Professional Documents

Culture Documents

Chapter 8 Capital Budgeting Models NPV IRR PI

Uploaded by

Admire MamvuraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 8 Capital Budgeting Models NPV IRR PI

Uploaded by

Admire MamvuraCopyright:

Available Formats

Chapter 8 Capital Budgeting

Decision Models

Learning Objectives

Differentiate between short term and long

term capital budgeting models

Apply the three basic decision models

Payback

NPV

IRR

Calculate cross-over rates

Use modified decision models

Know the strength and weaknesses of each

model

Short-term versus Long-term

Short-term decisions

In general, repetitive decisions

Low cost impacts

Long-Term decisions

Capital budgeting decisions

Impacts over many years

Difference

Time

Cost

Degree of Information

Payback Period

First and easiest model of capital

budgeting

Answers the question, how soon will I get

my money back?

Key Features

Need amount and timing of cash flow

Not concerned with cash flows after

repayment

Ad hoc cutoff date for repayment

Payback Period

Clinko Copiers (example 8.1)

Initial investment is $5,000

Positive cash flow each year

Year 1 -- $1,500

Year 2 -- $2,500

Year 3 -- $3,000

Year 4 -- $4,500

Year 5 -- $5,500

Payback in 2 and 1/3

rd

yearsignore

years 4 and 5 cash flows

Payback Period

Strengthens

Easy to apply

Initial cash flows most important

Good for small dollar investments

Weaknesses

Ignores cash flow after cutoff period

Ignores time value of money

Corrections

Discount cash flow

Discounted Payback Period

Attempt to correct one flaw of Payback

Periodtime value of money

Discount cash flow to present and see if

the discount cash flow are sufficient to

cover initial cost within cutoff time period

Careful in consistency

Discounting means cash flow at end of period

Appropriate discount rate for cash flow

Discounted Payback Period

Discounted Cash Flow of Copiers A & B

Discounted at 6% (APR)

Both 3 year discounted paybacks with annual

cash flow

Copier A 26 months with monthly cash flow

Copier B 29 months with monthly cash flow

Potential for poor choice

Large late positive cash flow

Longer positive cash flow

Net Present Value (NPV)

Correction to discounted cash flow

Includes all cash flow in decision

Changes decision (go vs. no-go) to dollars,

not arbitrary cutoff period

The Decision Model (a.k.a. Discounted

Cash Flow Model)

Need all cash flow

Need appropriate discount rate

Net Present Value (NPV)

Decision

Accept all positive NPVs

Reject all negative NPVs

Copier Example

Copier A NPV is $5,530.91 Accept

Copier B NPV is $9,253.09 Accept

Model good for comparing projects

Select project with highest NPV

Can assign different discount rates to projects

Net Present Value (NPV)

The Decision Model

Incorporates risk and return

Incorporates time value of money

Incorporates all cash flow

Internal Rate of Return (IRR)

Model closely resembles NPV but

Finding the discount rate (internal rate) that

implies an NPV of zero

Internal rate used to accept or reject project

If IRR > hurdle rate, accept

If IRR < hurdle rate, reject

Very popular model as managers like the

single return variable when evaluating

projects

Internal Rate of Return (IRR)

Process difficult without calculator or

spreadsheet iterative process

Need timing and amount of cash flows

Popcorn Machine (Example 8.4)

Grannies IRR is 19.86%

Kettle Corn IRR is 20.35%

Packaging Machine IRR is 14.91%

Decision Rule

Requires hurdle rate for comparison

Accept all with IRR > Hurdle Rate

Internal Rate of Return (IRR)

