Professional Documents

Culture Documents

SLT PPT Format

Uploaded by

Nadierohana Bernadge0 ratings0% found this document useful (0 votes)

66 views27 pagesFTTH, LTE and VoLTE - Need to define new product. Fixed Broadband Target Market in 2016 3 Item End 2013 End 2016 Remarks Population 20,435,726 21,054,949 based on 2012 Census Data and constant population growth rate of 1.00% Total Households 5,239,930 5,398,707 based on 2012 Census Data and constant average household size of 3.

Original Description:

Original Title

Slt Ppt Format

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFTTH, LTE and VoLTE - Need to define new product. Fixed Broadband Target Market in 2016 3 Item End 2013 End 2016 Remarks Population 20,435,726 21,054,949 based on 2012 Census Data and constant population growth rate of 1.00% Total Households 5,239,930 5,398,707 based on 2012 Census Data and constant average household size of 3.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views27 pagesSLT PPT Format

Uploaded by

Nadierohana BernadgeFTTH, LTE and VoLTE - Need to define new product. Fixed Broadband Target Market in 2016 3 Item End 2013 End 2016 Remarks Population 20,435,726 21,054,949 based on 2012 Census Data and constant population growth rate of 1.00% Total Households 5,239,930 5,398,707 based on 2012 Census Data and constant average household size of 3.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 27

Marketing and Sales Plans for

Deployment of FTTH, LTE and Wi-Fi

Presented to the Sri Lanka Telecom

Technology Sub-Committee

07/11/2013

Product Definitions

Megaline

Triple play services delivered over a wired connection

Can be provided over Copper or Fiber

Broadband

High Speed Internet Access over any access media

Can be provided over xDSL, FTTx, LTE or any others

PeoTV

HDTV and SDTV services delivered via SLT IP network

Can be provided over xDSL, FTTx, LTE or any others

VoLTE Need to define new product

Main Consumer Product Driving Sales will be Broadband

2

Fixed Broadband Target Market in 2016

3

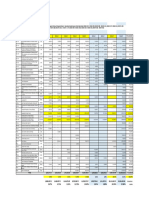

Item End 2013 End 2016 Remarks

Population 20,435,726 21,054,949

Based on 2012 Census Data and constant

population growth rate of 1.00%

Total Households 5,239,930 5,398,707

Based on 2012 Census Data and constant

average household size of 3.9

Percentage of Households with Electricity 90.00% 100.00%

Increase to 100% in 2016 based on vision

outlined in Mahinda Chinthana

Households with Electricity 4,715,937 5,398,707

2016 figure based on vision outlined in Mahinda

Chinthana

No. of Internet Connections 1,475,626 6,000,000

2013 Figure based on Telecommunication

statistics published by TRCSL - July 2013

Percentage of Population using Internet 7.22% 28.50%

Percentage of Households with Internet 28.16% 111.15%

Percentage of Population using Fixed Broadband 2.14% 10.00%

State of Broadband 2013 report by The

Broadband Commission (ITU/UNESCO)

2013 Figures: Global Average: 9.8%; Developed

Countries: 27.2%; Developing Countries: 6.1%

Percentage of Households with Fixed Broadband 8.35% 39.00%

Based on average household size of 3.9

Number of Fixed Broadband Connections 437,725 2,105,496

2013 Figure based on Telecommunication

statistics published by TRCSL - July 2013

Market Fixed Broadband Share to SLT 81.58% 80.00%

Number of SLT Fixed Broadband Connections 357,059 1,684,343

2013 Customer Base for Broadband based on

June MI-4 reports

Fixed Broadband Target Market in 2016

4

Region

Households

(2016)

Fixed BB HH

Penetration

(2016)

Target Fixed

BB Market in

2016

Expected SLT

Fixed BB

Market Share

in 2016

Target SLT

Fixed BB

Connections

2016

SLT BB

Subscribers

as at 2013

(Sep)

Fixed BB Net

Growth

between

2014-2016

Metro 798,415 64% 514,283 80% 411,426 170,408 241,018

Region I 1,920,063 37% 714,750 80% 571,800 108,525 463,275

Region II 2,021,986 33% 671,493 80% 537,194 84,246 452,948

Region III 658,311 32% 209,440 80% 167,552 34,840 132,712

All Island 5,398,775 39% 2,109,966 80% 1,687,973 398,019 1,289,954

Megaline Sales Plan for 2014

Type of Connection Existing NW New NW Total

Megaline New Connections (Voice + PeoTV) 10,000 5,000 15,000

Megaline New Connections (Voice + Broadband) 55,000 20,000 75,000

Megaline New Connections (Voice Only) 20,000 20,000

Megaline New Connections (Voice + Broadband +PeoTV) 10,000 5,000 15,000

95,000 30,000 125,000

5

Network Resources for New Megaline connections:

New Copper Loops from Small Scale Developments = 20,000 (with 75% utilization in 2014)

New Copper Loops from Cable Re-farming = 20,000 (with 75% utilization in 2014)

