Professional Documents

Culture Documents

Valuation Methods

Uploaded by

Ad QasimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Methods

Uploaded by

Ad QasimCopyright:

Available Formats

Assets Valuation Methods

Valuation Techniques

Using fundamental analysis, there are two

techniques

1. Discounted cash flow techniques

1. Dividend Discounted Model (Income Method)

2. Free Cash flow to equity (Cash Flow Analysis)

3. Free Cash flow to firm (Cash Flow Analysis)

2. Relative Valuation technique [these techniques measure the

stocks while comparing with some bench mark (such as the

market, industry) or stocks own history over time]

Tobins q (Asset-based Approach)

Price/Earning Ratio (Market-based Technique)

Fundamental analysis

Fundamental analysis is a term for studying a

companys accounting statements and other

financial and economic information to estimate

the economic value of a companys stock.

The fundamental analysis was formally used to

analyze and evaluate the balance sheets, annual

reports, trend analysis, profitability ratios and

profit & loss figures in order to beat the market.

The basic idea is to identify undervalued stocks to

buy and overvalued stocks to sell.

Intrinsic Value Vs Market Value

Intrinsic Value (IV) is the estimated value of

the stock today derived from discounting the

future cash flows for a stock

Market value (MV) is the current share price.

If IV > MV = the assets is undervalued and

should be purchased.

If IV < MV = the assets are overvalued and

should be sold

If IV = MV, the assets are correctly valued.

Dividend Discounted Model (DDM)

The basic idea behind the discounting model

is:

Present Value = Future Value

1+ Interest Rate

OR

Intrinsic Value of security = Cash flow

1+RRR

Intrinsic Value

As already mentioned that Intrinsic value of a share

is the present value of all cash payments to the

investor in the stock

To calculate intrinsic value we need,

All cash flows (dividend + closing price)

Discount rate (required rate of return)

6-7

The Dividend Discount Model

The Dividend Discount Model (DDM) is a method to

estimate the value of a share of stock by discounting all

expected future dividend payments. The DDM equation is:

In the DDM equation:

IV (Intrinsic Value) = the present value of all future

dividends

D(t) = the dividend to be paid t years from now

k = the appropriate risk-adjusted discount rate

T 3 2

k 1

D(T)

k 1

D(3)

k 1

D(2)

k 1

D(1)

IV

Three Foms of DDM

1. Zero Growth Model

2. Constant Growth Model

3. Multi-growth rate model

Zero Growth Model of DDM

If share produces same dividend over an

infinite period of time; then its become

perpetuity.

IV = D

K

Where IV = Intrinsic Value; D is the series of

equal dividend; K is the discounting rate

Constant Growth Model of DDM

If there is constant forever growth in the

dividend; then the dividend will increase on

the basis of compound rate;

Hence, the dividend next period (t + 1) is:

6-11

Constant Growth Model of DDM

If there is constant forever growth in the

dividend; then the dividend will increase on

the basis of compound rate;

Hence, the dividend next period (t + 1) is:

As

g 1 t D 1 D or 1 t D

T 3 2

k 1

D(T)

k 1

D(3)

k 1

D(2)

k 1

D(1)

IV

6-12

Constant Growth Model of DDM

Or it can be calculated like:

Using limit Theorem, the DDM formula for

constant growth becomes:

Or

Where, K g is the growth factor

g k

g D

IV

o

) 1 (

T

T

0

3

3

o

2

2

o o

k 1

g) (1 D

k 1

g) (1 D

k 1

g) (1 D

k 1

g) (1 D

IV

g k

D

IV

1

6-13

Estimating the Growth Rate

The growth rate in dividends (g) can be

estimated in a number of ways.

Using the companys historical average growth

rate.

Using an industry median or average growth rate.

The Multi growth rate model

Or

Two-Stage Dividend Growth Model

The firm grow at the faster rate in the

beginning years and then slow down to

normal growth (constant growth)

The two-stage dividend growth model

assumes that a firm will initially grow at a rate

g

1

for T years, and thereafter grow at a rate g

2

< k during a perpetual second stage of growth.

