Professional Documents

Culture Documents

Monetary Policy: How The Global Financial Crisis 2007 Was A Result of Loose Monetary Policy in The US

Uploaded by

Mortigou Richmond Oliver Labunda0 ratings0% found this document useful (0 votes)

18 views11 pagesGFC 2007 a result of loose monetary policy in the US

Original Title

Monetary Policy

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGFC 2007 a result of loose monetary policy in the US

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views11 pagesMonetary Policy: How The Global Financial Crisis 2007 Was A Result of Loose Monetary Policy in The US

Uploaded by

Mortigou Richmond Oliver LabundaGFC 2007 a result of loose monetary policy in the US

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 11

MONETARY POLICY

How the Global Financial Crisis 2007 was a result of

Loose Monetary policy in the US

MROL

AGENDAS FOR THIS PRESENTATION

What is Monetary Policy and types of Monetary Policy

Key Events Influencing to the Global Financial Crisis 2007

How Expansionary Monetary Policy led to the GFC 2007

The Response of the Federal Reserve

Conclusion

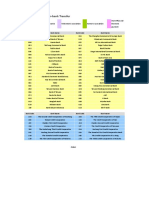

WHAT IS MONETARY POLICY

Expansionary or Loose

Monetary Policy

Attempts to promote aggregate demand

growth.

Reserve bank encourages private

consumption by Increasing the amount of

money in the economy,

When the quantity of money in circulation is

being rapidly increased, interest rates are

thus being pushed down which encourages

lending and investment.

The increase in consumption and

investment leads to a higher aggregate

demand.

Contractionary or Tight

Monetary Policy

Attempts to slow aggregate demand

growth.

The central bank discourages private

consumption by decreasing the amount of

money in the economy.

The quantity of money available is being

reduced, the interest rate increase, which

discourages lending and investment.

Higher interest rate promotes saving, which

further discourages private consumption.

The decrease in consumption and

investment leads to a decrease in growth in

aggregate demand.

Actions by the Reserve/Federal Bank to affect the price as well as the

quantity of money and credit in order to influence economic activity

KEY EVENTS INFLUENCING TOWARDS

THE GFC 2007

The bursting of the dot-com bubble, which saw the booming NASDAQ over

19982000 burst in 2001.

Fearing a downturn and possible deflation, the US Federal Reserve eased

monetary policy in 2001 in a series of steps till 2004.

Boom in house prices followed and a period of high growth in credit and

leveraged loans due to easy credit and a rising housing market

Rising demands from China (and, to some extent, India), plus a booming

world economy saw commodity prices rise across oil, minerals and food from

late 2004 to late 2007. The shock to the global economy from this commodity

price boom was as big as the first oil shock in the 1970s.

Rising prices and inflation caused monetary authorities to tighten policy from

mid-2004 to June 2006.

HOW DID LOOSE MONETARY POLICY

LED TO GFC 2007 IN THE US?

Due to the long term application of Expansionary Monetary policy by the Federal

Reserve

Started in 2001-2004

Gave rise to the asset price bubble and commodity price spike.

Led to the creation of the US housing bubble

Low interest rates

Adjustable-rate mortgages appeared to be very attractive to potential

buyers or prime buyers (responsible borrowers)

The Federal Reserve continued to liquidity into credit markets to ensure that

credit would continue to flow at low rates of interest

Support for the Sub-prime (most risky borrowers) market

Easier and cheaper low interest rate of from 2.8 in 2001 to 1.3% in 2007

(House of Commons Library 2009)

House of Commons Library (2009)

US National Home Price Index

1987-2008

HOW EXPANSIONARY MONETARY

POLICY LED TO THE GFC 2007

Loose monetary policy also led to imprudent mortgage lending caused by the

web of financial instruments.

When prices began to fall, loans started going bad.

