Professional Documents

Culture Documents

10-Asset Liability Management

Uploaded by

carltawiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10-Asset Liability Management

Uploaded by

carltawiaCopyright:

Available Formats

1

ASSET / LIABILITY

MANAGEMENT

2

Asset / Liability Management

Also known as asset-liability management, gap

management

Activity usually run in a Treasury Department of a

bank

Managed weekly or biweekly by a committee

Activity began in late 1970s as a result of high and

volatile interest rates

Banks assume much interest rate risk since they

borrow in one set of markets and lend in another

3

Asset / Liability Management

Measuring interest rate risk

Focus is on GAP , there are 3 types of GAPs.

Dollar Gap, Funds Gap, Repricing Gap

Maturity Gap

Duration Gap

4

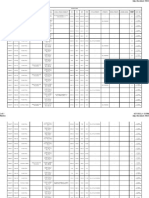

GAP

GAP

t

= RSA

t

RSL

t

where t = particular time interval

RSA

t

= $ of assets which are reset during

interval t, Rate-Sensitive-Assets

RSL

t

= $ of liabilities which are reset during

interval t, Rate-Sensitive-Liabilities

5

GAP

Example:

Bank with assets & liabilities of following

maturities

Days

0 60 61 90 91 120 121 - 180

Assets 10 0 40 20

Liabilities 20 5 30 50

GAP (A-L) -10 -5 10 -30

6

GAP

Example (cont.)

Cumulative GAP = C GAP

= GAP over whole period

C GAP = -10 5 + 10 30

= - 35

Note: If + GAP, then lose if rates fall

If GAP, then lose if rates rise

7

GAP

Federal Reserve has required banks to report

quarterly the repricing GAPs (schedule RC-J) as

follows:

1 day

2 day 3 months

over 3 months 6 months

over 6 months 1 year

over 1 year 5 year

over 5 year

8

GAP

Problems with GAP

1. Uses book-value approach: Focuses only on

income effect and not on capital gains effect

from rate changes.

2. Aggregation: Ignores distribution of

assets/liabilities within buckets could still

have mismatch

3. Runoffs ignored: Interest and principal paid

plus loan prepaid must be invested. This

feature is ignored.

9

Maturity Gap

Background

Consider a 1year bond with coupon 10% and YTM 10%

If rates increase to 11%

Conclude: If r| P+ AP / Ar < 0

100 + 0.10 100

1 + 0.10

P = = = 100

100 + 0.10 100

1 + 0.11

P = = = 99.10

110

1.10

110

1.11

10

Maturity Gap

Consider a 2 year bond

If rates increase to 11%

Price fell more than 1 year bond!

P = + = 100

110

1.10

2

10

1.10

P = + = 98.29

110

1.11

2

10

1.11

11

Maturity Gap

Conclusion:

The longer the maturity, the

greater the fall in price for a

given level increase in interest

rates.

12

Maturity Gap

Consider a 3 year bond

If rates increase to 11%

P = + + = 100

10

1.10

2

10

1.10

110

1.10

3

P = + + = 97.56

10

1.11

2

10

1.11

110

1.11

3

13

Maturity Gap

Notice Decline:

Time P0 Pn P0 Pn Pn1 Pn

1 yr 100 99.10 0.90 0.90

2 yr 100 98.29 1.71 0.81

3 yr 100 97.56 2.44 0.73

14

Maturity Gap

Conclude: The fall increases at a diminishing

rate as a function of maturity.

Maturity

AP

1

2 3

15

Maturity Gap

Now, these principles apply to

banks since they have portfolios

of interest-rate sensitive assets

and liabilities.

16

Maturity Gap

Let M

A

= W

A1

M

A1

+ W

A2

M

A2

+ + W

An

M

An

Where M

A

= average maturity of banks assets

M

Aj

= maturity of asset j

W

Aj

= market value of asset j as a % of total

asset market value

And M

L

= W

L1

M

L1

+ W

L2

M

L2

+ + W

Ln

M

Ln

Where M

L

= average maturity of banks liabilities

17

Maturity Gap

Then MG = M

A

M

L

For a minimum of interest rate risk, want: MG = 0

Typically, MG > 0 i.e. M

A

> M

L

Ex) Bank borrows at 1 yr deposit of $90 paying

10% and invests in $100 3 yr bond at 10% with

$10 of equity.