The intrinsic value is calculated while

calculating the PV of different growth stages

and sum up both PV.

The Multi growth rate model

Where P is calculated using the constant growth

model of DDM

t

k

P Dt

k

D

k

D

k

D

IV

) 1 (

...

) 1 (

3

) 1 (

2

1

1

3 2

) (

) 1 (

g k

G Dt

P

Example...

Suppose a firm current dividend is Rs. 8 per

share, the dividend increases at 7% in the first

stage for 5 years and grows at a constant

growth of 4% thereafter, required rate of

return (discount rate) is 9%, calculate the

intrinsic value of the firm?

Relative Valuation Methods

Tobins Q:

Tobins q is the ratio of the market value of a firm to the

replacement cost of its assets

The replacement cost of an asset is the cost of acquiring

an asset of identical characteristics, such as the

production capacity of a plant:

For example the market value of a firm is Rs. 500 and the

replacement cost of its assets is Rs. 250, its q is 2

Tobins q =

Market value of firm

Replacement cost of its assets

or Total Assets Value

Relative Valuation Methods

Tobins Q (cont):

Tobins q has been used in investment context to spot

undervalued companies

For example, a low Q (between 0 and 1) means that the cost

to replace a firm's assets is greater than the value of its stock.

This implies that the stock is undervalued.

Conversely, a high Q (greater than 1) implies that a firm's

stock is more expensive than the replacement cost of its

assets, which implies that the stock is overvalued.

This measure of stock valuation is the driving factor behind

investment decisions in Tobin's model.

Relative Valuation Methods

Price/Earning Ratio:

Price/Earning Ratio (PER) also known as the earnings

multiplier, expresses the relationship between a firms

earnings for equity market capitalization

P/E ratio means how much price investors are willing to

pay for one rupee of earning

In practice, equity value is proxied by the market value of

companies equity:

PER =

Market value of equity

Earnings for equity

PER =

Share price

Earnings per share (EPS)

or

For Example

OGDCL P/E ratio is = 500/50 = 10

It means for one rupee earnings investors are willing

to pay Rs.10 for buying one share of OGDCL

High P/E ratio refers that investors are paying for

money for shares for the same one rupee of

earnings. Similarly;

Low P/E shares are cheap, investors have to pay

lesser price for the same one rupee of earnings,

So it will be feasible for bidder to target the low P/E

ratio firm.

Relative Valuation Methods

There are two decision criteria

On the basis of firm own earnings estimates

On the basis of industry P/E

Relative Valuation Methods

Suppose OGDCL current earnings is Rs. 50

Million and current market price is Rs. 500

Million. It is expected that coming year

earnings will be Rs. 100 million. On the basis

of P/E ratio, whether OGDCL is suitable for

investment or not.

OGDCL P/E ratio is = 500/50 = 10x

On the basis of firm own earnings estimates

Current P/E is 10x

Price = (P/E)x future Earnings

= 10x 100 = 10,00

Current price is 500, so buyer should invest in

OGDCL.

On the basis of industry P/E

Analysts usually calculate P/E ratio for an

industry or whole market

An individual stocks P/E is compared with

others in the industry

If it is traded at discount in relations to others,

then the stock is recommended for buying

Example on P/E ratio

Firm OGDCL P/E ratio Vs Industry P/E ratio

10 = 10 (Correctly Valued)

10 Vs 15 (Under-Valued)

10 Vs 7 (Over-Valued)

You might also like

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Introduction To Capital MarketsDocument41 pagesIntroduction To Capital MarketsnisantiNo ratings yet

- Foreign Currency TransactionsDocument58 pagesForeign Currency TransactionsKatzkie Montemayor GodinezNo ratings yet

- Ifrs 3Document4 pagesIfrs 3Ken ZafraNo ratings yet

- Chapter 18 Policies Estimates and ErrorsDocument28 pagesChapter 18 Policies Estimates and ErrorsHammad Ahmad100% (1)

