Professional Documents

Culture Documents

Exchange Rate of Rupee

Uploaded by

parultCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exchange Rate of Rupee

Uploaded by

parultCopyright:

Available Formats

A generally accepted form of money Includes coins and paper notes and are issued by a government Used as a medium

of exchange for goods and services. Each country has its own currency Eg. Switzerland's official currency is the Swiss franc, and Japan's official currency is the yen. An exception would be the euro, which is used as the currency for several European countries.

The Indian rupee(sign: ) is the official currency of the Republic of India. The issuance of the currency is controlled by the Reserve Bank of India. Banknotes in circulation come in denominations of 5, 10, 20, 50, 100, 500 and 1000. Rupee coins are available in denominations of 1, 2, 5, 10.

Historically, the rupee (derived from the Sanskrit word raupya), was a silver coin The history of the Indian rupee traces back to Ancient India in circa 6th century BC Ancient India was one of the earliest issuers of coins in the world, along with the Chinese wen and Lydian staters.

Dates

Currency system

From 1835

1 rupee = 16 annas = 64 paise

From 1 April 1957

1 rupee = 100 naya paise

From 1 June 1964

1 rupee = 100 paise

The exchange rate between two countries is the rate at which one currency can be exchanged for another. For example, an interbank exchange rate of 91 Japanese yen (JPY, ) to the United States dollar (US$) means that 91 will be exchanged for each US$1.

The exchange rate of Rupee is the rate at which Rupee can be converted into another currency. Eg. The exchange rate of British Pound Sterling to Indian Rupee equals 100.61. The U.S. dollar is the world's most dominant reserve currency. So we mostly consider exchange rate of rupee to dollar.

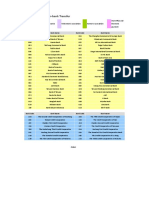

1947 Rupee at par with Dollar as there were no foreign borrowings. 1951 - Introduction of the Five-Year Plan for which the government started external borrowings which devaluated the rupee. 1948-1966 - India choose to adopt a fixed rate currency regime. The rupee was pegged at 4.79 against a dollar. 1966 Wars with China in 1962 and one with Pakistan in 1965, resulted in a huge deficit on India's budget, forcing the government to devalue the currency to 7.57 against the dollar. 1971 - The rupee's link with the British currency was broken and it was linked directly to the US dollar.

1975 - The Indian rupee was linked to three currencies, US dollar, Japanese yen and German mark. The value of the Indian rupee was pegged at 8.39 against a dollar. 1985 - Rupee was further devalued to 12 against a dollar. 1991 - India faced a serious balance of payment crisis following which the rupee was devalued to 17.90 against a dollar. 1993 - Rupee was let free to flow and exchange rate was freed to be determined by the market. Rupee was devalued to 31.37 against a dollar. 2000-2010 - The rupee was traded in the range of 40-50 against a dollar. 28th Aug 2013 - Rupee hit a record low of 68.79 per dollar.

10.0

15.0

20.0

25.0

30.0

35.0

45.0

50.0

40.0

55.0

5.0 1970-71 1971-72 1972-73 1973-74 1974-75 1975-76

1976-77

1977-78 1978-79 1979-80 1980-81 1981-82 1982-83 1983-84 1984-85 1985-86 1986-87 1987-88 1988-89

1989-90

1990-91 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07

Dollar Vs Rupee

2007-08

2008-09 2009-10 2010-11

Market sentiments Speculation RBI Intervention Imports and Exports Interest Rates

1966 Economic crisis 1991 Economic crisis Revaluation(20002007) 2013 Depreciation

Basic law of economics Price of crude oil Performance of dollar Volatility in the equity market Poor current account deficit Withdrawal of investors Contraction of Indian economy

Oil import demand could be staggered and purchases coordinated so that at no point there is undue bundling of imports. The government can take initiatives which encourage and increase the flow of foreign investments into India. The government can make investments attractive and invites long term FDI debt funds in infrastructure sector. Government can consider temporary import compression. FDI in the aviation industry, retail can also attract foreign investors.

