Professional Documents

Culture Documents

Citigroup Practical Banking Pres 06

Uploaded by

jwkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Citigroup Practical Banking Pres 06

Uploaded by

jwkCopyright:

Available Formats

The Practical Side of Investment Banking

October 10, 2006

Table of Contents

1. Citigroups Investment Banking Michigan Team

2. Structure of an Investment Bank

3. Deal Teams and the Role of an Associate

4. Why Citigroup?

1. Citigroups Investment Banking Michigan Team

Citigroups Investment Banking Michigan Team

Randy Barker

Co-Head, Global Fixed

Income

John Ciolek

Energy

James McCummings

Global Communications

Timothy Devine

FIG

Stephen Schiller

Client Strategy

Hugo Verdegaal

Latin America

Managing Directors

Nathan Eldridge

Mergers & Acquisitions

Jodi Schenk

Mergers & Acquisitions

Victor Voorheis

FIG

Peter Kapp

FIG

Directors

Rich Harding

Healthcare

Daniel Lee

Global

Communications

Jas Singh

Energy

Keith Anderson

London

Ramon Gonzalez

Global

Communications

Susan Manuelle

Global Industrial

Christa Volpicelli

Global Industrial

Vice Presidents

Ben Riback (A4)*

Global Consumer

Arun Prasad (A3)

Health Care

Owen Bittinger (A3)

Palo Alto

Benjamin Carpenter

(A3)

Los Angeles

Paul Croci (A3)

Pablo Pallas (A3)

London

Martin Valdes (A3)*

Latin America

Sarah Ransdell Bayer

(A2)

Palo Alto

Patty Yang (A2)

Hong Kong

Jason Godley

Generalist

Julius Peter

Generalist

Harsh Singh

Generalist

Associates

* Team Co-Captain

1

2. Structure of an Investment Bank

What is an Investment Bank?

Traditional

Investment Banking

Research Sales & Trading

Capital raising

Debt

Equity

Strategic advisory

services

Mergers &

acquisitions

Restructuring

Takeover defense

Analysis and

recommendations of

stocks and bonds

Includes company

coverage and sector

coverage

Distribution and

execution arm of the

investment bank

Sells and trades

stocks and bonds

Manages the firms

risk and makes

markets for the

securities underwritten

by the investment

bank

An investment bank typically consists of three distinct, but related businesses:

2

Large /

Global

Small /

Regional

Who are the Leading Investment Banks in the United States?

3

Structure of an Investment Bank Conduit to the Corporate Client

Client

Investment Banking

Coverage Groups

Other Product

Groups

M&A

Capital Markets

Bank Loans

Inv. Grade

Debt

High

Yield

Equity

C

h

i

n

e

s

e

W

a

l

l

Financial Strategies

Derivatives

Liability Management

Pensions

Corporate

Banking

Sales &

Trading

Research

Private Side Public Side

4

Products and Services

Balance Sheet

Management

Hedging

Share and Debt

Repurchases

Debt Exchanges

Consent Solicitations

Capital Raising Equity

Investment Grade

Debt

High Yield Debt

Syndicated Loans

Bridge Commitments

Advisory M&A

Restructuring

Financial Strategy

An investment bank provides numerous corporate finance functions.

5

Industry Coverage Groups

Consumer

Energy, Power

& Chemicals

Financial

Entrepreneurs

Financial

Institutions

Health Care

Industrials

Communications

Real Estate

Technology

6

3. Deal Teams and the Role of an Associate

Structure of a Typical Deal Team

Client

Investment Banking

Coverage Officer

IBD Support

Accountants

Associate

Analysts

Capital Markets

Compliance/

Legal

Attorneys

The Coverage Officer has primary client responsibility and the Associate ensures that all members of the

working party, both internal and external, are informed and working together.

7

Strategic Advisory

A good investment banker is a trusted advisor to their client a CEOs first call for

strategic advice

Investment bankers are most valuable when they can provide unique insight

regarding a companys operations or strategic direction

As part of a normal client dialogue, investment bankers will show clients strategic

ideas that may or may not be obvious to their client

CEOs often use their bankers to approach potential counterparties on an informal

basis

Investment bankers typically handle negotiations and most other aspects of the

M&A process, allowing management to focus on running their business

Valuation

Process management

Structuring

Fairness opinion

Purchase/Sale documentation

Whatever else it takes

8

Strategic Advisory M&A

Purchasing other companies

Friendly Mergers

Hostile Takeovers

Leveraged Buyouts

Selling companies

Selling entire companies

Spin-off of subsidiaries

Defending Company Buyouts

Poison Pill

9

Life of an M&A Transaction

The Pitch

Specific pitch ideas

Beauty contests

The Mandate:

Deal is Live

Announcement

Closing:

Its Official!

