Professional Documents

Culture Documents

Health Saver Training

Uploaded by

Parv Arora0 ratings0% found this document useful (0 votes)

39 views91 pagessjjkbcx

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsjjkbcx

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views91 pagesHealth Saver Training

Uploaded by

Parv Arorasjjkbcx

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 91

December, 2008

Presenting a new health plan.

Trust us,

your customer will thank

you for it!

V1

2

Life Expectancy in India

64

2005

75* 48

Age

(in Years)

2025 1955 Year

*Source: The OASIS (Old Age Social and Income Security committee report)

The customer will live longer

..but not necessarily healthier

V1

3

Working 42 yrs

Age 18 to 60

Retirement 7 yrs

Age 60 to 67

Working 30 years

Age 25 to 55

Retirement 20 years

Age 55 to 75

Life stage of average individual

Previous

generation

Today

The customer will live longer

but not necessarily work longer

Is our customer prepared to meet health expenses during this phase?

V1

4

Source : Outlook Money,31st May,2007`

The customer will make more money

but not necessarily meet the rising cost of healthcare

V1

5

26% of the consumers investing in tax saving

instruments in the last two years invested in

health insurance.

23% of the consumers who are planning to

invest in tax saving instruments in the next one

year want to invest in health insurance.

Findings from a consumer research conducted by ICICI

Prudential in Sep 08 across Mumbai, Chennai and Delhi

The customer will buy insurance to save tax

but not necessarily only for Section 80 C

91% of the consumers are aware of health

insurance as a tax saving instrument.

V1

6

A plan which:

Provides guaranteed reimbursement

hospitalization cover till age 75

Builds up a health fund and allows

claims for health expenses not

covered in the hospitalization cover

Flexibility in premium payment

Gives complete tax benefit under

Section 80D

Yes, the customer will need a health plan

but not necessarily the one You have in mind

V1

7

Rise to the health cover challenge

If this is the

customer s present

state

How will you balance?

V1

8

Presenting

V1

9

Complete Tax Benefit

under Section 80D

Cover with a dual benefit

Allows claim against

out-patient treatment,

diagnostics, dental

care etc

Reimbursement

based

hospitalization

coverage

Builds a health

fund to cope with

rising cost of

health care

Hospitalisation

Insurance

Benefit

Health

Savings

Benefit

Comprehensive whole life health offering

V1

10

How does the plan work?

Health Savings

Benefit

Hospitalisation Insurance

Benefit

To cover you against

hospitalization expenses

To cover you against all other

health expenses

Select the annual limit for the hospitalization cover

Select a suitable premium

*Invested premiums mean premiums post deduction of

applicable charges

Basis age and annual limit chosen, part of premium will go

towards the health cover and remaining invested to build a

health fund*

V1

11

Coverage

Scope

Comprehensive

Cover

(Including OPD &

Daily costs)

Hospitalization

CI/

Disability / Major

surgery

Comprehensive health offering

Specific cover

V1

12

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

V1

13

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

V1

14

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Covers actual expenses

incurred during

hospitalization

Room, boarding and nursing charges, ICU charges

Maximum room rent payable to be 1% of selected

annual limit only for single A/C rooms

Fees for doctor, surgeon, specialist, etc

Anesthesia, blood, oxygen, operation theatre,

surgical appliances, medicines, etc

Pre & Post hospitalization expenses for 30 & 60

days

125 listed day care procedures

Ambulance charges upto Rs 1000 per year

V1

15

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Guaranteed coverage

till age 75

No re-evaluation of health status or refusal of cover

during term

No addition of exclusions or increase in premiums

due to claims made

No claims Bonus

A bonus of 5% on annual limit added for every claim

free year

Bonus amount up to 25% can be added

Family floater

Cover yourself, spouse and upto 3 dependant children

under same plan

V1

16

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Free Health Checkup

A free health check-up once every 2 policy years after

the first year

Reimbursement of amount up to 1% of annual limit or

Rs 5000 whichever

Pre-Existing illnesses

Cover

Pre-existing illnesses covered after 2 years

The disease to be declared at inception & accepted

by the company

Cashless

Hospitalization

Cashless claims settlement in over 5000 network

hospitals

V1

17

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Wide network access

with preferred benefits

Access to a network of over 5000 hospitals

A Co Pay of 20% applicable for room upgrade over

prescribed limit in single A/c room or for claims in

outside network hospitals

In Emergency, co-pays does not apply in cardiac or

trauma cases at a outside network hospital

Click here for co-pay illustration

V1

18

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

V1

19

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

V1

20

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Build a Health Fund for

the future

Choose from two portfolio strategies :

Lifecycle strategy wherein allocation is based

on customers age with rebalancing on a quarterly

basis

As age progresses, allocation changed to suit Life

stage.

Click here to know more.

Fixed strategy wherein a customer can do his

own asset allocation.

The customer can chose from 7 funds

Click here to know more

Includes Health

Return

Guarantee Fund

With

Automatic

Transfer

Strategy

V1

21

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Claim for any health

expenses after 3 years

Claim are allowed from 4

th

year onwards against

medical bills. Claims can be made for:

Daily medicines and drugs

Diagnostic expenses

Doctor bills and other OPD expenses

Co-pays /deductibles of other medical insurance cover

Miscellaneous medical expense over and above that

covered by Hospitalization Insurance

Claim schedule:

Claims can be made once every year, with minimum claim amount of

Rs 1000

100% 50% 20%

Maximum claim

(% of fund value)

From 11

th

Yr 6

th

-10

th

Yr 4

th

& 5

th

Yr Policy Years

V1

22

The features in detail

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Cover Continuance

option after 5 years

Option of premium holiday after completion of 5

policy years

Hospitalization Insurance and Health Savings

benefit continues by deduction of charges from

accumulated fund

Once the fund value drops to <110%of annual

premium, the customer can still claim from it for the

next 5 years ( max 50% every year)

