Professional Documents

Culture Documents

IAS 41 - Agriculture

Uploaded by

Priya Darshini0 ratings0% found this document useful (0 votes)

166 views26 pagesaccounting

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

166 views26 pagesIAS 41 - Agriculture

Uploaded by

Priya Darshiniaccounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 26

Agriculture: IAS 41

Wiecek and Young

IFRS Primer

Chapter 9

2

Agriculture

Related standards

IAS 41

Current GAAP comparisons

IFRS financial statement disclosures

Looking ahead

End-of-chapter practice

3

Related Standards

FAS 144 Accounting for the Impairment or

Disposal of Long-lived Assets

FAS 157 Fair Value Measurements

SOP 85-3 Accounting by Agricultural

Producers and Agricultural Cooperatives

4

Related Standards

IAS 1 Presentation of Financial Statements

IAS 2 Inventories

IAS 18 Revenues

IAS 37 Provisions, Contingent Liabilities and

Contingent Assets

IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations

5

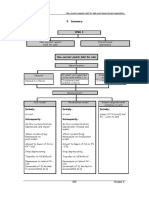

IAS 41 Overview

Objective and Scope

Recognition and Measurement

Government Grants

Disclosure

6

IAS 41 Objective and Scope

Standard deals with the accounting for agricultural activity

specifically covering:

Biological assets

Agricultural produce at the point of harvest

Related government grants

Excludes land and intangible assets

IAS 41 is considered a significant addition to GAAP since the

economies of many global countries rely on agriculture

In general, agricultural activities have the following common

characteristics: they are capable of biological transformation and

this transformation is managed, facilitated, measured, and

monitored by the entity

IAS 41 Objective and Scope

7

8

IAS 41 Objective and Scope

IAS 41 defines the following terms:

Agricultural activity is the management by an entity of the biological

transformation and harvest of biological assets for sale, or for conversion

into agricultural produce or into additional biological assets

Agricultural produce is the harvested product of the entitys biological

assets

A biological asset is a living animal or plant

Biological transformation comprises the processes of growth,

degeneration, production, and procreation that cause qualitative or

quantitative changes in a biological asset

A group of biological assets is an aggregation of similar living animals or

plants

Harvest is the detachment of produce from a biological asset or the

cessation of a biological assets life processes

9

IAS 41 Recognition and Measurement

Biological assets are recognized when:

Entity controls the asset as a result of past events

Future economic benefits are probable and

Fair value or cost is reliably measurable

IAS 41 Recognition and Measurement

As biological assets grow and mature through biological

transformation, they increase in value

Biological assets are measured at fair value less estimated

costs to sell on initial recognition, unless fair value cannot be

reliably measured

Costs to sell include commissions, taxes, and duties

Agricultural produce is measured at fair value less estimated

costs to sell at the point of harvest. Where fair value is used,

assets are remeasured at each reporting date

10

IAS 41 Recognition and Measurement

Fair value is felt to be the most relevant measure since many of these

assets trade in active markets and therefore objective information on

their current value is available

Market values are more reliable and relevant than cost figures, which

may be inconsistently accumulated from entity to entity due to differing

choices regarding allocations

In general, fair value is determined by reference to a market price if an

active market exists for the asset in its present location and condition

An active market is a market where the items traded are homogeneous

and there are buyers and sellers and publicly available prices

11

12

IAS 41 Recognition and Measurement

Where an active market does not exist or where markets

do not exist at all, the entity would do the following in attempting

to estimate fair value:

1. First, try to estimate current market prices by looking at the prices of

recent market transactions, market prices for similar assets, or sector

benchmarks such as the price of cattle expressed by weight

2. Second, if market-determined prices are not available for assets in their

present condition, use a discounted cash flow approach to measure the

value

This need not be carried out by an independent valuator

Cost may be close to fair value if there has been little or immaterial

biological transformation

13

IAS 41 Recognition and Measurement

When using a discounted cash flow approach, the

entity would:

Use a market-determined discount rate

Exclude cash flows for financing, taxation, or replacing the asset after

harvest

Incorporate risk by either using probability weighted cash flows or

adjusting the discount rate or some combination of the two; and

Ensure assumptions for calculating the discount rate are consistent with

calculating the cash flows to avoid double-counting

Where the biological assets are attached to land, the fair value of

the land and assets would be measured, and then the value of the

land would be deducted since land is not covered by this standard

14

IAS 41 Recognition and Measurement

Contracts:

If the entity has entered into a contract to sell the assets at a future

date, the price fixed in the contract does not necessarily dictate the

fair value since the contract price reflects an estimate of the future

fair value and therefore includes a time value factor

In addition, the locked-in contract price may be higher or lower than

the fair value at any point in time (spot price) due to changing

market conditions and expectations

Where an entity has locked into a price to sell the assets at a price

less than the current fair value, this would be reflected in the

statements as an onerous contract and IAS 37 would apply

15

IAS 41 Recognition and Measurement

Costs related to the biological transformation process:

May include planting, weeding, fertilizing, and others

IAS 41 does not prescribe how to treat these costs

Some feel that it is inconsistent to capitalize these costs in a fair

value model and that they should be expensed

Others feel that they should be capitalized and only the net amount

should be recognized as gain or loss in the statement of profit and

loss

Gains and losses:

Gains or losses are recognized in income when they arise

This may result in a gain or loss arising upon initial recognition such

as the birth of a calf

16

IAS 41 Recognition and Measurement

Inability to Measure Fair Value Reliably:

In general, the standard assumes that fair value is measurable

This rebuttable presumption may be overcome for biological assets only if the

market-determined prices are not available or fair value estimates are unreliable

at the time of initial recognition

As a default measurement method, the asset would be measured at cost

(amortized if relevant) and would also be tested for impairment

Once an asset is measured at fair value less point of sale costs it is assumed that

fair value is reliably measurable thereafter (no going back)

Agricultural produce is always presumed to have a reliably measurable fair value

17

IAS 41 Government Grants

Unconditional government grants are

recognized as income when receivable

For conditional grants, conditions must be met

before recognition of the grant

If the biological asset is measured at cost or

amortized cost, the government grant is

accounted for in accordance with IAS 20

18

IAS 41 Disclosure

IAS 1 requires biological assets to be presented separately on the statement

of financial position

The standard requires the following disclosures:

Recognized gains/losses (on initial recognitions and on revaluation)

Description of each type of biological asset

Nature of activities relating to the assets

Non-financial measures or estimates of the physical qualities of the assets

Methods and significant assumptions to determine fair value

Fair value of harvested assets at point of harvest

Any restrictions on title

Commitments for the development or acquisition of biological assets

Financial risk management strategies

A reconciliation of changes in the carrying amounts of biological assets between

the beginning and end of the period

Additional disclosure if measured at cost

Additional disclosures related to government grants

19

IAS 41 Disclosure

An entity is also encouraged but not required to disclose the

change in fair value due to physical changes (assets getting older)

and price changes (e.g., the price of beef increases)

Biological assets:

Are categorized as being consumable (beef cattle) and bearer (dairy

cows)

Bearer biological assets are long-term assets that produce each year

such as an orchard tree

Entities are encouraged to provide a description of different types of

assets differentiating between consumable and bearer biological assets

20

Current GAAP Comparisons

Pages 80 & 108 of 164 of

http://www.kpmg.co.uk/pubs/IFRScomparedtoU.S.GAAPAnOverview(2008).pdf

21

IFRS Financial Statement

Disclosures

Del Monte Pacific Limited

http://www.delmontepacific.com/ir/media/ar_ipo/AR2007.pdf

Biological Assets accounting

policy note page 62 of 108

Biological Assets note page 75 of 108

22

Looking Ahead

The use of fair value in this standard means that the standard is

intertwined with the larger fair value measurement project

The IASB has established an expert advisory panel to deal with the

issue of fair value measurement in general; the panel met for the first

time in June 2008

To date, the IASB has completed a standard-by-standard review of

existing measurements in IFRSs that are identified as fair value and

has decided to delete the requirement to use a pre-tax discount rate

Other than noted in footnote 6 and above, there are no other specific

plans to make any changes in the standard in the near future

23

End-of-Chapter Practice

24

End-of-Chapter Practice

25

End-of-Chapter Practice

Copyright 2010 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

by Access Copyright is unlawful. Requests for further

information should be addressed to the Permissions

Department, John Wiley & Sons Inc., 111 River Street, Hoboken,

NJ 07030-5774, (201) 748-6011, fax (201) 748-6008, website

http://www.wiley.com/go/permissions. The purchaser may make

back-up copies for his or her own use only and not for

distribution or resale. The author and the publisher assume no

responsibility for errors, omissions, or damages caused by the

use of these programs or from the use of the information

contained herein.

