Professional Documents

Culture Documents

Competition and Business Strategy in Historical Perspective Pankaj

Uploaded by

K VOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Competition and Business Strategy in Historical Perspective Pankaj

Uploaded by

K VCopyright:

Available Formats

Economics of Strategy

University of Victoria

Summer 2011

Pascal Courty

Economics of Strategy

Objectives for today

Discuss course outline

Introduction to economics of strategy

Academic influences

Course objectives: learn how market environment and firms

strategy influence firm performance

Learning approach: mix of formal lectures (1/2), discussion of

research articles (1/4), and class discussion(1/4)

Material: book, slides, weekly emails, research articles

Pre-requisites: Micro, IO, game theory

Expectations: read book chapters, read research articles,

follow instructions in weekly emails

Grading: pb sets (40%), midterm (30%), essay (30%)

Course outline

Part I. Incentives, Firms, and Markets

Chapters 3, 5, 6, 16, 17

Performance measurement and incentives within firms

Vertical boundaries of the firm

Part II. Markets and Competitive Analysis

Chapters 9, 10, 11, 12

Thinking strategically and strategic commitment

Pricing rivalry

Entry

Industry analysis

Part III. Competitive Advantage and Industry Dynamics

Chapters 13, 14, 15

Competitive advantage

Innovation and industry dynamics

Course Contents

Economics of Strategy

Academic Influences

Industrial organization (analysis of market

competition)

Game theory (strategic interactions)

Economics of organization (transaction cost

economics, contract theory)

Incentive theory (personnel economics,

information theory)

Focus can be on managerial ability to change firm

position (organizational behaviour) or market

environment (competition economics)

Research articles

Part I. Incentives, Firms, and Markets

The Dynamics of Franchise Contracting: Evidence from Panel Data. Francine Lafontaine and Kathryn L. Shaw. The Journal of Political Economy. Vol.

107, No. 5 (October 1999) (pp. 1041-1080)

Peers at Work. Alexandre Mas and Enrico Moretti. American Economic Review 2009, 99:1, 112145.

Competition and Business Strategy in Historical Perspective. Pankaj Ghemawat. The Business History Review, Vol. 76, No. 1 (Spring, 2002), pp. 37-

74

Performance Pay and Top-Management Incentives. Michael C. Jensen and Kevin J. Murphy. Journal of Political Economy, 98. Page 225 of 225-

264

Part II. Markets and Competitive Analysis

How Much Does Industry Matter, Really? by Anita M McGAHAN, Michael E Porter. Strategic Management Journal (1997) Volume: 18, Issue: S1,

Publisher: John Wiley \& Sons, Pages: 15-30

Commitment to a Process Innovation: Nucor, USX, and Thin-Slab Casting. Pankaj Ghemawat. Journal of Economics & Management Strategy

Volume 2, Issue 1, pages 135161, March 1993.

Entry, Exit, Growth, and Innovation over the Product Life Cycle. Steven Klepper. American Economic Review. 1996, vol 86, 562-58.

Klepper, S., and K. Simons, "The Making of an Oligopoly: Survival and Technological Change in the Evolution of the U.S. Tire Industry," Journal of

Political Economy 108 (2000), 728-760.

What do we know about entry? P. A. Geroski International Journal of Industrial Organization. Volume 13, Issue 4, December 1995, Pages 421-440

Part III. Competitive Advantage and Industry Dynamics

Managing with Style: The Effect of Managers on Firm Policies. Marianne Bertrand and Antoinette Schoar. Quarrterly Journal of Economics, Nov

2003, vol 143. Page 1169 of 1169-1208

Does management matter? Evidence from India. Nicholas Bloom, Benn Eifert, Aprajit Mahajan, David McKenzie and John Roberts. Mimeo 2011.

Measuring and Explaining Management Practices Across Firms and Countries. Nick Bloom and John Van Reenen. Quarterly Journal of Economics,

November 2007.

Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Rebecca M. Henderson and Kim

B. Clark. Administrative science quarterly, 1990, 35, 9-30.

Measuring Competence? Exploring Firm Effects in Pharmaceutical Research. Rebecca Henderson and Iain Cockburn. Strategic Management

Journal. 1994, vol 15, 63-84.

Exploiting a Cost Advantage and Coping with a Cost Disadvantage. David Besanko, David Dranove, Mark Shanley. Management Science, Vol. 47,

No. 2 (Feb., 2001), pp. 221-235

On the evolution of the firm size distribution: Facts and theory. Luis Cabral and Jose Mata. American Economic Review, 2003. 93, 1075-90.

