Professional Documents

Culture Documents

Islam and Accounting Mervyn K. Lewis

Uploaded by

Wan KhaidirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Islam and Accounting Mervyn K. Lewis

Uploaded by

Wan KhaidirCopyright:

Available Formats

ISLAM AND ACCOUNTING

MERVYN K. LEWIS

GROUP 1

SITI HAJAR BINTI JUMADIR (0931336)

HANISAH BINTI HAMZAH (0939158)

TENGKU MASTURAH BINTI TENGKU PARIS (0939682)

NURHIDAYAH BINTI ZAKARIA (0936052)

NUR IZZIANI BINTI MOHD ADNAN (0933900)

Islamic

law

Islamic

economic

and

financial

principles

Aspects that

shape

relationship

between

Islam and

accounting

NATURE OF ISLAMIC LAW

Shariah

-the way to the

source of life

The Qur'an is the

principal source of

Islamic law

The Hadith and

Sunna are

complementary

sources to the

Qur'an

The interpretations

and opinions of the

learned jurists-

secondary sources

Duty in Islamic law

-individual owes to

God

-those owed to

fellow

Reflects the will of

God

-covers all aspects

of life

Basis of Muslim

faith-the five

pillars of Islam

ISLAMIC BUSINESS ETHICS

Conduct business

-Fair, honest, just

Distribution

-Moderation

-Balance pattern of

consumption

Encourage trade and

commerce

-Earn a living

-Give charity

-Not allow to dominate

Social responsibility

-emphasize on welfare of

community over individual

rights

Requirement for work and

produce

never lazy and helpless

Business principle

-x deceive/ exploit others

-x hoarding

-x stolen goods

Property right

-God: absolute owner

-Man: vicegerent

-ownership of property:

trust

-accountable

Contract law

-freedom of contract,

terms do not conflict

with the shariah

-basic principles

(sale, hire. gift, loan)

Business organization

-partnership

(shirkah al-inan,

Musharakah, mudharaba)

-business entreprise

(ijarah,modern

corporation)

Managerial ethics

-shepherd of the

employee.

-provide guidance

-care for subordinates

ISLAMIC ACCOUNTING

TWO

APPROACHES OF

DEVELOPING

ACCOUNTING

THEORY

Establish objective (Islamic

principles) & relate to

contemporary accounting thought

Test the established objective of

contemporary accounting thought

against Shariah.

[e.g: AAIOFI]

SOCIAL

ACCOUNTABILITY

- Main obj. of Islamic Acctg.

FULL DISCLOSURE

- Truthful & relevant

RECORDS

- Debts (Material credit loans &

transactions)

MATERIALITY

- Useful to users

ASSETS & LIABILITIES

- Separate with unlawful

activities & properties

PERIODICITY

- Zakat obligation (lunar

system)

- Conventional acctg. (solar

system)

ISLAMIC FINANCING PRINCIPLES

Interest (Riba)

free

Zakat

payment

No prohibited

activities

Free from

gharar/maysir

Takaful

concept

Interest

Investment

acc.

Investors &

s/holders

Profit

Distribution

Accounting

Concepts

Social

Activities

1. INTEREST

Prohibited by

Islam

How Islamic

bank

operates?

Through

partnership

financing

arrangements

2.

INVESTMENT

ACCOUNT

Pre-

agreed

profit

sharing

ratio

Depositor

(Financier )

vs

Bank

(Entrepren

eurs)

Any

loss

will be

shared

as well

3. INVESTORS & SHAREHOLDER

Conventional

Shareholder

own

companys

equity

Entitled no

of rights

Can sell the

shares if

dissatisfied

Islamic

Accept deposits

from customer

Based from profit

sharing ratio

Lack of

protection for

depositors

Depositor will

tend to monitor

performance of IB

Profit Distribution

expenses

Direct- investment

related expenses

Indirect overheads,

depreciation,

directors salaries

revenue

Example : the 5

methods in

Murabaha

Accounting

Concept

Payment of zakat

Distribution of cash

profit for mudaraba

Accrual Basis

ISSUES

No

consistencies

in level of

disclosure

External

auditor

Conflicting

views

CONCLUSION

No division

between

worldly and

religious

activities

Accountability

Compliance to

Sharia law

You might also like

- Positioning Malaysia in the International Arena: Perdana Discourse Series 5From EverandPositioning Malaysia in the International Arena: Perdana Discourse Series 5No ratings yet

