Professional Documents

Culture Documents

WCM

Uploaded by

Rohit DhamijaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WCM

Uploaded by

Rohit DhamijaCopyright:

Available Formats

Working Capital

Management

Topics

Concept of working capital

Operating and cash conversion cycle

Permanent and variable working capital

Balanced working capital

Determinants of working capital

Issues In working capital management

Estimating working capital

Policies of working capital finance

Concepts of Working Capital

Gross working capital (GWC)

GWC refers to the firms total investment in

current assets.

Current assets are the assets which can be

converted into cash within an accounting

year (or operating cycle) and include cash,

short-term securities, debtors, (accounts

receivable or book debts) bills receivable

and stock (inventory).

Concepts of Working Capital

Net working capital (NWC).

NWC refers to the difference between

current assets and current liabilities.

Current liabilities (CL) are those claims

of outsiders which are expected to

mature for payment within an

accounting year and include creditors

(accounts payable), bills payable, and

outstanding expenses.

NWC can be positive or negative.

Positive NWC = CA > CL

Negative NWC = CA < CL

Concepts of Working Capital

GWC focuses on

Optimization of investment in current

Financing of current assets

NWC focuses on

Liquidity position of the firm

Judicious mix of short-term and long-tern

financing

Operating Cycle

Operating cycle is the time duration

required to convert sales, after the

conversion of resources into

inventories, into cash. The operating

cycle of a manufacturing company

involves three phases:

Acquisition of resources such as raw material,

labour, power and fuel etc.

Manufacture of the product which includes

conversion of raw material into work-in-progress into

finished goods.

Sale of the product either for cash or on credit. Credit

sales create account receivable for collection.

OC

The length of the operating cycle of a

manufacturing firm is the sum of:

inventory conversion period (ICP).

Debtors (receivable) conversion

period (DCP).

OC

Inventory conversion period is the total

time needed for producing and selling the

product. Typically, it includes:

raw material conversion period (RMCP)

work-in-process conversion period

(WIPCP)

finished goods conversion period

(FGCP)

OC

The debtors conversion period is the

time required to collect the outstanding

amount from the customers.

OC

Creditors or payables deferral period

(CDP) is the length of time the firm is able

to defer payments on various resource

purchases.

OC

Gross operating cycle (GOC)

The total of inventory conversion period and

debtors conversion period is referred to as gross

operating cycle (GOC).

Net operating cycle (NOC)

NOC is the difference between GOC and CDP.

Cash conversion cycle (CCC)

CCC is the difference between NOP and non-

cash items like depreciation.

Types of working capital

Permanent or fixed working capital

A minimum level of current assets,

which is continuously required by a firm

to carry on its business operations, is

referred to as permanent or fixed

working capital.

Fluctuating or variable working

capital

The extra working capital needed to

support the changing production and

sales activities of the firm is referred to

as fluctuating or variable working

capital.

Determinants of Working

Capital

Nature of business

Market and demand

Technology and manufacturing policy

Credit policy

Supplies credit

Operating efficiency

Inflation

Issues in Working Capital

Management

Levels of current assets

Current assets to fixed assets

Liquidity Vs. profitability

Cost trade-off

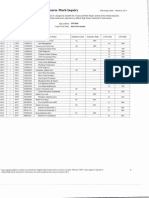

Estimating Working capital

Current assets holding period

To estimate working capital requirements on

the basis of average holding period of current

assets and relating them to costs based on

the companys experience in the previous

years. This method is essentially based on

the operating cycle concept.

Ratio of sales

To estimate working capital requirements as

a ratio of sales on the assumption that current

assets change with sales.

Ratio of fixed investment

To estimate working capital requirements as

a percentage of fixed investment.

Working Capital Finance

Policies

Long-term

Short-term

Spontaneous

Short-term Vs. Lon

Working Capital Finance

Policies

Matching

Conservative

Aggressive

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Woking Capital 1Document37 pagesWoking Capital 1Rohit DhamijaNo ratings yet

- Receivables Management: 6 March 2014Document10 pagesReceivables Management: 6 March 2014Rohit DhamijaNo ratings yet

- Receivables Management: December 7, 2021Document10 pagesReceivables Management: December 7, 2021Rohit DhamijaNo ratings yet

- Financing Decision: The Cost of CapitalDocument23 pagesFinancing Decision: The Cost of CapitalRohit DhamijaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RCA LCD26V6SY Service Manual 1.0 PDFDocument33 pagesRCA LCD26V6SY Service Manual 1.0 PDFPocho Pochito100% (1)

