Professional Documents

Culture Documents

Vazquez - Gas Markets

Uploaded by

Diego MenescalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vazquez - Gas Markets

Uploaded by

Diego MenescalCopyright:

Available Formats

Gas midstream From contracts to hubs

Miguel Vazquez

The previous world

Gas before restructuring

Wholesale markets as we wanted them to be

Wholesale markets as they are

Price formation

Challenges

Outline

2

Producers

National

monopoly

Consumers

Starting point

3

Contracts

Long-term, ToP

Structure

4

Consumer

Gas Sales

Agreement

Transport, Storage

and Distribution

Vertical integration

Ownership

Long-term

contract

Power Plant

Distribution

Cross-border

transmission

National

transmission

Gazprom

Sonatrach

Gasunie

GdF

British Gas

Ruhrgas

Gas industry developed around 60s with Groningen and the North Sea

In early 60s, The Netherlands began to negotiate with neighbors the

export of gas through pipeline

Subsequently

LNG from Algeria

Pipeline from Russia to Eastern Europe

Pipeline from Norway to Northwest Europe

How to price the gas?

Production-cost methodology

Production costs + Transportation + Profits = Gas price

Netback pricing

Gas price based on its market value

The Dutch standard Netback pricing

5

Gas seller finds customers if costs of gas are less than costs of

alternatives

Price formation Market Value

6

Commodity Transport End-use

Cost of alternative

Gas price

End-

use

Transport

Repeat for each consumer

Price discrimination

7

Residential

Industrial

Power

G

a

s

p

r

i

c

e

s

Profits are shared by producer and monopoly

GSA and buyer

8

Consumers willingness to

pay

Average for each sector

Depends on alternative

Monopoly cost

Profits shared by

producer and monopoly

Depends on price of

alternative

GSA indexed to alternative:

Oil indexation

Consumer Gas Sales Agreement

Transport, Storage

and Distribution

One of the factors in the price was the transmission cost

The Netherlands was selling simultaneously to Belgium, France and

Germany

At the Dutch border there were different prices for gas

In principle, cheap gas for distant markets should not be used to serve

closer markets

Solution: Destination clauses. Gas-to-gas competition was excluded

Additional features Destination clauses

9

The market value will change over time

It will change with technology, different alternative fuels, etc

Solution: Price review clauses in the contract Re-opener

Periodic review of prices to account for those changes

Additional features Re-opener

10

At the time, there was no local storage at Groningen field

Solution: Annual Contracted Quantity + Capacity charge

Gas producers would provide load modulation up to the Dutch border

Possible because short distances

Additional features Flexibility

11

ACQ Annual Contract Quantity

Price Defined by netback pricing

Additional clauses

Destination

Price review

Modulation

The Dutch contract - Summary

12

Gas from Russia or Norway was far away

Transportation was significantly more expensive

Flexibility was cheaper if provided by storage close to end-users

Long-distance trades also required big pipeline systems

Huge capital costs

Need for higher commitment

The agreement was the take-or-pay clause

Buyers would pay typically between 80 to 90% of the ACQ

Upwards flex was often set around 115%

Shipper takes the quantity risk, producer takes the price risk

It is a flexibility clause!

Subsequent contracts The ToP clauses

13

Annual Contract Quantity e.g. 2bcm

ToP Clause

Minimum Annual Quantity 85%ACQ

Make-up

Price

P0 x a Price of alternative

Periodic adjustments

The typical ToP contract

14

Might need to prove significant changes (sometimes need to be

unexpected)

The language gives an idea of how to change the contract

Significant changes in buyers market

Allow sellers to economically market gas

Enormous risks involved

GSA with general wording, which results in uncertainty

Long and expensive processes

Price review clause Arbitration

15

Asset specificity

When identity matters, long-term contracts are necessary

E&P is subject to significant uncertainty

When the pipeline is built, the producer is committed to the shipper

And the shipper is committed to the producer

Long-term contracts protected both sides

What does economic theory say?

16

The major objective was to end price discrimination

Introducing competition among suppliers would end monopoly pricing

The main barrier was destination clauses

Restructuring What did we want to achieve?

17

Restructuring End of price discrimination

18

Residential

Industrial

Power

G

a

s

p

r

i

c

e

s

Average

willingness to pay

Price

Consumers pay

for the cheapest

alternative fuel

Restructuring End of oil indexation?

19

Residential

Industrial

Power

G

a

s

p

r

i

c

e

s

Average

willingness to pay

Price

No oil indexation

Consumers pay

for the cost of

supplying gas

Restructuring The need for liquidity

20

We build on gas-to-gas

competition

Resale is

necessary

Incompatible with

destination clauses

Emergence of

spot index

Price reviews

based on index

Fewer arbitration

processes

Liquidity reduces

the need for long-

term contracts

We need more people trading the same in order to reduce specificity

Reducing specificity, contract duration decreases

But is the industry less specific?

End-users typically prefers short-term contract

Producers often prefer long-term contracts

The supplier is in the middle

An increasingly used strategy to deal with this is the integration with

power industry

Tension in contract duration

21

Price discrimination disappears

Commission declares destination clauses invalid

Competition authorities intervene with contract lengths

Hence, lower price for end-users and potential losses for incumbents

Incumbents call for price reviews (market has changed)

Need lower price to market economically

Producer pays the end of price discrimination

Transitions are hard Prices

22

Market value is now set by gas-to-gas competition

There is no liquid index to measure it

Reviews are harder

Transitions are hard Price reviews

23

Restructuring in Europe was aimed at ending price discrimination

End of long-term contracts or oil-indexation are possible (not

necessary) consequences

That requires liquid short-term trading

The scheme needs to be coordinated with a very specific activity: Gas

transmission

The EU market design has essentially been concerned with a

fundamental question: how to facilitate access in order to obtain liquidity?

