Professional Documents

Culture Documents

Petrozuata Case Study

Uploaded by

Basit Ali ChaudhryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petrozuata Case Study

Uploaded by

Basit Ali ChaudhryCopyright:

Available Formats

PETROLERA ZUATA

PETROZUATA C.A

GROUP MEMBERS

ALIM MUSHTAQ

BILAL ALAM

BASIT ALI

KHURRAM ALI

ATEEQ TAJ

The Case of Petrozuata

Petrolera

Zuata

Conoco

Incorporated

(USA)

Petrleos de

Venezuela

(PDVSA)

(50.1%

Interest)

(49.9%

Interest)

The Sponsors - PDVSA

Currently 3

rd

largest oil refinery and gasoline network in

USA.

State-owned and formed through the nationalization of

other companies assets (Mobil, Exxon, etc) in 1976 of

$1 billion bonds and cash.

Purpose of PDVSA is to mange country resource and

promote economic development

PDVSA is a member of (OPEC) organization of

petroleum exporting countries.

The Sponsors Conoco Inc.

Subsidiary of Dupont (USA)

Has operations in over 200 countries in

1996.

Known for expertise in technology and

extraction processes

Conoco was recognized world leader in

both refinery technology and project

development.

The Joint Venture

PDVSA & Conoco began early feasibility

studies for joint project in 1992.

Three key components

A series of inland wells to produce the extra

heavy crude.

Transportation of the crude oil to coast via

pipeline

An upgrader facility to partially refine the

extra heavy crude.

The Joint Venture (contd)

Estimated cost is $2.4 billion

Conoco (50.1%) and PDVSA (49.9%)

together invest $975 million

Remainder $1.450 billion to be financed

through debt

Petrozuatas debt rating

Conoco was rated single AA-

PDVSA was rated single B

Its target is to get a BBB rating

How?

Petrozuatas debt rating (Contd)

Conoco guaranteed to buy all the output that

Petrozuata would produce for the next 35 yrs (priced in

$)

All costs (ie: water, electricity and gas) are also under

long-term contracts, except labor (but it only

represented a small fraction of total cost)

Conoco & PDVSA guaranteed to pay project

expenses, including any unexpected cost overruns

stable revenue + stable cost + no extra costs BBB

Debt Financing

High leverage ratio (60%)

Bank debt, the traditional source of debt and

Rule 144A project bonds

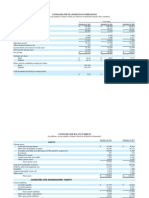

Sources of Funds in million %

Commercial Bank Debt $450 18.6

Rule 144A Project Bond $1,000 41.2

Paid-in Capital (incl. shareholder loans) $445 18.4

Operating Cash Flow $530 21.9

Total $2,425 100%

Where Are They Now

Conoco has merged with Philips Petroleum

and is the 3

rd

largest integrated energy

company

PDVSA is starting to collect oil from some

newly found sources despite a worker strike at

the end of 2002

Petrozuata is making new contracts and

continues to run well they still have an their B

rating

Question no: 1

Whether Petrozuata should use traditional (Internal Finance or

Project Finance (External) to fund the Petrozuata development?

Project finance is the long-term financing of infrastructure and

industrial projects based upon the projected cash flows of

the project rather than the balance sheets of its sponsors.

Petrozuata should use project finance Because many of reasons

For example project finance allows firms to isolate project risk,

to increase equity return,

to preserve debt capacity,

to mitigate sovereign.

Project finance create value by resolving agency problems and

improving risk management.

Project finance allow the firm to minimize the net cost associated

with market imperfections such as transaction cost, asymmetric

information, incentive conflicts, financial distress and taxes.

Question no: 2

What are identifications of major risks, assessment of their

severity and attempts to mitigate important risks faced while using

project finance in case of Petrozuata?

Project finance create value is by improving risk management.

Risk management consists of identifying, assessing, and

allocating risks with the goal of reducing cost and of ensuring

proper incentives.