Tax benefit under

Section 80D

Complete tax benefit under Section 80 D even for this

component of the premium

V1

23

Features summarized

No Claim Bonus

Guaranteed

Coverage till age 75

Family Floater

Over 125 Daycare

coverage

Pre-existing Illness

Cover after 2 yrs

Build a health fund

for the future

Cover Continuance

option after 5 years

Allows you to claim

for any health

expenses after 3

years

Hospitalisation

Insurance Benefit

Health Savings

Benefit

Tax Benefits of upto

Rs 15000 u/s 80D

Click here

Free Health Checkup

V1

Therefore the product positioning

A dual benefit

health plan

Flexibility in

premium payment

Comprehensive

guaranteed

reimbursement

coverage

Builds a

health fund

and allows

Claims for all

health expenses

Complete tax

benefit

under

Section 80 D

V1

25

Illustration 1

Customer insured with annual limit of 3 Lakhs for the hospitalization cover at age

32. He has chosen to pay a premium of Rs. 15000 annually.

He made a claim for hospitalization due to a road accident at age 38; during the

treatment he incurred total hospitalisation expenses of Rs.84,000. He also had to

pay additional charges for follow-up tests, crutches, belts, collars totaling

Rs.16,000. What can the policyholder claim?

Claim payable under the plan:

Hospitalization insurance benefit

All eligible expenses during hospitalization are payable to the customer i.e. Rs. 84,000

Heath savings benefit

Since the claim is in 5

th

Policy year, he can make a partial withdrawal up to 50%of fund

value. The remaining expenses which are not covered under Hospitalization insurance

benefit can be reimbursed up to the actual expense i.e. Rs.16,000

Total benefit payable : Rs.1,00,000

V1

26

Illustration 2

Customer insured with annual limit of 2 Lakhs for the hospitalization cover at age

35. He has chosen to pay a premium of Rs. 25000 annually.

At age 39, the customer had accumulated medical bills for the past 2 years ranging

from bills for daily medicines, doctor visits and even dental treatment up to Rs.

22,000. He however has not undergone any hospitalization. What can he claim?

Claim payable under the plan:

Hospitalization insurance benefit

No instance of hospitalization

Heath savings benefit

Since the claim is in 4

th

Policy year, he can make a partial withdrawal up to 20%of fund

value. In this case the entire amount can be claimed from the health fund i.e. Rs.22,000

Total benefit payable : Rs.22,000

V1

27

Illustration 3

Customer insured with annual limit of 3 Lakhs for the hospitalization cover at age

41. He has chosen to pay a premium of Rs. 20000 annually.

At age 50, the customer decides to take a premium holiday and exercises CCO

option. At age 52 he is hospitalized for CABG and incurs expenses of Rs.2 lakhs.

He also has bills for follow-up medication of Rs. 20000. How much can be claim?

Claim payable under the plan:

Hospitalization insurance benefit

Since he opted for CCO, he continued to remain covered and the entire amount of Rs. 2

lakhs is payable.

Heath savings benefit

Since the claim is in 11th Policy year, he can make a 100% withdrawal from the fund

value. In this case the entire amount can be claimed from the health fund i.e. Rs.20,000

Total benefit payable : Rs.2,22,000

V1

28

Boundary conditions at-a-glance

30 Days

No waiting period applies for claims due to accident

Waiting period of two years will apply to some conditions

Waiting period

25 - 55 years for individual policies

18 - 55 years for spouse in a family floater

Dependent children (90 days - 25 years of age)

Min/Max Age at Entry

2 lacs / 3 lacs / 5 lacs / 7 lacs / 10 lacs Annual Limit Options

(Rs.)

Whole Life Plan

(Hospitalisation Insurance guaranteed upto age 75 years)

Term

V1

29

Yearly, Half Yearly, Monthly Premium Paying

Modes

Premiums would be subject to the minimum premium grid

given below based on the age and number of members

selected

Minimum Premium

CIPS allowed once in every 2 years Change in portfolio

strategy

4 Free switches in a year.

Additional switches chargeable at Rs.100 per switch

Switch

Annual Limit

> 5 lacs

Annual Limit

upto 5 lacs

All Annual Limits

30000 25000 15000 40-55

20000 15000 10000 <40

Family Individual

Age

Boundary conditions at-a-glance

V1

30

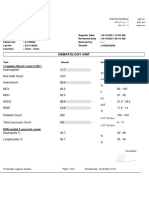

Health Saver charges

Allocation Charge

Policy Admin Charges

For Monthly : Rs 90 per month

For Yearly and Half yearly mode: Rs 60 per month

Fund Management Charge

1.5% for Health Flexi Growth , Health Multiplier, Health RGF

1.0% for Health Flexi Balanced, Health Balancer

0.75% for Health Protector, Health Preserver

2%

4-10

0 9% 20% % of Annual Premium

Thereafter 2-3 1 Year

All charges deducted in the form of units from fund

V1

31

Health Insurance Charges:

Inclusive of ST & Education Cess

The health insurance charges are valid from 1 year of policy

commencement date and are subject to change post IRDA approval

Health Saver charges

2 Lacs

3 lacs

5 lacs

7 lacs

10 lacs 3283

25 yrs 35 yrs 45 yrs 55 yrs

Annual Limit

2337

2756

3564

7052

2693

3179

3928

7836

2881

3402

4203

8384

3069

3624

4476

8929

3878

4790

9554

V1

32

Health Saver insurance charges versus

competition

For an annual limit of 2 Lakhs

Most competitive

insurance charges

Product

After product

Age

25

30

40

50

Health

Saver

2337

2547

3045

5737

ICICI

Lombard

2690

2690

3370

6000

Lombard

over HS

115%

105%

110%

104%

Age

25

30

40

50

Health

Saver

2337

2547

3045

5737

Bajaj HG

2627

3074

3074

6267

Bajaj

over HS

112%

121%

101%

109%

Age

25

30

40

50

Health

Saver

2337

2547

3045

5737

New

India

2775

2775

3196

5517

New

India/ HS

119%

109%

105%

96%

After product

Charges inclusive of Service tax and Edu Cess.

