.

Expected Value = EV If xs represent all outcomes and p(x) represents the probability of x happening: EV = [xp(x)] This formula may look confusing, but it is actually really easy to use.

EV = [xp(x)] is the Greek capital letter sigma. It means take the sum. All you have to do is multiply every x times its p(x) and then add up all those products. That is how you find expected value EV!

Lets say I am going to play a game where I spin a wheel with five equal parts. On three spots I lose $5, one spot I gain $10, and one spot I gain $1. What is the expected value of my bet?

Each part of the wheel has a 1/5 = 0.2 probability of landing. Since the lose $5 takes up three parts P( $5) = 3/5 = 0.6 Gain $10 takes up one part. P(+$10) = 1/5 = 0.2 Same for the gain $1 P(+$1) = 1/5 = 0.2

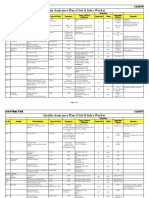

Lets make a table: x Lose $5 5 Gain $10 10 Gain $ 1 1 EV = $ 0.80

p(x) x p(x) 0.6 5 0.6 = 3.0 0.2 10 0.2 = 2.0 0.2 1 0.2 = 0.2 0.8

What does EV = $ 0.80 mean? Does it mean that every time you play you will lose 80 cents? That cant be it because losing 80 cents is not an outcome.

Does it mean you will lose every time you play? It cant mean that because you can very easily win this game.

EV = $ 0.80 It means that if you play many times, on average you will lose approximately 80 cents for every time you played.

If you play 100 times, you can expect to lose 100($0.80) = $80 Is this guaranteed? Anything could happen. But, like the Law of Large numbers, the more trials, the more accurate the EV.

Although gambling is the obvious example, expected value is very useful and can be used in many important ways. Lets say you are a banker that is completing an investment.

Your consultants tell you that with this investment there is a 70% chance of profiting $10,000, a 20% of losing $30,000, and a 10% chance of breaking even. What is the expected value of the investment? Should the bank do it?

Lets make a table x p(x) x p(x) 10,000 0.7 10,000 0.7 = 7,000 30,000 0.2 30,000 0.2 = 6,000 0 0.1 0 0.1 = 0 1,000 EV = $1,000

Be careful what this means. It doesnt mean that the bank will profit $1,000 dollars on this investment. Every investment is different, so the bank can only make this investment once. It cant have many trials with this investment.

What investors can do is find the expected value of all their investments and only make investments that have positive expected values. They will profit from some and lose some, but, in the end, if all EVs are positive, they should make an overall profit.

Maybe some of the bankers should have paid attention when they took QMB 3600! If they only made investments that had a positive EV, then we would not be in this financial crisis!

Expected value does not always have to be about money. Lets say a sports apparel store sells Rays baseball caps. The manager estimates that if the Rays win the World Series, the store will sell 500 caps. If the Rays do not win the world series, the store will sell only 100 caps. The paper gives the Rays a 20% chance of winning the World Series. Try to find the EV!

Lets make a chart. x p(x) x p(x) win WS 500 0.2 500 0.2 = 100 not win WS 100 0.8 100 0.8 = 80 180 The EV = 180 caps

A principle of a high school has a concern. The Rays are in the Word Series and it is tied in the 9th inning. He knows that many of his students are watching the game an it is already midnight (since the games start so darn late). He feels that the later the game goes, the less students will make 1st period tomorrow morning.

His wife is a math teacher and she has the following estimates. If the game ends in: 9th Inning: 30 % chance, 600 students make first period 10th Inning: 40%, 500 students 11th Inning 20%, 300 students 12th Inning or later: 10% 200 students You try and find the EV!

x 9th 600 10th 500 11th 300 12th 200

x p(x) 600 0.3 = 180 500 0.4 = 200 300 0.2 = 60 200 0.1 = _20 460 EV = 460 students

p(x) 0.3 0.4 0.2 0.1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case 7 United Way TNDocument14 pagesCase 7 United Way TNgators06100% (2)

- Clock of Destiny Book-1Document46 pagesClock of Destiny Book-1Bass Mcm87% (15)

- Case 02 Edward Marshall Boehm TNDocument11 pagesCase 02 Edward Marshall Boehm TNgators06100% (2)

- Using Ms-Dos 6.22Document1,053 pagesUsing Ms-Dos 6.22lorimer78100% (3)

- Header Tags - HeadertagsdothtmlDocument2 pagesHeader Tags - HeadertagsdothtmlHarsh BhattNo ratings yet

- Infopgraphic CanvasCheatSheet Final2Document1 pageInfopgraphic CanvasCheatSheet Final2Hermogenes Alcos JrNo ratings yet

- Forms PDFDocument2 pagesForms PDFgators06No ratings yet

- Robin HoodDocument8 pagesRobin Hoodmrzemn0% (2)

