Professional Documents

Culture Documents

Econex Presentation

Uploaded by

Lucky SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Econex Presentation

Uploaded by

Lucky SinghCopyright:

Available Formats

Mozambique transaction

costs

Dr. Nicola Theron

CASP XI

Maputo

October 2008

1

Structure of the report

Theoretical overview- transaction costs

Mozambique status quo

Quantification of transaction costs

Analysis of specific sectors

Agriculture

Transport

Tourism

Manufacturing

Overview of government programs

Comparison with SA government programs

2

Theory in brief

Role of government in correcting market failures?

Report - highlights a number of areas in which the Mozambique

government can improve the business friendly environment, and

show how this supports exports.

What are transaction costs?

Traditionally: costs incurred through handling, transport, storage,

processing, packaging, market fees, risk management,

brokerage, export handling, marketing, etc.

More recently (NIE): non-price costs, such as the expenses

incurred in finding someone to trade with, time spent negotiating

a deal and the costs involved in ensuring that contracts are

honoured

This report all relevant costs - domestic and cross-border.

3

Government vs. private sector

Entrepreneurs respond to incentives created by the rules of

business;

Maximising behaviour e.g. regular strikes in France; German

farmers destroying produce a response to the institutional

structures;

The institutional structure must make it attractive for the role-

players to invest in productive activities;

Asymmetric information between two parties to a transaction

e.g. pre-shipment inspections in Mozambique;

Observable and unobservable transaction costs (cost of

uncertainty in the market/ corruption, etc.);

4

Lowering transaction costs

To lower transaction costs, questions like the following should

be asked. What can be done about:

producer bargaining power;

road infrastructure and transport;

international freight costs;

finance for agricultural trade and agribusiness;

market information;

electricity supply;

local taxation;

contract enforcement;

Corruption.

5

Mozambique status quo

6

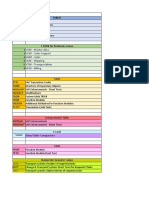

Country Agriculture Industry Services TOTAL (% Manufacturing)

Angola 7.2 74 18.7

100

3.6

Botswana 2.3 53.3 44.4

100

3.9

Congo DR 46 25.3 28.7

100

5.5

Lesotho 17.3 41.4 41.3

100

18.5

Madagascar 27.9 15.8 56.4

100

14

Malawi 34.7 19.4 45.9

100

12.5

Mauritius 6.1 28.2 65.7

100

20.2

Mozambique 22.3 29.8 47.9

100

14.2

Namibia 9.9 31.7 58.4

100

13.5

SA 2.5 30.3 67.1

100

18.6

Swaziland 11.5 47.6 40.9

100

36.9

Tanzania 44.5 17.8 37.6

100

7.5

Zambia 18.5 25.1 56.3

100

11.7

Zimbabwe 18.1 22.6 59.3

100

12.8

7

Composition of exports

Aluminium

ingots, 61.4

Other, 10.2

Electricity, 9.9

Natural gas

(Sasol), 5

Shrimp, 2.6

Sugar, 2.6

Tobacco, 2.1

Cotton, 1.7

Wood, 1.3

Cashews

(processed), 0.4

Cashews

(unprocessed),

0.4

Main exports (%) 2007

Doing business 2009 (was 134 in

2008)

8

1

24

32

38

51

82

104

141

Doing Business 2009

Mozambique has been reforming

9

Mozambique Mauritius Madagascar SA

Starting a business

Dealing with licences

Employing workers

Registering property

Getting credit

Protecting investors

Paying taxes

Trading across borders

Enforcing contracts

Closing a business

LPI

150 countries. Mozambique was number 110. Relatively worse than

some of the other SADC countries, i.e. South Africa (24

th

), Angola

(86

th

), Lesotho (108

th

), Malawi (91

st

).