Recovery of Faulty Loops through Rehabilitation = 5,000

Other connections provided on existing Copper Plant

Region wise Distribution of Megaline Target

Region wise Breakdown of Targets Metro R I R II R III

All

Island

Megaline New Connections (Voice + PeoTV) 4,560 4,410 4,170 1,860 15,000

Megaline New Connections (Voice + Broadband) 22,800 22,050 20,850 9,300 75,000

Megaline New Connections (Voice Only) 6,080 5,880 5,560 2,480 20,000

Megaline New Connections (Voice + Broadband +PeoTV) 4,560 4,410 4,170 1,860 15,000

All Types 38,000 36,750 34,750 15,500 125,000

6

Broadband Sales Plan for 2014

Type of Connection Existing NW New NW Total

Fiber-to-the-Home 50,000 50,000

Megaline New Connections (Voice + Broadband) 55,000 20,000 75,000

Megaline New Connections (Voice + Broadband +PeoTV) 10,000 5,000 15,000

Megaline Voice Only to Broadband Upgrade 25,000 25,000

Megaline Voice Only to Broadband + PeoTV Upgrade 10,000 10,000

(Voice + PeoTV) to (Voice + Broadband + PeoTV) Upgrade 5,000 5,000

105,000 75,000 180,000

7

Ports for Broadband Connections:

NGN Migration Phase V 650,000 New Ports

NGN Migration Phase IV 73,000 currently commissioned

Expansion of existing network elements

Region wise Distribution of Broadband Target

Region wise Breakdown of Targets Metro R I R II R III

All

Island

Megaline New Connections (Voice + Broadband) 23,077 21,346 20,192 10,384 74,999

Megaline New Connections (Voice + Broadband +PeoTV) 4,615 4,269 4,038 2,077 14,999

Megaline Voice Only to Broadband Upgrade 7,693 7,116 6,731 3,462 25,002

Megaline Voice Only to Broadband + PeoTV Upgrade 3,077 2,846 2,693 1,385 10,001

(Voice + PeoTV) to (Voice + Broadband + PeoTV) Upgrade 1,538 1,423 1,346 692 4,999

Copper Based Connections 40,000 37,000 35,000 18,000 130,000

8

PeoTV Sales Plan for 2014

Type of Connection Existing NW New NW Total

FTTH 20,000 20,000

Megaline New Connections (Voice + PeoTV) 10,000 5,000 15,000

Megaline New Connections (Voice + Broadband +PeoTV) 10,000 5,000 15,000

Megaline Voice Only to PeoTV Upgrade 10,000 10,000

Megaline Voice Only to Broadband + PeoTV Upgrade 16,000 16,000

(Voice + Broadband) to (Voice + Broadband + PeoTV)

Upgrade

5,000 5,000

51,000 30,000 81,000

9

Target may be changed if the new PeoTV Platform is not commissioned on schedule.

Region wise Distribution of PeoTV Target

Region wise Breakdown of Targets Metro R I R II R III

All

Island

Megaline New Connections (Voice + Broadband) 4,909 4,364 4,364 1,364 15,001

Megaline New Connections (Voice + Broadband +PeoTV) 4,909 4,364 4,364 1,364 15,001

Megaline Voice Only to Broadband Upgrade 3,273 2,909 2,909 909 10,000

Megaline Voice Only to Broadband + PeoTV Upgrade 5237 4655 4655 1455 16002

(Voice + PeoTV) to (Voice + Broadband + PeoTV) Upgrade 1,636 1,455 1,455 455 5,001

ADSL Based Connections 19,964 17,747 17,747 5,547 61,005

10

Region wise Distribution of FTTH Target

FTTH All New Connections in 2014 50,000

Metro 30,000

Region I 9,000

Region II 8,000

Region III 3,000

11

FTTx Network Deployment:

Fiber network to be deployed to cover 100,000 households within 2014

Network Equipment capacity to be planned to cater min. 150,000 FTTH connections by 2016.

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

0 6 12 18 24 30 36 42

LTE Deployment Plan

Linear Curve for Growth

Month

Scenario 2

Commence Dec 13

4Q

2013

1Q

2014

2Q

2014

3Q

2014

4Q

2014

2015

2016

Additions 8,070 24,211 32,281 32,281 32,281 201,755 395,440

Cumulative by end 8,070 32,281 64,562 96,842 129,123 330,878 726,318

Scenario 1

Commence Nov 13

4Q

2013

1Q

2014

2Q

2014

3Q

2014

4Q

2014

2015

2016

Additions 16,140 26,901 32,281 32,281 37,661 212,515 368,539

Cumulative by end 16,140 43,041 75,322 107,603 145,264 357,779 726,318

(A)

District

(B)

Area

SqKM

(C)

HH

(D)

% HH with

Electricity

(E)

Feasible HH

(F)

Potential HH for

Fixed BB

[ (E) * 75% ]

(G)

HH served by

Megalines

(H)

Potential HH for

Fixed LTE BB

[ (F) (G) ]

(I)

HH to be served

with Fixed LTE BB

[ 30% of (H)]

