Professional Documents

Culture Documents

Cost Volume Profit Analysis

Uploaded by

VanityHughOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Volume Profit Analysis

Uploaded by

VanityHughCopyright:

Available Formats

COST-VOLUME-PROFIT

ANALYSIS

Problem 1. Contribution Margin

Let us say:

Unit Sales Price

Unit Variable Costs

Total Fixed Costs

Units Sold

P200

120

400,000

8,000

What would be:

a.

Unit contribution margin, contribution margin ratio, and variable

cost ratio

b.

Break-even point in units and pesos

c.

Margin of safety in units and in pesos, and the margin of safety ratio

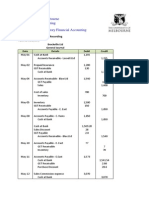

Unit Contribution Margin, Contribution

Margin Ratio, and Variable Cost Ratio

Units

Unit Prices

Amount

Ratio

Sales

8,000

200

1,600,000

100

Less: Variable Costs

8,000

120

960,000

60

Contribution Margin

8,000

80

640,000

40

Less: Fixed Costs

400,000

Operating Income

240,000

Break-even Point in Units and Pesos

BEP = Fixed Costs / Contribution Margin per unit

BEP = 400,000 / 80 = 5,000 units

BEP = 400,000 / 40% = P1,000,000

*it should be observed that at Break-even point, total

contribution margin equals total fixed costs

Margin of Safety in Units and

Pesos, Margin of Safety Ratio

Amount

Percentage

Budgeted Sales

(8,000 units x 200)

1,600,000

100.00

Less: Break-even Sales

1,000,000

62.50

600,000

37.50

Margin of Safety

Problem 2. Estimating Sales with Profit

To illustrate, let us say:

Unit Sales Price

Unit Variable Costs

Total Fixed Costs

P400

240

P800,000

How much is sales if profit is expressed as:

a. Income before tax of P400,000

b. Income after tax of P480,000, tax rate is 40%

c. 20% of sales

d. P25 per unit

Income before Tax of P400,000

() =

800,000:400,000

160

= 7,500

= 7,500 400

= 3,000,000

Income After Tax of 480,000, Tax Rate = 40%

:(1 )

() =

=

480,000

0.60

800,000:

160

= 10,000

= 10,000 400

= 4,000,000

20% of Sales

=

=

800,000

0.40;0.20

= 4,000,000

Profit per unit = P25

=

=

800,000

160 ;25

= 5,926

Problem 3. Composite Breakeven Point (Multi-Product Sales)

Consider the following data:

Products

Unit Sales Price

P 400

P 600

P700

100

350

500

Unit Variable Costs

Sales Mix

Total Fixed Costs,

P 795,000

Compute the:

a. Composite Break-even Point (CBEP) in units and pesos

b. Allocated CBEP

c. Sales per mix

Composite Break-even Point

(CBEP) in Units and Pesos

=

=

795,000

265

= 3,000

=

=

795,000

50.9615%

= 1,560,000

Allocated CBEP

CBEP Allocation

A = 3,000 x 5/10 = 1,500

B = 3,000 x 3/10 =

900

C = 3,000 x 2/10 =

600

CBEP

3,000

Sales Per Mix

795,000

2,650

The composite beak-even point would be

A = 300 units x 5 = 1,500 units

B = 300 units x 3 = 900 units

C = 300 units x 2 = 600 units

You might also like

- Cost-Volume-Profit Analysis: ACCT112: Management AccountingDocument36 pagesCost-Volume-Profit Analysis: ACCT112: Management AccountingSwastik AgarwalNo ratings yet

- June 1, 2007 June 30, 2007Document2 pagesJune 1, 2007 June 30, 2007አረጋዊ ሐይለማርያምNo ratings yet

- CH 22 Exercises ProblemsDocument3 pagesCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- 2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Document7 pages2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Ali MohammedNo ratings yet

- Natnael Wolde Advanced Financial AccountingDocument7 pagesNatnael Wolde Advanced Financial Accountingሔርሞን ይድነቃቸው100% (1)

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- CH 06Document74 pagesCH 06Mohammed Samy100% (1)

- A-2 Final Review 15-16 KeyDocument10 pagesA-2 Final Review 15-16 KeydanNo ratings yet

- Session 6 - Process Costing: Multiple ChoiceDocument10 pagesSession 6 - Process Costing: Multiple Choiceatty lesNo ratings yet