The identification of project risks and the assessment of severity

are typically done by the sponsors in conjunction with their

financial advisors.

Then to add credibility to the process the key assumption are

verified using independent experts.

Question no: 2

What are identifications of major risks, assessment of their

severity and attempts to mitigate important risks faced while using

project finance in case of Petrozuata?

In this case the sponsors hired three independent consultant to

analysis the oil reserve, project design, construction schedule,

operating cost, syncrude demand, and price.

in this case there are some risks that are identified in project

finance that are pre-completion risk, operating risks, sovereign

.risk, and financial risks.

allocate residual risk return to the party best able to influence the

outcomes. By thus joining risk and return you increase the

probability that parties will act in ways that maximize efficiency.

Question no: 3

Keeping in mind the financial risk, how much leverage should the

project have?

Financial risk is an umbrella term for multiple types

of risk associated with financing, including financial transactions

that include company loans in risk of default. Risk is a term often

used to imply downside risk, meaning the uncertainty of a return

and the potential for financial loss.

There are three primary financial risk, interest rate risk, funding

risk and credit risk.

Initially the sponsors hoped to finance 70% of the project.

Firstly they discussed whether to use 60% or 70% leverage. They

chose 60% leverage to show their commitment to the project and

to improve the project minimum debt service coverage ratio.

Question no: 4

Does Petrozuata financing strategy make sense?

Yes Petrozuata financing strategy make sense.

The sponsors achieved high leverage ratios, attracted new source

of capital and obtain better capital and obtain better pricing then

previous deal.

Because The sponsors agreed to use $975 million of equity

(40%) and $1.45 billion of debt (60%) to finance the project $2.425

billion total cost.

In the end the sponsor raised $450 million in bank finance and $1

billion in rule 144A bonds all of which was non-resource to the

sponsors following completion of the project.

Question no: 5

Do you think whether Petrozuata can pierce the sovereign risks?

Project finance is most valuable as an instrument for mitigation

sovereign risks.

Indeed it is the one feature that cannot be replicated under

conventional corporate financing scheme.

Sovereign risk was one of the biggest concern about the

Petrozuata deal because of Venezuela historical macroeconomic

and political instability.

The Venezuela government has more influence over political and

economic factors than any other entity if the government fails to

mitigate sovereign risk then it will lose the monetary benefits from

taxes royalties and dividend as well as accompanying benefits of

increased employment and access to refining technology.

Question no: 5

Do you think whether Petrozuata can pierce the sovereign risks?

The final reason why project structure helps mitigate sovereign

risk is that it facilities participation by local government local

financial institutions, multilateral agencies like the international

finance corporation and bilateral agencies like the U.S export

import banks.

The deal had many feature to mitigate risk one of the key feature

was the decision to keep oil revenue out of country.

Question no: 6

Whether Petrozuata would invest in the project?

Yes Petrozuata would invest in this project because this project

has many benefits and hallmarks like,.

it was an economically and legal independent entity.

it was an operating company with limited life (35) year.

it was funded with non-recourse debt for the least part of the life.

Q&A

You might also like

- Petrolera Zuata, Petrozuata CaseDocument8 pagesPetrolera Zuata, Petrozuata CaseAndy Vibgyor50% (2)

- Petrozuata Questions - SPR - 2015Document1 pagePetrozuata Questions - SPR - 2015daweizhang100% (1)

- Petrozuata Analysis WriteupDocument5 pagesPetrozuata Analysis Writeupgkfernandes0% (1)

- Project Finance Petrolera Zuata, Petrozuata C.A: BackgorundDocument3 pagesProject Finance Petrolera Zuata, Petrozuata C.A: BackgorundPearly ShopNo ratings yet

- Aamir Ansari Himanshu SaigalDocument25 pagesAamir Ansari Himanshu SaigalKetan SuriNo ratings yet

- Risks Petrolera Zuata Petrozuata CaDocument9 pagesRisks Petrolera Zuata Petrozuata CahdvdfhiaNo ratings yet

- Project Finance CaseDocument15 pagesProject Finance CaseDennies SebastianNo ratings yet