- A Handbook of Malaysian Cases: Contemporary Issues in Marketing & ManagementFrom EverandA Handbook of Malaysian Cases: Contemporary Issues in Marketing & ManagementNo ratings yet

- Singapore The CountryDocument36 pagesSingapore The CountryAnanya SinhaNo ratings yet

- Strategic Management Topic 3Document6 pagesStrategic Management Topic 3angiekilip100% (4)

- Islamic Ethical Business Practices Among Muslim Entrepreneurs: A Case Study in Syarikat FAIZA Sdn. Bhd. (SFSB)Document7 pagesIslamic Ethical Business Practices Among Muslim Entrepreneurs: A Case Study in Syarikat FAIZA Sdn. Bhd. (SFSB)inventionjournalsNo ratings yet

- Chapter 4 Entrepreneurship Development in MalaysiaDocument68 pagesChapter 4 Entrepreneurship Development in Malaysiabryan9422100% (1)

- Investment AssignmentDocument5 pagesInvestment AssignmentPrince Hiwot Ethiopia100% (1)

- MGT420 (Chap01)Document25 pagesMGT420 (Chap01)azwan ayop75% (4)

- ManagementDocument13 pagesManagementsha123gurlNo ratings yet

- UmwDocument4 pagesUmwFarrel JaarNo ratings yet

- Case Study Ethical Dilemmas 2Document8 pagesCase Study Ethical Dilemmas 2AsiiyahNo ratings yet

- Chapter 2 Mgt162Document15 pagesChapter 2 Mgt162Farahain MasriNo ratings yet

- David sm17 Case Im 07Document23 pagesDavid sm17 Case Im 07César David Pérez AguilarNo ratings yet

- Ims606 ElmsDocument68 pagesIms606 ElmsZydan RizqinNo ratings yet

- MPOBDocument251 pagesMPOBjigyasamiddhaNo ratings yet

- Griffin 9e PPT ch03Document44 pagesGriffin 9e PPT ch03Ngọc DươngNo ratings yet

- Different Approaches To Ethics & Social ResponsibilityDocument4 pagesDifferent Approaches To Ethics & Social ResponsibilityGomamameNo ratings yet

- Individual Assignment 2 - Article Review - Opm530Document2 pagesIndividual Assignment 2 - Article Review - Opm530Amir HafiyNo ratings yet

- Acn 3102 Introductory AccountingDocument35 pagesAcn 3102 Introductory AccountingLinda Liong100% (1)

- Meezan Bank, Organizational Behavior (Final Project)Document22 pagesMeezan Bank, Organizational Behavior (Final Project)Live_wire417No ratings yet

- Contoh PAper CSRDocument41 pagesContoh PAper CSRAnna Dewi WijayantoNo ratings yet

- Group 1 - STP Analysis (Duck Company) - Draft Report v.1 Final DraftDocument17 pagesGroup 1 - STP Analysis (Duck Company) - Draft Report v.1 Final DraftAmmitra NairNo ratings yet

- Rasmiyat e Maqala Nigari PDFDocument42 pagesRasmiyat e Maqala Nigari PDFadyan Riaz100% (1)

- Final Report For Community Service ProjectDocument14 pagesFinal Report For Community Service ProjectNaveeneh Raaj Kumar MunusamyNo ratings yet

- Burj Bank LimitedDocument17 pagesBurj Bank Limitedhusnainrazzaqbaloch1No ratings yet

- Block 1Document54 pagesBlock 1Zaki IrshadNo ratings yet

- Assignment 2:: Islamic Finance (PFS 2253) Semester: August 2021Document9 pagesAssignment 2:: Islamic Finance (PFS 2253) Semester: August 2021anis farehaNo ratings yet

- Islamic Banking and Finance Institute MalaysiaDocument5 pagesIslamic Banking and Finance Institute MalaysiaNurShamNo ratings yet

- 7 Eleven OverviewDocument21 pages7 Eleven OverviewDanilius KudoNo ratings yet

- EFE MatrixDocument10 pagesEFE MatrixRupok AnandaNo ratings yet

- Mkt558 Individual Assignment ReportDocument10 pagesMkt558 Individual Assignment ReportAINA SYAZWANINo ratings yet

- ZULAIKA BINTI MOHD TOURIOU at IDRUS CASE STUDYDocument17 pagesZULAIKA BINTI MOHD TOURIOU at IDRUS CASE STUDYZulaika IdrusNo ratings yet