- CVP AssignmentDocument5 pagesCVP AssignmentAccounting MaterialsNo ratings yet

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- Process Costing: True / False QuestionsDocument226 pagesProcess Costing: True / False QuestionsElaine Gimarino100% (1)

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- Chapter 13-Inv Center TranspferpricingDocument41 pagesChapter 13-Inv Center TranspferpricingKaren hapukNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Exercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Document2 pagesExercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Chryshelle LontokNo ratings yet

- Management Accounting 07-12-2007 Vragen Antwoorden (IBA)Document14 pagesManagement Accounting 07-12-2007 Vragen Antwoorden (IBA)kipkingleNo ratings yet

- Part A 3 Target CostingDocument9 pagesPart A 3 Target CostingJohn ElliottNo ratings yet

- Prepare A Statement of Partnership Liquidation,...Document3 pagesPrepare A Statement of Partnership Liquidation,...Alene AmsaluNo ratings yet

- Mock BoardDocument9 pagesMock BoardChristian Rey Sandoval DelgadoNo ratings yet

- Problem 1 - 5-6Document4 pagesProblem 1 - 5-6Lowellah Marie BringasNo ratings yet

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- Brkeven Ex2 PDFDocument1 pageBrkeven Ex2 PDFSsemakula Frank0% (1)

- Intangible AssetsDocument24 pagesIntangible AssetsSummer StarNo ratings yet

- Ace 202Document4 pagesAce 202bacad lyca jaynNo ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- CVP ActivityDocument7 pagesCVP ActivityANSLEY CATE C. GUEVARRANo ratings yet

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- Activity-Based Costing: Learning ObjectivesDocument39 pagesActivity-Based Costing: Learning Objectiveskashif aliNo ratings yet

- Chap7vanderbeck ReviewerDocument8 pagesChap7vanderbeck ReviewerSaeym SegoviaNo ratings yet

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jainNo ratings yet

- Quiz 1Document8 pagesQuiz 1alileekaeNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Case Study CVP AnalysisDocument6 pagesCase Study CVP AnalysisIdha RahmaNo ratings yet

- Chapter 4 SI WorksheetDocument5 pagesChapter 4 SI WorksheetFoster PerryNo ratings yet

- Problems On Flexible BudgetDocument3 pagesProblems On Flexible BudgetsafwanhossainNo ratings yet

- Accounting 202 Chapter 14 TestDocument2 pagesAccounting 202 Chapter 14 TestLương Thế CườngNo ratings yet

- Process Costing and Hybrid Product-Costing SystemsDocument17 pagesProcess Costing and Hybrid Product-Costing SystemsWailNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- Cost AccumulationDocument5 pagesCost AccumulationAccounting Files0% (1)

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Reviewer in Cost Accounting (Midterm)Document11 pagesReviewer in Cost Accounting (Midterm)Czarhiena SantiagoNo ratings yet

- INSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksDocument2 pagesINSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksSUPPLYOFFICE EVSUBCNo ratings yet

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocument17 pagesACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNo ratings yet

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- 1 Managerial Accounting General ConceptsDocument3 pages1 Managerial Accounting General ConceptsKuya ANo ratings yet

- High Low MethodDocument4 pagesHigh Low MethodMwandoza MnyiphapheiNo ratings yet

- Assignment - Cost BehaviorsDocument11 pagesAssignment - Cost BehaviorsMary Antonette LastimosaNo ratings yet

- Accounting For Labor ExercisesDocument6 pagesAccounting For Labor ExercisesNichole Joy XielSera TanNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanNo ratings yet

- Chapter 1 Cost Accounting Information For Decision MakingDocument5 pagesChapter 1 Cost Accounting Information For Decision MakingLorren K GonzalesNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Fair ValueDocument8 pagesFair Valueiceman2167No ratings yet

- Chap 6Document54 pagesChap 6Jose Martin Castillo Patiño100% (1)

- CVP Analysis: Management AccountingDocument46 pagesCVP Analysis: Management AccountingAngelo CastilloNo ratings yet

- CVP AnalysisDocument33 pagesCVP AnalysisnamuNo ratings yet

- Profit Planning and CVP AnalysisDocument33 pagesProfit Planning and CVP AnalysisVanessa Claire MontalbanNo ratings yet

- CVP AnalysisDocument18 pagesCVP AnalysisAlexander GordonNo ratings yet

- Noob Case Digest - Republic Vs Marcos Case Digest G.R. Nos. 130371 &130855 August 4, 2009Document3 pagesNoob Case Digest - Republic Vs Marcos Case Digest G.R. Nos. 130371 &130855 August 4, 2009VanityHughNo ratings yet