A L

B 100 90 D

10 E

18

Maturity Gap

Suppose rates rise to 11%, then 3 yr bond is

worth $97.56 (as before) and deposit is

worth

P = 99 / 1.11 = 89.19

Thus

Assets Liabilities

97.56 89.19

8.37

E = 97.56 89.19

AE = AA AL = 2.44 (0.81)

AE = 1.63

E = 10 1.63 = 8.37

19

Maturity Gap

Thus, equity must absorb interest-rate risk exposure.

Notice

MG = M

A

M

L

= 3 1 = 2

By previous propositions

If MG > 0

If r|, then bank will LOSE

If r+, then bank will GAIN

If MG < 0

If r|, then bank will GAIN

If r+, then bank will LOSE

20

Maturity Gap

At what rate change will bank become insolvent?

AE = 10 or AA AL = 10

Want:

If r 16% 12.07 (4.66) = 7.41

If r 17% 15.47 (5.38) = 10.09 YES!

+ + 100 [ 90] = 10

10

(1+x)

2

10

1 + x

110

(1+x)

3

99

1 + x

21

Maturity Gap

What if bank has matched with MG = 0, that is

invested in 1 yr bond, then

If r 11% from 10%

AA = 99.10 100 = 0.90

AL = 89.11 90 = 0.89

If r 12%

AA = 98.21 100 = 1.79

AL = 88.39 90 = 1.61

AE = 0.90 + 0.89 = 0.01

AE = 1.79 + 1.61 = 0.18

22

Maturity Gap

Setting MG = 0 does NOT insure one

completely from interest-rate risk but does

work quite well.

Reasons why some risk remains:

1. Amounts not matched (as before)

2. Timing of cash flows not considered

3. Rates may not move exactly together

Using a Duration Gap measure will resolve #2.

23

DURATION

Duration of an asset or liability is the

weighted-average time until cash flows are

received or paid.

The weights are the PV of each cash flow as

a % of the PV of all cash flows.

24

DURATION

= =

=

N

t

t

N

t

t

PV t PV D

1 1

Where N = last period of CF

CFt = cash flow at time t

PVt = CFt / (1+R)

t

R = yield on asset or liability

25

DURATION

Example:

Duration of 8% $1,000 6 year Euro-bond,

Eurobonds pay interest annually, yield is

8%.

26

DURATION

Example (cont.)

T CF

t

1/(1+R)

t

PV

t

PV

t

t

1 80 0.9259 74.07 74.07

2 80 0.8573 68.59 137.18

3 80 0.7938 63.51 190.53

4 80 0.7350 58.80 235.20

5 80 0.6806 54.45 272.25

6 1080 0.6302 680.58 4083.48

D = 4993.71 / 1000 = 4.993 years

27

DURATION

Features of Duration

1. Duration increases with maturity at a

decreasing rate.

0

) / (

<

A

A A A

M

M D

0 > A A M D

2. Duration increases as yield decreases.

0 / < A A R D

3. The higher the coupon, the lower the duration.

0 / < A A C D

28

DURATION

Consider a bond with annual coupon

payments C

or

N

R

F C

R

C

R

C

P

) 1 (

...

) 1 ( 1

2

+

+

+ +

+

+

+

=

=

+

=

N

t

t

t

R

C

P

1

) 1 (

29

DURATION

=

+

+

= =

A

A

N

t

t

t

R

tC

dR

dP

R

P

1

1

) 1 (

=

+ +

=

A

A

N

t

t

t

R

C

R

D

R

P

1

) 1 ( 1

= =

=

N

t

t

N

t

t

PV t PV D

1 1

Since and

t

t

t

R

CF

PV

) 1 ( +

=

Hence

R

R

D

P

P

+

A

=

A

1

30

DURATION

R

R

D

P

P

+

A

=

A

1

% Price Change

P

P A

R

R

+

A

1

0

Slope = D

31

DURATION

Example:

Consider 6 year Eurobond from before.

Recall D = 4.99

If yields rise 10 basis points

P

P A

= (4.99)(0.001/1.08) = 0.000462 = 0.0462%

If P=1000, price would fall to 999.538

32

DURATION

Example (cont):

For semi-annual payments, the equation

must be modified:

R

R

D

P

P

5 . 0 1+

A

=

A

R

R

D

P

P

+

A

=

A

1

Annual

Payment

33

DURATION

Example:

2 yr treasury with coupon of 8%, pays semi-

annually with price of $964.54, with face

value of $1000.