- Contoh SoalanDocument4 pagesContoh SoalanAwiePortagioieNo ratings yet

- KFC ProjectDocument29 pagesKFC ProjectTooba JamilNo ratings yet

- SCCG3123 Ia1 238529Document5 pagesSCCG3123 Ia1 238529نور شهبره فانوتNo ratings yet

- Padini - AR 2018 (Part 1)Document137 pagesPadini - AR 2018 (Part 1)JohnNo ratings yet

- MGT 321 Report Final ReportDocument12 pagesMGT 321 Report Final Reportanantika_01No ratings yet

- MGT300 - Ch01 ExerciseDocument4 pagesMGT300 - Ch01 Exercisekakpisz100% (2)

- Product Life CycleDocument5 pagesProduct Life CycleEkkala Naruttey0% (1)

- Financial Report GRPDocument83 pagesFinancial Report GRPafiqah aqilaNo ratings yet

- Satyam and Welli MultiDocument7 pagesSatyam and Welli Multilyj1017No ratings yet

- Strategic Analysis of Poh KongDocument36 pagesStrategic Analysis of Poh KongDin Aziz50% (4)

- Executive Summary & Product OverviewDocument5 pagesExecutive Summary & Product OverviewArnea Joy TajoneraNo ratings yet

- Surrounding Development LatestDocument4 pagesSurrounding Development LatestSyita HanaNo ratings yet

- Alia Syazwani Practical Training ReportDocument22 pagesAlia Syazwani Practical Training ReportAli Hisham GholamNo ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- CH1 - Case 5 Tiger Woods "Winning Takes Care of Everything" (Chapter 1, Pages 36-37)Document3 pagesCH1 - Case 5 Tiger Woods "Winning Takes Care of Everything" (Chapter 1, Pages 36-37)zoehyhNo ratings yet

- Assignment Case Study SGHE5013Document27 pagesAssignment Case Study SGHE5013ctkhadeejaNo ratings yet

- MGT 321 Report FinalDocument25 pagesMGT 321 Report FinalRakib_234No ratings yet

- Individual Task (Name: Ho Tat Peng No. Matric: A18A0176) ACS4103 L1 1. Pick One Malaysia Companies Operated InternationallyDocument2 pagesIndividual Task (Name: Ho Tat Peng No. Matric: A18A0176) ACS4103 L1 1. Pick One Malaysia Companies Operated InternationallyHo Tat Peng100% (1)

- BBPM 2103 Marketing Management 1Document1 pageBBPM 2103 Marketing Management 1isqmaNo ratings yet

- Draft Ads530Document11 pagesDraft Ads530Izzianie HusinNo ratings yet

- Topic 5 Policy Forecasting and Formulation 2015Document50 pagesTopic 5 Policy Forecasting and Formulation 2015Mohamad FarisNo ratings yet

- MSH 1109 Entrepreneurship and Small Business ManagementDocument1 pageMSH 1109 Entrepreneurship and Small Business Managementdeepansh5No ratings yet

- M.A. Manan, Sertifikat Wakaf Tunai, (Jakarta: CIBER Bekerjasama Dengan PKTTI-UI, 2001) Hlm. 30Document18 pagesM.A. Manan, Sertifikat Wakaf Tunai, (Jakarta: CIBER Bekerjasama Dengan PKTTI-UI, 2001) Hlm. 30oviesthaNo ratings yet

- SM Presentation 1 PDFDocument38 pagesSM Presentation 1 PDFtengku callystaNo ratings yet

- ANSWER TUTORIAL 1 Case Study - (Marriott 30.5.2023)Document3 pagesANSWER TUTORIAL 1 Case Study - (Marriott 30.5.2023)kelly noveliaNo ratings yet

- Ent Case StudyDocument23 pagesEnt Case StudyNick ArifNo ratings yet

- Internship ReportDocument31 pagesInternship ReportMuhammad Fazle Rabbi (202054005)No ratings yet

- Google - 1Document9 pagesGoogle - 1Wan KhaidirNo ratings yet

- MGT 785 - Google - Q4 (Amirul)Document16 pagesMGT 785 - Google - Q4 (Amirul)Wan KhaidirNo ratings yet

- MGT 785 - Google - Group 3Document16 pagesMGT 785 - Google - Group 3Wan KhaidirNo ratings yet