1. Efficiency and effectiveness of the clearance process by Customs and

other border control agencies;

2. Quality of Transport and IT infrastructure for logistics;

3. Ease and affordability of arranging shipments;

4. Competence in the local logistics industry (e.g., transport operators,

customs brokers);

5. Ability to track and trace shipments;

6. Domestic logistics costs (e.g., local transportation, terminal handling,

warehousing); and

7. Timeliness of shipments in reaching destination.

10

LPI (Scale 1(worse) 5)

Mozambique SA Sub-SA

Customs 2.23 3.22 2.21

Infrastructure 2.08 3.42 2.11

International

shipments

2.25 3.56 2.36

Timelines 2.83 3.78 2.77

Logistics

competence

2.36

3.54

2.33

11

Mozambique improvement in LPI

over past 3 years

12

Percent of respondents answering better/much better

Malawi Mauritius Mozambique South Africa

Overall business

environment

100% 50% 100% 50%

Good governance

and eradication of

corruption

100% 50% 0 33.33%

Regulatory regime 100% 50% 0 50%

Availability of private

sector services

100% 100% 100% 83.33%

Quality of

telecommunications

infrastructure

100% 100% 100% 66.67%

Quality of transport

infrastructure

50% 50% 100% 33.33%

Other border

crossing-related

government agencies

clearance procedures

100% 100% 100% 33.33%

Customs clearance

procedures

100% 100% 100% 50%

Quantification of transaction costs

13

Ranking Mozambique South Africa SADC (Best)

Global

Competitiveness

World (134) 130 45 45

Doing Business World (181) 141 32 24

Corruption World (145) 88 32 28

Property Rights World (134) 116 20 20

Licenses

USAID: Mozambiques burdensome system of approvals, licenses, and special levies that impede

market entry and raise the cost of doing business

14

Licenses Mozambique South Africa SADC (Best)

Building Permits Ranking (World

= 181)

153 48 21

(Swaziland)

Costs (% of

income per

capita)

747.8 27.5 27.5

(South Africa)

Number of

procedures

17 17 12

(Angola)

Time (days) 381 174 93

(Swaziland)

Registering

Property

Ranking (World

= 181)

149 87 -

Costs (% of

property value)

12.9 8.8 3.3

(Malawi)

Number of

procedures

8 6 4

(Botswana)

Time (days) 42 24 11

(Botswana)

Land

Registering a property - whereas the cost in SA (% of property value)

is 8.8%, it is almost 50% higher in Mozambique at 12.9%. It is almost

4 times as much as in Malawi (SADC best). Registering a property in

Mozambique (keeping in mind that it is in any case only leased), takes

on average 42 days compared to 24 days in SA (and 11 days in

Botswana);

DUAT complicated system;

Overlapping authority;

22 ministries and other governmental institutions as well as local

communities;

Cost elements:

Provisional authorisation;

Process costs location draft, consultation fees; community

incentive;

Definitive authorisation

15

Cost of capital

16

Cost of Capital Mozambique South Africa SADC (Best)

Ranking

(getting credit) World (181)

123 2 2

Interest rates

Nominal %/year 25 15.5

Real %/year 15 1.9

Interest Rate

Spread (Ranking) World (132)

97 45 45

Private bureau

coverage %/adults

0.0 64.8 64.8

Energy costs

17

Energy Mozambique SA Lesotho Zambia

Electricity Average

value of

electricity

$/MWh

Industrial 45-60 19-34 43 54

Commercial 120 75 91 77

Residential 90 70 70 38-106

Fuel $/litre

Petrol 1.66 1.25

Diesel 1.33 1.24

Energy related problems

Low cost energy- exported to SA for further processing;

Mozambique exports 35% of electricity to Zimbabwe and SA;

Quality of energy supplied- frequent outages;

Current Eskom power crisis impact on Mozambique;

No differentiated transmission tariffs not creating any

incentives;

Limitations of grid northern parts;

Average industrial tariffs and energy quality in Mozambique

have put the countrys industry at a distinct competitive

disadvantage vis--vis South Africa, but not against other

regional countries.

