Professional Documents

Culture Documents

Exponential Smoothing Methods

Uploaded by

Alexandra BluOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exponential Smoothing Methods

Uploaded by

Alexandra BluCopyright:

Available Formats

1

Exponential

Smoothing Methods

Slide 2

Chapter Topics

Introduction to exponential smoothing

Simple Exponential Smoothing

Holts Trend Corrected Exponential Smoothing

Holt-Winters Methods

Multiplicative Holt-Winters method

Additive Holt-Winters method

Slide 3

Motivation of Exponential Smoothing

Simple moving average method assigns equal

weights (1/k) to all k data points.

Arguably, recent observations provide more

relevant information than do observations in the

past.

So we want a weighting scheme that assigns

decreasing weights to the more distant

observations.

Slide 4

Exponential Smoothing

Exponential smoothing methods give larger

weights to more recent observations, and the

weights decrease exponentially as the

observations become more distant.

These methods are most effective when the

parameters describing the time series are

changing SLOWLY over time.

Slide 5

Data vs Methods

No trend or

seasonal

pattern?

Single

Exponential

Smoothing

Method

Holts Trend

Corrected

Exponential

Smoothing

Method

Holt-Winters

Methods

Use Other

Methods

Linear trend

and no seasonal

pattern?

Both trend

and seasonal

pattern?

N N N

Y

Y Y

Slide 6

Simple Exponential Smoothing

The Simple Exponential Smoothing method is

used for forecasting a time series when there is

no trend or seasonal pattern, but the mean (or

level) of the time series y

t

is slowly changing

over time.

NO TREND model

t o t

y c | + =

Slide 7

Procedures of Simple Exponential

Smoothing Method

Step 1: Compute the initial estimate of the mean

(or level) of the series at time period t = 0

Step 2: Compute the updated estimate by using

the smoothing equation

where o is a smoothing constant between 0 and 1.

1

(1 )

T T T

y o o

= +

n

y

y

n

t

t

=

= =

1

0

Slide 8

Procedures of Simple Exponential

Smoothing Method

Note that

The coefficients measuring the contributions of the

observations decrease exponentially over time.

1

(1 )

T T T

y o o

= +

1 2

(1 )[ (1 ) ]

T T T

y y o o o o

= + +

2

1 2

(1 ) (1 )

T T T

y y o o o o

= + +

2 1

1 2 1 0

(1 ) (1 ) ... (1 ) (1 )

T T

T T T

y y y y o o o o o o o o

= + + + + +

Slide 9

Simple Exponential Smoothing

Point forecast made at time T for y

T+p

SSE, MSE, and the standard errors at time T

Note: There is no theoretical justification for dividing SSE by (T

number of smoothing constants). However, we use this divisor

because it agrees to the computation of s in Box-Jenkins models

introduced later.

,

1

SSE

MSE s MSE

T

= =

( ) ( 1, 2, 3,...)

T p T

y T p

+

= =

=

=

T

t

t t

t y y SSE

1

2

)] 1 ( [

Slide 10

Example: Cod Catch

The Bay City Seafood Company recorded the monthly cod

catch for the previous two years, as given below.

Cod Catch (In Tons)

Month Year 1 Year 2

January 362 276

February 381 334

March 317 394

April 297 334

May 399 384

June 402 314

July 375 344

August 349 337

September 386 345

October 328 362

November 389 314

December 343 365

Slide 11

Example: Cod Catch

The plot of these data suggests that there is no trend or

seasonal pattern. Therefore, a NO TREND model is

suggested:

It is also possible that the mean (or level) is slowly changing

over time.

t o t

y c | + =

Monthly Cod Catch

250

270

290

310

330

350

370

390

410

0 5 10 15 20 25

Month

C

o

d

C

a

t

c

h

(

i

n

t

o

n

s

)

Slide 12

Example: Cod Catch

Step 1: Compute

0

by averaging the first twelve time

series values.

Though there is no theoretical justification, it is a

common practice to calculate initial estimates of

exponential smoothing procedures by using HALF of

the historical data.

12

1

0

362 381 ... 343

360.6667

12 12

t

t

y

=

+ + +

= = =

Slide 13

Example: Cod Catch

Step 2: Begin with the initial estimate

0

= 360.6667 and

update it by applying the smoothing equation to the 24

observed cod catches.

Set o = 0.1 arbitrarily and judge the appropriateness of

this choice of o by the models in-sample fit.

