Professional Documents

Culture Documents

FMI7e ch10

Uploaded by

lehoangthuchienOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMI7e ch10

Uploaded by

lehoangthuchienCopyright:

Available Formats

Chapter 10

Stock Offerings and Investor Monitoring

Financial Markets and Institutions, 7e, Jeff Madura Copyright 2006 by South-Western, a division of Thomson Learning. All rights reserved.

Chapter Outline

Background on stock Initial public offerings Secondary stock offerings Stock exchanges Investor participation in the secondary market Monitoring by investors The corporate monitoring role Globalization of stock markets

2

Background on Stocks

A stock is a certificate representing partial ownership in a corporation Stock is issued by firms to obtain long-term funds Owners of stock:

Can benefit from the growth in the value of the firm Are susceptible to large losses

Individuals and financial institutions are common purchasers of stock The primary market enables corporations to issue new stock The secondary market creates liquidity for investors who invest in stock Some corporations distribute earnings to investors in the form of dividends

Background on Stocks (contd)

Ownership and voting rights

The

owners are permitted to vote on key matters concerning the firm:

Election of the board of directors Authorization to issue new shares Approval of amendments to the corporate charter Adoption of bylaws

Voting

is often accomplished by proxy Management typically receives the majority of the votes and can elect its own candidates as directors

Background on Stocks (contd)

Preferred stock

Preferred stock represents an equity interest in a firm that usually does not allow for significant voting rights A cumulative provision on most preferred stock prevents dividends from being paid on common stock until all preferred dividends have been paid Preferred stock is less risky because dividends on preferred stock can be omitted Preferred stock is a less desirable source of funds than bonds because:

Dividends are not tax deductible Investors must be enticed to purchase the preferred stock since dividends do not legally have to be paid

Background on Stocks (contd)

Issuer participation in stock markets

The

ownership feature attracts many investors who want to have an equity interest but do not necessarily want to manage their own firm A firm issuing stock for the first time engages in an IPO If a firm issues additional stock after the IPO, it engages in a secondary offering

Initial Public Offerings

An IPO is a first-time offering of shares by a specific firm to the public Usually, a growing firm first obtains private equity funding from VC firms An IPO is used to obtain new funding and to offer VC firms a way to cash in their investment

Many

VC firms sell their shares in the secondary market between 6 and 24 months after the IPO

Initial Public Offerings (contd)

Process of going public

An investment banking firm normally serves as the lead underwriter for the IPO Developing a prospectus

The issuing firm develops a prospectus and files it with the SEC The prospectus contains detailed information about the firm and includes financial statements and a discussion of risks The prospectus is intended to provide investors with the information they need to decide whether to invest in the firm Once approved by the SEC, the prospectus is sent to institutional investors Underwriters and managers meet with institutional investors in the form of a road show

Initial Public Offerings (contd)

Process of going public (contd)

Pricing The offer price is determined by the lead underwriter During the road show, the number of shares demanded at various prices is assessed

Bookbuilding

In some countries, an auction process is used for IPOs

Transaction costs The issuing firm typically pays 7 percent of the funds raised The lead underwriter typically forms a syndicate with other firms who receive a portion of the transaction costs

Initial Public Offerings (contd)

Underwriter efforts to ensure price stability

The lead underwriters performance can be measured by the movement in the IPO shares following the IPO

If stocks placed by a securities firm perform poorly, investors may no longer purchase shares underwritten by that firm Prevents the original owners from selling shares for a specified period Prevents downward pressure When the lockup period expires, the share price commonly declines significantly

The underwriter may require a lockup provision

10

Initial Public Offerings (contd)

Timing of IPOs

IPOs tend to occur more frequently during bullish stock markets

Prices are typically higher In the 20002001 period, many firms withdrew their IPO plans First-day return averaged about 20 percent over the last 30 years In 1998, the mean one-day return for Internet stocks was 84 percent Most IPO shares are offered to institutional investors About 2 percent of IPO shares are offered as allotments to brokerage firms

Initial returns of IPOs

11

Initial Public Offerings (contd)

