Professional Documents

Culture Documents

Unit III

Uploaded by

Vijaya Prabhu KumarasamyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit III

Uploaded by

Vijaya Prabhu KumarasamyCopyright:

Available Formats

UNIT III

INTRODUCTION TO COST

ESTIMATION

Cost Estimation

Cost estimation may be defined as the process

of forecasting the expenses that must be

incurred to manufacture a product.

These expenses take into consideration all

expenditures involved in design and

manufacturing with all the related service

facilities such as pattern making, tool making as

well as portion of the general administrative

and selling costs.

OBJECTIVES OF COST ESTIMATION

The main purpose or objective of estimating are

To establish the selling price of a product.

To ascertain whether a proposed product can be

manufactured and marketed profitably.

To determine how much must be invested in

equipment.

To find whether parts or assemblies can be more

cheaply fabricated or purchased from outside (make or

buy decision).

To determine the most economical process, tooling or

material for making a product.

To establish a standard of performance at the start of

project.

For feasibility studies on possible new

products.

To assist in long term financial planning.

To prepare production budget.

To help in responding to tender enquiries.

To evaluate alternate designs of a product.

To set a standard estimate of costs.

BASIC STEPS IN COST ESTIMATION

1. Make thorough study of cost estimation request

to understand it fully.

2. Make an analysis of the product and prepare a

bill of materials.

3. Make separate lists of parts to be purchased

from the market and parts to be manufactured

in plant.

4. Determine the cost of parts to be purchased from

outside.

5.Estimate the material cost for the

parts/components to be manufactured in plant.

6. Make manufacturing process plan for the parts to

be manufactured in plant.

7. Estimate the machining time for each operation

listed in the manufacturing process plan.

8. Multiply each operation time by the labour wage

rate and add them up to find direct labour cost.

9. Add the estimate of step 4, 5, and 8 to get prime

cost of component.

10. Apply overhead costs to get the total cost of the

component.

Point of

comparison

Cost estimating Cost accounting

1. Type of cost It gives an expected cost of the

based on the calculations by means

of standard formulae or certain

established rules.

It gives actual cost of the product

Cost based on the data collected from

different expenditures actually done

for a product.

2. Duration of

the process

Generally carried before actual

production of a product

Usually starts with the issue of order

for production of a product and ends

after a product is dispatched for sale.

3. Nature of

quality

A qualified technical person or

engineer having thorough knowledge

of drawings and manufacturing

process is required

It can be done by a person qualified

for accounts instead of a technical

person.

4.Main

objectives

a. To set standard for , with actual

cost

b. To help in setting up market price

for a proposed product

c. To decide whether it is

economical to buy or

manufacture a product

a. To help in comparison of cost with

estimates

b. To facilitate the budget preparation

as well as to provide cost data for

future estimates

c. To facilitate in deciding output

targets time to time

METHODS OF COSTING

Process costing

This method indicates the cost of a product

at different stages as it passes through various

processes.

The total time spent and materials used on

each process, as well as services such as

power,light and heating are all charged.

Job costing.

It is essentially a method of costing

applicable to industrial manufacture in which

the cost figures are determined for each job or

a batch of jobs.

This method proves valuable in jobbing

work (job shop production i.e., or production

of low quantities, often one of a kind of

specialized products) or batch production.

Batch costing.

Batch costing is a form of job costing. Instead

of costing each component separately, each

batch of components are taken together and

treated as a job.

Besides maintaining job cost sheets it may also

be necessary to keep summary sheets on

which the cost of each component can be

transferred and the cost of the finished

product can be calculated.

Hybrid costing systems

Another variation is multiple costing, used

when many different finished products are

made.

Many components are made which are

subsequently assembled into the completed

article, which may be bicycles, cars, etc. Costs

have to be ascertained for operations,

processes, units and jobs, building together

until the total cost is found.

COST OF PRODUCT

(LADDER OF COSTS)

The components of cost discussed above can be grouped

as follows :

1. Prime cost = Direct material cost + Direct labour

cost + Direct expenses

2. Factory cost = Prime cost + Factory expenses

3. Production cost = Factory cost + Administrative

expenses

4. Total or Ultimate

cost = Production cost + Selling and

distribution expenses.

5. Selling price = Ultimate cost + Profit

LADDER OF COST

You might also like

- Part Design With CatiaDocument42 pagesPart Design With CatiaBirolC.YakupoğluNo ratings yet

- TimeDocument5 pagesTimeVijaya Prabhu KumarasamyNo ratings yet

- MOd Ans KeyDocument2 pagesMOd Ans KeyVijaya Prabhu KumarasamyNo ratings yet

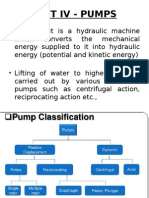

- Unit Iv - PumpsDocument6 pagesUnit Iv - PumpsVijaya Prabhu KumarasamyNo ratings yet

- நெகிழி 360°Document30 pagesநெகிழி 360°Vijaya Prabhu KumarasamyNo ratings yet

- En-Catia v5r13 Designer Guide Chapter3Document40 pagesEn-Catia v5r13 Designer Guide Chapter3Francisco FloresNo ratings yet

- ME2027 PPCE SyllabusDocument1 pageME2027 PPCE SyllabusbsamantonyNo ratings yet

- Int II Ans KeyDocument2 pagesInt II Ans KeyVijaya Prabhu KumarasamyNo ratings yet

- 02orthographic Projection Points LinesDocument21 pages02orthographic Projection Points LinesVijaya Prabhu KumarasamyNo ratings yet

- Unit Ii: Process PlanningDocument17 pagesUnit Ii: Process PlanningVijaya Prabhu KumarasamyNo ratings yet

- ME2027 - Process Planning and Cost Estimation: Internal I Answer Key Date: 25.08.14 Part - ADocument2 pagesME2027 - Process Planning and Cost Estimation: Internal I Answer Key Date: 25.08.14 Part - AVijaya Prabhu KumarasamyNo ratings yet

- 02orthographic Projection Points LinesDocument21 pages02orthographic Projection Points LinesVijaya Prabhu KumarasamyNo ratings yet

- 2 MarksDocument12 pages2 MarksVijaya Prabhu KumarasamyNo ratings yet

- A. Flat Belt & Pulleys: Unit I Design of Transmission Systems For Flexible ElementsDocument3 pagesA. Flat Belt & Pulleys: Unit I Design of Transmission Systems For Flexible ElementsVijaya Prabhu KumarasamyNo ratings yet

- Paper Code: Olq 5S194Document1 pagePaper Code: Olq 5S194Vijaya Prabhu KumarasamyNo ratings yet

- MTDocument69 pagesMTGokulraju RangasamyNo ratings yet

- PIDDDocument1 pagePIDDVijaya Prabhu KumarasamyNo ratings yet

- Design of Jigs, Fixures, Press Tools and Moulds Question Bank Unit I - Locating and Clamping Principles Part-ADocument4 pagesDesign of Jigs, Fixures, Press Tools and Moulds Question Bank Unit I - Locating and Clamping Principles Part-AVijaya Prabhu KumarasamyNo ratings yet

- Engineering Thermodynamics (Nov, Dec2012)Document4 pagesEngineering Thermodynamics (Nov, Dec2012)Vijaya Prabhu KumarasamyNo ratings yet

- PIDDDocument1 pagePIDDVijaya Prabhu KumarasamyNo ratings yet

- Bearing Length CalculationDocument1 pageBearing Length CalculationVijaya Prabhu KumarasamyNo ratings yet

- Jigs - and Fixtures PDFDocument29 pagesJigs - and Fixtures PDFNiel Cool100% (1)

- Cal End RingDocument4 pagesCal End RingVijaya Prabhu KumarasamyNo ratings yet

- Engineering Thermodynamics (Nov, Dec2008) R2004Document4 pagesEngineering Thermodynamics (Nov, Dec2008) R2004Vijaya Prabhu KumarasamyNo ratings yet

- Fluid Mechanics and Machinery (AP, May2010) R2004Document3 pagesFluid Mechanics and Machinery (AP, May2010) R2004Vijaya Prabhu KumarasamyNo ratings yet

- Applied Hydraulics and Pneumatics (Nov, Dec2012)Document3 pagesApplied Hydraulics and Pneumatics (Nov, Dec2012)Vijaya Prabhu KumarasamyNo ratings yet

- Fluid Mechanics and Machinery (May2009)Document4 pagesFluid Mechanics and Machinery (May2009)Vijaya Prabhu KumarasamyNo ratings yet

- Applied Thermo Dynamics (May2009)Document3 pagesApplied Thermo Dynamics (May2009)Vijaya Prabhu KumarasamyNo ratings yet

- Applied Hydraulics and Pneumatics (May, June2012)Document4 pagesApplied Hydraulics and Pneumatics (May, June2012)Vijaya Prabhu KumarasamyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bye Laws For MirzapurDocument6 pagesBye Laws For MirzapurUtkarsh SharmaNo ratings yet

- Tutorial 4 QuestionsDocument3 pagesTutorial 4 QuestionshrfjbjrfrfNo ratings yet

- HOWO SERVICE AND MAINTENANCE SCHEDULE SinotruckDocument3 pagesHOWO SERVICE AND MAINTENANCE SCHEDULE SinotruckRPaivaNo ratings yet

- Muscular System Coloring Book: Now You Can Learn and Master The Muscular System With Ease While Having Fun - Pamphlet BooksDocument8 pagesMuscular System Coloring Book: Now You Can Learn and Master The Muscular System With Ease While Having Fun - Pamphlet BooksducareliNo ratings yet

- Updated PDPDocument540 pagesUpdated PDPnikulaaaasNo ratings yet

- Eat Something DifferentDocument3 pagesEat Something Differentsrajendr200100% (1)

- UGC NET Paper I PreviousDocument16 pagesUGC NET Paper I PreviousKirran Khumar GollaNo ratings yet

- Game Audio - Tales of A Technical Sound Designer Volume 02Document154 pagesGame Audio - Tales of A Technical Sound Designer Volume 02Joshua HuNo ratings yet

- SAP IAG Admin GuideDocument182 pagesSAP IAG Admin GuidegadesigerNo ratings yet

- Comparison of Offline and Online Partial Discharge For Large Mot PDFDocument4 pagesComparison of Offline and Online Partial Discharge For Large Mot PDFcubarturNo ratings yet

- Shsa1105 - Unit-III Course MaterialsDocument58 pagesShsa1105 - Unit-III Course Materialssivanikesh bonagiriNo ratings yet

- Unknown 31Document40 pagesUnknown 31Tina TinaNo ratings yet

- Chiba International, IncDocument15 pagesChiba International, IncMiklós SzerdahelyiNo ratings yet

- Macro Economics A2 Level Notes Book PDFDocument33 pagesMacro Economics A2 Level Notes Book PDFMustafa Bilal50% (2)

- Fish Siomai RecipeDocument12 pagesFish Siomai RecipeRhyz Mareschal DongonNo ratings yet

- Computerised Project Management PDFDocument11 pagesComputerised Project Management PDFsrishti deoli50% (2)

- What Is An InfographicDocument4 pagesWhat Is An InfographicAryaaaNo ratings yet

- S L Dixon Fluid Mechanics and Thermodynamics of TurbomachineryDocument4 pagesS L Dixon Fluid Mechanics and Thermodynamics of Turbomachinerykuma alemayehuNo ratings yet

- Bai Tap Avtc2 PrepositionsDocument5 pagesBai Tap Avtc2 PrepositionsShy NotNo ratings yet

- Shape It! SB 1Document13 pagesShape It! SB 1Ass of Fire50% (6)

- Multidimensional Scaling Groenen Velden 2004 PDFDocument14 pagesMultidimensional Scaling Groenen Velden 2004 PDFjoséNo ratings yet

- Red Hat Ceph Storage-1.2.3-Ceph Configuration Guide-en-US PDFDocument127 pagesRed Hat Ceph Storage-1.2.3-Ceph Configuration Guide-en-US PDFJony NguyễnNo ratings yet

- CivilCAD2014 English Rev1Document443 pagesCivilCAD2014 English Rev1Nathan BisNo ratings yet

- Week 1 Lab #2 - Microscopy & Microscopic Examination of Living MicroorganismsDocument53 pagesWeek 1 Lab #2 - Microscopy & Microscopic Examination of Living MicroorganismsNgoc PhamNo ratings yet

- Strategy Guide To Twilight Imperium Third EditionDocument74 pagesStrategy Guide To Twilight Imperium Third Editioninquartata100% (1)

- 05271/MFP YPR SPL Sleeper Class (SL)Document2 pages05271/MFP YPR SPL Sleeper Class (SL)Rdx BoeNo ratings yet

- Ram BookDocument52 pagesRam BookRobson FletcherNo ratings yet

- MyResume RecentDocument1 pageMyResume RecentNish PatwaNo ratings yet

- The Community Reinvestment Act in The Age of Fintech and Bank CompetitionDocument28 pagesThe Community Reinvestment Act in The Age of Fintech and Bank CompetitionHyder AliNo ratings yet

- Chapter 1Document20 pagesChapter 1Li YuNo ratings yet