Professional Documents

Culture Documents

Money Laundering

Uploaded by

Naveen KhatakCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Money Laundering

Uploaded by

Naveen KhatakCopyright:

Available Formats

PRESENTATION

ON

MONEY LAUNDERING

PRESENTED BY

RAHUL KUMAR

ROLL NO. 11

WHAT IS MONEY LAUNDERING?

In other words, it is the process used by

criminals through which they make dirty

money appear clean or the profits of

criminal activities are made to appear

legitimate.

Process by which illegal funds and assets

are converted into legitimate funds and

assets.

MONEY LAUNDERING GENERALLY REFERS TO

WASHING OF THE PROCEEDS OR PROFITS

GENERATED FROM:

1. Drug trafficking

2. People smuggling

3. Arms, antique, gold smuggling

4. Prostitution rings

5. Financial frauds

6. Corruption

7. Illegal sale of wild life products and other specified

predicate offences

3

8. Kidnap and extortion;

9. Smuggling;

10. Fraud including credit card fraud;

11. Misuse of non-profit organizations and charities fraud;

12. Thefts and robbery; and

MONEY LAUNDERING ACT, 2002

Indian government considered necessary to have an Act

to prevent money-laundering and to provide for

confiscation of property derived from, or involved in,

money-laundering and for matters connected therewith

or incidental thereto, hence passed the

THE PREVENTION OF MONEY-LAUNDERING ACT,

2002, [Act No. 15 of 2003].

Section -3 defines money laundering

Section 4 provides for punishment for money-

laundering

Section -5 empowers the authority and enforcement

agency to attach the immovable property / movable

property.

Section 41 clarify that no civil court shall have

jurisdiction to entertain any suit or proceeding in respect

of any matter which the Director, an Adjudicating

Authority

THE MONEY LAUNDERING PROCESS

1. Placement

2. Layering

3. Integration

1. PLACEMENT

The initial movement of criminally derived

currency or other proceeds of crime, to initially

change its form or location to places beyond the

reach of law enforcement.

Placement: "Placement" refers to the physical disposal

of bulk cash proceeds derived from illegal activity.

FORMS OF PLACEMENT

Forms Depositing into

accounts via tellers,

ATMs, or night deposits

Changing currency to

cashiers checks or other

negotiable instruments of

Placement

Exchanging small bills for

large bills

smuggling or shipping out

side the county

2. LAYERING

The process of separating the proceeds of criminal

activity from their origin.. Disguising the origin through

the movement of funds through accounts and financial

institutions. The use of layers of complex financial

transactions; loans, letters of credit, investments and

insurance

3) INTEGRATION.

The third stage is called Integration. It represents the conversion

of illegal proceeds into apparently legitimate business earnings

through normal financial or commercial operations. Integration

creates the illusion of a legitimate source for criminally derived

funds and involves techniques as numerous and creative as those

used by legitimate businesses. For e.g false invoices for goods

exported, domestic loan against a foreign deposit, purchasing of

property and co-mingling of money in bank accounts.

Integration: "Integration" refers to the reinjection of the

laundered proceeds back into the economy in such a way that they

re-enter the financial system as normal business funds.

11

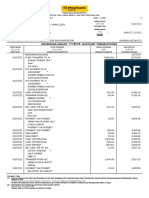

THE PROCESS

ADVANTAGES FOR MONEY LAUNDERERS

1. Launder money

2. Make a profit

3. Commit other securities fraud

MONEY LAUNDERING EXAMPLES

Purchase of securities for short period of time

with no discernable purpose. Selling out

Wash trades match buys and sells in particular

securities

Transactions involving penny stocks, Regulation

S stocks and bearer bonds

Insurance

products, agents and companies

Money donations to PM funds, National

emergency fund, Forming educational institutions

and trusts.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Banking AwarenessDocument130 pagesBanking AwarenessDAX LABORATORY100% (2)

- Bank Secrecy LawDocument33 pagesBank Secrecy LawTen Laplana100% (4)

- BOB Finance & Credit Specialist Officer SII Model Question Paper 2Document135 pagesBOB Finance & Credit Specialist Officer SII Model Question Paper 2Naveen KhatakNo ratings yet

- Tax Deduct at SourceDocument21 pagesTax Deduct at SourceNaveen KhatakNo ratings yet

- BOB Finance & Credit Specialist Officer SII Model Question Paper 1Document7 pagesBOB Finance & Credit Specialist Officer SII Model Question Paper 1Naveen KhatakNo ratings yet

- Forward ContractDocument19 pagesForward Contractsuhaspujari93No ratings yet

- 3d Optical Data StorageDocument27 pages3d Optical Data StorageNaveen KhatakNo ratings yet

- MarutiDocument2 pagesMarutiNaveen KhatakNo ratings yet

- S.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HDocument9 pagesS.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HNaveen KhatakNo ratings yet

- S.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HDocument9 pagesS.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HNaveen KhatakNo ratings yet

- MBBsavings - 164017 212412 - 2022 07 31 PDFDocument3 pagesMBBsavings - 164017 212412 - 2022 07 31 PDFAdeela fazlinNo ratings yet

- Foreign Aid in UgDocument6 pagesForeign Aid in UgIbrahim FazilNo ratings yet

- Sbi Po Mains 2019 Result PDFDocument5 pagesSbi Po Mains 2019 Result PDFYawar KhurshidNo ratings yet

- Banking Letters: 1) Somatie de PlataDocument7 pagesBanking Letters: 1) Somatie de PlataMireanu ElenaNo ratings yet

- Value Based Current Accounts Schedule of ChargesDocument2 pagesValue Based Current Accounts Schedule of ChargesDhawan SandeepNo ratings yet

- Vichitra StatementDocument3 pagesVichitra Statementsatyam dixitNo ratings yet

- White Refined Cane Sugar ICUMSA 45 RBU: Your Company Name XXXXDocument2 pagesWhite Refined Cane Sugar ICUMSA 45 RBU: Your Company Name XXXXNeharu KherNo ratings yet

- FIN226 Summer 2011 Lectures CH 6 SlidesDocument20 pagesFIN226 Summer 2011 Lectures CH 6 SlidesBasit F.No ratings yet

- 4305 01 PDFDocument28 pages4305 01 PDFSimra RiyazNo ratings yet

- Product InnovationDocument22 pagesProduct InnovationLarry AdenyaNo ratings yet

- OpTransactionHistory11 10 2021Document2 pagesOpTransactionHistory11 10 2021X HureNo ratings yet

- Module 5 Managing Liabilities: Types of DepositDocument9 pagesModule 5 Managing Liabilities: Types of DepositAnna-Clara MansolahtiNo ratings yet

- Edward Burns - 5444Document5 pagesEdward Burns - 5444Mark WilliamsNo ratings yet

- PNB Vs CirDocument8 pagesPNB Vs CirAnonymous VtsflLix1No ratings yet

- RFBT QuizzesDocument4 pagesRFBT QuizzesHannaniah PabicoNo ratings yet

- Joinder To Plat-LenderDocument3 pagesJoinder To Plat-LenderBobby SinghNo ratings yet

- BPI Employees Union Vs Bank of The Philippine IslandDocument6 pagesBPI Employees Union Vs Bank of The Philippine IslandAllen OlayvarNo ratings yet

- Hacking: Don't Learn To Hack - Hack To LearnDocument26 pagesHacking: Don't Learn To Hack - Hack To Learndineshverma111No ratings yet

- Cetak Kwintansi CR - 2019Document47 pagesCetak Kwintansi CR - 2019Andri RobiansyahNo ratings yet

- Sukhchain Aggarwal: Financial Statement Analysis of ICICI BankDocument1 pageSukhchain Aggarwal: Financial Statement Analysis of ICICI Banksandy_jadhaoNo ratings yet

- My Logo Art 20181203121246Document1 pageMy Logo Art 20181203121246shameer vcNo ratings yet

- Post Mid Sem EEFDocument64 pagesPost Mid Sem EEFYug ChaudhariNo ratings yet

- Notification APGBDocument14 pagesNotification APGBmahbub22dNo ratings yet

- Bank RobberyDocument18 pagesBank RobberyJed MendozaNo ratings yet

- Yökdil Sosyal 2018 SonbaharDocument20 pagesYökdil Sosyal 2018 SonbaharJackson LewisNo ratings yet

- 282 B-CR NewDocument4 pages282 B-CR Newwrite2ashishmalik6269100% (1)

- Universidad Iberoamericana - Unibe-: Disbursement RecordDocument2 pagesUniversidad Iberoamericana - Unibe-: Disbursement Recordodontologia unibeNo ratings yet

- I. Understanding The Client'S Business and Industry The ClientDocument2 pagesI. Understanding The Client'S Business and Industry The Clienthanna jeanNo ratings yet