1 1 0

(1 ) 0.1(362) 0.9(360.6667) 360.8000 y o o = + = + =

2 2 1

(1 ) 0.1(381) 0.9(360.8000) 362.8200 y o o = + = + =

Slide 14

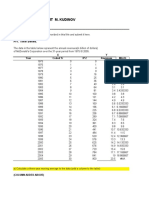

One-period-ahead Forecasting

n alpha SSE MSE s

24 0.1 28735.1092 1249.3526 35.3462

Time Smoothed Estimate Forecast Made Forecast Squared Forecast

Period y for Level Last Period Error Error

0 360.6667

1 362 360.8000 360.6667 1.3333 1.7777

2 381 362.8200 360.8000 20.2000 408.0388

3 317 358.2380 362.8200 -45.8200 2099.4749

4 297 352.1142 358.2380 -61.2380 3750.0956

5 399 356.8028 352.1142 46.8858 2198.2762

6 402 361.3225 356.8028 45.1972 2042.7869

7 375 362.6903 361.3225 13.6775 187.0735

8 349 361.3212 362.6903 -13.6903 187.4234

9 386 363.7891 361.3212 24.6788 609.0411

10 328 360.2102 363.7891 -35.7891 1280.8609

11 389 363.0892 360.2102 28.7898 828.8523

12 343 361.0803 363.0892 -20.0892 403.5753

13 276 352.5722 361.0803 -85.0803 7238.6517

14 334 350.7150 352.5722 -18.5722 344.9281

15 394 355.0435 350.7150 43.2850 1873.5899

16 334 352.9392 355.0435 -21.0435 442.8295

17 384 356.0452 352.9392 31.0608 964.7756

18 314 351.8407 356.0452 -42.0452 1767.8027

19 344 351.0566 351.8407 -7.8407 61.4769

20 337 349.6510 351.0566 -14.0566 197.5894

21 345 349.1859 349.6510 -4.6510 21.6317

22 362 350.4673 349.1859 12.8141 164.2015

23 314 346.8206 350.4673 -36.4673 1329.8638

24 365 348.6385 346.8206 18.1794 330.4918

Slide 15

Example: Cod Catch

Results associated with different values of o

Smoothing

Constant

Sum of Squared

Errors

0.1 28735.11

0.2 30771.73

0.3 33155.54

0.4 35687.69

0.5 38364.24

0.6 41224.69

0.7 44324.09

0.8 47734.09

Slide 16

Example: Cod Catch

Step 3: Find a good value of o that provides the

minimum value for MSE (or SSE).

Use Solver in Excel as an illustration

SSE

alpha

Slide 17

Example: Cod Catch

Slide 18

Holts Trend Corrected Exponential

Smoothing

If a time series is increasing or decreasing

approximately at a fixed rate, then it may be described

by the LINEAR TREND model

If the values of the parameters

0

and

1

are slowly

changing over time, Holts trend corrected exponential

smoothing method can be applied to the time series

observations.

Note: When neither

0

nor

1

is changing over time,

regression can be used to forecast future values of y

t

.

Level (or mean) at time T:

0

+

1

T

Growth rate (or trend):

1

t t

t y c | | + + =

1 0

Slide 19

Holts Trend Corrected Exponential

Smoothing

A smoothing approach for forecasting such a

time series that employs two smoothing

constants, denoted by o and .

There are two estimates

T-1

and b

T-1

.

T-1

is the estimate of the level of the time

series constructed in time period T1 (This is

usually called the permanent component).

b

T-1

is the estimate of the growth rate of the

time series constructed in time period T1

(This is usually called the trend component).

Slide 20

Holts Trend Corrected Exponential

Smoothing

Level estimate

Trend estimate

where o = smoothing constant for the level (0 o 1)

= smoothing constant for the trend (0 1)

1 1

(1 )( )

T T T T

y b o o

= + +

1 1

( ) (1 )

T T T T

b b

= +

Slide 21

Holts Trend Corrected Exponential

Smoothing

Point forecast made at time T for y

T+p

MSE and the standard error s at time T

,

2

SSE

MSE s MSE

T

= =

( ) ( 1, 2, 3,...)

T p T T

y T pb p

+

= + =

=

=

T

t

t t

t y y SSE

1

2

)] 1 ( [

Slide 22

T 1 T + 1 T + 2 T

Y

t

Y

T

T

Y

T+1

T+1

T T T

b T Y + =

+

) (

1

) 1 (

2 1 1

+ = +

+ + +

T Y b

T T T

t t

t Y c | | + + =

1 0

1 1

) 1 (

+ =

T T T

b T Y

1

1

) 1 ( ) (

+

+

=

+

T

T T T

b

b

T

T T T

b

b

=

+

1 1

) 1 ( ) (

Slide 23

Procedures of Holts Trend Corrected

Exponential Smoothing

Use the example of Thermostat Sales as an illustration

150

200

250

300

350

0 10 20 30 40 50 60

Time

T

h

e

r

m

o

s

t

a

t

S

a

l

e

s

(

y

)

Slide 24

Procedures of Holts Trend Corrected

Exponential Smoothing

Findings:

Overall an upward trend

The growth rate has been changing over the

52-week period

There is no seasonal pattern

Holts trend corrected exponential

smoothing method can be applied

Slide 25

Procedures of Holts Trend Corrected

Exponential Smoothing

Step 1: Obtain initial estimates

0

and b

0

by fitting a

least squares trend line to HALF of the historical

data.

y-intercept =

0

; slope = b

0

Slide 26

Procedures of Holts Trend Corrected

Exponential Smoothing

Example

Fit a least squares trend line to the first 26

observations

Trend line

0

= 202.6246; b

0

= 0.3682

202.6246 0.3682

t

y t =

Slide 27

Procedures of Holts Trend Corrected

Exponential Smoothing

Step 2: Calculate a point forecast of y

1

from time 0

Example

1 0 0

(0) 202.6246 0.3682 202.2564 y b = + = =

( ) 0, 1

T p T T

y T pb T p

+

= + = =

Slide 28

Procedures of Holts Trend Corrected

Exponential Smoothing

Step 3: Update the estimates

T

and b

T

by using some

predetermined values of smoothing constants.

