Professional Documents

Culture Documents

Cost of Capital, WACC and Beta

Uploaded by

Senith111Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Capital, WACC and Beta

Uploaded by

Senith111Copyright:

Available Formats

Cost of Capital

Presented by: www.GraduateTutor.com

Definition:

1: the opportunity cost of the funds employed as the result of an investment decision1; 2: The implicit (interest paid on debt) and explicit cost (expected return on equity) of the capital raised by the company2

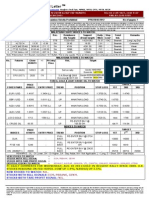

Different Types of Capital

Equity

Hybrid Capital with properties of debt and equity: eg: Preference Shares, Convertible debt

Debt

Expected return by Capital appreciation & Dividend

Future return uncertain and not promised. But expectation of a return exists

providers of capital Interest payments

A fixed rate of interested promised

Capital appreciation, Dividend, Interest

Cost of Capital

(Used to discount future cash flows to arrive at value) If a company has not debt (is all equity financed), its cost of EQUITY is its Cost of Capital When companies have multiple sources of capital, its cost of capital is its Weighted Average Cost of Capital In capital budgeting, you use project specific cost of capital not the companys cost of capital for decision making because

This is

Risk involved in different projects would be different!

Presented by www.GraduateTutor.com Phone: +1-214 691 8721 Email: care@graduatetutor.com

Sources: 1) http://wordnetweb.princeton.edu/perl/webwn?s=cost of capital 2) GraduateTutor.com

In valuation, you must discount at the appropriate level of risk

Got Questions on Valuation? Give us a call!

A Key Driver of Corporate Value

Weighted Average Cost of Capital

Presented by: www.GraduateTutor.com

Capital Structure: How much Debt vs. Equity?

Debt

A fixed rate of interested promised Hybrid Capital with properties of debt and equity: eg: Preference Shares, Convertible debt Return, Partly promised Partly based on Performance

Equity

Future return uncertain. But expectation of a return exists

When companies have multiple sources of capital, its cost of capital is its Weighted Average Cost of Capital

The cost of each type of capital is weighted according to the its proportion. Proportion of the capital uses is based on current market values. After tax cost of debt Weight of debt Cost of equity Weight of equity

WACC =

rd x (1- T) x

T= Marginal tax rate

D D+E

re x

E D+E

Cost of equity Do equity investors get a promised rate of return? No! Then why would they invest money in a company? .. Equity investors expect a return on investment. This expected return is the cost of equity. The cost of equity can be estimated in a multiple ways: 1 Capital Asset Pricing Model 2 Market Implied Premium 3 Arbitrage Pricing Model Fama French Three Factor 4 Model

(1-T) is the adjustment made to capture the interest tax shield (value created due to the taxability of interest paid) Cost of debt: What do you pay in return for borrowing money? Interest on money borrowed! Cost of debt is the effective market interest rate on debt. Or the Yield To Maturity which is the rate an investor gets if he/she bought this bond and held it to maturity.

Capital Asset Pricing Model (CAPM)

CAPM: re =

rf

Risk free rate of return

r f + e x ( r M - r f )

This is the rate of return you would get when investing in a totally risk free asset. While there is theoretically no totally risk free asset, the US treasury bonds are considered to be the closest to a risk less asset. The return from US treasury bonds is considered the risk free rate of return.

Note: use short (long) term T-bill rates for short (long) term projects

rM

Market rate of return

This is the rate of return you would get when investing in the entire market. You can use the historical return from the S&P 500 as an estimate of market rate of return. In class this is often given to students. This is the reward you get for taking the risk involved in investing in the market. It is the return you get more than the risk free rate of return. Market risk premium = market rate of return - risk free

Note: you could be given the market risk premium or the market return. If given the market return, you will need to compute the market risk premium ( rM - rf ). The market risk premium is historically between 7%-10%.

( rM - rf )

Market risk premium

or Beta

Beta is the responsiveness of a stocks price to the changes in the market. This will be given to you or estimated.

Market Implied Premium

r=

Dividend(next year) + Dividend Growth Rate Price today

Assuming constant growth rate in dividends.

Arbitrage Pricing Theory (APT)

3

APT: r = A + b1 x (rfactor1) + b2 x (rfactor2) + b3 x (rfactor3)..+ noise

The APT theory assumes that each stocks return is a linear function of a variety of factors. It does not specify the factors but examples include interest rate, GDP, inflation, oil prices, etc.

Fama Frenchs Three Factor Model (TFM) TFM: r = rf + bmarket x (rmarket factor) + bsize x (rsize factor) + bbook-market x (rbook-market factor)

The TFT theory assumes that each stocks return is a linear function of a the market, its size and book to market ratio.

