Professional Documents

Culture Documents

Add Topic Depreciation S

Uploaded by

KaLeung ChungOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Add Topic Depreciation S

Uploaded by

KaLeung ChungCopyright:

Available Formats

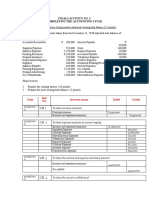

Plant Management: Depreciation

Construction asset loses value with age

Depreciation: The loss of value of a piece of plant or facility over time.

Why a manager needs to know depreciation?

Caused by wear & tear, deterioration, obsolescence, or reduced need. Determines decline in market value during the time period Determines the depreciation amount to use in replacement decision analysis Used to evaluate tax liability Realistically reflects asset/liability of a company

There are many depreciation accounting methods. We will only discuss two.

Depreciates the Equipment Value equally in each of the years the Equipment is Owned. R Annual Depreciation Rate N Number of years the equipment is owned. R = 1/N D Annual Depreciation Amount P Purchase Price F Salvage Value at the end of N years D = R(P - F )

BV Equipment value at the end of each year after the annual depreciation has been subtracted. BVm= BVm-1 - Dm Where BVm is the book value in the year m, BVm-1 is the book value in the year m-1, and Dm is the annual depreciation amount

Example 1

A contractor purchased a plant for $250,000 and will use it for 6 years. The estimated salvage value is $60,000. Using the straight-line method of depreciation accounting, what is the annual depreciation amount and the book value of the plant at the end of the third year?

Example 1

Annual depreciation rate

R=

Annual depreciation amount

D=

Book value

BVm= BVm-1 - Dm BV1= BV0 D1= BV2= BV1 D2=

BV3= BV2 D3=

Example 1

Annual depreciation rate

R = 1/N=1/6=0.167

Annual depreciation amount

D = R(P - F )=

BVm= BVm-1 - Dm BV1= BV0 D1= BV2= BV1 D2= BV3= BV2 D3=

Book value

Example 1

After Year

Depreciation Rate

Dep. Amount

Book Value

1

2 3

1/6

1/6 1/6

4

5 6

1/6

1/6 1/6

The Annual depreciation rate differs for each year.

Annual Depreciation Rate Rm = (N - m + 1) / SOY

N : the number of years the equipment is owned m : the specific year in which depreciation is being determined SOY : the sum of the years that equals N+(N-1)+(N-2)+! SOY = N(N+1) / 2 Annual Depreciation Amount Dm = Rm(P-F)

Example 1 Revisited

A contractor purchased a plant for $250,000 and plans to use if for 6 years. The estimated salvage value is $60,000. Using the sum-of-the-years method, what is the depreciation amount for the year three and the book value of the plant at the end of the third year?

Example 1 Revisited

The sum of the year

SOY = N(N+1) / 2=

Rm = (N - m + 1) / SOY=

Dm = Rm(P-F)=

Depreciation Rate Dep. Amount Book Value

Depreciation amount for the third year

1 2 3 4 5 6

Book value

After Year

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- THE HONG KONG POLYTECHNIC UNIVERSITY CBR TESTDocument6 pagesTHE HONG KONG POLYTECHNIC UNIVERSITY CBR TESTKaLeung ChungNo ratings yet

- X Accounting 2Document419 pagesX Accounting 2Amaury Guillermo Baez100% (2)

- Analysis of Financial StatementsDocument59 pagesAnalysis of Financial Statementssharique khan100% (2)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Alagappa University MBA in Airline and Airport Management RegulationsDocument39 pagesAlagappa University MBA in Airline and Airport Management RegulationsREMO RICA50% (4)

- Design CalDocument1 pageDesign CalKaLeung ChungNo ratings yet

- 2292 Design of High Strength Concrete Filled Tubular Columns For Tall BuildingsDocument8 pages2292 Design of High Strength Concrete Filled Tubular Columns For Tall BuildingsKaLeung ChungNo ratings yet

- LabSheet 03 - Instability of A ColumnDocument3 pagesLabSheet 03 - Instability of A ColumnKaLeung ChungNo ratings yet