Some problems with IRR

Cross-over Rates flip projects

Using NPV profiles, project choice changes at cross-over

rate so need to know both hurdle rate and cross-over rate

Cross-over rate is where two projects have same NPV

Multiple IRRs

Projects with changing cash flows can have multiple IRRs

Which is the correct IRR? Dont know

Risk of Project is not included

IRR calculation void of risk of project

Risk must be implied with different hurdle rates

Modified IRR

Major assumption of IRR is that all cash flow can

be reinvested at IRR rate

Alternative (and better) assumption is that all

cash flow can be reinvested at hurdle rate

MIRR

Find future value of all cash inflow at hurdle rate

Find present value of cash outflow

Find interest rate that equates future values with

present value

Adjust comparison projects for differences in the

time horizon

Profitability Index (PI)

Modified version of NPV

Decision Criteria

PI > 1.0, accept project

PI < 1.0, reject project

Profitability Index (PI)

Close to NPV as we calculate present

value of future positive cash flows (present

value of benefits) and initial cash flow

(present value of costs)

PI = (NPV + Initial cost) / Initial Cost

Answer is modified return

Choosing between two different projects?

Higher PI is best choice

Careful, cannot scale projects up and down

Profitability Index (PI)

Example of Large Copier and Mini-Copier

(page 247)

Large Copier B PI is 2.85 (normal level of risk)

Mini Copier PI is 2.95

Pick Mini Copier

Problem with copier choice

Original investment in mini-copier only $500

Original investment in Copier B is $5,000

Need to buy 10 mini-copiers to match

production of Copier B

Problems

Problem 6 Payback & Discounted Period

Problem 8 Net Present Value

Problem 12 Internal Rate of Return &

Modified Internal Rate of Return

Problem 16 Profitability Index

Problem 20 NPV Profile of Project

You might also like

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Car Rental Agreement (TORRES)Document3 pagesCar Rental Agreement (TORRES)Eduardo Anerdez50% (6)

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Show Me The Numbers CourseDocument172 pagesShow Me The Numbers CourseAdmire Mamvura83% (6)

- Business Intelligence Applications For Financial Analytics On JdeDocument57 pagesBusiness Intelligence Applications For Financial Analytics On JdeAdmire MamvuraNo ratings yet

- Accounting Policies and Procedures ManualDocument32 pagesAccounting Policies and Procedures ManualAdmire Mamvura100% (2)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- CIMA SyllabusDocument41 pagesCIMA Syllabuskara85098No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- IRR NPV and PBP PDFDocument13 pagesIRR NPV and PBP PDFyared haftuNo ratings yet

- Core Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvDocument16 pagesCore Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvSandip NandyNo ratings yet

- Net Present Value and Other Investment CriteriaDocument23 pagesNet Present Value and Other Investment CriteriaHanniel Madramootoo100% (1)

- Sabah Offshore FieldsDocument16 pagesSabah Offshore FieldsMarlon Moncada50% (2)

- MT Rwenzori Farm Lodge Business Plan Merged FileDocument100 pagesMT Rwenzori Farm Lodge Business Plan Merged FileInfiniteKnowledge100% (8)

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionNo ratings yet

- ValuFocus Investing: A Cash-Loving Contrarian Way to Invest in StocksFrom EverandValuFocus Investing: A Cash-Loving Contrarian Way to Invest in StocksNo ratings yet

- Ebtm3103 Slides Topic 3Document26 pagesEbtm3103 Slides Topic 3SUHAILI BINTI BOHORI STUDENTNo ratings yet

- Benefits Administration - 1Document34 pagesBenefits Administration - 1vivek_sharma13No ratings yet

- FCFChap 009Document48 pagesFCFChap 009polaris2184100% (1)

- 6939 - Cash and Accruals BasisDocument5 pages6939 - Cash and Accruals BasisAljur SalamedaNo ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Capital Budgeting Analysis TechniquesDocument63 pagesCapital Budgeting Analysis TechniquesSonali JagathNo ratings yet

- Enterprise Governance - A CIMA Discussion PaperDocument5 pagesEnterprise Governance - A CIMA Discussion PaperAdmire MamvuraNo ratings yet

- Understanding the Oracle COADocument7 pagesUnderstanding the Oracle COAAdmire Mamvura100% (1)