Charges for all competing products sourced from

the respective company websites as on Dec 2008.

V1

33

Health Saver insurance charges versus

competition

For an annual limit of 2 Lakhs

Most competitive

insurance charges

Even with a family

floater.

Age

25

30

40

50

Health

Saver

5887

6215

6954

11532

ICICI

Lombard

6423

6423

7443

11988

Lombard

over HS

109%

103%

107%

104%

Charges for a family of four - 2 adults and 2 children

Charges inclusive of Service tax and Edu Cess.

Charges for all competing products sourced from

the respective company websites as on Dec 2008.

V1

34

Health Saver the real Health ULIP plan

2x after 5 days x x Pre/ Post

Hospitalisation

80 D only on

health charges

80 D only on

health charges

80 D only on

health charges

80 D on full premium Tax benefits

(From Fund)

(From Fund)

(From Fund)

(From Fund)

Misc Health Expenses

Reimbursed (OPD)

x

Only 33 MSB &

25 CI (Rider)

NA

Fixed Benefit

Reliance

Health+Wealth

x

Only 900

20x, 12x, 8x,

4x, 2x

Fixed Benefit

TATA AIG

InvestAssure

Health

x

Only 49

200x, 120x, 80x

Fixed Benefit

LIC Health

Plus

Surgery Scope

Non-surgical benefit

Surgery Benefit

Complete

reimbursement cover

for surgeries and

medical expenses

incurred at hospital

ICICI Prudential

New Health Saver

Daily Hospitalisation

Benefit (DHCB) / ICU

Core Coverage

Benefits

V1

35

Health Saver the real Health ULIP plan

Tax benefit under

80 C

Reimbursement

Hospitalization

plan

Tax benefit under

80 D

Fixed benefit

Hospitalization

plan

Health Saver

Reliance Health + Wealth

LIC Health Plus

TATA AIG invest assure

The only insurance plan to have the

complete 80D tax advantage

The only insurance plan to have a

reimbursement based floater

hospitalization cover

Most comprehensive coverage with maximum tax advantage

V1

36

Maternity expenses

Medical equipment

expenses

Day to day medicines &

drugs expenditure

Dental treatment

OPD expenses

Daycare Procedures

Hospitalisation Coverage

Benefits

Traditional

Mediclaim

Health

Saver

The Health Saver advantage: The most

comprehensive coverage

Comprehensive coverage against

both inpatient and outpatient medical

instances

Pays for any kind of medical

expense incurred during the policy

term

V1

37

*For 25 year old with highest income tax slab of 33.66% with maximum

Tax advantage under section 80 D

** fund value net of all charges and insurance charges for a 5 lakh annual limit

The Health Saver advantage: Aapke health ka

savings account

Pay Rs 15,000 annual premium for Health

Saver for 10 years

Total premium paid

for 10 years

1,50,000

Earn back your premium:

Avail complete Tax advantage on the entire

premium paid for 10 years* (A)

Total tax saved

during 10 years

50,990

Total fund value available for health claim after

10 years ( assuming a modest growth at 10%) (B)

Total fund value

after 10 years

1,60,228

Total return advantage after 10 years (A)+(B) 2,11,218

Total return after

10 years

Plus Health Cover of 5 Lakhs during the 10

years

Plus Free medical worth Rs. 5000 every 2 yrs

V1

38

Retirement

The Health Saver advantage: Takes care of you today

and invests your money for tomorrow

Age 25

Retirement Phase Working Phase

Premium paying term 20 years

Age 55 Regular premium

Cover continuation phase

Whole life

Pay premiums

during

working years

Get a health

cover + build

a health fund

Opt for CCO

on retirement

and remain

protected

Continue

claiming from

health fund

for whole life

Relax!

Age 75

Hospitalisation Cover

Relax!

V1

39

What makes Health Saver a winner

Tax Benefits on

entire premiums u/s

80D

Build a health fund

which allows you to

claim for any other

health expenses

Long Term

Coverage against

Hospitalisation

Expenses

Flexible premium

payment options

continue cover even

after stopping

premiums

V1

40

An easy sale with high jet limits

Jet Limits

Only Standard Age proof allowed

No Backdation allowed

Health Saver would be rated with only MediAssure

Employer-Employee scheme subject to immediate assignment to the

employee

Age/ Annual Limit

1-35 Yrs

36-45 Yrs

46-55 Yrs

Upto 3 lacs

No Medicals

No Medicals

Medicals

Upto 10 lacs

No Medicals

Medicals

Medicals

V1

41

Imp: Please use Form Id: 02

A convenient sale with new 4 pager

application form

Only a 4 pager form and valid for all health products

V1

42

Premium payment frequency & mode

Premium payment frequency:

Yearly/

Semi-annually/

Monthly ECS/Monthly Non-ECS

Premium payment mode:

Cheque/DD/PDC/Pay Orders/Bankers Cheque/

Internet facility/Electronic Clearing System/Credit Card

To ensure all health policy customers derive 80 D tax benefits CASH will not be

accepted as a mode of First Premium Deposit.

Amount & Modalities will be subject to company rules &

relevant legislation/regulations.

V1

43

Underwriting guidelines

Previous life and health policies (other than MediAssure and

Health Saver) and riders will not be taken into consideration

for either triggering medicals, financial eligibility or rated up SA.

The total Annual Limit in case the insured person buys more

than one policy will be Rs. 2,500,000 (Health Saver +

MediAssure)

Only Standard Age proof allowed (PAN card allowed for rated

up AL of 15 L)

Underwriting would be done on individual lives under family

floater options.

Financial Eligibility Table

Income documents are compulsory for total rated up SA of LA

above 15L for all members.

Policy twisting norms of 2 years will apply for a HC , MA and HS

policy

Risk commencement date will be the final underwriting date.

