Professional Documents

Culture Documents

Session 9 Target

Uploaded by

tariqkanjuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session 9 Target

Uploaded by

tariqkanjuCopyright:

Available Formats

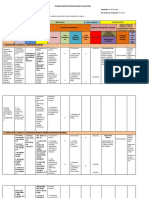

Targets

Differentiation Strategy

J ames Oldroyd

Kellogg Graduate School of Management

Northwestern University

J-oldroyd@northwestern.edu

801-422-7888

650 TNRB

1

To Date

Dual Advantage

Willingness

to Pay

Supplier

opportunity

cost

Differentiation

Goldman

Sachs

Merrill

Lynch

McDonalds

Burger

King

Low Cost

Wal-mart

K-mart

Mom

and Pop

Store

2

Dimensions of Value

Value

Price

Differentiation

Product

Service

Bottom Line

Value

Top Line

Value

Willingness to Pay

Cost

Price

Value Captured by

Customer

Value Captured

by Firm

Value Captured

by Supplier

Supplier Opportunity Costs

Achieving Differentiation Advantage

How one goes about obtaining a differentiation advantage

depends upon the nature of the product/service:

Observable Goods: the buyer can easily form accurate

judgements about the quality of a product.

Experience Goods: the buyer finds it difficult and/or costly to

determine the quality of the product prior to purchase and use.

Communication/Network Goods: the value to the buyer rises as

the number of buyers and users increases.

And it embraces the whole relationship between supplier and

customer

4

Differentiating Observable Goods

By differentiating an observable good the producer acts to reduce the total

cost of use to the buyer. Very often this requires an increase in product

price. But in successful differentiation the price increase is more than

offset by a reduction in the costs experienced by the buyer. The aim is not

be the low cost producer but TO BE THE LOW COST PROVIDER.

Manufacturer's

Value Added

Engineering

Labor

Marketing

Distribution

Administration

Product

Price

Raw

Materials

Buyers Costs

Search

Learning

Switching

Risk/loss

Performance

Service

Total Cost of

Use to Buyer

5

Differentiation-Based Strategy

Users Total Cost of New Software

Product

Price

Search

Learning

Risk

Utility Software

Resources

6

Firm A:

Firm B:

Price

Price

Total cost to buyer

Producers cost Producers margin Buyers cost

Firm A has a

cost advantage

Value Chains for Cost Advantage

and Differentiation Advantage

Firm C:

Firm B:

Price

Firm C has a

differentiation

advantage

Price

7

Strategic Positioning

The essence of strategic positioning is to

make choices that are different from those

of rivals

Strategy is not a race to one ideal position ---

it is the creation of a different position

Differences in positioning are necessary but

not sufficient for sustainable competitive

advantage

Sustainable advantage depends on barriers to

imitation

Advantage is magnified by mutual reinforcement

across activities

8

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

9

Multiple Data Sources

People have typically sought an

understanding of their customer

by using one or two of these

sourcesindependently

Customer

Research

Market Data

Internal

Data

Observation

Data

What is purchased,

not why

Behavioral not

attitudinal

Attitudinal

not behavioral

or fact-based

Market

conditions,

not customer

preferences

GAP

Source: Arthur Anderson, 2002

10

Customer Relationship Management

v To deepen customer relationships.

v To build customer loyalty

v To increase profitability

Purpose of CRM

The Proliferation of CRM

161 CRM companies funded since 1998

$1.3 billion raised by CRM companies

Source: Red Herring May 2002 p. 27

11

Sources of Expense:

Typically $5,000 a seat and $2 million to $5

million per deployment.

CRM systems required data conversion when

consolidating data from multiple legacy systems.

At the enterprise level, CRM software is just

plain difficult.

Additional Investments of $100,000 to $1

million.

Need to hard-wire and hard-code the two

systems together to connect the Siebel suite to

the mainframe.

Time and money running data reconciliations.