- Net Present Value and Other Investment Rules: Mcgraw-Hill/IrwinDocument34 pagesNet Present Value and Other Investment Rules: Mcgraw-Hill/Irwingizex2013No ratings yet

- Capital Budgeting Processes and TechniquesDocument4 pagesCapital Budgeting Processes and TechniquesZohaib hassanNo ratings yet

- How to Make Capital Budgeting DecisionsDocument37 pagesHow to Make Capital Budgeting DecisionsMikezCimafrancaDiputadoNo ratings yet

- CapbudgetDocument31 pagesCapbudgetnaveen penugondaNo ratings yet

- Capital Bud ..Updated FinalDocument36 pagesCapital Bud ..Updated FinalKeyur JoshiNo ratings yet

- CB TechniquesDocument55 pagesCB TechniquesRahul MoreNo ratings yet

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethNo ratings yet

- Capital Budgeting Project Selection MethodsDocument14 pagesCapital Budgeting Project Selection MethodsKazi HasanNo ratings yet

- NPV and Other BbaDocument31 pagesNPV and Other BbaArchit JainNo ratings yet

- 03 - 20th Aug Capital Budgeting, 2019Document37 pages03 - 20th Aug Capital Budgeting, 2019anujNo ratings yet

- MGT470 Chapter 3Document20 pagesMGT470 Chapter 3Coci KhouryNo ratings yet

- Capital BudgetingDocument31 pagesCapital BudgetingJanu JinniNo ratings yet

- Capital Budgeting Decision Rules for Long-Term ProjectsDocument34 pagesCapital Budgeting Decision Rules for Long-Term ProjectsRajesh ShresthaNo ratings yet

- Epeng 308-2Document46 pagesEpeng 308-2gwemeowenNo ratings yet

- MBA-622 - Financial ManagementDocument11 pagesMBA-622 - Financial Managementovina peirisNo ratings yet

- PROJECT APPRAISAL METHODSDocument28 pagesPROJECT APPRAISAL METHODSMîñåk ŞhïïNo ratings yet

- Project Appraisal Criteria Key Investment MetricsDocument49 pagesProject Appraisal Criteria Key Investment MetricsArun S BharadwajNo ratings yet

- CH 11 NotesDocument4 pagesCH 11 NotesLê Tuấn AnhNo ratings yet

- Capital BudgetingDocument12 pagesCapital Budgetingjunhe898No ratings yet

- Nature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsDocument49 pagesNature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsRam Krishna Krish100% (2)

- Capital Budgeting Decisions Under Uncertainity - 1 - 09 - 2019Document55 pagesCapital Budgeting Decisions Under Uncertainity - 1 - 09 - 2019Kaushik meridianNo ratings yet

- Capital Budgeting Techniques ExplainedDocument28 pagesCapital Budgeting Techniques Explainedhashmi4a4No ratings yet

- Project Selection: Chapter 3, Part 1Document19 pagesProject Selection: Chapter 3, Part 1Tudor AndreiNo ratings yet

- Capital Budgeting - Discounted and Undiscounted MethodDocument47 pagesCapital Budgeting - Discounted and Undiscounted MethodTacitus KilgoreNo ratings yet

- Capital BudgetingDocument16 pagesCapital BudgetingNikhil BapnaNo ratings yet

- Capital Budgeting Techniques ComparisonDocument27 pagesCapital Budgeting Techniques ComparisonSumit KumarNo ratings yet

- MBA711 - Answers To All Chapter 7 ProblemsDocument21 pagesMBA711 - Answers To All Chapter 7 Problemsshweta shuklaNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingRizwan Ali100% (1)

- Capital Budgeting Techniques for Evaluating Investment ProjectsDocument42 pagesCapital Budgeting Techniques for Evaluating Investment ProjectsMikiyas SeyoumNo ratings yet

- Capital Inv Appraisal Questions Notes PDFDocument6 pagesCapital Inv Appraisal Questions Notes PDFtaridanNo ratings yet