10.1 -15 L Above 3.5 L

2-5 L Above 50 K

5.1 -10L Above 2 L

15.1-25 L Above 5 L

Annual Limit Income

V1

The Claims Process

The Health Card to enable claims

A Health Card for every Policy Holder

Dispatched along with the Welcome Kit

Will carry customer and policy details

How does it work?

Card produced at the Network Hospital

to avail cashless benefit

Preprinted phone numbers for any kind of

claims or service assistance

The Health Card

V1

45

HOSPITALISATION

Network Hospital Non-Network Hospital

Post discharge,

submit claim form

Scrutiny

Cheque sent

to Customer

Planned Emergency

Submit Preauthorization Form

Cashless authorized

Customer settle bill with

Hospital

Cashless not

authorized

Scrutiny

Reject

ICICI pays Hospital

Customer signs

Documents on

Discharge

The claims process hospitalization

insurance benefit

HOSPITALISATION

Network Hospital Non-Network Hospital

Post discharge,

submit claim form

Scrutiny

Cheque sent

to Customer

Planned Emergency

Submit Preauthorization Form

Cashless authorized

Customer settle bill with

Hospital

Cashless not

authorized

Scrutiny

Reject

ICICI pays Hospital

Customer signs

Documents on

Discharge

Pre(30)&Post(60)

Hospitalization*

Reimbursed only in the Event of

acceptance of the Hospitalisation or Day

Care Procedures claim by the Company.

TAT -3hrs

V1

46

HOSPITALISATION

Medicines/Drugs

Diagnostics

Dental

Co-pays/Deductibles

Miscellaneous medical expenses

The claims process health savings benefit &

free health check-up

HEALTH SAVINGS BENEFIT*

Scrutiny

Cheque sent

to Customer

Reject

Submit original bills or proof

of expenses along with

withdrawal Form

**Subject to a limit of Rs. 5,000 or 1% of the

annual limit, whichever is lower.

Can be claimed once every two years after the

first year

One bill per insured member for given 2 yr

period

Submission of original bills or

proof of expense along

with claim form

MEDICAL CHECK-UP**

Scrutiny

Cheque sent

to Customer

Reject

*Allows policyholder to claim his funds for different health care

expenses, after the completion of three policy years.

Can be claimed once in every Policy year subject to a minimum limit

of Rs. 1000/-

V1

47

The Claims process Hospital Cover

documentation

Documents to be submitted within 10 days of discharge from the

Hospital or Nursing Home

Photocopy of Policy certificate

Claimant statement form

Photo Identification proof

Attending Physician Certificate

Original Discharge summary or card, test reports

Original Hospital bill and payment receipts

Original cash memo from the chemist(s) with prescription

Photocopy of Admission notes

FIR / MLC / Panchnama for accidental Claims

Other relevant Documents related to the current hospitalization/

surgery so as to process the claim faster

*ECS mandate and copy of cancelled cheque

to be submitted for direct credit facility

V1

48

SMS Service: To provide assistance & prompt resolution on claims

processing

To access SMS service type-

ICLAIM <space> <8 Digit Policy Number> & send SMS to 56767

Customers will receive call back from our certified claims expert

SMS service will prove to be a customer delight.

Claims initiatives : The I Claim

Service

V1

49

Claims initiatives

Document Reckoner shared with Branches: Checklist of

essential documents

Original Documents (Bills/Medical Reports) mandatory for

Medi Assure and now Health Saver

ECS Mandate along with a copy of cancelled cheque to be

submitted for availing direct credit of claims payout

Health Claims Documentation

Direct Credit Facility

V1

50

healthclaims@iciciprulife.com

TAT for response 1 working day

Critical Illness products claims enquiries

1800222020 (9AM 9PM) or approach Branches.

Hospitalization products (Hospital Care & Medi Assure)

(Toll free 24*7) 1800221719 & 022 23000431

Grievance

022 40398147

GM Call log Call type Health claims Subtype complaint

Branch Support from Health Claims Cell

Document reckoner deployed for support at branches

V1

51

Category rules

Condition Health Saver Category

Only as family floater. Plan starts from 90

days of age*(subj to policy anniversary)

Minor

The minimum age at entry for children

under Family floater is 90 days and

maximum is 25 years

Students will only be offered family

floater. Maximum cover up to AL- 15 L

can be offered under a parents family

floater of Health Saver/ MediAssure.

Student

Cannot be offered X Foreign National / PIO

For treatment in India only and upto

Annual Limit of Rs 5 Lakh

NRI

V1

52

Category rules - female lives

Condition Health Saver Category

Up to Annual limit of Rs 5 L without documentation/

husbands insurance

Higher cover subject to equivalent husbands

MediAssure/HS cover up to maximum AL of Rs 10 L

Family floater: Maximum cover up to AL- 15L can be

offered under husbands family floater of Health

Saver/ MediAssure

**Housewives can be offered maximum Health Saver

cover (Individual + Family floater) of 15 Lacs.

Single women: Can offer maximum AL - 3L subject to

approval from Health Team

Group III

Up to Annual limit of Rs 5 L without documentation

Higher cover subject to income documents

Group II

At par with male lives Group I

V1

53

Re-instatement norms

With Medicals / exclusions / Declaration of good health.

Reapplication of waiting periods

No claim payable within the lapsed period

Greater than 60 days

2 years

No revivals permitted post 2 years

Max Revival Period

Simple revival

(Payment of arrears premium with interest)

Upto 60 Days

Norm Time interval

V1

54

Underwriting Guidelines

Medical Examination Chart

MER, HbA1c, ECG, RUA, SMA12 46 55 years

MER, FBS MER 36 45 years

MER MER 35 years

>3 Lacs 3 Lacs Age / Option

V1

55

Things to note

Eldest member is the primary life

Individual underwriting questions for each family

member

DOB proofs required for all members

Signature for all members

V1

56

FAQs

Can I change my annual limit during the term of the plan?

You can increase or decrease your annual limit at every policy anniversary with

deduction of appropriate insurance charges based on change in annual limit. Any

increase in the annual limit will be subject to underwriting an as per terms and

condition set by the company.

