Professional Documents

Culture Documents

Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & Sons

Uploaded by

Piyush ChaturvediOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & Sons

Uploaded by

Piyush ChaturvediCopyright:

Available Formats

1

Multinational Financial

Management

Alan Shapiro

7

th

Edition

J.Wiley & Sons

Power Points by

Joseph F. Greco, Ph.D.

California State University, Fullerton

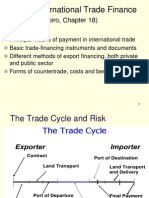

2

FINANCING FOREIGN

TRADE

CHAPTER 18

3

CHAPTER OVERVIEW:

I. PAYMENT TERMS

II. DOCUMENTS

III. FINANCING TECHNIQUES

IV. GOVERNMENT SOURCES OF

EXPORT FINANCING AND CREDIT

INSURANCE

V. COUNTERTRADE

4

I. PAYMENT TERMS

I. PAYMENT TERMS

A. Five Principal Means:

1. Cash in advance

2. Letter of Credit

3. Drafts

4. Consignment

5. Open Account

5

PAYMENT TERMS

B. Cash in Advance

1. Minimal risk to exporter

2. Used where there is

a. Political unrest

b. Goods made to order

c. New unfamiliar customer

6

PAYMENT TERMS

C. Letter of Credit (L/C)

1. A letter addressed to seller

a. written and signed by

buyers bank

b. promising to honor sellers

drafts.

c. Bank substitutes its own

commitment

d. Seller must conform to

terms

7

PAYMENT TERMS

2. Advantages of an L/C to Exporter

a. eliminates credit risk

b. reduces default risk

c. payment certainty

d. prepayment risk protection

e. financing source

8

PAYMENT TERMS

3. Advantages of L/C to Importer

a. shipment assured

b. documents inspected

c. may allow better sales terms

d. relatively low-cost financing

e. easy cash recovery if

discrepancies

9

PAYMENT TERMS

4. Types of L/Cs

a. documentary

b. non-documentary

c. revocable

d. irrevocable

e. confirmed

f. transferable

10

PAYMENT TERMS

D. DRAFTS

1. Definition:

- unconditional order in writing

- exporters order for importer

to pay

- at once (sight draft) or

- in future (time draft)

11

PAYMENT TERMS

2. Three Functions of Drafts

a. clear evidence of financial obliga-

tion

b. reduced financing costs

c. provides negotiable and uncondi-

tional financial instrument

(ie. May be converted to a

bankers acceptance)

12

PAYMENT TERMS

3. Types of Drafts

a. sight

b. time

c. clean (no documents needed)

d. documentary

13

PAYMENT TERMS

E. CONSIGNMENT

1. Exporter = the consignor

2. Importer = the consignee

3. Consignee attempts to sell

goods to a third party; keeps

some profit, remits rest to

consignor.

4. Use: Between affiliates

14

PAYMENT TERMS

F. OPEN ACCOUNT

1. Creates a credit sale

2. To importers advantage

3. More popular lately because

a. major surge in global trade

b. credit information improved

c. more global familiarity with

exporting.

15

PAYMENT TERMS

4. Benefits of Open Accounts:

a. greater flexibility in making

a trade

b. lower transactions costs

5. Major disadvantage:

highly vulnerable to government

currency controls.

16

II. DOCUMENTS

II. DOCUMENTS USED IN INTL TRADE

A. Four most used documents

1. Bill of Lading (most

important)

2. Commercial Invoice

3. Insurance Certificate

17

DOCUMENTS

B. Bill of Lading

Three functions:

1. Acts as a contract to carry

the goods.

2. Acts as a shippers receipt

3. Establishes ownership over

goods if negotiable type.

18

DOCUMENTS

2. Type of Bills

a. Straight

b. Order

c. On-board

d. Received-for-shipment

e. Clean

f. Foul

19

DOCUMENTS

C. COMMERCIAL INVOICE

Purpose:

1. Lists full details of goods

shipped

2. Names of importer/exporter given

3. Identifies payment terms

4. List charges for transport and

insurance.

20

DOCUMENTS

D. INSURANCE

1. Two Categories:

a. Marine: transport by sea

b. Air: transport by air

2. Insurance Certificate

issued to show proof of

insurance

3. All shipments insured today.

21

DOCUMENTS

E. CONSULAR INVOICE

Local consulate in host country

issues:

a visa for the exporters invoice

requires fee to be paid to consulate

22

III. FINANCING TECHNIQUES

III. FINANCING TECHNIQUES

A. Four Types:

1. Bankers Acceptances

a. Creation: drafts accepted

b. Terms: Payable at

maturity to holder

23

FINANCING TECHNIQUES

2. Discounting

a. Converts exporters drafts to

cash minus interest to maturity

and commissions.

b. Low cost financing with few fees

c. May be with (exporter still liable)

or without recourse(bank takes

liability for nonpayment).