- Al Column4 2013a1Document1 pageAl Column4 2013a1KaLeung ChungNo ratings yet

- Lect2-Truss 1213Document55 pagesLect2-Truss 1213KaLeung ChungNo ratings yet

- LabSheet 03 - Instability of A ColumnDocument3 pagesLabSheet 03 - Instability of A ColumnKaLeung ChungNo ratings yet

- Brickwork 2009 (Compatibility Mode)Document78 pagesBrickwork 2009 (Compatibility Mode)KaLeung ChungNo ratings yet

- Sy Chim and Felicidad Chan Sy V Sy Siy Ho & Sons, IncDocument7 pagesSy Chim and Felicidad Chan Sy V Sy Siy Ho & Sons, IncJohn YeungNo ratings yet

- Full Download Financial Accounting Theory and Analysis Text and Cases 10th Edition Schroeder Test BankDocument35 pagesFull Download Financial Accounting Theory and Analysis Text and Cases 10th Edition Schroeder Test BankjosephkvqhperezNo ratings yet

- Accounting Information Systems OverviewDocument9 pagesAccounting Information Systems OverviewKesiah FortunaNo ratings yet

- Auditing Trs by IcapDocument53 pagesAuditing Trs by IcapArif AliNo ratings yet

- AIS Midtern Exam AnswerDocument2 pagesAIS Midtern Exam AnswerWen CapunoNo ratings yet

- EXAM ABM 11 Jan 29Document1 pageEXAM ABM 11 Jan 29Roz AdaNo ratings yet

- FICO STD ReportsDocument12 pagesFICO STD Reportsshekar8876100% (1)

- Example Assignment 7003Document14 pagesExample Assignment 7003Javeriah Arif75% (4)

- Olam: Accounting For Biological Assets: BackgroundDocument14 pagesOlam: Accounting For Biological Assets: BackgroundHarsh JainNo ratings yet

- FA Assignment - 5 (Group 5)Document3 pagesFA Assignment - 5 (Group 5)Muskan ValbaniNo ratings yet

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersDocument4 pages2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakNo ratings yet

- Applying International Accounting Standards - Chapter 19 TestbankDocument5 pagesApplying International Accounting Standards - Chapter 19 TestbankralphalonzoNo ratings yet

- 8-1 Entering Account Balances (: Name Class Period Type Drop DownDocument17 pages8-1 Entering Account Balances (: Name Class Period Type Drop DownYoussef MoustafaNo ratings yet

- Aging Report MacroDocument119 pagesAging Report MacroSenthilkumar0606No ratings yet

- A. TheoryDocument10 pagesA. TheoryROMULO CUBID100% (1)

- The Audit Expectations Gap in BritainDocument33 pagesThe Audit Expectations Gap in Britainnguyenthuan1211No ratings yet

- Management Accounting Case AnalysisDocument6 pagesManagement Accounting Case AnalysisJulyaniNo ratings yet

- Understanding Financial Statements (Suman)Document77 pagesUnderstanding Financial Statements (Suman)Suman ChaudhuriNo ratings yet

- PIA3 A InglesDocument17 pagesPIA3 A Inglesmobbcarlos23No ratings yet

- Account - Statement - PDF - 1570007079602 - 07 June 2021Document1 pageAccount - Statement - PDF - 1570007079602 - 07 June 2021salman alfarisyNo ratings yet

- IAASB Strategy and Work Program 2012-2014-FinalDocument28 pagesIAASB Strategy and Work Program 2012-2014-FinalSwapnil ChoudhariNo ratings yet

- Accounting Problem CHART OF ACCOUNTSDocument6 pagesAccounting Problem CHART OF ACCOUNTSkarenlasuncionNo ratings yet

- UT Dallas Syllabus For Aim6383.501.07f Taught by Dana Bracy (dxb016100)Document6 pagesUT Dallas Syllabus For Aim6383.501.07f Taught by Dana Bracy (dxb016100)UT Dallas Provost's Technology GroupNo ratings yet

- Applied Auditing 2Document11 pagesApplied Auditing 2Leny Joy DupoNo ratings yet

- Ledger Accounting and Double Entry Bookkeeping: Chapter Learning ObjectivesDocument46 pagesLedger Accounting and Double Entry Bookkeeping: Chapter Learning Objectiveskoti kebele100% (1)