- Financial PlanningDocument22 pagesFinancial Planningangshu002085% (13)

- Financial Planning and ControlDocument52 pagesFinancial Planning and ControlCiptaAjengPratiwiNo ratings yet

- Chapter 08 Stock ValuationDocument34 pagesChapter 08 Stock Valuationfiq8809No ratings yet

- Financial Statement AnalysisDocument36 pagesFinancial Statement AnalysisDakshi Saini100% (1)

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationNo ratings yet

- Capital Budgeting and Investment DecisionDocument105 pagesCapital Budgeting and Investment DecisionRMKamranNo ratings yet

- Financial Statement AnalysisDocument57 pagesFinancial Statement AnalysisYogesh PawarNo ratings yet

- What Is Return On Equity - ROE?Document12 pagesWhat Is Return On Equity - ROE?Christine DavidNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementGansukh ZolbooNo ratings yet

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- Introduction To Valuation Techniques Section 1Document11 pagesIntroduction To Valuation Techniques Section 1goody89rusNo ratings yet

- Capital BudgetingDocument92 pagesCapital BudgetingSachin BabbiNo ratings yet

- Preparation of Financial StatementsDocument3 pagesPreparation of Financial StatementsMarc Eric Redondo0% (1)

- Financing Decisions 2Document12 pagesFinancing Decisions 2PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mutual Fund......Document113 pagesMutual Fund......Amrin ChaudharyNo ratings yet

- Cost of Capital Lecture Slides in PDF FormatDocument18 pagesCost of Capital Lecture Slides in PDF FormatLucy UnNo ratings yet

- Lecture 3 - Financial Markets and InstitutionsDocument36 pagesLecture 3 - Financial Markets and InstitutionsNithiyaa VijayanNo ratings yet

- Primary Market &: The Underwriting of SecurityDocument32 pagesPrimary Market &: The Underwriting of SecuritySumon100% (1)

- Investment and Portfolio Management AssignmentDocument29 pagesInvestment and Portfolio Management AssignmentLiaNo ratings yet

- Role of Financial Markets and InstitutionsDocument23 pagesRole of Financial Markets and InstitutionsIbnuIqbalHasanNo ratings yet

- Dividend Discount Model in Valuation of Common StockDocument15 pagesDividend Discount Model in Valuation of Common Stockcaptain_bkx0% (1)

- Payout Policy Elements of Payout PolicyDocument6 pagesPayout Policy Elements of Payout PolicyMarlon A. RodriguezNo ratings yet

- Financial LeverageDocument21 pagesFinancial LeverageSarab Gurpreet BatraNo ratings yet

- Chapter 5 - Asset ValuationDocument4 pagesChapter 5 - Asset ValuationSteffany RoqueNo ratings yet

- Cost Management TheoryDocument27 pagesCost Management TheoryKoteshwar Rao100% (2)

- Business Finance Lecture NotesDocument118 pagesBusiness Finance Lecture NotesYashrajsing Luckkana100% (1)

- Overview of Valuation Concepts and MethodsDocument7 pagesOverview of Valuation Concepts and Methodsprincess mae colinaNo ratings yet

- Financial Management NotesDocument10 pagesFinancial Management NotesMubarak Basha100% (1)

- Financial Statement AnalysisDocument55 pagesFinancial Statement AnalysisPravin UntooNo ratings yet

- Chap.5 FINANCIAL ASSET ValuationDocument39 pagesChap.5 FINANCIAL ASSET ValuationJeanette FormenteraNo ratings yet

- CHAPTER 16 Forecasting Short Term (Operating) Financial Requirements - ARCEODocument20 pagesCHAPTER 16 Forecasting Short Term (Operating) Financial Requirements - ARCEOPatricia Bianca ArceoNo ratings yet

- Cap BudDocument29 pagesCap BudJorelyn Joy Balbaloza CandoyNo ratings yet

- Financial RatiosDocument44 pagesFinancial RatiosOmaidNo ratings yet

- Financial System & BSPDocument46 pagesFinancial System & BSPZenedel De JesusNo ratings yet