24

FINANCING TECHNIQUES

3. Factoring

-firms sell accounts receivable to another firm

known as the factor.

a. Discount charged by factor

b. Non-recourse basis: Factor

assumes all payment risk.

c. When used:

1.) Occasional exporting

2.) Clients geographically

dispersed.

25

FINANCING TECHNIQUES

4. Forfaiting

a. Definition:

discounting at a fixed rate

without recourse of medium-term

accounts receivable denominated

in a fully convertible currency.

b. Use: Large capital purchases

c. Most popular in W. Europe

26

IV. GOVERNMENT SOURCES OF

EXPORT FINANCING

IV. GOVERNMENT SOURCES OF

EXPORT FINANCING AND CREDIT

INSURANCE

A. Export-Import Bank of the U.S.

-known as Ex-Im Bank

-finances and facilitates U.S.

exports only.

27

GOVERNMENT SOURCES OF

EXPORT FINANCING

1. Ex-Im Bank Programs:

a. Direct loans to exporters

b. Intermediate loans to

exporters

c. Loan guarantees

d. Preliminary commitments

e. Political and commercial

insurance

28

GOVERNMENT SOURCES OF

EXPORT FINANCING

B. Private Export Funding Corporation

(PEFCO)

1. Finances large sales from private

sources

2. May purchase loans of U.S.

importers

3. ExIm Bank provides loan

guarantees.

29

GOVERNMENT SOURCES OF

EXPORT FINANCING

C. Foreign Credit Insurance Association

(FCIA)

1. Offers commercial and political

risk insurance

2. When insured, exporter often

able to obtain financing faster.

30

V. COUNTERTRADE

V. COUNTERTRADE

A. Three Specific Forms:

1. Barter

direct exchange in kind

2. Counterpurchase

sale/purchase of unrelated

goods but with currencies

3. Buyback

repayment of original

purchase through sale of a

related product.

31

COUNTERTRADE

B. When to Use Countertrade

1. With soft-currency developing

countries

2. When foreign contractor must

perform.

You might also like

- Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsDocument31 pagesMultinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsSanjay DomdiyaNo ratings yet

- CH 18Document31 pagesCH 18Shifat SardarNo ratings yet

- Docs in International TradeDocument30 pagesDocs in International TradeYash MittalNo ratings yet

- IFMDocument31 pagesIFMShivanand KitturNo ratings yet

- Topic 2: International Trade Finance: (Reading: Shapiro, Chapter 18)Document15 pagesTopic 2: International Trade Finance: (Reading: Shapiro, Chapter 18)sittmoNo ratings yet

- Financing International Trade Methods Payment AgenciesDocument17 pagesFinancing International Trade Methods Payment AgenciesMASPAKNo ratings yet

- Letters of Credit ProceduresDocument25 pagesLetters of Credit Proceduresapi-246907195No ratings yet

- 14.letters of Credit ProceduresDocument26 pages14.letters of Credit ProceduresManish VensimalaniNo ratings yet

- Citf Practice TestDocument18 pagesCitf Practice TestKavitha selvarajNo ratings yet

- International Financial Management PPT Chap 1Document16 pagesInternational Financial Management PPT Chap 1serge folegweNo ratings yet

- IFM TB ch19Document11 pagesIFM TB ch19Faizan ChNo ratings yet

- EXIM Test Paper2Document4 pagesEXIM Test Paper2Karthikeya PrathipatiNo ratings yet

- Specimen Paper 2014 - FINALDocument33 pagesSpecimen Paper 2014 - FINALAbdulwahab AhmedNo ratings yet

- Risk Bearing Documents in International TradeDocument8 pagesRisk Bearing Documents in International TradeSukrut BoradeNo ratings yet

- Case Study #5Document2 pagesCase Study #5fhdiufhjdiejNo ratings yet

- Quizlet Flashcards Chapter 17 & 19 Intl Trade FinanceDocument17 pagesQuizlet Flashcards Chapter 17 & 19 Intl Trade FinanceDương DươngNo ratings yet

- CITF Specimen 1Document46 pagesCITF Specimen 1nguyentumkhanhNo ratings yet

- MCQ On Letter of CreditDocument25 pagesMCQ On Letter of CreditLakshman Singh75% (8)

