Professional Documents

Culture Documents

Marginal Break Even

Uploaded by

Namrata NeopaneyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marginal Break Even

Uploaded by

Namrata NeopaneyCopyright:

Available Formats

Marginal Costing and Break Even Analysis

Learning Objective:

1. Understand the meaning of Marginal Cost and

Marginal Costing

2. Understand Concepts of Contribution

3. Determine Break-even point and Margin of Safety

4. Prepare Break-even Charts.

5. Understand the application and limitations of

marginal costing.

Concepts of Marginal Costing

Marginal Costing is developed to overcome the deficiencies

of absorption costing.

In absorption costing both Fixed and Variable cost are

charged to the products manufactured.

Variable cost vary in the production with the change in the

volume of the output.

Hence they do not affect the production.

Quite opposite to this Fixed Cost remain constant upto

certain level of output. Fixed Costs per unit go on changing

per unit with every increase in production.

Because of the changing effect to fixe cost, the cost

of production per unit changes at different levels of

production.

To overcome this major limitation marginal costing

has been developed

The Term Marginal Costing is defined by the ICMA

London as follow

The ascertainment of marginal costing and of the

effect on profit of changes in volume or type of

output by differentiating between fixed costs and

variable costs.

Under marginal Costing only variable costs are

charged to operation and processes or Products.

Fixed Cost are charged against the excess of sales

revenue over the total variable costs.

Difference between Variable and Fixed Cost

Marginal Cost

Marginal Cost incurrent when one more unit is

produced.

It is typically differs across different range of

production quantities because the efficiency of the

production process changes.

The marginal Cost of producing a unit declines as

output increases.

So Marginal Cost means the amount at any given

volume of output by which aggregates costs are

changed if the volume of output is increased or

decreased by one unit.

Marginal cost included three elements :

1. Ascertainment of marginal costs

2. Finding out effects on profit, due to changes in

volume of production and type of output.

3. Differentiating between Fixed and Variable costs.

In Short run ,

Marginal cost refers to the aggregate of variable cost

i.e Prime cost + All variable overheads

Marginal Cost=Prime Cost +Total Variable Overheads

Or

Marginal Cost = Total Variable Cost.

Differentiation Fixed and Variable costs

Fixed Costs: Remain Fixed within a given rage of

output. They depend mainly on passage of time.

The do not vary directly with rate of output. Hence

they called Period Cost.

Example of Fixed Costs: Management expenses, Rent

rates, Insurance.

Fixed Costs are Transferred to the marginal profit

and loss account of the period. It is not carried to

the next Financial Period through Closing Stock in

the unit.

Variable Cost: is also called marginal Cost. Total

Variable costs increase with the increase in the

volume of output. But Variable cost per unit of

production remain constant at different lave of

output. Hence it is called Product Cost.

Valuation of Closing stock: Fixed Cost is not

changed to finished stock or work in progress as it is

treated as period cost. It is recovered during the

period in which it is incurred by transferring to the

profit and loss account. Thus closing stock(including

working progress) is valued at marginal

cost(Variable cost) only.

Concepts of Marginal Costing

The Difference between Selling Price and Marginal

cost (Variable cost) is called Contribution.

It Contributes towards fixed costs and Profit. It can

be represented as follow:

Contribution=Selling Price Variable (Marginal Cost)

Or Contribution = Fixed Cost + Profit (Or - Loss)

Thus

Sales= Variable Cost+ Fixed Cost + Profit (Or Loss)

Sales - Variable cost = Fixed Cost+ Profit (Or- Loss)

Concepts of P/V Ratio

[Profit Volume Ratio Or Contribution Sales Ratio]

A basic assumption in marginal costing is that

selling price remains constant at different levels of

sales.

Further marginal cost per unit also remains

constant at different volumes of production.

As a result these two factors contribution per unit

must also remain the same at all level of Sales.

Contribution always bears definite percentage to

sales. This relation of contribution to sales is called

P/V ratio.

P/V ratio measures profitability of Product, process,

departments etc. the P/V ratio can be increased by

improving the P/V ratio.

The P/V ratio can be improved by:

1. Increasing the Selling Price Per Unit

2. Decreasing the Marginal cost(mainly PC +VC)

3. Increasing the Sales and Decreasing the Marginal

costs.

