Professional Documents

Culture Documents

Financial Assets, Money, Financial Transactions, and Financial Institutions

Uploaded by

kashifhanif2412860 ratings0% found this document useful (0 votes)

67 views8 pagesFinancial assets promise future returns to their owners and serve as a store of value. Debt securities entitle their holders to a priority claim over the holders of equities. Investment institutions sell shares to the public and invest the proceeds in stocks, bonds, and mutual funds.

Original Description:

Original Title

Lec 2; Chap02

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial assets promise future returns to their owners and serve as a store of value. Debt securities entitle their holders to a priority claim over the holders of equities. Investment institutions sell shares to the public and invest the proceeds in stocks, bonds, and mutual funds.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views8 pagesFinancial Assets, Money, Financial Transactions, and Financial Institutions

Uploaded by

kashifhanif241286Financial assets promise future returns to their owners and serve as a store of value. Debt securities entitle their holders to a priority claim over the holders of equities. Investment institutions sell shares to the public and invest the proceeds in stocks, bonds, and mutual funds.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

Chapte

2

r Financial Assets, Money,

Financial Transactions, and

Financial Institutions

Money and Capital Markets

Financial Institutions and Instruments in a Global Marketplace

Eighth Edition

Peter S. Rose

McGraw Hill / Irwin Slides by Yee-Tien (Ted) Fu

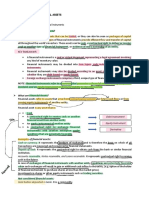

The Creation of Financial Assets

A financial asset is …

a claim against the income or wealth

of a business firm, household, or unit

of government,

represented usually by a certificate,

receipt, computer record file, or other

legal document,

and usually created by or related to

the lending of money.

Characteristics of Financial

Assets

Financial assets are required because

they promise future returns to their

owners and serve as a store of value

(purchasing power).

Characteristics of Financial

Assets

They do not depreciate like physical

goods, and their physical condition or form

is usually not relevant in determining their

market value.

Their cost of transportation and storage

is low, such that they have little or no value

as a commodity.

Financial assets are fungible – they can

easily be changed in form and substituted

for other assets.

Different Kinds of Financial

Assets

Any financial asset that is generally

accepted in payment for the purchases of

goods and services is a form of money.

Examples include currency and checking

accounts.

Equities represent ownership shares in a

business firm and are claims against the

firm’s profits and proceeds from the sale of

its assets. Common stock and preferred

stock are equities.

Different Kinds of Financial

Assets

Debt securities entitle their holders to a

priority claim over the holders of equities to

the assets and income of an economic unit.

They are either negotiable or

nonnegotiable. Examples include bonds,

notes, accounts payable, and savings

deposits.

Derivatives have a market value that is tied

to or influenced by the value or return on a

financial asset. Examples include futures

contracts, options, and swaps.

Classification of Financial

Institutions

Depository institutions derive the bulk of

their loanable funds from deposit accounts

sold to the public.

Commercial banks, savings and loan

associations, savings banks, credit unions.

Contractual institutions attract funds by

offering legal contracts to protect the saver

against risk.

Insurance companies, pension funds.

Classification of Financial

Institutions

Investment institutions sell shares to

the public and invest the proceeds in

stocks, bonds, and other assets.

Investment companies, money market

funds, real estate investment trusts.

You might also like

- How To Start A BusinessDocument30 pagesHow To Start A BusinessTermDefined80% (5)

- RosewoodDocument5 pagesRosewoodkyleplattner100% (2)

- Chapter 1 Introduction To Financial ManagementDocument22 pagesChapter 1 Introduction To Financial ManagementMikaella Adriana GoNo ratings yet

- 1st Part Outline InsuranceDocument12 pages1st Part Outline InsuranceCharmila SiplonNo ratings yet

- Financial Assets, Money, Financial Transactions, CH2Document51 pagesFinancial Assets, Money, Financial Transactions, CH2jaelou09100% (1)

- Bank PP Handout-Ch01Document10 pagesBank PP Handout-Ch01Frew Abebe100% (1)

