Professional Documents

Culture Documents

Tata Motor Split

Uploaded by

harshnikaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Motor Split

Uploaded by

harshnikaCopyright:

Available Formats

Splits Summary

Tata Motors had last split the face value of its shares from Rs 10 to Rs 2 in 2011.The share has been quoting on an ex-split basis from September 12, 2011 Splits History (Tata Motors) Announcement Date 26-05-2011 03-01-1996

.

Ex-Split Date 12-09-2011

Old FV 10 100

New FV 2 10

The result: After Split

The share, which closed at Rs 764.90 on the NSE on Friday, is currently trading at Rs 147.40. On a pre-split basis, its current value is Rs 737, lower by 3.65 percent over the previous close. The stock moved up after hitting a low of Rs 143.50.

Tata Motors to split stock

Mumbai, May 26: Tata Motors today announced a five for one stock split even as it reported a spectacular 260 per cent leap in consolidated net profit at Rs 9,273.62 crore in the year ended March 31 compared with Rs 2,571 crore in the previous year. Buoyed by strong sales of Jaguar Land Rover (JLR) vehicles in overseas markets and robust sales of trucks at home, the auto maker said it had sold more than 1 million units last year. Global sales of passenger vehicles stood at 568,263 units. Total income from operations stood at Rs 1,23,133 crore, an increase of 33 per cent over Rs 92,519.25 crore a year ago. The auto maker seemed to have taken a cue from group firm Tata Power, which had announced a 10 for 1 stock split exactly a week ago..

Several companies, including ONGC, Bhel, MMTC, Bajaj Corp and LIC Housing, have announced stock splits in the past 12 months after a sharp spurt in their share prices. The stock split will have to be approved by the companys shareholders. The Tata Motor stock has jumped 64 per cent since May last year and closed today at Rs 1,161.25 on the BSE ahead of the results. A stock split will make the stock affordable and is likely to boost trading. The board has announced a dividend of Rs 20 per ordinary share against Rs 15 last year. The sharp turnaround at JLR was evident with the subsidiary posting a profit after tax of 1.04 billion on a net revenue of 9.9 billion. Sales volumes improved to 243,621 from 193,982 a year ago, on the back of improved market conditions, better market mix with strong growth in China, strong response to product introduction, including the new XJ and Land Rover models and favourable exchange rates, the company said

The Tata Motors management warned of headwinds in the form of rising input costs and competitive pressures. Increased infrastructure spending in the country was, however, expected to boost demand for its trucks. In India, Tata Motors sales (including exports) of commercial and passenger vehicles stood at 836,629 units, a growth of 25.2 per cent over last year. While commercial vehicle sales rose 22.7 per cent, passenger vehicles, including Fiat and JLR distributed in India, grew 23 per cent. C. Ramkrishnan, chief financial officer, said sales of the Nano crossed 1,00,000 during the year. Cost pressures, including rising commodity prices, have brought down the operating margins to 9.9 per cent and the earning before interest tax depreciation and amortisation of Rs 4,771 crore was 14 per cent higher than last year. After Mamata Banerjees victory in the recent elections, the Bengal government has talked about taking back at least 400 acres of the 997 acres at Singur where the Tatas were originally supposed to set up the Nano plant. The company said it did not feel it was necessary to make a provision for the carrying cost of the building at Singur.

You might also like

- Consolidated Financial Results For The Year Ended March 31, 2008Document44 pagesConsolidated Financial Results For The Year Ended March 31, 2008Anurag AgarwalNo ratings yet

- News ArticlesDocument20 pagesNews ArticlesPriya GoyalNo ratings yet

- Ta MoDocument1 pageTa MobaNo ratings yet

- Auto Sales FiguresDocument5 pagesAuto Sales Figuressrishtiagarwal26No ratings yet

- Tata NewsDocument3 pagesTata Newsshorabhsharma22No ratings yet

- Internship at Rosy Blue SecuritiesDocument12 pagesInternship at Rosy Blue SecuritiesKrish JoganiNo ratings yet