Preparation

Solicitation of

preliminary bids

Solicitation of

binding bids

Negotiations

Contract Signing

Preparation for

announcement

Press release

Q&A script

Week of

announcement

Market reaction

Roadshow?

Bankers work is

largely done once the

deal is made public

Between

announcement &

closing

SH vote

HSR

Other regulatory

approvals

Closing

Lucites

Dinner

10

Valuation: The Foundation of Every Deal

Primary Valuation Techniques

Discounted Cash Flow Analysis

Public Market Analysis (Comparable

Companies)

Private Market Analysis (Precedent

Transactions)

LBO Analysis

Secondary Valuation Techniques

Pro Forma Consequences Analysis

Accretion/dilution

Capital Structure

EPS Growth Rates

Relative Contribution Analysis

Liquidation Analysis

How is my client trading relative to

peers?

WHY is it trading this way?

Growth? Margins?

Hot market versus fundamentals

HOW can the company improve its

valuation?

Does an acquisition make sense?

What is an appropriate price?

Is cash or stock a better choice?

What is appropriate leverage?

How would the market value the

company in a public offering?

How long will a company take to pay

back debt holders?

Do cash flows support an LBO?

11

Valuation and the Associate

A single, quantitatively derived answer

A precise number

A static number

Lots of number crunching

More art than science

Heavily dependent on judgment

Valuation is NOT . . . Valuation is . . .

The associate is responsible to ensure numbers are accurate and assumptions are realistic.

12

Raise Capital for Clients

One of the most common functions of investment bankers is to assist companies

in raising capital

Investment banks are the intermediaries between users of capital and providers

of capital

Equity

IPO

Secondary Offering

Preferred Stock

Debt

Investment Grade

High Yield Debt

Structured & New Product Financing

13

Capital Raising Assignment

Pitching Pre-Filing

Preparation

Marketing Post-deal

follow-up

Pricing /

Closing

The associate manages the flow of information and therefore must be organized and anticipate everything.

14

Capital Raising: Pre-Filing

Screen the Deal Internally

Put together all internal memos and coordinate meetings

Commitment Committee

Investor Issues Committee

Organizational Meeting

Establish agenda, timetable, information request list and working group list

Due Diligence Meetings

Drafting of Registration Statement

Development of business section and positioning

Participation in drafting sessions

Work with underwriters counsel on underwriting agreement

Marketing Preparation

Prepare roadshow presentation with company

Coordinate for reds to be delivered as necessary

15

Capital Raising: Marketing

Prepare memos for sales forces

Institutional sales memo

Retail Sales Memo

Coordinate dry-run (company presentation to sales force)

Denver

3 one-on-ones

Minneapolis

1 one-on-one

Milwaukee

2 one-on-ones

Chicago

1 one-on-one

Boston

7 one-on-ones

1 group mtg

New York

6 one-on-ones

1 group mtg

Philadelphia

6 one-on-ones

2 one-on-ones

Kansas City

1 group call

Europe

San Francisco

1 one-on-one

1 group call

4 one-on-ones

1 group mtg

San Diego

Toronto

5 one-on-ones

1 group mtg

Montreal

1 group mtg

Roadshow:

Responsible that

ALL logistics run

smoothly

Accompany

company to

investor

meetingskeep

meetings on time

Feedback to

Capital Markets

desk: know how

the book is

building

ANTICIPATE

everything

16

Capital Raising: Pricing/Closing

Pricing: Handled by ECM

Coordinate bring down due diligence call prior to pricing

Finalize registration statement

Meet with lawyers and printers to add in final pricing information

Closing: Help coordinate wiring of funds to company

How much? Where? When? Wire instructions via memo to syndicate

Post-deal client relationship

Create post-mortem book

Organize closing dinner

Design Lucite

17

Keys to Success as an Associate

Goals

Develop credibility early with team, especially

analysts

Leadership: Delegating authority

Time management skills: Balance multiple

projects

Understand the transaction and communicate

both up and down

Develop a rapport with the analysts and

communicate the big picture

Manage expectations and define responsibilities

Get your hands dirty

Dont be afraid to ask questions

Proactive client interaction

Educate senior bankers and exceed

expectations

Pitfalls

Presenting materials with mistakes or typos

Waiting to get involved

Failure to anticipate

Not leveraging firms resources appropriately

Getting lost in the detail and missing the big

picture

Insubstantial interaction with clients

Does not properly delegate work

Losing confidence under pressure

Lack of attention to detail

Lack of follow through

Lack of involvement in recruiting and training

activities

18

4. Why Citigroup?

Citigroup is the #2 Global M&A Advisor YTD

Source: Securities Data Company, Inc.

Note: Data as of September 30, 2006, based on rank date.

Global U.S. Europe

Volume

($B) Rank

Volume

($B) Rank

Volume

($B) Rank

769.5 1 437.9 1 326.1 5

714.7 2 315.1 3 440.9 1

664.3 3 315.3 2 384.9 2

592.2 4 260.4 5 371.0 3

524.2 5 185.0 7 344.8 4

472.9 6 166.5 8 279.6 8

452.8 7 297.6 4 175.3 13

19

Deal Size Companies

$89 Billion

$71 Billion

$44 Billion

$41 Billion

$38 Billion

We Advised on 7 of the 10 Largest Deals YTD

Source: Securities Data Company, Inc.

Data as of September 30, 2006, based on rank date.

Deal Size Companies

$32 Billion

$30 Billion

$28 Billion

$27 Billion

$26 Billion

20

We Have Advised on Many Landmark, Cross-Border Deals

$629 $622

$609

$575

$522

$474

GS C JPM MS DB ML

$106

$78

$74

$71

$68

$66

GS C JPM UBS MS CS

Source: Securities Data Company, Inc.

(1) Advising a non-U.S. or non-European client in a cross-border transaction.

M&A deals rank-eligible 2004-YTD 2006 (as of August 31

st

).

Announced Cross-Border (2004YTD 2006)

Volume (US$bn)

International

(1)

Client Advisory (2004YTD 2006)

Volume (US$bn)

Completed

Advised on CNPC Internationals

acquisition of PetroKazahkstan

US$3,957 mm

August 2005

Pending

Advised on Mittal Steels proposed

offer to acquire Arcelor

US$43,632 mm

January 2006

Pending

Advised on Autostrade SpAs

merger of equals with Albertis

Infraestructuras

US$28,389 mm

April 2006

Pending

Advised on NYSEs proposed

merger with Euronext

US$10,203 mm

May 2006

Completed

Advised on Bavarias sale of a

71.8% stake owned by Santo

Domingo to SABMiller

US$5,227 mm

July 2005

Completed

Advised on G-TECH Holdings

sale to Lottomatica SpA

US$4,736 mm

January 2006

21

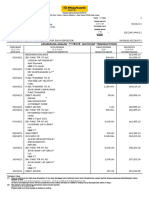

Citigroups Dominance in Capital Raising

THIRD CHANGE IN

QUARTER MARKET SHARE

MARKET SECTOR NO 1 RANKED MANAGER MKT. SHARE FROM PREV Q

Global Debt, Equity & Equity-related Citigroup 9.3% 0.80

U.S.Debt, Equity & Equity-related Citigroup 10.6 0.20

STOCKS

Global Common Stock J.P. Morgan 11.3 3.60

Global Convertibles Citigroup 19.2 3.30

Global Common Stock- U.S. Issuers Goldman Sachs 16.0 -0.40

Global Convertibles- U.S. Issuers Citigroup 31.6 17.00

BONDS

U.S. Asset-backed Securities Citigroup 9.6 -0.60

U.S. Investment Grade Corporate Debt Citigroup 17.1 2.20

U.S. High Yield Corporate Debt Citigroup 17.8 1.30

U.S.Mortgage-backed Securities Royal Bank of Scotland 10.8 0.30

SYNDICATED LOANS

U.S. Syndicated Loans J.P. Morgan 28.1 -5.40

THE WALL STREET JOURNAL.

YEAR-END REVIEW OF MARKETS & FINANCE

Citigroup is a leading bookrunner in Global Capital Markets.

Who's No. 1?

Leading stock and bond underwriters, by 2005 proceeds.

