Professional Documents

Culture Documents

TAXEFF

Uploaded by

catharinadasionCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAXEFF

Uploaded by

catharinadasionCopyright:

Available Formats

Excess Burden

The First Fundamental Theorem of Welfare Economics says that, under ideal conditions, the behavior of producers and consumers will automatically lead to efficiency. Thus when taxes distort economic decisions, they reduce efficiency and create what is called the excess burden of the tax. This excess burden is a welfare loss beyond the tax revenue collected. It is also referred to as the welfare cost or deadweight loss.

For example, if I stopped buying beer because of a tax on beer, no taxes would be collected but there would still be a welfare loss.

Terrel Gallaway: Public Finance

Tax Shifts Budget Constraint

Initially, there are no economic distortions. Original budget constraint has a slope -(Px/Py) After a tax on x less x can be bought. The new budget constraint has a slope -[(1 + t)Px/Py].

x

2

Terrel Gallaway: Public Finance

Measuring the Tax Payment

For any level of x, the vertical distance between the two budget constraints shows the tax payment measured in terms of the good y.

y y1

Set Py = $1 or let y represent y2 all other goods.

For example, if we hold purchases of x fixed at x1 then purchases of y would have to fall from y1 to y2 .

x1

x

3

Terrel Gallaway: Public Finance

A Decline in Utility

The tax causes the utilitymaximizing bundle of goods to switch from 1 to y 2. Naturally, utility decreases. A The tax revenue collected B is equal to the distance between A & B. Is the decrease in utility greater than the tax revenue collected?

x 4

Terrel Gallaway: Public Finance

Equivalent variation is the amount , if there were no tax, by which income would have to be reduced to yield an equivalent decline in utility. y Such a reduction income is shown as a parallel shift of the budget constraint and is equal A to the vertical distance between A and C. B C The distance between B & C is the dead weight loss (DWL). DWL is the difference between what is paid in taxes and an equivalent (in terms of utility) reduction in income

Equivalent Variation

x

5

Terrel Gallaway: Public Finance

Lump Sum Tax

A lump sum tax is a tax that is paid regardless of a consumers behavior. Significantly it doesnt change relative prices. Rather, it simply decreases income by the amount of the tax. Note that reduction in income is identical to the tax collected. (The distance between A& B.) There is no Deadweight Loss.

A

2 1

x 6

Terrel Gallaway: Public Finance

Why no Lump Sum Taxes?

An

example of such a tax is a head tax. Such taxes are regressive. If everybody has to pay $100, this is much more of a burden to a poor person than it is to a billionaire. Margaret Thatcher replaced property taxes with a head tax and was subsequently booted out of office.

Terrel Gallaway: Public Finance

Wherefore Excess Burden?

Remember,

allocative efficiency requires that MRSxy = MRTxy However, after the tax, the consumer faces a new budget constraint such that utility is maximized where MRSxy = (1 + tx)Px/Py. For producers, the important thing is price net of taxes. Thus, profit-maximizing producers will still set MRTxy = Px/Py. Since tx > 0, MRSxy > MRTxy. That is, the necessary condition for allocative efficiency is not satisfied.

Terrel Gallaway: Public Finance

Intuitive Explanation

As long as consumers are willing to cover the economic costs of producing a good, then economic efficiency dictates that the good should be produced. However when a tax, rather than production costs, pushes a good beyond a consumers price range, then too few resources will be dedicated to the production of a good for which consumers would have been willing to pay. Basically economists want decisions to reflect opportunity costs rather than the tax structure.

Terrel Gallaway: Public Finance

Does Quantity Have to Change for There to be Inefficiency?

Before and after the tax on x, the consumption of x is x1. The excess burden is equal to BC. Equivalent Variation equals E1S Tax Revenues equal E1E2. E2S is the excess burden A lump sum tax resulting in the same reduction in utility would raise more revenue. (IC runs tangent to both new BCs) Tax did change consumption of Y & alter the relative mix of X & Y!

Terrel Gallaway: Public Finance

10

Substitution and Income Effects

The

move from our initial equilibrium (1) to our new equilibrium (2) can be divided into two parts:

The move from 1 to 3 is the income effect. The move from 3 to 2 is the substitution effect.

y

A

1 2

B

C D

x1

x 11

Terrel Gallaway: Public Finance

SE causes DWL

Excess burden is caused when a tax changes relative prices and the consumers MRS--this is exactly what the substitution effect is. The income effect can offset or mask the substitution effect.