P/V ratio is used in the determination of

1. Break Even Point

2. Profit at any volume of Sales

3. Sales Volume to earn a desired Profit

4. Profitability of Product and Process

P/V ratio is calculated as Follows

P/V ratio = Contribution/Sales

Or P/V ratio= (Fixed Cost + Profit) /Sales

OR (Sales Variable Cost)/Sales

P/V ratio may be expressed as percentage by

multiplying the above calculation by 100.

Concept of Break- Even Point

Break Even point: represents the volume of sales or

production where there is No Profit No Loss.

At this point TOTAL SALES is just equal to TOTAL COST.

At Break Even point contribution is equal to fixed costs.

Sales below this point results in loss as the sales value

is less then the total cost.

Sales above the break-even point brings profit since

the total cost is less than the sales value.

Break even point is the point at which the total cost

line the total sales lines.

Break Even Point (Units)= Total fixed Cost/Contribution

per unit

Break Even Sales = Total Fixed Costs * Selling Price Per unit

Contribution Per Unit

Library Work:

Break Even Chart :

Advantages and Disadvantages of Break Even Chart

Margin of Safety: The Difference between sales and

the break even sales is called Margin of Safety. This

is the area of earning profit. A reasonable margin of

safety should be there, otherwise a small fall in

demand may be result in total loss.

Margin of Safety : Sales Break- even Sales

Or Profit / P/V ratio

Break Even Analysis

It is popularly know as cost volume profit

relationship. It show the level of operation where

cost and revenue are in equilibrium. It indicates

clearly the effect of changes in volume on profits.

As analysis of break-even data will reveal the effect

of various decision changing the size of fixed and

variable costs, Volume of production, Selling Prices

and Product Mix.

Advantages of Marginal costing

Fixation of Price:

Fixation of Price below the TOTAL COST of Production

In Special circumstances price may be below total cost

for Example:

1. Recession or depression

2. Competition

3. New level of Product

4 .Special Markets.

5. Special Customers etc.

Cost Control: Marginal Cost provides variable costs and

fixed costs separately. Cost information is reported

periodically and regularly to the management for decision

making and controlling the cost

Make or Buy Decision : it is often necessary to decided

whether a component be produced internally or to be

bought from outside. This decision can be taken by

comparing the purchase price with the marginal cost of

producing it. If the Marginal cost is less than the purchase

price the component may be manufacture utilizing existing

capacity.

Profit Planning: It is easy to plan the future operation to

earn maximum profit or to maintain specific levels of

production through break-even analysis

Utilization of Scares Resources:

{Problem of Key factor or limiting Factor}

Key factor is that resources which limits the

production and consequently decides the profit of

firm.

Limiting factor may be raw materials, Labor, Plant

capacity or capital.

The best utilization of such scarce resources is

guided by marginal costing technique. Contribution

and Contribution per unit of limiting factor indicates

the product or products whose production is to be

increased or reduced to stopped to earn the

maximum profit .

Choice of Profitability Product mix: Where

factory manufacture two or more product the

problem of selecting suitable combination of

different product arises. Marginal costing guides

that the products which gives the maximum

contribution, are to be produced in larger

quantities and products which gives lower

contribution are to reduced.

Performance Evaluation of Product.

Library Work

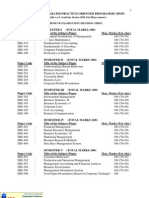

P/V Ratio = C/S; (S-V)/S ; (F+P)/S F/BEP;

Change in Profit

=(Changing in profit/Change in Sales)*100

BEP {Sales} = F/PV; (F*S)/ (S-V) ; (F*S)/C

B.E. Units = Total FC/ Contribution Per Unit

Profit = (PV)*(S-F); PV * Margin of safety

Fixed Cot = PV*BEP ; PV*(S-P)

Variable Cost = S-(F+P); S-C

Sales = C/PV; (S-V)/PV; (F+P)/PV

Desired Sales (units) = (F+ Desired Profit) C. per Unit

Desired Sales (Value) = Total C desired *Selling price

C. per Unit

Margin of Safety = S-BEP

Contribution = S-V

Contribution Margin Approach

How many Ice-Cream, having a unit costs of Rs. 2

and a selling price of Rs. 3, must a vendor sell in a

fair to recover the Rs. 800 fees paid by him for

getting a selling stall and additional cost of Rs. 400

to install the Stall?

