Professional Documents

Culture Documents

Chap12 2

Uploaded by

Nuur AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap12 2

Uploaded by

Nuur AhmedCopyright:

Available Formats

Econometrics

Chapter 12 Autocorrelation

Autocorrelation

In the classical regression model, it is

assumed that E(u

t

u

s

) = 0 if t is not

equal to s.

What happens when this assumption is

violated?

First-order autocorrelation

1 1 2 2

where:

t o t t k kt t

Y X X X u | | | | = + + + + +

1

2 2

( ) 0

( ) 0 for

( )

1

t t t

t

t s

t

u u

E

E t s

E

c

c

c

c c

c o

= +

=

= =

=

<

Positive first-order

autocorrelation ( > 0)

Negative first-order

autocorrelation ( < 0)

Incorrect model specification

and apparent autocorrelation

Violation of assumption of

classical regression model

1 1

2

1 1

2

( ) [( )( )]

( )

0

t s t t t

t t t

u

E u u E u u

E u u

c

c

o

= +

= +

= =

1

corr( )

t t

u u

=

Consequences of first-order

autocorrelation

OLS estimators are unbiased and

consistent

OLS estimators are not BLUE

Estimated variances of residuals is

biased

Biased estimator of standard errors of

residuals (usually a downward bias)

Biased t-ratios (usually an upward bias)

Detection

Durbin-Watson statistic

2

1

2

2

1

( )

N

t t

t

N

t

t

u u

d

u

=

=

2(1 ) d ~

Acceptance and rejection

regions for DW statistic

o

1

H : 0

H : 0

=

=

AR(1) correction: known

1 1 2 2

1

where:

t o t t k kt t

t t t

Y X X X u

u u

| | | |

c

= + + + + +

= +

Lagging this relationship 1 period:

1 1 1 1 2 2 1 1 1 t o t t k kt t

Y X X X u | | | |

= + + + + +

Multiplying this by -

1 1 1 1 2 2 1 1 1 t o t t k kt t

Y X X X u | | | |

=

With a little bit of algebra:

( ) ( ) ( ) ( ) ( )

1 1 1 1 1 2 2 2 1 1 1

1

t t o t t t t k kt kt t t

Y Y X X X X X X u u | | | |

= + + + + +

( ) ( ) ( ) ( )

1 1 1 1 1 2 2 2 1 1

1

t t o t t t t k kt kt t

Y Y X X X X X X | | | | c

= + + + + +

AR(1) correction: known

Solution?

quasi-difference each variable:

1

1 1 1 1

2 2 2 1

1

t t t

t t t

t t t

kt kt kt

Y Y Y

X X X

X X X

X X X

=

=

=

=

Regress:

1 1 2 2 t o t t k kt t

Y X X X | | | | c = + + + + +

AR(1) correction: known

This procedure provides unbiased and

consistent estimates of all model

parameters and standard errors.

If = 1, a unit root is said to exist. In

this case, quasi-differencing is

equivalent to differencing:

1 1 2 2 t o t t k kt t

Y X X X | | | | c A = + A + A + + A +

Generalized least squares

This approach is referred to as:

Generalized Least Squares (GLS)

GLS estimation strategy:

If one of the assumptions of the classical

regression model is violated, transform the

model so that the transformed model

satisfies these assumptions.

Estimate the transformed model

AR(1) correction: unknown

Cochrane-Orcutt procedure:

1. Estimate the original model using OLS. Save the

error terms

2. Regress saved error term on lagged error term

(without a constant) to estimate

3. Estimate a quasi-differenced version of original

model. Use the estimated parameters to

generate new estimate of error term.

4. Go to step 2. Repeat this process until change in

parameter estimates become less than selected

threshold value.

This results in unbiased and consistent estimates of

all model parameters and standard errors.

Prais-Winsten estimator

Cochrane-Orcutt method involves the loss of

1 observation.

Prais-Winsten estimator is similar to

Cochrane-Orcutt method, but applies a

different transformation to the first

observation (see text, p. 444).

Monte Carlo studies indicate substantial

efficiency gain from the use of the Prais-

Winsten estimator (relative to the Cochrane-

Orcutt method)

Hildreth-Lu estimator

A grid search algorithm helps ensure

that the estimator reaches a global

minimum sum of squared error terms

rather than a local minimum sum of

squared error terms

Maximum likelihood estimator

selects parameter values that maximize

the computed probability of observing

the realized outcomes for the

dependent and independent variables

an asymptotically efficient estimator

Higher-order autocorrelation

AR(p):

1 1 2 2 t t t p t p

u u u u

= + + +

Detection of AR(p) error process

Breusch-Godfrey test:

1. Estimate the parameters of original model and

save error term

2. Regress estimated error term on all independent

variables in the original model and the first p

lagged error terms

3. Compute the Breusch-Godfrey Lagrange

Multiplier test statistic: NR

2

4. An AR(p) process is found to exist if the LM

statistic exceeds the critical value for a _

2

variate

with p degrees of freedom.