Abuses in the IPO market

In

2003, regulators attempted to impose new guidelines that would prevent abuses

Spinning is the process in which an investment bank allocated IPO shares to executives requiring the help of an investment bank Laddering involves increasing the price above the offer price on the first day of issue in response to substantial demand Excessive commissions are sometimes charged by brokers when there is substantial demand for the IPO

12

Initial Public Offerings (contd)

Long-term performance following IPOs

IPOs

perform poorly on average over a period of a year or longer

Many IPOs are overpriced at the time of issue Investors may be overly optimistic about the firm Managers may spend excessively and be less efficient with the firms funds than they were before the IPO

13

Secondary Stock Offerings

A secondary stock offering is:

A new stock offering by a firm whose stock is already publicly traded Undertaken to raise more equity to expand operations Usually facilitated by a securities firm

In the late 1990s, the volume of publicly placed stock increased substantially From 2000 to 2002, the volume of publicly placed stock declined as a result of the weak economy Existing shareholders often have the preemptive right to purchase newly-issued stock

14

Secondary Stock Offerings (contd)

Shelf-registration

A

corporation can fulfill SEC requirements up to two years before issuing new securities Allows firms quick access to funds Potential purchasers must realize that information disclosed in the registration is not continually updated

15

Stock Exchanges

Stock trading between investors occurs on an organized stock exchange or on the over-thecounter (OTC) market Organized exchanges

Includes

the NYSE and AMEX The NYSE controls 80 percent of the value of all organized exchange transactions

There are 1,366 seats Floor brokers and specialists are members of the NYSE

16

Stock Exchanges (contd)

Organized exchanges (contd)

Trading floor

Consists of trading posts and trading booths 20 trading posts are maintained by specialists and their clerks There are 1,500 trading booths along the perimeter of the floor where brokers obtain orders NYSE requirements include number of shares outstanding, minimum level of earnings, cash flow, and revenue Minimum number of shares ensures adequate liquidity Exchanges charge a listing fee, which depends on the size of the firm

Listing requirements

17

Stock Exchanges (contd)

Over-the-counter market

Buy

and sell orders are completed through a telecommunications network Nasdaq

The Nasdaq is an electronic quotation system that provides immediate price quotations Firms must meet requirements on minimum assets, capital, and number of shareholders Transaction costs as a percentage of the investment tend to be higher on Nasdaq than on the NYSE

18

Stock Exchanges (contd)

Over-the-counter market (contd)

Nasdaq

(contd)

Nasdaq components are:

Nasdaq National Market Nasdaq Small Cap Market

More stocks are listed on Nasdaq than on NYSE The market value of stocks listed on Nasdaq is smaller than stocks listed on the NYSE

19

Stock Exchanges (contd)

Over-the-counter market (contd)

OTC Bulletin Board

Lists stocks that have a price below $1 per share (penny stocks) More than 3,500 stocks are listed Stocks are mostly traded by individual investors Lists stocks smaller than those listed on the OTC Bulletin Board Contains about 20,000 stocks Families and officers of the firms commonly control much of the stock

Pink sheets

20

Stock Exchanges (contd)

Extended trading sessions

The NYSE, AMEX, and Nasdaq markets all offer extended trading sessions Late trading sessions enable investors to buy or sell stocks after the market closes An early morning session enables investors to buy or sell stock just before the market opens on the following day Total trading volume of widely traded stocks is typically about 5 percent or less of the trading volume during the day ECNs also allow for trading at any time

21

Stock Exchanges (contd)

Stock quotations provided by exchanges

The

format varies among newspapers, but most provide similar information:

52-week price range Symbol Dividend Dividend yield Price-earnings ratio Volume Previous days price quotations

22

Computing A Dividend Yield

XYZ Corporation annual dividend is $1.02 per share. XYZs prevailing stock price is $20. What is the annual dividend yield of XYZ stock?