- BP Amoco CaseDocument37 pagesBP Amoco CaseIlayaraja DhatchinamoorthyNo ratings yet

- BP Amoco PDFDocument35 pagesBP Amoco PDFPankhil Shikha100% (2)

- Petrolera Zuata: A Project Finance Case StudyDocument15 pagesPetrolera Zuata: A Project Finance Case StudySaathwik ChandanNo ratings yet

- Petrozuata Case AnalysisDocument7 pagesPetrozuata Case AnalysisAmyo Roy100% (9)

- Petrozuata Case AnalysisDocument8 pagesPetrozuata Case AnalysisVishal VishyNo ratings yet

- Petrolera Zuata, Petrozuata C. A. Case AnalysisDocument10 pagesPetrolera Zuata, Petrozuata C. A. Case Analysisshivam saraffNo ratings yet

- Petrolera Zueta, Petrozuata CDocument6 pagesPetrolera Zueta, Petrozuata CAnkur SinhaNo ratings yet

- Petrolera Zuata Petrozuata CA. AnswerDocument8 pagesPetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- PetrozuataDocument13 pagesPetrozuataMikhail TitkovNo ratings yet

- Petrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Document1 pagePetrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Shrikant KrNo ratings yet

- Petroleraa ZuataDocument9 pagesPetroleraa ZuataArka MitraNo ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial AnalysisdewanibipinNo ratings yet

- Petrozuata Financial ModelDocument3 pagesPetrozuata Financial Modelsamdhathri33% (3)

- AJC CaseDocument46 pagesAJC CaseHemachandar Vaida100% (1)

- Petrozuata and Articles Handout 2020Document12 pagesPetrozuata and Articles Handout 2020Darshan Gosalia0% (1)

- Case Analysis - Petrolera ZuataDocument8 pagesCase Analysis - Petrolera ZuataAnupam Sharma0% (1)

- Petrozuata CaseDocument10 pagesPetrozuata CaseBiranchi Prasad SahooNo ratings yet

- BP Amoco (Case Study)Document25 pagesBP Amoco (Case Study)Abhik Tushar Das67% (3)

- Case 7 PetrozuataDocument13 pagesCase 7 PetrozuatalatecircleNo ratings yet

- Chad Cameroon PipelineDocument12 pagesChad Cameroon PipelineUmang ThakerNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- AJCDocument42 pagesAJCShashank Kanodia100% (1)

- BP Amoco (B)Document32 pagesBP Amoco (B)Arnab RoyNo ratings yet

- AJC Case Analysis.Document4 pagesAJC Case Analysis.sunny rahulNo ratings yet

- BP Amoco - A Case Study On Project FinanceDocument11 pagesBP Amoco - A Case Study On Project Financevinay5209100% (2)

- AJC CaseDocument18 pagesAJC CaseAbhinava Chanda100% (1)

- Stone Container CorporationDocument5 pagesStone Container Corporationalice123h21No ratings yet

- Updated Stone Container PaperDocument6 pagesUpdated Stone Container Paperonetime699100% (1)

- Financing The Mozal Project Case SolutionDocument4 pagesFinancing The Mozal Project Case SolutionSebastian100% (2)

- Group PetrozuataDocument5 pagesGroup PetrozuataBiranchi Prasad SahooNo ratings yet

- Stone Container CorporationDocument7 pagesStone Container Corporationanon_911384976No ratings yet

- Australian Japan CableDocument33 pagesAustralian Japan CableSourabh Dhawan100% (2)

- Chasecase PaperDocument10 pagesChasecase PaperadtyshkhrNo ratings yet

- Stone Container CorporationDocument11 pagesStone Container CorporationMeena100% (3)

- Williams Introduction+q1+Q2+Q4Document4 pagesWilliams Introduction+q1+Q2+Q4Anirudh SurendranNo ratings yet

- Guide Questions Liability Management at General MotorsDocument1 pageGuide Questions Liability Management at General MotorsZtreat Nohanih0% (1)