- En Banc JULY 3, 2018 G.R. No. 232395 Pedro S. Agcaoili, JR Vs - The Honorable Representative Rodolfo C. Farinas Decision Tijam, J.Document5 pagesEn Banc JULY 3, 2018 G.R. No. 232395 Pedro S. Agcaoili, JR Vs - The Honorable Representative Rodolfo C. Farinas Decision Tijam, J.VanityHughNo ratings yet

- RR No. 6-2019 - IRR Estate Tax AmnestyDocument5 pagesRR No. 6-2019 - IRR Estate Tax AmnestyAlexander Julio ValeraNo ratings yet

- Constitutional Law I 321. Guingona Vs CaragueDocument2 pagesConstitutional Law I 321. Guingona Vs CaragueVanityHugh100% (1)

- 85.NPC v. CA DigestDocument3 pages85.NPC v. CA DigestVanityHugh100% (1)

- Resident Marine Mammals of The Protected Seascape Tanon Strait v. Secretary Angelo Reyes G.R. No. 180771 (April 21, 2015) Leonen, J.: FactsDocument3 pagesResident Marine Mammals of The Protected Seascape Tanon Strait v. Secretary Angelo Reyes G.R. No. 180771 (April 21, 2015) Leonen, J.: FactsVanityHughNo ratings yet

- Makasiar, J P: Topic: Grossly Immoral Act Facts:: REYES V. WONG - Case No. 16Document3 pagesMakasiar, J P: Topic: Grossly Immoral Act Facts:: REYES V. WONG - Case No. 16VanityHughNo ratings yet

- 245 Reyes Vs ComelecDocument2 pages245 Reyes Vs ComelecVanityHughNo ratings yet

- Marinduque V CADocument2 pagesMarinduque V CAVanityHughNo ratings yet

- Torres, J.:: SyllabusDocument3 pagesTorres, J.:: SyllabusVanityHughNo ratings yet

- PP v. Dela CernaDocument11 pagesPP v. Dela CernaVanityHughNo ratings yet

- Supreme Court: Frisco T. Lilagan For PetitionerDocument8 pagesSupreme Court: Frisco T. Lilagan For PetitionerVanityHughNo ratings yet

- Mabanag vs. Lopez VitoDocument3 pagesMabanag vs. Lopez VitoRomeo Dator Sucaldito Jr.100% (2)

- Bondoc Vs PinedaDocument2 pagesBondoc Vs PinedaVanityHughNo ratings yet

- En Banc: Constitutional Law I 322. PCA Vs EnriquezDocument4 pagesEn Banc: Constitutional Law I 322. PCA Vs EnriquezVanityHughNo ratings yet

- 85.NPC v. CA DigestDocument3 pages85.NPC v. CA DigestVanityHugh100% (1)

- Tolentino VS Sec 1994Document2 pagesTolentino VS Sec 1994Romeo Dator Sucaldito Jr.No ratings yet

- Marinduque V CADocument2 pagesMarinduque V CAVanityHughNo ratings yet

- Tan v. People 313 SCRA 220Document6 pagesTan v. People 313 SCRA 220Khristine Ericke De MesaNo ratings yet

- En Banc Joker P. Arroyo, Et Al V. Jose de Venecia, Et Al (G.R. No. 127255, August 14, 1997) Mendoza, J. FactsDocument2 pagesEn Banc Joker P. Arroyo, Et Al V. Jose de Venecia, Et Al (G.R. No. 127255, August 14, 1997) Mendoza, J. FactsVanityHughNo ratings yet

- Makasiar, J P: Topic: Grossly Immoral Act Facts:: REYES V. WONG - Case No. 16Document3 pagesMakasiar, J P: Topic: Grossly Immoral Act Facts:: REYES V. WONG - Case No. 16VanityHughNo ratings yet

- RP v. de Knecht DigestDocument3 pagesRP v. de Knecht DigestVanityHughNo ratings yet

- Farinas VS ExecDocument2 pagesFarinas VS ExecVanityHugh100% (1)

- En Banc Rodolfo C. Fariñas V. The Executive Secretary (G.R. No. 147387, December 10, 2003) Callejo, SR., J. FactsDocument2 pagesEn Banc Rodolfo C. Fariñas V. The Executive Secretary (G.R. No. 147387, December 10, 2003) Callejo, SR., J. FactsVanityHughNo ratings yet