- Time Value of Money (Notes)Document13 pagesTime Value of Money (Notes)Zubair ArshadNo ratings yet

- C.A IPCC Ratio AnalysisDocument6 pagesC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- Flexible Budget ProblemDocument19 pagesFlexible Budget Problemmansurresy100% (1)

- Foreign Exchange MarketDocument73 pagesForeign Exchange MarketAmit Sinha100% (1)

- Stocks and Their ValuationDocument33 pagesStocks and Their ValuationTariqul Islam TanimNo ratings yet

- Residual Income ValuationDocument21 pagesResidual Income ValuationqazxswNo ratings yet

- Capital Budgeting Problem NPV Vs IRR Easy Case PDFDocument4 pagesCapital Budgeting Problem NPV Vs IRR Easy Case PDFHassanSheikh50% (4)

- Dillard R WK #7 Assignment Chapter 7Document2 pagesDillard R WK #7 Assignment Chapter 7Rdillard12100% (1)

- IFRS 2 Share Based PaymentsDocument14 pagesIFRS 2 Share Based Paymentsniichauhan100% (1)

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDocument4 pagesChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Valuation MethodsDocument21 pagesValuation Methodsbluisss100% (1)

- Unit 3 Financial Statement Analysis BBS Notes eduNEPAL - Info - PDFDocument3 pagesUnit 3 Financial Statement Analysis BBS Notes eduNEPAL - Info - PDFGrethel Tarun MalenabNo ratings yet

- Bond and Stock ValuationDocument14 pagesBond and Stock ValuationadikopNo ratings yet

- Sources of FinanceDocument91 pagesSources of Financeharinder2010No ratings yet

- Chapter 2Document31 pagesChapter 2Roseanne Yumang100% (1)

- Collective Investement SchemesDocument28 pagesCollective Investement SchemesEmeka Nkem100% (1)

- DCF Approach To Valuation PDFDocument8 pagesDCF Approach To Valuation PDFLucky LuckyNo ratings yet

- Cost of Capital 2Document29 pagesCost of Capital 2BSA 1A100% (2)

- Financial Statements and Ratio AnalysisDocument26 pagesFinancial Statements and Ratio Analysismary jean giananNo ratings yet

- CFA Level III MCQ Mocks Relevancy For 2014Document2 pagesCFA Level III MCQ Mocks Relevancy For 2014Ad QasimNo ratings yet

- Im 09Document7 pagesIm 09Ad QasimNo ratings yet

- CH 18 Financial RegulationDocument7 pagesCH 18 Financial RegulationAd QasimNo ratings yet

- Marketing Issues in PakistanDocument18 pagesMarketing Issues in PakistanAd QasimNo ratings yet

- Quantitative Problems Chapter 9Document3 pagesQuantitative Problems Chapter 9Ad Qasim100% (1)

- Foundations of Selection: Fundamentals of Human Resource Management, 10/E, Decenzo/RobbinsDocument25 pagesFoundations of Selection: Fundamentals of Human Resource Management, 10/E, Decenzo/RobbinsAd QasimNo ratings yet

- New IdeasDocument21 pagesNew IdeasAd QasimNo ratings yet

- For Information About Installing, Running and Configuring Firefox Including A List of Known Issues and Troubleshooting InformationDocument1 pageFor Information About Installing, Running and Configuring Firefox Including A List of Known Issues and Troubleshooting InformationAd QasimNo ratings yet

- Samplereport PDFDocument18 pagesSamplereport PDFDavid BayerNo ratings yet

- For Information About Installing, Running and Configuring Firefox Including A List of Known Issues and Troubleshooting InformationDocument1 pageFor Information About Installing, Running and Configuring Firefox Including A List of Known Issues and Troubleshooting InformationAd QasimNo ratings yet

- 9 Pdf&rendition 1.Document5 pages9 Pdf&rendition 1.boygenius21_39464798No ratings yet