While there is no perceived change in quantity demanded, there is still a deadweight loss.

y

A

1 2

B

C D

x1

x 12

Terrel Gallaway: Public Finance

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Professional Indemnity Zurich PolicyDocument16 pagesProfessional Indemnity Zurich Policykalih krisnareindraNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Tax Law Case DigestsDocument131 pagesTax Law Case DigestsThea Jane MerinNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2nd Batch Cases TaxDocument16 pages2nd Batch Cases TaxRay John Arandia DorigNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Mkuchajr ProposalDocument9 pagesMkuchajr ProposalinnocentmkuchajrNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Savage Worlds (Acc) - NecropolisDocument150 pagesSavage Worlds (Acc) - NecropolisEvendur_Umil100% (14)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Property Return Form 2014Document4 pagesProperty Return Form 2014rajat304shrivastavaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- RemediesDocument32 pagesRemediesrav danoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- IT Capital Gains Pt-2Document14 pagesIT Capital Gains Pt-2syedfareed596No ratings yet

- In Partial Fulfilment For The Award of The Degree ofDocument15 pagesIn Partial Fulfilment For The Award of The Degree ofnithyaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 1 Introduction: Multiple-Choice QuestionsDocument192 pagesChapter 1 Introduction: Multiple-Choice QuestionsSZANo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- WorksheetWorks Calculating Prices 1Document2 pagesWorksheetWorks Calculating Prices 1Julie Navarro100% (2)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 2 DIGEST Madrigal Vs Rafferty DigestDocument1 page2 DIGEST Madrigal Vs Rafferty DigestLeo FelicildaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ivan Gyulai Natural Resource Use Management PDFDocument28 pagesIvan Gyulai Natural Resource Use Management PDFatushemeza clinton tcoupNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Employee Downsizing: Downsizing Blues All Over The WorldDocument11 pagesEmployee Downsizing: Downsizing Blues All Over The WorldZoya KhanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Role of Home Libraries in Rural Districts of Malaysia in Creating A Knowledge SocietyDocument12 pagesRole of Home Libraries in Rural Districts of Malaysia in Creating A Knowledge SocietySaidatul Akmar IsmailNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 2015 AtcDocument27 pages2015 Atcmilanfan1984No ratings yet

- Chapter 7 Federal Taxation Textbook SolutionsDocument26 pagesChapter 7 Federal Taxation Textbook SolutionsReese Parker0% (1)

- Dabistan-e-Ijtihaad - 99 Names of Holy Prophet Muhammad (Saw)Document2 pagesDabistan-e-Ijtihaad - 99 Names of Holy Prophet Muhammad (Saw)Salman MirzaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- HSC Business Studies Operation1Document36 pagesHSC Business Studies Operation1Uttkarsh AroraNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Cosmetic Product Producing PlantDocument27 pagesCosmetic Product Producing Plantbig john100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Advanced Personal & Corporate Taxation Corporate Reorganizations (Part 2)Document15 pagesAdvanced Personal & Corporate Taxation Corporate Reorganizations (Part 2)Ashley WangNo ratings yet

- Abakada Guro Party List Vs Ermita GR 168056Document1 pageAbakada Guro Party List Vs Ermita GR 168056Lizzy WayNo ratings yet

- City of Rochester F22 Proposed Budget June 3 Version PDFDocument599 pagesCity of Rochester F22 Proposed Budget June 3 Version PDFNews 8 WROCNo ratings yet

- Oregon Urban Renewal HistoryDocument70 pagesOregon Urban Renewal Historyনূরুন্নাহার চাঁদনীNo ratings yet

- Income Tax Law Practice Question PaperDocument0 pagesIncome Tax Law Practice Question PaperbkamithNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

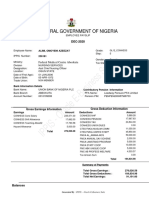

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaAlimi kehinde100% (1)

- Adopt-A-School Program Kit 2019Document30 pagesAdopt-A-School Program Kit 2019Winny FelipeNo ratings yet

- Bennett Jones - Ontario and Toronto Land Transfer TaxDocument30 pagesBennett Jones - Ontario and Toronto Land Transfer TaxRogaes EnpédiNo ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)