Professional Documents

Culture Documents

Determining Exchange Rate: Topic

Uploaded by

Greeshma SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determining Exchange Rate: Topic

Uploaded by

Greeshma SinghCopyright:

Available Formats

Determining Exchange Rate

3

Topic

C4 - 2

Discussion Objectives

To explain how exchange rate movements are measured;

To explain how the equilibrium exchange rate is determined;

To examine the factors - basically economic conditions&

market fundamentals - that affect the equilibrium exchange

rate; and

To assess how exchange rates affect (unhedged cashflows)

an MNC value /

Managing for Value : Impact of Exchange Rate Determinants

on Coca Colas ash Flows.

Discussion notes:

A. USD-INR Exchange Rate Is Rupee Headed for Depreciation?

B. Market Realities: RBI to add Yuan to rupee index

Blades Inc. Case: Assessing the future exchange rate

movements

Small Business Dilemma: Assessing the sports exports co., of

factors that affect the British sterlings value

C4 - 3

Measuring

Exchange Rate Movements

An exchange rate measures the value of

one currency in units of another currency.

When a currency declines in value, it is

said to depreciate. When it increases in

value, it is said to appreciate.

On the days when some currencies

appreciate while others depreciate against

the dollar, the dollar is said to be mixed

in trading.

C4 - 4

Measuring

Exchange Rate Movements

The percentage change (% A) in the value

of a foreign currency is computed as

S

t

S

t-1

S

t-1

where S

t

denotes the spot rate at time t.

A positive % A represents appreciation of

the foreign currency, while a negative % A

represents depreciation.

C4 - 5

1.40

1.45

1.50

1.55

1.60

1.65

1.70

1.75

1.80

1992 1996 2000

Approximate

Spot Rate of

$

5600

5800

6000

6200

6400

6600

6800

7000

1992 1996 2000

Approximate

that could be

Purchased with

$10,000

-20

-15

-10

-5

0

5

10

15

20

1992 1996 2000

Approximate

Annual % A

%

Fluctuation of the British Pound

Over Time

C4 - 6

Factors that Influence Exchange Rates

The following equation summarizes the

factors that can influence a currencys spot

rate:

C4 - 7

Value of

Quantity of

D: Demand for

$1.55

$1.50

$1.60

S: Supply of

equilibrium

exchange rate

Exchange Rate Equilibrium

An exchange rate represents the price of a

currency, which is determined by the

demand for that currency relative to the

supply for that currency, domestic or

foreign.

C4 - 8

Exchange Rate Equilibrium

Foreign Exchange Demand and Supply

Conditions:

effect of price being below equilibrium

effect of price being above equilibrium OR

competitive price. What are the

possible FX market conditions?

Quick Quiz: managers elaborate?

C4 - 9

$/

Quantity of

S

0

D

0

r

0

Case of U.S. inflation |

| U.S. demand for

British goods, and

hence .

D

1

r

1

S

1

Factors that Influence

Exchange Rates

1. Relative Inflation Rates

+ British desire for U.S.

goods, and hence the

supply of .

This relation sometimes

called PPP or REER.

C4 - 10

$/

Quantity of

r

0

S

0

D

0

S

1

D

1

r

1

Case of U.S. interest rates |

+ U.S. demand for British

bank deposits, and hence

.

Factors that Influence

Exchange Rates

2. Relative Interest Rates

| British desire for U.S.

bank deposits, and

hence the supply of .

What IRP says?

C4 - 11

Relative Interest Rates

Factors that Influence

Exchange Rates

It is thus useful to consider real interest

rates, which adjust the nominal interest

rates for inflation.

A relatively high interest rate may actually

reflect expectations of relatively high

inflation, which discourages foreign

investment.

C4 - 12

Relative Interest Rates

Factors that Influence

Exchange Rates

This relationship is sometimes called the

Fisher effect.

Real interest rates in U.S; Japan and Euro-

zone.

real nominal

interest ~ interest exp. inflation rate

rate rate

C4 - 13

$/

Quantity of

S

0

D

0

r

0

Case of U.S. income level |

| U.S. demand for British

goods, and hence .

