Professional Documents

Culture Documents

Initial Public Offer

Uploaded by

suchitracool10 ratings0% found this document useful (0 votes)

33 views11 pagesprimary market

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentprimary market

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views11 pagesInitial Public Offer

Uploaded by

suchitracool1primary market

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 11

Initial Public Offer

An IPO is when a company which is presently

not listed at any stock exchange makes either

a fresh issue of shares or makes an offer for

sale of its existing shares or both for the first

time to the public. Through a public offering

the issuer makes an offer for new investors to

enter its shareholding family.

Thus IPO is considered an important milestone

in a companys lifecycle making its transition

from a closely held company to listed entity.

IPO can be done either through a fresh issue

of shares by the company or through an offer

for sale of existing shares to investors.

In the case of fresh issue, fresh capital is

injected into the company and its equity base

expands.

In the offer for sale there is no infusion of

capital in the company because proceeds of

the issue go to the shareholders who offer

their shares for sale.

In 2010, SEBI prescribed a minimum threshold

level of public holding to be 25% for all listed

companies.

Why does a company make an IPO

It provides the companies to raise cash for

setting up a project or for

diversification/expansion or sometimes for

working capital or even to retire debt or for

potential acquisitions. In this the proceeds go

to the company.

Companies also go public to provide a route

for some of the existing shareholders

including venture capitalists to exit fully or

partially from the companys shareholding or

for promoters to partially dilute their holdings.

This called an offer for sale.

An offer for sale is open for only a single

trading day. The company shares are sold in a

single trading day and only during the normal

trading hours

An offer for sale (OFS) is the way by which

stakeholders of a company sell their holding.

OFS enables promoters to dilute their holdings

in listed companies in a transparent manner

with a wider participation through exchange

based bidding platform.

Capital market regulator SEBI (Securities and

Exchange Board of India) in July 2012 allowed

stock exchanges to set up a separate window

OFS wherein promoters can sell their

shares in listed companies.

The OFS window has been created to give

promoters an easy option to comply with the

minimum public shareholding requirement.

The OFS route helps the promoters of an

already listed company to sell their existing

shareholdings through an exchange-based

bidding platform.

Who are the participants -

The promoters of the company are sellers in

the OFS process. They can only sell the shares

and not buy them. The buyers include foreign

institutional investors (FIIs), mutual funds,

insurance companies, individuals and HUFs

(Hindu Undivided Families) among others.

The shares are made available to the investors

at the price determined by the promoters of

the company in consultation with its

investment bankers.

The successful completion of an IPO leads to

the listing and trading of the companys shares

at the designated stock exchanges

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

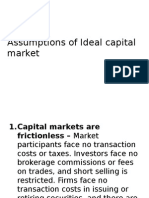

- Assumptions of Ideal Capital MKT and Its ViolationsDocument17 pagesAssumptions of Ideal Capital MKT and Its Violationssuchitracool133% (3)

- Competition Act 2002, IndiaDocument41 pagesCompetition Act 2002, Indiasuchitracool1No ratings yet

- Diffrence Between Monetary and Fiscal PolicyDocument1 pageDiffrence Between Monetary and Fiscal Policysuchitracool1No ratings yet

- Cost AnalysisDocument10 pagesCost Analysissuchitracool1No ratings yet

- Classical Theory of EmploymentDocument16 pagesClassical Theory of Employmentsuchitracool1100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- P394 WindActions PDFDocument32 pagesP394 WindActions PDFzhiyiseowNo ratings yet

- Group 1 Disaster Management Notes by D. Malleswari ReddyDocument49 pagesGroup 1 Disaster Management Notes by D. Malleswari Reddyraghu ramNo ratings yet

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocument31 pagesProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartNo ratings yet

- (X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Document9 pages(X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Bharath KumarNo ratings yet

- PFI High Flow Series Single Cartridge Filter Housing For CleaningDocument2 pagesPFI High Flow Series Single Cartridge Filter Housing For Cleaningbennypartono407No ratings yet

- Job Description For QAQC EngineerDocument2 pagesJob Description For QAQC EngineerSafriza ZaidiNo ratings yet

- Building and Other Construction Workers Act 1996Document151 pagesBuilding and Other Construction Workers Act 1996Rajesh KodavatiNo ratings yet

- Building New Boxes WorkbookDocument8 pagesBuilding New Boxes Workbookakhileshkm786No ratings yet

- Sample Opposition To Motion To Strike Portions of Complaint in United States District CourtDocument2 pagesSample Opposition To Motion To Strike Portions of Complaint in United States District CourtStan Burman100% (1)

- Kaitlyn LabrecqueDocument15 pagesKaitlyn LabrecqueAmanda SimpsonNo ratings yet

- CoDocument80 pagesCogdayanand4uNo ratings yet

- Squirrel Cage Induction Motor Preventive MaintenaceDocument6 pagesSquirrel Cage Induction Motor Preventive MaintenaceNishantPareekNo ratings yet

- MMC Pipe Inspection RobotDocument2 pagesMMC Pipe Inspection RobotSharad Agrawal0% (1)

- IdM11gR2 Sizing WP LatestDocument31 pagesIdM11gR2 Sizing WP Latesttranhieu5959No ratings yet

- SM Land Vs BCDADocument68 pagesSM Land Vs BCDAelobeniaNo ratings yet

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocument3 pagesArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarNo ratings yet

- Health Insurance in Switzerland ETHDocument57 pagesHealth Insurance in Switzerland ETHguzman87No ratings yet

- CLAT 2014 Previous Year Question Paper Answer KeyDocument41 pagesCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuNo ratings yet

- TAS5431-Q1EVM User's GuideDocument23 pagesTAS5431-Q1EVM User's GuideAlissonNo ratings yet

- Richards Laura - The Golden WindowsDocument147 pagesRichards Laura - The Golden Windowsmars3942No ratings yet

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Document11 pagesIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaNo ratings yet

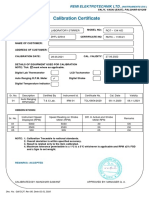

- Calibration CertificateDocument1 pageCalibration CertificateSales GoldClassNo ratings yet

- L1 L2 Highway and Railroad EngineeringDocument7 pagesL1 L2 Highway and Railroad Engineeringeutikol69No ratings yet

- Loading N Unloading of Tanker PDFDocument36 pagesLoading N Unloading of Tanker PDFKirtishbose ChowdhuryNo ratings yet

- Lab 6 PicoblazeDocument6 pagesLab 6 PicoblazeMadalin NeaguNo ratings yet

- Test & Drain Valve Model 1000Document2 pagesTest & Drain Valve Model 1000saifahmed7No ratings yet

- Innovations in Land AdministrationDocument66 pagesInnovations in Land AdministrationSanjawe KbNo ratings yet

- 2.1 Components and General Features of Financial Statements (3114AFE)Document19 pages2.1 Components and General Features of Financial Statements (3114AFE)WilsonNo ratings yet

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- Dry Canyon Artillery RangeDocument133 pagesDry Canyon Artillery RangeCAP History LibraryNo ratings yet