964.54 = + + +

40

(1+0.5R)

2

40

(1+0.5R)

40

(1+0.5R)

3

1040

(1+0.5R)

4

R = 0.10 yrs 89 . 1

54 . 964

37 . 1818

= =

P

t PV

D

t

34

DURATION GAP

Now we can apply these ideas to a bank.

Recall:

R

R

D

P

P

+

A

=

A

1

Now consider a bank and let:

A = value of assets

A A = change in value of assets

L = value of liabilities, excluding equity

A L = change in value of liabilities

35

DURATION GAP (Cont.)

Then,

) 1 ( R

R

D

A

A

A

+

A

=

A

Where, D

A

= weighted-average duration of the assets

=e

1

D

1

+ e

2

D

2

+ + e

n

D

n

e

i

= MV of asset i / total MV of assets

36

DURATION GAP (Cont.)

And for liabilities, we have the same:

) 1 ( R

R

D

L

L

L

+

A

=

A

Where, D

L

= e

1

D

1

+ e

2

D

2

+ + e

m

D

m

e

i

= MV of liability i / total MV of assets

37

DURATION GAP (Cont.)

Now, let

AE = AA AL

= - (D

A

A D

L

L) AR / (1+R)

So, AE / A = - DG AR / (1+R)

where DG = D

A

D

L

L / A

Duration Gap

AE = -DG A AR / (1+R)

38

DURATION GAP (Cont.)

Thus, the change in the net worth of a bank

depends on:

1. The duration gap of the bank (DG)

2. The size of the bank (A)

3. The size of the interest rate shock

(AR / (1+R))

39

DURATION GAP (Cont.)

Example:

Bank with D

A

= 5 years, D

L

= 3 years, R = 0.10,

A = $100 million, L = $90 million,

E = $10 million. If R 11%, what is effect on

net worth?

40

DURATION GAP (Cont.)

Example (cont.) :

AE = - (D

A

D

L

L/A) A AR / (1+R) = -$2.09 million

Thus, E : 10 million 7.91 million

Notice: AA = -D

A

A AR / (1+R) = -$4.55 million

AL = - D

L

L AR / (1+R) = -$2.46 million

41

DURATION GAP (Cont.)

Example (cont.) :

A L A L

100 90 95.45 87.54

10 7.91

Note: Both A and L fall with interest rate rise .

DG = 2.3 years

42

DURATION GAP (Cont.)

Thus,

If DG > 0 and R | bank lose

DG > 0 and R + bank gain

If DG < 0 and R | bank gain

DG < 0 and R + bank lose

Note: this is opposite to GAP = RSA RSL

if GAP > 0 and R | bank gain

Why?

43

DURATION GAP (Cont.)

Why? GAP in $ domain

DG in time domain

Want DG = 0 for fall protection, notice

DG = D

A

D

L

L / A

= D

A

D

L

(A K) / A where K = capital

= D

A

D

L

(1 k) where k = K/A

Duration depends directly on capital ratio!

DG = D

A

D

L

+ D

L

k DG | as k |

44

DURATION GAP (Cont.)

However, bank with more capital is better protected.

To see this, AE = -DG A AR / (1+R)

AE

E

=

-DG

A

E

AR

(1+R)

AE

E

=

-DG

1

k

AR

(1+R)

Thus, the larger the k, the smaller the % change in

equity will be.

45

DURATION GAP (Cont.)

Ex) In previous example,

AE / E = - 2.09 M / 10 M = -20.9%

Ex) Suppose same example except L = 95 M

So, K = 5, and k = 0.05

DG = D

A

D

L

(1 k) = 2.1

AE = - 1.95

E : 5 3.05

AE / E = - 2.15 1/0.05 0.01/1.10 = - 39.1%

or AE / E = -1.95/5 = -39%

46

DURATION GAP

Example: BANK

ASSETS AMT D LIABILITIES AMT D

ST Securities 150 0.5 DD 400 0

LT Securities 100 3.5 ST CDs 350 0.4

Loans Float 400 0 LT CDs 150 2.5

Loans Fixed 350 2 Equity 100

Total 1000 1000

47

DURATION GAP

Example: (continue)

D

A

=0.150.5+0.13.5+0.40+0.352=1.125 year

D

L

= 0+ 0.4+ 2.5=0.572 year

DG = D

A

D

L

= 1.125 0.572 0.9 = 0.6102

400

900

350

900

150

900

L

A

48

DURATION

Example: (continue)

If R = 0.08 0.08 0.09

AE

A

= DG

AR

1 + R

AE

A

= 0.6102 = 0.00565

0.01

1 + 0.08

AE = 0.00565 1000 = 5.65

E from 100 94.35

49

DURATION GAP

Although Duration Gap takes timing

of cash flows into account, there are

problems with its implementation and

use.