CE 86 69,127 98% 67,634

50,726

47,601

3,125

937

HK 50 40,039 98% 39,174

29,381

27,571

1,810

543

KX 123 98,122 98% 96,003

72,002

67,567

4,435

1,331

MD 113 90,594 98% 88,637

66,478

62383

4,095

1,228

WT 79 63,028 98% 61,667

46,250

43,401

2,849

855

ND 126 100,898 98% 98,718

74,039

69,478

4,561

1,368

RM 121 96,946 98% 94,852

71,139

66,757

4,382

1,315

Gampaha 1,387 593,317 97% 573,085 429,814

111,969

317,845

95,353

Kalutara 1,598 300,402 94% 282,468 211,851 71,693 140,158

42,047

kandy 1,940 344,681 93% 320,588 240,441 70,062 170,378

51,114

Matale 1,993 127,884 85% 108,522

81,392

18,613 62,779

18,834

Nuwara - Eliya 1,741 177,420 89% 157,762 118,321 26,518 91,804

27,541

Galle 1,652 269,740 94% 253,798 190,349 28,645 161,704

48,511

Matara 1,283 204,194 94% 192,126 144,095 32,318 111,776

33,533

Hambantota 2,609 155,299 89% 138,589 103,942 14,015 89,927

26,978

Jaffna 1,025 137,503 73% 100,858

75,644

21,559 54,085

16,225

Mannar 1,996 23,783 64% 15,188

11,391

2,682

8,709

2,613

District Wise HHs to be served by Fixed LTE BB (End 2016 Target)

19%

20%

10%

9%

16%

(A)

District

(B)

Area

SqKM

(C)

HH

(D)

% HH with

Electricity

(E)

Feasible HH

(F)

Potential HH for

Fixed BB

[ (E) * 75% ]

(G)

HH served by

Megalines

(H)

Potential HH for

Fixed LTE BB

[ (F) (G) ]

(I)

HH to be served with

Fixed LTE BB

[30% of (H)]

District Wise HH to be served by Fixed LTE BB (End 2016 Target)

Vavuniya 1,967 41,214 71% 29,254 21,940 6,170 15,770 4,731

Mullaitivu 2,617 24,334 24% 5,753 4,314 - 4,314 1,294

Kilinochchi 1,279 28,304 10% 2,873 2,155 - 2,155 646

Batticaloa 2,854 133,795 68% 90,312 67,734 30,072 37,661 11,298

Ampara 4,415 163,388 82% 133,700 100,275 4,247 96,029 28,809

Trincomalee 2,727 95,871 78% 74,914 56,185 10,088 46,097 13,829

Kurunegala 4,816 439,065 86% 377,947 283,460 46,540 236,920 71,076

Puttalam 3,072 200,784 84% 168,538 126,404 20,792 105,612 31,684

Anuradhapura 7,179 228,304 83% 190,406 142,804 16,937 125,867 37,760

Polonnaruwa 3,293 110,476 84% 92,402 69,302 8,453 60,848 18,255

Badulla 2,861 212,510 87% 183,885 137,914 11,039 126,875 38,062

Moneragala 5,639 117,935 71% 83,274 62,455 - 62,455 18,737

Ratnapura 3,275 280,581 84% 234,285 175,714 33,898 141,816 42,545

Kegalle 1,693 218,508 89% 193,664 145,248 21,027 124,220 37,266

65,610 5,188,047 4,550,876 3,413,157 992,095 2,421,061 726,318

20%

10%

12%

19%

1. eNodeB Deployment plan takes a high-level view; based on districts

2. Final number of eNodeBs required in a district is based on 30% of potential HH for

fixed BB in that District

3. 60 to 75 % of that requirement is provided in phases 0 ,1 & 2 combined in high

requirement areas and around 5 to 10 % in low requirement areas

4. Exact locations of the eNodeBs are decided by the distribution of such potential HH

in the district (marketing input), availability of sharable sites and the radio design -

subject to the integrated access technology utilization plan for BB

5. However, outcome of above need to ensure that the overall target set for Fixed LTE

BB is achievable

Basis For eNodeB (BTS) Deployment

Overall eNodeB Deployment Plan

Linear Curve for Growth

1Q

2013

2Q

2013

3Q

2013

4Q

2013

Additions 0 0 0 63

Cumulative

by end

0 0 0 63

1Q

2014

2Q

2014

3Q

2014

4Q

2014

Additions 365 0 734 0

Cumulative

by end

428 428 1,163

1,163

1Q

2015

2Q

2015

3Q

2015

4Q

2015

Additions 0 0 0 709

Cumulative

by end

1,163

1,163 1,163

1,871

1Q

2016

2Q

2016

3Q

2016

4Q

2016

Additions 0 0 0 0

Cumulative

by end

1,871 1,871 1,871 1,871

eNodeB Deployment Plan Phase 0 + Phase 1

District No. of eNodeB

Colombo 22 + 0 = 22

Gampaha 21 + 46 = 67

Kalutara 8 + 22 = 30

Kandy 1 + 35 = 36

Matale 11

Nuwara - Eliya 20

Galle 34

Matara 24

Hambantota* 1 + 23 = 24

Jaffna 3 + 09 = 12

Mannar 1

Vavuniya 1 + 0 = 1

Mullaitivu 1

Kilinochchi 1

Batticaloa 1

Ampara 2

Trincomalee* 1 + 1 = 2

Kurunegala 1 + 46 = 47

Puttalam* 10

Anuradhapura 3

Polonnaruwa 2

Badulla 22

Moneragala* 1

Ratnapura 24

Kegalle 4 + 26 = 30

Total 428

Note:- Shown in red are existing BTS (Phase 0)

