Professional Documents

Culture Documents

Fin 321 Case Presentation

Uploaded by

Jose ValdiviaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin 321 Case Presentation

Uploaded by

Jose ValdiviaCopyright:

Available Formats

Harvard Business Cases

Valuation

Fin 321

Dr. Ghosh

Adriana Nava

Kristie Tillett

Grace Tung

Eddie Pinela

Zhibin Yang

Introduction

o Background

o History

Question I : Is Mercury an appropriate target?

Question II: Are the given projections appropriate?

Question III: Estimate the value of Mercury

o Given information

o Formulas

o Detailed calculations

Conclusion

Outline

West Coast Fashions Inc.

WCF is a large designer and marketer of men's and

women's branded apparel

WCF is planning for a reorganization which includes the

shedding of its footwear division, Mercury Athletic

Athletic and Casual Footwear

Industry

Competitive

Casual segment

Athletic segment

Lifecycle

12-16 months

Import taxes and tariffs

China

Mercury Athletic

Branded athletic / Casual footwear

Mercury was founded by Daniel Fiore

$431.1 million / $51.8 million

Financial Performance

Mercury products

Athletic Footwear

o Men - largest segment and constituted its core business

o Women - had subpar performance

Casual Footwear

o Men - peaked in 2004, declined since then

o Women - worse-performing line of shoes

Mercury Athletic

Performance

In late 2006

o Didn't fit with WCF

Mercury's size

customers

brand image

o Determined to sell the business

Mercury's prospective buyer was Active Gear Inc.

Active Gear Inc.

Founded in 1965

Privately held footwear company

The most profitable firms in the footwear industry

Beginning 1970s

o Casual/ recreational footwear

o Age 25-45

Sold by 5700 retail stores

Outsourcing

However, the company was much smaller than many

competitors and AGI's executives felt its small size was

becoming a competitive disadvantage

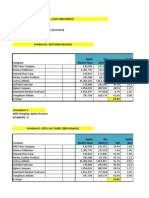

Given Information

Cost of debt - 6%

Risk free rate1 - 4.93%

Risk free rate2- 4.69%

Expected market return - 9.7%

Tax rate - 40%

Beta - 1.6

Question I

Is mercury an appropriate target for AGI? Why or why

not?

Estimates based on assumptions

Sufficient evidence to suggest it will be advantageous

for AGI to acquire Mercury Athletics.

Culture is important

o If the cultures drastically differ

Inhibit efficiency

Effectiveness of strategic planning.

Diagram

Diagram 1

Acti

The revenues

o Comparable

o Very closely identical

Mercury athletic has lower overhead costs

o Acquisition

o More leverage with producers.

Question II

Review the projections formulated by Liedtke. Are they appropriate? How

would you recommend modifying them?

CAGR = 9.7%

o Expected market return V.S. CAGR

o CAGR has no risk in formula

3.0% revenue growth end of time

Question III

Estimate the value of Mercury using a discounted cash flow approach

and Liedtkes base case projections. Please show your work, and explain

any assumptions that you make.

Free cash flows cont.

We repeated the same process for cash flow

years 2008 -2011.

o 2008 - $26,729

o 2009 - $22,098

o 2010 - $25,473

o 2011 - $29,544

Cost of Equity

CAPM = KRF1 + ( KM - KRF2 )

4.93%+ 1.6 (9.7%-4.69%)

= 12.95%

(CostS)

*assumption CAGR

WACC

WACC = WD costD (1 - T) + Ws costs

0.2 [0.06 ( 1- 0.4)] +0.8

(0.1295)

=0.0072 + 0.1036

=11.08%

Terminal Value Formulas

VN= FCFn ( 1 +g FCF )

WACC-gFCF

= $29,544 ( 1 + 0.03)

0.1108 - 0.03

= $376,613

Enterprise Value

Conclusion

Based on enterprise value $359,653 as well as

increasing market share in manufacturing

leverage we believe that AGI should go

through with the acquisition at the enterprise

value price.

ANY QUESTIONS?!

Thank you!