Example: let o = 0.2 and = 0.1

1 1 0 0

(1 )( )

0.2(206) 0.8(202.6246 0.3682) 203.0051

y b o o = + +

= + =

1 1 0 0

( ) (1 )

0.1(203.0051 202.6246) 0.9( 0.3682) 0.2933

b b = +

= + =

2 1 1

(1) 203.0051 0.2933 202.7118 y b = + = =

Slide 29

Slide 30

Procedures of Holts Trend Corrected

Exponential Smoothing

Step 4: Find the best combination of o and that

minimizes SSE (or MSE)

Example: Use Solver in Excel as an illustration

SSE

alpha

gamma

Slide 31

Slide 32

Holts Trend Corrected Exponential

Smoothing

p-step-ahead forecast made at time T

Example

- In period 52, the one-period-ahead sales forecast for

period 53 is

In period 52, the three-period-ahead sales forecast

for period 55 is

( ) ( 1, 2, 3,...)

T p T T

y T pb p

+

= + =

53 52 52

(52) 315.9460 4.5040 320.45 y b = + = + =

55 52 52

(52) 3 315.9460 3(4.5040) 329.458 y b = + = + =

Slide 33

Holts Trend Corrected Exponential

Smoothing

Example

If we observe y

53

= 330, we can either find a new set

of (optimal) o and that minimize the SSE for 53

periods, or

we can simply revise the estimate for the level and

growth rate and recalculate the forecasts as follows:

53 53 52 52

(1 )( )

0.247(330) 0.753(315.946 4.5040) 322.8089

y b o o = + +

= + + =

53 53 52 52

( ) (1 )

0.095(322.8089 315.9460) 0.905(4.5040) 4.7281

b b = +

= + =

54 53 53

(53) 322.8089 4.7281 327.537 y b = + = + =

55 53 53

(53) 2 322.8089 2(4.7281) 332.2651 y b = + = + =

Slide 34

Holt-Winters Methods

Two Holt-Winters methods are designed for time series

that exhibit linear trend

- Additive Holt-Winters method: used for time series

with constant (additive) seasonal variations

Multiplicative Holt-Winters method: used for time

series with increasing (multiplicative) seasonal

variations

Holt-Winters method is an exponential smoothing

approach for handling SEASONAL data.

The multiplicative Holt-Winters method is the better

known of the two methods.

Slide 35

Multiplicative Holt-Winters Method

It is generally considered to be best suited to forecasting

time series that can be described by the equation:

SN

t

: seasonal pattern

IR

t

: irregular component

This method is appropriate when a time series has a

linear trend with a multiplicative seasonal pattern for

which the level (

0

+

1

t), growth rate (

1

), and the

seasonal pattern (SN

t

) may be slowly changing over

time.

0 1

( )

t t t

y t SN IR | | = +

Slide 36

Multiplicative Holt-Winters Method

Estimate of the level

Estimate of the growth rate (or trend)

Estimate of the seasonal factor

where o, , and are smoothing constants between 0 and 1,

L = number of seasons in a year (L = 12 for monthly data,

and L = 4 for quarterly data)

1 1

( / ) (1 )( )

T T T L T T

y sn b o o

= + +

1 1

( ) (1 )

T T T T

b b

= +

( / ) (1 )

T T T T L

sn y sn o o

= +

Slide 37

Multiplicative Holt-Winters Method

Point forecast made at time T for y

T+p

MSE and the standard errors at time T

( ) ( ) ( 1, 2, 3,...)

T p T T T p L

y T pb sn p

+ +

= + =

,

3

SSE

MSE s MSE

T

= =

=

=

T

t

t t

t y y SSE

1

2

)] 1 ( [

Slide 38

Procedures of Multiplicative Holt-

Winters Method

Use the Sports Drink example as an illustration

0

50

100

150

200

250

0 5 10 15 20 25 30 35

Time

S

p

o

r

t

s

D

r

i

n

k

(

y

)

Slide 39

Procedures of Multiplicative Holt-

Winters Method

Observations:

Linear upward trend over the 8-year period

Magnitude of the seasonal span increases as

the level of the time series increases

Multiplicative Holt-Winters method can be

applied to forecast future sales

Slide 40

Procedures of Multiplicative Holt-

Winters Method

Step 1: Obtain initial values for the level

0

, the

growth rate b

0

, and the seasonal factors sn

-3

, sn

-2

, sn

-1

,

and sn

0

, by fitting a least squares trend line to at

least four or five years of the historical data.

y-intercept =

0

; slope = b

0

Slide 41

Procedures of Multiplicative Holt-

Winters Method

Example

Fit a least squares trend line to the first 16

observations

Trend line

0

= 95.2500; b

0

= 2.4706

95.2500 2.4706

t

y t = +

Slide 42

Procedures of Multiplicative Holt-

Winters Method

Step 2: Find the initial seasonal factors

1. Compute for the in-sample observations used

for fitting the regression. In this example, t = 1, 2,

, 16.

t

y

1

2

16

95.2500 2.4706(1) 97.7206

95.2500 2.4706(2) 100.1912

......

95.2500 2.4706(16) 134.7794

y

y

y

= + =

= + =

= + =

Slide 43

Procedures of Multiplicative Holt-

Winters Method

Step 2: Find the initial seasonal factors

2. Detrend the data by computing for each

time period that is used in finding the least squares

regression equation. In this example, t = 1, 2, , 16.