Presented by www.GraduateTutor.com Phone: +1-214 691 8721 Email: care@graduatetutor.com

Sources: 1) http://wordnetweb.princeton.edu/perl/webwn?s=cost of capital 2) GraduateTutor.com

Got Questions on WACC? Give us a call!

A Ky Driver of Corporate Value

Beta or

Presented by:

www.GraduateTutor.com

Definition: (finance)

1: is a number describing the correlated volatility of an asset in relation to the volatility of the benchmark that the asset is being compared to. 1; 2: A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.2

Different Types of Betas

Equity Beta

Used to compute Cost of equity in CAPM

Asset Beta

Used to compute Equity beta

Portfolio Beta

Weighted average of individual betas in portfolio

Debt Beta

Assumed to be zero in class settings

Equity Beta

Statistically From the Slope

Beta is the responsiveness of a stocks price to the changes in the market. The beta of an individual stock can also be computed as

Individual Stocks Beta = Covariance of stocks return vs market return Standard deviation of market return

An Individual stocks beta can also be estimated from the slope of the fitted line plotting the stocks return (y-axis) vs. markets return (x-axis).

stock return

Beta = Slope =

Change in Y Change in x

market return

Note: Remove outliers for better results. Remember we are assuming that the nature of the business hasnt changed.

Levering Industry If a company is a private company, we will not have prior market data to estimate beta or it as above. Therefore, we use comparable public companies date to estimate asset Comparable beta and then compute equity beta as follows. company beta 1. Find comparable pure play (companies with only one line of business) in the same business. 2. Estimate their Equity Beta (statistically or from the slope: above methods) 3. Since they will have different leverage structures, we first un-lever their Equity Beta to get their Asset Beta.

A =

d x D + e x E D+E D+E

(If d is assumed to be zero, then we get)

Or A =

d x D + e x E D+E D+E

4. Get the average of these pure play companies to get the Industry Beta. We assume that this will be the beta of any company/project in this business. 5. Since un-levered Industry Beta assumes no debt, we re-lever the Industry Beta with the actual level of debt to get our Equity Beta

(If d is assumed to be zero, then we get)

e= A - d x

D x D+E D+E E

Or e= A - d x

D x D+E D+E E

Beta is a measure of volatility and therefore traits that reduce volatility reduce beta

Business with steady cash flow have lower betas. Higher fluctuations occur in the following: Cyclical companies Growth firms Luxury goods markets Companies with a higher proportion of fixed costs have higher operating leverage. This causes more volatility of cash flows and so causes higher betas

Nature of Business

+

Operating Leverage

Asset Beta

(industry)

+

(debt)

Equity Beta

Companies with more debt (financial leverage) will have higher betas.

Financial Leverage

Presented by www.GraduateTutor.com Phone: +1-214 691 8721 Email: care@graduatetutor.com

Sources: 1) http://wordnetweb.princeton.edu/perl/webwn?s=cost of capital 2) GraduateTutor.com

Got Questions on WACC? Give us a call!

You might also like

- Free Cash Flow Valuation: Wacc FCFF VDocument6 pagesFree Cash Flow Valuation: Wacc FCFF VRam IyerNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Modeling and Agency ContractDocument3 pagesModeling and Agency ContractMysweethearts40% (5)

- Balance Sheet RatiosDocument3 pagesBalance Sheet RatiosMohit Sunil Anju MehtaNo ratings yet

- Securities Regulation Short Outline: I. BackgroundDocument14 pagesSecurities Regulation Short Outline: I. BackgroundzklvkfdNo ratings yet

- Cheat Sheet For Valuation (2) - 1Document2 pagesCheat Sheet For Valuation (2) - 1RISHAV BAIDNo ratings yet

- Risk and ReturnDocument15 pagesRisk and ReturnShimanta EasinNo ratings yet

- Final Formula Sheet DraftDocument5 pagesFinal Formula Sheet Draftsxzhou23No ratings yet

- Bond Portfolio Management StrategiesDocument32 pagesBond Portfolio Management StrategiesSwati VermaNo ratings yet

- Financial Ratio Analysis: List of Financial RatiosDocument3 pagesFinancial Ratio Analysis: List of Financial RatiosshahbazsiddikieNo ratings yet

- EM302 Formula Sheet 2013Document4 pagesEM302 Formula Sheet 2013Jeff JabeNo ratings yet

- Interviews Financial ModelingDocument7 pagesInterviews Financial ModelingsavuthuNo ratings yet

