Professional Documents

Culture Documents

Hedging

Uploaded by

PinkyChoudhary50%(2)50% found this document useful (2 votes)

70 views11 pagesdytguohijl

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdytguohijl

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

50%(2)50% found this document useful (2 votes)

70 views11 pagesHedging

Uploaded by

PinkyChoudharydytguohijl

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 11

1

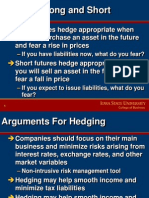

Hedging: Long and Short

Long futures hedge appropriate when

you will purchase an asset in the future

and fear a rise in prices

If you have liabilities now, what do you fear?

Short futures hedge appropriate when

you will sell an asset in the future and

fear a fall in price

If you expect to issue liabilities, what do you

fear?

2

Arguments For Hedging

Companies should focus on their main

business and minimize risks arising from

interest rates, exchange rates, and other

market variables

Non-intrusive risk management tool

Hedging may help smooth income and

minimize tax liabilities

Hedging may help smooth income and

reduce managerial salaries

3

Arguments Against Hedging

Well-diversified shareholders can make

their own risk management decisions

It may increase business risk to hedge

when competitors do not

Explaining a loss on the hedge and a

gain on the underlying can be difficult

4

Basis Risk

Basis is the difference between spot and

futures prices

Basis risk arises because of uncertainty

about the price difference when the

hedge is closed out

Basis risk usually less than the risk of

price or rate level changes

Basis risk depends on futures pricing

forces

5

Choice of Hedging Contract

Delivery month should be as close

as possible to, but later than, the

end of the life of the hedge

If no futures contract hedged

position, choose the contract whose

futures price is most highly

correlated with the asset price

Called cross-hedging

Additional basis risk

6

Naive Hedge Ratio

Divide the face value of the cash position

by the face value of one futures contract

Problems:

Market values should be focus

Ignores differences between the cash and

futures instruments

Variation: divide the market value of the

cash position by the market value of one

futures contract

7

h

2

F

F , S

F

S

o

o

o

o

= =

Minimum Variance Hedge

Ratio

Proportion of the exposure that

should optimally be hedged is

hedge per dollar of cash market value

Hedge ratio estimated from:

FP CP

t t

c A | o A + + =

8

Hedging Stock Portfolios

If hedging a well-diversified stock portfolio

with a well-diversified stock index futures

contract, what are implications?

No diversifiable risk in the cash stock portfolio

and futures hedge removes systematic risk

Since no risk, systematic or unsystematic,

what can an investor expect to earn by

hedging a well-diversified stock portfolio?

9

But has all risk been eliminated?

Problems:

Stock portfolio being hedged may have

a different price volatility than the

stock-index futures

Hedging goal is not to reduce all

systematic risk

Price sensitivity to market

movements determined by beta

Hedging Stock Portfolios

10

contract futures one of MV

portfolio spot of MV

) (

F

*

S

|

| |

Hedging Stock Portfolios

Optimal number of contracts to

hedge a portfolio is

Future contracts can be used to

change the beta of a portfolio

If |* >(<) |

S

, hedging implies a long

(short) stock index futures position

11

Rolling The Hedge Forward

What if hedging further in the future than

available delivery dates?

Series of futures contracts used to

increase the life of a hedge

Each time a futures contract matures,

switch position into another, later

contract

Basis risk, cash flow problems possible

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Fidelity Multi-Sector Bond Fund - ENDocument3 pagesFidelity Multi-Sector Bond Fund - ENdpbasicNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2016 WB 2578 QuantInsti ImplementAlgoTradingCodedinPythonNotesDocument40 pages2016 WB 2578 QuantInsti ImplementAlgoTradingCodedinPythonNotesBartoszSowulNo ratings yet

- Trading Plan Small ACCOUNTDocument62 pagesTrading Plan Small ACCOUNTAndrew100% (3)

- BFS L0 Ques464Document360 pagesBFS L0 Ques464Aayush AgrawalNo ratings yet

- Evaluation Chapter 11 LBO M&ADocument32 pagesEvaluation Chapter 11 LBO M&AShan KumarNo ratings yet

- Pertemuan 11 - EkuitasDocument34 pagesPertemuan 11 - EkuitasCristian Kumara PutraNo ratings yet

- AMFI Mutual Fund (Advisor) Module: Preparatory Training ProgramDocument231 pagesAMFI Mutual Fund (Advisor) Module: Preparatory Training Programallmutualfund100% (5)

- Kalyan Jewellers HSBC 3oct2022Document33 pagesKalyan Jewellers HSBC 3oct2022Ankk Tenderz100% (1)

- Investment OverviewDocument6 pagesInvestment OverviewPinkyChoudharyNo ratings yet