Can I change my premium during the term of the plan?

You can increase or decrease your premium at every policy anniversary, any

decrease in premium will be subject to the minimum premium grid based on

annual limit , age and number of members in the family.

What if I am unable to pay my premiums after the first 3 years?

If premium is discontinued in the first three policy years and if the policy is not

revived within the period of two years from the due date of the first unpaid

premium, then the policy will be terminated. During this period, Hospitalisation

Insurance Benefit will cease and the policyholder will only have the benefit of

investment in the respective unit funds.

V1

57

FAQs

What if I am unable to pay my premiums after the first five years?

On payment of at least first five years premium, you have the option of opting for a

cover continuance option wherein your further charges would be deducted from

your fund until fund value falls below 110% after which the policy would be

foreclosed.

What happens if my fund value falls below 110%?

If premiums have been paid for three full policy years and after three policy years

have elapsed and fund value falls below 110% of one full years premium, the

policyholder will be given intimation and option to reduce the Health Savings

Benefit claim amount so that the fund value does not fall below 110%. If the

policyholder does not opt to reduce the Health Savings Benefit claim then, the

benefit shall be paid and the policy will be foreclosed.

What happens on foreclosure?

On the date of foreclosure, the fund value will be calculated as per prevailing NAV

on that date. The fund value so calculated can be withdrawn by you within 5 years

for health expenses upon submission of original bills for expenses incurred. This

withdrawal will be subject to a maximum of 50% per annum of the fund value as on

date of foreclosure. This condition will also apply during the cover continuance

stage, if opted for.

V1

58

FAQs

How does the Health Checkup benefit function under the plan?

The free health checkup will be available to all insured members after the first

year once every 2 years. Each member can submit only a single bill in every

block of 2 years after the first year. (i.e. once in the 2nd -3rd yr , 4th -5th yr and

so on). We will not allow of aggregation of bills of any member The cumulative

limit for all the members under the policy would be 1% of the annual limit or Rs

5000 whichever is lower.

Can the family floater be issued in a case single parent and children?

Yes, the family floater in Health Saver allows for a single parent to include

himself/herself and upto 3 dependant children under the plan.

Can I add a family member to my plan at a later date?

Addition of family members to the policy shall be allowed only in the event of

marriage or birth or legal adoption of a child. You should opt for this within 90

days from the date of event or at the next policy anniversary. The change shall

be effective for the purpose from the next premium due date which would be the

risk commencement date for the new member added. You shall have to pay

additional premium on addition of a family member as determined by the

Company.

V1

59

FAQs

What would happen to the fund value in case of death of the primary insured

or

any other insured member during term of plan?

In the unfortunate event of death of the primary insured member during the term

of the policy, the nominee shall receive the total fund value and the policy shall

be terminated. The fund value paid out on death of the primary insured may be

taxable in the hands of the nominee as per the prevailing tax regulations at that

time. The remaining insured members have the option of continuing coverage

by availing a new policy.In the unfortunate event of death of any other insured

members the policy Would continue for remaining insured members with the

appropriate reduction in health insurance charges

Can I make a claim if I get treated outside India?

No, you are entitled to a claim for treatment undergone in India only.

What is the duration within which a claim has to be reported to ICICI

Prudential?

If the claim is from a network hospital then 4 days prior to the planned

hospitalization by forwarding the pre-authorization form. In case of emergency,

within 24 hours of getting admitted. If the claim is from a non-network hospital

then within 60 days of getting discharged from the hospital, the claim request

should be given to the insurer. All claims will be settled in 7 working days after

receiving request.

V1

60

FAQs

Are the claims made through withdrawals from the Health Savings Benefit tax

free?

Yes all claims made from your health fund will not be taxed as they would be

treated as a health claim on the policy.

Can I claim for non allopathic medical expenses under the Health

Savings Benefit?

Yes the Health Saver allows you to claim for all health care expenses under the

Health Savings Benefit which includes non allopathic expenses.

Will any claims under the Health Savings Benefit reduce the annual limit in the

hospitalisation insurance benefit?

No all claims from your Health Savings Benefit are settled by withdrawals against

your health savings kitty and will not effect your annual limit offered in your

Hospitalisation Insurance benefit

V1

61

FAQs

What are the policy twisting norms for the Health Saver?

In case customer has lapsed any of the following policies i.e. Hospital Care

,MediAssure & Health Saver within the last 1 year , he must reinstate his lapsed

policy before being entitled to buy a new Health saver policy.

Are the insurance charges deducted from my policy constant throughout the

policy term?

No the insurance charges will be deducted every year based on the new age of

the customer.

Can the Health Saver be sold as a combo plan?

The Health Saver application form allows you to buy a Health Saver along with

any other health plan. However in case of a family floater only the primary life

will be able to buy the additional health plan.

V1

62

Thank You

V1

63

For any product related queries, please write into:

healthinfo@iciciprulife.com

V1

64

LIFECYCLE BASED PORTFOLIO STRATEGY

V1

65

How Does It Work

Initial allocation based on customers age

Rebalancing on a quarterly basis

As age progresses, allocation changed to suit Life

stage

65% 35% 66 75

100% 0% 75+

55% 45% 56 65

55%

65%

75%

85%

Health Flexi Growth

45% 46 55

35% 36 45

25% 26 35

15% 0 25

Health Protector

Allocation Age Band

V1

66

NAV CHANGES

ALTER THE

EQUITY-DEBT

RATIO

WITH CHANGE IN

AGE,

ALLOCATION IS

ALTERED

Flowchart for lifecycle based strategy

Customer

Policy Inception

EQUITY

75%

DEBT

25%

ALLOCATIONS

BASED ON AGE

Every Quarter

PORTFOLIO

REBALANCING

75%

25%

50% 50%

75%

25%

Age = 30

Every shift in

age band

DEBT EQUITY

65%

35%

Age = 36

V1

67

Asset Allocation

What is it?