D

1

r

1

Factors that Influence

Exchange Rates

4. Relative Income Levels

No expected change

for the supply of !.

,S

1

C4 - 14

5. Government Controls

Governments may influence the

equilibrium exchange rate by:

imposing foreign exchange barriers,

imposing foreign trade barriers,

intervening in the foreign exchange market,

and

affecting macro variables such as inflation,

interest rates, and income levels.

Factors that Influence

Exchange Rates

C4 - 15

6. Expectations - of ?

Foreign exchange markets react to any

news that may have a future effect.

Institutional investors (FIIs) often take

currency positions based on anticipated

interest rate movements in various

countries - ex: Asian currency melt-down

& the market perceptions.

Because of speculative transactions,

foreign exchange rates can be very

volatile.

Factors that Influence

Exchange Rates

C4 - 16

Expectations

Factors that Influence

Exchange Rates

Fed chairman suggests Fed is Strengthened

unlikely to cut U.S. interest rates

A possible decline in German Strengthened

interest rates

Central banks expected to Weakened

intervene to boost the euro

Signal Impact on $

Poor U.S. economic indicators Weakened

C4 - 17

7. Interaction of Factors

Trade-related / real factors and financial

factors sometimes interact. Exchange rate

movements may be simultaneously

affected by these factors.

For example, an increase in the level of

income sometimes causes expectations of

higher interest rates and its effect on trade

& financial flows.

Factors that Influence

Exchange Rates

C4 - 18

Interaction of Factors

Factors that Influence

Exchange Rates

The sensitivity of the exchange rate to

these factors is dependent on the volume

of international transactions between the

two countries.

Over a particular period, different factors

may place opposing pressures on the

value of a foreign currency.

For example, an increase in the trade

deficit and strong economy fundamentals,

may sometimes out-weigh each other,

leaving exchange rates unchanged.

C4 - 19

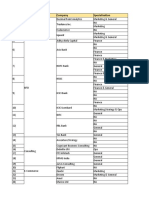

Trade-Related

Factors

1. Inflation

Differential

2. Income

Differential

3. Govt Trade

Restrictions

Financial

Factors

1. Interest Rate

Differential

2. Capital Flow

Restrictions

How Factors Can Affect Exchange Rates

U.S. demand for foreign

goods, i.e. demand for

foreign currency

Foreign demand for U.S.

goods, i.e. supply of

foreign currency

U.S. demand for foreign

securities, i.e. demand

for foreign currency

Foreign demand for U.S.

securities, i.e. supply of

foreign currency

Exchange

rate

between

foreign

currency

and the

dollar / Rs.

C4 - 20

How Factors Have Influenced Exchange Rates

Because the dollars value changes by

different magnitudes relative to each

foreign currency, analysts often measure

the dollars strength with an index.

The weight assigned to each currency is

determined by its relative importance in

international trade and/or finance.

Factors that Influence

Exchange Rates

C4 - 21

With Respect to the Dollar

Value of Foreign Currency Index Over Time

0

50

100

150

200

250

1972 1976 1980 1984 1988 1992 1996 2000

s

t

r

e

n

g

t

h

e

n

s

$

w

e

a

k

e

n

s

Note: The index reflects weights of , , French franc, Euro, and Swiss franc.

$+ due to

relatively high

U.S. inflation

& growth

high U.S.

interest rates, a

somewhat depressed

U.S. economy, & low

inflation

large

balance

of trade

deficit

relatively high U.S.

interest rates, &

lower balance of

trade deficit

Persian

Gulf War

U.S. interest rates +

Higher

U.S.

interest

rates

C4 - 22

Exchange at

$0.52/NZ$

4. Holds

$20,912,320

2. Holds

NZ$40 million

Exchange at

$0.50/NZ$

Speculating on Anticipated Exchange Rates

Chicago Bank expects the exchange rate of the New Zealand dollar to

appreciate from its present level of $0.50 to $0.52 in 30 days. Present

short-term annualised rates are: US$ 6.72%-7.20%;NZ$ 6.48%-6.96%

1. Borrows

$20 million

Borrows at 7.20%

for 30 days

Lends at 6.48%

for 30 days

3. Receives

NZ$40,216,000

Returns $20,120,000

Profit of $792,320

C4 - 23

Speculating on Anticipated Exchange Rates

Chicago Bank expects the exchange rate of the New

Zealand dollar to depreciate from its present level of

$0.50 to $0.48 in 30 days.