50

DURATION GAP

Problems with DG

1. Not easy to manipulate D

A

and D

L

. (reason for

using artificial hedges such as swaps, options, or

futures)

2. Immunization is a DYNAMIC problem. (i.e.,

requires constant rebalancing)

3. Large rate changes and convexity (model only

applies to small changes)

51

DURATION GAP

P

P A

R

R

+

A

1

Model

Actual

We are here

52

DURATION GAP

P

P A

R

R

+

A

1

Actual

Model

AR +

If AR > 0, DG overpredicts P decrease

53

DURATION GAP

If AR < 0, DG underpredicts P increase

P

P A

R

R

+

A

1

Actual

Model

AR

54

DURATION GAP

Problems with DG (Continue)

Convexity =

It can be measured.

Convexity is good for banks. They do better

as a result.

measure of curvature

of duration curve

55

DURATION GAP

Problems with DG (Continue)

4. Flat Term Structure. (Notice all rates R, implies

flat term structure. There are models which

make different assumptions.)

5. Non-Traded Assets. (Small business loans and

consumer loans have no market value estimates

as R changes.)

6. Not consider Default Risk or Prepayment Risk.

56

DURATION GAP

Problems with DG (Continue)

7. Duration of Equity. (Should equity be included?

POSSIBLY.)

To see this, using dividend growth model

d

1

= div in year 1

k = required return

g = growth rate in dividend

P

0

=

d

1

(k g)

57

DURATION GAP

Problems with DG (Continue)

Recall

R

R

D

P

P

+

A

=

A

1

or

P

R

dR

dP

P

R

R

P

R

R

P

P

D

+

=

+

A

A

=

A

+ A

=

1 1 1

but

2

1

) ( g k

d

dk

dP

dR

dP

= =

58

DURATION GAP

Problems with DG (Continue)

So

) (

) 1 (

) (

) 1 (

) (

1

2

1

2

1

g k

d

k

g k

d

P

k

g k

d

D

+

=

+

=

g k

k

D

+

=

1

Example:

Stock with k=10%, g=5%

D

= = 22 years

1.10

0.05

59

DURATION GAP

Problems with DG (Continue)

8. DD and Passbook savings Duration?

Must analyze runoff and turnover as well as rate

elasticity.

60

TYPES OF RISK FOR BANKS

1. Market risk

Equity price

Interest rate

2. Liquidity risk

3. Credit risk (default)

Use of credit derivatives

4. Operation risk

Technology

Processing

Legal

Regulatory

61

How to manage Interest Rate Risk

1. Do nothing

2. Attempt to set GAPs to zero

3. Derivatives

Forward contracts

Interest rate futures contracts (e.g. Eurodollar, TBill)

Option contracts (exchange-traded)

Exotic options (OTC)

4. Interest rate swaps

Plain-vanilla

Exotic

You might also like

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Compound InterestDocument20 pagesCompound InterestKarla Anexine ValenciaNo ratings yet

- Valuation of Fixed Income SecuritiesDocument29 pagesValuation of Fixed Income SecuritiesTanmay MehtaNo ratings yet

- 1 Business Mathemetics - AFB Module-ADocument22 pages1 Business Mathemetics - AFB Module-Awaste mailNo ratings yet

- Interest Rate Risk: Definition & ManagementDocument37 pagesInterest Rate Risk: Definition & ManagementThảo Nhi Đinh TrầnNo ratings yet

- Chap 9 Interest Rate Risk IIDocument123 pagesChap 9 Interest Rate Risk IIAfnan100% (2)

- Simple Annuity: General MathematicsDocument18 pagesSimple Annuity: General MathematicsAezcel SunicoNo ratings yet

- Problem Set 3 (Duration II) With AnswersDocument5 pagesProblem Set 3 (Duration II) With Answerskenny013No ratings yet

- Duration Model Explains Interest Rate RiskDocument28 pagesDuration Model Explains Interest Rate RiskRoger RogerNo ratings yet