How can it be done?

Why should you do it?

It is the diversification of your portfolio

By distributing wealth amongst different asset

classes viz. equity, debt & money market

In order to optimize your risk-return balance

V1

68 68

Why is Asset Allocation

important?

Studies have shown that asset allocation is the single

most important factor in determining returns

Studies have shown that asset allocation is the single

most important factor in determining returns

Brinson Study on the Importance of Asset

Allocation

Security

Selection ,

5%

Market

timing, 2%

Others, 1%

Long Term

Asset

Allocation ,

92%

Long Term Asset Allocation Security Selection Market timing Others

V1

69

FIXED PORTFOLIO STRATEGY

V1

70 70

Fixed Strategy : Choice of Funds

A customer may wish to do his allocations on his own

We have given him a flexibility of allocating his wealth

as per his choice

Health Flexi Growth

Health Multiplier

Health Flexi Balanced

Health Balancer

Health Protector

Health Preserver

Health Return Guarantee Fund

V1

71

ATS ( Automatic Transfer Strategy ) is a mechanism that

eliminates the need to time ones investments in the market.

Through ATS you can regularly switch a fixed sum of

investment at a monthly frequency from Health Preserver to

Health Multiplier or Health Flexi Growth

Advantages

Reduce risk in overall investment

Bulk of investment in Health Preserver

A good strategy in a volatile market to average out cost of acquisition

Automatic Transfer Strategy (ATS)

V1

73

What is the Return Guarantee Fund?

Return Guarantee Fund ( RGF) is a close ended

debt fund

It offers a Minimum Guaranteed NAV at the end

of 5 years.

100 100 Debt, Money market & Cash

Min (%) Max (%) Indicative Portfolio Allocation

Fund Management Charge: 1.50%

V1

74

Upside Potential

On Dec 20, 2013 you get Min Guaranteed NAV of

Rs 15.03 or the NAV on that day; whichever is

higher

The falling interest rate regime is expected to boost

the returns given by debt funds- as seen in the past

GET THE ADVANTAGE OF HIGHER RETURNS

WITH THE PROMISE OF A MINIMUM GUARANTEE

V1

75

Health RGF Snapshot

It will open with an NAV of Rs.10 on Dec 22, 2008

Subscription to this fund is open for a limited period

The fund can be closed by giving a notice of 5 working

days notice

The fund will terminate (mature) on Dec 20, 2013

V1

76

Health RGF Snapshot

Only your First Premium Deposit is invested in the RGF

Subsequent Premiums:

Allocation must be chosen at inception ( in app form); and can be allocated

into any of the fund / strategy available with the product

Switch out of Return Guarantee fund at the prevailing NAV at any point of time

and re-invest in any of our other funds

Subscription to this fund is open for a limited period

The fund can be closed by giving a notice of 5 working days notice

V1

77

Co-pay illustration

Plan : Annual limit of Rs 5L

Following expenses incurred during treatment

0 1000

Telephone

0 1500

Food bill for

attending person

Total Eligible Bill (Rs) Total Bill (Rs) Eligible for cover Expenses

30000 30000

Room & ICU

49000 51500 Grand Total (Rs)

10000 10000

Opn Procedure

4000 4000

Medicines

5000 5000

Doctors Fees

V1

78

Appropriate choice of hospital will avoid any co-

pay for the customer

8200

(20% Co Pay for outside

network claims)

0

(0% Co Pay for within

network claims)

Amount to be paid

by customer (Rs)

39200

(80% of eligible bill)

49000

(100% of eligible bill)

Amount covered

by policy (Rs)

Non Network Hospital Network Hospital Network

Co-pay illustration 2

V1

79

Mr Rakesh K (age 72) with a 10 year old

mediclaim policy of Rs 3 lacs

8000

12000

60000

P

r

e

m

i

u

m

(

R

s

)

Year 1 Year 2

No Claim

Claim

Source: Mediclaim premium hike capped at 75%,1 Dec

2007, IST,Prabhakar Sinha,TOI,

Increase in premiums after claims

Reason for this huge rise in premium: Customer had

claimed Rs 1,50,000 for an angioplasty after developing

a heart ailment

V1

80

Mr Joshi (age 67) had purchased a mediclaim

policy in 1992

Policy Issued

1992

Disease/Condition

Occurs

1999 2002

New Exclusion

added at renewal

Current Status

Premium Doubled

New Exclusion added

Source: Two more PILs filed in Mediclaim cases.14 Apr 2003, TOI

Adding exclusions after claims

For the first 10 years of taking the policy, there was no

claim and now that the time has come to encash on the

policy, they are asking me to discontinue, - Joshi

V1

81

Pre existing illnesses not covered

Mr Vasant Rao underwent by-pass 1986

Bought Mediclaim with disclosure of by-pass

and renewed regularly since

Mar 95

Apr 99

Underwent surgical procedure for the same

Underwent Angioplasty and diagnosed with

Ischemic Heart Disease (IHD)

Jul 99

(Source:Honour Mediclaim policy: National panel

Friday J uly 7 2006 ,www.newindpress.com)

Claim was not honoured by the company citing exclusion

clause on pre-existing disease

V1

82

Comparisons with other players

Not covered Star Allied & Health

Upto 5 years* Bajaj Life Care First

Not covered Bajaj Gen Health Guard

4 years New India Assurance

4 years National Insurance

2 years ICICI Lombard Health Advantage Plus

4 years ICICI Lombard- Family floater

2 (gold) / 4

(silver/standard) years

Reliance Healthwise

Pre-existing disease

waiting period

Company/Product

* Some ailments

V1

83

Day Care Comparison

None New India

None

Star Allied & Health (Premier

Plan)

7 Listed Procedures Reliance Healthwise

9 Listed Procedures ICICI Lombard Family Floater

Over 125 listed Day care

procedures

ICICI Pru Medi Assure

Day Care procedures/

Specified treatments

Company/Product

V1

84

No Claim Bonus

625,000

600,000

575,000

550,000

600,000

575,000

5,50,000

5,25,000

Annual Limit

with bonus

6 lacs (10%X

5lacs)