Exchange at

$0.48/NZ$

4. Holds

NZ$41,900,000

2. Holds

$20 million

Exchange at

$0.50/NZ$

1. Borrows

NZ$40 million

Borrows at 6.96%

for 30 days

Lends at 6.72%

for 30 days

3. Receives

$20,112,000

Returns NZ$40,232,000

Profit of NZ$1,668,000

or $800,640

C4 - 24

Impact of Exchange Rates on an MNCs Value

( ) ( ) | |

( )

=

n

t

t

m

j

t j t j

k

1 =

1

, ,

1

ER E CF E

= Value

E (CF

j,t

) = expected cash flows in currency j to be received

by the U.S. parent at the end of period t

E (ER

j,t

) = expected exchange rate at which currency j can

be converted to dollars at the end of period t

k = weighted average cost of capital of the parent

Inflation Rates, Interest Rates,

Income Levels, Government Controls,

Expectations

You might also like

- Fin 444 CHP 4 SlidesDocument24 pagesFin 444 CHP 4 SlidesBappi MahiNo ratings yet

- Exchange Rate Determination: South-Western/Thomson Learning © 2006Document24 pagesExchange Rate Determination: South-Western/Thomson Learning © 2006Praveen JaganNo ratings yet

- Determination of Foreign Exchange Chapter 4Document20 pagesDetermination of Foreign Exchange Chapter 4Sazedul Ekab100% (1)

- Fin 444Document22 pagesFin 444mrinmoy royNo ratings yet

- IFM8e ch04Document21 pagesIFM8e ch04adnanNo ratings yet

- IFM8e ch04Document25 pagesIFM8e ch04Abid KhanNo ratings yet

- CH 4 Exchange Rate Determination 11edDocument42 pagesCH 4 Exchange Rate Determination 11edNazmul HossainNo ratings yet

- Enhanced 04Document28 pagesEnhanced 04Tanvir Ahmed ChowdhuryNo ratings yet

- Chapter 4Document28 pagesChapter 4Aminul Islam AmuNo ratings yet

- Balance of Payments and Exchange RatesDocument53 pagesBalance of Payments and Exchange RatesGalib HossainNo ratings yet

- Chapter 4 PDFDocument24 pagesChapter 4 PDFTania ParvinNo ratings yet

- L2 Exchange Rate DeterminationDocument25 pagesL2 Exchange Rate DeterminationKent ChinNo ratings yet

- Part 1: The International Financial Environment Chapter 4 Exchange Rate DeterminationDocument32 pagesPart 1: The International Financial Environment Chapter 4 Exchange Rate DeterminationAbdelrahman HassanNo ratings yet

- Determination of Exchange RatesDocument15 pagesDetermination of Exchange RatesBaek AerinNo ratings yet

- International Financial Management: Exchange Rate DeterminationDocument19 pagesInternational Financial Management: Exchange Rate Determinationmagma rachmaniNo ratings yet

- The Foreign Exchange Markets: Case: 1. The Collapse of Thai BahtDocument21 pagesThe Foreign Exchange Markets: Case: 1. The Collapse of Thai BahtsoheltushNo ratings yet

- CH 04 - Exchange Rate DeterminationDocument24 pagesCH 04 - Exchange Rate DeterminationadamNo ratings yet

- Presentedby: Shaily Srivastava Sneha Kumari Manjunath Anamika SrivastavaDocument57 pagesPresentedby: Shaily Srivastava Sneha Kumari Manjunath Anamika SrivastavaSneha SinghNo ratings yet