- Material CostsDocument1 pageMaterial CostssethhutchinsonNo ratings yet

- Microsoft Word - Castrol India LTDDocument6 pagesMicrosoft Word - Castrol India LTDAady RockNo ratings yet

- Automobile Industry Updates - July 2009Document51 pagesAutomobile Industry Updates - July 2009paulfernNo ratings yet

- Tata Motors: Q1FY11 Results Review - Press Meet 19 August 2010Document18 pagesTata Motors: Q1FY11 Results Review - Press Meet 19 August 2010karthikeyan un reclusNo ratings yet

- Tata Motors LTDDocument63 pagesTata Motors LTDEntertainment OverloadedNo ratings yet

- Directors Report Year EndDocument18 pagesDirectors Report Year EndGanesh SharmaNo ratings yet

- Literature Review Tata MotorsDocument5 pagesLiterature Review Tata Motorsfvhgssfm100% (1)

- Powerpoint of MahindraDocument17 pagesPowerpoint of MahindraCuteAngel06No ratings yet

- EID Parry Second Quarter Profit RisesDocument1 pageEID Parry Second Quarter Profit RisesEIDParryMDblogNo ratings yet

- Tata Power CompanyDocument5 pagesTata Power Companylaloo01No ratings yet

- Equity 9819300244Document4 pagesEquity 9819300244tusharloharNo ratings yet

- Tata Motors'domestic Biz Reports Best Net Sales: On A HighDocument1 pageTata Motors'domestic Biz Reports Best Net Sales: On A HighLalith KumarNo ratings yet

- Press 12may23Document5 pagesPress 12may23Arun SinghNo ratings yet

- Maruti Suzuki, Tata Motors, and Mahindra & Mahindra Firm ComparisonDocument9 pagesMaruti Suzuki, Tata Motors, and Mahindra & Mahindra Firm Comparisongbulani11No ratings yet

- Bajaj AutoDocument14 pagesBajaj Autonehasoningras0% (1)

- Tata Motors LimitedDocument4 pagesTata Motors Limitedprajapati kumar paswanNo ratings yet

- Tata Motors Unveils Upgraded Versions of Indica, Indigo, Sumo, Safari and NanoDocument5 pagesTata Motors Unveils Upgraded Versions of Indica, Indigo, Sumo, Safari and NanoDhiraj IppiliNo ratings yet

- Group 4 - TATA JLR DealDocument22 pagesGroup 4 - TATA JLR DealXyz YxzNo ratings yet

- Summary 2Document16 pagesSummary 2Harishankar PareekNo ratings yet

- Press 25jul23 ResultsDocument5 pagesPress 25jul23 ResultsNagendranNo ratings yet

- Tata Motors LatestDocument11 pagesTata Motors LatestAnisha SubramaniamNo ratings yet

- Ing Coverage ReportDocument7 pagesIng Coverage ReportsaurabhnigamNo ratings yet

- Auto Sector Analysis SridharDocument2 pagesAuto Sector Analysis Sridharsridhar4u18No ratings yet

- Tata Motors January Sales Up 77% at 65,478 VehiclesDocument8 pagesTata Motors January Sales Up 77% at 65,478 VehiclesasraaazeenNo ratings yet

- Project Report Two Wheeler IndustryDocument7 pagesProject Report Two Wheeler IndustrysouravNo ratings yet

- Weekly News: By: Kapil Singh PathaniaDocument14 pagesWeekly News: By: Kapil Singh PathaniaCapil Path A NiaNo ratings yet

- The Economics Hub Edition 273Document8 pagesThe Economics Hub Edition 273minakshi.pandey8No ratings yet

- TATA MotorsDocument16 pagesTATA MotorsShweta Gupta0% (1)

- Hike in PricesDocument1 pageHike in PricesSaurabh GuptaNo ratings yet

- About Tata Motors: Reasons For AcquisitionDocument6 pagesAbout Tata Motors: Reasons For AcquisitionApurva GuptaNo ratings yet