- Module3 1 PDFDocument85 pagesModule3 1 PDFlalu0123100% (1)

- Indoor Plant QuestionnaireDocument4 pagesIndoor Plant Questionnairekashifhanif241286No ratings yet

- Sapm Full Unit Notes PDFDocument112 pagesSapm Full Unit Notes PDFnandhuNo ratings yet

- Qualities of Sucessful Investing: (Pick The Date)Document20 pagesQualities of Sucessful Investing: (Pick The Date)Manoj ThadaniNo ratings yet

- FM 8 Module 2 Multinational Financial ManagementDocument35 pagesFM 8 Module 2 Multinational Financial ManagementJasper Mortos VillanuevaNo ratings yet

- Statement of AccountDocument3 pagesStatement of AccountJohar Safana50% (4)

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (2)

- FIN - 605 - Lecture NotesDocument195 pagesFIN - 605 - Lecture NotesDebendra Nath PanigrahiNo ratings yet

- Purchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390Document1 pagePurchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390IzzathNo ratings yet

- Amira Berdikari - Jurnal Khusus - Hanifah Hilyah SyahDocument9 pagesAmira Berdikari - Jurnal Khusus - Hanifah Hilyah Syahreza hariansyah100% (1)

- A Study On Technical Analysi in Selected Sectors at Karvy Stock Broking LTD., HubliDocument81 pagesA Study On Technical Analysi in Selected Sectors at Karvy Stock Broking LTD., HublighbdgbgdbNo ratings yet

- A Comparative Study of Home Loan Schemes of Private Sector Banks Public Sector BanksDocument12 pagesA Comparative Study of Home Loan Schemes of Private Sector Banks Public Sector BanksKapil KumarNo ratings yet

- Instant Download Ebook PDF Finance Applications and Theory 5th Edition by Marcia Cornett PDF ScribdDocument41 pagesInstant Download Ebook PDF Finance Applications and Theory 5th Edition by Marcia Cornett PDF Scribdannie.kahn136100% (39)

- Economic Functions of The Financial InstitutionsDocument3 pagesEconomic Functions of The Financial InstitutionsKemotherapy LifesucksNo ratings yet

- CHAPTER ONE Fi&m InfolinkDocument10 pagesCHAPTER ONE Fi&m InfolinkmuluNo ratings yet

- CH 2Document13 pagesCH 2LIKENAWNo ratings yet

- Chapter 4 - Review QuestionsDocument17 pagesChapter 4 - Review QuestionsNicole AgostoNo ratings yet

- 2 Financial Assets and MarketsDocument42 pages2 Financial Assets and MarketsM-Faheem AslamNo ratings yet

- Business Finance Week 2 3Document44 pagesBusiness Finance Week 2 3Grazelle FrancoNo ratings yet

- What Is A Financial AssetDocument2 pagesWhat Is A Financial AssetYhamNo ratings yet

- Understanding A Financial AssetDocument7 pagesUnderstanding A Financial AssetShahbaz NoorNo ratings yet

- Define Finance: Finance Is Defined As The Management of Money and IncludesDocument5 pagesDefine Finance: Finance Is Defined As The Management of Money and IncludesGil TeodosipNo ratings yet

- Financial Institutions and Markets Chapter1Document26 pagesFinancial Institutions and Markets Chapter1Mintayto TebekaNo ratings yet

- Business FinanceDocument3 pagesBusiness Financepauline cunananNo ratings yet

- Chapter 1, 2, 3, 4 Investment Analysis and Portfolio Management SSSSSSDocument12 pagesChapter 1, 2, 3, 4 Investment Analysis and Portfolio Management SSSSSSSalman KhanNo ratings yet

- # Fin. Market Chapter 4Document4 pages# Fin. Market Chapter 4Kanbiro OrkaidoNo ratings yet

- Lesson 3Document2 pagesLesson 3Safh SalazarNo ratings yet

- Financial Markets - Chapter 1 PDFDocument19 pagesFinancial Markets - Chapter 1 PDFBuzon Kyle BluNo ratings yet