- Cdcs PresentationDocument64 pagesCdcs PresentationAlok Pathak75% (4)

- New Syllabus - Examiners ReportDocument70 pagesNew Syllabus - Examiners ReportPrecious Onyeka OkoyeNo ratings yet

- Chapter 01 - Test Bank MCQsDocument24 pagesChapter 01 - Test Bank MCQselkieNo ratings yet

- Đáp Án TMQTDocument5 pagesĐáp Án TMQTThị Nga PhạmNo ratings yet

- IMM MCQ ImpDocument7 pagesIMM MCQ ImpKushagra Nigam40% (5)

- DocDocument16 pagesDocNorman Delirio100% (1)

- Unit 4 1701015030Document4 pagesUnit 4 1701015030Hồng Anh Nguyễn100% (1)

- International Trade and Finance GuidanceMultipleChoiceQuestionsDocument12 pagesInternational Trade and Finance GuidanceMultipleChoiceQuestionsBhagyashree DevNo ratings yet

- Trắc nghiệm TACN 2Document269 pagesTrắc nghiệm TACN 2Ngoc AnhNo ratings yet

- Chapter 01 - Test Bank: Multiple Choice QuestionsDocument48 pagesChapter 01 - Test Bank: Multiple Choice QuestionsW11No ratings yet

- FabozziCM4 TB Ch20Document6 pagesFabozziCM4 TB Ch20jay rockNo ratings yet

- Regarding costs of currency appreciation in sales contractsDocument15 pagesRegarding costs of currency appreciation in sales contractsHoàng LêNo ratings yet

- ch1 PDFDocument36 pagesch1 PDFJie Wen YUNo ratings yet

- Outline For IBTDocument43 pagesOutline For IBTtwbrown1220100% (3)

- Test Bank Capital Markets Institutions Instruments 4th Edition FabozziDocument6 pagesTest Bank Capital Markets Institutions Instruments 4th Edition FabozziBích Ngọc100% (1)

- Chapter 01 Testbank: of Mcgraw-Hill EducationDocument58 pagesChapter 01 Testbank: of Mcgraw-Hill EducationshivnilNo ratings yet

- TN NHTM GKDocument44 pagesTN NHTM GKTrần Quốc KhánhNo ratings yet

- International Trade Payment MethodsDocument19 pagesInternational Trade Payment Methodsfarhadcse30No ratings yet

- Money - Banking - MCQ 2-3Document14 pagesMoney - Banking - MCQ 2-3Phương Nghi Lê0% (1)

- Chapter 01 - Test Bank: Multiple Choice QuestionsDocument47 pagesChapter 01 - Test Bank: Multiple Choice QuestionsMark Angelo BustosNo ratings yet

- Trắc nghiệm tiếng anhDocument270 pagesTrắc nghiệm tiếng anhNguyễnLongThànhNo ratings yet

- Lecture 9 International Credit Market enDocument42 pagesLecture 9 International Credit Market enElla Marie WicoNo ratings yet

- Pretest Ib AnswerDocument10 pagesPretest Ib AnswerCekelat UdangNo ratings yet

- CDCS &CITF Mixed Paper - 2020Document8 pagesCDCS &CITF Mixed Paper - 2020Phương Anh100% (3)

- Biggest IMPORTER of WorldDocument8 pagesBiggest IMPORTER of WorldRahul SoniNo ratings yet

- 4 & 5. HomeworkDocument4 pages4 & 5. Homeworkmanar.boulaabaNo ratings yet

- Banking Law Pre University Question Paper LLBDocument4 pagesBanking Law Pre University Question Paper LLBKRISHNA VIDHUSHANo ratings yet

- Unit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUDocument6 pagesUnit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUvunguyenvankhanh171104No ratings yet

- Unit II Assessment Financial System and Financial MarketDocument9 pagesUnit II Assessment Financial System and Financial MarketMICHAEL DIPUTADO100% (2)

- The Role of Money and Financial Markets in Facilitating Economic ExchangeDocument35 pagesThe Role of Money and Financial Markets in Facilitating Economic ExchangesanjayshahdevNo ratings yet

- Tutorial 2 - DFM5214 (Q)Document5 pagesTutorial 2 - DFM5214 (Q)1211210517No ratings yet

- Finance 18UCF102-FINANCIAL-SERVICESDocument24 pagesFinance 18UCF102-FINANCIAL-SERVICESAvinash GurjarNo ratings yet