Consequences:

The house prices started to fall

Number of foreclosures of houses rose dramatically

Bear Stearns announced a large loss, the fall of Lehman Brothers and a series

of fall of investment and insuring companies like AIG

THE RESPONSE OF THE FEDERAL RESERVE

Prior to September 2008

Governing institutions in the US primarily pursued to address liquidity concerns,

stimulate demand and prevent mortgage foreclosures. The main policy

responses included:

Lowering interest rates as well as a introducing number of liquidity-enhancing

schemes to abate the emerging credit crisis by the Federal Reserves

The orderly takeover of failed investment bank Bear Stearns

Stimulate demand and mitigate mortgage foreclosure.

THE RESPONSE OF THE FEDERAL RESERVE

CONT.

Response after October 2008

The Federal Reserve and the US Treasury became a key body in administering the

Emergency Economic Stabilization Act passed by Congress in October 2008. The

central features of the post-September response included:

Continuing efforts from the Fed to lower interest rates and increase liquidity;

Federal Reserve and US Treasury decision not to bail out investment bank Lehman

Brothers

Treasury-administered capital injections into troubled financial institutions in

exchange for preferred stock and common equity stakes

Sequence of bailouts by the Fed and Treasury for the insurance giant AIG;

The temporary suspension of the short-selling of financial institutions by the Securities

and Exchange Commission;

The Homeowner Affordability and Stability Plan, which permitted struggling

homeowners to refinance their mortgages

THE RESPONSE OF THE FEDERAL RESERVE

APPLICATION OF QUANTITATIVE EASY (QE) POLICY

Lower interest rates encourage people to spend, not save. But when interest

rates can go no lower, a central bank's only option is to pump money into the

economy directly, this quantitative easing (QE).

To revive consumer spending and economic growth

Cutting interest rates to raise the amount of lending and the economy indirectly

The way the central bank does this is by buying assets - usually government

bonds - using money it has simply created out of thin air.

The institutions selling bonds (either commercial banks or other financial

businesses such as insurance companies) will then have "new" money in their

accounts, which then boosts the money supply.

CONCLUSION

GFC revealed the importance of establishing conditions to ensure

the continuous functioning of the financial system

A long period of expansionary monetary policy should be avoided

as they could produce inadequate incentives

Central banks and other regulators should have a tight framework

of mortgage

THANK YOU!

You might also like

- The Definition of EconomicsDocument12 pagesThe Definition of EconomicsKyeung Ah Cynthia LeeNo ratings yet

- Fiscal Hour: Your Subtitle Goes HereDocument12 pagesFiscal Hour: Your Subtitle Goes Heresushma_mrao2003No ratings yet

- Unconventional Monetary Policy ToolsDocument21 pagesUnconventional Monetary Policy ToolsPeik KheeNo ratings yet

- Introduction To Monetary PolicyDocument21 pagesIntroduction To Monetary PolicyHisham JawharNo ratings yet

- 2008 Fin CrisisDocument8 pages2008 Fin CrisisXyz YxzNo ratings yet

- U S Economy T BondDocument29 pagesU S Economy T BondAmeer Taimur AliNo ratings yet

- US Economy and Financial CrisisDocument31 pagesUS Economy and Financial CrisisTalal SiddiquiNo ratings yet

- SubprimeDocument46 pagesSubprimeChaitanya KrishnaNo ratings yet

- Lecture 7 PDFDocument44 pagesLecture 7 PDFAmna NoorNo ratings yet

- Monetary PolicyDocument31 pagesMonetary Policyapi-3748231100% (1)

- Banking & Finance Basics Class 8Document39 pagesBanking & Finance Basics Class 8Anèse mabouanaNo ratings yet

- The Federal Reserve and The Financial CrisisDocument41 pagesThe Federal Reserve and The Financial CrisisTong BiNo ratings yet

- What Causes A Currency CrisisDocument3 pagesWhat Causes A Currency CrisisDon Pelicio NgohoNo ratings yet

- International Crisis: David Azpilizcueta Ana Rita Gouveia Cesar Luis Lozano Claudia PereiraDocument22 pagesInternational Crisis: David Azpilizcueta Ana Rita Gouveia Cesar Luis Lozano Claudia PereiraCesarlle Soc LimNo ratings yet