Custom coding to pay for, too. Source:

Computerworld Inc. Dec 3, 2001

And Fall

Surveys show 55 per cent of North

American executives don't believe

they've seen a return on their CRM

investments.

Gartner Group

Major Players:

Siebel Systems

26%

Oracle and

Broadvision

6% share

Despite the troubles CRM

software sales are expected

to rise 10% to $4 billion in

2002 and to rise 33% to $29.4

billion in 2003

12

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

13

Customer Management Loop

Respond

Identify

Dialogue

Interpret

1. Decide what you will do with the information. Make it a part of your overall customer plan.

2. Establish customers as the information pivot in your organization. Gather the right Customer

Information (Who what when where and WHY) from the right customers through the right means

(not the most expensive).

3. Make this information useable, available and actionable throughout the organization where it is

needed.

4. Add context to the information. Interact with customers and understand their needs.

14

Case Study: Harrahs

Created a Total Rewards program to track players at

electronic gaming machines. These machines account

for 80% of operating profits

Links 40,000 machines in 12 states

The goal is to create brand loyal customers

Comps

(comps) good

toward shows,

meals or hotel

rooms.

Identify

15

Customers Are Not Created Equal

F

r

e

q

u

e

n

c

y

:

N

u

m

b

e

r

o

f

C

u

s

t

o

m

e

r

s

a

t

E

a

c

h

V

a

l

u

e

L

e

v

e

l

Value Per Customer

Mean

Standard Deviation

Why are they

unprofitable?

Can behavior or

cost be changed?

Should we

disengage?

Unprofitable

Modestly

profitable

or break

even

Modestly

profitable

What can be done to

develop the profitability

of these customers?

Who are these

customers? How do

we keep them, attract

more like them?

Very

profitable

Identify

16

Tufts Plan

As the pie shrinks

the table manners

get worse.

A prominent physician on

the current state of

physician satisfaction

.01% = $7,880

PMPM

5% = $1,191 PMPM

95% = $22 Per

Member Per Month

(PMPM)

The Problem

Information Solution - CRM

Patient Identification and Treatment Recommendation

Workflow Standardization

Multi-disciplinary Collaboration

Alerts care managers enables them to intervene early

Persistently reminds and motivates patients, families and

providers to comply with proven health management care

plans

Results from

similar programs:

44% reduction in

readmission

36% reduction in

hospital days for

patients with

congestive heart

failure

400% ROI for

pediatric asthma

program

12% annual cost

savings for diabetes

management

Identify

17

Pharmaceutical

Health Care

Physicians

Patients

Insurance/Gov.

Pharmacies

Defining your customers

Identify

18

Tribunes Customers

The Reader

The Advertiser

The Brick Wall

The Division Between Church and State

20% of Revenues 80% of Revenues

Identify

19

General Electric Medical Systems

Customers

Hospital

Purchasing

Department

The Lab

Technicians

Doctors

Hospital

Administration

Patients

Identify

20

Guidants Customers

Electro-

Physiologists

Implanting

Cardiologists

Cardiologists

Primary Care

Physicians

Patients

Primary

Relationship

Secondary

Relationships

Referral Chain

Identify

21

Customer Management Loop

Respond

Identify

Dialogue

Interpret

1. Decide what you will do with the information. Make it a part of your overall customer plan.

2. Establish customers as the information pivot in your organization. Gather the right Customer

Information (Who what when where and WHY) from the right customers through the right means

(not the most expensive).

3. Make this information useable, available and actionable throughout the organization where it is

needed.

4. Add context to the information. Interact with customers and understand their needs.

22

Using Customer Information to

Initiate Dialogue

Customized Web

Interface

Customer Service

and Support

Email

Pop-up ads

Sales Force Calls

Bulk Mailers

Broadcast ads

Internet

Physical

Push

Pull

Dialogue

23

Response Rates For

Marketing Communications

Differential Marketing

6-15% range depending

on quality of marketing

lists/segments defined

Relationship (1:1) Mktg.