- Exchange Rate SUKHIDocument18 pagesExchange Rate SUKHISukhi SinghNo ratings yet

- Exchange RateDocument18 pagesExchange RateZain JawadNo ratings yet

- Exchange Rate Determination: Dr. M. Budi Widiyo IryantoDocument36 pagesExchange Rate Determination: Dr. M. Budi Widiyo IryantoKojiro FuumaNo ratings yet

- Exchange Rate DeterminationDocument22 pagesExchange Rate DeterminationBilal Raja0% (1)

- The Rise and Evolution of Exchange RatesDocument34 pagesThe Rise and Evolution of Exchange RatesSimoNo ratings yet

- International Financial Management 9th Edition Jeff Madura Solutions Manual 1Document36 pagesInternational Financial Management 9th Edition Jeff Madura Solutions Manual 1paulagomezcjsqfeaoyi100% (24)

- International Financial Management 9th Edition Jeff Madura Solutions Manual 1Document15 pagesInternational Financial Management 9th Edition Jeff Madura Solutions Manual 1eleanor100% (39)

- 2 Exchange Rate DeterminationDocument28 pages2 Exchange Rate Determinationshakil zibranNo ratings yet

- Capitulo 19 en Ingles Libro CelesteDocument57 pagesCapitulo 19 en Ingles Libro CelesteGinneth Jiménez MadrigalNo ratings yet

- Exchange Rate Determination: Chapter ObjectivesDocument18 pagesExchange Rate Determination: Chapter Objectiveschauhan ShivangiNo ratings yet

- Slide 02Document21 pagesSlide 02Shashika Anuradha KoswaththaNo ratings yet

- Global Financial System: International InstitutionsDocument21 pagesGlobal Financial System: International Institutionsapi-265248190% (1)

- Topic Determination of Exchange Rate: Balance of Payments (BOP)Document27 pagesTopic Determination of Exchange Rate: Balance of Payments (BOP)sittmoNo ratings yet

- Exchange Rate Determination: Rashedul HasanDocument17 pagesExchange Rate Determination: Rashedul HasanMeenaRajpootNo ratings yet

- Summary MKI Chapter 4Document4 pagesSummary MKI Chapter 4DeviNo ratings yet

- Chapter 4Document24 pagesChapter 4Manjunath BVNo ratings yet

- Chapter 25 NotesThe Exchange Rate and The Balance of PaymentsDocument6 pagesChapter 25 NotesThe Exchange Rate and The Balance of PaymentsJocelyn WilliamsNo ratings yet

- Measuring Exchange Rate MovementsDocument26 pagesMeasuring Exchange Rate MovementsNouman AhmadNo ratings yet

- Global Financial System: International InstitutionsDocument15 pagesGlobal Financial System: International Institutionsapi-26524819No ratings yet

- Multinational Financial ManagementDocument95 pagesMultinational Financial ManagementANo ratings yet

- Exchange Rate Determination and PolicyDocument33 pagesExchange Rate Determination and PolicyJunius Markov OlivierNo ratings yet

- 01 Global Financial System: 1.1 International InstitutionsDocument25 pages01 Global Financial System: 1.1 International Institutionsapi-26524819No ratings yet

- Exchange RatesDocument32 pagesExchange RatesStuti BansalNo ratings yet

- Lecture3 Intl FinanceDocument24 pagesLecture3 Intl FinanceVaibhav BarickNo ratings yet

- The Exchange Rate - A-Level EconomicsDocument13 pagesThe Exchange Rate - A-Level EconomicsjannerickNo ratings yet

- Chapter-8. Introduction To Open EconomyDocument25 pagesChapter-8. Introduction To Open EconomyprashantNo ratings yet

- Master of Internation Al Business: Sub-International Financial ManagementDocument15 pagesMaster of Internation Al Business: Sub-International Financial ManagementfinancefundaNo ratings yet