Global Stocks and Bonds

U.S. public, Rule 144a, domestic and international equity and euro-market issues, ranked by 2005 proceeds.

R10 TUESDAY, JANUARY, 3, 2006 THE WALL STREET JOURNAL.

SCORECARD OF WALL STREET UNDERWRITING:

FIRST NINE MONTHS

C12 MONDAY, OCTOBER, 1, 2006

Who's No. 1?

Leading stock-and-bond underwriters, by volume, third-quarter 2006.

Global Stocks and Bonds

In the U.S. public, Rule 144a, domestic and international equity and Euro markets, ranked by first nine months

2006 proceeds.

2005 MKT CHANGE FROM

MARKET SECTOR NO 1 RANKED MANAGER SHARE 2004 (pct. Pts.)

Global Debt, Stock & Stock-Related Citigroup 8.7% -0.70

U.S.Debt, Stock & Stock-Related Citigroup 10.1 -0.90

STOCKS

Global Common Stock Citigroup 9.5 -1.10

Global Convertible Offerings J.P. Morgan 14.6 5.00

Global Common Stock- U.S. Issuers Morgan Stanley 12.1 -3.30

Global Conv. Offerings- U.S. Issuers Goldman Sachs 15.7 4.90

BONDS

U.S. Asset-backed Securities Citigroup 8.6 -1.10

U.S. Investment Grade Corporate Debt Citigroup 16.5 -3.90

U.S. High Yield Corporate Debt J.P. Morgan 13.0 1.60

U.S.Mortgage-backed Securities Bear Sterms 10.7 -1.70

SYNDICATED LOANS

U.S. Syndicated Loans J.P. Morgan 28.1 -4.00

2005 2004

PROCEEDS NO. OF MARKET PROCEEDS

MANAGER (billions) ISSUES SHARE (billions) RANK

Citigroup $564.7 1,856 8.7% $539.9 1

Lehman Brothers 420.8 1,249 6.5 377.2 5

Deutsche Bank AG 418.1 1,398 6.4 343.4 7

J.P. Morgan 414.6 1,553 6.4 395.6 3

Morgan Stanley 383.5 1,238 5.9 416.3 2

Merill Lynch 343.2 1,450 5.3 385.7 4

Credit Suisse First Boston 337.3 1,138 5.2 366.5 6

UBS 323.5 1,188 5.0 303.6 8

Goldman Sachs 310.2 819 4.8 291.1 9

Barclays Capital 269.7 853 4.1 191.8 12

TOP 10 TOTALS $3,785.6 12,742 58.3% $3,611.2

INDUSTRY TOTAL $6,511.3 20,118 100.0% $5,767.0

FIRST NINE MONTHS 2006 FIRST NINE MONTHS 2005

PROCEEDS MARKET NO. OF PROCEEDS MARKET

(billions) SHARE ISSUES (billions) SHARE RANK

Citigroup $490.0 9.0% 1,384 $431.5 8.8% 1

J.P. Morgan 382.6 7.0 1,270 322.6 6.5 4

Deutsche Bank AG 340.5 6.2 1,072 331.2 6.7 2

Lehman Brothers 330.9 6.1 955 326.1 6.6 3

Morgan Stanley 319.3 5.8 968 299.2 6.1 5

Merill Lynch 300.9 5.5 1,097 259.9 5.3 6

Goldman Sachs 276.6 5.1 643 246.8 5.0 9

Credit Suisse 262.9 4.8 834 256.4 5.2 8

Barclays Capital 241.3 4.4 757 194.2 3.9 12

UBS 232.2 4.3 870 256.5 5.2 7

TOP 10 TOTALS $3,177.1 58.2% 9,850 $2,924.3 59.3%

INDUSTRY TOTAL $5,463.5 100.0 15,264 $4,933.9 100.0

22

So What Does This Mean For You?

Acquisition of American

Household Inc.

Buy-Side Advisor

Acquisition Finance

$890,000,000

January 2005

$1,310,000,000

June 2006

Acquisition of

Vincor International

Advisor to Constellation

Acquisition by

Constellation Brands Inc.

Advisor to Mondavi

$1,355,000,0000

December 2004

$4,400,000,000

September 2004

New Credit Facility in Connection

with Acquisition of Grey Goose

Joint Book-Runner

Acquisition by GTCR

Buy-Side Advisor

$240,000,000

January 2004

1,850,000,000

February 2006

Financing of Acquisition by

Blackstone and Lion Capital

Joint Book-Runner

European Beverages

7.250% Senior Notes due 2016

Joint Book-Runner

$700,000,000

July 2006

18,200,000,000

July 2006

Sale of Tohato, Inc. to

Yamazaki Baking Co, Ltd.