18-30% range when using

highly targeted, one-to-one

type marketing campaigns

Traditional Marketing

2-5% range for traditional

types of mass media type

campaigns

Informational Marketing

1-3% range for customer

passively collecting

information

Passive

Interactive

Company Initiated

(Outbound)

Customer Initiated

(Inbound)

Dialogue

24

Customer Management Loop

Respond

Identify

Dialogue

Interpret

1. Decide what you will do with the information. Make it a part of your overall customer plan.

2. Establish customers as the information pivot in your organization. Gather the right Customer

Information (Who what when where and WHY) from the right customers through the right means

(not the most expensive).

3. Make this information useable, available and actionable throughout the organization where it is

needed.

4. Add context to the information. Interact with customers and understand their needs.

25

The potential of segmentation has

vastly increased in the new world

In the old world, segmentation was mostly static using demo- and

socio-graphics, attitudes and customer value. In the new

world, segmentation is behavior based, real-time and dynamic

Is there no value in static segmentations anymore and does every

segmentation have to be real-time?

Is behavioral segmentation the means to all ends and how do you

integrate it with existing (mostly offline) segmentation

methods?

Can multiple segmentations methods be used simultaneously for

different value creation purposes?

Interpret

Segmentation of Customers

26

The Customer Pyramid

Platinum

Gold

Iron

Lead

Least

Profitable

Most

Profitable

Differentiate

Customers

Depending on the

Level of

Involvement

Source: the Customer Pyramid, Zeithaml, Rust, and Lemon. Cal. Management Review, Summer 2001

Interpret

Prediction to

Optimize

27

Customer Break Even Analysis

Cost to Serve

Price

High

Low

Low

High

Goal is to

move

Customers

from below

the line

above the

line or to

lower the

line

Interpret

Understanding Customers patterns

28

Customer Management Loop

Respond

Identify

Dialogue

Interpret

1. Decide what you will do with the information. Make it a part of your overall customer plan.

2. Establish customers as the information pivot in your organization. Gather the right Customer

Information (Who what when where and WHY) from the right customers through the right means

(not the most expensive).

3. Make this information useable, available and actionable throughout the organization where it is

needed.

4. Add context to the information. Interact with customers and understand their needs.

29

Target right

customers

Cross-

selling

Reduce

lapse rate

Attract

more effective

acquisition

Develop

More sales per

customer per

year

Retain

Increase

customer

lifetime

Source of

impact

Typical lever

Stages of

customer

relationship

lifecycle

Churn

Market capitalisation

($ bn)

Market cap./customer ($)

5.4%

7.0

3,721

1.4%

35.3

5,883

CRM Creates Value by Improving Attraction,

Development, and Retention of Customers

Average revenue per

customer per year ($)

Average assets per account

($)

130

21,000

170

102,000

Number of accounts

New accounts (Q4 1999)

Average acquisition costs ($)

E-trade

1,881,000

413,500

360

Charles

Schwab

6,000,000

390,000

200

Respond

30

Segmentation

Victorias Secret places all visitors on its slower

servers but once a customer places something in

the shopping cart they are switched to a faster

server.

Customer Patterns

Amazon monitors browsing and makes

suggestions. Customer who bought this book also

purchased a book by.

Businesses that use Differential

Treatment

Respond

31

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

32

Organizational Barriers to Customer

Information

1. Information Flow

2. Channel Obstacles

3. Company Barriers to Entering the

Data

33

Why CRM Fails: Strategy & Organization

What CRM is:

A strategy

A cross functional and cross

divisional initiative

Difficult both costly and time

consuming

What CRM is not:

a technology

A software package

A marketing department

initiative

Easy

55% of CRM implementations dont produce results

(Gartner Group)

20% Damage long standing customer relationships

(Bain Report)

Implement a CRM without a strategy

Implement CRM before readying the organization

The perception that more is better

Staking not wooing customers

Source: Avoid the four perils of CRM by Rigby, Reichheld and Schefter. HBR, February 2002.