Use Box-Pierce or Ljung-Box statistic (see p.

451)

Lagged dependent variable as

regressor

Durbin-Watson statistic is biased

downward when a lagged dependent

variable is used as a regressor.

Use Durbins h test or Lagrange

Multiplier test (test statistic = (N-1)R

2

in

this case).

Correction: Hatanakas estimator (on

pp. 458-9 of the text)

Correction of AR(p) process

Use Prais-Winsten (modified for an

AR(p) process) or maximum likelihood

estimator

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chi Square Tests and F DistributionDocument83 pagesChi Square Tests and F DistributionMark Jovince CardenasNo ratings yet

- Chapter 6 The Statistical ToolsDocument38 pagesChapter 6 The Statistical ToolsAllyssa Faye PartosaNo ratings yet

- FAU S PSG 0221 Capability CalculationDocument24 pagesFAU S PSG 0221 Capability CalculationHammamiSalahNo ratings yet

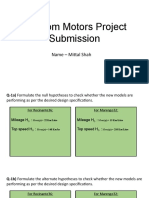

- Final Presentation by Mittal ShahDocument10 pagesFinal Presentation by Mittal ShahPradeep Nambiar100% (3)

- Principles of Microeconomics - AttributedDocument1,128 pagesPrinciples of Microeconomics - AttributedAlfonso J Sintjago100% (1)

- English Grammar TensesDocument38 pagesEnglish Grammar Tensesapi-283719185No ratings yet

- Passenger Satisfaction Prediction: Asaaju BabatundeDocument10 pagesPassenger Satisfaction Prediction: Asaaju BabatundeTunde Asaaju100% (1)

- Quantitative Research MethodologyDocument8 pagesQuantitative Research Methodologyhjaromptb97% (32)

- Ffdriver PDFDocument62 pagesFfdriver PDFNuur AhmedNo ratings yet

- Time in LoanDocument51 pagesTime in LoanNuur AhmedNo ratings yet

- Econtrics RESOURCEDocument65 pagesEcontrics RESOURCEramboriNo ratings yet

- Digit+Ft Html5 Oct2011 LRDocument97 pagesDigit+Ft Html5 Oct2011 LRluiz.teixeira100% (1)

- AbuAlFoul - The Causal Relation Between Savings and Economic GrowthDocument12 pagesAbuAlFoul - The Causal Relation Between Savings and Economic GrowthElias ErraNo ratings yet

- MonteCarlo PDFDocument84 pagesMonteCarlo PDFNuur AhmedNo ratings yet

- Empirical Time Series AnalysisDocument15 pagesEmpirical Time Series AnalysisNuur AhmedNo ratings yet

- Pesaran Bounds Test TableDocument38 pagesPesaran Bounds Test TableNuur Ahmed100% (5)

- PamphletDocument68 pagesPamphletPradeepNo ratings yet

- SPSS Step-by-Step Tutorial: Part 2Document48 pagesSPSS Step-by-Step Tutorial: Part 2Elok Faiqotul UmmaNo ratings yet

- Cointegration and ARCHDocument31 pagesCointegration and ARCHapi-3814468100% (1)

- Time in LoanDocument51 pagesTime in LoanNuur AhmedNo ratings yet

- SPSSTutorial 1Document50 pagesSPSSTutorial 1BharatNo ratings yet

- Logistic ModelDocument20 pagesLogistic ModelNuur AhmedNo ratings yet

- LectureDocument39 pagesLectureNuur AhmedNo ratings yet

- Madjedi ShourbaguiDocument37 pagesMadjedi ShourbaguiSamarHassanAl-BagouryNo ratings yet

- Forecasting Inflation in Saudi Arabia Using ARIMA ModelsDocument26 pagesForecasting Inflation in Saudi Arabia Using ARIMA ModelsNuur AhmedNo ratings yet

- Long RunDocument33 pagesLong RunNuur AhmedNo ratings yet

- AbuAlFoul - The Causal Relation Between Savings and Economic GrowthDocument12 pagesAbuAlFoul - The Causal Relation Between Savings and Economic GrowthElias ErraNo ratings yet

- UMCoRS Time Series Econometrics For The PractitionerDocument2 pagesUMCoRS Time Series Econometrics For The PractitionerNuur AhmedNo ratings yet

- Forecasting Inflation in Saudi Arabia Using ARIMA ModelsDocument26 pagesForecasting Inflation in Saudi Arabia Using ARIMA ModelsNuur AhmedNo ratings yet

