Professional Documents

Culture Documents

Basics of Accounting in Tally Erp

Uploaded by

Ankushsharma11110 ratings0% found this document useful (0 votes)

34 views6 pagesBasics of Accounting in Tally Erp

We are Maintain your accounting in tally erp.9 software

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBasics of Accounting in Tally Erp

We are Maintain your accounting in tally erp.9 software

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views6 pagesBasics of Accounting in Tally Erp

Uploaded by

Ankushsharma1111Basics of Accounting in Tally Erp

We are Maintain your accounting in tally erp.9 software

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 6

Accounting is the process of indentify, recording, classifying and reporting

information on financial transactions in a systematic manner for the

purpose of providing financial information for decision making.

Basically, accounting is a finance support system that:

Records transactions

Classifies transactions and events

Expresses transactions in monetary terms

Helps to monitor the financial performance and condition of the

business

Helps to evaluate the business

Helps to establish controls for the business

Accounting helps to arrive at the financial of an organisation at any given

point of time. The organisatons financial status, as on a particular date,

is reflected in the balance sheet, while the financial performance for the

year in stated in the profit and loss accont.

Tally erp.9 the accounting principles, concept and

conventions form the basis for how business

transactions are recorded. A number of principals,

concepts and conventions are developed to ensure

that accounting information is presented accurately

and consistently. Some of these concepts are briefly

described in the following sections.

Revenue Realisaton

Accounting to revenue concept, revenue is considered

as the income earned on the date, when it is realised.

As per this concepts, unearned or unrealised revenue

is not taken into account. This concepts is vital for

determining income and profits

Matching Concepts

As per this concepts, matching of the revenues earned

during an accounting period with the cost associated with

the respective period to ascertain the results of the

business concern is carried out. This concept serves as the

basis for finding accurate profit for a period which can be

distributed to the owners.

Accrual

Under accrual method of accounting, the transactions are

recorded are recorded when earned or incurred rather

when collected or paid i.e., transactions are recorded on

the basis of income earned or expanse incurred

irrespective of actual receipt or payment. For example, a

seller bills the buyer at the time of sale and treats the bill

amount as revenue, even though the payment may be

recevied later.

Going Concern

As per this assumption, the business will exist for

a long period and transactions are recorded from

this point of view.

Accounting period

The users of financial statements require periodical

reports to ascertain the operational and the

financial position of the business concern. Thus,

it is essential to close the accounts at regular

intervals, viz., 365 days or 52 weeks or 1 years,

which is considerd as the accounting period.

Accounting Entity

Accounting to this assumption, a business is

considered as a unit or entity apart from its

owners, creditors and others. For example, in

case of a sole proprietor concern, the proprietor

is treated as a creditor to the extent of his capital

and all the business transactions are recorded in

the books of accounts from the business stand

point.

Money measurement

In accounting, only business transactions and

events of financial nature are recorded.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Form No. 3CdDocument15 pagesForm No. 3CdSachin SharmaNo ratings yet

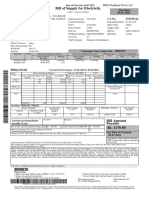

- E BillDocument1 pageE BillManglesh SinghNo ratings yet

- Fee Info Template EuroDocument13 pagesFee Info Template EuroMIRO GroupNo ratings yet

- USG College Treasurer GuidelinesDocument42 pagesUSG College Treasurer GuidelinesGian Carlo RamonesNo ratings yet

- Loyalist College Program Availability List For JAN - 2023 Intake 240522Document6 pagesLoyalist College Program Availability List For JAN - 2023 Intake 240522Jayrajsinh ParmarNo ratings yet

- Chapter 2 - Taxes, Tax Laws, and Tax AdministrationDocument7 pagesChapter 2 - Taxes, Tax Laws, and Tax Administrationreymardico100% (2)

- Procurement Policy Office: General Conditions of Contract (Goods)Document23 pagesProcurement Policy Office: General Conditions of Contract (Goods)ahtionjNo ratings yet

- Agreement of SaleDocument3 pagesAgreement of SaleAYAN AHMEDNo ratings yet

- NUS Coop Academic Dress Online OrderDocument1 pageNUS Coop Academic Dress Online OrderChristine ChowNo ratings yet

- Chapter 3 - Financial DocumentsDocument40 pagesChapter 3 - Financial Documents48. Lê Nguyễn Anh ThưNo ratings yet

- Gourishankar - BihaniDocument5 pagesGourishankar - BihaniSunny MittalNo ratings yet

- Chapter 4-Modes of ExtinguishmentDocument8 pagesChapter 4-Modes of ExtinguishmentCedrickBuenaventuraNo ratings yet

- Municipal Payroll Report for Tampilisan, Zamboanga del NorteDocument32 pagesMunicipal Payroll Report for Tampilisan, Zamboanga del NorteMary Jane Katipunan CalumbaNo ratings yet

- Fee Protection AgreementDocument3 pagesFee Protection AgreementMohamad Zamawi100% (2)

- CIR v. AlgueDocument3 pagesCIR v. AlguedyosaNo ratings yet

- Muncher BankruptcyDocument17 pagesMuncher BankruptcyKate ClarkNo ratings yet

- UntitledDocument8 pagesUntitledGreat WhizdomNo ratings yet

- E Comm - Unit 3Document8 pagesE Comm - Unit 3prashanttendolkarNo ratings yet

- Technical Specification and Price Proposal 400 KVA Substation-RO1Document8 pagesTechnical Specification and Price Proposal 400 KVA Substation-RO1shanta skymarkNo ratings yet

- JAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)Document16 pagesJAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)REG.A/0117101094/SITI SOBARIAH63% (8)

- Credit ReportDocument37 pagesCredit Reportmanish kumarNo ratings yet

- Final Answers For Taxation!Document11 pagesFinal Answers For Taxation!jerald delloro100% (1)

- SAP FI/CO module overviewDocument230 pagesSAP FI/CO module overviewleorajan86% (7)

- Client Manual Consumer Banking - CitibankDocument29 pagesClient Manual Consumer Banking - CitibankNGUYEN HUU THUNo ratings yet

- Sage Accounting Software PDFDocument32 pagesSage Accounting Software PDFvaall4me410% (1)

- Review of Literature:: Definition of Electronic Payment SystemsDocument3 pagesReview of Literature:: Definition of Electronic Payment SystemsAvula Shravan YadavNo ratings yet

- Your July Bank StatementDocument2 pagesYour July Bank StatementA VNo ratings yet

- Petty Cash VoucherDocument1 pagePetty Cash VoucherEduardo SajoniaNo ratings yet

- Assignment#2Document4 pagesAssignment#2Lorraine CaliwanNo ratings yet