Due to the power supply crisis in South Africa, its competitive

advantage is about to disappear

18

Example

Case study: Industrial firm electricity costs (June 2008)

Consider a firm with a demand for 1,152,000 kWh/month (load

factor of 80%);

In Mozambique an industrial customer will pay

US$51,840- $69,120/month

In South Africa an industrial customer will pay

US$28,296 (low season) to $56,569 (high season)

Weighted average monthly bill is US$35 365

Savings over Mozambique is ~$US 16-24k per month

South African firms enjoy a 32-49% cost advantage

New tariff structure for Eskom should eliminate this differential

19

Water

20

Water Mozambique South Africa

Maputo and

Matola cities ($/month)

Up to 50 m

(Industrial use)

35 34.9

44.21

Tariff for Rent of

Counter

Meter/Valve

(Diameter = 8)

20.176 5.44

Labour costs (Labour law reforms)

21

Labour Mozambique South Africa SADC (Best)

Ranking

(Employing

workers) World (181)

161 102 34

(Namibia)

Costs (Minimum

wage) $/month

80 250 n.a.

Firing costs weeks 134 24 24

Transport costs (Cost of transport from Maputo and

Durban to selected destinations in US$)

(indicative data from the Maputo Corridor Logistics Initiative (2006))

22

Maputo Durban Difference Maputo Durban Difference

US$ Long

haul

Long

haul

Rail Rail

JHB/Pretoria 1323.08 769.23 553.85 412.15 466.92 -54.77

Middelburg 1076.92 1366.92 -290.00 398.15 907.69 -509.54

Witbank 1076.92 1308.46 -231.54 398.15 923.08 -524.92

Nelspruit 769.23 1923.08 -1153.85 241.23 1076.92 -835.69

Swaziland 769.23 1584.62 -815.38 438.46 538.46 -100.00

Telecoms costs

23

Telecommunications Mozambique South Africa

Off-peak Peak

Fixed line to fixed

line

Domestically

($/min)

0.12 0.0434 0.0867

SADC

Initial 3

minutes

($)

($/per

additional

min)

0.984 0.328 0.1533 0.1867

Europe and

USA

1.056 0.352 0.0964 0.1077

24

Mobile

Vodacom

Mozambique

Vodacom

South Africa

Monthly

subscription

($)

67,4 85.33

(106.67)

Domestic calls

($/min)

Off-peak Peak Off-peak Peak

Vodacom to

Vodacom

0.1296 0.1584 0.12 0.1906

Vodacom to

other mobile

networks

0.2616 0.312 0.1533 0.2466

Vodacom to

fixed

0.1608 0.2688 0.12 0.1533

International

calls ($/min)

Off-peak Peak Off-peak Peak

South Africa

(Vodacom)/

Mozambique

(Vodacom)

0.4704 0.4704 0.17 0.3213

SADC, UK &

US

($/min)

0.5304 0.5304 0.17 0.3213

Europe

($/min)

1.0632 1.0632 0.17 0.3213

SMS

(domestic)

0.045 0.045 0.0467 0.1133

SMS

(international)

0.1236 0.1236 0.232 0.232

Data

($/Mb)

0.2698 0.2698 0.2667 0.2667

ADSL $/month

128kb/s 35.96 19.87

25

Telecoms costs: South Africa vs. best

practice

Taxes

26

Taxes Mozambique South Africa SADC (Best)

Ranking World (178) 43 62 6

Corporate

Income taxes Max %

32 29 21.7

Personal

Income Taxes Max %

32 29

VAT Max % 17 14

Costs % of profits 34.3 37.1 16.1

Time Hours/year 230 350 76

Number Payments 37 11 7

Tax reforms

Replacing a distortionary turnover tax with a 17% value added tax (VAT) in

1999;

Restructuring the excise tax which currently applies to over 140 specific

products at rates between 15 to 65%;

The introduction of two new income tax codes, a company tax with a basic rate

of 32% and an individual tax with marginal tax rates ranging from 10-32% in

2002;

The reduction of import duties with standard tariff rates which range from 0% on

designated basic goods, to 20% on consumer goods. The standard tariff on

intermediate goods is 7.5%, 5% on capital goods and fuel and 2.5% on raw

materials;

Adopting reforms for fuel tax, the stamp tax and municipal levies;

Introducing Unique Taxpayer Identification Numbers, enacting a new decree on

tax penalties, restructuring the tax department and establishing a legal

framework for the establishment of a central revenue authority.

