Professional Documents

Culture Documents

Cash Management 2013

Uploaded by

Avneesh BansalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Management 2013

Uploaded by

Avneesh BansalCopyright:

Available Formats

Defined as demand deposits plus currency. Cash is often called a nonearning asset.

Sufficient cash is required

(1) to take trade discounts, (2) to maintain its credit rating, and (3) to meet unexpected cash needs.

Cash management managing of:

is

concerned

with

the

cash flows into and out of the firm, cash flows within the firm, and cash balances held by the firm at a point of time by

financing deficit or investing surplus cash

Transactions Balance A cash balance associated with payments and collections; the balance necessary for day-to-day operations.

Precautionary Balance

A cash balance held in reserve for random, unforeseen fluctuations in cash inflows and outflows. The less predictable the firms cash flows, the larger such balances should be. firms that would need large precautionary balances tend to hold highly liquid marketable securities rather than cash.

Speculative Balance A cash balance that is held to enable the firm to take advantage of any bargain purchases that might arise. Firms today are more likely to rely on reserve borrowing capacity and/or marketable securities portfolios than on cash per se for speculative purposes.

Optimum Cash Balance under Certainty: Baumols Model Optimum Cash Balance under Uncertainty: The MillerOrr Model

The firm is able to forecast its cash needs with certainty. The firms cash payments occur uniformly over a period of time. The opportunity cost of holding cash is known and it does not change over time. The firm will incur the same transaction cost whenever it converts securities to cash.

The firm incurs a holding cost for keeping the cash balance. It is an opportunity cost; that is, the return foregone on the marketable securities. If the opportunity cost is k, then the firms holding cost for maintaining an average cash balance is as follows: Holding cost = k (C / 2) The firm incurs a transaction cost whenever it converts its marketable securities to cash. Total number of transactions during the year will be total funds requirement, T, divided by the cash balance, C, i.e., T/C. The per transaction cost is assumed to be constant. If per transaction cost is c, then the total transaction cost will be:

Transaction cost = c(T / C )

The total annual cost of the demand for cash will be: Total cost = k (C / 2) c(T / C ) The optimum cash balance, C*, is obtained when the total cost is minimum. The formula for the optimum cash balance is as follows: 2cT C* k

Baumol's model for cash balance

Cost trade-off: Baumol's model

The MO model provides for two control limits the upper control limit and the lower control limit as well as a return point.

If the firms cash flows fluctuate randomly and hit the upper limit, then it buys sufficient marketable securities to come back to a normal level of cash balance (the return point).

When the firms cash flows wander and hit the lower limit, it sells sufficient marketable securities to bring the cash balance back to the normal level (the return point).

The difference between the upper limit and the lower limit depends on the following factors:

the transaction cost (c) the interest rate, (i) the standard deviation (s) of net cash flows.

The formula for determining the distance between upper and lower control limits (called Z) is as follows:

(Upper Limit Lower Limit) = (3/ 4 Transaction Cost Cash Flow Variance / Interest Rate)1/ 3

Upper Limit = Lower Limit + 3Z Return Point = Lower Limit + Z The net effect is that the firms hold the average the cash balance equal to: Average Cash Balance = Lower Limit + 4/3Z

Treasury bills Commercial papers Certificates of deposits Bank deposits Inter-corporate deposits Money market mutual funds

http://www.fimmda.org

Ready Cash Segment: Optimal balance of marketable securities held to take care of probable deficiencies in the firms cash account. Controllable Cash Segment: Marketable securities held for meeting controllable (knowable) outflows, such as taxes and dividends. Free cash segment :Free marketable securities (that is, available for as yet unassigned purposes).

Cash planning Managing the cash flows Optimum cash level Investing surplus cash

Cash planning is a technique to plan and control the use of cash. Cash Forecasting and Budgeting

Cash budget is the most significant device to plan for and control cash receipts and payments. Cash forecasts are needed to prepare cash budgets.

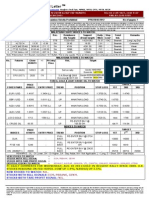

A table showing cash flows (receipts, disbursements, and cash balances) for a firm over a specified period.

Target Cash Balance The desired cash balance that a firm plans to maintain in order to conduct business.

You dont have to worry about predicting short-term fluctuations in cash flow, if you have solid bank commitments. Cash budget page 8

Selecting Investment Opportunities:

Safety, Maturity, and Marketability.