Working

600,000 0 8

575,000 0 7

550,000 0 6

Claim

Amount

Year

600,000

575,000

550,000

525,000

500,000

Available

Annual Limit

400000

0

0

0

0

5

4

3

2

1

Amounts in Rs

V1

85

Income Tax Norms

Tax Benefits U/S 80D for premia paid towards Health Insurance *

Tax deduction benefit available on Income Insured members

Upto Rs 15000 (Additional to benefit on

premiums towards policy for self, spouse

and children)

For Parents

Upto Rs 20000 For Senior Citizens (Over 65 yrs old)

Upto 15000 For Self , Spouse and dependant

children

*No Benefit available if premiums towards Health

Insurance are paid in cash

10% 1.5L 2.99 lacs

20% 3 lacs 4.99 lacs

30% 5lacs and more

0% Less than 1.5 L

Rate of Tax for an Individual Total Income (Rs)

V1

86

Exclusions

Please refer to policy document for detailed exclusions

Permanent exclusions & Pre existing illness or conditions unless specifically

accepted by the Company

Pre and Post Hospitalization benefits are payable only when the ailments or illnesses

are directly related to the covered hospitalization event/Day care Procedure.

Any expenses more than 30 days prior to hospitalization/Day care Procedure & 60

days beyond discharge are not payable

Diagnosis and treatment or any expenses incurred outside India.

Treatment & investigations for conditions arising due to Diabetes & Hypertension if

disclosed at inception are excluded for first 2 policy years from risk commencement

date or 2 years from the reinstatement date in case reinstatement done after 60 days

from last unpaid premium.

Any treatment directly or indirectly consequent to war, civil war, terrorism, active

military or police duties ,military aircraft or vessels

Circumcision, Sex change surgery ,cosmetic surgery & plastic surgery not due to

accident or treatment of disease etc

Vaccinations, inoculations & expenses on vitamins & tonics until medically necessary

Refractive error correction, Hearing impairment correction, Corrective & cosmetic

Dental surgeries apart from for any treatment arising due to systemic disease or

injury.

Any hospitalization for tests or diagnosis wherein such investigations are possible as

out patient procedures / weight loss / weight gain / Preventive / recuperation

purposes/ routine check-ups & issue of any medical certificate or examination for

employment or travel.

Any treatment / expenses incurred by a Donor of an Organ

V1

87

Exclusions (Continued)

Any Treatment for Congenital Conditions / Physical defects/genetic

disorders etc

Any stream or type of medicines other than Allopathy ( Western medicine)

Any Treatment related to Contraception / Pregnancy / Child birth and

infertility or assisted conception procedures except for life threatening

ectopic pregnancy.

Any treatment directly or indirectly arising from alcoholism/drug abuse,

self-inflicted injuries or attempted suicide or intoxication of drugs,

psychiatry ailments.

Any treatment due to and as a result of HIV / AIDS / Sexually Transmitted

Disease (STD)

Any treatment related to sleep disorders & Sleep Apnoea syndrome.

Durable medical/Non medical equipments including all non medical

expenses including personal comfort expenses, domiciliary treatment.

More than one coronary angiography in a policy year.

Any treatment arising out of professional / hazardous sports or activities

etc. or deliberate exposure to exceptional danger.

Any kind of service charge, surcharge, admission fees, registration fees.

Extension of duration of hospital stay without any medical requirement as

per the specialist or expenses incurred for investigations/treatment not

relevant to the reason for hospitalization.

Disease or ailment other for one where hospitalisation was necessary &

Hospitalization or treatment not actually performed

Back

V1

88

Terms & Conditions

Free Look Period: A period of 15 days is available

to review the policy from the date of receipt of the

policy document by the policyholder.

Revival Norms:

Foreclosure Norms

Incase fund value falls below 110% post 3 years of

policy

Fund value can be withdrawn by policy holder for

health expenses post 5 years of termination.

No other benefits will be applicable

2 years Uw/g, Waiting periods

and exclusions to

reapply

T+60 (No claim

payable in lapsed

period)

T+15 (Monthly)

T+30 (Yearly & H.Y)

Max revival Revival Post 60 Simple Revival Grace Period

Back

V1

89

Procedures covered after 2 years

Lithotripsy / Basketing for Renal Calculus 12

Lap / Open Chole cystectomy for Cholecystitis / Gall stones 11

Myomectomy for Fibroids and menorrhagia 10

Hysterectomy for Fibroids, menorrhagia, Dysfunctional Uterine Bleeding ,

Prolapse

9

Dilation & Curettage for menstrual irregularities 8

Trans Urtheral Resection of Prostrate / Open Prostatectomy for Benign

Enlargement of Prostrate

7

Piles / Fissure / Fistula / Rectal prolapse 6

Hydrocoel / Varicocoel / Spermatocoel surgery 5

Hernia (Inguinal / Ventral / Umbilical / Incisional) 4

Thyroidectomy for Nodule / Multi Nodular Goitre 3

Surgery for Tonsillitis / Adenoiditis 2

Functional Endoscopic Sinus Surgery / Septoplasty for Deviated Nasal

Septum / Sinusitis

1

V1

90

Procedures covered after 2 years

Osteoarthrosis leading to Total Knee Replacement or Total Hip

Replacement (After two years from Risk Commencement Date or revival

date, where the revival occurred more than 60 days after the first unpaid

premium, whichever is later, claims for up to one knee or hip treatment

will be covered in any policy year )

19

Cataract (After two years from Risk Commencement Date or revival

date, where the revival occurred more than 60 days after the first unpaid

premium, whichever is later, only claims up to Rs. 20,000 will be covered

in any policy year)

18

Osteoporosis leading to Fracture Neck of Femur 17

Renal failure due to diabetes 16

Amputation due to diabetes 15

Vitrectomy and Retinal Detachment surgery for Retinopathy 14

Traction / Discectomy / Laminectomy for Prolapsed Inter Vertebral Disc

13

V1

91

Claims initiatives

To access this service, our customers will simply have to type:

ICLAIM <space> <8 Digit Policy Number> and send to 56767

The customer would receive a quick call back from our certified

claims expert.