27

International trade

28

International

Trade

Mozambique South Africa SADC (Best)

Ranking World (181) 98 116 127 133 12 - 22

Export Costs

$/Container 1,200 1,445 725

Documents

(Number)

8 8 4

Time (days) 26 30 17

Import Costs

$/Container 1,475 1,721 677

Documents

(Number)

10 9 6

Time (days) 32 35 16

Scanning Costs

Scheduled fees: Mozambique Durban

Import containers $100 per TEU zero

Export containers $ 70 per TEU zero

Empty containers $ 20 per TEU zero

Transit containers $ 45 per TEU zero

Vehicles $ 65 per unit zero

Bulk cargo $ 0.25 to $1.90 per ton. zero

Example:

Port scanning fees: World Bank research

1% increase in transportation costs 2.4% decline in merchandise trade;

Shipments from Mozambique to US or EU - $100= increase of 5%;

Could reduce trade by more than 10%.

29

Starting a business

30

Starting a

business

Mozambique South Africa SADC (Best)

Ranking World (181) 144 47 27

Procedures Number 10 6 5

Duration Time (days) 26 22 6

Minimum

Capital

% of gross

national income

per capita

122.5 0 0

Cost % GNI per

capita

22.9 6.0 2.3

Improvement in registering times

31

Year Number of days Number of procedures

2004 540 18

2005 153 14

2006 153 14

2007 113 13

2008 26 10

Sector specific analysis - Transport

Problems with infrastructure

USAID: weaknesses in the transport infrastructure and in border

crossing procedures that raise transport and transaction costs,

rendering Mozambican products uncompetitive in global markets. One

of 3 main impediments to export growth;

Role of transport corridors (e.g. Maputo corridor);

Issues identified in interviews:

Delays and discretion at customs

Inappropriate weighbridge facilities

Delays in the returns of value added tax paid on inputs

Labour law and its relation to skilled workforce

Lack of skills, especially with regards to skilled drivers

32

Sectors - Agriculture

Issues identified by other consultants:

1. system used to administrate land use (DUAT),

2. lack of available finance,

3. insufficient or low quality infrastructure investment (and the maintenance of this

infrastructure),

4. difficulties with tax administration,

5. meeting sanitary and phytosanitary requirements for export,

6. various kinds of delays when importing and exporting; and

7. difficulties in obtaining returns of value added tax (VAT) paid on inputs into the production

process.

Issues identified in our interviews:

1. Assignment of land use (DUAT)

2. Labour law and discretion in labour inspections

3. Electricity costs and disruption in supply

4. Phytosanitary implementation

5. Delays in the return of value added tax paid on inputs

6. Delays and discretion at customs

33

Sectors- Tourism

General constraints :

1. Infrastructure;

2. Air transport, road networks, energy distribution, telecoms;

3. Water quality and solid waste management;

4. Land use and land tenure;

5. Licensing procedures;

6. Labour regulations seasonal workers and training of staff

7. Visa requirements

Issues identified in our interviews:

1. Assignment of land use (DUAT)

2. Labour law and discretion in labour inspections

3. Electricity costs and disruptions in supply

4. Monopoly market conditions in supply of air transport

34

Government programs

Investment Act (1993) and Investment Promotion Centre (1997)

Various financial incentives and investment guarantees;

Industrial policy;

Estratgia de Moambique para o processo de integrao regional na

SADC;

Trade policy;

Industrial Free Trade Zones;

Comparative SA programs

NIPF (IPAP)

35

Comparison business environment

36

Mozambique SA SADC (best)