- Chapter 1 FimDocument11 pagesChapter 1 FimRobel AddisNo ratings yet

- FMI Unit 1Document34 pagesFMI Unit 1Raman KumarNo ratings yet

- InvestmentDocument19 pagesInvestmentvenu457No ratings yet

- Security Analysis Midterm TopicDocument5 pagesSecurity Analysis Midterm TopicJames Herl Y VirtudazoNo ratings yet

- Investment MGMT - CH1Document13 pagesInvestment MGMT - CH1bereket nigussieNo ratings yet

- Economics 122: Financial Economi Cs (Lecture 1) M. Debuque - G Onz Ales AY2014 - 201 5Document24 pagesEconomics 122: Financial Economi Cs (Lecture 1) M. Debuque - G Onz Ales AY2014 - 201 5cihtanbioNo ratings yet

- Chap1 Concepts in Review - AleDocument14 pagesChap1 Concepts in Review - AleAubrey AleNo ratings yet

- Financial CapitalDocument7 pagesFinancial Capitaljackie555No ratings yet

- Chap001 Why Are Financial Intermediary ImportantDocument38 pagesChap001 Why Are Financial Intermediary ImportantSreynak SemNo ratings yet

- Chapter 1 Financial System OverviewDocument44 pagesChapter 1 Financial System OverviewLakachew GetasewNo ratings yet

- Financial Institutions Ch-1Document28 pagesFinancial Institutions Ch-1Shimelis Tesema100% (1)

- Financial Assets MarketDocument4 pagesFinancial Assets MarketShellian CunninghamNo ratings yet

- A Study On Trading Financial Instruments111Document19 pagesA Study On Trading Financial Instruments111Rajendra NishadNo ratings yet

- MODULE 1 Lecture Notes (Jeff Madura)Document4 pagesMODULE 1 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- Chapter 1 Financial System OverviewDocument44 pagesChapter 1 Financial System OverviewTamrat KindeNo ratings yet

- Lesson 2Document3 pagesLesson 2CjNo ratings yet

- Fin Inst & Cap Markt Short NotesDocument61 pagesFin Inst & Cap Markt Short NotesASHENAFI GIZAWNo ratings yet

- Investment Is The Commitment ofDocument4 pagesInvestment Is The Commitment ofPraveen SaNo ratings yet

- BAP 4 Capital Market L1-3Document17 pagesBAP 4 Capital Market L1-3Mabel Jean RambunayNo ratings yet

- 1.1. The Role of Financial System in The EconomyDocument5 pages1.1. The Role of Financial System in The EconomyKanbiro OrkaidoNo ratings yet

- Foundations of Finance - Money and CapitalDocument5 pagesFoundations of Finance - Money and CapitalCallum MatthewNo ratings yet

- Security AnalysisDocument7 pagesSecurity AnalysisSandeep KaleNo ratings yet

- Financial Markets and InstitutionsDocument31 pagesFinancial Markets and Institutionsqueen estevesNo ratings yet

- Saint Mary'S University: Faculty of Accounting and FinanceDocument10 pagesSaint Mary'S University: Faculty of Accounting and FinanceruhamaNo ratings yet

- Saint Mary'S University: Faculty of Accounting and FinanceDocument10 pagesSaint Mary'S University: Faculty of Accounting and FinanceruhamaNo ratings yet

- Tutorial 1 SolutionsDocument4 pagesTutorial 1 SolutionsnatashaNo ratings yet

- Chapter 4 - Review Questions 1Document8 pagesChapter 4 - Review Questions 1Mizzy FernandezNo ratings yet

- Understanding Investment and Financial MarketDocument12 pagesUnderstanding Investment and Financial MarketPrecious JoyNo ratings yet

- Acc104 - Assignment 1Document2 pagesAcc104 - Assignment 1CLEVERAINE ANYA MATRONo ratings yet

- Functions:: Financial InstitutionsDocument3 pagesFunctions:: Financial InstitutionskimNo ratings yet

- The Cost of Long-Term Resources: Financial ManagementDocument19 pagesThe Cost of Long-Term Resources: Financial ManagementFeenyxNo ratings yet