/

t t t

S y y =

1 1 1

2 2 2

16 16 16

/ 72/ 97.7206 0.7368

/ 116/100.1912 1.1578

......

/ 120/134.7794 0.8903

S y y

S y y

S y y

= = =

= = =

= = =

Slide 44

Procedures of Multiplicative Holt-

Winters Method

Step 2: Find the initial seasonal factors

3. Compute the average seasonal values for each of the

L seasons. The L averages are found by computing

the average of the detrended values for the

corresponding season. For example, for quarter 1,

1 5 9 13

[1]

4

0.7368 0.7156 0.6894 0.6831

0.7062

4

S S S S

S

+ + +

=

+ + +

= =

Slide 45

Procedures of Multiplicative Holt-

Winters Method

Step 2: Find the initial seasonal factors

4. Multiply the average seasonal values by the

normalizing constant

such that the average of the seasonal factors is 1. The

initial seasonal factors are

[ ]

1

L

i

i

L

CF

S

=

=

[ ]

( ) ( 1, 2,..., )

i L i

sn S CF i L

= =

Slide 46

Procedures of Multiplicative Holt-

Winters Method

Step 2: Find the initial seasonal factors

4. Multiply the average seasonal values by the

normalizing constant such that the average of the

seasonal factors is 1.

Example

CF = 4/3.9999 = 1.0000

3 1 4 [1]

2 2 4 [2]

1 3 4 [3]

0 4 4 [1]

( ) 0.7062(1) 0.7062

( ) 1.1114(1) 1.1114

( ) 1.2937(1) 1.2937

( ) 0.8886(1) 0.8886

sn sn S CF

sn sn S CF

sn sn S CF

sn sn S CF

= = = =

= = = =

= = = =

= = = =

Slide 47

Procedures of Multiplicative Holt-

Winters Method

Step 3: Calculate a point forecast of y

1

from time 0

using the initial values

1 0 0 1 4 0 0 3

( ) ( ) ( 0, 1)

(0) ( ) ( )

(95.2500 2.4706)(0.7062)

69.0103

T p T T T p L

y T pb sn T p

y b sn b sn

+ +

= + = =

= + = +

= +

=

Slide 48

Procedures of Multiplicative Holt-

Winters Method

Step 4: Update the estimates

T

, b

T

, and sn

T

by using

some predetermined values of smoothing constants.

Example: let o = 0.2, = 0.1, and = 0.1

1 1 1 4 0 0

( / ) (1 )( )

0.2(72/ 0.7062) 0.8(95.2500 2.4706) 98.5673

y sn b o o

= + +

= + + =

1 1 0 0

( ) (1 )

0.1(98.5673 95.2500) 0.9(2.4706) 2.5553

b b = +

= + =

2 1 1 2 4

(1) ( )

(98.5673 2.5553)(1.1114) 112.3876

y b sn

= +

= + =

1 1 1 1 4

( / ) (1 )

0.1(72/ 98.5673) 0.9(0.7062) 0.7086

sn y sn o o

= +

= + =

Slide 49

( ) ( )( )

( ) ( )

( ) ( )

( ) ( )

( ) ( )

( ) ( )

( ) ( )

( )( )

053 . 135

2937 . 1 62031 . 2 7727 . 101

2

114239 . 1

1114 . 1 9 . 0 7727 . 101 116 1 . 0

1

62031 . 2

5553 . 2 9 . 0 5673 . 98 7727 . 101 1 . 0

1

7727 . 101

5553 . 2 5673 . 98 8 . 0 1114 . 1 116 2 . 0

1

4 3 2 2 3

4 2 2 2 2

1 1 2 2

1 1 4 2 2 2

=

+ =

+ =

=

+ =

+ =

=

+ =

+ =

=

+ + =

+ + =

sn b y

sn y sn

b b

b sn y

o o

o o

Slide 50

( ) ( )( )

( ) ( )

( ) ( )

( ) ( )

( ) ( )

( ) ( )

( ) ( )

( )( )

945 . 77

7086 . 0 65212 . 2 3464 . 107

4

889170 . 0

8886 . 0 9 . 0 3464 . 107 96 1 . 0

1

65212 . 2

6349 . 2 9 . 0 5393 . 104 3464 . 107 1 . 0

1

3464 . 107

6349 . 2 5393 . 104 8 . 0 8886 . 0 96 2 . 0

1

4 5 4 4 5

4 4 4 4 4

3 3 4 4

3 3 4 4 4 4

=

+ =

+ =

=

+ =

+ =

=

+ =

+ =

=

+ + =

+ + =

sn b y

sn y sn

b b

b sn y

o o

o o

Slide 51

Slide 52

Procedures of Multiplicative Holt-

Winters Method

Step 5: Find the most suitable combination of o,

, and that minimizes SSE (or MSE)

Example: Use Solver in Excel as an illustration

SSE

alpha

gamma

delta

Slide 53

Slide 54

Multiplicative Holt-Winters Method

p-step-ahead forecast made at time T

Example

( ) ( ) ( 1, 2, 3,...)