Global competitiveness 130 45 45

Doing business 141 32 24

Corruption 88 32 28

Property rights 116 20 20

Building permits 153 48 21

Cost of capital (getting

credit)

123 2 2

Labour 161 102 34

Taxes 43 62 6

International trade 98-116 127-133 12-22

Starting a business 144 62 6

Interest rate spread 97 45 45

Overall Comparison

37

Measurement

Unit

Mozambique SA SADC (best)/

(other SADC

country)

Building permits Costs (% of per

capita GNI)

747.8 27.5 27.5

Time Days 381 174 93

Registering

property

Costs (% of

property value)

12.9

8.8

3.3

Nominal interest

rate

%

25

15.5

n.a.

Real interest

rate

% 15 1.9 n.a.

Electricity Average value

$/MWh

(Industrial)

45-60

19-34

43 (Lesotho)

Commercial 120 75 77 (Zambia)

Residential 90 70 70 (Lesotho)

Fuel Petrol ($/litre) 1.66 1.25 n.a.

Diesel ($/liter) 1.33 1.24 n.a.

Labour Minimum wage

($ per month)

80

250

n.a.

Firing costs

(weeks)

134

24

24

Comparison

38

Taxes Personal

income (max

%)

32 29 n.a.

Corporate

taxes (max %)

32 29 21.7

VAT % 17 14 n.a.

International

trade

Export

($/container)

1 200

1445

725

Import ($ per

container)

1 475

1 721

677

Scanning costs Per TEU ($) 100 0

Starting a

business

Minimum

capital (% of

per capita GNI)

122.5

0

0

Cost (% of per

capita GNI)

22.5

6.0

2.3

Proposals for lowering transaction

costs

Eliminate minimum capital requirement (Botswana, Mauritius &

SA);

Registrations at various authorities merged;

Selective scanning of cargo (e.g. 20%);

Abolish pre-shipment inspections;

Create a single window that links customs with banks and port

authorities;

Labour termination costs;

Property transfer tax rather a service fee;

39

40

Telecoms: South Africa vs. best

practice

You might also like

- Econex Presentation 1Document38 pagesEconex Presentation 1calixrvNo ratings yet

- StatandroanyDocument145 pagesStatandroanyTinavonizaka Razafimandimby AlyNo ratings yet

- Frequency Assignment To Cellular Mobile Operators in AJK & GBDocument1 pageFrequency Assignment To Cellular Mobile Operators in AJK & GBAzam KhanNo ratings yet

- Improving coverage and capacity in cellular networksDocument6 pagesImproving coverage and capacity in cellular networksAvis NarayanNo ratings yet

- 2G 3G 4G CountersDocument16 pages2G 3G 4G CountersAgeu MuandaNo ratings yet

- Antenna Port-AMB4519R2V06 2T6S AntennaDocument1 pageAntenna Port-AMB4519R2V06 2T6S AntennaBorju AjeNo ratings yet

- Enabling Reuse 1 in 4G Networksv0.1Document5 pagesEnabling Reuse 1 in 4G Networksv0.1Tuvia ApelewiczNo ratings yet

- UMTS Troubleshooting Guideline 1 02Document107 pagesUMTS Troubleshooting Guideline 1 02Ankur VermaNo ratings yet

- KPIs in Actix Guide Book 0118Document73 pagesKPIs in Actix Guide Book 0118dtvt40No ratings yet

- 4G1-MW Project MoP for Maghdarah SiteDocument90 pages4G1-MW Project MoP for Maghdarah SiteAbdallahMohmmedNo ratings yet

- Incoming Call Avaya Problem SolvedDocument5 pagesIncoming Call Avaya Problem SolvednanoyspNo ratings yet

- GRP FDocument9 pagesGRP FAbdelkarim AitNo ratings yet

- Cell Search Procedures in LTE SystemsDocument6 pagesCell Search Procedures in LTE Systemshassan abousalehNo ratings yet