- TRAC - Nghiem-TTQT - ĐẠI HỌC NGÂN HÀNG '1Document19 pagesTRAC - Nghiem-TTQT - ĐẠI HỌC NGÂN HÀNG '1Minh Châu NguyễnNo ratings yet

- Americans benefit from lower euro pricesDocument13 pagesAmericans benefit from lower euro pricesLê KhánhNo ratings yet

- International Trade Multiple Choice QuestionsDocument24 pagesInternational Trade Multiple Choice QuestionsMarvin DevannyNo ratings yet

- CAIIB-BFM Practice Que Set-1Document5 pagesCAIIB-BFM Practice Que Set-1Surya PillaNo ratings yet

- Foreign Exchange ManagementDocument21 pagesForeign Exchange ManagementSreekanth GhilliNo ratings yet

- Test 1: D. Advance PaymentDocument231 pagesTest 1: D. Advance Paymenthoaoaihuong0401No ratings yet

- CDCS Practice Question Paper 1Document11 pagesCDCS Practice Question Paper 1Mahendar Weezyholic Bist92% (12)

- Multiple Choice Questions Financial MarketsDocument16 pagesMultiple Choice Questions Financial Marketshannabee00No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- BLCKDocument1 pageBLCKPiyush ChaturvediNo ratings yet

- PassportApplicationForm Main English V3.0Document1 pagePassportApplicationForm Main English V3.0Piyush ChaturvediNo ratings yet

- Tai Pie 101 Building AnalysisDocument3 pagesTai Pie 101 Building AnalysisPiyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- New Microsoft Word Document - For Merge1Document1 pageNew Microsoft Word Document - For Merge1Piyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- HHH 8Document1 pageHHH 8Piyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- New Microsoft Word Document - For Merge1Document1 pageNew Microsoft Word Document - For Merge1Piyush ChaturvediNo ratings yet

- New Microsoft Word Document - For MergeDocument1 pageNew Microsoft Word Document - For MergePiyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- TopicDocument7 pagesTopicPiyush ChaturvediNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentPiyush ChaturvediNo ratings yet

- Piyush CVDocument2 pagesPiyush CVPiyush ChaturvediNo ratings yet

- BBA FreshersDocument5 pagesBBA FreshersPiyush ChaturvediNo ratings yet

- Jniujjjjjjjjjjjjjjjjjjjjjjjjjjjjj 9000000000000000000000000Document1 pageJniujjjjjjjjjjjjjjjjjjjjjjjjjjjjj 9000000000000000000000000Piyush ChaturvediNo ratings yet

- Piyush CVDocument2 pagesPiyush CVPiyush ChaturvediNo ratings yet

- Top of FormDocument4 pagesTop of FormPiyush ChaturvediNo ratings yet

- Obtain A Digital Certificate To Create A Digital SignatureDocument3 pagesObtain A Digital Certificate To Create A Digital SignaturePiyush ChaturvediNo ratings yet

- When Timing Is EverythingDocument8 pagesWhen Timing Is EverythingPiyush ChaturvediNo ratings yet

- Compatibility Changes Between VersionsDocument2 pagesCompatibility Changes Between VersionsPiyush ChaturvediNo ratings yet

- Siti Faridah Ab RahmanDocument24 pagesSiti Faridah Ab RahmanPiyush ChaturvediNo ratings yet

- AstrologyDocument4 pagesAstrologyPiyush ChaturvediNo ratings yet

- Home News Topics Resources Job Sites About UsDocument1 pageHome News Topics Resources Job Sites About UsPiyush ChaturvediNo ratings yet

- Ujnunhuuuuuuuuuuuuuuuuuuuuuuuuuuuuuhujhurfh4hgfutruhgv3hgv3htgh34fhu4tfvhjbvfb4t8vib43tg0899thhhhhhhhhhhhhhhhhhhCustomize Keyboard ShortcutsDocument3 pagesUjnunhuuuuuuuuuuuuuuuuuuuuuuuuuuuuuhujhurfh4hgfutruhgv3hgv3htgh34fhu4tfvhjbvfb4t8vib43tg0899thhhhhhhhhhhhhhhhhhhCustomize Keyboard ShortcutsPiyush ChaturvediNo ratings yet

- Home News Topics Resources Job Sites About UsDocument1 pageHome News Topics Resources Job Sites About UsPiyush ChaturvediNo ratings yet

- Sheemaduchisstaganeshaynamah!!: International Trade Cross Border Investment Reallocation of Capital Nation StatesDocument1 pageSheemaduchisstaganeshaynamah!!: International Trade Cross Border Investment Reallocation of Capital Nation StatesPiyush ChaturvediNo ratings yet