You might also like

- Mercury Athletic Footwear - Valuing The OpportunityDocument55 pagesMercury Athletic Footwear - Valuing The OpportunityKunal Mehta100% (2)

- HBS Mercury CaseDocument4 pagesHBS Mercury CaseDavid Petru100% (1)

- Mercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentDocument9 pagesMercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentBharat KoiralaNo ratings yet

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Mercury Athletic Case PDFDocument6 pagesMercury Athletic Case PDFZackNo ratings yet

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- Group19 Mercury AthleticDocument11 pagesGroup19 Mercury AthleticpmcsicNo ratings yet

- Mercury Athletic QuestionsDocument1 pageMercury Athletic QuestionsRazi UllahNo ratings yet

- Mercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinDocument7 pagesMercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinFaith AllenNo ratings yet

- Mercury Athletic (Student Templates) FinalDocument6 pagesMercury Athletic (Student Templates) FinalGarland GayNo ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic FootwearJon BoNo ratings yet

- MERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISDocument16 pagesMERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISBharat KoiralaNo ratings yet

- Mercury Athletic Footwear Acquisition AnalysisDocument8 pagesMercury Athletic Footwear Acquisition AnalysisVaidya Chandrasekhar100% (1)

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenNo ratings yet

- Mercury QuestionsDocument6 pagesMercury Questionsapi-239586293No ratings yet

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- ANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARDocument9 pagesANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARVedantam GuptaNo ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- Mercury Athletic Footwear Acquisition AnalysisDocument9 pagesMercury Athletic Footwear Acquisition Analysisandy117950% (2)

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Document25 pagesIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420No ratings yet

- Mercury Athletic SlidesDocument28 pagesMercury Athletic SlidesTaimoor Shahzad100% (3)

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearMahnoor MaalikNo ratings yet

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandNo ratings yet

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Mercury Athletic G7Document11 pagesMercury Athletic G7Nanda PallerlaNo ratings yet

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghNo ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearAbhishek KumarNo ratings yet

- Tottenham Case HBS Financials ValuationDocument14 pagesTottenham Case HBS Financials ValuationPaco Colín0% (2)

- Ocean Carrier CaseDocument17 pagesOcean Carrier CasechiaweesengNo ratings yet

- TN-1 TN-2 Financials Cost CapitalDocument9 pagesTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Mercury Athletic Footwear Case SolutionDocument3 pagesMercury Athletic Footwear Case SolutionDI WU100% (2)

- OceanCarriers KenDocument24 pagesOceanCarriers KensaaaruuuNo ratings yet

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDocument11 pagesMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- INTERCO CaseDocument35 pagesINTERCO Casezyamanda0% (1)

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoNo ratings yet

- Ocean CarriersDocument17 pagesOcean CarriersMridula Hari33% (3)

- Financial analysis of American Chemical Corporation plant acquisitionDocument9 pagesFinancial analysis of American Chemical Corporation plant acquisitionBenNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Airthread Connections Case Work SheetDocument45 pagesAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293No ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Receivables Management - ClassDocument24 pagesReceivables Management - ClassGloryNo ratings yet

- Nike 090423061745 Phpapp01Document17 pagesNike 090423061745 Phpapp01Rahul SamantNo ratings yet

- CIMA Management Case Study AnalysisDocument33 pagesCIMA Management Case Study AnalysisAli RaziNo ratings yet

- CIMA Management Case Study Analysis PDFDocument33 pagesCIMA Management Case Study Analysis PDFAli RaziNo ratings yet

- CABV Class 1Document18 pagesCABV Class 1Abhishek SachdevaNo ratings yet

- Sumbitted By: Varsha Kumari Roll. No.:05 Section:A Mba (HR)Document38 pagesSumbitted By: Varsha Kumari Roll. No.:05 Section:A Mba (HR)ABHISHEK SINGHNo ratings yet

- Ford PresentationDocument47 pagesFord PresentationDIEGONo ratings yet

- Team Members - Qaisar S. Khokher 2541 - M. Afzal Hashmi 2517 - Tehmina Hafeez 1760Document42 pagesTeam Members - Qaisar S. Khokher 2541 - M. Afzal Hashmi 2517 - Tehmina Hafeez 1760Qaisar Sardar Khokher100% (21)