T p T T T p L

y T pb sn p

+ +

= + =

33 32 32 33 4

(32) ( ) (168.1213 2.3028)(0.7044) 120.0467 y b sn

= + = + =

34 32 32 34 4

(32) ( 2 ) [168.1213 2(2.3028)](1.1038) 190.6560 y b sn

= + = + =

35 32 32 35 4

(32) ( 3 ) [(168.1213 3(2.3028)](1.2934) 226.3834 y b sn

= + = + =

36 32 32 36 4

(32) ( 4 ) [(168.1213 4(2.3028)](0.8908) 157.9678 y b sn

= + = + =

Slide 55

Multiplicative Holt-Winters Method

Example

Forecast Plot for Sports Drink Sales

0

50

100

150

200

250

0 5 10 15 20 25 30 35 40

Time

F

o

r

e

c

a

s

t

s

Observed values

Forecasts

Slide 56

Additive Holt-Winters Method

It is generally considered to be best suited to forecasting

a time series that can be described by the equation:

SN

t

: seasonal pattern

IR

t

: irregular component

This method is appropriate when a time series has a

linear trend with a constant (additive) seasonal pattern

such that the level (

0

+

1

t), growth rate (

1

), and the

seasonal pattern (SN

t

) may be slowly changing over

time.

t t t

IR SN t y + + + = ) (

1 0

| |

Slide 57

Additive Holt-Winters Method

Estimate of the level

Estimate of the growth rate (or trend)

Estimate of the seasonal factor

where o, , and are smoothing constants between 0 and 1,

L = number of seasons in a year (L = 12 for monthly data,

and L = 4 for quarterly data)

) )( 1 ( ) (

1 1

+ + =

T T L T T T

b sn y o o

1 1

) 1 ( ) (

+ =

T T T T

b b

L T T T T

sn y sn

+ = ) 1 ( ) ( o o

Slide 58

Additive Holt-Winters Method

Point forecast made at time T for y

T+p

MSE and the standard error s at time T

,

3

SSE

MSE s MSE

T

= =

3,...) 2, 1, ( ) ( = + + =

+ +

p sn pb T y

L p T T T p T

=

=

T

t

t t

t y y SSE

1

2

)] 1 ( [

Slide 59

Procedures of Additive Holt-Winters

Method

Consider the Mountain Bike example,

0

10

20

30

40

50

60

0 2 4 6 8 10 12 14 16 18

Time

B

i

k

e

s

a

l

e

s

(

y

)

Slide 60

Procedures of Additive Holt-Winters

Method

Observations:

Linear upward trend over the 4-year period

Magnitude of seasonal span is almost constant

as the level of the time series increases

Additive Holt-Winters method can be

applied to forecast future sales

Slide 61

Procedures of Additive Holt-Winters

Method

Step 1: Obtain initial values for the level

0

, the

growth rate b

0

, and the seasonal factors sn

-3

, sn

-2

, sn

-1

,

and sn

0

, by fitting a least squares trend line to at

least four or five years of the historical data.

y-intercept =

0

; slope = b

0

Slide 62

Procedures of Additive Holt-Winters

Method

Example

Fit a least squares trend line to all 16 observations

Trend line

0

= 20.85; b

0

= 0.9809

t y

t

980882 . 0 85 . 20 + =

Slide 63

Procedures of Additive Holt-Winters

Method

Step 2: Find the initial seasonal factors

1. Compute for each time period that is used in

finding the least squares regression equation. In

this example, t = 1, 2, , 16.

t

y

1

2

16

20.85 0.980882(1) 21.8309

20.85 0.980882(2) 22.8118

......

20.85 0.980882(16) 36.5441

y

y

y

= + =

= + =

= + =

Slide 64

Procedures of Additive Holt-Winters

Method

Step 2: Find the initial seasonal factors

2. Detrend the data by computing for each

observation used in the least squares fit. In this

example, t = 1, 2, , 16.

t t t

y y S =

5441 . 11 5441 . 36 25

......

1882 . 8 8112 . 22 31

8309 . 11 8309 . 21 10

16 16 16

2 2 2

1 1 1

= = =

= = =

= = =

y y S

y y S

y y S

Slide 65

Procedures of Additive Holt-Winters

Method

Step 2: Find the initial seasonal factors

3. Compute the average seasonal values for each of the

L seasons. The L averages are found by computing

the average of the detrended values for the

corresponding season. For example, for quarter 1,

2162 . 14

4

) 6015 . 14 ( ) 6779 . 15 ( ) 7544 . 14 ( ) 8309 . 11 (

4

13 9 5 1

] 1 [

=

+ + +

=

+ + +

=

S S S S

S

Slide 66

Procedures of Additive Holt-Winters

Method

Step 2: Find the initial seasonal factors

4. Compute the average of the L seasonal factors. The

average should be 0.

Slide 67

Procedures of Additive Holt-Winters

Method

Step 3: Calculate a point forecast of y

1

from time 0

using the initial values

7.6147 (-14.2162) 0.9809 20.85

) 0 (

1) , 0 ( ) (

3 0 0 4 1 0 0 1

= + + =

+ + = + + =

= = + + =

+ +

sn b sn b y

p T sn pb T y

L p T T T p T

Slide 68

Procedures of Additive Holt-Winters

Method

Step 4: Update the estimates

T

, b

T

, and sn

T

by using

some predetermined values of smoothing constants.