eNodeB Deployment Plan Under Phase 2

District No. of eNodeB

Colombo* 10

Gampaha 120

Kalutara 54

Kandy 65

Matale 20

Nuwara - Eliya 35

Galle 62

Matara 44

Hambantota* 38

Jaffna 22

Mannar 1

Vavuniya 1

Mullaitivu 1

Kilinochchi 1

Batticaloa 2

Ampara 3

Trincomalee* 4

Kurunegala 90

Puttalam* 13

Anuradhapura 4

Polonnaruwa 2

Badulla 43

Moneragala 2

Ratnapura 49

Kegalle 48

Total 734

Region wise Distribution of LTE Target

LTE All New Connections in 2014 129,200

Metro 13,500

Region I 50,800

Region II 51,500

Region III 13,400

19

LTE Network Deployment: Base station deployment to get 129,200 customers in 2014

Wi-Fi Site Deployment Plan All Island

Year Indoor Sites Outdoor Sites

Cumulative Hotspot

Sites

2013/14 98 51 149

2014 1600* 300* 2049

2015 640** 120** 2809

2016 640** 120** 3569

2017 640** 120** 4389

1. Wi-Fi Location may have one or many sites - e,g. A2 , A4 etc

2. * - Requirement provided by Marketing

3. ** - Estimate provided by Marketing

THE END

RTOM Area wise Fixed Broadband Targets

Region wise Summary

Area

Househol

ds with

Elec.

(2016)

Fixed BB

HH

Penetrati

on (2016)

Target

Fixed BB

Market in

2016

Target SLT

Fixed BB

Connecti

ons 2016

BB

Customer

Base (Sep

2013)

BB NC to

be

provided

between

2014-

2016

Revised

LTE

Targets

Revised

DSL +

FTTH

Targets

DSL+FTTH

2014

DSL+FTTH

2015

DSL+FTTH

2016

Metro 798,415 64% 510,986 407,797 170,408 237,389 102,000 135,389 61,312 51,094 22,983

Region I 1,920,063 37% 710,424 571,800 108,525 463,275 347,300 115,975 52,520 43,766 19,688

Region II 2,021,986 33% 667,256 537,194 84,246 452,948 349,200 103,748 46,983 39,151 17,612

Region III 658,311 32% 210,660 167,552 34,840 132,712 90,350 42,362 19,184 15,987 7,191

All Island 5,398,775 39% 2,105,523 1,684,343 398,019 1,286,324 888,850 397,474 179,999 149,998 67,474

Metro

Area

Household

s with Elec.

(2016)

Fixed BB

HH

Penetratio

n (2016)

Target

Fixed BB

Market in

2016

Target SLT

Fixed BB

Connection

s 2016

BB

Customer

Base (Sep

2013)

BB NC to

be

provided

between

2014-2016

Revised LTE

Targets

Revised

DSL + FTTH

Targets

DSL+FTTH

2014

DSL+FTTH

2015

DSL+FTTH

2016

Havelock Town 90,725 80% 72,580 58,064 30,411 27,653 5,000 22,653 10,259 8,549 3,846

Kotte 153,707 60% 92,225 73,780 34,455 39,325 15,000 24,325 11,016 9,180 4,129

Metro Central 244,432 67% 163,770 131,844 64,866 66,978 20,000 46,978 21,275 17,729 7,975

Maradana 184,747 60% 110,849 88,679 22,786 65,893 42,000 23,893 10,820 9,017 4,056

Wattala 98,081 60% 58,849 47,079 18,994 28,085 12,500 15,585 7,058 5,882 2,646

Metro North 282,828 60% 169,697 135,758 41,780 93,978 54,500 39,478 17,878 14,899 6,702

Nugegoda 125,492 70% 87,845 70,276 34,798 35,478 13,250 22,228 10,066 8,388 3,773

Ratmalana 145,663 60% 87,398 69,918 28,964 40,954 14,250 26,704 12,093 10,078 4,533

Metro South 271,155 65% 176,251 140,194 63,762 76,432 27,500 48,932 22,159 18,466 8,306

Metro Region 798,415 64% 510,986 407,797 170,408 237,389 102,000 135,389 61,312 51,094 22,983

Region I

Area

Household

s with Elec.