A Company budget productions of 5,00,000 units at a

variable cost of Rs. 20 each. Fixed Costs are Rs. 20,00,000.

the selling price is fixed to yeild 25% profit on total cost.

You are required to calculate

A. P/V Ratio B. Break-even Point

Ans: Variable Cost: Rs. 20

Fixed Cost Rs. 4

Total Cost =Rs. 24

Profit = 24*25/100 = Rs. 6

Selling Price = Rs. 30

Contribution = Selling Price Variable Cost = 30 20= Rs.10

P/V ratio= C/S = 10/30 = 1/3 0r 33.33%

BEP = F/P/V = 20,00,000/1/3 or

= 20,00,000*3/1 = Rs. 60,00,000

1. Calculate the break-even point from the following

figures. Total sales Rs. 2,75,000 Variable Exp. Rs.

5,00,000 Net Profit Rs. 1,08,000.

2. From the following Details find out the BEP

Variable cost per unit Rs. 30. Total Fixed Cost

Rs.1,08,000. Selling Price per unit Rs. 40. What

should be the selling Price per unit is BEP should

be bought down to 6,000 units?

3. From the following data calculate BEP and number

of units to be sold to earn a profit of Rs. 3,000 per

year. Selling price per unit Rs. 10, Variable cost per

unit Rs. 7. Fixed cost Rs. 27,000 Selling Rs. 12,600.

The cost data of Makaibari Tea Estate Ltd as

Material Rs.400; Labour- Skilled (Fixed) Rs. 200

other Rs 300: fixed Expenses Rs.400; Variable

Expenses Rs.200. the selling price per(kg) is Rs.

1700. These Figures are for an output of 80,000 Kg.

The capacity is 1,00,000 Kg. A foreign customer is

desirous of buying 20,000 Kg at a price of Rs.1200/

per Kg. Advice the manufacturer whether the order

should be accepted or rejected.

KS oil factory is producing two different product

kinds of articles, the limiting factor is the availability

of labour. From the following information show

which product is more profitable.

Product Blue Product Red

Material Rs. 5 Rs. 5

Labour 6 hr @Rs. 5 Per Hr Rs. 30

Labour 3 hr @Rs. 5 Per Hr Rs.15

Fixed Overheads- 50% :Labour Rs. 15 Rs. 7

Variable Cost Rs. 15 Rs. 15

Selling Price Rs. 95 Rs.65

Total production units 500 600

The Following Figures are available from the records

of Venus Enterprises as at 31

st

March

2008 2009

Sales (Rs. Lacs) 150 200

Profit (Rs.Lacs) 30 50

Calculate:

a) the P/V Ratio and Total Fixed Expenses

b) The Break-even Analysis

C) Sales Required to earn a profit of Rs.90Lacs

d) Profit Or loss that would arise if the Sales were

Rs. 280 lacs.

Reprographics Ltd. Manufacture a duplicating machine

which gas a variable cost structure as material Rs.

40,Labor Rs. 10, Overhead Rs. 4 and selling price of

Rs.90. Sales During the current year are expected to be

Rs. 13,50,000 and fixed cost Rs.1,40,000. Under a

Wages agreement, an increment of 10% is payable to

all direct workers from the beginning of the information

year while material costs are expected to increase by

7.5% Variable cost by 5% and fixed cost by 3%

You are required to calculate:

A . New selling Price if the current P/V ratio is to

maintained

The quantity to be sold during the forthcoming year to

yield the same amount of profit s the current year

assuming the selling price to remain at Rs. 90.

From the following information, calculate the

turnover required to earn a profit of Rs. 30,000 and

Break-even Point. Fixed Cost Rs. 21,000 variable

Cost Rs. 2 per unit; Selling Price Rs. 5 Per Unit. if

the company is earning a profit of Rs. 30,000

express the margin of Safety available to it.

From the Following Data calculate the Break-even

Point; Sales Price Rs. 40, Direct Material Rs.16

Direct Labour Rs. 4 Variable Overheads Rs. 6.

Fixed Cost Rs. 40,000. if Sales are 20% above the

Break-even Point, Calculate the profit.