- Chap 006Document36 pagesChap 006gators06No ratings yet

- Chap 001Document4 pagesChap 001bullinerfamily7498No ratings yet

- John Loucks: 1 Slide © 2009 South-Western, A Part of Cengage LearningDocument59 pagesJohn Loucks: 1 Slide © 2009 South-Western, A Part of Cengage Learninggators06No ratings yet

- Chapter 4 Lecture & DiscussionDocument15 pagesChapter 4 Lecture & Discussiongators06No ratings yet

- Dekker V Weida Amicus Brief by 17 AGsDocument35 pagesDekker V Weida Amicus Brief by 17 AGsSarah WeaverNo ratings yet

- 1 s2.0 S0378432004002465 MainDocument20 pages1 s2.0 S0378432004002465 MainMuhammad JameelNo ratings yet

- HW Chapter 25 Giancoli Physics - SolutionsDocument8 pagesHW Chapter 25 Giancoli Physics - SolutionsBecky DominguezNo ratings yet

- Buku BaruDocument51 pagesBuku BaruFirdaus HoNo ratings yet

- The Story of An Hour QuestionpoolDocument5 pagesThe Story of An Hour QuestionpoolAKM pro player 2019No ratings yet

- Evaluating Websites A Checklist - JOHN CARLO G. GAERLANDocument3 pagesEvaluating Websites A Checklist - JOHN CARLO G. GAERLANMarvin CincoNo ratings yet

- STAB 2009 s03-p1Document16 pagesSTAB 2009 s03-p1Petre TofanNo ratings yet

- Jail Versus Substance Abuse TreatmentDocument5 pagesJail Versus Substance Abuse Treatmentapi-240257564No ratings yet

- PC300-8 New ModelDocument22 pagesPC300-8 New Modeljacklyn ade putra100% (2)

- Uxc01387a PDFDocument16 pagesUxc01387a PDFmahesh123No ratings yet

- Module 17 Building and Enhancing New Literacies Across The Curriculum BADARANDocument10 pagesModule 17 Building and Enhancing New Literacies Across The Curriculum BADARANLance AustriaNo ratings yet

- Security Policy 6 E CommerceDocument6 pagesSecurity Policy 6 E CommerceShikha MehtaNo ratings yet

- Promoting Services and Educating CustomersDocument28 pagesPromoting Services and Educating Customershassan mehmoodNo ratings yet

- Student Committee Sma Al Abidin Bilingual Boarding School: I. BackgroundDocument5 pagesStudent Committee Sma Al Abidin Bilingual Boarding School: I. BackgroundAzizah Bilqis ArroyanNo ratings yet

- Color Coding Chart - AHGDocument3 pagesColor Coding Chart - AHGahmedNo ratings yet

- IPMI Intelligent Chassis Management Bus Bridge Specification v1.0Document83 pagesIPMI Intelligent Chassis Management Bus Bridge Specification v1.0alexchuahNo ratings yet

- Unit 6B - PassiveDocument18 pagesUnit 6B - PassiveDavid EstrellaNo ratings yet

- Annotated Bibliography 2Document3 pagesAnnotated Bibliography 2api-458997989No ratings yet

- Smashing HTML5 (Smashing Magazine Book Series)Document371 pagesSmashing HTML5 (Smashing Magazine Book Series)tommannanchery211No ratings yet

- Vmware It Academy Program May2016Document26 pagesVmware It Academy Program May2016someoneNo ratings yet

- Quality Assurance Plan - CivilDocument11 pagesQuality Assurance Plan - CivilDeviPrasadNathNo ratings yet

- EQUIP9-Operations-Use Case ChallengeDocument6 pagesEQUIP9-Operations-Use Case ChallengeTushar ChaudhariNo ratings yet

- Body Temperature PDFDocument56 pagesBody Temperature PDFBanupriya-No ratings yet

- HSG Vs SonohysterographyDocument4 pagesHSG Vs Sonohysterography#15No ratings yet

- 1.nursing As A ProfessionDocument148 pages1.nursing As A ProfessionveralynnpNo ratings yet

- List of Practicals Class Xii 2022 23Document1 pageList of Practicals Class Xii 2022 23Night FuryNo ratings yet

- Zimbabwe - Youth and Tourism Enhancement Project - National Tourism Masterplan - EOIDocument1 pageZimbabwe - Youth and Tourism Enhancement Project - National Tourism Masterplan - EOIcarlton.mamire.gtNo ratings yet

- Study of Subsonic Wind Tunnel and Its Calibration: Pratik V. DedhiaDocument8 pagesStudy of Subsonic Wind Tunnel and Its Calibration: Pratik V. DedhiaPratikDedhia99No ratings yet