- Corporate Finance CheatsheetDocument4 pagesCorporate Finance CheatsheetAbhisek PandaNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- 2.4 Earnings Per ShareDocument40 pages2.4 Earnings Per ShareMinal Bihani100% (1)

- Strategic Analysis For More Profitable AcquisitionsDocument26 pagesStrategic Analysis For More Profitable Acquisitionsankur khudaniaNo ratings yet

- Midterm 3 AnswersDocument7 pagesMidterm 3 AnswersDuc TranNo ratings yet

- A Note On Valuation in Entrepreneurial SettingsDocument4 pagesA Note On Valuation in Entrepreneurial SettingsUsmanNo ratings yet

- MM PropositionDocument61 pagesMM PropositionVikku AgarwalNo ratings yet

- Risk in The BoardroomDocument2 pagesRisk in The BoardroomDwayne BranchNo ratings yet

- LN10 EitemanDocument35 pagesLN10 EitemanFong 99No ratings yet

- Bond Valuation: Bond Analysis: Returns & Systematic RiskDocument50 pagesBond Valuation: Bond Analysis: Returns & Systematic RiskSamad KhanNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewadjoeadNo ratings yet

- Technical Analysis in Forex TradingDocument7 pagesTechnical Analysis in Forex TradingIFCMarketsNo ratings yet

- Financial Ratio Calculator: Income StatementDocument18 pagesFinancial Ratio Calculator: Income StatementPriyal ShahNo ratings yet

- Principle of AccountingDocument4 pagesPrinciple of AccountingMahabub Alam100% (1)

- CH - 04 Mutual Funds and Other Investment CompaniesDocument27 pagesCH - 04 Mutual Funds and Other Investment CompaniesshomudrokothaNo ratings yet

- Rajiv Gandhi FoundationDocument6 pagesRajiv Gandhi FoundationSaumya RiteshNo ratings yet

- Answer FIN 401 Exam2 Fall15 V1Document7 pagesAnswer FIN 401 Exam2 Fall15 V1mahmudNo ratings yet

- Nomad Capitalist - How To Reclaim Your Freedom With Offshore Bank Accounts - Dual Citizenship - Foreign NotebookDocument9 pagesNomad Capitalist - How To Reclaim Your Freedom With Offshore Bank Accounts - Dual Citizenship - Foreign NotebookBran K100% (1)

- Hand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadDocument55 pagesHand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadHamad Bakar HamadNo ratings yet

- Jasmin's Black Book ProjectDocument67 pagesJasmin's Black Book ProjectJasmin John Sara83% (12)

- Investments & RiskDocument20 pagesInvestments & RiskravaladityaNo ratings yet

- Cost of Capital Lecture Slides in PDF FormatDocument18 pagesCost of Capital Lecture Slides in PDF FormatLucy UnNo ratings yet

- Capital Structure and Dividend PolicyDocument25 pagesCapital Structure and Dividend PolicySarah Mae SudayanNo ratings yet

- Practice Midterm SolutionsDocument18 pagesPractice Midterm SolutionsGNo ratings yet

- Rose Packing v. CADocument3 pagesRose Packing v. CAJustin MoretoNo ratings yet

- Cost of Capital & CAPM - CMA & ACCADocument13 pagesCost of Capital & CAPM - CMA & ACCAMahesh SadhNo ratings yet

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriNo ratings yet

- Empirical Studies in FinanceDocument8 pagesEmpirical Studies in FinanceAhmedMalikNo ratings yet

- Bond ValuationDocument52 pagesBond ValuationDevi MuthiahNo ratings yet

- Chapter 16Document23 pagesChapter 16JJNo ratings yet

- Ernst & Young Islamic Funds & Investments Report 2011Document50 pagesErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- ENG 111 Final SolutionsDocument12 pagesENG 111 Final SolutionsDerek EstrellaNo ratings yet

- Social Impact Bond CaseDocument21 pagesSocial Impact Bond CaseTest123No ratings yet

- Fin 3101Document5 pagesFin 3101Park JiyeonNo ratings yet

- Quiz 2 - QUESTIONSDocument18 pagesQuiz 2 - QUESTIONSNaseer Ahmad AziziNo ratings yet

- WACC Capital StructureDocument68 pagesWACC Capital StructuremileticmarkoNo ratings yet

- Business Economics ICFAIDocument20 pagesBusiness Economics ICFAIDaniel VincentNo ratings yet

- 6 Dividend DecisionDocument31 pages6 Dividend Decisionambikaantil4408No ratings yet