(2016)

Fixed BB

HH

Penetratio

n (2016)

Target

Fixed BB

Market in

2016

Target SLT

Fixed BB

Connection

s 2016

BB

Customer

Base (Sep

2013)

BB NC to

be

provided

between

2014-2016

Revised LTE

Targets

Revised

DSL + FTTH

Targets

DSL+FTTH

2014

DSL+FTTH

2015

DSL+FTTH

2016

Gampola 140,802 40% 56,321 45,057 8,047 37,010 27,900 9,110 4,125 3,438 1,546

Kandy 240,807 40% 96,323 77,058 21,551 55,507 35,000 20,507 9,287 7,739 3,481

Matale 140,513 35% 49,180 39,344 7,064 32,280 23,250 9,030 4,089 3,408 1,533

Central 522,122 39% 203,628 161,459 36,662 124,797 86,150 38,647 17,501 14,585 6,560

Anuradhapura 240,870 35% 84,305 67,444 4,672 62,772 54,750 8,022 3,633 3,027 1,362

Chilaw 233,252 35% 81,639 65,311 7,245 58,066 51,000 7,066 3,200 2,667 1,200

Kurunegala 425,147 35% 148,802 119,042 14,438 104,604 88,000 16,604 7,519 6,266 2,819

Polonnaruwa 131,286 20% 26,258 21,006 2,462 18,544 15,650 2,894 1,311 1,092 491

NC&NW 1,030,555 33% 340,084 272,803 28,817 243,986 209,400 34,586 15,663 13,052 5,872

Gampaha 235,447 45% 105,952 84,762 18,436 66,326 46,750 19,576 8,865 7,387 3,323

Negombo 131,939 50% 65,970 52,776 24,610 28,166 5,000 23,166 10,491 8,742 3,933

Western North 367,386 47% 172,672 137,538 43,046 94,492 51,750 42,742 19,356 16,129 7,256

Region I 1,920,063 37% 710,424 571,800 108,525 463,275 347,300 115,975 52,520 43,766 19,688

Region II

Area

Household

s with Elec.

(2016)

Fixed BB

HH

Penetratio

n (2016)

Target

Fixed BB

Market in

2016

Target SLT

Fixed BB

Connection

s 2016

BB

Customer

Base (Sep

2013)

BB NC to

be

provided

between

2014-2016

Revised LTE

Targets

Revised

DSL + FTTH

Targets

DSL+FTTH

2014

DSL+FTTH

2015

DSL+FTTH

2016

Awissawella 132,892 35% 46,513 37,210 4,643 32,567 26,000 6,567 2,974 2,478 1,115

Kegalle 146,333 35% 51,217 40,974 7,840 33,134 24,450 8,684 3,932 3,277 1,474

Ratnapura 236,786 40% 94,715 75,772 5,982 69,790 62,100 7,690 3,482 2,902 1,305

Sabaragamuwa 516,011 37% 190,925 153,956 18,465 135,491 112,550 22,941 10,388 8,657 3,894

Galle 267,700 40% 107,080 85,664 11,438 74,226 61,000 13,226 5,990 4,991 2,245

Hambantota 222,031 30% 66,610 53,288 4,112 49,176 43,150 6,026 2,729 2,274 1,023

Matara 212,486 35% 74,371 59,497 12,162 47,335 30,500 16,835 7,624 6,353 2,858

Southern 702,217 35% 245,776 198,449 27,712 170,737 134,650 36,087 16,343 13,618 6,126

Badulla 151,459 20% 30,292 24,234 3,222 21,012 16,500 4,512 2,043 1,703 766

Bandarawela 142,986 30% 42,896 34,317 3,953 30,364 24,900 5,464 2,474 2,062 928

Hatton 78,070 15% 11,711 9,369 2,072 7,297 4,500 2,797 1,267 1,055 475

Nuwara Eliya 105,643 15% 15,847 12,678 1,808 10,870 8,500 2,370 1,073 894 402

Uva 478,158 21% 100,414 80,597 11,055 69,542 54,400 15,142 6,857 5,714 2,571

Kalutara 192,574 40% 77,030 61,624 11,685 49,939 36,400 13,539 6,131 5,109 2,298

Panadura 133,026 40% 53,211 42,569 15,329 27,240 11,200 16,040 7,264 6,053 2,723

Western South 325,600 40% 130,240 104,193 27,014 77,179 47,600 29,579 13,395 11,162 5,021

Region II 2,021,986 33% 667,256 537,194 84,246 452,948 349,200 103,748 46,983 39,151 17,612

Region III

Area

Household

s with Elec.

(2016)

Fixed BB

HH

Penetratio

n (2016)

Target

Fixed BB

Market in

2016

Target SLT

Fixed BB

Connection

s 2016

BB

Customer

Base (Sep

2013)

BB NC to

be

provided

between

2014-2016

Revised LTE

Targets

Revised

DSL + FTTH

Targets

DSL+FTTH

2014

DSL+FTTH

2015

DSL+FTTH

2016

Ampara 70,040 20% 14,008 11,206 1,203 10,003 7,800 2,203 998 832 374

Batticaloa 139,229 25% 34,808 27,846 6,979 20,867 12,350 8,517 3,857 3,214 1,446

Kalmunai 87,067 40% 34,827 27,862 4,361 23,501 18,100 5,401 2,446 2,038 917

Eastern 296,336 28% 82,975 66,914 12,543 54,371 38,250 16,121 7,301 6,084 2,737

Mannar 24,751 40% 9,901 7,921 1,064 6,857 5,000 1,857 841 701 315

Trincomalee 96,472 25% 24,118 19,294 3,561 15,733 11,500 4,233 1,917 1,598 719

Vavuniya 45,239 30% 13,572 10,858 3,744 7,114 2,600 4,514 2,044 1,703 766

North East

Central

166,462 29% 48,274 38,073 8,369 29,704 19,100 10,604 4,802 4,002 1,800

Jaffna +

Killinochchi

195,513 40% 78,206 62,565 13,928 48,637 33,000 15,637 7,081 5,901 2,654

Northern 195,513 40% 78,206 62,565 13,928 48,637 33,000 15,637 7,081 5,901 2,654

Region III 658,311 32% 210,660 167,552 34,840 132,712 90,350 42,362 19,184 15,987 7,191

