Professional Documents

Culture Documents

Capital Markets Managing Risk 2014

Uploaded by

traungoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Markets Managing Risk 2014

Uploaded by

traungoCopyright:

Available Formats

Financial Markets and International Risk

Management

Objectives:

Describe the nature and role of capital

markets

Explain the types of risk associated with

multinational firms

Discuss the strategies for managing risk

Further Reading: Shapiro Alan. Multinational Financial Management, 9

th

edition: chapter 6: Country risk

Professor. A. Boateng

Financial markets

Financial Markets

are structures through which funds flow

Dimensions of Financial Markets:

Primary versus Secondary Markets

Money versus Capital Markets

Primary Market

are markets in which companies raise funds

through new issues of securities such as

stocks and bonds

Financial markets

Secondary markets

Are markets for existing securities, that is,

Securities are re-bought and resold

Secondary markets offer buyers and sellers

Liquidity- the ability to turn assets into cash

quickly

Provides information about the prices of their

instruments

Financial markets

Capital Markets

markets that trade debt (bond) and equity

(shares) instruments with maturities of more

than one year.

Money markets

markets that trade debt securities with

maturities of less than one year. For

example, Treasury bills and Commercial

papers

Stock Markets

Stock Exchange:

is a market where securities can be bought

and sold,

market where government and industry can

raise long-term capital

Principal functions:

enables companies to raise new capital the

primary market); and

Stock Markets

to facilitate the trading of existing shares the

secondary market) between investors

Dominant financial centres

form the golden triangle in three different

time zones:

USA

London, and

Tokyo

Stock Markets

America :

largest source of equity capital

over one-third of the Worlds total capital

Global Total Capitalisation stands around 20,000

bn

split into three competing stock exchanges: NYSE,

NASDAQ and AMEX

NYSE:

largest in terms of market capitalisation

Stock Markets

NASDAQ-

National Association of Securities Dealers

Automated Quotations

Twice as many companies listed compared to

NYSE

London stock exchange

largest in non-domestic shares last year with 501

firms but now overtaken by New York

Stock Markets

Stock Exchange Capitalisation Firms Int. Firms

NYSE 7660 2308 (433)

NASDAQ 2395 3294 (343)

London 1812 2692 (381)

Tokyo 2113 2206 (32)

Hong Kong 417 1037 (10)

Brazil 100 389 (2)

India 155 5644

South Africa 137 390 (21)

Financial Markets and the Economy

Information Role

Central role in the capital allocation

Investors in stock markets decide which

companies should live or die depending on

information that goes to the market

Consumption Timing

Helps shift your consumption from now to

future

Allocation of Risk

Financial markets allows investors to allocate

their risks according to their tastes

International Risk Management

Foreign Exchange Risk

Foreign Exchange 1

The Foreign Exchange Market:

Is a market where one countrys currency can be

exchanged for another countrys.

It is not a geographical location - it is an informal

network of telephone, telex satellite, fax, and

computer communication between banks, foreign

exchange dealers and speculators.

Function

transfer purchasing power dominated in one currency

to another.

Foreign Exchange Risk

Foreign exchange risk

is the risk of loss due to changes in the international

exchange value of national currencies

Why Exchange risk management important?

Daily currency fluctuations

Increasing integration of the world economy

FOREX Exposure

possibility that a firm will gain or lose due to changes

in the exchange rate

Finance Managers role

compare potential losses with the cost of avoiding

these losses.

Share of Forex Market April

2010

Country Daily Av. T/o US$ bn Overall Share %

United Kingdom 1,853,594 36.66

United States 904,357 17.88

Japan 312,326 6.18

Singapore 265,977 5.26

Switzerland 262,582 5.19

Hong Kong 237,568 4.50

Australia 192,052 3.80

France 151,621 3.00

Denmark 120,463 2.38

Germany 108,598 2.15

Others 647,144 5.38

Source: Bank for International Settlements, 2010

Types of Exchange exposure

Exchange rate risk is commonly divided into three

types:

transaction risk

translation risk

economic risk

Transaction risk

occurs as a consequence of either importing or

exporting goods and services

refers to the possibility that, as a result of transaction

of overseas assets, liabilities and profits into domestic

currency, the holding company may experience a loss

or a gain due to changes in the exchange rate.