- BP Amoco (A)Document8 pagesBP Amoco (A)BhartiMahawarNo ratings yet

- WrigleyDocument14 pagesWrigleysotki4100% (1)

- WilliamsDocument20 pagesWilliamsUmesh GuptaNo ratings yet

- Chad CameroonDocument17 pagesChad CameroonAshish BhartiNo ratings yet

- Q-Case 5 - Williams 2002Document1 pageQ-Case 5 - Williams 2002Yun Clare Yang0% (1)

- MegaPower Project Memo VfinalDocument5 pagesMegaPower Project Memo VfinalSandra Sayarath AndersonNo ratings yet

- Poland MotorwayDocument16 pagesPoland MotorwayPrateek Agarwal100% (2)

- Chad Cameroon Case FinalDocument28 pagesChad Cameroon Case FinalAbhi Krishna ShresthaNo ratings yet

- Stone Container Corporation: Strategic Financial ManagementDocument3 pagesStone Container Corporation: Strategic Financial ManagementMalika BajpaiNo ratings yet

- Mozal ProjectDocument7 pagesMozal Projectprajeshgupta100% (1)

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- Financing The Mozal Projec1Document6 pagesFinancing The Mozal Projec1Kapil Arora100% (1)

- Group - 3 - FM Case StudyDocument18 pagesGroup - 3 - FM Case StudyBiswa Mohan PatiNo ratings yet

- AJC Case AnalysisDocument30 pagesAJC Case Analysisarpit127100% (1)

- Mozal ExcelDocument4 pagesMozal Excelderek4wellNo ratings yet

- Petrozuata's Use of Debt Financing: International Financial ManagementDocument26 pagesPetrozuata's Use of Debt Financing: International Financial ManagementAbhishek SinghNo ratings yet

- Project Finance: Professor Pierre HillionDocument72 pagesProject Finance: Professor Pierre Hillionzhongyi87No ratings yet

- KapcoDocument3 pagesKapcoBasit Ali ChaudhryNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Canon Marketing ProjectDocument25 pagesCanon Marketing ProjectBasit Ali Chaudhry100% (1)

- Affective CommitmentDocument2 pagesAffective CommitmentBasit Ali ChaudhryNo ratings yet

- Coca Cola India's Thirst For The Rural Market: ' Thanda' Goes RuralDocument2 pagesCoca Cola India's Thirst For The Rural Market: ' Thanda' Goes RuralBasit Ali ChaudhryNo ratings yet

- Sisdn Called Number Call Type Call Time Call Duration Call ChargesDocument2 pagesSisdn Called Number Call Type Call Time Call Duration Call ChargesBasit Ali ChaudhryNo ratings yet

- DBNJCDocument1 pageDBNJCBasit Ali ChaudhryNo ratings yet

- Link CP 2008Document1 pageLink CP 2008Aaqib SheikhNo ratings yet

- Regression BTW SHRM V IpDocument6 pagesRegression BTW SHRM V IpBasit Ali ChaudhryNo ratings yet

- Internship Report HBLDocument79 pagesInternship Report HBLNadeem100% (1)

- Job AnalysisDocument30 pagesJob AnalysisBasit Ali ChaudhryNo ratings yet

- Assignment On Reference Sample ProportionDocument3 pagesAssignment On Reference Sample ProportionBasit Ali ChaudhryNo ratings yet

- Financial Analysis of DG Khan Cement Factory Ratio AnalysisDocument54 pagesFinancial Analysis of DG Khan Cement Factory Ratio AnalysisBasit Ali Chaudhry100% (1)

- Invisible Rainbow A History of Electricity and LifeDocument17 pagesInvisible Rainbow A History of Electricity and LifeLarita Nievas100% (3)

- SunEdison Pancho Perez Complaint As FiledDocument47 pagesSunEdison Pancho Perez Complaint As FiledLizHoffmanNo ratings yet

- Characters: Philadelphia Here I Come! by Brian FrielDocument4 pagesCharacters: Philadelphia Here I Come! by Brian FrielDominic LenihanNo ratings yet