You might also like

- Satellite Communications: Principles and ApplicationsFrom EverandSatellite Communications: Principles and ApplicationsRating: 5 out of 5 stars5/5 (2)

- Introduction, Overview & Explanation of The Before Model: Author: Charles Williams, Decision Models, 3 December 2003Document143 pagesIntroduction, Overview & Explanation of The Before Model: Author: Charles Williams, Decision Models, 3 December 2003JORGENo ratings yet

- Project 3 - Stock Valuation With Comparable Companies AnalysisDocument3 pagesProject 3 - Stock Valuation With Comparable Companies AnalysisARPIT GILRANo ratings yet

- Growth and Stabilization: : at Average Exchange Rate P: ProvisionalDocument17 pagesGrowth and Stabilization: : at Average Exchange Rate P: ProvisionalWaqas TayyabNo ratings yet

- Wireless Fig MaDocument8 pagesWireless Fig MaKapsno1No ratings yet

- TABLE 1.1 Gross National Product at Constant Basic Prices of 2005-06Document12 pagesTABLE 1.1 Gross National Product at Constant Basic Prices of 2005-06sidraNo ratings yet

- Municipality of Bacoor, Cavite: 1. PropertyDocument9 pagesMunicipality of Bacoor, Cavite: 1. PropertyJoaquin Isaac NgNo ratings yet

- ElL 304 Lab2 ReportDocument9 pagesElL 304 Lab2 ReportGayank NegiNo ratings yet

- A2D302 Maintenance Cost Performance 2021Document16 pagesA2D302 Maintenance Cost Performance 2021Raul TicllacuriNo ratings yet

- Concept Design Mep - Kawasan Pulomas 09-01-2020Document23 pagesConcept Design Mep - Kawasan Pulomas 09-01-2020Bintang TimoerNo ratings yet

- 2020-1 Diseño Flexibles, Rígidos y Articulados Monroy-Moreno-TovarDocument70 pages2020-1 Diseño Flexibles, Rígidos y Articulados Monroy-Moreno-TovarKatherin MonroyNo ratings yet

- Analog Lab ReportDocument9 pagesAnalog Lab ReportGayank NegiNo ratings yet

- IT For Managers: Introducing Computer SystemsDocument142 pagesIT For Managers: Introducing Computer SystemsKapil GargNo ratings yet

- DepresiasiDocument139 pagesDepresiasiFachri MunadiNo ratings yet

- Gross Domestic Product of Pakistan (At Constant Basic Prices of 2005-06)Document2 pagesGross Domestic Product of Pakistan (At Constant Basic Prices of 2005-06)M Jahanzaib KhaliqNo ratings yet

- ENERGY DEMAND FORECAST 2018-2030 PT PLN NTBDocument74 pagesENERGY DEMAND FORECAST 2018-2030 PT PLN NTBAdhijaya MuhammadNo ratings yet

- AUSPOS GPS Processing Report: July 15, 2019Document7 pagesAUSPOS GPS Processing Report: July 15, 2019Phillip CanonizadoNo ratings yet

- Customer Demand Cube: PurposeDocument15 pagesCustomer Demand Cube: PurposeTiyaNo ratings yet

- Palm Oil Mill, Biogas Reactor and Composting Plant Project ParametersDocument9 pagesPalm Oil Mill, Biogas Reactor and Composting Plant Project ParametersashxerNo ratings yet

- Market Structure Analysis EcoDocument9 pagesMarket Structure Analysis EcoPalak MendirattaNo ratings yet

- Analysis of India's Plywood Market - Fall 2016 HAMK - RemovedDocument19 pagesAnalysis of India's Plywood Market - Fall 2016 HAMK - Removedramsiva354No ratings yet

- Cost Price 2023Document15 pagesCost Price 2023bryaninmyanmarNo ratings yet

- NPV Calculation of Euro DisneylandDocument5 pagesNPV Calculation of Euro DisneylandRama SubramanianNo ratings yet

- Calculos TotalDocument29 pagesCalculos TotalMaria De Los Angeles YomeyeNo ratings yet

- TABLE B - Employment by Major Industry Group and Total Hours Worked, Philippines_2Document6 pagesTABLE B - Employment by Major Industry Group and Total Hours Worked, Philippines_2cotiadanielNo ratings yet