Dividend yield Dividends paid per share Prevailing stock price $1.02 5.10% $20

23

Stock Exchanges (contd)

Stock index quotations

The Dow Jones Industrial Average (DJIA) is a price-weighted average of stock prices of 30 large U.S. firms

Assigns a higher weight over time to those stocks that experience higher prices Does not necessarily serve as an adequate indicators of the overall market

The Standard and Poors (S&P) 500 is a value-weighted index of stock prices of 500 large U.S. firms

Does not serve as a useful indicator for stock prices of smaller firms

24

Stock Exchanges (contd)

Stock index quotations (contd)

Wilshire 5000 Total Market Index Created in 1974 to reflect the values of 5,000 U.S. stocks Represents the broadest index of the U.S. stock market Closely monitored by the Federal Reserve New York Stock Exchange Indexes The Composite Index represents the average of all stocks traded on the NYSE Sector indexes:

Industrial Transportation Utility Financial

25

Stock Exchanges (contd)

Stock index quotations (contd)

Other

stock indexes

AMEX indexes Nasdaq indexes

26

Investor Participation in the Secondary Market

The price of a firms stock represents the value of the firm per share of stock: Value of firm Stock price Number of shares

The stock price by itself does not clearly indicate the firms value The return on the investment is determined by dividends received and the price of the stock from the time when they purchased the shares until they sell them

27

Investor Participation in the Secondary Market (contd)

How investor decisions affect the stock price

Investors

buy or sell shares based on their valuation of the stock relative to the prevailing market price Investors arrive at different valuations which means there will be buyers and sellers at a given point in time As investors change their valuations of a stock, there is a shift in the demand for and supply of shares and the equilibrium price changes

28

Investor Participation in the Secondary Market (contd)

How investor decisions affect the stock price (contd)

Investor

reliance on information

Favorable news increases the demand for and reduces the supply of the security Unfavorable news reduces the demand for and increases the supply of the security Investors continually respond to new information in their attempt to purchase or sell stocks

29

Investor Participation in the Secondary Market (contd)

Types of investors

Individual investors typically hold more then 50 percent of the total equity in a large corporation

Ownership is scattered

Institutional investors have large equity positions in corporations and have more voting power

Can influence corporate policies through proxy contests Insurance companies, pension funds, and stock mutual funds are common purchasers of newly issued stock in the primary market The collective sales and purchases of stocks by institutions can significantly affect stock market prices

30

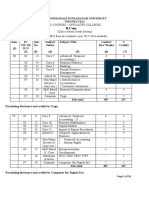

Type of Financial Institution

Commercial banks Stock-owned savings institutions Savings banks Finance companies Stock mutual funds Securities firms

Participation in Stock Markets

Issue

stock Manage trust funds

Issue

stock to boost their capital base in stocks for their investment portfolios stock

Invest Issue Use

the proceeds from selling shares to invest in stocks

Issue

stock Place new issues of stock Offer advice to corporations that consider acquiring stock companies Execute buy and sell orders

Issue

Insurance companies Pension funds

stock Invest a large proportion of their premiums in the stock market

Invest

a large proportion of pension fund contributions in the stock market

31

Monitoring by Investors

Managers serve as agents for shareholders to maximize the stock price Managers may be tempted to serve their own interests rather than those of investors Shareholders monitor their stocks price movements to assess whether the managers are achieving their goal

When the stock price declines or does not rise as high as shareholders expected, shareholders may blame the weak performance on the firms managers

32

Monitoring by Investors (contd)

Accounting irregularities

To

the extent that firms can manipulate financial statements they may be able to hide information from investors

e.g., Enron, Tyco, and WorldCom

The

auditors hired to audit financial statements allowed them to use unusual accounting methods

Board members on the audit committee were not always monitoring the audit

33

Monitoring by Investors (contd)

The Sarbanes-Oxley Act:

Was implemented in 2002 to ensure more accurate disclosure of financial information to investors Attempts to force accountants of a firm to conform to regular accounting standards Attempts to force auditors to take their auditing role seriously Prevents a public accounting firm from auditing a client whose CEO, CFO, or other employees are employed by the client firm within one year prior to the audit

34

Monitoring by Investors (contd)

The Sarbanes-Oxley Act:

Requires that only outside board members of a firm be on the firms audit committee Prevents the members of a firms audit committee from receiving consulting or advising fees from the firm Requires that the CEO and CFO of firms that are of at least a specified size level to certify that the audited financial statements are accurate Specifies major fines or imprisonment for employees who mislead investors or hide evidence Allows public accounting firms to offer non-audit consulting services to an audit client only if the client pre-approves those services

35

Monitoring by Investors (contd)

Shareholders activism

Communication

with the firm

Shareholders can communicate their concerns to other investors to place more pressure on managers or its board members Institutional investors commonly communicate with highlevel corporate managers and offer their concerns

Institutional Shareholder Serves (ISS) Inc. is a firm that organizes institutional shareholders to push for a common cause

36

Monitoring by Investors (contd)

Shareholders activism (contd)

Proxy

contest

Normally considered only if an informal request for a change in the board is ignored If dissident shareholders gain enough votes, they can elect one or more directors who share their views As a result of a more organized effort, institutional shareholders are more influential on management decisions

37

Monitoring by Investors (contd)

Shareholders activism (contd)

Shareholder lawsuits Investors may sue the board if they believe that the directors are not fulfilling their responsibilities to shareholders Lawsuits are often filed when corporations prevent takeovers, pursue acquisitions, or make other restructuring decisions that shareholders believe will reduce the stocks value When directors are sued, courts typically focus on whether the directors decision seems reasonable, rather than on whether the decision led to higher profitability

38

The Corporate Monitoring Role

If managers believe their stock is undervalued in the market, they may take actions to capitalize on this discrepancy Stock repurchases

Use

excess cash to purchase shares in the market at a low price Stock prices respond favorably to stock repurchase announcements

39

The Corporate Monitoring Role (contd)

Market for corporate control

A firm may engage in acquisitions to increase the value of a target firm

Can also create synergistic benefits

A high stock price is useful to exchange acquirer shares for target shares Share prices of target firms react very positively Leveraged buyouts

LBOs are acquisitions that require substantial amounts of borrowed funds A reverse LBO is desirable when the stock can be sold at a high price

40

The Corporate Monitoring Role (contd)

Barriers to corporate control

Antitakeover amendments are designed to protect shareholders against an acquisition that will ultimately reduce the value of their investment in the firm

e.g., may require at least two-thirds of shareholder votes to approve a takeover

Poison pills are special rights awarded to shareholders or specific managers upon specified events

e.g., the right for all shareholders to be allocated an additional 30 percent of all shares without cost whenever a potential acquirer attempts to acquire the firm

41

The Corporate Monitoring Role (contd)

Barriers to corporate control (contd)

A

golden parachute specifies compensation to managers in the event that they lose their jobs

e.g., all managers have the right to receive 100,000 shares of the firms stock whenever the firm is acquired

42

Globalization of Stock Markets

Barriers between countries have been removed or reduced

Firms in need of funds can tap foreign markets Investors can purchase foreign stocks Large privatization programs in Latin America and Europe can not be digested in local markets By issuing stock in the U.S., foreign firms diversify their shareholder base SEC regulations may prevent some firms from offering stock in the U.S. Some foreign firms use American depository receipts (ADRs)

Foreign stock offerings in the U.S.

43

Globalization of Stock Markets (contd)

International placement process

Many

U.S. investment banks and commercial banks provide underwriting services in foreign countries Listing on a foreign stock exchange:

Enhances the liquidity of the stock May increase the firms perceived financial standing Can protect the firm against hostile takeovers Entails some costs

44

Globalization of Stock Markets (contd)

Global stock exchanges

Recently, stocks outside the U.S. have been issuing stock more frequently The percentage of individual versus institutional ownership varies across countries

Emerging stock markets:

Enable foreign firms to raise large amounts of capital by issuing stock Provide a means for investors from other countries to invest their funds May not be as efficient as the U.S. stock market May exhibit high returns and high risk May be volatile because of fewer shares and trading based on rumors

45

Globalization of Stock Markets (contd)

Methods used to invest in foreign stocks

Direct

purchases involves directly buying stock of foreign companies listed on the local stock exchanges American depository receipts are attractive because:

They are closely followed They are required to file financial statements with the SEC They are quoted reliably

46

Globalization of Stock Markets (contd)

