Professional Documents

Culture Documents

Comex Group Presentation

Uploaded by

thundercoder92880 ratings0% found this document useful (0 votes)

351 views15 pagesComex Group case presentation

Original Title

20141806 Comex Group Presentation

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentComex Group case presentation

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

351 views15 pagesComex Group Presentation

Uploaded by

thundercoder9288Comex Group case presentation

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

A Mexican Firm Goes International

Jun 18, 2014

Comex Group (Mexico)

Group 9:

Rijul Bhardwaj

Rashmi Chauhan

Sureshkumar A.

2

Based in Mexico, Comex Group has grown through international

acquisitions in last decade

Source: Case author, Company Website

1954

Inception of Comex in

Mexico

Business of mixing water-

based and paint oils

1958

Shifted to new facilities

Started manufacturing

Vinyl Paint

1988

Marcos Achar Levy, nephew

of the founder joined Comex

2012

Fourth largest paint

manufacturer in North America

Has 3,300 Retail Stores

2004

Marcos Achar Levy became

CEO

First Cross- border acquisition

of Professional paints

Established own

stores after boycott

from retailers

Established 100 stores

owned by themselves

Current

Was acquired by

Sherwin Williams

Company

Journey of Comex Group so far

3

Using a unique combination of franchising model and family values,

Comex achieved domestic and international success

Franchising

Family

Success Story at Home

Exclusive distributor of its own paint

Stores specialized in one brand of paint unlike

multi-brand shops.

Allowed stores to become franchises

Managers became business owners

Family owned business

Guiding principles

Openness to brothers

Respect for elders

Opportunity for the most capable

Development of dedicated workforce and

dealers

Employee satisfaction from increased

responsibility

Customer satisfaction from vast array of

products of a single brand

Ahead of competition because of Increased

alertness

No. 1 in Mexico

No. 4 in U.S. , Canada &

Central America

3,300 retail stores

Source: Case author

4

Major paint manufacturers were acquired post 2004 in North

America

4

International Acquisitions

Head office

> To maintain a major growth

rate, Comex has expanded

internationally

> Acquisition was chosen as

mode for international

expansion

> Professional Paints

acquired in 2004 allowed a

lot of subsidiary paint

companies to come in

Comex fold

COMMENTS

Major Brands acquired in North America

Frazee Paints

San Diego

Parker Paint

Tacoma, WA

Ideal Paint

Toronto

Kwal Paint

Denver

Professional Paints

Lone Tree, Colorado

Central Paints

New Hampshire

General

Paints

Vancouver

Source: Case author, News reports

5

International expansion through acquisitions remains an important

mode, but has its own specific HR issues

Why Acquisitions? HR Issues to be tackled

> Need to compete with global firms achieving world

class market entry and industry leadership

> Acquire assets and resources needed to compete

that would be either

> Expensive

> Impossible to develop internally

> Usually seen as a quick and effective way to develop

a presence in local market

> Acquisition helps yield value and profits due to:

> Industry consolidation

> Geographic Expansion

> New Market Entry

> Acquisition of Technology/Knowledge

> Realization of Synergies

HR complications often include issues like

> Overestimation of the abilities of partner firm

> Exaggerated assumption of the synergies

> Inadequate attention to incompatibilities of the firms

programs, ways of conducting business and culture

> Unwillingness to prepare for loss of productivity and staff

post acquisition

> Integration issues surrounding legal and cultural

systems in different countries

Comex Group wanted to bring color without

borders for creativity without bounds

Issues need to be tackled at every stage of the

acquisition process

Source: Case author

6

These issues must be tackled across all phases of acquisition

activity

Activity HR Involvement

Phase 1: Pre

Combination

> Initial target screening and

pre-bid courtcship

> Due diligence

> Price Setting and negotiations

> Agreement on contract

wording

> Involvement in due diligence to

analyze potential issues

> Preparation Stage

> Content Stage

Phase 2:

Combination and

Agreement Signing

> Detailing implementation

> Discovery and resolution of

differences

> Signing of Agreement

> Advice on implementing the deal

> Anticipating problems during

implementation

Phase 3: Post

Combination and

implementation

> Enforcement of deal

> Implementation

> Facilitating integration

> Creating employee communication

regarding business consummation

> Training employees for new fits,

staffing and compensation systems

P

r

o

c

e

s

s

o

f

C

o

m

b

i

n

a

t

i

o

n

P

r

o

b

l

e

m

s

i

n

P

h

a

s

e

3

t

o

b

e

a

d

d

r

e

s

s

e

d

i

n

P

h

a

s

e

1

a

n

d

P

h

a

s

e

2

1

2

3

7

Due Diligence is the most essential pre-combination activity

performed by the acquirer

PHASE 1: PRE COMBINATION 1

Due Diligence: A detailed audit

> Financial Issues: Review Annual Reports

> Marketing Issues: Product brochures

> Legal issues: Legal documentation

> Strategic issues: Business memos

> Company credentials: Certificates concerning

principals, activities and other requirements

Key components in any Due Diligence activity

Overall HR Issues

> Build understanding of HRM practices and

people issues of acquired firm

> Compatibilities in corporate cultures

> Employee attrition

> Succession and talent planning

1

2

Preparation: Items to determine ahead of time

Content of Due Diligence: Specific issues to assess ahead of time during the due

diligence phase

8

Preparation work for due diligence has its own peculiar HR issues

which must be addressed

Key Steps

> Development of Pre-determined

action plan and checklist of items

to evaluate due diligence

HR Issues

> When and where will deliberations

occur

> Measuring deliverables and

outcomes

Recommendations

> Information from internal and

external sources, determined ahead

of time

> Standardizing outcomes in the form

of a report or recommendations

> Creating a SWAT team: Identifying

individuals who have strong non-

directive interviewing skills

> Must have cross-cultural, language

and business expertise

> Familiarity with Compensation and

Benefits financials

> Sensitivity to cultural and language

differences

> Awareness of union and labor

differences

> Senior executives with past

experience in acquisition

management

> Internal reorganization to draw the

right talent out

> Forming and communicating new

culture

> Clear communication on

expectations of culture from new

firm

> Create and communicate

expectations to old and new

workforce members

PHASE 1: PRE COMBINATION 1

9

Various concerns must be tackled when designing content for due

diligence

General concerns

> Adequate funding for pension and healthcare plans

> Foreign employment regulations (legal requirements and their enforcement)

> HR department status, practices, policies and organization

> Merger of corporate cultures

Specific Concerns

Staffing

> Laws on hiring/firing

> Scrutiny of employment contracts

> (Potential) Downsizing costs

HR Information Systems

> Data protection norms

> Hardware/Software differences

Compensation and Benefits

> Mandates on benefit plans

> Country and firm pay scales

> Treatment of ESOPs, incentives

Labour Relations

> Presence of unions and their

forms

> Role of government

Career Development

> Importance in overall strategy

> Details on location and channels

> Cultural and national values

Works Council

> Presence or absence in different

countries

PHASE 1: PRE COMBINATION 1

10

Integration may pose unique effects on morale of employees, which

impact acculturation of acquired firm

Effect on Employees Effects on Culture

> Integration problems originate from resistance

to change

> Employees feel frustration and insecurity in

new firm

> Teamwork may break down due to stress

> Employees lose faith in the organization

> Lack of commitment, loyalty and enthusiasm

> Loss of identity post acquisition

> Short term attrition can make recovery and

integration difficult

> Employees sense loss of corporate culture and

values

> Assimilation of cultures may be driven by

dominating culture

> Worries about loss of national character important

Leads to acculturation: individuals and organizations

adapting and reacting to each others cultures.

> Involves formal acquisition process and post-acquisition (Phase 2 and Phase 3)

> Organizational integration leads to several key issues

COMBINATION AND POST COMBINATION 2,3

11

Comex Group has allowed blending of cultures across its acquired

firms

11

> Comex group allowed its

acquisitions to retain most of their

culture

> Its subsidiaries adopted the

franchising model and complete

store concept

> Branding was changed to match

Comex Group identity

> Acquired firms however were

allowed to operate their sales and

distribution independently

COMMENTS

Positioning Comex Group acquisitions

Portfolio

Blending

New Creation

Assimilation

Four Approaches

to Integration

Maintain separate cultures Choose best from each culture

Develop a new culture to fit the new

organization

Assign legitimacy to one culture and expect

assimilation by members of other culture

COMBINATION AND POST COMBINATION 2,3

Source: Case author, News reports

12

Firms must follow key steps to ensure smooth acculturation

Source: Pfizer website, Bayer Website, Lessl (2011), Roland Berger

> Identify and address cultural gaps

> Assign an executive leadership group including participants from acquired firm leading the change

> Create and communicate shared vision for the organization, clearly defining goals, roles and

responsibilities

> Establish a strong link between business strategy and quality, skills and number of people to achieve the

plan

> Reach a consensus on processes and procedures around compensation, incentives and recognition

programs

> Create a plan to consolidate health, welfare and retirement benefits

> Establish measures and rewards, and communicate and align them with organizations goal.