- 01 Role of Financial Markets and Institutions GRCDocument13 pages01 Role of Financial Markets and Institutions GRCJohanna Nina UyNo ratings yet

- Capital InvestmentDocument22 pagesCapital InvestmentAryan AzimNo ratings yet

- Financial Assets VsDocument4 pagesFinancial Assets Vsm.g.sh0011No ratings yet

- Financial Institutions, Markets, & Money, 10 Edition: Power Point Slides ForDocument56 pagesFinancial Institutions, Markets, & Money, 10 Edition: Power Point Slides Forsamuel debebeNo ratings yet

- Module1 FAR1 MergedDocument53 pagesModule1 FAR1 MergedKin LeeNo ratings yet

- The Financial System (FFM)Document10 pagesThe Financial System (FFM)ALLONA BATONGHINOGNo ratings yet

- Let'S Go Back To The Past: Quiz For The Last Lesson DiscussedDocument26 pagesLet'S Go Back To The Past: Quiz For The Last Lesson DiscussedReina Mae Martinez RiegoNo ratings yet

- NSSPBP 03Document54 pagesNSSPBP 03kashifhanif241286No ratings yet

- All CredibilityDocument1 pageAll Credibilitykashifhanif241286No ratings yet

- Kentucky Fried ChickenDocument24 pagesKentucky Fried Chickenkashifhanif241286No ratings yet

- Student Teacher InteractionDocument1 pageStudent Teacher Interactionkashifhanif241286No ratings yet

- Distributed Computing EnvironmentDocument1 pageDistributed Computing Environmentkashifhanif241286No ratings yet

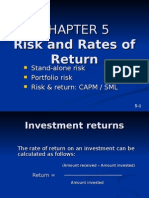

- RiskDocument68 pagesRiskkashifhanif241286100% (2)

- European Indices: Technically SpeakingDocument22 pagesEuropean Indices: Technically SpeakingmanuNo ratings yet

- E - Portfolio Assignment MacroDocument8 pagesE - Portfolio Assignment Macroapi-316969642No ratings yet

- Name of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Document2 pagesName of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Trần Phương AnhNo ratings yet

- Monetisation of Fiscal DeficitDocument2 pagesMonetisation of Fiscal DeficitGaurav GoyalNo ratings yet

- Chapter 2 Problem SolutionsDocument14 pagesChapter 2 Problem SolutionsAdelia DivandaNo ratings yet

- Asda Asd Dasad Sda Asda Das Da Asde Policy 2017Document18 pagesAsda Asd Dasad Sda Asda Das Da Asde Policy 2017hahaha555plusNo ratings yet

- AnnexureDocument7 pagesAnnexureshaantnuNo ratings yet

- Mini Project Financial Reporting Statements and Analysis MB20104Document11 pagesMini Project Financial Reporting Statements and Analysis MB20104KISHORE KRISHNo ratings yet

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet

- 2 - AccentForex Competitive Analysis No ScreenshotsDocument1 page2 - AccentForex Competitive Analysis No ScreenshotsTanveer HussainNo ratings yet

- Comprehensive Exam BDocument14 pagesComprehensive Exam Bjdiaz_646247No ratings yet

- Eun 9e International Financial Management PPT CH06 AccessibleDocument31 pagesEun 9e International Financial Management PPT CH06 AccessibleDao Dang Khoa FUG CTNo ratings yet

- The Foreign Exchange Management Act, 1999: Legislative HistoryDocument26 pagesThe Foreign Exchange Management Act, 1999: Legislative HistoryPrince VenkatNo ratings yet

- Foundations of Financial Planning - Overview& ProcessDocument90 pagesFoundations of Financial Planning - Overview& ProcesstsrajanNo ratings yet

- Công TH CDocument9 pagesCông TH CLê Hồng ThuỷNo ratings yet

- Introduction TABDocument2 pagesIntroduction TABShreshtha ShahNo ratings yet

- Tax Card Moldova EN 2023Document20 pagesTax Card Moldova EN 2023VNo ratings yet

- Final POA PDFDocument6 pagesFinal POA PDFGautam BhadadraNo ratings yet