- Gen MIX2Document4 pagesGen MIX2Lerma AdvinculaNo ratings yet

- Power StatisticsDocument10 pagesPower Statisticsempty87No ratings yet

- Itm EnabledDocument3 pagesItm EnabledRed TanNo ratings yet

- LakeHouse Combined SU 6-28-16 PDFDocument1 pageLakeHouse Combined SU 6-28-16 PDFRecordTrac - City of OaklandNo ratings yet

- Gross Capital Formation in Agriculture & Allied Sector (At Current Prices)Document2 pagesGross Capital Formation in Agriculture & Allied Sector (At Current Prices)Anushka GoelNo ratings yet

- UL THPDocument15 pagesUL THPAdil MuradNo ratings yet

- Wcms 305886Document59 pagesWcms 305886elenaNo ratings yet

- Development Since1991 27december2018Document9 pagesDevelopment Since1991 27december2018Bhaskar SahaNo ratings yet

- ZurnDocument34 pagesZurnLight saberNo ratings yet

- Projections & ValuationDocument109 pagesProjections & ValuationPulokesh GhoshNo ratings yet

- 3516 ProductInformation 31-03-2020Document46 pages3516 ProductInformation 31-03-2020adewunmi olufemiNo ratings yet

- By Leased and Owned Space: Estimates and Projections of Federal Employment (1994 To 2030)Document1 pageBy Leased and Owned Space: Estimates and Projections of Federal Employment (1994 To 2030)M-NCPPCNo ratings yet

- ISO 9001 Certified Air Handling UnitsDocument4 pagesISO 9001 Certified Air Handling UnitsYudhi YudadmokoNo ratings yet

- Tidt 094Document12 pagesTidt 094Ovidiu GrigorescuNo ratings yet

- Driefontein and Kloof gold mine performance reportDocument14 pagesDriefontein and Kloof gold mine performance reportMashudu MbulayeniNo ratings yet

- Reporte AusposDocument7 pagesReporte AusposCarlos Dario Chipana Quispe100% (1)

- Imaging Appwith BModel CR1Document6 pagesImaging Appwith BModel CR1Red TanNo ratings yet

- AUSPOS GPS Processing Report: June 5, 2022Document7 pagesAUSPOS GPS Processing Report: June 5, 2022JORGE ROBERTO MALAGA TERRAZASNo ratings yet

- 01 - Summary of 2022 Power StatisticsDocument2 pages01 - Summary of 2022 Power StatisticsLealyn V. MadayagNo ratings yet

- 2021 Power Statistics - Electricity Sales and Consumption Per Sector Per Grid (DOE-Philippines)Document1 page2021 Power Statistics - Electricity Sales and Consumption Per Sector Per Grid (DOE-Philippines)NikkiNo ratings yet

- AUSPOS - Online GPS Processing ServiceDocument7 pagesAUSPOS - Online GPS Processing ServiceRanjith KumarNo ratings yet

- Tamil Nadu GDP Sector GrowthDocument2 pagesTamil Nadu GDP Sector GrowthskumarsrNo ratings yet

- SPU DImensioning Table - Ed1Document10 pagesSPU DImensioning Table - Ed1Anice NoureddineNo ratings yet

- Adb IndoDocument35 pagesAdb IndoHoang Giang NguyenNo ratings yet

- 2505 Interco Case 13Document12 pages2505 Interco Case 13Fabián AlvaradoNo ratings yet

- MFF 2021-2027 Breakdown Current PricesDocument2 pagesMFF 2021-2027 Breakdown Current PricesCaelum DsfmnnNo ratings yet

- Handbook of Energy & Economic Statistics of Indonesia 2009Document66 pagesHandbook of Energy & Economic Statistics of Indonesia 2009isan najmiNo ratings yet

- Description 2017 % 2018 % 2019 % 2020 % AFY 2021 % Total %Document27 pagesDescription 2017 % 2018 % 2019 % 2020 % AFY 2021 % Total %Khaled ShangabNo ratings yet

- Revenue ProjectionDocument17 pagesRevenue ProjectionKriti AhujaNo ratings yet

- For PrintDocument1 pageFor PrintkenkenmusicNo ratings yet

- Bab IiiDocument13 pagesBab IiiBerlina YunitaNo ratings yet

- LTE Serving Cell Performance Report for Semarang 3 NetworkDocument11 pagesLTE Serving Cell Performance Report for Semarang 3 NetworkNarto MujiatmikoNo ratings yet

- Jan Feb 1.7.1 Acquisition 1.7.3 Subscribe: 1.7 Product Funnel Conversion Analysis (Acquisition, Activation)Document55 pagesJan Feb 1.7.1 Acquisition 1.7.3 Subscribe: 1.7 Product Funnel Conversion Analysis (Acquisition, Activation)jeremiah eliorNo ratings yet

- Millimetre Wave Antennas for Gigabit Wireless Communications: A Practical Guide to Design and Analysis in a System ContextFrom EverandMillimetre Wave Antennas for Gigabit Wireless Communications: A Practical Guide to Design and Analysis in a System ContextNo ratings yet

- Country ReportDocument46 pagesCountry ReportNadierohana BernadgeNo ratings yet

- Sri LankaConnectivityDocument23 pagesSri LankaConnectivityNadierohana BernadgeNo ratings yet