Types of Exchange exposure

Example 1:

A US parent company has a wholly owned

subsidiary in Singapore. This subsidiary has

exposed assets of 100 million Singapore

dollars and exposed liabilities of 50 million

Singapore dollars. The exchange rate

declines from S$4 per US$ to S$5 per dollar

Calculate the potential exchange loss

Types of Exchange exposure

Suggested solution 1:

Expected assets S$100 m

exposed liabilities 50 m

Net exposure 50 m

pre-devaluation rate(S$4=1) 50/4 12.5 m

post-devaluation rate (S$5=1) 50/5 10.0 m

potential loss 2.5 m

Types of Exchange exposure

Economic risk/ Operating Exposure

refers to the risk of long-term movement in

exchange rates and national economies

undermining the international competitiveness

of a company

Effect of exchange rates on cost and price

competitiveness. Affects all firms.

Types of Exchange Exposure

Translation Exposure

Exposure of consolidated financial statements

to exchange rate fluctuations.

Affected by:

Proportion of its business conducted by

foreign subsidiaries

Location of subsidiaries

Techniques for managing

Exchange risk -Internal

Leading and lagging:

leading is bringing forward from the original

due date the payment of a debt;

lagging is the postponement of a payment

beyond the due date.

The speeding up or delaying of payments is

particularly useful if the exchange rates will

shift significantly between now and the due

date

when making a lead payment, must consider

the finance cost

Traditional Strategies for Eliminating

Transaction Exposure

Currency of invoice

insist on being paid or paying in your home

currency

this shifts the risk to the other party

but may also limit trade if the other party is not

prepared to take the risk

Invoice the customer in the home currency

One easy way is to bypass exchange risk is to insist that all

foreign customers pay in your local currency and your firm

pays for all imports in your home currency

Traditional Strategies for Eliminating

Transaction Exposure

Netting

Subsidiaries in large multinationals can net off payments so that

the number of foreign exchange payments is minimised

is where the subsidiaries settle intra-organisational currency

debts for the net amount owed in a currency rather than have it

hedged

example multilateral netting

Matching

try to match receipts and payments in a particular currency

Matching Long Term Assets and Liabilities

Assets in foreign currencies can be financed by foreign currency

borrowing

this means that the revenues generated by the assets can be

used to pay the financing of the assets with no need to exchange

currencies

External Hedging Strategies:

Outline

Forward Contracts

A binding contract to buy or sell a fixed

amount of currency, on a specified future

date, at an exchange rate agreed when the

contract is taken out (the forward rate)

Forward contracts are bespoke, so they can

be for any amount on any date

Futures

A financial future is a standard (legally binding) contract

between buyer and seller, in which there is a binding

obligation to buy/sell a standard fixed quantity of one

currency in exchange for another, at a fixed price, on a

fixed date.

Futures are traded on exchanges.

Characteristics of Currency

Futures

Deals with transactions that will be made in

future;

Involves a promise to exchange a product for

cash by a set delivery date

It involves a process known as marking to

market (No paper gains or losses; money

actually moves between accounts each day).

Contracts are standardised and traded in

organised futures market for specific delivery

date

Options

Option

Is a contract that gives the holder the right to

either buy or sell security at a set price, on or

before a given date

Characteristics:

Contingent claim: payoffs depend upon

underlying value

Exercise is optional: can be avoided

Striking price: the predetermined transaction

price

Option Premium

Option premium

the amount or price you pay for the option

Option Premium has two components

Intrinsic value and Time value

Types of Option Contract

Call option

Right, but not the obligation, to BUY the

underlying asset at a predetermined price

(called exercise or strike price), within a set

period of time.

Put option

Right, but not the obligation, to SELL the

underlying asset at a predetermined price

(called exercise or strike price), within a set

period of time

28

Market and Exercise Price

Relationship

In the Money - exercise of the option would

be profitable.