Example: let o = 0.2, = 0.1, and = 0.1

3079 . 22 ) 9808 . 0 85 . 20 ( 8 . 0 )) 2162 . 14 ( 10 ( 2 . 0

) )( 1 ( ) (

0 0 4 1 1 1

= + + =

+ + =

b sn y o o

0286 . 1 ) 9809 . 0 ( 9 . 0 ) 85 . 20 3079 . 22 ( 1 . 0

) 1 ( ) (

0 0 1 1

= + =

+ = b b

0254 . 14 ) 2162 . 14 ( 9 . 0 ) 3079 . 22 10 ( 1 . 0

) 1 ( ) (

4 1 1 1 1

= + =

+ =

sn y sn o o

8895 . 29 5529 . 6 0286 . 1 3079 . 22

) 1 (

2 1 1 4 2 1 1 2

= + + =

+ + = + + =

sn b sn b y

Slide 69

Slide 70

Procedures of Additive Holt-Winters

Method

Step 5: Find the most suitable combination of o,

, and that minimizes SSE (or MSE)

Example: Use Solver in Excel as an illustration

SSE

alpha

gamma

delta

Slide 71

Slide 72

Additive Holt-Winters Method

p-step-ahead forecast made at time T

Example

3,...) 2, 1, ( ) ( = + + =

+ +

p sn pb T y

L p T T T p T

1073 . 23 2162 . 14 9809 . 0 3426 . 36 ) 16 (

4 17 16 16 17

= + = + + =

sn b y

8573 . 44 5529 . 6 ) 9809 . 0 ( 2 3426 . 36 2 ) 16 (

4 18 16 16 18

= + + = + + =

sn b y

8573 . 57 5721 . 18 ) 9809 . 0 ( 3 3426 . 36 3 ) 16 (

4 19 16 16 19

= + + = + + =

sn b y

3573 . 29 9088 . 10 ) 9809 . 0 ( 4 3426 . 36 4 ) 16 (

4 20 16 16 20

= + = + + =

sn b y

Slide 73

Additive Holt-Winters Method

Example

Forecast Plot for Mountain Bike Sales

0

10

20

30

40

50

60

70

0 2 4 6 8 10 12 14 16 18 20

Time

F

o

r

e

c

a

s

t

s

Observed values

Forecasts

Slide 74

Chapter Summary

Simple Exponential Smoothing

No trend, no seasonal pattern

Holts Trend Corrected Exponential Smoothing

Trend, no seasonal pattern

Holt-Winters Methods

Both trend and seasonal pattern

Multiplicative Holt-Winters method

Additive Holt-Winters Method

You might also like

- Exponential Smoothing MethodsDocument74 pagesExponential Smoothing MethodsMandeep SinghNo ratings yet

- Digital Electronics For Engineering and Diploma CoursesFrom EverandDigital Electronics For Engineering and Diploma CoursesNo ratings yet

- Chapter 12Document60 pagesChapter 12رضا قاجهNo ratings yet

- To Determine The Cubic Expansivity of A Liquid As A Function of TemperatureDocument14 pagesTo Determine The Cubic Expansivity of A Liquid As A Function of TemperaturecatskipNo ratings yet

- Time Series Analysis Exercises: Universität PotsdamDocument30 pagesTime Series Analysis Exercises: Universität PotsdamSD100% (1)

- Finding Truth in Forecasting DataDocument37 pagesFinding Truth in Forecasting DataMohamad soltaniNo ratings yet

- EE 627: Term 2/2016 Homework 4 Due April 25, 2017: Solution: The Autoregressive Polynomial Can Be Factorized AsDocument4 pagesEE 627: Term 2/2016 Homework 4 Due April 25, 2017: Solution: The Autoregressive Polynomial Can Be Factorized AsluscNo ratings yet

- Time Series Analysis Components Trends Seasonal Cyclic RandomDocument48 pagesTime Series Analysis Components Trends Seasonal Cyclic Randomcaamitthapa100% (1)

- Laboratory Report PHYS 103: Experimental General PhysicsDocument5 pagesLaboratory Report PHYS 103: Experimental General PhysicsRaghad Abu znadNo ratings yet

- Tutorial 3 SolutionDocument8 pagesTutorial 3 Solutionthanusha selvamanyNo ratings yet

- PMPH120 - Lab 3 - SHM and Spring Constant - SolutionsDocument11 pagesPMPH120 - Lab 3 - SHM and Spring Constant - SolutionsTavonga ShokoNo ratings yet

- CH 18Document42 pagesCH 18Saadat Ullah KhanNo ratings yet

- Time Series Models and Forecasting and ForecastingDocument49 pagesTime Series Models and Forecasting and ForecastingDominic AndohNo ratings yet

- Correlation and Regression AnalysisDocument13 pagesCorrelation and Regression AnalysisManoj Mudiraj100% (2)

- Solow-Swan Growth Model:: Calibration Tutorial Using MS-ExcelDocument16 pagesSolow-Swan Growth Model:: Calibration Tutorial Using MS-ExcelSharjeel Ahmed Khan100% (1)

- Session 07Document41 pagesSession 07Jehan ZebNo ratings yet

- STA302 Mid 2010FDocument9 pagesSTA302 Mid 2010FexamkillerNo ratings yet

- V I ExerciseAnswersDocument95 pagesV I ExerciseAnswersRony Pestin0% (1)