- Financial Management Chapter 09 IM 10th EdDocument24 pagesFinancial Management Chapter 09 IM 10th EdDr Rushen SinghNo ratings yet

- Capital BudgetingDocument30 pagesCapital BudgetinganupsuchakNo ratings yet

- Capital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm's Long TermDocument4 pagesCapital Budgeting (Or Investment Appraisal) Is The Planning Process Used To Determine Whether A Firm's Long TermAshish Kumar100% (2)

- Capital Budgeting ToolsDocument48 pagesCapital Budgeting ToolsAbdullah Al AshryNo ratings yet

- NPV & Other CriteriaDocument49 pagesNPV & Other CriteriaPrimasty Mohammad KalifaNo ratings yet

- Cid IntropptDocument42 pagesCid IntropptSaira BanuNo ratings yet

- PFS: Financial Aspect - Project Financing and EvaluationDocument31 pagesPFS: Financial Aspect - Project Financing and EvaluationBjoy DalisayNo ratings yet

- Project Selection and Portfolio Process ExplainedDocument71 pagesProject Selection and Portfolio Process ExplainedNguyễn Xuân TùngNo ratings yet

- Capital Budgeting Methods ComparedDocument95 pagesCapital Budgeting Methods ComparedMohammad Salim HossainNo ratings yet

- Capital Budgeting Techniques ExplainedDocument57 pagesCapital Budgeting Techniques ExplainedAlethea DsNo ratings yet

- International Capital Budgeting ExplainedDocument18 pagesInternational Capital Budgeting ExplainedHitesh Kumar100% (1)

- Project SelectionDocument58 pagesProject SelectionShoaib Aziz Meer100% (2)

- Project SelectionDocument55 pagesProject Selectionbilal khanNo ratings yet

- Net Present Value and Other Investment Criteria: Mcgraw-Hill/IrwinDocument48 pagesNet Present Value and Other Investment Criteria: Mcgraw-Hill/IrwinwinbiNo ratings yet

- Module 6 CanvasDocument9 pagesModule 6 CanvasMon RamNo ratings yet

- ACCA F7 Study GuideDocument14 pagesACCA F7 Study GuideAdmire MamvuraNo ratings yet

- Diploma in Business Process ManagementDocument1 pageDiploma in Business Process ManagementAdmire MamvuraNo ratings yet

- Planning Budgeting Forecasting InsightDocument20 pagesPlanning Budgeting Forecasting Insightrams08No ratings yet

- Qlikview FileDocument586 pagesQlikview FileAdmire MamvuraNo ratings yet

- Business Intelligence Masters ProgrammeDocument32 pagesBusiness Intelligence Masters ProgrammeAdmire MamvuraNo ratings yet

- Management Information SystemsDocument49 pagesManagement Information SystemsAdmire MamvuraNo ratings yet

- CGMA Magazine Issue 2 2014Document58 pagesCGMA Magazine Issue 2 2014Admire MamvuraNo ratings yet

- Optimal for a 185 Line DocumentDocument185 pagesOptimal for a 185 Line DocumentAdmire MamvuraNo ratings yet

- BMW 3 - Series 2006 - 2008 With Idrive: Mul$Media Interface Installa$On GuideDocument40 pagesBMW 3 - Series 2006 - 2008 With Idrive: Mul$Media Interface Installa$On GuideAdmire MamvuraNo ratings yet

- Financial Statement Analysis Business RatiosDocument63 pagesFinancial Statement Analysis Business RatiosAdmire MamvuraNo ratings yet

- Oracle GL Allocation Process MapDocument3 pagesOracle GL Allocation Process MapAdmire MamvuraNo ratings yet

- Rules For Gathering RequirementsDocument49 pagesRules For Gathering RequirementsAdmire MamvuraNo ratings yet

- MBA Guide On Selecting A SchoolDocument52 pagesMBA Guide On Selecting A SchoolAdmire MamvuraNo ratings yet