Methods used to invest in foreign stocks (contd)

International

mutual funds are portfolios of international stocks created and managed by various financial institutions World equity benchmark shares represent indexes that reflect composites of stocks for particular countries that can be purchased or sold

47

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Course07 2Document32 pagesCourse07 2Henry BascuguinNo ratings yet

- Pollution Haven Hypothesis: I I 0 I I IDocument6 pagesPollution Haven Hypothesis: I I 0 I I IlehoangthuchienNo ratings yet

- IFM Review Questions 2014-10-09Document11 pagesIFM Review Questions 2014-10-09lehoangthuchienNo ratings yet

- VCB - Jul 8 2014 by HSC PDFDocument6 pagesVCB - Jul 8 2014 by HSC PDFlehoangthuchienNo ratings yet

- Data1203 All PDFDocument288 pagesData1203 All PDFlehoangthuchienNo ratings yet

- CalculationDocument2 pagesCalculationlehoangthuchienNo ratings yet

- FDI SolutionsDocument5 pagesFDI SolutionsSam MadzokereNo ratings yet

- Chapter 7 - FDI MCQDocument11 pagesChapter 7 - FDI MCQlehoangthuchien100% (1)

- Multinational Finance: Country Risk AnalysisDocument62 pagesMultinational Finance: Country Risk Analysiswendel100% (6)

- IFM M&A Homework 2014-09-25Document2 pagesIFM M&A Homework 2014-09-25lehoangthuchienNo ratings yet

- Case Studies in Financial ManagementDocument2 pagesCase Studies in Financial ManagementlehoangthuchienNo ratings yet

- Chap 15 - International Acquisitions - AnsDocument7 pagesChap 15 - International Acquisitions - AnslehoangthuchienNo ratings yet

- Mockexam Withsolutions20111004082649Document6 pagesMockexam Withsolutions20111004082649lehoangthuchienNo ratings yet

- FMI7e ch24Document45 pagesFMI7e ch24lehoangthuchien100% (1)

- OBU - Rap Checklist 2013 2014Document1 pageOBU - Rap Checklist 2013 2014RabiaasadNo ratings yet

- FMI7e ch25Document61 pagesFMI7e ch25lehoangthuchienNo ratings yet

- FMI7e ch15Document39 pagesFMI7e ch15lehoangthuchienNo ratings yet

- M, 7e, Jeff MaduraDocument21 pagesM, 7e, Jeff MaduraPhuong Viet NguyenNo ratings yet

- FMI7e ch22Document20 pagesFMI7e ch22lehoangthuchienNo ratings yet

- FMI7e ch23Document53 pagesFMI7e ch23lehoangthuchienNo ratings yet

- FMI7e ch16Document38 pagesFMI7e ch16lehoangthuchien100% (1)

- FMI7e ch14Document46 pagesFMI7e ch14lehoangthuchienNo ratings yet

- FMI7e ch21Document46 pagesFMI7e ch21lehoangthuchienNo ratings yet

- FMI7e ch19Document49 pagesFMI7e ch19lehoangthuchienNo ratings yet

- FMI7e ch17Document37 pagesFMI7e ch17lehoangthuchienNo ratings yet

- FMI7e ch18Document45 pagesFMI7e ch18lehoangthuchienNo ratings yet

- FMI7e ch13Document44 pagesFMI7e ch13lehoangthuchien100% (1)

- FMI7e ch11Document54 pagesFMI7e ch11lehoangthuchienNo ratings yet

- FMI7e ch12Document41 pagesFMI7e ch12lehoangthuchienNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Impact of FIIs on Indian Stock MarketDocument66 pagesImpact of FIIs on Indian Stock MarketAmit ViraniNo ratings yet

- Financial Services Provided by Anand RathiDocument65 pagesFinancial Services Provided by Anand RathimiksharmaNo ratings yet

- FinancialTheoryandPractice PDFDocument96 pagesFinancialTheoryandPractice PDFbaha146No ratings yet

- Key Features of India's 2014-15 BudgetDocument9 pagesKey Features of India's 2014-15 Budgetgmaruthi_1No ratings yet