- Quantitative Forecasting MethodsDocument22 pagesQuantitative Forecasting MethodsBadr AlghamdiNo ratings yet

- Forecasting AR model with 12 lagsDocument56 pagesForecasting AR model with 12 lagsShashwat DesaiNo ratings yet

- Chapter 3Document36 pagesChapter 3asdasdasd122No ratings yet

- Supiri FunDocument34 pagesSupiri Funinfo trafficboostNo ratings yet

- Survival Models Exam Key FindingsDocument12 pagesSurvival Models Exam Key FindingsJasonNo ratings yet

- Network Analysis Alexander SadikuDocument24 pagesNetwork Analysis Alexander SadikuDynaz TashaNo ratings yet

- Resistencia de Materiales I - Esfuerzo y Deformación por Carga Axial (UNIDocument8 pagesResistencia de Materiales I - Esfuerzo y Deformación por Carga Axial (UNIBianca HerreraNo ratings yet

- NSM UNIT IV PPTsDocument27 pagesNSM UNIT IV PPTsRamjan ShidvankarNo ratings yet

- Classical Decomposition: Boise State University By: Kurt Folke Spring 2003Document37 pagesClassical Decomposition: Boise State University By: Kurt Folke Spring 2003vanhung2809No ratings yet

- Perencanaan dan Pengendalian Produksi dengan Teknik PeramalanDocument42 pagesPerencanaan dan Pengendalian Produksi dengan Teknik PeramalanarivvvvvvNo ratings yet

- Time Series Analysis Course OutlineDocument173 pagesTime Series Analysis Course OutlineMiningBooksNo ratings yet

- Chapter 10Document7 pagesChapter 10karthu48No ratings yet

- Isye4031 Regression and Forecasting Practice Problems 2 Fall 2014Document5 pagesIsye4031 Regression and Forecasting Practice Problems 2 Fall 2014cthunder_1No ratings yet

- MA321 FINAL EXAM - TIME SERIES, REGRESSION, ANOVA ANALYSISDocument33 pagesMA321 FINAL EXAM - TIME SERIES, REGRESSION, ANOVA ANALYSISEliott SanchezNo ratings yet

- Class Exercise Before MIDDocument2 pagesClass Exercise Before MIDKhalil AhmedNo ratings yet

- Statistical Forecasting ModelsDocument37 pagesStatistical Forecasting ModelsBalajiNo ratings yet

- Assumption C.5 States That The Values of The Disturbance Term in The Observations in The Sample Are Generated Independently of Each OtherDocument129 pagesAssumption C.5 States That The Values of The Disturbance Term in The Observations in The Sample Are Generated Independently of Each OtherEddie BarrionuevoNo ratings yet

- Exp-4,5 I19ph039Document10 pagesExp-4,5 I19ph039Ankit PatelNo ratings yet

- Worksheet # 3 - SolutionDocument7 pagesWorksheet # 3 - SolutionFarah TarekNo ratings yet

- Regression analysis of time series data using Holt's methodDocument5 pagesRegression analysis of time series data using Holt's methodGandhi Jenny Rakeshkumar BD20029No ratings yet

- Holt-Winters Exponential Method of ForecastingDocument16 pagesHolt-Winters Exponential Method of ForecastingMahnoor KhalidNo ratings yet

- Chapter 4. ARIMA - SVDocument49 pagesChapter 4. ARIMA - SVthucnhi.2003hnntNo ratings yet

- General Linear Model: Regression Analysis and ANOVADocument33 pagesGeneral Linear Model: Regression Analysis and ANOVAjck07No ratings yet

- Engg2013 Unit 1Document25 pagesEngg2013 Unit 1Dhany SSatNo ratings yet

- FASE II: TEMA 6 - Time Series Analysis and ForecastingDocument27 pagesFASE II: TEMA 6 - Time Series Analysis and ForecastingAngela MelgarNo ratings yet

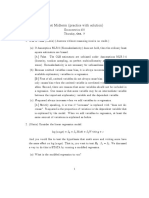

- First Midterm (Practice With Solution)Document3 pagesFirst Midterm (Practice With Solution)umutNo ratings yet

- MIT 2.810 Homework 9 Solutions Process Control ChartsDocument8 pagesMIT 2.810 Homework 9 Solutions Process Control ChartsWinpee SacilNo ratings yet

- Autoregressive Conditional Heteroskedasticity (ARCH) : Volatility ClusteringDocument9 pagesAutoregressive Conditional Heteroskedasticity (ARCH) : Volatility ClusteringLyana ZainolNo ratings yet

- 02.3 DekomposisiDocument51 pages02.3 DekomposisiMuhamad Iqbal ArsaNo ratings yet

- Table 1- Calculation of χ2 for Graph 1Document3 pagesTable 1- Calculation of χ2 for Graph 1Jonique MajorNo ratings yet

- Problem Set No. 2 in Partial Fulfillment of CE 226 Earthquake Engineering RequirementsDocument14 pagesProblem Set No. 2 in Partial Fulfillment of CE 226 Earthquake Engineering RequirementsAllenNo ratings yet

- Financial Test ReportDocument11 pagesFinancial Test ReportAsad GhaffarNo ratings yet

- Finals (STS)Document120 pagesFinals (STS)Johnleo AtienzaNo ratings yet

- Summary Chapter 2Document28 pagesSummary Chapter 2kspbakNo ratings yet

- Statistical Forecasting Models ExplainedDocument37 pagesStatistical Forecasting Models ExplainedShyam PillaiNo ratings yet