Realistically, the management of cash and marketable securities cannot be separated Benefits and costs associated with holding cash and marketable securities.

The benefits are twofold: (1) the firm reduces transactions costs because it wont have to issue securities or borrow as frequently to raise cash; and (2) it will have ready cash to take advantage of bargain purchases or growth opportunities.

The primary disadvantage is that the after-tax return on cash and short-term securities is very low. Thus, firms face a trade-off between benefits and costs.

Capital markets

Ready Cash Segment: Safety and ability to convert to cash is most important. Select TB for this segment. Controllable Cash Segment: Marketability less important. Possibly match time needs. May select CD, REPOS for this segment. Free cash segment : Base choice on yield subject to risk-return trade-offs. Any money market instrument may be selected for this segment.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- HBS Case Report Analysis of Newbridge's Investment in Shenzhen Development BankDocument11 pagesHBS Case Report Analysis of Newbridge's Investment in Shenzhen Development BankAmandaTranNo ratings yet

- Inventory Management For EM StudentsDocument24 pagesInventory Management For EM StudentsShahriar KabirNo ratings yet

- Olcae06 - Midterm ExamDocument19 pagesOlcae06 - Midterm ExamShienell PincaNo ratings yet

- Depreciation Practice in BangladeshDocument11 pagesDepreciation Practice in BangladeshSadharon CheleNo ratings yet

- SBI Mutual Fund Report on Portfolio Management and AnalysisDocument50 pagesSBI Mutual Fund Report on Portfolio Management and AnalysisShivaji Rao Karthik VagmoreNo ratings yet

- Economic Analysis Chapter 5Document32 pagesEconomic Analysis Chapter 5School BackupNo ratings yet

- BUS 110 Project Tabs and DefinitionsDocument3 pagesBUS 110 Project Tabs and DefinitionsGopiGunigantiNo ratings yet

- David SwensonDocument35 pagesDavid SwensonSunil ParikhNo ratings yet

- PMK Slides 5 MirjhamDocument40 pagesPMK Slides 5 MirjhamTran PhamNo ratings yet

- Unilever Indonesia Financial AnalysisDocument17 pagesUnilever Indonesia Financial AnalysissaridNo ratings yet

- Application of The Value Averaging Investment Method On The Us Stock MarketDocument10 pagesApplication of The Value Averaging Investment Method On The Us Stock MarketN C NAGESH PRASAD KOTINo ratings yet

- 1Document14 pages1प्रवीण कुमारNo ratings yet

- Capital StructureDocument5 pagesCapital StructurePavithra GowthamNo ratings yet

- Financial System of Nepal: Kiran ThapaDocument22 pagesFinancial System of Nepal: Kiran ThapaAnuska JayswalNo ratings yet

- Cautionary note on sharing access to our websiteDocument21 pagesCautionary note on sharing access to our websiteHarman MultaniNo ratings yet

- Student PortalDocument1 pageStudent PortalCyber CityNo ratings yet

- 2023 08Document7 pages2023 08Priyanka NarwalNo ratings yet

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanNo ratings yet

- FA MCQ On PrinciplesDocument9 pagesFA MCQ On Principlestiwariarad100% (1)

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargNo ratings yet

- Chapter 17 HomeworkDocument70 pagesChapter 17 HomeworkCarl Agape DavisNo ratings yet

- ABC Business Financial Analysis for 13 June 2019Document2 pagesABC Business Financial Analysis for 13 June 2019siraj sonsNo ratings yet

- Module 7 Incremental Method - RevDocument18 pagesModule 7 Incremental Method - RevYun TelNo ratings yet

- Depreciation MethodsDocument21 pagesDepreciation MethodsPawan PoynauthNo ratings yet

- Why SIP is key to long term wealth creationDocument2 pagesWhy SIP is key to long term wealth creationVasu TrivediNo ratings yet

- BK 11th 12&3Document3 pagesBK 11th 12&3Obaid KhanNo ratings yet

- AmazonDocument4 pagesAmazonbonnieNo ratings yet

- WC ExercisesDocument5 pagesWC ExercisesRaniel PamatmatNo ratings yet

- BAM Quiz 6Document15 pagesBAM Quiz 6Nads MemerNo ratings yet

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongNo ratings yet