- Chapter 2Document14 pagesChapter 2Um E AbdulSaboorNo ratings yet

- PREETI and RahulDocument22 pagesPREETI and Rahulnitinkhandelwal2911No ratings yet

- Click Here For Download: (PDF) HerDocument2 pagesClick Here For Download: (PDF) HerJerahm Flancia0% (1)

- Schemes and Tropes HandoutDocument6 pagesSchemes and Tropes HandoutJohn LukezicNo ratings yet

- Gullivers TravelDocument3 pagesGullivers TravelRanen Das MishukNo ratings yet

- BTCTL 17Document5 pagesBTCTL 17Alvin BenaventeNo ratings yet

- World War I Almanac Almanacs of American WarsDocument561 pagesWorld War I Almanac Almanacs of American WarsMatheus Benedito100% (1)

- Khutbah About The QuranDocument3 pagesKhutbah About The QurantakwaniaNo ratings yet

- 1386258018727Document21 pages1386258018727Roberto MuñozNo ratings yet

- Fernando Pessoa LectureDocument20 pagesFernando Pessoa LecturerodrigoaxavierNo ratings yet

- VW Golf 2 Sam Naprawiam PDFDocument3 pagesVW Golf 2 Sam Naprawiam PDFScottNo ratings yet

- Fouts Federal LawsuitDocument28 pagesFouts Federal LawsuitWXYZ-TV DetroitNo ratings yet

- Prayer For Stages On The PathDocument6 pagesPrayer For Stages On The PathEijō JoshuaNo ratings yet

- Failure of Composite Materials PDFDocument2 pagesFailure of Composite Materials PDFPatrickNo ratings yet

- 1 2 4 Ak Sequentiallogicdesign Counters DLBDocument7 pages1 2 4 Ak Sequentiallogicdesign Counters DLBapi-290804719100% (1)

- Noceda vs. Court of Appeals (Property Case)Document3 pagesNoceda vs. Court of Appeals (Property Case)jokuanNo ratings yet

- M40 Mix DesignDocument2 pagesM40 Mix DesignHajarath Prasad Abburu100% (1)

- Gallirei Weekend 2018Document7 pagesGallirei Weekend 2018Reiner Albert BraunNo ratings yet

- AMBROSE PINTO-Caste - Discrimination - and - UNDocument3 pagesAMBROSE PINTO-Caste - Discrimination - and - UNKlv SwamyNo ratings yet

- The Flowers of May by Francisco ArcellanaDocument5 pagesThe Flowers of May by Francisco ArcellanaMarkNicoleAnicas75% (4)

- Merger of Bank of Karad Ltd. (BOK) With Bank of India (BOI)Document17 pagesMerger of Bank of Karad Ltd. (BOK) With Bank of India (BOI)Alexander DeckerNo ratings yet

- Second Unit Test 2022: Radha Madhav Public School BareillyDocument4 pagesSecond Unit Test 2022: Radha Madhav Public School BareillyRaghav AgarwalNo ratings yet

- Teaching and Assessment of Literature Studies and CA LitDocument9 pagesTeaching and Assessment of Literature Studies and CA LitjoshuaalimnayNo ratings yet

- MagellansssdsaDocument2 pagesMagellansssdsaPrincess NaleNo ratings yet

- Iver Brevik, Olesya Gorbunova and Diego Saez-Gomez - Casimir Effects Near The Big Rip Singularity in Viscous CosmologyDocument7 pagesIver Brevik, Olesya Gorbunova and Diego Saez-Gomez - Casimir Effects Near The Big Rip Singularity in Viscous CosmologyDex30KMNo ratings yet

- Florida Firearm Bill of SaleDocument4 pagesFlorida Firearm Bill of SaleGeemoNo ratings yet

- 18 Ex Parte Applic Shorten Time Consolidate 11/01/21Document13 pages18 Ex Parte Applic Shorten Time Consolidate 11/01/21José DuarteNo ratings yet