34

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

35

10% beneficial change in

increases NPV by %

Targets Differentiation Strategy:

Loyalty

New customer acquisition cost

New customer conversion rate

New customer revenue change

Cost of repeat customer

Conversion

0.84

2.32

4.64

0.69

Repeat customer revenue change

Repeat customer conversion rate

Customer churn rate

Retention 5.78

9.49

6.65

Visitor acquisition cost

Visitor growth

Attraction 0.74

3.09

36

Source: Frederick Reichheld and W. Earl Sasser, Customer Retention: A New Star to Steer By, Working Paper, Bain & Company,

November 1999.

10

20

30

40

50

60

Auto Service

Chain

Business

Banking

Credit

Card

Credit

Insurance

Insurance

Brokerage

Industrial

Distrib.

Industrial

Laundry

Office

Building

Management

Software

P

e

r

c

e

n

t

I

n

c

r

e

a

s

e

i

n

P

r

o

f

i

t

28%

35%

125%

25%

50%

45%

55%

40%

35%

And Profits

Profit Impact of 5% Increase in Retention

37

Loyalty

Loyalty has been hijacked and

tortured by opportunistic

marketeers. Your search will

reveal more than 100,000

(1,620,000 actual) loyalty related

pages overwhelmingly dominated

by loyalty cards, loyalty marketing,

loyalty programs, and my personal

favorite loyalty schemes. It seems

that loyalty has been reduced to a

potpourri of marketing gimmicks

designed to manipulate customer

behavior with cheap bribes.

Frederich Reichheld,

Loyalty Rules!

Loyalty obviously demands

superior profits, but it demands

more. It requires that those

profits be earned through the

success of partners, not at

their expense. Loyalty can be

earned only when leaders put

the welfare of their customers

and their partners ahead of

their own self-serving interests.

Isnt

Is

Data = Satisfaction = Loyalty

38

Lock-in vs. Loyalty

Truly Loyal Accessible

Locked-in High Risk

Attitude

Behavior

Positive Negative

High

Low

Source: Stakeholder Power, 2001 Steven Walker and Jeffrey W. Marr Perseus Publishing

Purchase Dont Purchase

Enjoy

Despise

39

Loyalty Programs

American Stores

Neiman Marcus

J.C. Penney

Toys R Us

Office Max

Staples

Kohls

Target

Saks

Sears

CVS

Citgo

Rite Aid

Daytons

Nordstrom

Federated

Medicine Shoppe

Amoco Conoco Exxon Phillips Shell Ultramar A&P Albertsons

TJX

Kroger

Zellers

Talbots

Safeway

Value City

Food Lion

Foot Locker

Victorias Secret

Source: The Price of Loyalty by James Cigliano, Margaret Georgiadis, Darren Pleasance, and Susan Whalley. The McKinsey Quarterly 2000 number 4.

US Retailers

with Loyalty

Programs

Costs: $1.2 Billion tied up in

annual customer discounts

Entitlement: The programs

are nearly impossible to

stop

Dont work: most customers

are looking for an alternative

Non-value Reward: If

customer spends $500 per

year most programs would

only give $5.

Most Programs Fail Because:

1 Dual Purpose programs. (Targets Take

Charge of Education donates 1% of Purchases)

2 Built to provide customer

information. (Grocery Stores use to obtain information)

3 Align the Organization!!

Successful programs are:

40

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

41

The Perils of Market Focus

Listen to the wrong

customers:

Too many

messages:

everyone is

approaching

customers

with

relationship

Companies

offer intimacy

but are not

able to

reciprocate

with custom

offerings

Focus on

too small

of a group

while

alienating

many

customers

1

2

3

4

Data = Satisfaction = Loyalty = Payback

Customers actually

miss the days when

a transaction was

just a transaction,

when purchasing a

bar of soap didnt

mean entering into a

lifetime value

relationship.

The Hotel

asks me for

detailed

information

every time I

check in.