Advisor to Unison Capital

Partners

$555,000,000

April 2004

Acquisition by GTCR

Buy-Side Advisor

$400,000,000

May 2006

Senior Notes

Sole Bookrunning Manager

$190,000,000

May 2006

Convertible Senior

Subordinated Notes

Sole Bookrunning Manager

$600,000,000

January 2006

Senior Subordinated Notes

Joint Bookrunning Manager

$1,600,000,000

Pending

Acquisition of

FileNet Corporation

Advisor to IBM

$300,000,000

July 2004

Senior Notes

Joint Bookrunning Manager

23

[TRADEMARK SIGNOFF: add the appropriate signoff for the relevant legal vehicle]

2006 Citigroup Global Markets Inc. Member SIPC. All rights reserved. CITIGROUP and the Umbrella Device are trademarks and service marks of Citigroup or its affiliates and are used and registered

throughout the world.

2006 Citigroup Global Markets Limited. Authorized and regulated by the Financial Services Authority. All rights reserved. CITIGROUP and the Umbrella Device are trademarks and service marks of Citigroup

or its affiliates and are used and registered throughout the world.

2006 [Name of Legal Vehicle] [Name of regulatory body]. All rights reserved. CITIGROUP and the Umbrella Device are trademarks and service marks of Citigroup or its affiliates and are used and registered

throughout the world.

Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This presentation is not a commitment to lend, syndicate a

financing, underwrite or purchase securities, or commit capital nor does it obligate us to enter into such a commitment, nor are we acting as a fiduciary to you. By accepting this presentation, subject to applicable law or

regulation, you agree to keep confidential the existence of and proposed terms for any transaction contemplated hereby (a Transaction).

Prior to entering into any Transaction, you should determine, wi thout reliance upon us or our affiliates, the economic risks and merits (and independently determine that you are able to assume these risks) as well as the

legal, tax and accounting characterizations and consequences of any such Transaction. In this regard, by accepting this present ation, you acknowledge that (a) we are not in the business of pr oviding (and you are not

relying on us for) legal, tax or accounting advice, (b) there may be legal, tax or accounting risks associated with any Transact ion, (c) you should receive (and rely on) separate and qualified legal, tax and accounting advice

and (d) you should apprise senior management in your organization as to such legal, tax and accounting advice (and any risks ass ociated with any Transaction) and our disclaimer as to these mat ters. By acceptance of

these materials, you and we hereby agree that from the commencement of discussions with respect to any Transaction, and notwiths tanding any other provision in this presentation, we hereby conf irm that no participant in

any Transaction shall be limited from disclosing the U.S. tax tr eatment or U.S. tax structure of such Transaction.

IRS Circular 230 Disclosure: Citigroup Inc. and its affiliates do not provide tax or legal advice. Any discussion of tax matters in these materials (i) is not intended or written to

be used, and cannot be used or relied upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the "promotion or

marketing" of the Transaction. Accordingly, you should seek advice based on your particular circumstances from an independent t ax advisor.

We are required to obtain, verify and record certain information that identifies each entity that enters into a formal business relationship with us. We will ask for your complete name, street address, and taxpayer ID number.

We may also request corporate formation documents, or other forms of identification, to verify information provided.

Any prices or levels contained herein are preliminary and indicative only and do not represent bids or offers. These indications are provided solely for your information and consideration, ar e subject to change at any time

without notice and are not intended as a solicitation with respect to the purchase or sale of any instrument. The information c ontained in this presentation may include results of analyses fr om a quantitative model which

represent potential future events that may or may not be realized, and is not a complete analysis of every material fact representing any product. Any estimates included herein constitute our judgment as of the date hereof

and are subject to change without any notice. We and/or our aff iliates may make a market in these instruments for our customers and for our own account. Accordingly, we may have a position i n any such instrument at

any time.