Document Reckoner shared with Branches: Checklist of essential

documents

Original Documents (Bills/Medical Reports) mandatory for Medi

Assure and now Health Saver

ECS Mandate along with a copy of cancelled cheque to be

submitted for availing direct credit of claims payout

Introduction of ICLAIM SMS service

Health Claims Documentation

Direct Credit Facility

V1

92

Underwriting Guidelines

Crisis cover Comprehensive Critical illness products 5

Hospital Care

Mediassure

Health Saver

Hospitalization & Surgery products 4

Diabetes Care

Diabetes Care Plus

Diabetes Assure

Diabetes Care Active

Diabetes specific products 3

Cancer Care

Cancer Care Plus

Cancer specific products 2

Health Assure

Health Assure Plus

Critical Illness benefit products 1

Plans covered Product Category Sr. No

Policy Twisting Norms: If a customer wants to buy a new policy, but his earlier policy within

the same category (refer the grid below for different categories) has lapsed within the last 12

months. Then the lapsed policy needs to be revived prior to taking a new policy. Thus Health

saver, Mediassure and Hospital Care fall under the same category.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fullsize SBAR Report SheetDocument1 pageFullsize SBAR Report SheetShane LambertNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- OB - Normal Labor and DeliveryDocument51 pagesOB - Normal Labor and DeliveryJosh Matthew Rosales33% (3)

- 25 Psychiatric Nursing Mnemonics and Tricks - NurseBuffDocument24 pages25 Psychiatric Nursing Mnemonics and Tricks - NurseBuffMelissa100% (3)

- Homeopathic ImmunizationDocument53 pagesHomeopathic Immunizationalex100% (2)

- Kalish GI ProtocolsDocument5 pagesKalish GI Protocolsgoosenl100% (1)

- Concept PaperDocument3 pagesConcept PaperGi Al75% (8)

- YS Curodont Sell Sheet - 8.5x11 - FINAL 1Document1 pageYS Curodont Sell Sheet - 8.5x11 - FINAL 1lucian hahaianuNo ratings yet

- Appendix 1: Chemotherapy ProtocolsDocument3 pagesAppendix 1: Chemotherapy ProtocolsImam Hakim SuryonoNo ratings yet

- Sterile TechDocument85 pagesSterile TechBSN II - Tutor, Rel joshuaNo ratings yet

- Communication and Swallowing Disorders (Speech)Document27 pagesCommunication and Swallowing Disorders (Speech)Asma JamaliNo ratings yet

- C-Reactive Protein: TurbilatexDocument1 pageC-Reactive Protein: TurbilatexAssane Senghor100% (1)

- What Is Caffeine? How Does Caffeine Work?Document16 pagesWhat Is Caffeine? How Does Caffeine Work?Agustinus SiswantoNo ratings yet

- Jaw Fractures Managing The Whole PatientDocument2 pagesJaw Fractures Managing The Whole PatientElisa BaronNo ratings yet

- Hematology Unit: Complete Blood Count (CBC)Document2 pagesHematology Unit: Complete Blood Count (CBC)Rasha ElbannaNo ratings yet

- Chamani Essay VAPEDocument2 pagesChamani Essay VAPEChamani MadawalaNo ratings yet

- High Volume HDF - Scientific Brochure - EN - 01oct2018 - Approved - Original - 112Document2 pagesHigh Volume HDF - Scientific Brochure - EN - 01oct2018 - Approved - Original - 112HARUMUKIZA Jean DomitienNo ratings yet

- Clinicopathologic Conference: Governor Celestino Gallares Memorial Hospital Department of Obstetrics and GynecologyDocument57 pagesClinicopathologic Conference: Governor Celestino Gallares Memorial Hospital Department of Obstetrics and GynecologyramwshNo ratings yet

- J Clin Aph - Guidelines TADocument95 pagesJ Clin Aph - Guidelines TAadainuri100% (1)

- HSC4555 0001 Fall17 SyllabusDocument6 pagesHSC4555 0001 Fall17 SyllabusDilly RijoNo ratings yet

- Gastric GavageDocument3 pagesGastric GavageRico Delgado of WorldbexNo ratings yet

- Hema - Guide Notes PDFDocument21 pagesHema - Guide Notes PDFVanessa Ladra100% (1)

- Inflammatory Myofibroblastic TumourDocument4 pagesInflammatory Myofibroblastic TumourThiruNo ratings yet

- Cryptosporidiosis in Ruminants: Update and Current Therapeutic ApproachesDocument8 pagesCryptosporidiosis in Ruminants: Update and Current Therapeutic ApproachesDrivailaNo ratings yet

- Biology Investigatory Project On Caffeine AddectionDocument5 pagesBiology Investigatory Project On Caffeine AddectionShivam SinghNo ratings yet

- The Chronicle of Neurology + Psychiatry Aug 30 2011Document24 pagesThe Chronicle of Neurology + Psychiatry Aug 30 2011Nino AvantiNo ratings yet

- Teknik Operasi Splenektomi 2Document31 pagesTeknik Operasi Splenektomi 2sphericalfaNo ratings yet

- Week 3 Acute TracheobronchitisDocument2 pagesWeek 3 Acute TracheobronchitisLu BeibeiNo ratings yet

- EBMDocument6 pagesEBMjoyce_garcia_10No ratings yet

- Daftar Pustaka Refrat Koas HoreDocument4 pagesDaftar Pustaka Refrat Koas HoreShinta Amalia KartikaNo ratings yet

- Deficiencies Bariatric SurgeryDocument10 pagesDeficiencies Bariatric SurgeryYazen JoudehNo ratings yet