- Bajaj Auto: About The Bajaj GroupDocument16 pagesBajaj Auto: About The Bajaj GroupKiran JainNo ratings yet

- Final Report Tata MotorsdoneDocument10 pagesFinal Report Tata Motorsdone2K20MC10 AdityaNo ratings yet

- L&T India's Leading Infrastructure CompanyDocument12 pagesL&T India's Leading Infrastructure CompanyDwarkesh PanchalNo ratings yet

- Tata Motors Limited: ModeratorDocument23 pagesTata Motors Limited: ModeratorAditi Gulati GroverNo ratings yet

- Swaraj Engines LTD (NSE Code: SWARAJENG) - Alpha/Alpha + Stock Recommendation For Oct'13Document25 pagesSwaraj Engines LTD (NSE Code: SWARAJENG) - Alpha/Alpha + Stock Recommendation For Oct'13Shivam ChopraNo ratings yet

- Fundamental Analysis of Tata Motors 10 September 2008Document23 pagesFundamental Analysis of Tata Motors 10 September 2008raju100% (10)

- Report Submitted By:: 12113125 Utkalika Pattanaik RQOC01A50Document9 pagesReport Submitted By:: 12113125 Utkalika Pattanaik RQOC01A50Utkalika PattanaikNo ratings yet

- Astra International Q3 2010 Financial StatementsDocument4 pagesAstra International Q3 2010 Financial StatementsJim Andy HermawanNo ratings yet

- Presented By: Sanket Patel (D002) Mahesh Dacha (D004) Chaithanya K. (D006) Ketan Shroff (D010) Ronak Parmar (D013)Document17 pagesPresented By: Sanket Patel (D002) Mahesh Dacha (D004) Chaithanya K. (D006) Ketan Shroff (D010) Ronak Parmar (D013)Ronak ParmarNo ratings yet

- Tata Motors Group Global Wholesales Up 13% to Over 322K Vehicles in Q3FY23Document1 pageTata Motors Group Global Wholesales Up 13% to Over 322K Vehicles in Q3FY23pawan rakteNo ratings yet

- Jamna AutoDocument5 pagesJamna AutoSumit SinghNo ratings yet

- Maruti SuzukiDocument4 pagesMaruti SuzukiDhaval MandaviyaNo ratings yet

- LGB ResearchNote 28march2012Document14 pagesLGB ResearchNote 28march2012equityanalystinvestorNo ratings yet

- Oject ImDocument24 pagesOject ImKomal SinghNo ratings yet

- TATA MOTORS Equity Valuation ReportDocument24 pagesTATA MOTORS Equity Valuation ReportPrachir GuptaNo ratings yet

- Company Promoters:: Mahanagar GasDocument8 pagesCompany Promoters:: Mahanagar GasAbhijeet PatilNo ratings yet

- Presented By:: Anmol Kalucha Aniket Choudhary Animesh Batra Ashmik Paul Ashish Chawla Anshul AggarwalDocument25 pagesPresented By:: Anmol Kalucha Aniket Choudhary Animesh Batra Ashmik Paul Ashish Chawla Anshul AggarwalAniket ChoudharyNo ratings yet

- The New People's Car: Why The Nano Alone Cannot Solve The Mounting Problems of Its MakerDocument4 pagesThe New People's Car: Why The Nano Alone Cannot Solve The Mounting Problems of Its MakerShine KhanNo ratings yet

- Mahindra & Mahindra LTD: Key Financial IndicatorsDocument4 pagesMahindra & Mahindra LTD: Key Financial IndicatorsIntigate NoidaNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryFrom EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Automobile & Motor Vehicle Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomobile & Motor Vehicle Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Banking History and Role in the EconomyDocument21 pagesBanking History and Role in the EconomyharshnikaNo ratings yet

- International Monetary Fund (IMF)Document14 pagesInternational Monetary Fund (IMF)harshnika0% (1)

- International Cash ManagementDocument36 pagesInternational Cash Managementharshnika100% (1)