- Central Bank Portfolio DraftDocument55 pagesCentral Bank Portfolio DraftReese WongNo ratings yet

- Overview of The 2007-2009 Financial Crisis - The Panic Vitoria SaddiDocument61 pagesOverview of The 2007-2009 Financial Crisis - The Panic Vitoria SaddiVic SaddiNo ratings yet

- The Financial Crisis of 2008 Simplified: By: EconomyriaDocument43 pagesThe Financial Crisis of 2008 Simplified: By: EconomyriaMUDITSAHANINo ratings yet

- What Causes RecessionDocument23 pagesWhat Causes Recessionashwini_anaredyNo ratings yet

- Historical View On The Crisis of 2007Document4 pagesHistorical View On The Crisis of 2007jansher_wazirNo ratings yet

- How Global Factors and Domestic Policies Impacted India's High InflationDocument14 pagesHow Global Factors and Domestic Policies Impacted India's High InflationVirak GandhiNo ratings yet

- Lecture 9 Monetary Policy Decision Making 2022Document40 pagesLecture 9 Monetary Policy Decision Making 2022Onyee FongNo ratings yet

- The Global Financial CrisisDocument15 pagesThe Global Financial CrisisFahd KassemNo ratings yet

- Managerial Economics g4Document16 pagesManagerial Economics g4Sankalp ShuklaNo ratings yet

- NU ECO DEV - Chapter 7 - Savings and Financial SystemDocument52 pagesNU ECO DEV - Chapter 7 - Savings and Financial SystemAbegail Mercado PamplonaNo ratings yet

- FIN 2 Powerpoint Report 2Document12 pagesFIN 2 Powerpoint Report 2garod saghdejianNo ratings yet

- PHILIPPINE MONETARY POLICY OBJECTIVESDocument54 pagesPHILIPPINE MONETARY POLICY OBJECTIVESIra Faith Montefalco BombeoNo ratings yet

- A Recession Is When Your Neighbour Loses His Job. A Depression Is When You Lose Your JobDocument83 pagesA Recession Is When Your Neighbour Loses His Job. A Depression Is When You Lose Your JobAppurva SharmaNo ratings yet

- The Fed and Interest RatesDocument26 pagesThe Fed and Interest RatesJackie RaborarNo ratings yet

- Global Financial Crisis (Edited)Document7 pagesGlobal Financial Crisis (Edited)AngelicaP.Ordonia100% (1)

- Lecture 5 Banking Regulation GFC T2 2020-21-Pages-39-46Document8 pagesLecture 5 Banking Regulation GFC T2 2020-21-Pages-39-46Jean KwokNo ratings yet

- Assignment 4 Subprime Mortgage Crisis 2008: Case BackgroundDocument6 pagesAssignment 4 Subprime Mortgage Crisis 2008: Case BackgroundShrey ChaudharyNo ratings yet

- Important Money QuesDocument12 pagesImportant Money QuesrashiNo ratings yet

- Economic Development: Capistrano, Karen Dumdum, Christine Maraño, Mary Rose Milario, AngeloDocument14 pagesEconomic Development: Capistrano, Karen Dumdum, Christine Maraño, Mary Rose Milario, AngeloRAMIREZ, KRISHA R.No ratings yet

- Markets Discussion: Hosted by C.JDocument18 pagesMarkets Discussion: Hosted by C.JChan Jun YoonNo ratings yet

- Course: 0062J Perekonomian Indonesia: Monetary Crisis in Indonesia Week 7Document19 pagesCourse: 0062J Perekonomian Indonesia: Monetary Crisis in Indonesia Week 7Edwa WarnerNo ratings yet

- DoneDocument275 pagesDoneNeha TalwarNo ratings yet

- US Subprime Mortgage Crisis ExplainedDocument7 pagesUS Subprime Mortgage Crisis ExplainedTestNo ratings yet