- EXAM 1 IPM Solutions Spring 2012 (B)Document12 pagesEXAM 1 IPM Solutions Spring 2012 (B)kiffeur69100% (6)

- Coba BDocument4 pagesCoba BCesar Felipe UauyNo ratings yet

- Capital StructureDocument11 pagesCapital StructureSathya Bharathi100% (1)

- Valuation of SecuritiesDocument18 pagesValuation of Securitiessam989898No ratings yet

- Sharpe RatioDocument7 pagesSharpe RatioSindhuja PalanichamyNo ratings yet

- Home Work Chapter 10Document3 pagesHome Work Chapter 10Tien Dao0% (1)

- 46370bosfinal p2 cp6 PDFDocument85 pages46370bosfinal p2 cp6 PDFgouri khanduallNo ratings yet

- SynergyDocument19 pagesSynergyYash AgarwalNo ratings yet

- Reading 31 Slides - Private Company ValuationDocument57 pagesReading 31 Slides - Private Company ValuationtamannaakterNo ratings yet

- Financial Statement AnalysisDocument39 pagesFinancial Statement AnalysisunnijadejaNo ratings yet

- Arbitrage PDFDocument60 pagesArbitrage PDFdan4everNo ratings yet

- Financiam Modling FileDocument104 pagesFinanciam Modling FileFarhan khanNo ratings yet

- Beta Value - Levered & UnleveredDocument2 pagesBeta Value - Levered & UnleveredVijayBhasker VeluryNo ratings yet

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- Investment Fund (Share Class)Document272 pagesInvestment Fund (Share Class)bobjaseNo ratings yet

- Analysis of Financial Statements: QuestionsDocument44 pagesAnalysis of Financial Statements: QuestionsgeubrinariaNo ratings yet

- Investment BKM 5th EditonDocument21 pagesInvestment BKM 5th EditonKonstantin BezuhanovNo ratings yet

- Kmart CaseDocument22 pagesKmart CaseDamiano SciutoNo ratings yet

- Retail Strategic Planning and Operations ManagementDocument18 pagesRetail Strategic Planning and Operations ManagementishNo ratings yet

- Consolidated Accounts QuestionsDocument10 pagesConsolidated Accounts QuestionsGiedrius SatkauskasNo ratings yet

- OTCEIDocument11 pagesOTCEIvisa_kpNo ratings yet

- Case Study No. 10 Gordon Engineering CompanyDocument2 pagesCase Study No. 10 Gordon Engineering CompanyRonJacintoReyes50% (2)

- MDCM (B)Document13 pagesMDCM (B)VinayKumarNo ratings yet

- Tanaka 2Document15 pagesTanaka 2Firani Reza ByaNo ratings yet

- Certificate in Accounting Level 2/series 3-2009Document14 pagesCertificate in Accounting Level 2/series 3-2009Hein Linn Kyaw100% (1)

- Derivatives Market Forwarded To ClassDocument51 pagesDerivatives Market Forwarded To ClassKaushik JainNo ratings yet

- AlmaraiDocument5 pagesAlmaraiJawad_22100% (2)

- Circular Flow ModelDocument7 pagesCircular Flow ModelshaheenNo ratings yet

- Revised Tobin's Demand For MoneyDocument4 pagesRevised Tobin's Demand For MoneySnehasish MahataNo ratings yet

- Tutorial Answers - Topic 5: Q1: Mcdonalds (Based On A Past Exam Question)Document8 pagesTutorial Answers - Topic 5: Q1: Mcdonalds (Based On A Past Exam Question)technowiz11No ratings yet

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongNo ratings yet

- Company Tax Return: 2017 (The Instructions), Available From The ATODocument12 pagesCompany Tax Return: 2017 (The Instructions), Available From The ATOhansolo1974No ratings yet

- Chapter 6 - Accounting For SalesDocument4 pagesChapter 6 - Accounting For SalesArmanNo ratings yet

- Guidelines and Procedures For Entering Into Joint Venture (JV) Agreements Between Government and Private EntitiesDocument25 pagesGuidelines and Procedures For Entering Into Joint Venture (JV) Agreements Between Government and Private EntitiesPoc Politi-ko ChannelNo ratings yet

- Engineering Economics Lecture 1Document36 pagesEngineering Economics Lecture 1NavinPaudelNo ratings yet

- The Stoic Investor: Possessed by Your PossessionsDocument6 pagesThe Stoic Investor: Possessed by Your PossessionspadmaniaNo ratings yet

- AuditingDocument85 pagesAuditingAiyub Uddin100% (1)

- Coa MyobDocument4 pagesCoa Myobalthaf alfadliNo ratings yet