You might also like

- Ias 41 AgricultureDocument23 pagesIas 41 AgricultureSunshine KhuletzNo ratings yet

- IAS 41 Application of Fair Value MeasurementDocument22 pagesIAS 41 Application of Fair Value MeasurementgigitoNo ratings yet

- IAS 41 - AgricultureDocument2 pagesIAS 41 - AgricultureRafaelLeeNo ratings yet

- 10 IAS 41 AgricultureDocument18 pages10 IAS 41 AgricultureAANo ratings yet

- Summary of Ias 41 - AgricultureDocument3 pagesSummary of Ias 41 - AgricultureJoana TatacNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- Investment Property: DefinitionsDocument17 pagesInvestment Property: Definitionssamit shresthaNo ratings yet

- IAS16 Defines PPE CostsDocument71 pagesIAS16 Defines PPE CostsmulualemNo ratings yet

- Ias 12 - Income Taxes DefinitionsDocument4 pagesIas 12 - Income Taxes DefinitionsFurqan ButtNo ratings yet

- Ifrs 5 Assets Held For Sale and Discontinued OperationsDocument45 pagesIfrs 5 Assets Held For Sale and Discontinued OperationstinashekuzangaNo ratings yet

- Ifrs 3 Business CombinationsDocument11 pagesIfrs 3 Business CombinationsEshetieNo ratings yet

- Insurance Contracts (IFRS 17Document6 pagesInsurance Contracts (IFRS 17Dere Guranda100% (1)

- IFRS 2 Share Based PaymentsDocument14 pagesIFRS 2 Share Based Paymentsniichauhan100% (1)

- IAS 2 Inventories PDFDocument12 pagesIAS 2 Inventories PDFViplav RathiNo ratings yet

- Ifrs 16 LeasesDocument33 pagesIfrs 16 Leasesesulawyer2001100% (1)

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- Scope and exclusions of IAS 39Document11 pagesScope and exclusions of IAS 39Muhammad Qasim FareedNo ratings yet

- Investment PropertyDocument28 pagesInvestment PropertydedYno1100% (1)

- IFRS 16 Leases: You Might Want To Check That Out HereDocument10 pagesIFRS 16 Leases: You Might Want To Check That Out HerekoshkoshaNo ratings yet

- IAS-12 BinderDocument27 pagesIAS-12 Binderzahid awanNo ratings yet

- IAS 33: Earnings Per ShareDocument15 pagesIAS 33: Earnings Per SharecolleenyuNo ratings yet

- IFRS 2 Share Based Payment Final Revision ChecklistDocument17 pagesIFRS 2 Share Based Payment Final Revision ChecklistEmezi Francis ObisikeNo ratings yet

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Full Ifrs Vs SmeDocument6 pagesFull Ifrs Vs SmeMina ValenciaNo ratings yet

- IAS 20 Accounting for Government GrantsDocument4 pagesIAS 20 Accounting for Government GrantsSandia EspejoNo ratings yet

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- Assignment For PAS 41-1Document7 pagesAssignment For PAS 41-1Carolyn Talaboc100% (1)

- Cfas Revenue Recognition - StudentsDocument41 pagesCfas Revenue Recognition - StudentsMiel Viason CañeteNo ratings yet

- Ias 16 & Ias 40Document47 pagesIas 16 & Ias 40Etiel Films / ኢትኤል ፊልሞች100% (1)

- Ias 7Document13 pagesIas 7Ajinkya MohadkarNo ratings yet

- Ifrs December 2020 EnglishDocument10 pagesIfrs December 2020 Englishjad NasserNo ratings yet

- Module 04 - Financial InstrumentsDocument19 pagesModule 04 - Financial Instrumentsapostol ignacioNo ratings yet

- Unit II Consolidated Financial Statements Date of AcquisitionDocument17 pagesUnit II Consolidated Financial Statements Date of AcquisitionDaisy TañoteNo ratings yet

- IAS 40 - Investment PropertyDocument6 pagesIAS 40 - Investment PropertyAllana NicdaoNo ratings yet

- IAS 40 Investment Property (2021)Document7 pagesIAS 40 Investment Property (2021)Tawanda Tatenda HerbertNo ratings yet

- Question On IFRS 15Document2 pagesQuestion On IFRS 15Adeleke TemitayoNo ratings yet