The rental car

shuttle made

me walk

because I

wasnt club

member. But I

was a loyal

customer

Sony Walkman

and Chrysler

Minivan were

both products

that customers

in focus groups

said they did

not want.

Source: Torment Your Customers (theyll love it) by Stephen Brown. Harvard Business Review, October 2001. And Preventing the Premature Death of Relationship

Marketing by Susan Fournier, Susan Dobscha and David Glen Mick. HRB Jan-Feb1998.

42

Examples

Sure they can call me at dinner, but I cant reach

them on the phone. They can send me 100 pieces

of mail per year, but I cant register one meaningful

response with them. Companies claim that theyre

interested in the customer. But the focus is on the

company

From Preventing the Premature Death

of Relationship Marketing Fournier,

Dobscha, and Mick, HBR 1997.

43

Build to Order

Build to Replenish

Build to Forecast

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1992 1994 1997 1999

From Dealer

Stock

Via Dealer

Out of

Distribution

Centers

Build to Order

McKinsey estimates

that in auto

manufacturing alone

BTO could save $80

Billion a year in

reduced excesses

stock

Why the Clamor?

Sales of mass market cars in Britain

While BTO has

eluded many firms,

others have made

significant progress

by using

ChoiceBoards.

The Myth of Mass Customization

DELLs ChoiceBoard Options

Source: A long march The Economist, July 14, 2001

44

Chaos

Conflict

Coordination Failure

Ownership and Accountability

From Matrix to Cubic Organization

CEO

North America Europe Asia

Production

Service

Sales

Marketing

Geography

2X 3X

1

2

3

1

2

Matrix

2

45

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

46

The Duality of Market Driven

Organizations

Accountability

Coordination

Decentralized

Centralized

Product Focused Market Focused

Vs.

Vs.

Vs.

47

Internal Challenges - Information

Wall Street doesnt care how much product

we sell to a particular customer.

A Corporate Executive

Getting the information from the business silos and

combining it to see all interaction with a customer

Coordinating

Mechanism

Unified View of

the Customer

Aggregate the

information

Business

Silos

We had 86 internal

accounts for IBM

We aggregated

all IBM

information

One view of the

big picture of IBM

48

Challenges - Coordination

Give and Take

A B C

A

B

C

Product Silos

Solution

Clients dont care if a certain business line is losing money.

They view the account in its entirety. Clients want

accountability. They want you to run the relationship as

business not a product

Account Manager

49

External Challenges

New Sales Methods Alignment

Economics Mega Aggregators

Channel Conflicts

50

Information Can Be Consolidated at a

Any Level

No Segments

The Organization

Level

Some Segments

Various Types of

Customers

1-2-1 Direct

The Individual

Customer

Customer Segmentation Continuum

Average

Customer the

Soccer Mom

Club Wed

Lullaby Club

Target.direct

51

Targets Vendor Club

6 Premium Charter

Memberships

Exclusive opportunity to partner

Guest centric analytics

Targeted offers

Target Visa - electronic offers and

marketing support

Club Red exclusive offers

Now September 2003

$1.5 Million

10 Charter

Memberships

Target Visa electronic offers and

marketing support

Club Red exclusive offers

Now September 2003

$750,000 Million

Vendors input $16.5 million

Target will offer:

52

Other Benefits of the Vendor Club

Build a Competitive Advantage

18 month limited access

Guest Data Base

Analytics Suite

Focused Attention

New Channels

Vendor Opportunities

1. Offer a $ or % off one

or more items bought

in a single

transaction

2. Offer $ or % off one

or more items bought

in multiple

transactions

3. Offer free item with

single or multi

purchase

Access to Guest Specific Data

Whos Buying What

Who Are Your Key Segments

Market Basket Analysis

Geographic Profile

53

Case Study: The Problem of Complexity-

Who Owns Customer Loyalty?