- MGT 785 - Google - Group 3Document16 pagesMGT 785 - Google - Group 3Wan KhaidirNo ratings yet

- MGT 785 - Google - Q1 AZAMDocument17 pagesMGT 785 - Google - Q1 AZAMWan KhaidirNo ratings yet

- MGT 785 - Google - Q3 (Askyel)Document16 pagesMGT 785 - Google - Q3 (Askyel)Wan KhaidirNo ratings yet

- Marketing PlanDocument1 pageMarketing PlanWan KhaidirNo ratings yet

- Individual Assignment 1 - Case 2.3 (Wan Khaidir)Document8 pagesIndividual Assignment 1 - Case 2.3 (Wan Khaidir)Wan Khaidir100% (1)

- Budget Control in Retail Div. TNBDocument12 pagesBudget Control in Retail Div. TNBWan KhaidirNo ratings yet

- VUCADocument4 pagesVUCAWan KhaidirNo ratings yet

- Organic Approach To TM - KhaidirDocument5 pagesOrganic Approach To TM - KhaidirWan KhaidirNo ratings yet

- Segmentation and Value Proposition Design: ©2003 Mohan Sawhney Kellogg School of Management Northwestern UniversityDocument30 pagesSegmentation and Value Proposition Design: ©2003 Mohan Sawhney Kellogg School of Management Northwestern UniversityWan KhaidirNo ratings yet

- GROUP 3 Marketing Plan For New Integrated Alam Sentral Updated 1.3Document16 pagesGROUP 3 Marketing Plan For New Integrated Alam Sentral Updated 1.3Wan KhaidirNo ratings yet

- Etia Enture: Where Your Dreams Property Turns Into RealityDocument18 pagesEtia Enture: Where Your Dreams Property Turns Into RealityWan KhaidirNo ratings yet

- Group 2 - Marketing Plan - Part 1 - KhaidirDocument22 pagesGroup 2 - Marketing Plan - Part 1 - KhaidirWan KhaidirNo ratings yet

- Competitive Market Analysis - Ardence LabDocument5 pagesCompetitive Market Analysis - Ardence LabWan KhaidirNo ratings yet

- Environmental Analysis of Top Glove (V2)Document8 pagesEnvironmental Analysis of Top Glove (V2)Albert Lim100% (2)

- Marketing Plan - Part 1 - AskyelDocument27 pagesMarketing Plan - Part 1 - AskyelWan KhaidirNo ratings yet

- UITM FormDocument2 pagesUITM FormBlipsy BlichNo ratings yet

- Marketing Management Bus506 Case Study Analysis: Procter & Gamble, Inc.: ScopeDocument4 pagesMarketing Management Bus506 Case Study Analysis: Procter & Gamble, Inc.: ScopevivekgautamhiiNo ratings yet

- Environmental Analysis of Top Glove V2Document20 pagesEnvironmental Analysis of Top Glove V2Wan Khaidir100% (1)

- Environmental Analysis of Top Glove (V2)Document8 pagesEnvironmental Analysis of Top Glove (V2)Albert Lim100% (2)

- Top Glove PDFDocument39 pagesTop Glove PDFWan Khaidir71% (7)

- MKT 761 Individual AssignmentDocument4 pagesMKT 761 Individual AssignmentWan Khaidir0% (1)

- Fact Sheet ICD 10 Coding of Neoplasms April 2017Document10 pagesFact Sheet ICD 10 Coding of Neoplasms April 2017Wan KhaidirNo ratings yet

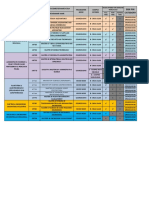

- Listofprogrammes Mac19 CWDocument5 pagesListofprogrammes Mac19 CWWan KhaidirNo ratings yet

- Py c7 Q MurabahaDocument6 pagesPy c7 Q MurabahaWan KhaidirNo ratings yet

- Air Asia and KLIA2 (News Summary)Document2 pagesAir Asia and KLIA2 (News Summary)Wan KhaidirNo ratings yet

- Proton:from Saga To ExoraDocument11 pagesProton:from Saga To ExoraWan Khaidir100% (3)

- Nestle India Valuation ReportDocument10 pagesNestle India Valuation ReportSIDDHANT MOHAPATRANo ratings yet

- Gradient Series and AsDocument8 pagesGradient Series and AsJayrMenes100% (1)