- Macro Econometric S 3Document7 pagesMacro Econometric S 3Nuur AhmedNo ratings yet

- 4 4 Slides Dynamical Models For Migration ProjectionsDocument21 pages4 4 Slides Dynamical Models For Migration ProjectionsNuur AhmedNo ratings yet

- Oheads Chapter12Document30 pagesOheads Chapter12Nuur AhmedNo ratings yet

- The Impact of Exchange Rate Volatility On Exports in TurkeyDocument15 pagesThe Impact of Exchange Rate Volatility On Exports in TurkeyNuur AhmedNo ratings yet

- An Autoregressive Distributed Lag Modelling Approach To Cointegration AnalysisDocument33 pagesAn Autoregressive Distributed Lag Modelling Approach To Cointegration AnalysisNuur AhmedNo ratings yet

- Trade Balance (Malaysia)Document20 pagesTrade Balance (Malaysia)Nuur AhmedNo ratings yet

- Eviews 7.0 ManualDocument108 pagesEviews 7.0 ManualNuur AhmedNo ratings yet

- Projection SampleDocument6 pagesProjection SampleSesennNo ratings yet

- Introduction To Machine Learning IIT KGP Week 2Document14 pagesIntroduction To Machine Learning IIT KGP Week 2Akash barapatreNo ratings yet

- Discrete Random Variables MS 1.: IB Questionbank Maths SL 1Document8 pagesDiscrete Random Variables MS 1.: IB Questionbank Maths SL 1Kumar VermaNo ratings yet

- Chapter 3Document2 pagesChapter 3Sassa IndominationNo ratings yet

- SIIP ReportDocument63 pagesSIIP ReportAnderson Joe100% (1)

- MTE3105 Statistics: Tan Sui Chin Institut Perguruan GayaDocument30 pagesMTE3105 Statistics: Tan Sui Chin Institut Perguruan GayarhyzoneNo ratings yet

- PennStateSchool08 LecNotesDocument529 pagesPennStateSchool08 LecNotesSivaNo ratings yet

- STA 101 LECTURE NOTES (September 2017)Document28 pagesSTA 101 LECTURE NOTES (September 2017)Abdulsamad OyetunjiNo ratings yet

- Do Psychedelics Mimic KundaliniDocument10 pagesDo Psychedelics Mimic KundaliniGabriel MarquesNo ratings yet

- IISc Lecture on Stochastic Hydrology ModelsDocument56 pagesIISc Lecture on Stochastic Hydrology ModelsPrasadNo ratings yet

- Four models of causation in anti-corruption policy designDocument19 pagesFour models of causation in anti-corruption policy designDonatella Bourne CNo ratings yet

- UntitledDocument3 pagesUntitledapi-262707463No ratings yet

- Generalizability Theory: An Introduction With Application To Simulation EvaluationDocument10 pagesGeneralizability Theory: An Introduction With Application To Simulation Evaluationbella swanNo ratings yet

- A Protocol For Data Exploration To Avoid Common Statistical ProblemsDocument12 pagesA Protocol For Data Exploration To Avoid Common Statistical ProblemsSelene TorresNo ratings yet

- RM Cia 1 1620203Document12 pagesRM Cia 1 1620203Aditya JainNo ratings yet

- Factors Affecting Employees Work Ethical in Organizations: The Case of Addis Ababa City Road AuthorityDocument9 pagesFactors Affecting Employees Work Ethical in Organizations: The Case of Addis Ababa City Road Authorityabel asratNo ratings yet

- Statistics Module 7Document13 pagesStatistics Module 7Lagcao Claire Ann M.No ratings yet

- This Study Resource Was: RSCH6352 Methods of ResearchDocument4 pagesThis Study Resource Was: RSCH6352 Methods of ResearchReuel Patrick CornagoNo ratings yet

- GraphPad Prism SlidesDocument79 pagesGraphPad Prism SlidesVasincuAlexandruNo ratings yet

- Deep Learning Detects Traffic Accidents from Social MediaDocument47 pagesDeep Learning Detects Traffic Accidents from Social MediaRicardo HoganNo ratings yet

- Stats Formula SheetDocument5 pagesStats Formula Sheetmsmithmail21No ratings yet

- 08 An Example of NN Using ReLuDocument10 pages08 An Example of NN Using ReLuHafshah DeviNo ratings yet

- No - Evaluación de La Escala de Fluctuación de Parámetros GeotécnicosDocument7 pagesNo - Evaluación de La Escala de Fluctuación de Parámetros GeotécnicosCimentaciones Geotecnia RiveraNo ratings yet

- M818A: Machine Learning and Cyber Security-ADocument11 pagesM818A: Machine Learning and Cyber Security-ASahag TopouzkhanianNo ratings yet