- Mid Term Exam 2018-SolDocument6 pagesMid Term Exam 2018-SolDiego AguirreNo ratings yet

- Interest Rate Risk Measurement TechniquesDocument23 pagesInterest Rate Risk Measurement TechniquesDomingoFeriadoNo ratings yet

- Skinning FundsDocument12 pagesSkinning FundsNehemia T MasiyaziNo ratings yet

- CHAPTER 2 Discount Rate and Cash DiscountDocument10 pagesCHAPTER 2 Discount Rate and Cash DiscountKiki PurwaningsihNo ratings yet

- Team4 FmassignmentDocument10 pagesTeam4 FmassignmentruchirNo ratings yet

- Discounted Cash Flow Valuations: Time Value of Money.: An Example of Finding The Future Value and Present ValueDocument3 pagesDiscounted Cash Flow Valuations: Time Value of Money.: An Example of Finding The Future Value and Present ValueTolulope AkandeNo ratings yet

- CH2SOLUTIONS-AnswersProblemSetsDocument4 pagesCH2SOLUTIONS-AnswersProblemSetsandreaskarayian8972100% (4)

- Bond Value and ReturnDocument82 pagesBond Value and Returnbhaskar5377No ratings yet

- Adex 58K Special Topics in Finance: Valuation - Theory and PracticeDocument19 pagesAdex 58K Special Topics in Finance: Valuation - Theory and PracticeKivanc GocNo ratings yet

- A-Present Value For Real EstateDocument35 pagesA-Present Value For Real EstateSiva RamanNo ratings yet

- Capital Budgeting and FinancingDocument21 pagesCapital Budgeting and FinancingCérine AbedNo ratings yet

- 1 Valuing Cash FlowsDocument14 pages1 Valuing Cash FlowsdipanajnNo ratings yet

- Coporate FinanceDocument6 pagesCoporate Financeplayjake18No ratings yet

- Interest Rates and Bond Valuation: Solutions To Questions and ProblemsDocument7 pagesInterest Rates and Bond Valuation: Solutions To Questions and ProblemsFelipeNo ratings yet

- Bond Portfolio ManagementDocument90 pagesBond Portfolio ManagementAbhishek DuaNo ratings yet

- Day 4Document39 pagesDay 4Bikash GajurelNo ratings yet

- Chapter 10Document14 pagesChapter 10Beatrice ReynanciaNo ratings yet

- Lec 78 CH 7 S14Document9 pagesLec 78 CH 7 S14Li YuNo ratings yet

- Financial ratios and bond valuation calculationsDocument9 pagesFinancial ratios and bond valuation calculationsodie99No ratings yet

- Finance Chapter009 - Solutions AbcDocument3 pagesFinance Chapter009 - Solutions AbckysovutdaNo ratings yet

- UntitledDocument6 pagesUntitledShuHao ShiNo ratings yet

- 15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritiesDocument29 pages15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritieswelcometoankitNo ratings yet

- Time Value of Money ConceptsDocument76 pagesTime Value of Money ConceptsAmit KaushikNo ratings yet

- FIM Exercise AnsDocument6 pagesFIM Exercise AnsSam MNo ratings yet

- Bond Math Casepgdl01teamDocument8 pagesBond Math Casepgdl01teamFernando Carrillo AlejoNo ratings yet

- FM Textbook Solutions Chapter 8 Second EditionDocument11 pagesFM Textbook Solutions Chapter 8 Second EditionlibredescargaNo ratings yet

- ECOBAM Duration ExamplesDocument24 pagesECOBAM Duration ExamplesVenkatsubramanian R IyerNo ratings yet

- Yoliana - Measuring Interest Rate RiskDocument17 pagesYoliana - Measuring Interest Rate RiskyolianaaNo ratings yet

- DurationDocument36 pagesDurationnguyenlt22No ratings yet

- Solutions Review Problems Chap002Document4 pagesSolutions Review Problems Chap002andreaskarayian8972No ratings yet

- Solution MS 291 - Assignment 1 MUDocument4 pagesSolution MS 291 - Assignment 1 MUM HarisNo ratings yet

- Money Amp Amp BankingDocument15 pagesMoney Amp Amp BankingMaxim IgoshinNo ratings yet

- Chapter 12 Bond Portfolio MGMTDocument41 pagesChapter 12 Bond Portfolio MGMTsharktale2828No ratings yet