- GERAN LTE Interworking Vodacom SA WES (Camps Bay)Document6 pagesGERAN LTE Interworking Vodacom SA WES (Camps Bay)haryantojogjaboyNo ratings yet

- Assam MPBN Configuration - PB18-28th-Jan-2014Document497 pagesAssam MPBN Configuration - PB18-28th-Jan-2014Vinod BishtNo ratings yet

- GSM Overview Non Technical Module PDFDocument90 pagesGSM Overview Non Technical Module PDFm100% (1)

- D2hanjar Hourly Running HourlyDocument55 pagesD2hanjar Hourly Running HourlyHanjar PrakasiwiNo ratings yet

- GSM SystraDocument84 pagesGSM SystraJm RoxasNo ratings yet

- Alu-Nsn Kpis Mapping CsDocument70 pagesAlu-Nsn Kpis Mapping Csfahmi1987No ratings yet

- Analysis of Monthly Report On GSM Network Performance IndicatorsDocument16 pagesAnalysis of Monthly Report On GSM Network Performance Indicatorsf1cysNo ratings yet

- Wcdma Utran Interface and Signaling ProcedureDocument66 pagesWcdma Utran Interface and Signaling Proceduregiorgi nebieridzeNo ratings yet

- Breezemax Si 4000 Cpe PDFDocument135 pagesBreezemax Si 4000 Cpe PDFLong Tai-YangNo ratings yet

- Cellular Spectrum Allocation and Pricing Final Draft NepalDocument47 pagesCellular Spectrum Allocation and Pricing Final Draft NepalDilip GyawaliNo ratings yet

- RE NUMDocument52 pagesRE NUMNilayNo ratings yet

- What is GSM? Understanding 2G Mobile TechnologyDocument8 pagesWhat is GSM? Understanding 2G Mobile TechnologyAvanish SharmaNo ratings yet

- EIRENE - System Reqs - Specs PDFDocument197 pagesEIRENE - System Reqs - Specs PDFivopiskov100% (1)

- LTE E-UTRAN and Its Access Side Protocols: Authors: Suyash Tripathi, Vinay Kulkarni, and Alok KumarDocument22 pagesLTE E-UTRAN and Its Access Side Protocols: Authors: Suyash Tripathi, Vinay Kulkarni, and Alok KumarEivar Davila SanchezNo ratings yet

- A Over IP BSCDocument4 pagesA Over IP BSCpraveen04330% (1)

- What Is Ec - Io (And Eb - No) - TelecomHallDocument8 pagesWhat Is Ec - Io (And Eb - No) - TelecomHallromansoyNo ratings yet

- ConfigurationData 2021 02 28 17 58 30Document1,959 pagesConfigurationData 2021 02 28 17 58 30fazadoNo ratings yet

- Coverage Comparison of UMTS Networks in 900 and 2100 MHZ Frequency Bands-Wireless Mobile and Multimedia Networks 2008 IET International Conference OnDocument4 pagesCoverage Comparison of UMTS Networks in 900 and 2100 MHZ Frequency Bands-Wireless Mobile and Multimedia Networks 2008 IET International Conference OnAfzal LodhiNo ratings yet

- BSS Clear Codes NSNDocument237 pagesBSS Clear Codes NSNDenny A MukhlisNo ratings yet

- Flexi Network Gateway Rel. 10 CD8, Operating Documentation, v. 1Document89 pagesFlexi Network Gateway Rel. 10 CD8, Operating Documentation, v. 1Trần Quang TânNo ratings yet

- Combined and UncombinedDocument10 pagesCombined and UncombinedBala SubramanianNo ratings yet

- AMR V 21 PDFDocument94 pagesAMR V 21 PDFgadekaNo ratings yet

- TTCN3 in DetailsDocument513 pagesTTCN3 in DetailsNeeraj GoyalNo ratings yet

- GSM Frequency Planning StrategyDocument22 pagesGSM Frequency Planning Strategyسعید خزاییNo ratings yet