- Foreign ExchangeDocument9 pagesForeign ExchangeTopuNo ratings yet

- 04-Exchange Rate DeterminationDocument24 pages04-Exchange Rate DeterminationRoopa ShreeNo ratings yet

- International Financial Markets and Foreign Exchange PolicyDocument20 pagesInternational Financial Markets and Foreign Exchange PolicyHisham Jawhar0% (1)

- Exchange Rate DeterminationDocument18 pagesExchange Rate DeterminationBini MathewNo ratings yet

- RizwanDocument9 pagesRizwanRizwan BashirNo ratings yet

- P4-Foreign Exchange RateDocument39 pagesP4-Foreign Exchange Rateenacengic99No ratings yet

- Key Currencies:: Share of National Currencies in Total Identified Official Holdings of Foreign Exchange, 1998Document12 pagesKey Currencies:: Share of National Currencies in Total Identified Official Holdings of Foreign Exchange, 1998KaranPatilNo ratings yet

- The Determination of Exchange Rate: BY Annisa Ramadhani Bertha Muhammad Karina Fitri Zahira SalsabellaDocument25 pagesThe Determination of Exchange Rate: BY Annisa Ramadhani Bertha Muhammad Karina Fitri Zahira SalsabellaRatu ShaviraNo ratings yet

- Financial Markets: Session 02: Determinants of Exchange RateDocument32 pagesFinancial Markets: Session 02: Determinants of Exchange Rategonzgd90No ratings yet

- International Monetary System and Exchange RatesDocument19 pagesInternational Monetary System and Exchange Ratessayujya DahalNo ratings yet

- Facts About Emerging Global ImbalancesDocument45 pagesFacts About Emerging Global ImbalanceshariNo ratings yet

- Measuring Exposure To Exchange Rate FluctuationsDocument38 pagesMeasuring Exposure To Exchange Rate Fluctuationsইয়াসিন খন্দকার রাতুলNo ratings yet

- FIM AssignmentDocument5 pagesFIM AssignmentNoor AliNo ratings yet

- MODULE 2 FinalDocument26 pagesMODULE 2 Finalblue252436No ratings yet

- Inside the Currency Market: Mechanics, Valuation and StrategiesFrom EverandInside the Currency Market: Mechanics, Valuation and StrategiesNo ratings yet

- Consolidated Finanical StatsDocument195 pagesConsolidated Finanical StatsGreeshma SinghNo ratings yet

- 4 Exchange Rate INR vs. Currency Majors - RBIDocument2 pages4 Exchange Rate INR vs. Currency Majors - RBIGreeshma SinghNo ratings yet

- NSEL: The Inside Story: The Success Story of NSEL Seems To Be Turning Into Something Else Now. Here's What's HappeningDocument1 pageNSEL: The Inside Story: The Success Story of NSEL Seems To Be Turning Into Something Else Now. Here's What's HappeningGreeshma SinghNo ratings yet

- Five Years After LehmanDocument2 pagesFive Years After LehmanGreeshma SinghNo ratings yet

- 2 Investment AlternativesDocument27 pages2 Investment AlternativesGreeshma SinghNo ratings yet

- Overview 1Document39 pagesOverview 1Greeshma SinghNo ratings yet

- CitiDocument16 pagesCitiGreeshma SinghNo ratings yet

- CitiDocument16 pagesCitiGreeshma SinghNo ratings yet

- Letter of Credit: in India LC Is Resorted Even For Trade Within The Country For Two Basic ReasonsDocument86 pagesLetter of Credit: in India LC Is Resorted Even For Trade Within The Country For Two Basic ReasonsGreeshma SinghNo ratings yet

- Financial Analysts Journal Jan/Feb 2003 59, 1 ABI/INFORM CompleteDocument15 pagesFinancial Analysts Journal Jan/Feb 2003 59, 1 ABI/INFORM CompleteGreeshma SinghNo ratings yet

- Letter of Credit: in India LC Is Resorted Even For Trade Within The Country For Two Basic ReasonsDocument54 pagesLetter of Credit: in India LC Is Resorted Even For Trade Within The Country For Two Basic ReasonsGreeshma SinghNo ratings yet