- Bond RiskDocument31 pagesBond RiskSophia ChouNo ratings yet

- Time Value of MoneyDocument20 pagesTime Value of MoneyAkashdeep SaxenaNo ratings yet

- Actuarial Notation: AnnuitiesDocument12 pagesActuarial Notation: AnnuitiesCallum Thain BlackNo ratings yet

- Pre-"Derivatives" Basics: 1.1.1 Time Value of MoneyDocument6 pagesPre-"Derivatives" Basics: 1.1.1 Time Value of MoneyowltbigNo ratings yet

- Ch09 Solations Brigham 10th EDocument12 pagesCh09 Solations Brigham 10th ERafay HussainNo ratings yet

- Ch10 Solutions 6thedDocument14 pagesCh10 Solutions 6thedMrinmay kunduNo ratings yet

- Mini CaseDocument18 pagesMini CaseZeeshan Iqbal0% (1)

- Finance Homework 1Document6 pagesFinance Homework 1Ardian Widi100% (1)

- Fund - Finance - Lecture 2 - Time Value of Money - 2011Document101 pagesFund - Finance - Lecture 2 - Time Value of Money - 2011lucipigNo ratings yet

- Week 3Document34 pagesWeek 3Fabrizio Da MotaNo ratings yet

- InterestRate ReviewSheetDocument2 pagesInterestRate ReviewSheetDinh TonNo ratings yet

- Actuarial Investigations Slides 1Document102 pagesActuarial Investigations Slides 1implus112No ratings yet

- Gap Dur AnalysesDocument8 pagesGap Dur AnalysesmanishapecNo ratings yet

- Chapter-3-Answers To Practice QuestionsDocument4 pagesChapter-3-Answers To Practice QuestionsqadirqadilNo ratings yet

- The Time Value of Money: 1 © 2007 Thomson/South-WesternDocument74 pagesThe Time Value of Money: 1 © 2007 Thomson/South-WesternNguyệtt HươnggNo ratings yet

- 14 Fixed Income Portfolio ManagementDocument60 pages14 Fixed Income Portfolio ManagementPawan ChoudharyNo ratings yet

- International Trade ServicesDocument76 pagesInternational Trade ServicescarltawiaNo ratings yet

- Law and Practice OutlinesDocument98 pagesLaw and Practice OutlinescarltawiaNo ratings yet

- The HeirDocument8 pagesThe HeircarltawiaNo ratings yet

- Law and Practice OutlinesDocument98 pagesLaw and Practice OutlinescarltawiaNo ratings yet

- Normal Trading FinanceDocument6 pagesNormal Trading FinancecarltawiaNo ratings yet

- Credit Origination and AppraisalDocument32 pagesCredit Origination and AppraisalcarltawiaNo ratings yet

- Financial Statement AnalysisDocument1 pageFinancial Statement AnalysiscarltawiaNo ratings yet

- Company LiquidationDocument9 pagesCompany LiquidationcarltawiaNo ratings yet

- Trip On A BoatDocument9 pagesTrip On A BoatcarltawiaNo ratings yet

- Cheques and the Paying BankDocument8 pagesCheques and the Paying BankcarltawiaNo ratings yet

- Assets and Liabilities Management - RisksDocument55 pagesAssets and Liabilities Management - RiskscarltawiaNo ratings yet

- ADR GhanaDocument121 pagesADR GhanacarltawiaNo ratings yet

- Credit Origination and AppraisalDocument36 pagesCredit Origination and AppraisalcarltawiaNo ratings yet

- Practice of Banking I Law and PracticeDocument171 pagesPractice of Banking I Law and Practicecarltawia100% (1)

- COSO - Effective Enterprise Risk Oversight The Role of The Board of Directors. (2009)Document4 pagesCOSO - Effective Enterprise Risk Oversight The Role of The Board of Directors. (2009)Sanath FernandoNo ratings yet

- Strategic Decision MakingDocument14 pagesStrategic Decision MakingSehar GulNo ratings yet

- A History of English LawDocument4 pagesA History of English LawcarltawiaNo ratings yet

- Collecting Bankers Duty of CareDocument2 pagesCollecting Bankers Duty of CareSa RojNo ratings yet

- 2005 009 Lord Denning and Judicial Role Pt2Document5 pages2005 009 Lord Denning and Judicial Role Pt2carltawiaNo ratings yet

- Commercial Bank Risk Management - An Analysis of ProcessDocument49 pagesCommercial Bank Risk Management - An Analysis of ProcessbboyvnNo ratings yet