- Post Merger IntegrationDocument22 pagesPost Merger Integrationharshnika100% (1)

- IF - IntroDocument43 pagesIF - IntroharshnikaNo ratings yet

- International Monetary Fund (IMF)Document14 pagesInternational Monetary Fund (IMF)harshnika0% (1)

- Performance Appraisal Effectiveness Analysis at Champion Voyager Designers PVT LTD by Jean ThomasDocument72 pagesPerformance Appraisal Effectiveness Analysis at Champion Voyager Designers PVT LTD by Jean ThomasShresta ReddyNo ratings yet

- Insurance Case StudyDocument2 pagesInsurance Case Studyharshnika100% (1)

- Management Development: A Strategic Initiative: by Lin Grensing-PophalDocument4 pagesManagement Development: A Strategic Initiative: by Lin Grensing-PophalharshnikaNo ratings yet

- Career Planning PPT 120620143221 Phpapp02Document26 pagesCareer Planning PPT 120620143221 Phpapp02harshnikaNo ratings yet

- SaamnaDocument10 pagesSaamnaharshnikaNo ratings yet

- INTUC and Bharatiya Kamgar SenaDocument18 pagesINTUC and Bharatiya Kamgar SenaharshnikaNo ratings yet

- Buying, Bonding and Broadening Talent in An OrganizationDocument14 pagesBuying, Bonding and Broadening Talent in An OrganizationharshnikaNo ratings yet

- Oil CrisisDocument12 pagesOil CrisisharshnikaNo ratings yet

- Career Planning PPT 120620143221 Phpapp02Document26 pagesCareer Planning PPT 120620143221 Phpapp02harshnikaNo ratings yet

- Buying, Bonding and Broadening Talent in An OrganizationDocument14 pagesBuying, Bonding and Broadening Talent in An OrganizationharshnikaNo ratings yet

- Dairy Co OperativesDocument19 pagesDairy Co OperativesharshnikaNo ratings yet

- Foreign Trade and IndiaDocument51 pagesForeign Trade and IndiaSaurabh DhimanNo ratings yet

- Buying, Bonding and Broadening Talent in An OrganizationDocument14 pagesBuying, Bonding and Broadening Talent in An OrganizationharshnikaNo ratings yet

- Buying, Bonding and Broadening Talent in An OrganizationDocument14 pagesBuying, Bonding and Broadening Talent in An OrganizationharshnikaNo ratings yet

- BusinessDocument22 pagesBusinessharshnikaNo ratings yet

- Buying, Bonding and Broadening Talent in An OrganizationDocument14 pagesBuying, Bonding and Broadening Talent in An OrganizationharshnikaNo ratings yet

- Report On The Apo Study Meeting On Strategic Merger & Acquisition For SmesDocument8 pagesReport On The Apo Study Meeting On Strategic Merger & Acquisition For SmesharshnikaNo ratings yet

- Management DevelopmentDocument7 pagesManagement DevelopmentharshnikaNo ratings yet

- Organizational DevelopmentDocument49 pagesOrganizational DevelopmentMuhammad Risalat Siddique AlveeNo ratings yet

- Bond MarketDocument25 pagesBond MarketNagabhushanaNo ratings yet

- Presentation 1Document3 pagesPresentation 1harshnikaNo ratings yet

- Es A Tabl IshmentDocument2 pagesEs A Tabl IshmentharshnikaNo ratings yet

- Job Rotation: Fiona Nolan Employment Project & Enterprise Manager Northside PartnershipDocument35 pagesJob Rotation: Fiona Nolan Employment Project & Enterprise Manager Northside PartnershipLokesh SharmaNo ratings yet

- OYO Business Model ExplainedDocument1 pageOYO Business Model ExplainedVikash KumarNo ratings yet

- Order in The Matter of Exelon Infrastructure LimitedDocument22 pagesOrder in The Matter of Exelon Infrastructure LimitedShyam SunderNo ratings yet