Median Age (female) in 2001

Median Income

% College Graduate +

% Professional/ Managerial

% with Children <18 at Home

Target Wal-mart Kmart

44 46 47

$51 $44 $42

40

38

41

32 29

31 29

38 35

Guest

Location: The Store Managers own this Dimension

MULTIBRAND Target, Mervyns, Marshall Fields

Item The Merchants

Own the Item

Dimension

MULTICHANNEL-

Store, Web, Mail

Transaction Need to introduce the guest

dimension without losing the

Item and Location

dimension

54

The Role of The Chief Guest Officer

Chief Guest Officer

Vendors

Information

Merchants

Store

Managers

Other relationships are much more difficult

55

Trade Offs

High

Low

Independent

Integrated

56

Road Map

CRM= Customer + Relationship + Management

The Rise and Fall of CRM

Strategic Framework for CRM

Why CRM Fails

Lock-in vs. Loyalty

The Dark Side of Market Focus

Targets Market Focused Strategy and the

Challenges of Implementation

Conclusion

57

Differentiation Advantages

Differentiation allows a firm to command a premium price for its product or

service.

Competitive advantage is realized if the value of the price premium is greater than

the cost of differentiation.

Differentiation strategies require a deeper understanding of the customers needs

(customer value chain) than cost-based strategies. This typically requires an

in-depth customer segmentation analysis.

Differentiation strategies often require a different firm value chain with

appropriate linkages between the value chain of the firm and that of the

customer (e.g., Dell provides desired customization for each customer).

Differentiation may be more sustainable than cost leadership because it is build

on features that are harder to imitate.

58

CRM and Loyalty

Respond

Identify

Dialogue

Interpret

Truly Loyal Accessible

Locked-in High Risk

Attitude

Behavior

Positive Negative

High

Low

Purchase Dont Purchase

Enjoy

Despise

59

Challenges

Accountability

Coordination

Decentralized Centralized

Product Focused Market Focused

Vs.

Vs.

Vs.

New Sales Methods Alignment

Economics Mega Aggregators

Channel Conflicts

Internal

External

60

Examples

61

CRM Best Practice: Williams - Sonoma

Source: Adapted from 2000 Annual Statement

Seek to own the home through multi-channel retailing

Become the single most dominant force in

home furnishings by selling great products in

stores, through catalogs, and on the Internet.

Williams-Sonoms delivers on this vision

through powerful brands, consumer

satisfaction, channel synergy, vertical

integration, and operating efficiency.

Williams-Sonoma knows their consumers, and understands how the

marketing they do impacts their behavior. For example, they know

that mailing a new catalog boosts traffic in the retail stores. The

stores in turn provide consumer data that is leveraged by the

catalog, Internet, and merchandising groups to deliver better

solutions to consumers.

62

CRM Best Practice: Ford

Source: Accenture Consulting

The company began by building a data warehouse to provide a single, integrated

view of each consumer.

The second step was analyzing the consolidated data to achieve superior

consumer understanding as a basis for one-to-one marketing. The result:

unprecedented ability to understand consumers and differentiate and target

marketing messages.

The third step was leveraging the results of data analysis to create highly targeted

marketing campaigns. They also developed metrics to gauge campaign

effectiveness, as well as procedures to ensure that all data collected in campaigns

are captured by the company's data warehouse for continual enrichment of

consumer profiles.

The company now has a rich,

constantly expanding data source for

predicting consumers' long-term value

and developing appropriate, targeted

campaigns for every stage of its

relationship with a consumer.

1

2

3

63

CRM Best Practice: DuPont Agricultural

Products

DuPont project team that began by interviewing employees to gain

insight into their needs for serving consumers and to help them

understand the multi-level consumer base resulting from DuPont's

acquisition of Pioneer. Then the team designed and built a data

warehouse, seeing it as the strongest solution for gaining consumer

insight and the best basis for building consumer offers.

The data warehouse consolidated and cleaned existing consumer

information from all sources and was equipped to capture new data from

transactions and to permit updates.