Although this material may contain publicly available information about Citigroup corporate bond research or economic and market analysis, Citigroup policy (i) prohibits employees from offering, directly or indirectly, a

favorable or negative research opinion or offering to change an opinion as consideration or inducement for the receipt of business or for compensation; and (ii) prohibits analysts from being compensated for specific

recommendations or views contained in research reports. So as t o reduce the potential for conflicts of interest, as well as to reduce any appearance of conflicts of interest, Citigroup has enacted policies and procedures

designed to limit communications between its investment banking and research personnel to specifically prescribed circumstances.

24

You might also like

- The Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsFrom EverandThe Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsNo ratings yet

- Copal Partners ModuleDocument210 pagesCopal Partners ModulescribedheenaNo ratings yet

- Ubs I Banking GuideDocument47 pagesUbs I Banking GuideEvan YangNo ratings yet

- Investment Banking Preparation Week 1Document12 pagesInvestment Banking Preparation Week 1Andrusha MakalewskiNo ratings yet

- Investment Banking ModuleDocument98 pagesInvestment Banking Modulesandeep chaurasiaNo ratings yet

- Ey 2022 Practitioner Cost of Capital WaccDocument26 pagesEy 2022 Practitioner Cost of Capital WaccFrancescoNo ratings yet

- WSO M&a Modeling Course - VFDocument173 pagesWSO M&a Modeling Course - VFZeehenul IshfaqNo ratings yet

- Advanced Financial Modeling: Mergers and Acquisitions (M&A)Document38 pagesAdvanced Financial Modeling: Mergers and Acquisitions (M&A)Akshay SharmaNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Tts Core 2015Document6 pagesTts Core 2015Gianluca TurrisiNo ratings yet

- Lecture 5 - A Note On Valuation in Private EquityDocument85 pagesLecture 5 - A Note On Valuation in Private EquitySinan DenizNo ratings yet

- Leveraged Buyout (LBO)Document40 pagesLeveraged Buyout (LBO)Souhail TihaniNo ratings yet

- Piper Jaffray - US LBO MarketDocument40 pagesPiper Jaffray - US LBO MarketYoon kookNo ratings yet

- Blackstone - A Primer For Today's Secondary PE Market - Fall 2017v7Document18 pagesBlackstone - A Primer For Today's Secondary PE Market - Fall 2017v7zeScribdm15No ratings yet

- Guide To PE Due DiligenceDocument23 pagesGuide To PE Due DiligenceKhurram ShahzadNo ratings yet

- 06 12 LBO Model Quiz Questions Basic PDFDocument16 pages06 12 LBO Model Quiz Questions Basic PDFVarun AgarwalNo ratings yet

- Role of The Sell SideDocument8 pagesRole of The Sell SideHoward AndersonNo ratings yet

- Lbo ReportDocument9 pagesLbo ReportNikhilesh MoreNo ratings yet

- KKR Investor UpdateDocument8 pagesKKR Investor Updatepucci23No ratings yet

- Lazard - Analyst Recruitment Process For WebsiteDocument3 pagesLazard - Analyst Recruitment Process For WebsiteAndor JákobNo ratings yet

- Leveraged Buyout Analysis - Street of Walls PDFDocument13 pagesLeveraged Buyout Analysis - Street of Walls PDFWeijing LiNo ratings yet

- LBO TutorialDocument8 pagesLBO Tutorialissam chleuhNo ratings yet

- Practitioners Insights Valuing Tech IPOsDocument73 pagesPractitioners Insights Valuing Tech IPOsPaulo Mattos100% (1)

- JAZZ Sellside MA PitchbookDocument47 pagesJAZZ Sellside MA PitchbookBernardo FusatoNo ratings yet

- Bain CapitalDocument14 pagesBain Capitalw_fibNo ratings yet

- Practitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeDocument25 pagesPractitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeМаксим ЧернышевNo ratings yet

- 2023 WSO IB Working Conditions SurveyDocument46 pages2023 WSO IB Working Conditions SurveyHaiyun ChenNo ratings yet

- Equity - Valuation Introduction PDFDocument17 pagesEquity - Valuation Introduction PDFhukaNo ratings yet

- LBO OverviewDocument21 pagesLBO Overviewjason0No ratings yet

- PitchBook SampleDocument8 pagesPitchBook SampleMopis100% (1)

- M&A Financial Modeling PDFDocument22 pagesM&A Financial Modeling PDFRoma BhatiaNo ratings yet

- CLO Primer PinebridgeDocument16 pagesCLO Primer PinebridgeAditya DeshpandeNo ratings yet

- Private Eq Interview QsDocument7 pagesPrivate Eq Interview QsVignesh VoraNo ratings yet