- Business Finance Xii SP New SyllabusDocument21 pagesBusiness Finance Xii SP New SyllabusSanthosh Kumar100% (1)

- Lecture 25&26Document26 pagesLecture 25&26Nasira IdreesNo ratings yet

- KFC History, Strategy, Marketing & EnvironmentDocument21 pagesKFC History, Strategy, Marketing & EnvironmentCarl VillafuerteNo ratings yet

- (Paper Size 8.11x13) Economic Survey FormDocument3 pages(Paper Size 8.11x13) Economic Survey FormKevin Jove Yague100% (1)

- Hindustan Zinc Limited - Tanisha 08351Document4 pagesHindustan Zinc Limited - Tanisha 08351Tanisha KalraNo ratings yet

- Forms of Business Organisation EOBDocument2 pagesForms of Business Organisation EOBmisha003No ratings yet

- Karnataka Police Establishment BoardDocument64 pagesKarnataka Police Establishment BoardxfilesindiaNo ratings yet

- AVERY DENNISON CORPORATION v. MARSH & MCLENNAN COMPANIES, INC. Et Al DocketDocument6 pagesAVERY DENNISON CORPORATION v. MARSH & MCLENNAN COMPANIES, INC. Et Al DocketACELitigationWatchNo ratings yet

- Sales Ops Best PracticesDocument31 pagesSales Ops Best PracticesSamuel Saavedra100% (3)

- Employers - Confirmation Letter 2015Document3 pagesEmployers - Confirmation Letter 2015East Can DarrNo ratings yet

- SOTC PPTDocument18 pagesSOTC PPTanupamjeet kaur100% (1)

- Yutivo Sons Hardware CoDocument3 pagesYutivo Sons Hardware CoEmaleth LasherNo ratings yet

- CFO MagazineDocument84 pagesCFO MagazinehenrydeeNo ratings yet

- Cheat Sheet Strategy Exam MiguelDocument2 pagesCheat Sheet Strategy Exam MiguelMiguel GarçãoNo ratings yet

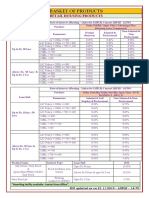

- BASKET OF RETAIL PRODUCTS RATESDocument3 pagesBASKET OF RETAIL PRODUCTS RATESVirendra K VermaNo ratings yet

- Business Express Loan Application FormDocument4 pagesBusiness Express Loan Application Formgosmiley67% (3)

- UBI Global - Rankings 1920 v2Document25 pagesUBI Global - Rankings 1920 v2Marcos CostaNo ratings yet

- Chapter 5Document35 pagesChapter 5Suzanne PadernaNo ratings yet

- Missed call balance checking numbers for major Indian banksDocument17 pagesMissed call balance checking numbers for major Indian banksS.N.RajasekaranNo ratings yet

- Decision - ERC Case No. 2013-169 RCDocument17 pagesDecision - ERC Case No. 2013-169 RCDan Santos100% (1)

- IATA Introduction - International Air Transport Association OverviewDocument20 pagesIATA Introduction - International Air Transport Association OverviewFUNBOYZNo ratings yet

- SingaporeDocument1 pageSingaporeava1234567890No ratings yet

- TGTGGDocument44 pagesTGTGGNidhi JalanNo ratings yet

- Partnership ReviewerDocument21 pagesPartnership ReviewerDaniel John Cañares Legaspi100% (1)

- Accredited partners in constructionDocument2 pagesAccredited partners in constructionHershey GabiNo ratings yet

- LDD - PT - Mitra - Setia - Tanah - Bumbu dtd.021209Document40 pagesLDD - PT - Mitra - Setia - Tanah - Bumbu dtd.021209Emily Mitchell100% (1)

- 2 Management Catlyn 3.1 3.3Document11 pages2 Management Catlyn 3.1 3.3llerry racuyaNo ratings yet

- Rights of Shareholders in Corporate GovernanceDocument13 pagesRights of Shareholders in Corporate GovernanceGilang Aditya100% (1)