Call: market price>exercise price

Put: exercise price>market price

Out of the Money - exercise of the option

would not be profitable.

Call: market price<exercise price

Put: exercise price<market price

At the Money - exercise price and asset price

are equal.

Political Risk

Political Risk

Is the assessment of economic opportunity against

political odds

Thus political risk assessment requires that MNCs

evaluate both economic and political indicators.

It is difficult to separate political and economic risks.

While government decisions are political by definition,

the underlying forces behind the decision may be purely

economic.

For example, funds may be blocked because of

unexpected shortage or certain types of domestic

pressures

The United Nations imposed economic sanctions on Iraq

in 1990 because of Iraqs invasion of Kuwait

Nature of Political Risk

Countrywide political risks depend on three broad groups

of variables:

Political climate

Measured by tendencies toward subversion, rebellion, or political

turmoil. Example, recent events in Thailand where Red shirt

opposition say they want the government out now.

Economic climate

Likelihood of government intervention in the economy, levels of

interest and inflation rates, persistent balance of payments

deficits, worsening monetary reserves

Foreign relations

Investors should determine the extent to which host countries

manifest hostility toward other countries.

1-32

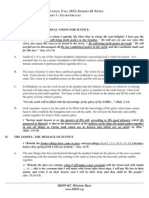

Business risks

Foreign-exchange

risks

Governance risks

Blocked funds

Nepotism & corruption

Religious heritage

Intellectual property rights

Terrorism & War

Anti-globalization

movement

Cyberattacks

Poverty

Environmental

concerns

Protectionism

Transfer Risk

Cultural and

Institutional Risk

Ownership structure

Human resource norms

Firm-Specific

Risks

Country-Specific

Risks

Global-Specific

Risks

Classification of Political

Risks

1-33

Assessing Political Risk

Macro level

firms attempt to assess a host countrys

political stability and attitude toward foreign

investors.

Micro level

firms analyze whether their firm-specific

activities are likely to conflict with host-country

goals as evidenced by existing regulations.

1-34

Firm-Specific Risks

The firm-specific risks that confront MNEs include:

Business risk

Foreign exchange risk

Governance risks

Governance risk

is the ability to exercise effective control over an MNEs

operations within a countrys legal and political environment

For an MNE, it must be addressed from the individual

business unit as well as for the MNE as a whole

1-35

Firm-Specific Risks

Corporate governance principles include:

Accountability (transparent ownership, appropriate

board size, defined board accountability, and

ownership neutrality)

Disclosure and transparency (broad, timely and

accurate disclosure, use of proper accounting

standards)

Independence (dispersed ownership, independent

audits and oversight, independent directors)

Shareholder equity (one share, one vote)

Pre-investment strategy to

anticipate blocked funds

Fronting loans

Creating unrelated exports

Obtaining special dispensation

Forced reinvestment

Blocked Funds

Ownership Structure

Intellectual Property

Joint venture

Legal action in host

country courts

Human Resource Norms

Understand and respect host

country religious heritage

Local management & staffing

Religious Heritage

Nepotism and Corruption

Disclose bribery policy to both

employees and clients

Retain a local legal advisor

Support worldwide treaty

to protect intellectual

property rights

Protectionism

Support government

actions to create

regional markets

Transfer Risk

Cultural and

Institutional Risk

Exhibit 1: Management Strategies for

Country-Specific Risks

Country-Specific Risks:

Transfer Risk

At least six popular strategies are used to move

blocked funds:

Providing alternative conduits for repatriating funds

Transfer pricing

Leading and lagging payments

Using fronting loans

Creating unrelated exports

Obtaining special dispensation

Support government

efforts to flight terrorism

and war

Crisis planning

Terrorism & War

Poverty

Anti-Globalization

Support government

efforts to reduce trade

barriers

Recognize that MNEs

are the targets

Provide stable, relatively

well-paying jobs

Cyber Attacks

No effective strategy

except internet security

efforts

Support government

anti-cyber attack efforts

Environmental Concerns

Show sensitivity to

environmental concerns

Support government efforts

to maintain a level playing

field for pollution controls

Establish the strictest of

occupational safety standards

MNE movement towards multiple primary objectives:

Profitability, Sustainable Development, Corporate Social Responsibility

Exhibit 2: Management Strategies for

Global-Specific Risks

You might also like

- up để downDocument4 pagesup để downtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- up để downDocument4 pagesup để downtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- Scoring With Logic Pro Berklee Arrangeing Creative Orchestration Hormo Form in Orchestration Musical Composition Material Used in CompositionDocument1 pageScoring With Logic Pro Berklee Arrangeing Creative Orchestration Hormo Form in Orchestration Musical Composition Material Used in CompositiontraungoNo ratings yet

- Scoring With Logic Pro Berklee Arrangeing Creative Orchestration Hormo Form in OrchestrationDocument1 pageScoring With Logic Pro Berklee Arrangeing Creative Orchestration Hormo Form in OrchestrationtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- Scoring With Logic Pro Berklee Arrangeing Creative Orchestration Hormo Form in Orchestration Musical CompositionDocument1 pageScoring With Logic Pro Berklee Arrangeing Creative Orchestration Hormo Form in Orchestration Musical CompositiontraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- Scoring With Logic Pro Berklee ArrangeingDocument1 pageScoring With Logic Pro Berklee ArrangeingtraungoNo ratings yet

- Basel IiiDocument27 pagesBasel IiiBianca AlexandraNo ratings yet

- Scoring With Logic Pro Berklee Arrangeing Creative OrchestrationDocument1 pageScoring With Logic Pro Berklee Arrangeing Creative OrchestrationtraungoNo ratings yet

- Rạng Rỡ Việt Nam: pianoDocument1 pageRạng Rỡ Việt Nam: pianotraungoNo ratings yet

- RRVN - BandDocument1 pageRRVN - BandtraungoNo ratings yet

- HFPDocument1 pageHFPtraungoNo ratings yet

- up để downDocument1 pageup để downtraungoNo ratings yet

- YSADocument1 pageYSAtraungoNo ratings yet

- Research Article: An Optimal Portfolio and Capital Management Strategy For Basel III Compliant Commercial BanksDocument12 pagesResearch Article: An Optimal Portfolio and Capital Management Strategy For Basel III Compliant Commercial BankstraungoNo ratings yet

- Both Medical Systems and Patients Cry Out For Care: Emerging MarketsDocument4 pagesBoth Medical Systems and Patients Cry Out For Care: Emerging MarketstraungoNo ratings yet

- YSADocument1 pageYSAtraungoNo ratings yet

- April May 2014 Examination TimetableDocument25 pagesApril May 2014 Examination TimetabletraungoNo ratings yet

- Adjusted From Keith Comments - Step 6 - Newest Draft - Just Copy PasteDocument4 pagesAdjusted From Keith Comments - Step 6 - Newest Draft - Just Copy PastetraungoNo ratings yet

- Access To Loan o VN - Bai Thesis Cua Duke UniDocument36 pagesAccess To Loan o VN - Bai Thesis Cua Duke UnitraungoNo ratings yet

- Vicky's Framework and Results DemonstrationDocument15 pagesVicky's Framework and Results DemonstrationtraungoNo ratings yet

- Answer To Homework For Lecture 3Document3 pagesAnswer To Homework For Lecture 3traungoNo ratings yet

- Adjusted From Keith Comments - Step 3 & 6 - Newest Draft - Just Copy PasteDocument8 pagesAdjusted From Keith Comments - Step 3 & 6 - Newest Draft - Just Copy PastetraungoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RPMDocument35 pagesRPMnisfyNo ratings yet

- 2017 Ecatalogue Howtim Exit SignDocument38 pages2017 Ecatalogue Howtim Exit SignSatish Phakade-PawarNo ratings yet

- Menu EngineeringDocument7 pagesMenu EngineeringVijay KumaranNo ratings yet

- Josephine Morrow: Guided Reflection QuestionsDocument3 pagesJosephine Morrow: Guided Reflection QuestionsElliana Ramirez100% (1)