Lets aim towards it

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Financial Market FinalDocument327 pagesFinancial Market Finalvarshadumbre100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Modern Money MechanicsDocument56 pagesModern Money MechanicshiddenloregamesNo ratings yet

- Cookie Ch2Document5 pagesCookie Ch2Charmaine Bernados Brucal100% (3)

- Electronic Payment SystemsDocument36 pagesElectronic Payment SystemsSaurabh G82% (11)

- Monzo Bank Statement 2020 11 10 205737 PDFDocument6 pagesMonzo Bank Statement 2020 11 10 205737 PDF13KARATNo ratings yet

- Hello Lemonia: Direct Debit - The Easy Way To Pay You'Re in Control With My EeDocument5 pagesHello Lemonia: Direct Debit - The Easy Way To Pay You'Re in Control With My EeLemonia Marina RempoutsikaNo ratings yet

- Retail Banking Indusind BankDocument54 pagesRetail Banking Indusind BankNithin NitNo ratings yet

- PMSL 3 PDFDocument14 pagesPMSL 3 PDFparultNo ratings yet

- Shakil 23092013 Proof PDFDocument27 pagesShakil 23092013 Proof PDFProst Ethic Paro XismNo ratings yet

- RuleBasedModelingGuide PDFDocument6 pagesRuleBasedModelingGuide PDFparultNo ratings yet

- Advanced Molecular Dynamics: Sampling May 8, 2019Document25 pagesAdvanced Molecular Dynamics: Sampling May 8, 2019parultNo ratings yet

- Wednesday ForceFields PDFDocument48 pagesWednesday ForceFields PDFrafelNo ratings yet

- SimbiologyTutorial PDFDocument11 pagesSimbiologyTutorial PDFparultNo ratings yet

- Modeling smooth thresholds for eCB-dependent plasticityDocument1 pageModeling smooth thresholds for eCB-dependent plasticityparultNo ratings yet

- Matlab Lect SPDocument6 pagesMatlab Lect SPparultNo ratings yet

- Sergyan PDFDocument36 pagesSergyan PDFparultNo ratings yet

- Wednesday ForceFields PDFDocument48 pagesWednesday ForceFields PDFrafelNo ratings yet

- SimbiologyTutorial PDFDocument11 pagesSimbiologyTutorial PDFparultNo ratings yet

- Scientific Writing Cheat SheetDocument2 pagesScientific Writing Cheat SheetparultNo ratings yet

- Theoretical KM KDDocument13 pagesTheoretical KM KDparultNo ratings yet

- Reactions Old New KF (NM S ) KB (S ) Kcat (S ) KF (NM S ) KB (S ) Kcat (S )Document2 pagesReactions Old New KF (NM S ) KB (S ) Kcat (S ) KF (NM S ) KB (S ) Kcat (S )parultNo ratings yet

- Matlab FunctionsDocument1 pageMatlab FunctionsparultNo ratings yet

- Quantum Mechanics III: Question 1Document2 pagesQuantum Mechanics III: Question 1parultNo ratings yet

- Corporate StrategiesDocument22 pagesCorporate StrategiesparultNo ratings yet

- Postdoc Transition Grants Support International NetworksDocument4 pagesPostdoc Transition Grants Support International NetworksparultNo ratings yet

- Monthly stock market closing prices and returns 2012Document11 pagesMonthly stock market closing prices and returns 2012parultNo ratings yet

- 6680 SimbiologyDocument4 pages6680 SimbiologyparultNo ratings yet

- Quantum Mechanics III: Question 1Document2 pagesQuantum Mechanics III: Question 1parultNo ratings yet

- ValuesDocument4 pagesValuesparultNo ratings yet

- Taleo Recruiting Cloud ServiceDocument4 pagesTaleo Recruiting Cloud ServiceparultNo ratings yet

- DNA-Protein Interactions TechniquesDocument21 pagesDNA-Protein Interactions TechniquesparultNo ratings yet