- Treasury HandbookDocument137 pagesTreasury Handbookcarltawia100% (8)

- Risk Management - 2Document53 pagesRisk Management - 2Pravin LakudzodeNo ratings yet

- Term Paper On The Topic Monetary Policy of Nepal 2080 - 81 Aadhar Babu KhatiwadaDocument15 pagesTerm Paper On The Topic Monetary Policy of Nepal 2080 - 81 Aadhar Babu KhatiwadaPrashant GautamNo ratings yet

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocument14 pagesInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloLindaCruzykeaz100% (80)

- Bankruptcy of Lehman BrothersDocument12 pagesBankruptcy of Lehman Brothersavinash2coolNo ratings yet

- DTC REFERENCE SECURITIES Corporate and Municipal Issuers of DTC Eligible Securities Relying A Section 3 (C) (7) of The Investment Company ActDocument310 pagesDTC REFERENCE SECURITIES Corporate and Municipal Issuers of DTC Eligible Securities Relying A Section 3 (C) (7) of The Investment Company Actjacque zidane100% (1)

- Supplier Payments SampleDocument23 pagesSupplier Payments SampleAndhika Artha PrayudhaNo ratings yet

- EXCEL Lab ExerciseDocument20 pagesEXCEL Lab ExerciseMohit SainiNo ratings yet

- Pujita B Gaddi (10skcma044)Document17 pagesPujita B Gaddi (10skcma044)Pramod ShekarNo ratings yet

- Corporate Strategy - Plan For A Diversified CompanyDocument49 pagesCorporate Strategy - Plan For A Diversified CompanyRavi GuptaNo ratings yet

- Art. 1416 TMBC Vs SilverioDocument4 pagesArt. 1416 TMBC Vs SilverioBam BathanNo ratings yet

- Soy Flour Project Report SummaryDocument8 pagesSoy Flour Project Report SummaryAkhilesh KumarNo ratings yet

- Take Home Quiz - UASDocument2 pagesTake Home Quiz - UASMonalusiNo ratings yet

- Engineering EconomyDocument18 pagesEngineering EconomyWesam abo HalimehNo ratings yet

- CIR vs. Shinko Elec. Industries Co., LTDDocument5 pagesCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNo ratings yet

- Jackson Automotive Financial Crisis RecoveryDocument3 pagesJackson Automotive Financial Crisis RecoveryErika Theng25% (4)

- Sailendra Yak TSA Presentation EnglishDocument36 pagesSailendra Yak TSA Presentation EnglishInternational Consortium on Governmental Financial Management100% (1)

- Capital Gains Tax (CGT) RatesDocument15 pagesCapital Gains Tax (CGT) RatesMargaretha PaulinaNo ratings yet

- 10 HowToPredictForexBWDocument6 pages10 HowToPredictForexBWWihartono100% (1)

- Finance - Cost of Capital TheoryDocument30 pagesFinance - Cost of Capital TheoryShafkat RezaNo ratings yet

- Chapter 17 Homework ProblemsDocument5 pagesChapter 17 Homework ProblemsAarti JNo ratings yet

- PrivatizationDocument69 pagesPrivatizationgakibhaiNo ratings yet

- Finnifty Sum ChartDocument5 pagesFinnifty Sum ChartchinnaNo ratings yet

- Ringkasan Saham-20201120Document64 pagesRingkasan Saham-2020112012gogNo ratings yet

- Presentation On The Topic of Theory of Journal, Trial and LedgerDocument20 pagesPresentation On The Topic of Theory of Journal, Trial and LedgerharshitaNo ratings yet

- GST Past Exam AnalysisDocument17 pagesGST Past Exam AnalysisSuraj PawarNo ratings yet

- Letter of IntentDocument5 pagesLetter of Intentpugnat100% (1)

- Special Proceedings Outline: Rules on Estates, Wills, and SuccessionDocument7 pagesSpecial Proceedings Outline: Rules on Estates, Wills, and SuccessionRuperto A. Alfafara IIINo ratings yet

- Donor S TaxDocument68 pagesDonor S TaxLuna CakesNo ratings yet

- March PDFDocument4 pagesMarch PDFzaidaan khanNo ratings yet

- MBA (Financial Services)Document36 pagesMBA (Financial Services)Prajwal BhattNo ratings yet

- HDocument21 pagesHFaizal KhanNo ratings yet