- IAS 41 - AgricultureDocument17 pagesIAS 41 - AgricultureArshad BhuttaNo ratings yet

- Difference Between GAAP and IFRSDocument3 pagesDifference Between GAAP and IFRSGoutam SoniNo ratings yet

- Earnings Per ShareDocument30 pagesEarnings Per ShareTanka P Chettri100% (1)

- IAS 21 Overview: Accounting for Foreign Currency Transactions and Foreign OperationsDocument22 pagesIAS 21 Overview: Accounting for Foreign Currency Transactions and Foreign OperationsJayesh S BoharaNo ratings yet

- IAS - 23 - Borrowing - Costs Edited 6 KiloDocument19 pagesIAS - 23 - Borrowing - Costs Edited 6 KilonatiNo ratings yet

- Ias 12 Income TaxesDocument70 pagesIas 12 Income Taxeszulfi100% (1)

- Chap 6Document54 pagesChap 6Jose Martin Castillo Patiño100% (1)

- Ifrs 5: 9. SummaryDocument14 pagesIfrs 5: 9. SummaryCISA PwCNo ratings yet

- Module1 - Foreign Currency Transaction and TranslationDocument3 pagesModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Residual Equity TheoryDocument3 pagesResidual Equity Theorybrix simeonNo ratings yet

- IAS37Document2 pagesIAS37Mohammad Faisal SaleemNo ratings yet

- Consolidated Financial Statements: Intercompany TransactionsDocument23 pagesConsolidated Financial Statements: Intercompany TransactionsDr-Mohammad Nahawi-Abu AwsNo ratings yet

- Process CostinggDocument22 pagesProcess CostinggKurt Del RosarioNo ratings yet

- Degree of Operating LeverageDocument2 pagesDegree of Operating LeveragesabetaliNo ratings yet

- Earning Per ShareDocument51 pagesEarning Per ShareNdung'u Evans100% (1)

- Sa Sept10 Ias16Document7 pagesSa Sept10 Ias16Muiz QureshiNo ratings yet

- IAS 16 Property Plant Equipment GuideDocument4 pagesIAS 16 Property Plant Equipment GuideMD Hafizul Islam HafizNo ratings yet

- Advanced FA I - Chapter 01, Accounting For Investment in JADocument58 pagesAdvanced FA I - Chapter 01, Accounting For Investment in JAKalkidan G/wahidNo ratings yet

- AFAR 13 Derivatives and Hedge Accounting Under PFRS 9Document10 pagesAFAR 13 Derivatives and Hedge Accounting Under PFRS 9Louie RobitshekNo ratings yet

- IFRS 10 Consolidation RRDocument43 pagesIFRS 10 Consolidation RRYared HussenNo ratings yet

- F2 Notes LatestDocument267 pagesF2 Notes LatestWaseem Ahmad100% (1)

- Pas 41 - AgricultureDocument2 pagesPas 41 - AgricultureGGNo ratings yet

- #13 Biological AssetsDocument3 pages#13 Biological AssetsZaaavnn VannnnnNo ratings yet

- Ias 41 AgricultureDocument37 pagesIas 41 AgricultureDiane ClarisseNo ratings yet

- CG Cimb To UploadDocument19 pagesCG Cimb To UploadPriya DarshiniNo ratings yet

- Oli Group - UploadDocument14 pagesOli Group - UploadPriya DarshiniNo ratings yet

- Security and Information Systems: Interpreting The Collapse of Barings BankDocument12 pagesSecurity and Information Systems: Interpreting The Collapse of Barings BankPriya DarshiniNo ratings yet

- Cadbury ReportDocument90 pagesCadbury ReportPriya DarshiniNo ratings yet

- Oli Group - UploadDocument14 pagesOli Group - UploadPriya DarshiniNo ratings yet

- Ryanair Case Study PDFDocument10 pagesRyanair Case Study PDFPriya DarshiniNo ratings yet

- Group 5Document19 pagesGroup 5Priya DarshiniNo ratings yet

- Strategic Analysis On Ford MotorDocument20 pagesStrategic Analysis On Ford Motorm_ebad93% (30)

- YahooDocument41 pagesYahooPriya Darshini100% (2)

