Professional Documents

Culture Documents

Global Takeaway Food Delivery Market - Focus On Online Channel (2014-2019) - New Report by Daedal Research

Uploaded by

Daedal ResearchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Takeaway Food Delivery Market - Focus On Online Channel (2014-2019) - New Report by Daedal Research

Uploaded by

Daedal ResearchCopyright:

Available Formats

Takeaway Food Delivery Market: Focus on Online

Channel (2014-2019)

July 2014

Scope of the Report

The Report titled Takeaway Food Delivery market: Focus on Online Channel (2014-2019)

provides an insight into takeaway Food Delivery market with a special focus on online

takeaway food. The report also includes the market value, segmentation and also country-wise

market analysis. It also discusses key growth drivers, challenges and upcoming trends of the

market. Further, companies like Just Eat, GrubHub, Delivery Hero, and Takeaway.com are

profiled in the report.

Countries Coverage

The UK, Spain, France, Italy, Netherlands, Denmark, Norway, Switzerland, The US,

Canada, Brazil

Company Coverage

GruhHub Holdings Inc.

Just Eat Plc.

Delivery Hero and Hungryhouse

Takeaway.com

Foodpanda & HelloFood

View Report Details

Executive Summary

Takeout food offers a convenient alternative, providing diners with a wide variety of options.

Consumers have many choices for takeaway food, including online takeaway food aggregator portals,

restaurant chains offering online ordering services, as well as local restaurants offering telephone-

based and walk-in takeaway food services. Growth in takeaway food delivery market is outpacing

global GDP growth with online ordering growing much faster, proliferated by the adoption of E-

commerce and increased smartphones/tablet penetration. Consumers are shifting from traditional

telephone based takeaway ordering to online platform as it offers wide variety of choices, ratings and

reviews, including payment by credit or debit card, and a more efficient consumer experience.

Companies that offer online food ordering services include Just Eat, GrubHub, Delivery Hero,

Takeaway.com etc. Takeaway restaurants (TRs) sign contracts with these companies to join their

platform and have their menus made accessible to consumers. These online companies primarily derive

its revenue from commissions charged to TRs on order value placed through its platform.

The US is the largest market for takeaway food delivery market followed by the UK, Italy, Spain,

Canada, France, Brazil and others. The online food ordering industry saw a major consolidation with

Delivery Hero acquiring Lieferheld of Germany and hungryhouse of the UK in 2012. In 2013, GrubHub

merged with Seamless took making it the largest online takeaway food company.

View Report Details

Global Takeaway Food Delivery Market

The global takeaway food delivery market grew at a CAGR of ..% over the period 2011-2013

and amounted to approximately US$...... billion in 2013. Growth in takeaway food delivery

market is outpacing global GDP growth with online ordering growing much faster, proliferated

by the adoption of E-commerce and increased smartphones/tablet penetration.

Global Takeaway Food Delivery Market Size in

US$ Billion, 2011-2013

The US is the largest market for takeaway food with % of global share in 2013. GrubHub is

the largest online takeaway food service provider that focuses on both restaurants and diners

through two-sided network. The UK is the second largest market.

Global Takeaway Food Delivery Market Share by

Regions, 2013

2011 2012 2013

US

UK

Italy

Spain

Canada

France

Brazil

Netherlands

Denmark

Others

Country Analysis Takeaway Food Delivery Market

The UK takeaway food market grew at a CAGR of .% over the period 2011-13 with online

penetration of takeaway ordering in the UK at ..%. The online takeaway food market in the US

was valued at US$.... billion in 2013. There are approximately .. restaurants in the UK.

Takeaway Food Delivery Market Value in the UK

in US$ Billion, 2011-2015

Spain is considered as one of the key markets in European region with high growth potential.

The total annual delivery takeaway order value in Spain grew at a CAGR of .% over the

period 2011-13 despite the economic slowdown to reach US$..... billion (GBP . billion) in

2013.

Spain- Takeaway Food Delivery Market in US$

Billion, 2011-2013

2011 2012 2013 2014F 2015F

2011 2012 2013

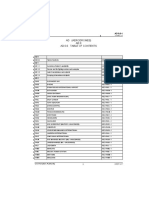

Table of Contents

1. Executive Summary

2. Takeaway Food

2.1 An Overview

2.2 Mode of Delivery

2.3 Global Takeaway Food Delivery Market (2011-2013)

2.4 Forecast - Global Online Takeaway Food Market

(2014-2019)

2.5 Penetration of Online Takeaway Food

2.6 Geographical Segmentation

3. Country Analysis Delivery Takeaway Food Market

3.1 The UK

3.2 Spain

3.3 France

3.4 Italy

3.5 Netherlands

3.6 Denmark

3.7 Norway

3.8 Switzerland

3.9 The US

3.10 Canada

3.11 Brazil

4. Market Drivers

4.1 Rising Usage of Smartphones and Tablets

4.2 Rising Urbanization

4.3 Demand from Emerging Markets

4.4 Growth of Fast Food Chains

5. Challenges

5.1 Regulations Regarding Internet

5.2 Seasonal Demand

5.3 Food Safety Regulations

Table of Contents

6. Market Trends

6.1 Industry Consolidation

6.2 Increase in Commission Rates

6.3 Pick-Up/Collection As New Market Opportunity

7. Competitive Landscape

8. Company Profiles

8.1 GrubHub Holdings Inc.

8.1.1 Business Description

8.1.2 Financial Overview

8.1.3 Business Strategies

8.2 Just Eat Plc. (JE)

8.2.1 Business Description

8.2.2 Financial Overview

8.2.3 Business Strategies

8.3 Delivery Hero and Hungryhouse

8.3.1 Business Description

8.3.2 Business Strategies

8.4 Takeaway.com

8.4.1 Business Description

8.4.2 Geographical Coverage

8.5 Foodpanda and Hellofood

8.5.1 Business Description

8.5.2 Geographical Coverage

9. About Us

List of Charts

Figure 1: Lifecycle of Takeaway Food Delivery

Figure 2: Revenue Model of Online Food Ordering Companies

Figure 3: Global Takeaway Food Delivery Market Size in US$ Billion, 2011-2013

Figure 4: Forecast Global Delivery Takeaway Food Market Size in US$ Billion, 2014-2019

Figure 5: Online Penetration of Takeaway Ordering as a % of Total Number of Customers Ordering Takeaway

Food in Key Markets, 2013

Figure 6: Global Takeaway Food Delivery Market Share by Regions, 2013

Figure 7: Delivery Takeaway Food Market Value in the UK in US$ Billion, 2011-2015

Figure 8: Total Delivery Takeaway Food Market and Online Takeaway Food Market Size in the UK in US$ Billion,

2013

Figure 9: UK GDP Growth vs Takeaway Market Growth in %

Figure 10: Online spend as % of total retail spend in the UK, 2009-2013

Table 1: Favorites Takeaway Food in the UK, 2013

Figure 11: Spain- Delivery Takeaway Food Market in US$ Billion, 2011-2013

Table 2: Spain Takeaway Food Market: Key Statistics, 2013

Figure 12: France - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Figure 13: France Share of Online Delivery as % of Total delivery Takeaway Food Market, 2013

Table 3: France Takeaway Food Market: Key Statistics 2013

Figure 14: Italy - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Table 4: Italy Takeaway Food Market: Key Statistics 2013

Figure 15: Netherlands - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Table 5: Netherlands Takeaway Food Market: Key Statistics 2013

Figure 16: Denmark - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Figure 17: Norway - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Table 7: Norway Takeaway Food Market: Key Statistics 2013

Figure 18: Switzerland- Delivery Takeaway Food Market in US$ Billion, 2011-2013

Table 8: Switzerland Takeaway Food Market: Key Statistics 2013

Figure 19: The US - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Figure 20: Smartphones Penetration as % of Total Population in the US, 2011-2013

Figure 21: Canada - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Figure 22: Canada Share of Online Delivery as % of Total delivery Takeaway Food Market, 2013

Figure 23: Brazil - Delivery Takeaway Food Market in US$ Billion, 2011-2013

Table 10: Brazil Takeaway Food Market: Key Statistics 2013

Figure 24: Smartphones Penetration (Base: Total Population) in %, 2011-2013

Figure 25: Just Eat - % of Orders via Mobile, 2013

Figure 26: Global Urban Population in Billion, 2006-2013E

Figure 27: Real GDP Growth in Emerging Countries in US$ Billion (2009 versus 2015F)

Figure 28: Global Fast Food Restaurant Industry in US$ Billion, 2009-2013

Figure 29: Average Commission Rates for Just Eat as % of Total Transaction Volume, 2011-2013

Figure 30: Spontaneous Brand Awareness in the UK in % (Oct 2012Dec 2013)

Table 11: GrubHub Inc Key Business Metrics, 2011-2013

Figure 31: Number of Restaurants on Grubhub and Seamless Platforms in 000, 2011-2013

List of Charts

Figure 32: GrubHub Inc Net Revenues and Income in US$ Million, 2011-2013

Table 12: Key Performance Indicators, 2011-2013

Table 13: Launch and Position of JEs Business in Each Territory

Figure 33: Just Eat Net Revenues in US$ Million, 2011-2013

Figure 34: Just Eat Revenue by Sources in %, 2013

Figure 35: Just Eat Marketing Cost as a % of Total Sales, 2011-2013

Table 14: Delivery Hero Geographical Footprint, 2013

Table 15: Takeaway.com Geographical Footprint, 2013

Table 16: Takeaway.com: no. of Restaurants Available on Sites, 2013

Table 17: Markets in which Foodpanda And Hellofood Services Operate, 2013

List of Charts

View Report Details

Daedal Research

Daedal Research is a research and consulting firm specialized in providing research reports and

customized business research and analysis. The research firm offers a blend of the best strategic

consulting and market research solutions, which promise data rich, cost effective, and highly

insightful analysis to help its clients with perfect answers to their important business queries.

For more details please contact Mr. Rajeev Kumar:

Tel: +91-120-4553017 (9.30 am - 6.30 pm) IST

Mobile: +91-8743975789 (24 X7)

Enquiries: info@daedal-research.com

Title: Takeaway Food Delivery Market: Focus on Online Channel (2014-19)

Published: July 2014

Pages: 62

Price: US$ 800 (Single-User License)

: US$ 1600 (Corporate License)

For placing an order of the Report, please press the following link:

http://www.daedal-research.com/global-takeaway-food-delivery-market-focus-on-online-channel-2014-2019

You might also like

- UK CB Food and Beverage 2020Document28 pagesUK CB Food and Beverage 2020HisExcellencyNo ratings yet

- An Overview of The IndustryDocument9 pagesAn Overview of The IndustryTomy VargheseNo ratings yet

- Food DeliveryDocument2 pagesFood DeliveryNara KhalilovaNo ratings yet

- Glovo Case AnalysisDocument8 pagesGlovo Case AnalysisBill Jason DuckworthNo ratings yet

- World: Melon - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Melon - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- E-Commerce in Europe: June 9, 2016 by GemmaDocument9 pagesE-Commerce in Europe: June 9, 2016 by GemmaFhamida IslamNo ratings yet

- 1.1 Brief History of The IndustryDocument46 pages1.1 Brief History of The IndustryTomy VargheseNo ratings yet

- World: Tomato - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Tomato - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Methodology Final Exam NDocument14 pagesMethodology Final Exam NOussama MimoNo ratings yet

- 1 2 Revised UpdatedDocument26 pages1 2 Revised UpdatedDan Dan ManaoisNo ratings yet

- Chapter-1: Industry AnalysisDocument27 pagesChapter-1: Industry Analysisnaman acharyaNo ratings yet

- Business Plan AnalysisDocument2 pagesBusiness Plan AnalysisSydney MittoNo ratings yet

- Gea Pre-Analysis.: Japan & VenezuelaDocument8 pagesGea Pre-Analysis.: Japan & Venezuelaapi-555578456No ratings yet

- Is Traditional Advertising Dead, or Just On Its Last Legs?: Marketing CommunicationsDocument11 pagesIs Traditional Advertising Dead, or Just On Its Last Legs?: Marketing CommunicationslaeraliNo ratings yet

- Oneplus Report Ready For SubmissionDocument27 pagesOneplus Report Ready For SubmissiongeetaNo ratings yet

- New Zealand Fast Food IndustryDocument12 pagesNew Zealand Fast Food IndustryPutra Anggita100% (2)

- Food OnlineDocument12 pagesFood OnlineAmber PreetNo ratings yet

- Cushman & Wakefield's 'Chanigng World of Trade'Document36 pagesCushman & Wakefield's 'Chanigng World of Trade'Angie BrennanNo ratings yet

- Report Foodcorner - Updated-1Document13 pagesReport Foodcorner - Updated-1Muzamil ChannaNo ratings yet

- Impact of External Environment Factors Have On A Fashion BusinessDocument3 pagesImpact of External Environment Factors Have On A Fashion BusinessAmar narayanNo ratings yet

- 2016 Promo h2 Case Study Question PaperDocument4 pages2016 Promo h2 Case Study Question PaperWong Yu Han Amelia (Yijc)No ratings yet

- How The Covid-19 Pandemic Is CDocument19 pagesHow The Covid-19 Pandemic Is CAsHish KasHyapNo ratings yet

- Changing Roles of HR ManagersDocument98 pagesChanging Roles of HR Managerssachin mohanNo ratings yet

- Propose An Innovative Food Product Using The Traditional Technique. Present It Through Video Presentation or Through A Paper by Writing The ProposalDocument2 pagesPropose An Innovative Food Product Using The Traditional Technique. Present It Through Video Presentation or Through A Paper by Writing The ProposalIan AmuraoNo ratings yet

- Online Food Delivery Industry (Zomato) PDFDocument9 pagesOnline Food Delivery Industry (Zomato) PDFLavato GustoNo ratings yet

- Business FinalDocument72 pagesBusiness FinalVitaliiNo ratings yet

- Market Research Report - For CindyDocument19 pagesMarket Research Report - For CindySheryl NgNo ratings yet

- Dark Kitchens & The British Takeaway Revolution: What Is A 'Dark Kitchen'?Document15 pagesDark Kitchens & The British Takeaway Revolution: What Is A 'Dark Kitchen'?johnpobrien76No ratings yet

- Strategic Retail Multichannel QVC Rachel Barber ScribdDocument15 pagesStrategic Retail Multichannel QVC Rachel Barber ScribdMissBarberNo ratings yet

- Food Delivery: Riego, Janella Mae C. BSCMM-2Y2-3BDocument8 pagesFood Delivery: Riego, Janella Mae C. BSCMM-2Y2-3BJanella MaeNo ratings yet

- Kantar Worldpanel - FMCG Monitor - P2'13 - enDocument11 pagesKantar Worldpanel - FMCG Monitor - P2'13 - enLinh LạiNo ratings yet

- Digital Disruption at The Grocery StoreDocument8 pagesDigital Disruption at The Grocery StoreDanica Diamante100% (1)

- E-Commerce YouGov Paper - RevisionsDocument33 pagesE-Commerce YouGov Paper - RevisionsMohd WaseemNo ratings yet

- Food and Hos - Delivery TaskDocument4 pagesFood and Hos - Delivery TaskMikala HooperNo ratings yet

- Quick Commerce Will The Disruption of The Food RetailDocument28 pagesQuick Commerce Will The Disruption of The Food RetailPrateek Gupta IPM 2021-26 BatchNo ratings yet

- Microeconomics Group Work Report BCN RestaurantsDocument24 pagesMicroeconomics Group Work Report BCN RestaurantsYoussef Charif 2No ratings yet

- US Food & Beverage Industry Analysis - Sakshi GuptaDocument8 pagesUS Food & Beverage Industry Analysis - Sakshi GuptaSakshi GuptaNo ratings yet

- World: Avocados - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Avocados - Market Report. Analysis and Forecast To 2020IndexBox Marketing100% (1)

- A6 - Global Frozen Food Market Analysis and Forecasts 2020-2025Document1 pageA6 - Global Frozen Food Market Analysis and Forecasts 2020-2025mariaNo ratings yet

- Delivery Hero Research GateDocument8 pagesDelivery Hero Research GateSAURAVENDRA TOMARNo ratings yet

- Consumer Foodservice in The Philippines: Euromonitor International April 2019Document16 pagesConsumer Foodservice in The Philippines: Euromonitor International April 2019Abby ArmadoNo ratings yet

- Tracxn Research Grocery Tech LandscapeDocument104 pagesTracxn Research Grocery Tech LandscapeMOhitNo ratings yet

- Chapter 1 - Introduction of StudyDocument22 pagesChapter 1 - Introduction of StudyShubh ShahNo ratings yet

- Market Research For Cindy XinDocument22 pagesMarket Research For Cindy XinSheryl NgNo ratings yet

- Just Eat Limited - SWOT AnalysisDocument3 pagesJust Eat Limited - SWOT AnalysisVIVEK SOMANINo ratings yet

- BCG How Digital Delivery Puts The Restaurant Value Chain Up For Grabs Jan 2017 Tcm30 161464Document17 pagesBCG How Digital Delivery Puts The Restaurant Value Chain Up For Grabs Jan 2017 Tcm30 161464Hemanth Kumar KolluruNo ratings yet

- Strategic Management Project OnDocument12 pagesStrategic Management Project Onashutoshy vermaNo ratings yet

- Feeding future generations: How finance can boost innovation in agri-food - Executive SummaryFrom EverandFeeding future generations: How finance can boost innovation in agri-food - Executive SummaryNo ratings yet

- ENGLISH (WRITTEN PROJECT) (Food Expenditure Trends) (Christopher Gae Gutiérrez Melitón) (2.-C) (School of Economics)Document5 pagesENGLISH (WRITTEN PROJECT) (Food Expenditure Trends) (Christopher Gae Gutiérrez Melitón) (2.-C) (School of Economics)Ani CruzNo ratings yet

- Assignment 1Document7 pagesAssignment 1mariyaNo ratings yet

- Vivekanand Education Society Institute of Management Studies and ResearchDocument63 pagesVivekanand Education Society Institute of Management Studies and ResearchManish RamnaniNo ratings yet

- Impact of COVID-19 Pandemic On Zomato: A Case Study: Dr. Maneesha KaushikDocument8 pagesImpact of COVID-19 Pandemic On Zomato: A Case Study: Dr. Maneesha KaushikSHIVANI PATELNo ratings yet

- Project Report by Mahima Gupta - Zomato Vs SwiggyDocument50 pagesProject Report by Mahima Gupta - Zomato Vs Swiggyshikha chaudharyNo ratings yet

- Uber Report EditedDocument27 pagesUber Report EditedShah ZeeshanNo ratings yet

- World: Plantains - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Plantains - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- FNB Disrupt ReportDocument44 pagesFNB Disrupt ReportTitan KNo ratings yet

- Global Pet Food Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDocument11 pagesGlobal Pet Food Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDaedal Research0% (1)

- Source of All StatisticsDocument26 pagesSource of All StatisticsDavid DuncanNo ratings yet

- World: Cucumbers and Gherkins - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Cucumbers and Gherkins - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Global Pest Control Services Market: 2015 Edition - New Report by Daedal ResearchDocument11 pagesGlobal Pest Control Services Market: 2015 Edition - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Refinery Catalyst Market: Trends and Opportunities (2015-2019) - New Report by Daedal ResearchDocument12 pagesGlobal Refinery Catalyst Market: Trends and Opportunities (2015-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Middle East Chemical Market: Trends and Opportunities (2015-2019) - New Report by Daedal ResearchDocument16 pagesMiddle East Chemical Market: Trends and Opportunities (2015-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Industrial PC (IPC) Market: Trends and Opportunities (2015-2019) - New Report by Daedal ResearchDocument11 pagesGlobal Industrial PC (IPC) Market: Trends and Opportunities (2015-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Sportswear Market With Focus On China: Trends & Opportunities (2015-2019) - New Report by Daedal ResearchDocument13 pagesGlobal Sportswear Market With Focus On China: Trends & Opportunities (2015-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Glaucoma Treatment Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument11 pagesGlobal Glaucoma Treatment Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Biosimilar Market Trends & Opportunities: 2015 Edition - New Report by Daedal ResearchDocument10 pagesGlobal Biosimilar Market Trends & Opportunities: 2015 Edition - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Life Re-Insurance Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument12 pagesGlobal Life Re-Insurance Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- The US Firearms and Ammunition Market: 2014 Edition - New Report by Daedal ResearchDocument11 pagesThe US Firearms and Ammunition Market: 2014 Edition - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Aortic Aneurysm Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument12 pagesGlobal Aortic Aneurysm Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Combined Hormonal Contraceptives (CHC) Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDocument9 pagesGlobal Combined Hormonal Contraceptives (CHC) Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Welding and Cutting Market Report - New Report by Daedal ResearchDocument12 pagesGlobal Welding and Cutting Market Report - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Indian Edible Oil Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument13 pagesIndian Edible Oil Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Nitrile Gloves Market: Trends & Opportunities (2014-2019) - New Report by Daedal ResearchDocument11 pagesGlobal Nitrile Gloves Market: Trends & Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Pet Insurance Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument10 pagesGlobal Pet Insurance Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Feminine Hygiene (Sanitary Protection) Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDocument14 pagesGlobal Feminine Hygiene (Sanitary Protection) Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDaedal Research100% (1)

- Global Lubricants and Base Oil Market: Trends & Opportunities (2014 Edition) - New Report by Daedal ResearchDocument12 pagesGlobal Lubricants and Base Oil Market: Trends & Opportunities (2014 Edition) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Antifungal Therapeutics Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument10 pagesGlobal Antifungal Therapeutics Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Cocoa and Cocoa Products Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDocument12 pagesGlobal Cocoa and Cocoa Products Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Cyber Security Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDocument11 pagesGlobal Cyber Security Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Indian Poultry and Red Meat Market: An Analysis - New Report by Daedal ResearchDocument12 pagesIndian Poultry and Red Meat Market: An Analysis - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Indian Innerwear Market: Trends & Opportunities (2014-2019) - New Report by Daedal ResearchDocument10 pagesIndian Innerwear Market: Trends & Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Anti Migraine Drugs Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDocument10 pagesGlobal Anti Migraine Drugs Market: Trends and Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Theme Park Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDocument10 pagesGlobal Theme Park Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Indian Automotive and Industrial Lubricants Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDocument12 pagesIndian Automotive and Industrial Lubricants Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Bioplastics Market: Trends & Opportunities (2013-2018) - New Report by Daedal ResearchDocument13 pagesGlobal Bioplastics Market: Trends & Opportunities (2013-2018) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Global Pet Food Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDocument11 pagesGlobal Pet Food Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDaedal Research0% (1)

- DIAGRAMA - 2007 - NEW YarisDocument1 pageDIAGRAMA - 2007 - NEW YarisLuis M. Valenzuela Arias50% (2)

- Hazardous Area Heater Crex 020 Old Version 2721512-544292Document2 pagesHazardous Area Heater Crex 020 Old Version 2721512-544292Achintya KarmakarNo ratings yet

- Machxo2™ Family Data Sheet: Ds1035 Version 3.3, March 2017Document116 pagesMachxo2™ Family Data Sheet: Ds1035 Version 3.3, March 2017Haider MalikNo ratings yet

- Seipl Profile and CapabilitiesDocument32 pagesSeipl Profile and CapabilitiesAbhishek GuptaNo ratings yet

- Aerodromes PDFDocument522 pagesAerodromes PDFaditya100% (1)

- Acct Statement XX6669 23062023Document66 pagesAcct Statement XX6669 23062023Suraj KoratkarNo ratings yet

- Polymer and Web ComponentsDocument26 pagesPolymer and Web ComponentsAdjetey Adjei-laryeaNo ratings yet

- Cs2000 Universal Translations3006a 50 SGDocument508 pagesCs2000 Universal Translations3006a 50 SGAleksandr BashmakovNo ratings yet

- Bittorrent-Like P2P NetworkDocument41 pagesBittorrent-Like P2P NetworkNguyễn Ngọc GiàuNo ratings yet

- Spray Nozzle Flow Rate CalculatorDocument10 pagesSpray Nozzle Flow Rate CalculatorRavindra VasudevaNo ratings yet

- Move All Database Objects From One Tablespace To AnotherDocument2 pagesMove All Database Objects From One Tablespace To AnotherJabras GuppiesNo ratings yet

- Project 5 - Magic 8 Ball Fortune Telling ProjectDocument23 pagesProject 5 - Magic 8 Ball Fortune Telling ProjectHidden Gem50% (2)

- GSECL - Daily Progress Report 11.9.21Document2 pagesGSECL - Daily Progress Report 11.9.21krishna mohanNo ratings yet

- Lab Nov 2013Document35 pagesLab Nov 2013balajigandhirajanNo ratings yet

- Walls2017 DemolitionforsustainableconstructionRGDocument6 pagesWalls2017 DemolitionforsustainableconstructionRGStefan GhidiuNo ratings yet

- Oracle Fusion Financials Set Up Journal ApprovalsDocument64 pagesOracle Fusion Financials Set Up Journal Approvalssohaibmuzaffar0070% (3)

- Kstar Inverosores DatasheetDocument1 pageKstar Inverosores DatasheetJosueLopesFariasNo ratings yet

- Hotel Cleaning Equipment Used byDocument9 pagesHotel Cleaning Equipment Used byLeonardo ViridisNo ratings yet

- The Business Analyst and The SDLCDocument8 pagesThe Business Analyst and The SDLCErlet ShaqeNo ratings yet

- 2014 BayHelix Annual Conference Program v2Document19 pages2014 BayHelix Annual Conference Program v2Ulfa Yasmin ShahabNo ratings yet

- Operating Manual: Wheel Loader L538 - 432 From 13100Document284 pagesOperating Manual: Wheel Loader L538 - 432 From 13100Jacques Van Niekerk80% (5)

- Amca - 201 Fans and SystemsDocument80 pagesAmca - 201 Fans and SystemsenricoNo ratings yet

- Boostherm DWV 01 2017 ENDocument6 pagesBoostherm DWV 01 2017 ENCarlos LehmanNo ratings yet

- Aa1a32 02Document3 pagesAa1a32 02MramirezNo ratings yet

- Chapter 5 SupplementsDocument5 pagesChapter 5 SupplementsGabriela MironNo ratings yet

- Chapter 5 Hydraulic JumpDocument31 pagesChapter 5 Hydraulic JumpUsman AliNo ratings yet

- Reading and Writing Writing An EmailDocument1 pageReading and Writing Writing An EmailferfonsegonNo ratings yet

- 5065-Article Text-17890-1-10-20230110Document18 pages5065-Article Text-17890-1-10-20230110Januar KristianNo ratings yet

- The Diffusion of Innovation and Adopter CategoriesDocument3 pagesThe Diffusion of Innovation and Adopter CategoriesMark Angelo TitcoNo ratings yet

- Hardware Compatibility List (HCL) For Veritas Storage Foundation (TM) and High Availability Solutions 4.1 MP2 For SolarisDocument5 pagesHardware Compatibility List (HCL) For Veritas Storage Foundation (TM) and High Availability Solutions 4.1 MP2 For SolarisbennialNo ratings yet