Slides by: Richard Ponarul, California State University, Chico

Copyright 2010 John Wiley Sons, Inc.

Chapter 4

The Power of Principles:

A Historical Perspective

1840, 1910, and Today

The years 1840, 1910 and 2009 represent

widely disparate business conditions.

The general economic principles behind

business strategy are enduring.

Business practices evolve with changing

environment.

Doing Business in 1840

Numerous intermediaries - Farmers to factors to

brokers agents to buyers

Substantial price risk for participants

Infrequent transactions

Scarcity of information regarding sales and

prices of comparable goods

Infrastructure in 1840

Infrastructure in transportation, communication

and finance were poorly developed in 1840.

Poor infrastructure meant the dominance of

small family run firms.

Markets were local.

Transportation in 1840

Railroads, in their infancy, were fragmented.

National railway network had not yet arrived.

Waterways were used for long distance

transportation. Yet routes were limited.

With poor transportation, producers were

limited to local markets

Communication in 1840

Postal service was the dominant mode of long

distance communication.

Postal service relied on the horse and

stagecoach.

Telegraph was expensive and was used only for

important time-sensitive information.

Finance in 1840

Most businesses were sole proprietorships or

partnerships which made long term debt difficult to

obtain.

Shares of stock were not easily traded and cost of

capital was high.

No institutional mechanism existed for handling

business risk.

Futures trading to manage price risk was yet to come

about.

Production Technology in 1840

Most factories used century old methods of

production.

Textile manufacture was mechanized.

Use of standardized parts (prevalent in clocks

and guns then) was just beginning.

Scale intensive industries and high volume

production were non existent.

Government in 1840

Government was involved in large infrastructure

investments such as canals and railroads.

Later in the century government regulation of

the business environment was emerging.

Prime Meridian Conference led to the system of

standard time.

Business in 1840

Technology limited production to traditional

modes.

Production served local markets.

Without transportation infrastructure and

access to large markets, mass production

technologies would not have been useful.

Business in 1840

Without communication infrastructure,

information on prices, sellers and buyers was

not readily available.

Credit was available based on personal

relationships.

As a result businesses were small and informally

organized.

Business Conditions in 1910

Mass-production technologies made possible

high volume low cost manufacture of goods.

Railroads dominated transportation and

allowed mass distributors to reach widely

scattered customers.

Telegraph and telephones greatly improved long

distance communications.

Business Conditions in 1910

Manufacturing became more vertically

integrated.

Multidivisional firms emerged in response to

the size and complexity of operations.

Industries were becoming concentrated.

As standardization increased so did labor

related conflicts.

Finance in 1910

Securities markets traded shares of large

industrial firms.

Credit bureaus made credit related information

easily accessible.

Innovations appeared in monitoring and

reporting business activities.

Public disclosure of accounting information was

in vogue.

Government in 1910

Government regulation extended to such areas

as corporate law, antitrust and worker safety.

Increased regulation forced managers to collect

a lot of data on internal operations.

Mandatory secondary schooling provided the

labor force needed by large bureaucratic

organizations.

Business in 1910

Expanded infrastructure allowed firms to

expand their markets, product lines and

production scale.

New technologies allowed high volume

standardized production.

Growth of financial infrastructure made large

scale firms viable.

Doing Business Today

Large vertically integrated firms have been

declining.

Alliances and joint ventures could work better

than mergers and acquisitions.

Firms adopt complex matrix structures.

Transportation Infrastructure Today

Air, water, rail and ground transportation have

become better coordinated.

Sophisticated communication and data

processing technologies enable container

shipping.

Cities like Atlanta have grown relying on air

transport in spite of poor rail and water

connections.

Communications Technology Today

Capacity for instantaneous transmission of

complex information makes possible global

markets for products and services.

Technology has enhanced worker productivity.

Coordination of activities has become easier

with modern computer and communication

technologies.

Finance

Regulation of banking and securities markets

resulted in a stable financial services sector.

Capital markets and financial institutions

became more active in evaluating firm

performance.

Globalization of financial markets made many

mergers and acquisitions possible.

Liquidity crisis of 2008 has slowed economic

and entrepreneurial activity.

Production Technology

Modern technologies such as CAD/CAM have

made low cost tailor-made production feasible.

Use of new technologies often means

reorganizing the firm around these

technologies.

Government

In some areas (airlines, trucking and financial

services) traditional regulation has been

relaxed.

Regulation has increased in other areas

(workplace safety, discrimination and

environmental protection).

Government

Intergovernmental treaties and agreements

create regional free trade zones.

Governments anti trust policy encourages in-

house development of capabilities.