- GLG Institute: Private Equity: Understanding Leveraged BuyoutsDocument37 pagesGLG Institute: Private Equity: Understanding Leveraged BuyoutsanubhavhinduNo ratings yet

- HL Valuation Exhibit - 99-2Document32 pagesHL Valuation Exhibit - 99-2Evelyn Chua-FongNo ratings yet

- WSO-2022-IB-Working-Conditions-Survey - (Parts-1 And-2)Document20 pagesWSO-2022-IB-Working-Conditions-Survey - (Parts-1 And-2)Iris T.No ratings yet

- Investment Memo TemplateDocument3 pagesInvestment Memo TemplateColin DanielNo ratings yet

- Alvarez and Marsal City of Harrisburg Report Debt Restructuring Report 09152013 PDFDocument43 pagesAlvarez and Marsal City of Harrisburg Report Debt Restructuring Report 09152013 PDFEmily PrevitiNo ratings yet

- Lbo Mechanics New PDFDocument10 pagesLbo Mechanics New PDFPaola Verdi100% (1)

- Private Equity The Top of The Financial Food ChainDocument46 pagesPrivate Equity The Top of The Financial Food ChainAbhy SinghNo ratings yet

- McKinsey DCF Valuation 2005 User GuideDocument16 pagesMcKinsey DCF Valuation 2005 User GuideMichel KropfNo ratings yet

- DCF PrimerDocument30 pagesDCF PrimerAnkit_modi2000No ratings yet

- Pitch CS SunguardDocument33 pagesPitch CS SunguardAlejandro Medina IbanezNo ratings yet

- Discussion Materials, Dated May 20, 2010, of Goldman SachsDocument29 pagesDiscussion Materials, Dated May 20, 2010, of Goldman Sachsmayorlad100% (1)

- Presentation PE Valuation Session 1 - IPEV Guidelines PDFDocument43 pagesPresentation PE Valuation Session 1 - IPEV Guidelines PDFqcrvtbNo ratings yet

- Finance Placement Preparation GuideDocument14 pagesFinance Placement Preparation GuideYash NyatiNo ratings yet

- 2011 Houlihan Lokey PPA Study PDFDocument49 pages2011 Houlihan Lokey PPA Study PDFSoloUnico100% (1)

- Evercore DellDocument28 pagesEvercore DelljwkNo ratings yet

- Pre-Formatted Slides Pitchbook A4/Teal/English (Uk) : 25 February 2009Document58 pagesPre-Formatted Slides Pitchbook A4/Teal/English (Uk) : 25 February 2009lacosterossNo ratings yet

- AMT - Valuation IssuesDocument60 pagesAMT - Valuation Issuesalexander ThielNo ratings yet

- Fitch Special Report US Private Equity Overview October 2010Document19 pagesFitch Special Report US Private Equity Overview October 2010izi25No ratings yet

- KCM Valuation ReportDocument228 pagesKCM Valuation ReportBilguun BatbayarNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- JPM DellDocument26 pagesJPM DelljwkNo ratings yet

- GS DellDocument20 pagesGS DelljwkNo ratings yet

- Mandarain Orient Investment ThesisDocument15 pagesMandarain Orient Investment ThesisjwkNo ratings yet

- Evercore DellDocument28 pagesEvercore DelljwkNo ratings yet

- David Einhorn's Presentation On Green Mountain RoastersDocument110 pagesDavid Einhorn's Presentation On Green Mountain RoastersDealBook100% (1)

- 2013 02 12 BoT MUFJ Project Finance Officer JDDocument2 pages2013 02 12 BoT MUFJ Project Finance Officer JDjwkNo ratings yet

- Corporate Finance Intern - Sindicatum Carbon Capital (South East Asia) Private LimitedDocument2 pagesCorporate Finance Intern - Sindicatum Carbon Capital (South East Asia) Private LimitedjwkNo ratings yet

- Tech PrimerDocument353 pagesTech PrimerEdward SchwartzNo ratings yet

- Yoma 120905 Oir FinalDocument53 pagesYoma 120905 Oir FinaljwkNo ratings yet

- Spelling BeeDocument4 pagesSpelling BeeJayson Benjamin RodriguezNo ratings yet

- International Finance Chapter 7 Part 1Document11 pagesInternational Finance Chapter 7 Part 1Rohil ChitrakarNo ratings yet