Calculate the Break even Volume From the

Following information. Profit Rs. 10,000 [20% Sales]

P/V ratio 50%.

Find out the total Profit and Marginal Cost per unit

from the following details. Fixed cost Rs. 9000

Break-even Units 3000, Total Sales (units) 5000

Selling Price per Units Rs. 9.00.

From the Following Details, find out the BEP.

Variable cost per unit Rs. 30. Total Fixed Cost Rs.

108000. Selling Price Per Unit Rs. 40. What would

be the selling price per unit if the BEP should be

brought down to 6000 units.

A Company established that next year it would be

possible to sell 100000 units of product at Rs. 1 per

unit. The estimated Fixed cost and Variable cost are

Rs. 50000 and Rs. 40,000 respectively. Assuming the

price increase of 10% and consequently a reduction

of 5% is sale volume, compute the amount of sales

which company will earn Rs. 30,000 more profit

that the estimated Profit.

Mr. Ramesh sells a line of article for Rs. 18 per unit.

Each unit sold contributes Rs. 60 to the recovery of

fixed cost and to profit. His fixed cost of operation is

Rs. 84000. show how many units must be sold to

Break-even and compute the sales revenue at the

BEP and the sales required to earn a net profit of

Rs. 54000

Profit/ Volume Analysis

A Cost Volume Profit analysis can be used to

measure the effect of factor changes and

management decision alternative on profit.

These Factors Include possible changes in Selling

Price, Changes in Variable Cost or Fixed Cost

Expansion or Contraction of Sales Volume, or other

changes in operating methods.

It More useful in Profit Analysis is also useful for

problems of Product pricing, Sales mix, Adding and

Deleting product lines and Accepting a new sales

order.

Changes in Selling Price: (Effects)

Increase In Selling Price:

Will Increase P/V ratio, and the

Rate of Fixed Cost recovery is Increased

The breakeven Point (Sales Volume) declines.

Profit beyond the break point will increase

Loss below the break even point will decrease.

Decrease in Selling Price

All point will reverse.

A Company produce a product with a selling price

of Rs. 10 per unit and a variable cost of Rs. 4 per

unit. Fixed Costs are Rs. 36,000 per year.

Show the effect of 20% increase and decrease in the

present selling price.

Change in Variable Cost

Increase in Variable Cost:

(increase in Variable Cost has the same effect in

Decrease in Selling Price)

It Decrease the P/V Ratio

fixed Cost Recovery is slower

The break Even point will move to higher side

Profit after the break even point decreases

Loss before the Break Even Point will increase.

Decrease in Variable Cost:

Same Effect as Increase in Selling Price

A Company is selling a product for Rs. 40 a

unit and has a variable cost of Rs. 20 per unit.

Fixed cost total Rs.48,000 per year. Show the

effect of a 20% increased and a 20 % decrease

in Variable cost.

Change in Fixed Cost

Increase in Fixed Costs : (Effects)

The break-even point (Volume) will increase.

Profit Above the break-even point are lower by

the amount of the increase in Fixed cost.

Below the Break Even point losses Increase

Decrease in Fixed Costs : (Effects)

It Lowers the break-even point

The Profit are greater by the amount of the

decrease, and the losses are smaller by the

amount of the decrease in Fixed Cost.

A Company has a P/V ratio of 40% and present Fixed

Cost of Rs. 50,000. Show the effects of changes in

the fixed cost by Rs. 10,000.

You might also like

- Break Even Analysis Chapter IIDocument7 pagesBreak Even Analysis Chapter IIAnita Panigrahi100% (1)

- Lathe Machine FormulaDocument5 pagesLathe Machine Formulaaman srivastavaNo ratings yet

- 4 CVP AnalysisDocument36 pages4 CVP AnalysisBibaswan BanerjeeNo ratings yet

- Linear Programming ExamplesDocument7 pagesLinear Programming ExamplesgoforjessicaNo ratings yet

- Design For CastingDocument14 pagesDesign For CastingArtemis FowlNo ratings yet

- Final Cost SheetDocument21 pagesFinal Cost Sheetneerajmgoyal100% (1)

- Unit I Office System & ProceduresDocument7 pagesUnit I Office System & ProceduresVishal PatelNo ratings yet