Transmission is a fundamental barrier

We will see next how to regulate it

Concluding remarks Need for market design

24

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Safety Products Catalog PDFDocument852 pagesSafety Products Catalog PDFjulio perezNo ratings yet

- Islamic Marriage Contract PDFDocument3 pagesIslamic Marriage Contract PDFadeleidNo ratings yet

- Mutual Fund Insight Mar 2023Document116 pagesMutual Fund Insight Mar 2023Manoj100% (1)

- Creative Int'l LLC V Sheila Paper Corp - Opening BriefDocument68 pagesCreative Int'l LLC V Sheila Paper Corp - Opening BriefBrianKStanleyNo ratings yet

- San Beda Transportation Law ReviewerDocument44 pagesSan Beda Transportation Law ReviewerJay Francis NodadoNo ratings yet

- Introduction To LawDocument15 pagesIntroduction To LawChe Coronado100% (1)

- 8.2 UHP-M 1.2m Dual Polarization Compact C3 Antenna Datasheet (AXXD12MAC-3NX)Document4 pages8.2 UHP-M 1.2m Dual Polarization Compact C3 Antenna Datasheet (AXXD12MAC-3NX)Nomaan MalikNo ratings yet

- Ramana D, Setty Vs International Airport (AIR 1979 SC 1628)Document20 pagesRamana D, Setty Vs International Airport (AIR 1979 SC 1628)guru charanNo ratings yet

- Television and Production ExponentsDocument53 pagesTelevision and Production ExponentsShyra AscanNo ratings yet

- ORIENT AIR SERVICES V CADocument1 pageORIENT AIR SERVICES V CAEmmanuel YrreverreNo ratings yet

- (Assignment Towards Partial Fulfillment of The Assessment in The Subject of ADR) (Final Word Count: 2537, Excluding Footnotes)Document8 pages(Assignment Towards Partial Fulfillment of The Assessment in The Subject of ADR) (Final Word Count: 2537, Excluding Footnotes)Meghna SinghNo ratings yet

- Bonding and Insurance WorkshopDocument36 pagesBonding and Insurance WorkshopMikeDouglas100% (1)

- 2 Asian Terminals, Inc. v. Malayan Insurance, Co., Inc. G.R. No. 171406, April 4, 2011Document11 pages2 Asian Terminals, Inc. v. Malayan Insurance, Co., Inc. G.R. No. 171406, April 4, 2011Ian Kenneth MangkitNo ratings yet

- BAR Q&A Civil LawDocument175 pagesBAR Q&A Civil LawdervinNo ratings yet

- Pe vs. CA, 195 SCRA 137 (1991)Document1 pagePe vs. CA, 195 SCRA 137 (1991)Lu CasNo ratings yet

- Dai-Ichi Karkaria Private LTD., Bombay vs. Oil and Natural GasDocument36 pagesDai-Ichi Karkaria Private LTD., Bombay vs. Oil and Natural GasAmartya ChoubeyNo ratings yet

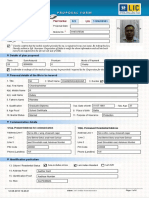

- Chandrashekhar LIC 1193406093228formsDocument12 pagesChandrashekhar LIC 1193406093228formsShahil KumarNo ratings yet

- JUSCO Catalogue For Rejected Scrap ITEM at TGS Dated 17.01.2019 - 50333 - 1.10Document9 pagesJUSCO Catalogue For Rejected Scrap ITEM at TGS Dated 17.01.2019 - 50333 - 1.10Rakesh SinghNo ratings yet

- RTP - CAP - III - Gr-I - Dec - 2022 (2) - 82-105Document24 pagesRTP - CAP - III - Gr-I - Dec - 2022 (2) - 82-105Mahesh PokharelNo ratings yet

- FY 2022 Audited Financial Statements 1Document87 pagesFY 2022 Audited Financial Statements 1Amira OkashaNo ratings yet

- Dissenting Opinion by M. Caicedo Castilla (Translation) PDFDocument23 pagesDissenting Opinion by M. Caicedo Castilla (Translation) PDFLester AgoncilloNo ratings yet

- Arbitrator IntegrityDocument76 pagesArbitrator IntegritypieremicheleNo ratings yet

- Dai-Chi vs. VillaramaDocument2 pagesDai-Chi vs. VillaramaAlisha Adams100% (1)

- Spec Pro ReviewerDocument8 pagesSpec Pro ReviewerJovi PlatzNo ratings yet

- 05 Phil. School of Business Administration vs. Court of AppealsDocument7 pages05 Phil. School of Business Administration vs. Court of AppealsD Del SalNo ratings yet

- PAM Contract 2006 (Without Quantity)Document38 pagesPAM Contract 2006 (Without Quantity)Jonathan ChongNo ratings yet

- BL Unit - IiDocument10 pagesBL Unit - IiRisha A.MNo ratings yet

- Lawsuit Against Tornado Masters, Jesse StuttsDocument14 pagesLawsuit Against Tornado Masters, Jesse StuttsThe Huntsville TimesNo ratings yet

- Trade Assurance Purchase ContractDocument7 pagesTrade Assurance Purchase Contractarcandra100% (1)

- मेटो रेलवे, कोलकाता/METRO RAILWAY/KOLKATA भंड़ार िवभाग/STORES DEPARTMENT General Tender Conditions:Document26 pagesमेटो रेलवे, कोलकाता/METRO RAILWAY/KOLKATA भंड़ार िवभाग/STORES DEPARTMENT General Tender Conditions:Santu PaniNo ratings yet