- Prospectus 2009 10Document46 pagesProspectus 2009 10William CareyNo ratings yet

- Art of Stock Investing Indian Stock MarketDocument10 pagesArt of Stock Investing Indian Stock MarketUmesh Kamath80% (5)

- The Oil Council's May MagazineDocument36 pagesThe Oil Council's May MagazinerossstewartcampbellNo ratings yet

- M.Com Final Papers Accounting, Strategic Management, FinanceDocument26 pagesM.Com Final Papers Accounting, Strategic Management, FinanceDanish Ahmad JamaliNo ratings yet

- Business Finance Book DigestDocument11 pagesBusiness Finance Book DigestLovella JeresanoNo ratings yet

- Various Investment AvenuesDocument59 pagesVarious Investment Avenuesagarwal_vinay85315088% (8)

- Financial Markets Advanced Module PDFDocument134 pagesFinancial Markets Advanced Module PDFAditya Vikram SinghNo ratings yet

- Zerodha ComDocument25 pagesZerodha ComBalakrishna BoyapatiNo ratings yet

- Chap 26Document34 pagesChap 26Samira AlhashimiNo ratings yet

- Essentials of Corporate Finance 1st Edition Parrino Test BankDocument18 pagesEssentials of Corporate Finance 1st Edition Parrino Test BankDavidRobertsnczte100% (14)

- Commodity Market With Marwadi Shares & Finance LTD by Rohit ParmarDocument72 pagesCommodity Market With Marwadi Shares & Finance LTD by Rohit ParmarCharanjit Singh SainiNo ratings yet

- Teaching Notes-FMI-342 PDFDocument162 pagesTeaching Notes-FMI-342 PDFArun PatelNo ratings yet

- Syllabus For BBA (Hons.) Comprehensive ExamDocument5 pagesSyllabus For BBA (Hons.) Comprehensive Examking0027No ratings yet

- INVESTMENT ANALYSISDocument21 pagesINVESTMENT ANALYSISअक्षय गोयलNo ratings yet

- Chapter 1Document28 pagesChapter 1Audrey ConcepcionNo ratings yet

- Ug Courses - Affiliated Colleges (Choice Based Credit System) (With Effect From The Academic Year 2017-2018 Onwards)Document35 pagesUg Courses - Affiliated Colleges (Choice Based Credit System) (With Effect From The Academic Year 2017-2018 Onwards)Vinayaga MoorthyNo ratings yet

- Zero Hedge - On A Long Enough Timeline The Survival Rate For Everyone Drops To Zero PDFDocument5 pagesZero Hedge - On A Long Enough Timeline The Survival Rate For Everyone Drops To Zero PDFcaldaseletronica280No ratings yet

- Summer Project at Jainam.Document143 pagesSummer Project at Jainam.Soyeb JindaniNo ratings yet

- The Impact of Risk Based Audit on Financial Performance in Commercial Banks in KenyaDocument88 pagesThe Impact of Risk Based Audit on Financial Performance in Commercial Banks in KenyaAn NguyenNo ratings yet

- Mba Internship ReportDocument23 pagesMba Internship ReportAkshaySaxenaNo ratings yet

- ASX-SGX Failed Merger ProjectDocument21 pagesASX-SGX Failed Merger Projectameyapatkar1975No ratings yet

- CFA Magazine Jan - FebDocument60 pagesCFA Magazine Jan - FebHoàng MinhNo ratings yet

- Investor Herds and Oil Prices Evidence in The Gulf Coopera 2017 Central BankDocument13 pagesInvestor Herds and Oil Prices Evidence in The Gulf Coopera 2017 Central BankarciblueNo ratings yet

- Prospectus BedmuthaIndustriesDocument380 pagesProspectus BedmuthaIndustriesMurali KrishnaNo ratings yet

- Prospectus Gayatri Projects Limited PDFDocument258 pagesProspectus Gayatri Projects Limited PDFKishore KumarNo ratings yet

- Foreign Exchange Market: Operation and MechanicsDocument50 pagesForeign Exchange Market: Operation and Mechanicsronni gunadi sNo ratings yet