- Hierarchy of VariancesDocument1 pageHierarchy of VariancesQaisar AbbasNo ratings yet

- 7 Costing Formulae Topic WiseDocument86 pages7 Costing Formulae Topic WiseHimanshu Shukla100% (1)

- Cost Accounting MCQs and ProblemsDocument5 pagesCost Accounting MCQs and ProblemsEnbathamizhanNo ratings yet

- Cost and Management Accounting TechniquesDocument5 pagesCost and Management Accounting TechniquesRupal Rohan DalalNo ratings yet

- Lecture 2 Quality ManagementDocument22 pagesLecture 2 Quality ManagementWilliam DC RiveraNo ratings yet

- PepsiCo India's Organizational Structure, Vision, Mission and Core BrandsDocument45 pagesPepsiCo India's Organizational Structure, Vision, Mission and Core Brandsj_sachin09100% (1)

- Demand ForecastingDocument36 pagesDemand Forecastingkcdelacruz.knowledgeNo ratings yet

- Objective Questions and Answers On Operation ManagementDocument24 pagesObjective Questions and Answers On Operation ManagementAjit KumarNo ratings yet

- Cost Classification Theory and Practice QuestionsDocument9 pagesCost Classification Theory and Practice QuestionsBilal Rauf100% (1)

- Criteria For The Choice of Business OrganizationDocument2 pagesCriteria For The Choice of Business OrganizationKavita SinghNo ratings yet

- C&MDocument18 pagesC&MSultanaQuader50% (2)

- I. Product Costs and Service Costs: Absorption CostingDocument12 pagesI. Product Costs and Service Costs: Absorption CostingLinyVatNo ratings yet

- Advanced Assembly LearningDocument3 pagesAdvanced Assembly Learningsusil kumarNo ratings yet

- Chap 14Document59 pagesChap 14DEVYANI WANKHEDENo ratings yet

- Lathe Machine Definition, Working Principle & OperationsDocument13 pagesLathe Machine Definition, Working Principle & OperationsAmin MalikNo ratings yet

- Operation Research & Decision Models EditedDocument26 pagesOperation Research & Decision Models EditedChandru ThulasidassNo ratings yet

- Assembly Line BalancingDocument28 pagesAssembly Line BalancingKashif MirzaNo ratings yet

- New Instructions Manual - New (30-06-2022)Document19 pagesNew Instructions Manual - New (30-06-2022)rarhi.krish8480No ratings yet

- Financial Statement Analysis in 40 CharactersDocument11 pagesFinancial Statement Analysis in 40 CharactersGurneet Singh7113No ratings yet

- Absorption Costing (Or Full Costing) and Marginal CostingDocument11 pagesAbsorption Costing (Or Full Costing) and Marginal CostingCharsi Unprofessional BhaiNo ratings yet

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidNo ratings yet

- Gitman - Principle of Managerial Finance Chapter 2 SummaryDocument6 pagesGitman - Principle of Managerial Finance Chapter 2 SummaryNisha hernandezNo ratings yet

- Decisions Involving Alternative ChoicesDocument3 pagesDecisions Involving Alternative ChoicesHimani Meet JadavNo ratings yet

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow StatementSriram BastolaNo ratings yet

- Ppce - Unit2. Ppts. 02 Aug 15Document26 pagesPpce - Unit2. Ppts. 02 Aug 15Shivam RajNo ratings yet

- Master Budget Case: Turabi LTDDocument4 pagesMaster Budget Case: Turabi LTDFarwa SamreenNo ratings yet

- 7.0 Inventory ManagementDocument24 pages7.0 Inventory Managementrohanfyaz00No ratings yet

- Cost EstimationDocument37 pagesCost EstimationDani WedajeNo ratings yet

- Unit 5Document15 pagesUnit 5Ramesh Thangavel TNo ratings yet

- BEP N CVP AnalysisDocument49 pagesBEP N CVP AnalysisJamaeca Ann MalsiNo ratings yet

- Traditipn Production Planning and ControlDocument16 pagesTraditipn Production Planning and ControlpaulineNo ratings yet

- The Mixed CostsDocument13 pagesThe Mixed CostsFatima's WorldNo ratings yet

- Scope of Supply Chain ManagementDocument7 pagesScope of Supply Chain Managementali afzaly0% (1)