- AWS PowerPoint PresentationDocument129 pagesAWS PowerPoint PresentationZack Abrahms56% (9)

- The Exalted Evening Litany of The Great Pir Nureddin Jerrahi May His Holy Secret Be VictoriousDocument23 pagesThe Exalted Evening Litany of The Great Pir Nureddin Jerrahi May His Holy Secret Be Victoriousnazemuddeen100% (1)

- Mapeh Reviewer For My LabidabsDocument3 pagesMapeh Reviewer For My LabidabsAshley Jovel De GuzmanNo ratings yet

- Dairy IndustryDocument11 pagesDairy IndustryAbhishek SharmaNo ratings yet

- Business Law Term PaperDocument19 pagesBusiness Law Term PaperDavid Adeabah OsafoNo ratings yet

- 2012 Fall TSJ s03 The Mystery of The Gospel PT 1 - Stuart GreavesDocument5 pages2012 Fall TSJ s03 The Mystery of The Gospel PT 1 - Stuart Greavesapi-164301844No ratings yet

- Unit 1 Revision PDFDocument2 pagesUnit 1 Revision PDFИлья ЕвстюнинNo ratings yet

- Gaffney S Business ContactsDocument6 pagesGaffney S Business ContactsSara Mitchell Mitchell100% (1)

- 22 Habits of Unhappy PeopleDocument2 pages22 Habits of Unhappy PeopleKlEər OblimarNo ratings yet

- CASE STUDY GGHDocument4 pagesCASE STUDY GGHSanthi PriyaNo ratings yet

- Food Security: Its Components and ChallengesDocument9 pagesFood Security: Its Components and ChallengesSimlindile NgobelaNo ratings yet

- Portales Etapas 2022 - MonicaDocument141 pagesPortales Etapas 2022 - Monicadenis_c341No ratings yet

- Labor Law Review Midterm Exercise 2ndsem 2017-2018Document17 pagesLabor Law Review Midterm Exercise 2ndsem 2017-2018MaeJoyLoyolaBorlagdatanNo ratings yet

- Composition Notes Essay C1 and C2Document7 pagesComposition Notes Essay C1 and C2Γιάννης ΜατσαμάκηςNo ratings yet

- The Theory of Paulo FreireDocument8 pagesThe Theory of Paulo FreireLola Amelia100% (3)

- Sourabh ResumeDocument2 pagesSourabh ResumeVijay RajNo ratings yet

- Art CriticismDocument3 pagesArt CriticismVallerie ServanoNo ratings yet

- B Blunt Hair Color Shine With Blunt: Sunny Sanjeev Masih PGDM 1 Roll No.50 Final PresentationDocument12 pagesB Blunt Hair Color Shine With Blunt: Sunny Sanjeev Masih PGDM 1 Roll No.50 Final PresentationAnkit Kumar SinghNo ratings yet

- MMB To OIG Request For Further Investigation 6-27-23Document2 pagesMMB To OIG Request For Further Investigation 6-27-23maustermuhleNo ratings yet

- HeLa B Cell LineDocument3 pagesHeLa B Cell LineAhnaph RafinNo ratings yet

- X-by-Wire: Fred SeidelDocument9 pagesX-by-Wire: Fred SeidelHồng TháiNo ratings yet

- Godfrey David KamandeDocument19 pagesGodfrey David KamandeDismus Ng'enoNo ratings yet

- Spring 2021 NBME BreakdownDocument47 pagesSpring 2021 NBME BreakdownUmaNo ratings yet

- CFJ Seminars TrainingGuide L1EnglishDocument136 pagesCFJ Seminars TrainingGuide L1EnglishAttila AygininNo ratings yet

- Polygamy A Very Short Introduction Pearsall Sarah M S Download PDF ChapterDocument51 pagesPolygamy A Very Short Introduction Pearsall Sarah M S Download PDF Chapterharry.bailey869100% (5)

- Upvc CrusherDocument28 pagesUpvc Crushermaes fakeNo ratings yet