- Culture and Developmental Self RegulationDocument15 pagesCulture and Developmental Self RegulationparultNo ratings yet

- Guiding Principles for Ethical Decision-MakingDocument9 pagesGuiding Principles for Ethical Decision-MakingparultNo ratings yet

- Toward Spiritual LeadershipDocument35 pagesToward Spiritual LeadershipltcmenishadNo ratings yet

- All About Information Systems in GenpactDocument18 pagesAll About Information Systems in GenpactparultNo ratings yet

- ImproveGICQuestionnaireDocument5 pagesImproveGICQuestionnaireSowmi DaaluNo ratings yet

- A Study On State Bank of India's Doorstep Banking ServiceDocument3 pagesA Study On State Bank of India's Doorstep Banking ServiceEditor IJTSRDNo ratings yet

- Banking Ombudsman Project (40/40Document23 pagesBanking Ombudsman Project (40/40Mukesh ManwaniNo ratings yet

- KFS - Doc - Mon Sep 05 2022 19 - 03 - 51 GMT+0400 (Gulf Standard Time)Document3 pagesKFS - Doc - Mon Sep 05 2022 19 - 03 - 51 GMT+0400 (Gulf Standard Time)Abdul QadirNo ratings yet

- Bank Codes For Inter-Bank Transfer: PublicDocument6 pagesBank Codes For Inter-Bank Transfer: PublicGia nnaNo ratings yet

- Compound Interest: (2018 To 2020 All SSC Previous Year Questions)Document17 pagesCompound Interest: (2018 To 2020 All SSC Previous Year Questions)HakjsNo ratings yet

- Banking + Current Affairs Questions For SBI PODocument4 pagesBanking + Current Affairs Questions For SBI POsruthyaNo ratings yet

- Vdocuments - MX Internship Report On Askari Bank 5685e2e32007bDocument127 pagesVdocuments - MX Internship Report On Askari Bank 5685e2e32007bqwe100% (1)

- Chapter-2: Audit of Cash and Marketable SecuritiesDocument27 pagesChapter-2: Audit of Cash and Marketable Securitiesbikilahussen100% (1)

- Yahoo Mail - FWD - Mal 312 - Outstanding BalanceDocument6 pagesYahoo Mail - FWD - Mal 312 - Outstanding BalancemichelleNo ratings yet

- Plastic MoneyDocument40 pagesPlastic Moneytotalpalu33% (3)

- Analysis of Unsecured LoanDocument65 pagesAnalysis of Unsecured LoanJeremy TaylorNo ratings yet

- ABM NumericalsDocument38 pagesABM NumericalsBasavaraj GadadavarNo ratings yet

- ECO211 Chapter 4Document158 pagesECO211 Chapter 4Adam ZafryNo ratings yet

- SUDDICK CY JAMES XDocument3 pagesSUDDICK CY JAMES XITNo ratings yet

- Resolution To Change The Signatories at Land BankDocument2 pagesResolution To Change The Signatories at Land BankBLGU Lake DanaoNo ratings yet

- Bar Examination 2008 (NIL)Document2 pagesBar Examination 2008 (NIL)Anonymous gG0tLI99S2No ratings yet

- POS Class Diagram PDFDocument1 pagePOS Class Diagram PDFSaad HassanNo ratings yet

- Class A:ï¿ Commercial Banks: Names Operation Date (A.D.) Head OfficeDocument9 pagesClass A:ï¿ Commercial Banks: Names Operation Date (A.D.) Head OfficeSwami Yog BirendraNo ratings yet

- TYBBI - FSM - ImportanceDocument2 pagesTYBBI - FSM - Importancesneehaayadav2004No ratings yet

- Exercise ISB548 January 2021Document4 pagesExercise ISB548 January 2021Atiqah AzmanNo ratings yet

- Cce 3Document2 pagesCce 3Charish Jane Antonio CarreonNo ratings yet

- Unit Test 4Document12 pagesUnit Test 4Tin Nguyen0% (1)

- Hathway Internet BillDocument1 pageHathway Internet BillRamesh V MNo ratings yet