- Myanmar Health Care SystemDocument13 pagesMyanmar Health Care SystemNyein Chan AungNo ratings yet

- Disposal of Unserviceable AssetsDocument6 pagesDisposal of Unserviceable AssetsJOHAYNIENo ratings yet

- Md. Shafiqullah Khan Vs Md. Samiullah Khan On 19 July, 1929: AssignmentDocument8 pagesMd. Shafiqullah Khan Vs Md. Samiullah Khan On 19 July, 1929: AssignmentPratham Garg0% (1)

- Nanna'S House: Case AnalysisDocument10 pagesNanna'S House: Case AnalysisMigo SalvadorNo ratings yet

- Strategic Financial Performance Analysis Using Altman's Z Score Model: A Study of Listed Unicorn Startups in India From 2019 To 2023Document12 pagesStrategic Financial Performance Analysis Using Altman's Z Score Model: A Study of Listed Unicorn Startups in India From 2019 To 2023index PubNo ratings yet

- London Standard Platform Form 2009Document11 pagesLondon Standard Platform Form 2009awjfernandez100% (1)

- Preliminary PagesDocument17 pagesPreliminary PagesvanexoxoNo ratings yet

- From Disaster To Diversity: What's Next For New York City's Economy?Document81 pagesFrom Disaster To Diversity: What's Next For New York City's Economy?Drum Major InstituteNo ratings yet

- Economic SurveyDocument4 pagesEconomic SurveyMapuii FanaiNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- 1) Leung Yee V Strong Machinery Co., G.R. No. L-11658, 15 Feb. 1918, 37 Phil 644Document3 pages1) Leung Yee V Strong Machinery Co., G.R. No. L-11658, 15 Feb. 1918, 37 Phil 644TrinNo ratings yet

- Free Trade ZoneDocument3 pagesFree Trade ZonemanoramanNo ratings yet

- City-Sample Copy of BbaDocument25 pagesCity-Sample Copy of BbaKuldeep ShuklaNo ratings yet

- ValuationDocument20 pagesValuationNirmal ShresthaNo ratings yet

- Accounting Assignment Bilal 18798Document4 pagesAccounting Assignment Bilal 18798Muhammad Shahid KhanNo ratings yet

- Madagascar 2013Document15 pagesMadagascar 2013HayZara MadagascarNo ratings yet

- Wallstreetjournal 20160125 The Wall Street JournalDocument40 pagesWallstreetjournal 20160125 The Wall Street JournalstefanoNo ratings yet

- Advance Paper Corp. vs. Arma Traders Corp., Et - Al. (G.R. No. 176897, Dec. 11, 2013)Document8 pagesAdvance Paper Corp. vs. Arma Traders Corp., Et - Al. (G.R. No. 176897, Dec. 11, 2013)Michelle CatadmanNo ratings yet

- Marine InsuranceDocument7 pagesMarine InsuranceAngel VirayNo ratings yet

- Chuidian V Sandiganbayan Rule 57Document2 pagesChuidian V Sandiganbayan Rule 57KISSINGER REYESNo ratings yet

- Sriya Sip ProjectDocument37 pagesSriya Sip ProjectMegha DeshmukhNo ratings yet

- Linear Programming ApplicationsDocument12 pagesLinear Programming ApplicationsManoranjan DashNo ratings yet

- The Importance of Forex Reserves For RBI, Economy: Job Scene BrightensDocument16 pagesThe Importance of Forex Reserves For RBI, Economy: Job Scene BrightensVidhi SharmaNo ratings yet

- Innocents Abroad Currencies and International Stock ReturnsDocument39 pagesInnocents Abroad Currencies and International Stock ReturnsShivaniNo ratings yet

- Top 20 Questions of Percentages For Du Jat Ipm 025d90a2641bcDocument5 pagesTop 20 Questions of Percentages For Du Jat Ipm 025d90a2641bcChaman GowalaNo ratings yet

- BA7106-Accounting For Management Question Bank - Edited PDFDocument10 pagesBA7106-Accounting For Management Question Bank - Edited PDFDhivyabharathiNo ratings yet

- Starbucks Corporation Analysis Executive SummaryDocument32 pagesStarbucks Corporation Analysis Executive Summarylarry_forsberg100% (4)

- Gross Domestic Product and GrowthDocument26 pagesGross Domestic Product and Growthbea mendeaNo ratings yet