Government policy supports basic research and

the commercialization of R & D projects.

Business Today

With rising demand from developing nations

the market size has increased.

Firms focus on a narrow range of activities and

enjoy the economies of scale.

Financial innovation enables faster growth of

firms and the ability of new entrants to

challenge the incumbents.

Infrastructure in Emerging Markets

Unlike the advanced nations, many developing

nations still lack transportation and finance

infrastructures.

Businesses are reluctant to invest in countries

where corruption, cronyism and conflicts are

rampant.

Business Conditions and Strategy

Business conditions change over time and so do

the optimal strategies.

Principles needed to arrive at successful

strategies do not change.

Recipes change from period to period but

principles behind the recipes do not.

You might also like

- Production & Operations Mangement Master Slide.Document358 pagesProduction & Operations Mangement Master Slide.SakshiAgarwalNo ratings yet

- Kauffman's Stress Indicator - Code For PlatformsDocument25 pagesKauffman's Stress Indicator - Code For PlatformsKaustubh KeskarNo ratings yet

- Teacher Manual Economics of Strategy by David BesankoDocument227 pagesTeacher Manual Economics of Strategy by David BesankoCéline van Essen100% (4)

- Form-Business Assessment QuestionnaireDocument3 pagesForm-Business Assessment QuestionnaireOveine SmallNo ratings yet

- Investor's Guide On CMBSDocument36 pagesInvestor's Guide On CMBSBalu MahindraNo ratings yet

- Besanko HarvardDocument228 pagesBesanko Harvardkjmnlkmh100% (1)

- How Mintoff Killed The NBMDocument4 pagesHow Mintoff Killed The NBMsevee2081No ratings yet

- MTKNG DashboardDocument16 pagesMTKNG DashboardDageeshNo ratings yet

- Architect As Developer PDFDocument105 pagesArchitect As Developer PDFKarlo De Soto100% (1)

- Market Delta Help ManualDocument682 pagesMarket Delta Help Manuallewis86100% (3)

- Principles of World Class Manufacturing PDFDocument171 pagesPrinciples of World Class Manufacturing PDFSavetaVukadinović100% (1)

- Solectron Cases - 1Document36 pagesSolectron Cases - 1kundan50% (2)

- Book Solution Economics of Strategy Answer To Questions From The Book Also Relevant For Later Editions of The BookDocument229 pagesBook Solution Economics of Strategy Answer To Questions From The Book Also Relevant For Later Editions of The Bookvgfalcao84100% (2)

- Techno-Ready Marketing: How and Why Customers Adopt TechnologyFrom EverandTechno-Ready Marketing: How and Why Customers Adopt TechnologyNo ratings yet

- Manufacturing Technology (ME461) Lecture1Document28 pagesManufacturing Technology (ME461) Lecture1Jayant Raj SauravNo ratings yet

- Platforms and EcosystemsDocument51 pagesPlatforms and EcosystemsGio2No ratings yet

- Profiting from Innovation: The Report of the Three-Year Study from the National Academy of EngineeringFrom EverandProfiting from Innovation: The Report of the Three-Year Study from the National Academy of EngineeringRating: 5 out of 5 stars5/5 (1)

- Intoduction To Project ManagementDocument57 pagesIntoduction To Project ManagementIshita GuptaNo ratings yet

- BOS - Ch-1Document26 pagesBOS - Ch-1aditya.babarNo ratings yet

- Technologicalenvironment of IBDocument12 pagesTechnologicalenvironment of IBVedant KaleNo ratings yet

- CH1: Introduction To Operations Management: - Learning ObjectivesDocument39 pagesCH1: Introduction To Operations Management: - Learning ObjectivesOumer ShaffiNo ratings yet

- K&N Case Group - 3Document41 pagesK&N Case Group - 3priya_pritika6561100% (1)

- Simultaneous Revolutions: New Competitors New Political Agendas New Technologies New Rules of CompetitionDocument51 pagesSimultaneous Revolutions: New Competitors New Political Agendas New Technologies New Rules of CompetitionKritika JainNo ratings yet

- Developing The Framework For An Innovation StrategyDocument17 pagesDeveloping The Framework For An Innovation StrategyAminaNo ratings yet

- Chapter Four GlobalizationDocument30 pagesChapter Four GlobalizationAlayou Tefera100% (1)

- Importance of Service Sector in IndiaDocument15 pagesImportance of Service Sector in Indiadipesh jainNo ratings yet

- E-Business: Management and StrategyDocument45 pagesE-Business: Management and StrategyMayank Jain NeerNo ratings yet

- E Business02Document26 pagesE Business02Tanu KhareNo ratings yet

- Om 1Document44 pagesOm 1wubeNo ratings yet

- IT Industry: Group 4 Hemangi Goud 20 Vrinda Goyal 21 Ekta Gupta 23 Sahej Gupta 24Document14 pagesIT Industry: Group 4 Hemangi Goud 20 Vrinda Goyal 21 Ekta Gupta 23 Sahej Gupta 24Pooja PatilNo ratings yet

- Angelou EventDocument18 pagesAngelou EventShady A HajjarNo ratings yet

- Chap.3 Mullins - UNDERSTANDING MARKET OPPORTUNITIESDocument29 pagesChap.3 Mullins - UNDERSTANDING MARKET OPPORTUNITIESAdriani Eka Juniarti100% (1)

- Inb 372 Chapter 1Document24 pagesInb 372 Chapter 1Jawadul IslamNo ratings yet

- Innovation Africa 2012Document22 pagesInnovation Africa 2012Francis Stevens GeorgeNo ratings yet

- Lecture1 - Concepts and TheoriesDocument46 pagesLecture1 - Concepts and TheoriesHammad KamranNo ratings yet

- The Evolution of The Modern Firm: Chapter ContentsDocument14 pagesThe Evolution of The Modern Firm: Chapter Contentsleisurelarry999No ratings yet

- E-Commerce - LectureDocument25 pagesE-Commerce - LecturezamildaudzaiusaNo ratings yet

- Group 5 IB CAT 1 PresentationDocument16 pagesGroup 5 IB CAT 1 PresentationMoann JhaNo ratings yet

- Session 8a-Btechonological EnvironmentDocument24 pagesSession 8a-Btechonological EnvironmentRohit Vijay PatilNo ratings yet

- Speciemen Exam - deDocument7 pagesSpeciemen Exam - deSamuel RomanyNo ratings yet

- Chapt 1Document25 pagesChapt 1Farah KuyinNo ratings yet

- The Global Economy and Southeast AsiaDocument17 pagesThe Global Economy and Southeast AsiatendaiNo ratings yet

- Manufacturing Technology (ME461) Lecture1Document39 pagesManufacturing Technology (ME461) Lecture1Rishabh JainNo ratings yet

- ITB Chapter 01-JknDocument24 pagesITB Chapter 01-JknArafat SifatNo ratings yet

- MGT464 Ch02Document20 pagesMGT464 Ch02emily leungNo ratings yet

- Operations Management: Chapter 1: Operations and ProductivityDocument55 pagesOperations Management: Chapter 1: Operations and ProductivityzubairsalmanpkNo ratings yet

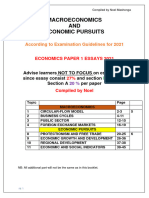

- Macro and Economic Pursuits Essays 2021 OnlyDocument45 pagesMacro and Economic Pursuits Essays 2021 Onlylsibeko288No ratings yet

- Economics of Strategy (Rješenja)Document227 pagesEconomics of Strategy (Rješenja)Antonio Hrvoje ŽupićNo ratings yet

- MBM 302 Management and IT Applications: Ashish Mani 2011-2012Document39 pagesMBM 302 Management and IT Applications: Ashish Mani 2011-2012baygoniNo ratings yet

- Chap 3-GlobalizationDocument24 pagesChap 3-GlobalizationANAS ASLAMNo ratings yet

- 1 - Introduction and Requirements 2Document30 pages1 - Introduction and Requirements 2Alfonso Almagro GambinNo ratings yet

- TechnologyManagement - Jan 22, 2014Document63 pagesTechnologyManagement - Jan 22, 2014hamdullahNo ratings yet

- Introduction To International Business Environment AnalysisDocument33 pagesIntroduction To International Business Environment Analysisshoumo12345No ratings yet

- 4 WEG - Commodity ChainsDocument43 pages4 WEG - Commodity ChainsTuyến BắpNo ratings yet

- Lec 5Document20 pagesLec 5عايشها لوحديNo ratings yet

- The Revolution Is Just BeginningDocument24 pagesThe Revolution Is Just Beginningfyfyg411No ratings yet

- Share QUS 111-Lecture Series 1-1Document16 pagesShare QUS 111-Lecture Series 1-1linusdreokokonNo ratings yet

- PPT W1Document31 pagesPPT W1Hilda mayang sariNo ratings yet

- (Chapter 2) Globalization of Markets & The Internationalization of The FirmDocument57 pages(Chapter 2) Globalization of Markets & The Internationalization of The FirmPatrice MarandaNo ratings yet

- IT Support of Organizational Performance: Information Technology For Management 6 EditionDocument30 pagesIT Support of Organizational Performance: Information Technology For Management 6 EditionJayson PambagoNo ratings yet

- 1.1 What Is A BusinessDocument37 pages1.1 What Is A BusinessMarina Peña BenitaNo ratings yet

- CH01-Introduction To Operations ManagementDocument25 pagesCH01-Introduction To Operations Managementsourplum34No ratings yet

- Wk1 Seminar Intro T0 2021Document65 pagesWk1 Seminar Intro T0 2021Heidi DaoNo ratings yet

- Innovation and Catching-Up: The General Trends of Technology DevelopmentDocument31 pagesInnovation and Catching-Up: The General Trends of Technology DevelopmentKLinh NguyenNo ratings yet

- Financial Technology Themes Meeting # 07-08: Course: Z0919 - ERP For Financial and Controlling Year: 2017Document17 pagesFinancial Technology Themes Meeting # 07-08: Course: Z0919 - ERP For Financial and Controlling Year: 2017Stella BenitaNo ratings yet

- EXIMDocument13 pagesEXIMDipesh ParmarNo ratings yet

- IT Perspectives Conference: The Future of Information TechnologyFrom EverandIT Perspectives Conference: The Future of Information TechnologyNo ratings yet

- Write-Up Sample (Financial Analysis)Document18 pagesWrite-Up Sample (Financial Analysis)chialunNo ratings yet

- Metals Exploration PLC - Update Presentation March 2010Document21 pagesMetals Exploration PLC - Update Presentation March 2010PTIC LondonNo ratings yet

- New Microsoft Office PowerPoint PresentationDocument6 pagesNew Microsoft Office PowerPoint Presentationhemanth rNo ratings yet

- Investments, 8 Edition: Equity Valuation ModelsDocument45 pagesInvestments, 8 Edition: Equity Valuation ModelsErryNo ratings yet

- Chapter 8 Part 1 (B)Document88 pagesChapter 8 Part 1 (B)Nurul AsyilahNo ratings yet

- Summer Internship Project Hindustan Times 2018Document63 pagesSummer Internship Project Hindustan Times 2018Deepanshu VermaNo ratings yet

- Financial Performance of HSLDocument151 pagesFinancial Performance of HSLNareshkumar Koppala100% (2)

- Masterskill Education Group Berhad: Public Issue of 41.0m New Shares, Offering 205.0m Shares in Total - 4/5/2010Document6 pagesMasterskill Education Group Berhad: Public Issue of 41.0m New Shares, Offering 205.0m Shares in Total - 4/5/2010Rhb InvestNo ratings yet

- Erp 2011Document83 pagesErp 2011Hadi P.No ratings yet

- Deepak InsDocument3 pagesDeepak InsNaveen Kumar E ( Brand Champion )No ratings yet

- Previously Incurred Project Cost Future Eligible Project CostDocument29 pagesPreviously Incurred Project Cost Future Eligible Project CostTammy WilliamsNo ratings yet

- Reliance PowerDocument32 pagesReliance PowerKarlosNo ratings yet

- Impact of Working Capital Parameters On The Profitability of Various Industries PDFDocument9 pagesImpact of Working Capital Parameters On The Profitability of Various Industries PDFarcherselevatorsNo ratings yet

- Chapter 6 - Accounting For SalesDocument4 pagesChapter 6 - Accounting For SalesArmanNo ratings yet

- SEBI ICDR Regulations 2018 Key Amendments 1Document19 pagesSEBI ICDR Regulations 2018 Key Amendments 1jimit0810No ratings yet

- Banking Law and PracticeDocument5 pagesBanking Law and PracticeJunaid MalikNo ratings yet

- MAIN PPT Stock Exchange of India - pptmATDocument42 pagesMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Acroynms Capital MarketsDocument37 pagesAcroynms Capital MarketsAnuj Sharma100% (1)

- 7110 Specimen Paper 2010 P2msDocument8 pages7110 Specimen Paper 2010 P2msfgaushiya67% (3)

- As Roma Bond SaleDocument880 pagesAs Roma Bond SaleMichael OzanianNo ratings yet

- CH 7Document41 pagesCH 7Abdulrahman AlotaibiNo ratings yet

- 7 Reasons To Avoid A ULIPDocument5 pages7 Reasons To Avoid A ULIPKandarp PandyaNo ratings yet

- Kota Fibres ExhibitsDocument13 pagesKota Fibres ExhibitsHaemiwan FathonyNo ratings yet