- FT12 - Day 6 - SSV - GKR - 06062021Document81 pagesFT12 - Day 6 - SSV - GKR - 06062021AnshulNo ratings yet

- Goals, Values and Performance: OutlineDocument15 pagesGoals, Values and Performance: OutlineNarayanan SubramanianNo ratings yet

- University of Nigeria Nsukka Faculty of Agriculture: Department of Human Nutrition and DieteticsDocument29 pagesUniversity of Nigeria Nsukka Faculty of Agriculture: Department of Human Nutrition and DieteticsBright Ikpang100% (2)

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- Islamic Banking: A Brief Summary of The IndustryDocument6 pagesIslamic Banking: A Brief Summary of The IndustryAbimbola Adewale MonsurNo ratings yet

- SK HeadingsDocument2 pagesSK HeadingsDevorah Jane A. AmoloNo ratings yet

- Solutions BD3 SM14 GEDocument9 pagesSolutions BD3 SM14 GEAgnes Chew100% (1)

- Joint VentureDocument23 pagesJoint VentureArun MishraNo ratings yet

- Certified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Document10 pagesCertified College of Accountancy's Mock Exam: PAPER: Financial Accounting (FA)Chaiz MineNo ratings yet

- CA Certificate For VisaDocument4 pagesCA Certificate For VisaVamshi Krishna Reddy Pathi0% (1)

- CH 2Document62 pagesCH 2robel popNo ratings yet

- Investor Perception About Systematic Investment Plan (SIP) Plan: An Alternative Investment StrategyDocument7 pagesInvestor Perception About Systematic Investment Plan (SIP) Plan: An Alternative Investment StrategyUma Maheswar KNo ratings yet

- List of Bonded Accountable Public OfficersDocument1 pageList of Bonded Accountable Public Officersuixisminee14No ratings yet

- Verizon Investment ThesisDocument7 pagesVerizon Investment Thesisafksooisybobce100% (2)

- Dubad General Trading PartnershipDocument12 pagesDubad General Trading PartnershipDaniel AlemayehuNo ratings yet

- N S Toor Table of ContentsDocument6 pagesN S Toor Table of ContentsAYUSH RAINo ratings yet

- Top 100 Volume Robocallers April 2021-CombinedDocument6 pagesTop 100 Volume Robocallers April 2021-CombinedAnonymous Pb39klJ0% (1)

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- March Payroll 2022 F FFFDocument45 pagesMarch Payroll 2022 F FFFJale Ann A. EspañolNo ratings yet

- BUSINESS LAW - Tax Law FSJES SOUISSI LPE-BADocument45 pagesBUSINESS LAW - Tax Law FSJES SOUISSI LPE-BAAMINENo ratings yet

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument17 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- Horizontal Analysis Interpretation PDFDocument2 pagesHorizontal Analysis Interpretation PDFAlison JcNo ratings yet

- A Study On The Challenges in Banking Sector in 21ST Century Due To E-CommerceDocument10 pagesA Study On The Challenges in Banking Sector in 21ST Century Due To E-CommercepramrutaNo ratings yet

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- Uts Epii 2022Document17 pagesUts Epii 2022Ranessa NurfadillahNo ratings yet

- Mark Boucher - 2001 Watching Macro Indicators. The DollarDocument4 pagesMark Boucher - 2001 Watching Macro Indicators. The Dollardavin_zi100% (1)

- Capital Budgeting With Illustration and TheoryDocument145 pagesCapital Budgeting With Illustration and Theorymmuneebsda50% (2)

- E Banking of Sonali BankDocument37 pagesE Banking of Sonali Bankmd shadab zaman RahatNo ratings yet

- Pevc Outline Spring 2018Document14 pagesPevc Outline Spring 2018Venkat Narayan RavuriNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Syazliana KasimNo ratings yet

- CH 08Document4 pagesCH 08flrnciairnNo ratings yet

- Get covered with Corona Rakshak PolicyDocument6 pagesGet covered with Corona Rakshak PolicyAJOONEE AUTO PARTSNo ratings yet