- Measuring Relevant Costs and Revenues for Decision MakingDocument44 pagesMeasuring Relevant Costs and Revenues for Decision MakingMzimasi MjanyelwaNo ratings yet

- Supplier Integration, Mass Customization, Issues To Customer ValueDocument43 pagesSupplier Integration, Mass Customization, Issues To Customer Valuebalaji suryaNo ratings yet

- Chapter Seven: Basic Accounting Principles & Budgeting FundamentalsDocument35 pagesChapter Seven: Basic Accounting Principles & Budgeting FundamentalsbelaynehNo ratings yet

- Managerial Accounting Chapter 5 Practice Exam SolutionsDocument4 pagesManagerial Accounting Chapter 5 Practice Exam Solutionsjklein2588No ratings yet

- Productivity Improvement of AutomotiveDocument26 pagesProductivity Improvement of AutomotivechetanNo ratings yet

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanNo ratings yet

- Lean Principles: Being Fast, Flexible, Economic Author: DR Rhys Rowland-JonesDocument20 pagesLean Principles: Being Fast, Flexible, Economic Author: DR Rhys Rowland-JonesabhijitfrNo ratings yet

- JitDocument26 pagesJitRachanakumari100% (1)

- 6e Brewer CH03 B EOCDocument10 pages6e Brewer CH03 B EOCLiyanCenNo ratings yet

- Management AccountingDocument112 pagesManagement AccountingSugandha Sethia100% (1)

- Topic 7 - Absorption & Marginal CostingDocument8 pagesTopic 7 - Absorption & Marginal CostingMuhammad Alif100% (5)

- "IMPROVING OVERALL EFFICIENCY OF THE CUTTING MACHINES BY IMPLETATION OF PILLARS OF TPM"project Done at Godrej&boyce........Document89 pages"IMPROVING OVERALL EFFICIENCY OF THE CUTTING MACHINES BY IMPLETATION OF PILLARS OF TPM"project Done at Godrej&boyce........Harshad_SNo ratings yet

- Backflush Costing, Kaizen Costing, and Strategic CostingDocument9 pagesBackflush Costing, Kaizen Costing, and Strategic CostingShofiqNo ratings yet

- Module IV - Working Capital ManagementDocument50 pagesModule IV - Working Capital ManagementAshwin DholeNo ratings yet

- BCGTM: Analyze Products Using Growth-Share MatrixDocument31 pagesBCGTM: Analyze Products Using Growth-Share MatrixAshirbad NayakNo ratings yet

- Cost and Cost Classifications PDFDocument5 pagesCost and Cost Classifications PDFnkznhrgNo ratings yet

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Production And Operations Management A Complete Guide - 2020 EditionFrom EverandProduction And Operations Management A Complete Guide - 2020 EditionNo ratings yet

- Coma - 03 - CVPDocument16 pagesComa - 03 - CVPAbhijeet ChandraNo ratings yet

- History AssignmentDocument9 pagesHistory AssignmentNamrata NeopaneyNo ratings yet

- TENSES AND CONCORDDocument4 pagesTENSES AND CONCORDNamrata NeopaneyNo ratings yet

- CH 6 DRsDocument25 pagesCH 6 DRsNamrata NeopaneyNo ratings yet

- Standard CostingDocument15 pagesStandard CostingNamrata NeopaneyNo ratings yet

- CRMDocument23 pagesCRMNamrata NeopaneyNo ratings yet

- Budgetring ControlDocument16 pagesBudgetring ControlNamrata NeopaneyNo ratings yet

- Presentation 1Document13 pagesPresentation 1Namrata NeopaneyNo ratings yet

- DecisionTreePrimer 1Document18 pagesDecisionTreePrimer 1Andrew Drummond-MurrayNo ratings yet

- HRM ProjectDocument45 pagesHRM ProjectNamrata NeopaneyNo ratings yet

- Master Production Scheduling: SCM 461 Dr. Ron Tibben-Lembke Pages: 168-181, 183-188Document35 pagesMaster Production Scheduling: SCM 461 Dr. Ron Tibben-Lembke Pages: 168-181, 183-188A.J. StoneNo ratings yet

- Chapter 3 Sales Ion - Sales and Distribution ManagementDocument14 pagesChapter 3 Sales Ion - Sales and Distribution ManagementNikhil Chand100% (1)