- DandO White Paper 2 2014Document28 pagesDandO White Paper 2 2014Nadierohana BernadgeNo ratings yet

- 013 Fundementals of Electronic Communication 3Document68 pages013 Fundementals of Electronic Communication 3Nadierohana BernadgeNo ratings yet

- SonetLynx Technical Overview Sect 14Document7 pagesSonetLynx Technical Overview Sect 14240GL guyNo ratings yet

- AWR-8210 Wireless ADSL Router: Product InformationDocument2 pagesAWR-8210 Wireless ADSL Router: Product InformationMatt SephtonNo ratings yet

- LAN TechnologiesDocument4 pagesLAN TechnologiesCCNAResourcesNo ratings yet

- BSCDocument1 pageBSCAbdirihmanNo ratings yet

- What's The Difference Between RJ11 and RJ45 Ethernet Cables?Document2 pagesWhat's The Difference Between RJ11 and RJ45 Ethernet Cables?David SofitaNo ratings yet

- Siae CatalogoDocument6 pagesSiae CatalogoSandibell SanchezNo ratings yet

- Building Cisco Service Provider Next Generation Networks (SPNGN1), Part 1 (640-875)Document3 pagesBuilding Cisco Service Provider Next Generation Networks (SPNGN1), Part 1 (640-875)desai_erNo ratings yet

- SWITCH-EnterpriseNets and VLANs PDFDocument118 pagesSWITCH-EnterpriseNets and VLANs PDFSabri BalafifNo ratings yet

- COMPUTER NETWORKS OVERVIEWDocument24 pagesCOMPUTER NETWORKS OVERVIEWDjordje OrasaninNo ratings yet

- Syn-2151 10/100/1000baset Ethernet Media ConverterDocument2 pagesSyn-2151 10/100/1000baset Ethernet Media ConverterAlan VillalpandoNo ratings yet

- Belden Optical Fiber Catalog 12.13Document60 pagesBelden Optical Fiber Catalog 12.13Ricardo Jhonatan Bueno PortillaNo ratings yet

- Maxis Fiber InstallationDocument15 pagesMaxis Fiber InstallationMuhamad AshraffNo ratings yet

- Design, Installation and Implementation of School Net, For Addis Ababa City Government Education BureauDocument2 pagesDesign, Installation and Implementation of School Net, For Addis Ababa City Government Education BureauMenase NahomNo ratings yet

- CDCDocument9 pagesCDCMelvin P. FiguraNo ratings yet

- Chapter 1: WAN Concepts: CCNA Routing and Switching Connecting Networks v6.0Document44 pagesChapter 1: WAN Concepts: CCNA Routing and Switching Connecting Networks v6.0Ardale PalilloNo ratings yet

- Networking Lecture 2 Common DevicesDocument4 pagesNetworking Lecture 2 Common DevicesEman FatimaNo ratings yet

- Cisco Validated Design Icon LibraryDocument5 pagesCisco Validated Design Icon LibraryYesid CamargoNo ratings yet

- Homework 2Document1 pageHomework 2Nguyễn Hoàng Khánh LinhNo ratings yet

- Physical Infrastructure Systems: Opticam Pre-Polished Cam Fiber Optic Termination KitsDocument1 pagePhysical Infrastructure Systems: Opticam Pre-Polished Cam Fiber Optic Termination KitsMitchell SANo ratings yet

- TranscoderDocument15 pagesTranscoderanand_k_singhNo ratings yet

- Nimbra MSR 600 DatasheetDocument4 pagesNimbra MSR 600 Datasheetsam75000sugNo ratings yet

- Surpass Hit 7050: Multi-Service Provisioning PlatformDocument2 pagesSurpass Hit 7050: Multi-Service Provisioning Platformrohit007220% (1)

- IV ECE ESS Question BankDocument3 pagesIV ECE ESS Question BankVeerayya JavvajiNo ratings yet

- GB Interface Detailed Planning - FinalDocument63 pagesGB Interface Detailed Planning - FinalMichel SilvaNo ratings yet

- PSTN part II: Call Progress and Local Access NetworkDocument25 pagesPSTN part II: Call Progress and Local Access NetworkKarisha Andhika Puspita Sari0% (1)

- (HUAWEI) Poster-GPON TechnologyDocument1 page(HUAWEI) Poster-GPON TechnologyCutui MariusNo ratings yet

- CAP, MAP and ISUP Overviews for CAMEL OperationsDocument5 pagesCAP, MAP and ISUP Overviews for CAMEL OperationsO'Tobiloba AjibawoNo ratings yet

- Next Generation G-PON: XG-PON Technology and StandardizationDocument20 pagesNext Generation G-PON: XG-PON Technology and StandardizationangelpyNo ratings yet

- Cisco 850 Series Integrated Services Routers Data SheetDocument8 pagesCisco 850 Series Integrated Services Routers Data SheetJoannaNo ratings yet

- Deu DWR 921 Datasheet en 20130118Document3 pagesDeu DWR 921 Datasheet en 20130118Marius Gabriel LNo ratings yet