- Tolentino vs. SecretaryDocument2 pagesTolentino vs. SecretaryVanityHughNo ratings yet

- Nunez V Sandiganbayan Case Digest With PD 1606Document11 pagesNunez V Sandiganbayan Case Digest With PD 1606VanityHugh100% (2)

- RP v. de Knecht DigestDocument3 pagesRP v. de Knecht DigestVanityHughNo ratings yet

- Abakada v. PurisimaDocument2 pagesAbakada v. PurisimaVanityHughNo ratings yet

- 244 Bello Vs ComelecDocument2 pages244 Bello Vs ComelecVanityHugh100% (1)

- Philippine Judges Association Vs PradoDocument1 pagePhilippine Judges Association Vs PradoLuna Baci100% (1)

- This Study Resource Was: Problem 1Document5 pagesThis Study Resource Was: Problem 1xicoyiNo ratings yet

- Aacctg For Bus CombDocument8 pagesAacctg For Bus CombMaurice AgbayaniNo ratings yet

- AKL 2 - Tugas 4 Marselinus A H T (A31113316)Document5 pagesAKL 2 - Tugas 4 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- 5.7 AA Asset Fiscal Year Closing - AJABDocument9 pages5.7 AA Asset Fiscal Year Closing - AJABvaishaliak2008No ratings yet

- Audit Program-MSBPLDocument21 pagesAudit Program-MSBPLTasdik MahmudNo ratings yet

- Management Accountant June-2016Document124 pagesManagement Accountant June-2016ABC 123No ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Quizzer #8 PPEDocument13 pagesQuizzer #8 PPEAseya CaloNo ratings yet

- Tally Syllabus: 1. Basics of AccountingDocument4 pagesTally Syllabus: 1. Basics of AccountingijrailNo ratings yet

- Module 4 - Business SustainabilityDocument16 pagesModule 4 - Business SustainabilityAbelNo ratings yet

- Trial Balance - PoaDocument9 pagesTrial Balance - PoaStrawberryNo ratings yet

- Soal Process Costing 1Document5 pagesSoal Process Costing 1Mita PutryanaNo ratings yet

- 1 s2.0 S0957178716301151 MainDocument16 pages1 s2.0 S0957178716301151 MainFlor De Maria Rodriguez SucapucaNo ratings yet

- Acctg5 C15 Summary Error CorrectionDocument2 pagesAcctg5 C15 Summary Error CorrectionJan Anthony Carlo GuevaraNo ratings yet

- Activity 1Document7 pagesActivity 1Joanah TayamenNo ratings yet

- A Study On Fixed Asset ManagementDocument8 pagesA Study On Fixed Asset ManagementShrid GuptaNo ratings yet

- Director CFO Controller in San Francisco Bay CA Resume Herbert GottliebDocument2 pagesDirector CFO Controller in San Francisco Bay CA Resume Herbert GottliebHerbertGottliebNo ratings yet

- BADVAC2X - MOD 1 Partnership FormationDocument4 pagesBADVAC2X - MOD 1 Partnership FormationAlice WuNo ratings yet

- A Study On Responsibility Accounts On StakeholdersDocument6 pagesA Study On Responsibility Accounts On StakeholdersresearchparksNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- MonteBianco-Solution - With Comments and AlternativesDocument27 pagesMonteBianco-Solution - With Comments and AlternativesGiudittaBiancaLuràNo ratings yet

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocument9 pagesIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelNo ratings yet

- End of Chapter 1 Exercises - Toralde, Ma - Kristine E.Document7 pagesEnd of Chapter 1 Exercises - Toralde, Ma - Kristine E.Kristine Esplana ToraldeNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument76 pagesAnalysis and Interpretation of Financial StatementsSufyan Sadiq60% (5)

- Cover Letter Sample For A New College Grad JobDocument6 pagesCover Letter Sample For A New College Grad JobJoo GabrielNo ratings yet

- Arup Sinha. Topic - ACI Ltd.Document49 pagesArup Sinha. Topic - ACI Ltd.pranta senNo ratings yet

- Chapter 4 - Audit PlanningDocument43 pagesChapter 4 - Audit PlanningMy DgNo ratings yet

- Financial Accounting WorkbookDocument91 pagesFinancial Accounting Workbookkea padua100% (1)

- BSA 3102 Management Accounting PRELIMS PDFDocument20 pagesBSA 3102 Management Accounting PRELIMS PDFRyzel BorjaNo ratings yet