- EAadhaar 729903033801 11062018192543 831288Document5 pagesEAadhaar 729903033801 11062018192543 831288Pritam GanjaveNo ratings yet

- Sample PDFDocument30 pagesSample PDFNur KarimaNo ratings yet

- IAS 36 Impairment of AssetsDocument29 pagesIAS 36 Impairment of AssetsziyuNo ratings yet

- Chapter 5 Problems IA3Document6 pagesChapter 5 Problems IA3monsta x noona-yaNo ratings yet

- A Summer Internship Presentation ON "Banking Operations" inDocument16 pagesA Summer Internship Presentation ON "Banking Operations" insweetashusNo ratings yet

- Rhode Island Participating Lenders of PPP (SBA Rhode Island District Office)Document2 pagesRhode Island Participating Lenders of PPP (SBA Rhode Island District Office)Frank MaradiagaNo ratings yet

- Cost Accounting and Control OutputDocument21 pagesCost Accounting and Control OutputApril Joy Obedoza100% (5)

- Quezon City University: Bachelor of Science in AccountancyDocument13 pagesQuezon City University: Bachelor of Science in AccountancyRiza Mae Alce50% (2)

- Questions AnswersDocument3 pagesQuestions AnswersajitNo ratings yet

- Final Exam Cheat Sheet ADM1340Document11 pagesFinal Exam Cheat Sheet ADM1340Chaz PresserNo ratings yet

- Account StatementDocument1 pageAccount StatementИван ИвановNo ratings yet

- Ibs Jerantut 1 30/06/21Document8 pagesIbs Jerantut 1 30/06/21HARRESH VARMMAN A/L SIVAPRAGASAM MoeNo ratings yet

- HTTPS:WWW - Modiproperties.com:plans:1486128385 Booking FormDocument2 pagesHTTPS:WWW - Modiproperties.com:plans:1486128385 Booking FormPalm ONo ratings yet

- Nishant Sharma Mba Final File 02Document58 pagesNishant Sharma Mba Final File 02Sourav BawaNo ratings yet

- Format For Course Curriculum: Course Title: Advanced Financial Accounting Course Code: ACCT 603 Credit Units: 3 Level: PGDocument4 pagesFormat For Course Curriculum: Course Title: Advanced Financial Accounting Course Code: ACCT 603 Credit Units: 3 Level: PGUbaid DarNo ratings yet

- Data 5Document6 pagesData 5abhinash biswal0% (1)

- One Day in March 2013 John Sutherland Industrial Commissioner ForDocument2 pagesOne Day in March 2013 John Sutherland Industrial Commissioner ForDoreenNo ratings yet

- Week 9 Lecture 9 (2017) - FTM Construction of Financial Technical ModelsDocument43 pagesWeek 9 Lecture 9 (2017) - FTM Construction of Financial Technical ModelsElijah MuntembaNo ratings yet

- Questionnaire On Retail Banking FinalDocument3 pagesQuestionnaire On Retail Banking FinalRohit Shaw50% (4)

- How To Enter FD (Fixe3d Deposit) Entries in TallyDocument3 pagesHow To Enter FD (Fixe3d Deposit) Entries in TallyHemlata LodhaNo ratings yet

- Powerscreen InvoiceDocument1 pagePowerscreen InvoiceJuan Felipe GómezNo ratings yet

- A Further Look at Financial Statements: Financial Accounting, Seventh EditionDocument64 pagesA Further Look at Financial Statements: Financial Accounting, Seventh EditionUstaz Jibril YahuzaNo ratings yet

- CH 4 Smart BookDocument32 pagesCH 4 Smart BookEmi NguyenNo ratings yet

- Fair Value Measurement - Questions and Answers (November 2013)Document144 pagesFair Value Measurement - Questions and Answers (November 2013)XNo ratings yet

- Corporate Governance and Risk Management in Malaysia: December 2017Document9 pagesCorporate Governance and Risk Management in Malaysia: December 2017KIRUTHIGAAH A/P KANADASANNo ratings yet

- Finlatics Sector Project - 1Document2 pagesFinlatics Sector Project - 1Aditya ChitaliyaNo ratings yet

- Buy Back IntroductionDocument5 pagesBuy Back Introduction7013 Arpit DubeyNo ratings yet

- ComputerDocument4 pagesComputersanthoshjee73No ratings yet