- Item Code Description Rate Quantity On Hand Value of StockDocument1 pageItem Code Description Rate Quantity On Hand Value of StockPiyush ChaturvediNo ratings yet

- Nurturing First Class Engineers into World Class Managers through Industry InteractionDocument13 pagesNurturing First Class Engineers into World Class Managers through Industry InteractionkamatNo ratings yet

- b383 Traverse Business Plan PDFDocument11 pagesb383 Traverse Business Plan PDFN.SNo ratings yet

- Salary Statistics 2018Document48 pagesSalary Statistics 2018Sourav KarthickNo ratings yet

- Inventories: Chapter 8: Theory of Accounts ReviewerDocument25 pagesInventories: Chapter 8: Theory of Accounts ReviewerYuki100% (1)

- 3M Corporate Headquarters 3M Center St. Paul, MN 55144-1000: Letter of IntentDocument3 pages3M Corporate Headquarters 3M Center St. Paul, MN 55144-1000: Letter of IntentTahsin Islam100% (1)

- Capital DeductionsallowancesDocument35 pagesCapital DeductionsallowancesKenyan GNo ratings yet

- Country Attractiveness 1Document17 pagesCountry Attractiveness 1Selena NguyenNo ratings yet

- Robert Whitaker ResumeDocument3 pagesRobert Whitaker ResumeBrandon GordonNo ratings yet

- Salesperson Skills Legal ConsiderationsDocument7 pagesSalesperson Skills Legal Considerationssi touloseNo ratings yet

- Mock PDFDocument26 pagesMock PDFCamiNo ratings yet

- KGPL LOT-I-E-Auction Process InformationDocument46 pagesKGPL LOT-I-E-Auction Process InformationDr. PriyaNo ratings yet

- DORC Management HSE Committee Meeting ProcedureDocument6 pagesDORC Management HSE Committee Meeting ProcedureJosiahNo ratings yet

- M.a.part - I - Industrial Economics - EngDocument228 pagesM.a.part - I - Industrial Economics - Engsamir2989No ratings yet

- 1 - Using Dataflow DiagramsDocument34 pages1 - Using Dataflow Diagramsabdallameme555No ratings yet

- Cma Part 1 Mock Test 3Document37 pagesCma Part 1 Mock Test 3armaghan186% (22)

- AT Quizzer 17 - Other Assurance and Non Assurance ServicesDocument10 pagesAT Quizzer 17 - Other Assurance and Non Assurance ServicesRachel LeachonNo ratings yet

- Chapter 26-Smes Assets (Inventories, Basic Chapter 27 - Smes Assets (Ppe, GovernmentDocument2 pagesChapter 26-Smes Assets (Inventories, Basic Chapter 27 - Smes Assets (Ppe, GovernmentRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Talent Management - DellDocument3 pagesTalent Management - DellTien VuNo ratings yet

- Problem Solution Meal DeliveryDocument1 pageProblem Solution Meal DeliveryKhả LộNo ratings yet

- Jake Burgmeier ResumeDocument2 pagesJake Burgmeier Resumeapi-510316324No ratings yet

- 9th Chapter 3 - Planning and Implementing Customer Relationship Management ProjectsDocument32 pages9th Chapter 3 - Planning and Implementing Customer Relationship Management ProjectsHarpreetNo ratings yet

- JKMS Business Loan ApplicationDocument3 pagesJKMS Business Loan Applicationgerhard greylingNo ratings yet

- The Accounting Cycle: Capturing Economic EventsDocument55 pagesThe Accounting Cycle: Capturing Economic EventsK KNo ratings yet

- Anchoring Script For SeminarDocument3 pagesAnchoring Script For Seminarvikramsinghnikhil79% (61)

- Retail Manager JDDocument4 pagesRetail Manager JDMj PayalNo ratings yet

- Vennu Task 1 - Model AnswerDocument1 pageVennu Task 1 - Model Answersid100% (1)

- Opc-Guidelines For IncorporationDocument11 pagesOpc-Guidelines For IncorporationShaina Santiago AlejoNo ratings yet

- Marketing PlanDocument30 pagesMarketing PlanMinhas Khan100% (1)

- Evolution of Management TheoriesDocument20 pagesEvolution of Management TheoriesKanishq BawejaNo ratings yet

- GCB - 2qcy23Document6 pagesGCB - 2qcy23gee.yeap3959No ratings yet