- Robin Greenwood and David S. Scharfstein: Y.V.S.Kalyan Pgdm-Bifaas B616Document22 pagesRobin Greenwood and David S. Scharfstein: Y.V.S.Kalyan Pgdm-Bifaas B616Kishore ReddyNo ratings yet

- US Financial Crisis 2007-08: Assignment TopicDocument2 pagesUS Financial Crisis 2007-08: Assignment Topicanik024No ratings yet

- Global Financial CrisisDocument7 pagesGlobal Financial CrisiskendecruzNo ratings yet

- Financial Crisis 2007-2008 Summary/TITLEDocument25 pagesFinancial Crisis 2007-2008 Summary/TITLENAOMYNo ratings yet

- Monetary and Fiscal PoliciesDocument19 pagesMonetary and Fiscal PoliciesMayank TripathiNo ratings yet

- The Financial Crisis and Economic Downturn in 2008 and 2009Document3 pagesThe Financial Crisis and Economic Downturn in 2008 and 2009Nick GrzebienikNo ratings yet

- The Global Financial Crisis - Causes and Solutions.Document5 pagesThe Global Financial Crisis - Causes and Solutions.Sherlene GarciaNo ratings yet

- Energetics Draft PresentationDocument17 pagesEnergetics Draft PresentationKhurram IqbalNo ratings yet

- Fiscal and Monitary Policy-1Document43 pagesFiscal and Monitary Policy-1ANITTA M. AntonyNo ratings yet

- Monetary Policy UpdatedDocument4 pagesMonetary Policy UpdatedVidhi AgarwalNo ratings yet

- 4.2.4. Interest Rate DeterminationDocument21 pages4.2.4. Interest Rate DeterminationGuy WilkinsonNo ratings yet

- Economics ProjectDocument33 pagesEconomics Projectshaqash744No ratings yet

- Us Credit Crisis and Feds Response 1229898176101407 2Document26 pagesUs Credit Crisis and Feds Response 1229898176101407 2salonid17No ratings yet

- 1990s Japanese Financial Crisis ExplainedDocument21 pages1990s Japanese Financial Crisis Explainedsiddis316No ratings yet

- Bus16 11Document30 pagesBus16 11TrungLuan NguyenNo ratings yet

- Financial Liberalization and Stock Market VolatilityDocument46 pagesFinancial Liberalization and Stock Market VolatilityazeemNo ratings yet

- 2008 Credit CrisisDocument7 pages2008 Credit Crisis982063957No ratings yet

- Cengage Eco Dev Chapter 8 - Savings and The Financial System - 32804569Document50 pagesCengage Eco Dev Chapter 8 - Savings and The Financial System - 32804569Wonwoo JeonNo ratings yet

- Ben Bernanke Testimony B-F Congress 4-3-08Document7 pagesBen Bernanke Testimony B-F Congress 4-3-08TNT1842No ratings yet

- Group 8 Adelantar & AragonDocument12 pagesGroup 8 Adelantar & AragonEdrian Joseph AragonNo ratings yet

- What is subprime lending and its impactDocument5 pagesWhat is subprime lending and its impactseema.simsrNo ratings yet

- Negative Interest Rate PolicyDocument24 pagesNegative Interest Rate PolicyPratheesh TulsiNo ratings yet

- ABM NumericalsDocument38 pagesABM NumericalsBasavaraj GadadavarNo ratings yet

- Acct Statement XX8038 12102023Document5 pagesAcct Statement XX8038 12102023middeslifesciencesNo ratings yet

- Managing credit risk through effective principlesDocument2 pagesManaging credit risk through effective principlesaivan john CañadillaNo ratings yet

- Wire Request FormDocument3 pagesWire Request Formkhushbu25No ratings yet

- Fringe Benefit Taxes Sample ProblemsDocument4 pagesFringe Benefit Taxes Sample Problemscharlene marie goNo ratings yet

- Importance and Levels of E-banking ServicesDocument4 pagesImportance and Levels of E-banking ServicesFalansh JainNo ratings yet

- Online Shoppers - 30 Lack DataDocument12 pagesOnline Shoppers - 30 Lack DataRavee Unlikes RascalsNo ratings yet

- CREDIDCARDVerkoop Afstand Bankkaarten ENDocument12 pagesCREDIDCARDVerkoop Afstand Bankkaarten ENmatik5512No ratings yet

- Fatimiyah College General Journal and LedgerDocument3 pagesFatimiyah College General Journal and LedgerJohn RazaNo ratings yet

- A Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Document120 pagesA Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Vaibhav ShuklaNo ratings yet

- A detailed study on The Malkapur Bank's operations and performanceDocument5 pagesA detailed study on The Malkapur Bank's operations and performanceSwapnil BhagatNo ratings yet

- Introduction EbcDocument5 pagesIntroduction EbckmkesavanNo ratings yet

- Citi Statment PDFDocument4 pagesCiti Statment PDFBERNARD KUSINo ratings yet

- 1559 East Amar Road, Suite U, West Covina, CA 91792 Tel.: (626) 363-9808 Fax: (626) 363-9811Document1 page1559 East Amar Road, Suite U, West Covina, CA 91792 Tel.: (626) 363-9808 Fax: (626) 363-9811Rheajin DelfinNo ratings yet

- Account Type / Jenis Akaun: Borang Permohonan Membuka Akaun - Komersial / KorporatDocument5 pagesAccount Type / Jenis Akaun: Borang Permohonan Membuka Akaun - Komersial / KorporatCik NurNo ratings yet

- ALTRUIST FullDocument2 pagesALTRUIST Fullganesh pandiNo ratings yet

- Oyo BillDocument1 pageOyo BillAkash DesaiNo ratings yet

- Loan Sanction-Letter With kfs4330739025633689315Document4 pagesLoan Sanction-Letter With kfs4330739025633689315Sapan MishraNo ratings yet

- Kunal Jain 29589438528759262180371182184Document1 pageKunal Jain 29589438528759262180371182184trav baeNo ratings yet

- Dubai Islamic Bank P.J.S.C. (DIB) - Financial and Strategic SWOT Analysis ReviewDocument32 pagesDubai Islamic Bank P.J.S.C. (DIB) - Financial and Strategic SWOT Analysis ReviewChiranjiv Jain75% (4)

- Bank Codes For Inter-Bank Transfer: PublicDocument6 pagesBank Codes For Inter-Bank Transfer: PublicGia nnaNo ratings yet

- Repurchase FormDocument1 pageRepurchase FormmanjubellurNo ratings yet

- Principles of Managerial Finance 13th Edition Gitman Test BankDocument25 pagesPrinciples of Managerial Finance 13th Edition Gitman Test BankSheilaEllisgxsnNo ratings yet

- Lecture No. 12 The Supply of MoneyDocument11 pagesLecture No. 12 The Supply of MoneyMilind SomanNo ratings yet

- Lecture 1 - Cash and Cash Equivalents (Student File - Questionnaire)Document147 pagesLecture 1 - Cash and Cash Equivalents (Student File - Questionnaire)JOSCEL SYJONGTIANNo ratings yet

- Online Application PDFDocument2 pagesOnline Application PDFAyesha RafiqNo ratings yet

- Important Banking TermsDocument11 pagesImportant Banking TermsIndu GuptaNo ratings yet

- Í Np10È Alvero Jevanniâââââââ R Ça, 02?Î Mr. Jevanni Rodriguez AlveroDocument3 pagesÍ Np10È Alvero Jevanniâââââââ R Ça, 02?Î Mr. Jevanni Rodriguez AlveroJevanni AlveroNo ratings yet

- Beneficiary Details SBCOADUD2795489: (Items Marked Must Be Incorporated in The NEFT/RTGS Message)Document1 pageBeneficiary Details SBCOADUD2795489: (Items Marked Must Be Incorporated in The NEFT/RTGS Message)thweesha tanejaNo ratings yet

- Bank of the Creed Time Deposit FeaturesDocument2 pagesBank of the Creed Time Deposit FeaturesGreg PeraltaNo ratings yet