- Paper18b PDFDocument47 pagesPaper18b PDFAnonymous SgD5u8R100% (1)

- SAPM WorkbbookDocument117 pagesSAPM WorkbbookMujeeb Ur RahmanNo ratings yet

- Enterprises v. SEC)Document3 pagesEnterprises v. SEC)Mike E DmNo ratings yet

- Submitted: University of Mumbai A Project Report OnDocument60 pagesSubmitted: University of Mumbai A Project Report OnLijoy LijuNo ratings yet

- Columbia DC LiveOnline AgendaDocument1 pageColumbia DC LiveOnline AgendaTawicimNo ratings yet

- Financial Markets - Overview - PresentationDocument12 pagesFinancial Markets - Overview - PresentationalexmursaNo ratings yet

- PRM Study Guide Exam 1Document29 pagesPRM Study Guide Exam 1StarLink1No ratings yet

- Motilal Oswal 23rd Annual Wealth Creation Study - Detailed ReportDocument43 pagesMotilal Oswal 23rd Annual Wealth Creation Study - Detailed ReportRajeshPandeyNo ratings yet

- Question 1: Explain Black Whastcholes Model and Show That It Satisfies Put Call Parity ?Document8 pagesQuestion 1: Explain Black Whastcholes Model and Show That It Satisfies Put Call Parity ?arpitNo ratings yet

- A4 Chapter 5 - Bonds PayableDocument8 pagesA4 Chapter 5 - Bonds PayableMa Jhenelle De Leon100% (1)

- Options, Futures and Other Derivatives Course Lecture 3Document51 pagesOptions, Futures and Other Derivatives Course Lecture 3SolNo ratings yet

- 17 A To Z of Stock Market WordsDocument14 pages17 A To Z of Stock Market WordsyashlathaNo ratings yet

- Factors Affecting Stock MarketDocument80 pagesFactors Affecting Stock MarketAjay SanthNo ratings yet

- Background of The StudyDocument12 pagesBackground of The StudyMichael Asiedu100% (1)

- Goldman Exhibits - Hearing On Wall Street and Financial CrisisDocument901 pagesGoldman Exhibits - Hearing On Wall Street and Financial CrisisFOXBusiness.com100% (1)

- Tutorial - Corporation Stock - StudentsDocument3 pagesTutorial - Corporation Stock - StudentsBerwyn GazaliNo ratings yet

- Overview of The Chittagong Stock ExchangeDocument30 pagesOverview of The Chittagong Stock ExchangeSalman YaddadNo ratings yet

- Hesham AldandashiDocument11 pagesHesham Aldandashihisham aldandashiNo ratings yet

- MEGAN-AnnualReport2006 (1.1MB)Document86 pagesMEGAN-AnnualReport2006 (1.1MB)Hong You LeongNo ratings yet

- SyllabusDocument7 pagesSyllabusjiosNo ratings yet

- Notes - Option PayoffsDocument49 pagesNotes - Option PayoffsBilal AhmedNo ratings yet

- Unit 5 Tutorial SolutionDocument3 pagesUnit 5 Tutorial SolutionEleanor ChengNo ratings yet

- Glossary of Financial Terms English Traditional ChineseDocument160 pagesGlossary of Financial Terms English Traditional ChinesehwmawNo ratings yet

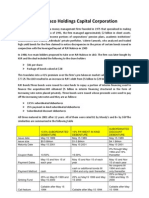

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaNo ratings yet

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeDocument1,553 pagesEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassNo ratings yet

- Tentamen November 2013Document10 pagesTentamen November 2013Vishay HardwarsingNo ratings yet

- Blackstone IPO Group 13Document12 pagesBlackstone IPO Group 13AnirudhNo ratings yet

- Alphatrends Understanding Market Structure PDFDocument1 pageAlphatrends Understanding Market Structure PDFSino33% (3)

- Project Report On Buy - Back of Shares-KhushbuDocument7 pagesProject Report On Buy - Back of Shares-KhushbucahimanianandNo ratings yet