- Finance Reading List PHDDocument8 pagesFinance Reading List PHDAnonymous P1xUTHstHTNo ratings yet

- PoudDocument3 pagesPoudPrajwal AlvaNo ratings yet

- DATA ANALYSIS AND INTERPRETATION of Rain Bow PipesDocument10 pagesDATA ANALYSIS AND INTERPRETATION of Rain Bow Pipesarmeena falakNo ratings yet

- StatementDocument10 pagesStatementTemidayo EmmanuelNo ratings yet

- Braden River High School BandsDocument2 pagesBraden River High School BandsAlex MoralesNo ratings yet

- Can Fin Homes Ltd. at A Glance: Information To InvestorsDocument21 pagesCan Fin Homes Ltd. at A Glance: Information To InvestorsDhrubajyoti DattaNo ratings yet

- Trader's Psychology and Key Rules of Forex TradingDocument3 pagesTrader's Psychology and Key Rules of Forex TradingAkingbemi MorakinyoNo ratings yet

- Ma'am MaconDocument7 pagesMa'am MaconKim Nicole Reyes100% (1)

- 1231.3376.01 -ל הרמהל ח"גאמ - Convertible ArbitrageDocument3 pages1231.3376.01 -ל הרמהל ח"גאמ - Convertible ArbitrageitzikhevronNo ratings yet

- Crypto Trading Secrets How To Earn Big in The Cryptocurrency MarketDocument25 pagesCrypto Trading Secrets How To Earn Big in The Cryptocurrency MarketSiddharth KaulNo ratings yet

- FINS 3616 Tutorial Questions-Week 7 - AnswersDocument2 pagesFINS 3616 Tutorial Questions-Week 7 - AnswersbenNo ratings yet

- Auto Loan: Most Important Terms and ConditionsDocument1 pageAuto Loan: Most Important Terms and ConditionsVinod TripathiNo ratings yet

- Commercial Invoice ExerciseDocument9 pagesCommercial Invoice ExerciseAnna Sanchez AlvarezNo ratings yet

- GST Challan FloraciaDocument2 pagesGST Challan Floraciasalini jhaNo ratings yet

- Market Analysis November 2020Document21 pagesMarket Analysis November 2020Lau Wai KentNo ratings yet

- A Project Report OnDocument27 pagesA Project Report OnHarshika DaswaniNo ratings yet

- Statement 36823447Document7 pagesStatement 36823447Robert SchumannNo ratings yet

- Class On Pay Fixation in 8th April.Document118 pagesClass On Pay Fixation in 8th April.Crick CompactNo ratings yet

- 3 Topic 2 Earning Per Share - Tutorial 1Document4 pages3 Topic 2 Earning Per Share - Tutorial 1izwanNo ratings yet

- History of EXIM BankDocument54 pagesHistory of EXIM BankMasood PervezNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- SABIC (Detailed Analysis)Document17 pagesSABIC (Detailed Analysis)Mirza Zain Ul AbideenNo ratings yet

- Cruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryDocument11 pagesCruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryBLOG BLOGNo ratings yet

- Bank Statement 4Document4 pagesBank Statement 4Jardan Nelli86% (7)

- Master of Business Administration: Summer Internship Project OnDocument18 pagesMaster of Business Administration: Summer Internship Project OnVarun NagarNo ratings yet

- Assignment Unit VIDocument21 pagesAssignment Unit VIHạnh NguyễnNo ratings yet

- Form PDF 870914450231220Document8 pagesForm PDF 870914450231220Sachin KumarNo ratings yet

- IIM Udaipur Placements DecodedDocument4 pagesIIM Udaipur Placements DecodedUjjwalPratapSinghNo ratings yet

- Stevens Textiles S 2010 Financial Statements Are Shown BelowDocument1 pageStevens Textiles S 2010 Financial Statements Are Shown BelowAmit PandeyNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet