Professional Documents

Culture Documents

Mortgages: Additional Concepts, Analysis, and Applications: Mcgraw-Hill/Irwin

Uploaded by

Tam Nguyen0 ratings0% found this document useful (0 votes)

48 views32 pagesThe more you borrow, the higher the Interest Rate will be, but there is a point at which you shouldn't borrow more money. A borrower can earn an equivalent risk adjusted return on the $15,000 that is not invested in the home. If the borrower expects to relocate after 8 years, what is the required return to justify a lower down payment?

Original Description:

Original Title

Chap006-2

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe more you borrow, the higher the Interest Rate will be, but there is a point at which you shouldn't borrow more money. A borrower can earn an equivalent risk adjusted return on the $15,000 that is not invested in the home. If the borrower expects to relocate after 8 years, what is the required return to justify a lower down payment?

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views32 pagesMortgages: Additional Concepts, Analysis, and Applications: Mcgraw-Hill/Irwin

Uploaded by

Tam NguyenThe more you borrow, the higher the Interest Rate will be, but there is a point at which you shouldn't borrow more money. A borrower can earn an equivalent risk adjusted return on the $15,000 that is not invested in the home. If the borrower expects to relocate after 8 years, what is the required return to justify a lower down payment?

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 32

Chapter 06:

Mortgages: Additional Concepts,

Analysis, and Applications

McGraw-Hill/I rwin Copyright 2011 by the McGraw-Hill Companies, I nc. All rights reserved.

6-2

Incremental Borrowing Cost

Compare financing alternatives

What is the real cost of borrowing more

money at a higher interest rate?

Alternatively, what is the required return to

justify a lower down payment?

Basic principle when comparing choices:

What are the cash flow differences?

6-3

Incremental Borrowing Cost

Example 6-1:

Home Value = $150,000

Two Financing Alternatives

#1: 90% Loan to Value, 8.5% Interest Rate, 30

Years

#2: 80% Loan to Value, 8% Interest Rate, 30

Years

It appears there is only a 0.5% interest rate

difference, but

6-4

Incremental Borrowing Cost

Alternative #1 Alternative #2

LTV 90% 80%

i 8.5% 8%

Term 30 Years 30 Years

Down payment $15,000 $30,000

Loan $135,000 $120,000

Payment $1,038.03 $880.52

6-5

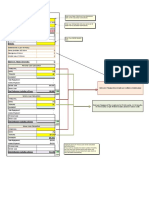

Exhibit 6-2

Effect of Loan-to-Value Ratio on Loan Cost

6-6

Take-Home Message

The more you borrow, the higher the

interest rate will be.

While we will discuss this in detail later on,

there is a point at which you should not

borrow more money. The interest rate will

be just too high.

It is not economically rational to borrow as

much money as possible.

6-7

Incremental Borrowing Cost

Cash Flow Differences

Borrow $15,000 more

Pay $157.51 per month more

= $15,000

= $157.51

= 360

= $0

= 12.28%

n

i CPT

FV

PMT

PV

6-8

Incremental Borrowing Cost

12.28% represents the real cost of

borrowing the extra $15,000.

Can you earn an equivalent risk adjusted

return on the $15,000 that is not invested

in the home?

Alternatively, can you borrow the

additional $15,000 elsewhere at a lower

cost?

6-9

Incremental Borrowing Cost

In Example 6-1, what if the borrower

expects to relocate after 8 years?

We need the future expected loan

balances:

Alt #1: $123,810.30

Alt #2: $109,221.24

Difference: $14,589.06

This becomes a future value in our

analysis.

6-10

Incremental Borrowing Cost

Cash Flow Differences

= $15,000

= $157.51

= 96

= $14,589.06

= 12.40%

n

i CPT

FV

PMT

PV

6-11

Incremental Borrowing Cost

Use of discount points

Analysis would change

Depending on the points, the cash flow difference

at time zero would change.

In Example 6-1, the $15,000 difference would

change.

Different maturities

In Example 6-1, lets change the term of the

alternative #2 to 25 years.

6-12

Incremental Borrowing Cost

Alternative #1 Alternative #2

LTV 90% 80%

i 8.5% 8%

Term 30 Years 25 Years

Down payment $15,000 $30,000

Loan $135,000 $120,000

Payment $1,038.03 $926.18

6-13

Incremental Borrowing Cost

Cash Flow Differences

At time 0: $15,000

For the first 300 months: $111.85

For the final 60 months: $1038.03

6-14

Incremental Borrowing Cost

Using the Cash Flow Register,

= $15,000

= $111.85

= 300

= $1038.03

= 60

= .8926 x 12 = 10.71%

C0

CPT

C1

F1

C2

F2

IRR

6-15

Loan Refinancing

Borrower considerations

Terms on the present outstanding loan

What are the new loan terms?

What are the fees associated with paying off

the old loan and obtaining a new one?

Application of basic capital budgeting

investment decision

What is our return on an investment in a new

loan?

6-16

Loan Refinancing

Example 6-2:

A borrower has secured a 30 year, $120,000

loan at 7%. Fifteen years later, the borrower

has the opportunity to refinance with a fifteen

year mortgage at 6%. However, the up front

fees, which will be paid in cash, are $2,500.

What is the return on investment if the

borrower expects to remain in the home for

the next fifteen years?

6-17

Loan Refinancing

Initial Loan:

$120,000

30 Years

7% Interest

Payment = $789.36

15 Years Later

Loan Balance = $88,822.64

New Payment at 6% = $749.54

6-18

Loan Refinancing

Cost = $2,500

Benefit = $48.82 per month for 15 years

= ($2500)

= $0

= $48.82

= 180

= 22.62%

n

i CPT

FV

PMT

PV

6-19

Loan Refinancing

In Example 6-2, what is the return on

investment if the borrower expects to

relocate after seven years and not remain

in the home for the full fifteen years?

Now we need the expected future loan

balances for the original loan and the possible

new loan.

6-20

Loan Refinancing

Original Loan Balance = $58,557.76

Refinanced Loan Balance = $57,036.41

Difference = $1521.35

= ($2500)

= $1521.35

= $48.82

= 84

= 20.93%

n

i CPT

FV

PMT

PV

6-21

Loan Refinancing

In Example 6-2, refinancing appears to be a

good investment.

Effective cost of refinancing: Prepayment fees

on old loan can be thought of as being of new

fees for new loan.

Borrowing the refinancing cost

Biweekly payments

Lower the amount of interest over the life of the loan

Repay the loan sooner

6-22

Market Value of a Loan

How much would an investor pay for the

loan?

The investor is buying the cash flow stream of

the loan.

Discount loan cash flow at the market rate of

interest that the investor can earn on

investments of equivalent risk.

6-23

Market Value of a Loan

Example 6-3:

$100,000 Loan

30 Years

6% interest

Payment = $599.55

One year later, book value = $98,771.99

Assume interest rates have risen to 7%.

6-24

Market Value of a Loan

The investor will not pay book value.

To compute the market value:

= $599.55

= 348

= $0

= 7

= $89,201.49

Compare this to book value.

n

i

CPT

FV

PMT

PV

6-25

Effective Cost of Two or More

Loans

Basic Technique

Compute the payments for the loans

Combine into a cash flow stream

Compute the effective cost of the amount

borrowed, given the cash flow stream.

Compare the cost to alternative financing

options.

6-26

Effective Cost of Two or More

Loans

Example 6-4:

You need a $500,000 financing package.

$100,000 at 7%, 30 Years

Payment = $665.30

$200,000 at 7.5%, 20 Years

Payment = $1611.19

$200,000 at 8% 10 Years

Payment = $2426.55

6-27

Effective Cost of Two or More

Loans

Using the Cash Flow Register,

= $500,000

= $4703.04

= 120

= $2276.49

= 120

= $665.30

= 120

= .6239 x 12 = 7.49%

CF0

CPT IRR

C1

F1

F2

C3

F3

C2

6-28

Below Market Financing

A seller with a below market rate assumable

loan in place may be able to sell the property for

more than the seller would otherwise be able to.

All else equal, a buyer is paying a higher

purchase price now in exchange for lower debt

payments over the life of the loan.

Similar to other problems, we compute i and

compare it to other equivalent risk investments.

6-29

Below Market Financing

Example 6-6: Identical Homes A & B

A B

Price $120,000 $115,000

Loan Balance $80,000

(assumable)

$80,000

(new loan)

Down payment $40,000 $35,000

I 7% 8%

Term 20 Years 20 Years

Payment $620.24 $669.15

6-30

Below Market Financing

In Example 6-6, the buyer can secure

below market financing by paying $5000

more for an identical home.

The below market financing results in a

monthly payment of $48.91 less than if

regular financing was used.

6-31

Below Market Financing

= $5000

= $0

= $48.91

= 240

= 10.20%

The buyer earns 10.20% on the $5000

investment by reducing the monthly

payment by $48.91.

n

i CPT

FV

PMT

PV

6-32

Additional Financing Concepts

Cash Equivalency

Wraparound Loans

Buydown Loans

Home Equity Loans

Home Equity Lines of Credit

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Personal LoanDocument49 pagesPersonal Loantodkarvijay50% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Taxation Law 2 ReviewerDocument44 pagesTaxation Law 2 ReviewerShi MartinezNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HBS Case2 ToyRUs LBODocument22 pagesHBS Case2 ToyRUs LBOTam NguyenNo ratings yet

- Intermediate Accounting Borrowing Costs Exercises - Doc 1Document4 pagesIntermediate Accounting Borrowing Costs Exercises - Doc 1Angelica Danuco0% (1)

- HBS Case1 CooperDocument6 pagesHBS Case1 CooperTam NguyenNo ratings yet

- ValuationDocument109 pagesValuationsdfdsfNo ratings yet

- Report On Investment Activities of Islami Bank Bangladesh LimitedDocument93 pagesReport On Investment Activities of Islami Bank Bangladesh Limitedmithila75% (4)