- Multinational MarketingDocument11 pagesMultinational MarketingraghavelluruNo ratings yet

- Genuine Fakes: How Phony Things Teach Us About Real StuffDocument2 pagesGenuine Fakes: How Phony Things Teach Us About Real StuffGail LeondarWrightNo ratings yet

- Traditional Perceptions and Treatment of Mental Illness in EthiopiaDocument7 pagesTraditional Perceptions and Treatment of Mental Illness in EthiopiaifriqiyahNo ratings yet

- HUMSS - Introduction To World Religions & Belief Systems CGDocument13 pagesHUMSS - Introduction To World Religions & Belief Systems CGAliuqus SirJasper89% (18)

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984No ratings yet

- Continuing Professional Development PlanDocument4 pagesContinuing Professional Development Planvviki50% (2)

- Volvo BL 71 ManualDocument280 pagesVolvo BL 71 ManualAlberto G.D.100% (2)

- PostScript Quick ReferenceDocument2 pagesPostScript Quick ReferenceSneetsher CrispyNo ratings yet

- Lady in The House, Her Responsibilities & Ambitions: Amrita DuhanDocument7 pagesLady in The House, Her Responsibilities & Ambitions: Amrita DuhanFitness FableNo ratings yet

- Create A Visual DopplerDocument1 pageCreate A Visual DopplerRahul GandhiNo ratings yet

- FHWA Guidance For Load Rating Evaluation of Gusset Plates in Truss BridgesDocument6 pagesFHWA Guidance For Load Rating Evaluation of Gusset Plates in Truss BridgesPatrick Saint-LouisNo ratings yet

- The Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairDocument36 pagesThe Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairLangson phiriNo ratings yet

- Tutorial Chapter 5 - Power System ControlDocument2 pagesTutorial Chapter 5 - Power System ControlsahibNo ratings yet

- Chapter 5 Constructing An Agile Implementation PlanDocument4 pagesChapter 5 Constructing An Agile Implementation PlanAHMADNo ratings yet

- The Ovation E-Amp: A 180 W High-Fidelity Audio Power AmplifierDocument61 pagesThe Ovation E-Amp: A 180 W High-Fidelity Audio Power AmplifierNini Farribas100% (1)

- The Palestinian Centipede Illustrated ExcerptsDocument58 pagesThe Palestinian Centipede Illustrated ExcerptsWael HaidarNo ratings yet

- Perdarahan Uterus AbnormalDocument15 pagesPerdarahan Uterus Abnormalarfiah100% (1)

- How Chargers WorkDocument21 pagesHow Chargers WorkMuhammad Irfan RiazNo ratings yet

- Csir Life Sciences Fresh Instant NotesDocument4 pagesCsir Life Sciences Fresh Instant NotesAlps Ana33% (3)

- 4.2.4.5 Packet Tracer - Connecting A Wired and Wireless LAN InstructionsDocument5 pages4.2.4.5 Packet Tracer - Connecting A Wired and Wireless LAN InstructionsAhmadHijaziNo ratings yet

- Mushroom Project - Part 1Document53 pagesMushroom Project - Part 1Seshadev PandaNo ratings yet

- SCERT Kerala State Syllabus 9th Standard English Textbooks Part 1-1Document104 pagesSCERT Kerala State Syllabus 9th Standard English Textbooks Part 1-1Athulya ThondangattilNo ratings yet

- 3D Printing & Embedded ElectronicsDocument7 pages3D Printing & Embedded ElectronicsSantiago PatitucciNo ratings yet

- Geotechnical PaperDocument16 pagesGeotechnical PaperTxavo HesiarenNo ratings yet

- MH5-C Prospekt PDFDocument16 pagesMH5-C Prospekt PDFvatasaNo ratings yet

- G10 Lesson2 DLPDocument13 pagesG10 Lesson2 DLPAngeles, Mark Allen CNo ratings yet

- Inspección, Pruebas, Y Mantenimiento de Gabinetes de Ataque Rápido E HidrantesDocument3 pagesInspección, Pruebas, Y Mantenimiento de Gabinetes de Ataque Rápido E HidrantesVICTOR RALPH FLORES GUILLENNo ratings yet

- Vitamins - CyanocobalaminDocument12 pagesVitamins - CyanocobalaminK PrashasthaNo ratings yet

- Theorising Mobility Justice-Mimi ShellerDocument18 pagesTheorising Mobility Justice-Mimi Shellerjllorca1288No ratings yet