The next step: leveraging the warehouse with TruChoice, a marketing

application with built-in incentives for farmers to encourage purchases

and for dealers to encourage data sharing.

TruChoice launched at the end of 1999, and results have been

outstanding. DuPont expects sales growth in their corn and soybean

operations; dealers and distributors have overcome their distrust and

begun providing consumer data; and farmers are so sold on TruChoice

that in areas in which it's not offered they're demanding dealers make it

available.

Source: Accenture Consulting

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- American AccentDocument40 pagesAmerican AccentTimir Naha67% (3)

- Electrical ConnectorsDocument5 pagesElectrical ConnectorsRodrigo SantibañezNo ratings yet

- 7 TariffDocument22 pages7 TariffParvathy SureshNo ratings yet

- Sophia Program For Sustainable FuturesDocument128 pagesSophia Program For Sustainable FuturesfraspaNo ratings yet

- Appendix - 5 (Under The Bye-Law No. 19 (B) )Document3 pagesAppendix - 5 (Under The Bye-Law No. 19 (B) )jytj1No ratings yet

- Bajaj Allianz InsuranceDocument93 pagesBajaj Allianz InsuranceswatiNo ratings yet

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocument2 pagesSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNo ratings yet

- Hayashi Q Econometica 82Document16 pagesHayashi Q Econometica 82Franco VenesiaNo ratings yet

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- Agricultural Economics 1916Document932 pagesAgricultural Economics 1916OceanNo ratings yet

- COOKERY10 Q2W4 10p LATOJA SPTVEDocument10 pagesCOOKERY10 Q2W4 10p LATOJA SPTVECritt GogolinNo ratings yet

- NOP PortalDocument87 pagesNOP PortalCarlos RicoNo ratings yet

- Efs151 Parts ManualDocument78 pagesEfs151 Parts ManualRafael VanegasNo ratings yet

- TEVTA Fin Pay 1 107Document3 pagesTEVTA Fin Pay 1 107Abdul BasitNo ratings yet

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNo ratings yet

- Form Three Physics Handbook-1Document94 pagesForm Three Physics Handbook-1Kisaka G100% (1)

- Discover Mecosta 2011Document40 pagesDiscover Mecosta 2011Pioneer GroupNo ratings yet

- CIR Vs PAL - ConstructionDocument8 pagesCIR Vs PAL - ConstructionEvan NervezaNo ratings yet

- Historical Development of AccountingDocument25 pagesHistorical Development of AccountingstrifehartNo ratings yet

- Laporan Praktikum Fisika - Full Wave RectifierDocument11 pagesLaporan Praktikum Fisika - Full Wave RectifierLasmaenita SiahaanNo ratings yet

- Hexoskin - Information For Researchers - 01 February 2023Document48 pagesHexoskin - Information For Researchers - 01 February 2023emrecan cincanNo ratings yet

- Properties of Moist AirDocument11 pagesProperties of Moist AirKarthik HarithNo ratings yet

- Continue: Rudolf Bultmann Theology of The New Testament PDFDocument3 pagesContinue: Rudolf Bultmann Theology of The New Testament PDFpishoi gerges0% (1)

- BCG - Your Capabilities Need A Strategy - Mar 2019Document9 pagesBCG - Your Capabilities Need A Strategy - Mar 2019Arthur CahuantziNo ratings yet

- Final ExamSOMFinal 2016 FinalDocument11 pagesFinal ExamSOMFinal 2016 Finalkhalil alhatabNo ratings yet

- Hip NormDocument35 pagesHip NormAiman ArifinNo ratings yet

- Fidp ResearchDocument3 pagesFidp ResearchIn SanityNo ratings yet

- PVAI VPO - Membership FormDocument8 pagesPVAI VPO - Membership FormRajeevSangamNo ratings yet

- Unit Process 009Document15 pagesUnit Process 009Talha ImtiazNo ratings yet

- CV Ovais MushtaqDocument4 pagesCV Ovais MushtaqiftiniaziNo ratings yet