- Profiles of Founders/management Team/promoters: Business Plan TemplateDocument2 pagesProfiles of Founders/management Team/promoters: Business Plan TemplateTam NguyenNo ratings yet

- Brochure TD TADocument21 pagesBrochure TD TATam NguyenNo ratings yet

- Cross Border M&ADocument36 pagesCross Border M&ATam NguyenNo ratings yet

- Corporate Governance Spring 2014Document9 pagesCorporate Governance Spring 2014Tam NguyenNo ratings yet

- Corp Governance M&a Spring 2014Document21 pagesCorp Governance M&a Spring 2014Tam NguyenNo ratings yet

- Chap 013Document59 pagesChap 013Tam NguyenNo ratings yet

- CA Sterling Merger Spring 2014 DesignDocument19 pagesCA Sterling Merger Spring 2014 DesignTam NguyenNo ratings yet

- Chapter 08Document18 pagesChapter 08Tam NguyenNo ratings yet

- Anti Takeover Defenses: Class Notes For Discussion: Prof Harvey Poniachek Mergers & Acquisitions SPRING 2014Document26 pagesAnti Takeover Defenses: Class Notes For Discussion: Prof Harvey Poniachek Mergers & Acquisitions SPRING 2014Tam NguyenNo ratings yet

- Lim Tay vs. CA (293 SCRA 634 (1998) )Document20 pagesLim Tay vs. CA (293 SCRA 634 (1998) )Michelle T. CatadmanNo ratings yet

- Financial Inclusion and Its Implications For Inclusive Growth in PakistanDocument29 pagesFinancial Inclusion and Its Implications For Inclusive Growth in PakistanBasavaraj MtNo ratings yet

- BBFS (R-3)Document4 pagesBBFS (R-3)Mohammed ShoaibNo ratings yet

- Consumer Credit in The PhilippinesDocument8 pagesConsumer Credit in The PhilippinesJet GarciaNo ratings yet

- SUEZ 2020 Consolidated Financial Statements ENDocument6 pagesSUEZ 2020 Consolidated Financial Statements ENchemicalchouhan9303No ratings yet

- Analysis of Credit Management System of Jamuna Bank Limited (JBL)Document38 pagesAnalysis of Credit Management System of Jamuna Bank Limited (JBL)Sayed Farrukh AhmedNo ratings yet

- PCI LeasingDocument6 pagesPCI LeasingAnonymous MmbSn3No ratings yet

- Case Study:: LetshegoDocument2 pagesCase Study:: Letshegocaballero470No ratings yet

- Sunga-Chan v. CA, GR 164401Document16 pagesSunga-Chan v. CA, GR 164401Anna NicerioNo ratings yet

- Tandon CommitteeDocument3 pagesTandon CommitteeNeha ModiNo ratings yet

- Manage Overdue Customer AccountsDocument15 pagesManage Overdue Customer Accountsmulehabesha.mhNo ratings yet

- Bayanihan Act FAQ'sDocument11 pagesBayanihan Act FAQ'sHero MirasolNo ratings yet

- Theme 5 Management Science and Financial Management Course GuideDocument48 pagesTheme 5 Management Science and Financial Management Course Guidedanielnebeyat7No ratings yet

- Priti CaseDocument3 pagesPriti Casecarry minatteeNo ratings yet

- KingCast Mortgage Movies in Re Nissen, 11-30546 Challenged Ocwen Loan Servicing's Very ExistenceDocument17 pagesKingCast Mortgage Movies in Re Nissen, 11-30546 Challenged Ocwen Loan Servicing's Very ExistenceChristopher KingNo ratings yet

- CLJ Law ReportDocument27 pagesCLJ Law ReportBro Ikhwan IliasNo ratings yet

- Personal Loan - CalculaterDocument3 pagesPersonal Loan - CalculaterSalman Fateh AliNo ratings yet

- Business Studies: Paper 7115/11 Short Answer/Structured ResponseDocument13 pagesBusiness Studies: Paper 7115/11 Short Answer/Structured ResponseBurhanNo ratings yet

- Report On ConsolidationDocument463 pagesReport On ConsolidationJosephandjessica SutherlandNo ratings yet

- Ghana CHRAJ Investigation Report On MP Car LoansDocument26 pagesGhana CHRAJ Investigation Report On MP Car LoansKwakuazarNo ratings yet

- Complaint Final (B&W Petition)Document85 pagesComplaint Final (B&W Petition)jeremybwhiteNo ratings yet

- 970rfs7p-YS Akamai India Emerging 100 Report PDFDocument48 pages970rfs7p-YS Akamai India Emerging 100 Report PDFShubham KumarNo ratings yet

- Busn 8 8th Edition Kelly Test BankDocument38 pagesBusn 8 8th Edition Kelly Test Bankhumidityhaygsim8p100% (16)

- 2fm5 fm563Document10 pages2fm5 fm563헤라No ratings yet

- Malayan Insurance Company, Inc., vs. Diana P. Alibudbud, G.R. No. 209011Document6 pagesMalayan Insurance Company, Inc., vs. Diana P. Alibudbud, G.R. No. 209011Christopher Julian ArellanoNo ratings yet