- JDSU WhitePaper On Optimizing Small Cells and HetNet NetworkDocument16 pagesJDSU WhitePaper On Optimizing Small Cells and HetNet NetworkAtul DeshpandeNo ratings yet

- Satellite Communication: OECD Digital Economy Papers No. 17Document81 pagesSatellite Communication: OECD Digital Economy Papers No. 17Hasnain ArshadNo ratings yet

- GSA LTE in Unlicensed SpectrumDocument8 pagesGSA LTE in Unlicensed SpectrumMuhammad Jamil AwanNo ratings yet

- Training WCDMA Handover Fundamentals GSM To UMTSDocument103 pagesTraining WCDMA Handover Fundamentals GSM To UMTSObimma Ambrose Chukwudi100% (2)

- Carrier WiFi and Small Cells Market to Reach $9B by 2017Document8 pagesCarrier WiFi and Small Cells Market to Reach $9B by 2017eutopia2211No ratings yet

- Skylo - Connect Your Machines. Anywhere. 100% of The TimeDocument2 pagesSkylo - Connect Your Machines. Anywhere. 100% of The TimeSkylo TechnologyNo ratings yet

- 3GPP TS 44.018Document463 pages3GPP TS 44.018Corey IngramNo ratings yet

- WCDMA Drive Test AnalysisDocument61 pagesWCDMA Drive Test AnalysiskarthikiwsNo ratings yet

- Nokia CommandsDocument9 pagesNokia CommandsSalil PariNo ratings yet

- White Paper For CDMA2000 1xEV-DO Rev.B Network Planning V1.3 (20100112)Document42 pagesWhite Paper For CDMA2000 1xEV-DO Rev.B Network Planning V1.3 (20100112)cyclicprefixNo ratings yet

- Cluster Corrected KPI - OR JTSG 0069Document8 pagesCluster Corrected KPI - OR JTSG 0069shaikhNo ratings yet

- LTE Introduction TrainingDocument24 pagesLTE Introduction TrainingTrần Hoàng TuấnNo ratings yet

- Benefits of SONDocument28 pagesBenefits of SONGaurav MishraNo ratings yet

- Mobile Network DimensioningDocument8 pagesMobile Network DimensioningJaspreet Singh WaliaNo ratings yet

- HCIP-LTE-RNP - RNO V1.0 Exam OutlineDocument6 pagesHCIP-LTE-RNP - RNO V1.0 Exam OutlineSemirNo ratings yet

- BSS Radio Parameters Laboratory Exercise 3Document41 pagesBSS Radio Parameters Laboratory Exercise 3Oni Ayodeji100% (1)

- Information Document: Country Case Studies of The Changing International Telecommunications EnvironmentDocument3 pagesInformation Document: Country Case Studies of The Changing International Telecommunications Environmentsheemona kocharNo ratings yet

- RESEARCH - Mobile Banking in The GambiaDocument10 pagesRESEARCH - Mobile Banking in The Gambiadaniel koikiNo ratings yet

- Issues On West African Transport Corridors Niels Rasmussen USAID Trade HubDocument5 pagesIssues On West African Transport Corridors Niels Rasmussen USAID Trade HubwatradehubNo ratings yet

- Policy, Leadership and Institutions: Randeep Sudan Senior ICT Policy Specialist Global ICT DepartmentDocument33 pagesPolicy, Leadership and Institutions: Randeep Sudan Senior ICT Policy Specialist Global ICT DepartmentRohit BajajNo ratings yet

- Data Center in The GambiaDocument18 pagesData Center in The Gambialalou4No ratings yet

- E-Readiness in AfricaDocument15 pagesE-Readiness in AfricaWarrenKPNo ratings yet

- 3Q16 Presentation of ResultsDocument20 pages3Q16 Presentation of ResultsMillsRINo ratings yet

- Chapter 7 SummaryDocument3 pagesChapter 7 SummaryAce Hulsey TevesNo ratings yet

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Document2 pagesForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyNo ratings yet