- CIMA T4 Preseen Mar-May14Document17 pagesCIMA T4 Preseen Mar-May14Admire MamvuraNo ratings yet

- Rules For Gathering RequirementsDocument49 pagesRules For Gathering RequirementsAdmire MamvuraNo ratings yet

- Technical Brief - How To Create A Profit and Loss Statement in QlikViewDocument26 pagesTechnical Brief - How To Create A Profit and Loss Statement in QlikViewAdmire MamvuraNo ratings yet

- Cid Execrep Unlocking Business Intelligence Oct09Document50 pagesCid Execrep Unlocking Business Intelligence Oct09MOMO_1962No ratings yet

- CAPM HandbookDocument43 pagesCAPM HandbookShriya GuptaNo ratings yet

- SQL Server 2008 CertifikatiDocument1 pageSQL Server 2008 CertifikatizilzilzigazigaNo ratings yet

- Acctg for changes in group structureDocument4 pagesAcctg for changes in group structureJane KoayNo ratings yet

- MPKJDocument36 pagesMPKJJoshua Capa FrondaNo ratings yet

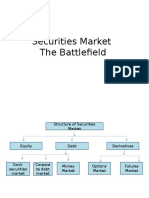

- Securities Market The BattlefieldDocument14 pagesSecurities Market The BattlefieldJagrityTalwarNo ratings yet

- Assets Liobililies Owner's Equity: Balance SheetsDocument2 pagesAssets Liobililies Owner's Equity: Balance SheetsVARGAS PALOMINO KIARA PAMELANo ratings yet

- ValueMax IPO (Clean)Document379 pagesValueMax IPO (Clean)Invest StockNo ratings yet

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Inventory ManagementDocument3 pagesInventory Managementrayjoshua12No ratings yet

- REPORT ON Bank Performance Analysis: A Comparative Study of Premier Bank and One BankDocument36 pagesREPORT ON Bank Performance Analysis: A Comparative Study of Premier Bank and One BankTakia KhanNo ratings yet

- Investment Unit: Key Terms and ConceptsDocument3 pagesInvestment Unit: Key Terms and ConceptsnhNo ratings yet

- Analysis of Surety ReservesDocument14 pagesAnalysis of Surety ReservesPaola Fuentes OgarrioNo ratings yet

- N - Chandrasekhar Naidu (Pronote)Document3 pagesN - Chandrasekhar Naidu (Pronote)raju634No ratings yet

- LIC Jeevan Anand Plan PPT Nitin 359Document11 pagesLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeNo ratings yet

- TESCO worker plans retirement savings with 10% returnsDocument8 pagesTESCO worker plans retirement savings with 10% returnsTarun SukhijaNo ratings yet

- Ifrs Framework PDFDocument23 pagesIfrs Framework PDFMohammad Delowar HossainNo ratings yet

- Solution To Chapter 15Document9 pagesSolution To Chapter 15Ismail WardhanaNo ratings yet

- Ca Q&a Dec 2017Document101 pagesCa Q&a Dec 2017Bruce GomaNo ratings yet

- Ifnotes PDFDocument188 pagesIfnotes PDFmohammed elshazaliNo ratings yet

- Mathematical Modeling and Computation in FinanceDocument4 pagesMathematical Modeling and Computation in FinanceĐạo Ninh ViệtNo ratings yet

- PRESENT VALUE TABLE TITLEDocument2 pagesPRESENT VALUE TABLE TITLEChirag KashyapNo ratings yet

- Time Value - Future ValueDocument4 pagesTime Value - Future ValueSCRBDusernmNo ratings yet

- UK House of Lords & Commons Changing Banking For Good Final-report-Vol-IIDocument503 pagesUK House of Lords & Commons Changing Banking For Good Final-report-Vol-IICrowdfundInsiderNo ratings yet

- Section 2. Original Certificates of Title Shall Be Reconstituted From Such of TheDocument2 pagesSection 2. Original Certificates of Title Shall Be Reconstituted From Such of TheAlexylle ConcepcionNo ratings yet