COMBINATION AND POST COMBINATION 2,3

13

Franchising model offers an alternative to acquisition as a mode of

expansion, has its own specific HR issues

Franchise: mix of successful ingredients at home with training and marketing support from franchisor

To motivate the employees at local level

To have standard training methodology

across franchises for employees

To have the correct employment policies and

provide training to managers on recruitment

and managing payrolls

To communicate the budget and similar

expectations

To provide help in identifying the correct

organizational structure

To ensure that appropriate , safe and

healthy work environment is available for the

employees

Legal compliance

Tax reporting

Adaption to the market conditions

is limited

Security cover of the parent

organization

Can benefit from the existing

brand name & defined

performance measures

Business owners can benefit

from the existing customer

insights

Quicker intervention

Easy means to gain the assets

and resources

F

r

a

n

c

h

i

s

i

n

g

A

c

q

u

i

s

i

t

i

o

n

s

l

Franchising vs Acquisitions

HR issues in franchising

14

Franchises can tackle these HR issues through certain long-term

and short-term steps

Regular interaction with the leadership teams and communication of the organizational goals

Clearly define and effectively communicate plan for employee growth

Set targets for franchise buyers and timely reward them for their contribution in the for business growth

Deploy own resources at franchise for people management

Well defined labor law communication and job descriptions

Set-up standard processes and forms for hiring, training, employee appraisal and counselling

Deploy technological solutions for HR management

Solutions

Thank you

You might also like

- 675 Ways To Develop Yourself and Your PeopleDocument244 pages675 Ways To Develop Yourself and Your Peopleviswa100% (2)

- Jazz Style and ArticulationDocument8 pagesJazz Style and ArticulationChristina Syriopoulou100% (1)

- Vietnamese Phonemic InventoryDocument2 pagesVietnamese Phonemic InventoryfroseboomNo ratings yet

- 10 Conflict and Management PDFDocument44 pages10 Conflict and Management PDFDennisNo ratings yet

- A Global Review of Good Distribution Practices: Brought To You by Cold Chain IqDocument13 pagesA Global Review of Good Distribution Practices: Brought To You by Cold Chain Iqthundercoder9288100% (1)

- Hill & Jones CH 08Document17 pagesHill & Jones CH 08Md. Shadman Sakib ShababNo ratings yet

- StarBucks - Case StudyDocument29 pagesStarBucks - Case Studyzackatt100% (7)

- Chap 3Document16 pagesChap 3Timothy BlakeNo ratings yet

- BUS 444 - Chapter 2Document34 pagesBUS 444 - Chapter 2JYNo ratings yet

- Hill 8e Basic Ch10Document30 pagesHill 8e Basic Ch10Adnan Ahmad Al-NasserNo ratings yet

- ChinaDocument92 pagesChinaLhanz SilvestreNo ratings yet

- The Radiance of Dailiness: Don Delillo and The Everyday BookDocument8 pagesThe Radiance of Dailiness: Don Delillo and The Everyday BookMark SampleNo ratings yet

- Procurement Schedule MawaridDocument1 pageProcurement Schedule MawaridAmy FitzpatrickNo ratings yet

- ITC SampleDocument20 pagesITC SampleDEVENDRA RATHORENo ratings yet

- Measures and AcquisitionDocument25 pagesMeasures and AcquisitionMpho Peloewtse TauNo ratings yet

- Tata Business ModelDocument15 pagesTata Business ModelJoaquinNo ratings yet

- In House Management Versus Management OutsourcedDocument38 pagesIn House Management Versus Management OutsourcedBhanuChopraNo ratings yet

- Gati LimitedDocument30 pagesGati Limitedthundercoder9288No ratings yet

- Excon2017 ListofExhibitors10122017Document23 pagesExcon2017 ListofExhibitors10122017thundercoder9288No ratings yet

- Resource Based View Model V1Document12 pagesResource Based View Model V1JEMIMAH MONTEMAYORNo ratings yet