- IELTS Writing Task 2 Band 6.5 Public Transportation - Paramount IELTSDocument1 pageIELTS Writing Task 2 Band 6.5 Public Transportation - Paramount IELTSbytht6fdbqNo ratings yet

- PaymentDocument1 pagePaymentPepe PeprNo ratings yet

- 06272023-Aurora Escalades-22e26Document4 pages06272023-Aurora Escalades-22e26Joone M GutierrezNo ratings yet

- Market and Feasibility StudiesDocument35 pagesMarket and Feasibility StudiesprinthubphNo ratings yet

- 2014 IRS Form 1040-ES Guide for Estimated Tax PaymentsDocument12 pages2014 IRS Form 1040-ES Guide for Estimated Tax PaymentsClaudia MaldonadoNo ratings yet

- DISPOSAL OF SUBSIDIARY SHARESDocument9 pagesDISPOSAL OF SUBSIDIARY SHARESCourage KanyonganiseNo ratings yet

- Flange PricesDocument96 pagesFlange PricesSalik ShabbirNo ratings yet

- IntermediateDocument139 pagesIntermediateabdulramani mbwanaNo ratings yet

- Employment Slips T4 / RL 1Document35 pagesEmployment Slips T4 / RL 1kanika019No ratings yet

- Microeconomics 5th Edition Krugman Solutions ManualDocument15 pagesMicroeconomics 5th Edition Krugman Solutions Manualtheclamarrowlkro21100% (18)

- Steps To Start A Small Scale IndustryDocument3 pagesSteps To Start A Small Scale Industrysajanmarian80% (5)

- Balance Sheet and Financial Ratios for 2009 FYDocument19 pagesBalance Sheet and Financial Ratios for 2009 FYpradeepkallurNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- Analisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiDocument23 pagesAnalisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiNidha NianNo ratings yet

- Caspian Oil and Gas Potential and Export ChallengesDocument285 pagesCaspian Oil and Gas Potential and Export ChallengespauldmeNo ratings yet

- Ajay Bio-Tech (India) Limited: Gat No 879-At Post - Khalad-Taluka - PurandharDocument1 pageAjay Bio-Tech (India) Limited: Gat No 879-At Post - Khalad-Taluka - PurandharDnyaneshwar Dattatraya PhadatareNo ratings yet

- 2022 Comprehensive Real Estate Property Due Diligence Checklist For Land SalesDocument4 pages2022 Comprehensive Real Estate Property Due Diligence Checklist For Land SalesLupang HinirangNo ratings yet

- INTL TRADE Case Study Coca Cola FINALDocument20 pagesINTL TRADE Case Study Coca Cola FINALMaria Laurenzia LunaNo ratings yet

- Establishing A Financial Services Institution in The UKDocument56 pagesEstablishing A Financial Services Institution in The UKCrowdfundInsiderNo ratings yet

- Tables s4 HanaDocument68 pagesTables s4 Hanasurajit biswas100% (5)

- ECAP BasicsDocument14 pagesECAP BasicsSky KleinNo ratings yet

- Medical Marijuana Dispensary Laws: Fees and TaxesDocument4 pagesMedical Marijuana Dispensary Laws: Fees and TaxesMPP100% (2)

- Factsheet Supply Chain S Ge en 2018Document4 pagesFactsheet Supply Chain S Ge en 2018voumeregistrarNo ratings yet

- Resource Mobilization and Special ProgramsDocument47 pagesResource Mobilization and Special ProgramsGear Arellano IINo ratings yet

- IMChap005Document34 pagesIMChap005cynthia dewiNo ratings yet

- Forms of Business Ownership & Factors to ConsiderDocument47 pagesForms of Business Ownership & Factors to ConsiderHamidul IslamNo ratings yet

- Settlement Commissionb Tax FDDocument15 pagesSettlement Commissionb Tax FDhani diptiNo ratings yet

- Ketentuan Terbaru PBB-P2 JakartaDocument2 pagesKetentuan Terbaru PBB-P2 JakartaDaisy Anita SusiloNo ratings yet