- FORECASTINGDocument37 pagesFORECASTINGRegina Jazzmim QuezadaNo ratings yet

- LABTC - Post4-González MaresDocument15 pagesLABTC - Post4-González MaresDztNo ratings yet

- PN - Tugas Rancob2 - 20190122032 - David Yosef Genaro SitanggangDocument5 pagesPN - Tugas Rancob2 - 20190122032 - David Yosef Genaro SitanggangYosef GenaroNo ratings yet

- Forecasting Models: Chapter Guide. in Decision Making, We Deal With Devising Future Plans. The Data deDocument10 pagesForecasting Models: Chapter Guide. in Decision Making, We Deal With Devising Future Plans. The Data deHKNo ratings yet

- AE3110 Take-Home Test 1 Wing AnalysisDocument11 pagesAE3110 Take-Home Test 1 Wing AnalysisMuhammad Rizki ZuhriNo ratings yet

- Computer Network MCQsDocument55 pagesComputer Network MCQsTarandeep singh100% (2)

- Information Technology in Business Process ReengineeringDocument9 pagesInformation Technology in Business Process Reengineeringasadbajwaamtn100% (1)

- Mahesh Kumar GS - Technical Project Manager - Technical Lead - Senior Developer - DeveloperDocument9 pagesMahesh Kumar GS - Technical Project Manager - Technical Lead - Senior Developer - Developernagaraj.hNo ratings yet

- Risc VDocument102 pagesRisc VShraddha GuptaNo ratings yet

- Codigo de Fallas BHM Modulo de Tabique M2 112 PDFDocument53 pagesCodigo de Fallas BHM Modulo de Tabique M2 112 PDFNestor Zela MamaniNo ratings yet

- Digitarq: Creating and Managing A Digital Archive.: January 2004Document9 pagesDigitarq: Creating and Managing A Digital Archive.: January 2004Oumayma AyadiNo ratings yet

- Upgrading Cowon A2 HDDDocument11 pagesUpgrading Cowon A2 HDDgaddNo ratings yet

- Data0305 MX816Document3 pagesData0305 MX816Abdelhamid SammoudiNo ratings yet

- Packet Loss PDFDocument4 pagesPacket Loss PDFRamiz RzaogluNo ratings yet

- Adxl345 App Note An-1023Document28 pagesAdxl345 App Note An-1023b0bb0bb0bNo ratings yet

- Practical No 06Document5 pagesPractical No 06Vaibhav BhagwatNo ratings yet

- Null 2Document85 pagesNull 2FC UKNo ratings yet

- CS CP1 R105 1L2WFDocument2 pagesCS CP1 R105 1L2WFcomprasjrcoltradeNo ratings yet

- 04 STARTER Connection To Target Device en - IDESA - BRASKEMDocument41 pages04 STARTER Connection To Target Device en - IDESA - BRASKEMADRIANA ESCOBAR HERNANDEZNo ratings yet

- Enri SSR Mode S Downlink Aircraft Parameters Validation and EvaluationDocument23 pagesEnri SSR Mode S Downlink Aircraft Parameters Validation and EvaluationIsaacNo ratings yet

- Lecture 3Document51 pagesLecture 3Nagia KoushiouNo ratings yet

- Computer Application 1 Practical July 2017 1Document8 pagesComputer Application 1 Practical July 2017 1Samson Oteba100% (1)

- Flexible Manufacturing SystemDocument4 pagesFlexible Manufacturing SystemJensen ManaloNo ratings yet

- Et200sp Im 155 6 PN ST Manual en-US en-USDocument50 pagesEt200sp Im 155 6 PN ST Manual en-US en-USOmar AbdussaidNo ratings yet

- Intertrip Distance F21Document4 pagesIntertrip Distance F21JNo ratings yet

- Computer Studies Form 1 2 3 4 Schemes of Work CombinedDocument60 pagesComputer Studies Form 1 2 3 4 Schemes of Work Combineddesmond mugambi85% (13)

- Data CentersDocument8 pagesData CentersmksayshiNo ratings yet

- Harish Saidu Abu Dhabi 16.04 Yrs PDFDocument5 pagesHarish Saidu Abu Dhabi 16.04 Yrs PDFRamanujan IyerNo ratings yet

- Function Requirement SpecificationDocument11 pagesFunction Requirement SpecificationAseem guptaNo ratings yet

- MS Excel Handout 3Document3 pagesMS Excel Handout 3Killes SmileNo ratings yet

- Siemens 7SA510 7SA511 V3.x Line PTT User Manual ENUDocument4 pagesSiemens 7SA510 7SA511 V3.x Line PTT User Manual ENUjaime anibal navarrete aburtoNo ratings yet

- User Guide GC 075 XXX FI Verze 1.00 EN - 2Document20 pagesUser Guide GC 075 XXX FI Verze 1.00 EN - 2michaelmangaa0% (1)

- Effective Communication SkillsDocument12 pagesEffective Communication SkillsPHENYO SEICHOKONo ratings yet

- Preparing a Highway ModelDocument4 pagesPreparing a Highway Modelrinlu patilNo ratings yet

- Med TransDocument8 pagesMed TransAnya MayNo ratings yet