- WalmartDocument36 pagesWalmartMohan Lal AroraNo ratings yet

- Sample ReportDocument25 pagesSample ReportTolga BilgiçNo ratings yet

- Business Stratergy of Top Indian It CompanyDocument9 pagesBusiness Stratergy of Top Indian It CompanySandeep MohantyNo ratings yet

- Financial Management: Sandeep GokhaleDocument90 pagesFinancial Management: Sandeep GokhaleVikram Singh Thakur100% (1)

- Family BusinessDocument12 pagesFamily BusinessJagadeesh PutturuNo ratings yet

- Reliance Jio - Acquisition StrategyDocument34 pagesReliance Jio - Acquisition StrategytanimaNo ratings yet

- Facilitation or BriberyDocument1 pageFacilitation or BriberyEssa_karimmNo ratings yet

- Case Study BDODocument2 pagesCase Study BDOSaumya GoelNo ratings yet

- Final Report of Shree CmsDocument117 pagesFinal Report of Shree CmsPuneet DagaNo ratings yet

- Avenue Supermart AnalysisDocument394 pagesAvenue Supermart Analysisashish.forgetmenotNo ratings yet

- E Value ServeDocument9 pagesE Value ServeAkritiAggarwalNo ratings yet

- OverviewDocument18 pagesOverviewGaurav SinghNo ratings yet

- Tata Consultancy ServicesDocument5 pagesTata Consultancy ServicesNithin NallusamyNo ratings yet

- Electrical Equipment Industry 2020Document2 pagesElectrical Equipment Industry 2020Ipsita Bhattacharjee100% (1)

- Case Analysis: Bain & Company's IT PracticeDocument1 pageCase Analysis: Bain & Company's IT PracticeVishal SairamNo ratings yet

- Analysis On The Basis of 7 Ps and SwotDocument28 pagesAnalysis On The Basis of 7 Ps and Swotvedanshjain100% (3)

- A Study On Tata Consultancy ServicesDocument4 pagesA Study On Tata Consultancy Servicesarun kumarNo ratings yet

- Friedman Doctrine NotesDocument3 pagesFriedman Doctrine NotesHimanshu MehraNo ratings yet

- Arthur - Keller Case Study INSEADDocument2 pagesArthur - Keller Case Study INSEADAnirudh GuptaNo ratings yet

- CSF Analysis Telecom IndustryDocument20 pagesCSF Analysis Telecom IndustryAbinash Biswal100% (1)

- Case 6 GoogleDocument13 pagesCase 6 Googleshoeb1276No ratings yet

- Globalization at GEDocument3 pagesGlobalization at GEMunib Ahmad100% (1)

- Porter's Five Force Analysis of Industry: Rivalry Among Competitors - Attractiveness: HighDocument5 pagesPorter's Five Force Analysis of Industry: Rivalry Among Competitors - Attractiveness: HighPrasanta MondalNo ratings yet

- Tata Group's Growth StrategiesDocument6 pagesTata Group's Growth Strategiesajay krishnaNo ratings yet

- A Study On: by Agil.P Register No. 412518631003Document69 pagesA Study On: by Agil.P Register No. 412518631003Dr.Maran KaliyamoorthyNo ratings yet

- MUDRA Case Study - 2127640Document4 pagesMUDRA Case Study - 2127640Sri DharshiniNo ratings yet

- Fundamental Analysis OF 5 COMPANIESDocument27 pagesFundamental Analysis OF 5 COMPANIESManish Nandal50% (2)

- Assignment of International ManagementDocument5 pagesAssignment of International ManagementHamzadHazir0% (1)

- Merger Ril IpclDocument5 pagesMerger Ril IpclsurajjosepNo ratings yet

- India's Cost of Capital: A Survey: January 2014Document16 pagesIndia's Cost of Capital: A Survey: January 2014Jeanette JenaNo ratings yet

- Digital Transformation in TQMDocument26 pagesDigital Transformation in TQMHarsh Vardhan AgrawalNo ratings yet

- Five Forces Analysis of The Indian IT IndustryDocument2 pagesFive Forces Analysis of The Indian IT IndustryFUNTV5No ratings yet

- Elixir CaseDocument11 pagesElixir CaseAnoushkaBanavarNo ratings yet

- Competition Analysis On Iron and Steel IndustryDocument18 pagesCompetition Analysis On Iron and Steel Industryatre100% (1)