- Efficient Front. Capital Market LineDocument5 pagesEfficient Front. Capital Market LinePinkyChoudharyNo ratings yet

- HedgingDocument11 pagesHedgingPinkyChoudhary50% (2)

- Portfolio Return and RiskDocument4 pagesPortfolio Return and RiskPinkyChoudharyNo ratings yet

- CTPDocument12 pagesCTPPinkyChoudharyNo ratings yet

- Assignment FDDocument1 pageAssignment FDPinkyChoudharyNo ratings yet

- Group Dynamics: Ajay Kumar SainiDocument45 pagesGroup Dynamics: Ajay Kumar SainiPinkyChoudharyNo ratings yet

- Question On SMDocument1 pageQuestion On SMPinkyChoudharyNo ratings yet

- Single Index ModelDocument3 pagesSingle Index ModelPinkyChoudhary100% (1)

- Group Dynamics: Ajay Kumar SainiDocument45 pagesGroup Dynamics: Ajay Kumar SainiPinkyChoudharyNo ratings yet

- Portfolio Return and RiskDocument4 pagesPortfolio Return and RiskPinkyChoudharyNo ratings yet

- Project ReportDocument73 pagesProject ReportPinkyChoudharyNo ratings yet

- Systematic Risk Unsystematic Risk: Market-Wide Company-WideDocument2 pagesSystematic Risk Unsystematic Risk: Market-Wide Company-WidePinkyChoudharyNo ratings yet

- A Study of Application of ERP Software ForDocument8 pagesA Study of Application of ERP Software ForPinkyChoudharyNo ratings yet

- Efficient Front. Capital Market LineDocument5 pagesEfficient Front. Capital Market LinePinkyChoudharyNo ratings yet

- South AfricaDocument14 pagesSouth AfricaPinkyChoudharyNo ratings yet

- Chapter 7-10Document8 pagesChapter 7-10Jolina T. OrongNo ratings yet

- AxasxDocument26 pagesAxasxГал БадрахNo ratings yet

- Metallgesellschaft Brief SolutionsDocument2 pagesMetallgesellschaft Brief SolutionsarunzexyNo ratings yet

- BMAN23000 Online Exam 2019-20Document5 pagesBMAN23000 Online Exam 2019-20Munkbileg MunkhtsengelNo ratings yet

- Busi431 - Formative Assessment 1Document4 pagesBusi431 - Formative Assessment 1hamzaNo ratings yet

- Chapter 19 - OptionsDocument23 pagesChapter 19 - OptionsSehrish Atta0% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument65 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMohan KumarNo ratings yet

- ER - Assignment # 2 - VaibhavGuptaDocument3 pagesER - Assignment # 2 - VaibhavGuptaVaibhav Gupta0% (1)

- Postal Ballot Notice - ZELDocument10 pagesPostal Ballot Notice - ZELCSNo ratings yet

- 5301 Ch. 7-14 Additional Multiple Choice QuestionsDocument9 pages5301 Ch. 7-14 Additional Multiple Choice QuestionsZhou Tian YangNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document8 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Security Analysis and Portfolio Management: Question BankDocument12 pagesSecurity Analysis and Portfolio Management: Question BankgiteshNo ratings yet

- CEDDIA TAYLOR - ClassworkDocument2 pagesCEDDIA TAYLOR - ClassworkCeddia TaylorNo ratings yet

- Tybbi Ibf Sem V Khushbu RuparelDocument22 pagesTybbi Ibf Sem V Khushbu RuparelNandhini0% (1)

- FM 01 04Document14 pagesFM 01 04maaz01888No ratings yet

- The Philippine Financial SystemDocument39 pagesThe Philippine Financial Systemathena100% (1)

- FIN2424 - BFN2034 Chapter 5 Risk and ReturnsDocument42 pagesFIN2424 - BFN2034 Chapter 5 Risk and ReturnsPratap RavichandranNo ratings yet

- DSE 20 Index 2001-2012Document30 pagesDSE 20 Index 2001-2012sazzad_ßĨdNo ratings yet

- Prospectus Msinvf EnluDocument238 pagesProspectus Msinvf EnluDesaulus swtorNo ratings yet

- HBJ Capital's - The Millionaire Portfolio (TMP) Update - Latest SampleDocument19 pagesHBJ Capital's - The Millionaire Portfolio (TMP) Update - Latest SampleHBJ Capital Services Private Limited100% (1)

- Finance Exercise BondDocument2 pagesFinance Exercise Bonddinoo1898No ratings yet

- Spinoff Splitoff Splitup CarveoutDocument2 pagesSpinoff Splitoff Splitup CarveouttransitxyzNo ratings yet