- A Study On Content Marketing On FacebookDocument67 pagesA Study On Content Marketing On FacebookRoney JoseNo ratings yet

- Vacheron Constantin HandoutDocument4 pagesVacheron Constantin HandoutSimon LászlóNo ratings yet

- Supplementary Material in EconomicsDocument75 pagesSupplementary Material in Economicsshelley AgarwalNo ratings yet

- Sample Marketing Plan 2 - Bitis Hunter PDFDocument52 pagesSample Marketing Plan 2 - Bitis Hunter PDFMi ThưNo ratings yet

- Ugc Net Chapter 1 - Tourism and AdministrationDocument17 pagesUgc Net Chapter 1 - Tourism and AdministrationMandeep KaurNo ratings yet

- CB Sec-B - Group-12 - EILEEN FISHERDocument8 pagesCB Sec-B - Group-12 - EILEEN FISHERraghavNo ratings yet

- Used The Business Model of Canvas (BMC) To Create Alternative Strategies in Business Development of The Micro Small Medium EnterprisesDocument10 pagesUsed The Business Model of Canvas (BMC) To Create Alternative Strategies in Business Development of The Micro Small Medium EnterprisesJoven SegueraNo ratings yet

- Perspectives on Events ManagementDocument20 pagesPerspectives on Events ManagementAngelaLingNo ratings yet

- Consumer Buying BehaviorDocument13 pagesConsumer Buying Behaviorsophia naidaNo ratings yet

- Marketing Crop Products 4 StudentDocument34 pagesMarketing Crop Products 4 Studentfeleke philiphosNo ratings yet

- Management Consultant: National Competitiveness, Market Dynamics & Business Analysis Mahesh NarayanDocument183 pagesManagement Consultant: National Competitiveness, Market Dynamics & Business Analysis Mahesh NarayanSidhant NayakNo ratings yet

- Percent Word ProblemsDocument2 pagesPercent Word ProblemsRosemarie AgcaoiliNo ratings yet

- Gorman AggregationDocument26 pagesGorman AggregationGerald HartmanNo ratings yet

- Sunk CostDocument8 pagesSunk Costpratik12188No ratings yet

- Social Media Specialist Skills and ExperienceDocument26 pagesSocial Media Specialist Skills and ExperienceFaisal NurNo ratings yet

- Merchandising Inventory System ComparisonDocument5 pagesMerchandising Inventory System Comparisonmama's cornerNo ratings yet

- 1a. Introduction To RetailDocument32 pages1a. Introduction To RetailAbhay Singh SolankiNo ratings yet

- YouTube Business - Cheat SheetDocument4 pagesYouTube Business - Cheat SheetChristian WagnerNo ratings yet

- Passionate ZomansDocument12 pagesPassionate ZomansRishabh WadhwaNo ratings yet

- UEU Undergraduate 10227 5.ABSTRAK - Image.markedDocument2 pagesUEU Undergraduate 10227 5.ABSTRAK - Image.markedAndy FajarNo ratings yet

- List Two (2) Areas of Legislative and Regulatory Context of An Organisation and Briefly Describe What They InvolveDocument19 pagesList Two (2) Areas of Legislative and Regulatory Context of An Organisation and Briefly Describe What They InvolveTanveer MasudNo ratings yet

- 00 Brief History of PharmacoeconomicsDocument8 pages00 Brief History of PharmacoeconomicsEka Franciska Indra MulyaniNo ratings yet

- BPP Coursework Cover SheetDocument17 pagesBPP Coursework Cover SheetGurpreet KaurNo ratings yet

- Apple Marketing ResearchDocument18 pagesApple Marketing ResearchFARAHNo ratings yet

- MNB 1601Document41 pagesMNB 1601Janine ToffarNo ratings yet

- ColgateDocument7 pagesColgateravina10008No ratings yet

- Ims Kuk SullybusDocument84 pagesIms Kuk SullybusJoginder ChhikaraNo ratings yet

- Deceptive Similarity of TrademarksDocument9 pagesDeceptive Similarity of TrademarksMo0% (1)

- Writing Marketing Plan TemplateDocument8 pagesWriting Marketing Plan TemplateSharon Cadampog MananguiteNo ratings yet