- Archies Case GroupDocument17 pagesArchies Case GroupVenugopal NairNo ratings yet

- (191018) Aerospace Co. - BainDocument12 pages(191018) Aerospace Co. - BainRossieDameLasriaNo ratings yet

- Project On Parag MilkDocument74 pagesProject On Parag MilkraisNo ratings yet

- The Pitfalls of Parenting Mature CompaniesDocument4 pagesThe Pitfalls of Parenting Mature Companieschandola.mayank6566No ratings yet

- Me N Moms FI FranchiseeDocument32 pagesMe N Moms FI FranchiseeLovlesh NagoriNo ratings yet

- Can Amazon Trim Fat at Whole Foods?: Case AnalysisDocument12 pagesCan Amazon Trim Fat at Whole Foods?: Case AnalysisAkshaya LakshminarasimhanNo ratings yet

- Einventing Your Business ModelDocument17 pagesEinventing Your Business ModelSrishti Chadha100% (1)

- Asset-Light Model of Supply ChainDocument3 pagesAsset-Light Model of Supply ChainRajesh kumarNo ratings yet

- ERP@ Hero HondaDocument4 pagesERP@ Hero HondavishwesheswaranNo ratings yet

- Bliss Meadows Possible SolutionDocument2 pagesBliss Meadows Possible SolutionNic KnightNo ratings yet

- What Do Think Was This BankDocument20 pagesWhat Do Think Was This BankZeena HodaNo ratings yet

- Jakson Evolution of A Brand - Section A - Group 10Document4 pagesJakson Evolution of A Brand - Section A - Group 10RAVI RAJNo ratings yet

- Car IndustryDocument64 pagesCar IndustryDr Amit RangnekarNo ratings yet

- Snapdeal CaseDocument12 pagesSnapdeal CaseAswinAni100% (1)

- Precision Turned Products World Summary: Market Values & Financials by CountryFrom EverandPrecision Turned Products World Summary: Market Values & Financials by CountryNo ratings yet

- Energies: Electric Vehicle Charge Stations Location Analysis and Determination-Ankara (Turkey) Case StudyDocument22 pagesEnergies: Electric Vehicle Charge Stations Location Analysis and Determination-Ankara (Turkey) Case StudySweta DeyNo ratings yet

- mOoHCthe Story of Cold Chain Iq 0Document8 pagesmOoHCthe Story of Cold Chain Iq 0thundercoder9288No ratings yet

- Bhagvad Gita Summary - v1Document4 pagesBhagvad Gita Summary - v1thundercoder9288No ratings yet

- BhalaDocument4 pagesBhalathundercoder9288No ratings yet

- Roland Berger South East Asia Passenger Vehicle MarketDocument20 pagesRoland Berger South East Asia Passenger Vehicle Marketthundercoder9288No ratings yet

- Agrochemical Patent Watch Q1 2018Document4 pagesAgrochemical Patent Watch Q1 2018thundercoder9288No ratings yet

- Jet Airways - Visit NoteDocument10 pagesJet Airways - Visit Notethundercoder9288No ratings yet

- The Cool Side of ManufacturingDocument2 pagesThe Cool Side of Manufacturingthundercoder9288No ratings yet

- Akar Tools AR 2015 16Document84 pagesAkar Tools AR 2015 16thundercoder9288No ratings yet

- Suzuki Drives India S Car Manufacturing StoryDocument3 pagesSuzuki Drives India S Car Manufacturing Storythundercoder9288No ratings yet

- Indian CV Industry - Change Is The Only ConstantDocument4 pagesIndian CV Industry - Change Is The Only Constantthundercoder9288No ratings yet

- Agri Machinery in GermanyDocument36 pagesAgri Machinery in Germanythundercoder9288No ratings yet

- Aircraft Condition MonitoringDocument16 pagesAircraft Condition Monitoringthundercoder9288No ratings yet

- Caterpillar Analyst PresentationDocument17 pagesCaterpillar Analyst Presentationthundercoder9288100% (1)

- AQR FundDocument14 pagesAQR Fundthundercoder9288100% (1)

- WST Excel Shortcuts 2Document1 pageWST Excel Shortcuts 2Sami MohammedNo ratings yet

- Before Starting With Our Project Here Are Some Facts About Taj ..Document43 pagesBefore Starting With Our Project Here Are Some Facts About Taj ..Arvind S NairNo ratings yet

- HNA Airlines - Case Analysis Prasun BansalDocument11 pagesHNA Airlines - Case Analysis Prasun Bansalthundercoder9288No ratings yet

- Hindware Sanitarywares PricelistDocument12 pagesHindware Sanitarywares Pricelistthundercoder9288No ratings yet

- Tajhotel ppt20 091117093036 Phpapp01Document42 pagesTajhotel ppt20 091117093036 Phpapp01Yash AcharyaNo ratings yet

- Q1 2014 China: Autos ReportDocument79 pagesQ1 2014 China: Autos Reportthundercoder9288No ratings yet

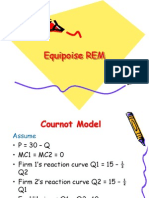

- Micro EconomicsDocument52 pagesMicro Economicsthundercoder9288100% (1)

- Case AquatredDocument5 pagesCase Aquatredthundercoder9288No ratings yet

- Compensation Problems With A Global Workforce: Case PresentationDocument13 pagesCompensation Problems With A Global Workforce: Case Presentationthundercoder9288No ratings yet

- Animation 2014 Mínguez LópezDocument21 pagesAnimation 2014 Mínguez Lópezthundercoder9288No ratings yet

- Hitler, Adolf (1889-1945)Document15 pagesHitler, Adolf (1889-1945)thundercoder9288No ratings yet

- Ucsp ReportingDocument23 pagesUcsp ReportingAliyah Kaye RomeroNo ratings yet

- SomrasDocument85 pagesSomrasSomnath PaulNo ratings yet

- Herodotus Greek Historian Father of HistoryDocument6 pagesHerodotus Greek Historian Father of Historypaulsub63100% (1)

- A Main Character Analysis in Hansel and Gretel Written by Jacob and Wilhelm GrimmDocument0 pagesA Main Character Analysis in Hansel and Gretel Written by Jacob and Wilhelm Grimmsintamelya7No ratings yet

- İstanbul Medeniyet University Erasmus+ Proficiency ExamDocument8 pagesİstanbul Medeniyet University Erasmus+ Proficiency ExammurgilalNo ratings yet

- Persian LanguageDocument19 pagesPersian LanguageThe Overlord Girl0% (1)

- List of Malayalam-Language Newspapers - WikipediaDocument3 pagesList of Malayalam-Language Newspapers - WikipediaDinesh SaminathanNo ratings yet

- Definition of Rural TourismDocument19 pagesDefinition of Rural TourismRahul Prasad SinghNo ratings yet

- Some Opinions About Romanian EthnogenesisDocument3 pagesSome Opinions About Romanian EthnogenesisDragos GengiuNo ratings yet

- ThailandDocument152 pagesThailandjitendragoenkaNo ratings yet

- Esl Classes - in ManhattanDocument2 pagesEsl Classes - in Manhattanapi-46748333No ratings yet

- History - Published Works of PhuleDocument1 pageHistory - Published Works of Phulealancia menezesNo ratings yet

- Galaxy Global Group of Institutions, Ambala: Course-MBA Sem. - IIIDocument22 pagesGalaxy Global Group of Institutions, Ambala: Course-MBA Sem. - IIIshallu26No ratings yet

- First Floor Plan PDFDocument1 pageFirst Floor Plan PDFSumit SharmaNo ratings yet

- Ubiquity of MicroorganismsDocument17 pagesUbiquity of MicroorganismsAbdallah Essam Al-Zireeni75% (4)

- Pablo PicassoDocument1 pagePablo PicassomichuttyNo ratings yet

- Narrative TextDocument4 pagesNarrative TextTarwedi TartorNo ratings yet

- Bod Ma ThesisDocument75 pagesBod Ma ThesisDavid BoltonNo ratings yet

- Advance Information Sheet: Written in StoneDocument1 pageAdvance Information Sheet: Written in StoneFrederick NoronhaNo ratings yet

- Week 5 Chapter 4 Reading Response 2 - Mcintosh MartinDocument3 pagesWeek 5 Chapter 4 Reading Response 2 - Mcintosh Martinapi-340865637No ratings yet

- Common Topics Common Topic 4: Safety CultureDocument4 pagesCommon Topics Common Topic 4: Safety CultureAnonymous ANmMebffKRNo ratings yet

- Docs BioDocument14 pagesDocs BiomujislavNo ratings yet