- Tata MotorsDocument10 pagesTata MotorsPriya DarshiniNo ratings yet

- Group 3Document20 pagesGroup 3Priya DarshiniNo ratings yet

- ANN Taylor Case Study - Retail Strategy Challenges"TITLE"Fresh Direct Online Grocery - Innovation & Market Share" TITLE"Jamba Juice Growth Strategy - Healthy Brand ManagementDocument3 pagesANN Taylor Case Study - Retail Strategy Challenges"TITLE"Fresh Direct Online Grocery - Innovation & Market Share" TITLE"Jamba Juice Growth Strategy - Healthy Brand ManagementPriya DarshiniNo ratings yet

- Group 4Document18 pagesGroup 4Priya DarshiniNo ratings yet

- Group 2Document22 pagesGroup 2Priya DarshiniNo ratings yet

- Tata MotorsDocument10 pagesTata MotorsPriya DarshiniNo ratings yet

- Strategic ManagementDocument20 pagesStrategic ManagementShalu Suntari67% (3)

- Digital Vs Print MediaDocument3 pagesDigital Vs Print MediaPriya DarshiniNo ratings yet

- Ford's $5.9 Billion Energy Loan to Boost Electric Car ProductionDocument8 pagesFord's $5.9 Billion Energy Loan to Boost Electric Car Productionmrzemn100% (2)

- Susila FinalDocument7 pagesSusila FinalPriya DarshiniNo ratings yet

- Cisco's business model, products and strategiesDocument14 pagesCisco's business model, products and strategiesPriya DarshiniNo ratings yet

- Oli Group - UploadDocument14 pagesOli Group - UploadPriya DarshiniNo ratings yet

- Oli GroupDocument14 pagesOli GroupPriya DarshiniNo ratings yet

- CISCODocument1 pageCISCOPriya DarshiniNo ratings yet

- AssignmentDocument8 pagesAssignmentPriya DarshiniNo ratings yet

- Cisco Systems Architecture Class 3: IT and Internal OrganizationDocument4 pagesCisco Systems Architecture Class 3: IT and Internal OrganizationPriya DarshiniNo ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentPriya DarshiniNo ratings yet

- Cisco Erp Case StudyDocument20 pagesCisco Erp Case StudyPriya Darshini50% (2)

- GSM5301 - Group 1 Assignment - 2 FinalDocument6 pagesGSM5301 - Group 1 Assignment - 2 FinalPriya DarshiniNo ratings yet

- Case 14-4 Accounting at MacCloud WineryDocument4 pagesCase 14-4 Accounting at MacCloud WineryPriya Darshini50% (2)

- ADEVA Task#1Document3 pagesADEVA Task#1Maria Kathreena Andrea AdevaNo ratings yet

- 1.3.4 Sources of Business Finance-2Document31 pages1.3.4 Sources of Business Finance-2javier.mayor83No ratings yet

- Entrep PPT 1 StudentDocument15 pagesEntrep PPT 1 StudentShaina LuisNo ratings yet

- Banking Sector Overview: Definitions, Regulation, FunctionsDocument39 pagesBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenNo ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- Business To Business MarketingDocument604 pagesBusiness To Business MarketingWael Khattab100% (1)

- 50 Companies Act MCQs SEBIDocument97 pages50 Companies Act MCQs SEBIpreeti siriyaNo ratings yet

- I-Byte Technology March 2021Document92 pagesI-Byte Technology March 2021IT ShadesNo ratings yet

- CH - 3 - Question BankDocument22 pagesCH - 3 - Question BankEkansh AgarwalNo ratings yet

- SAP T-Codes Module IS - DFPS Defense Forces and Public SecurityDocument39 pagesSAP T-Codes Module IS - DFPS Defense Forces and Public Securityharisomanath100% (1)

- Business PlanDocument19 pagesBusiness Plansona_ktk100% (2)

- Materials Set A Part 1. Theory (1pt Each)Document3 pagesMaterials Set A Part 1. Theory (1pt Each)Trixie HicaldeNo ratings yet

- HR Sip Project at HCL InfosysytemsDocument28 pagesHR Sip Project at HCL InfosysytemsSaurabh SharmaNo ratings yet

- The Opportunity Analysis CanvasDocument186 pagesThe Opportunity Analysis Canvasjose inacio100% (7)

- Question Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Document41 pagesQuestion Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Sharif MahmudNo ratings yet

- McDonald's Financial Ratios AnalysisDocument11 pagesMcDonald's Financial Ratios AnalysisFahad Khan TareenNo ratings yet

- Full Download:: Test BankDocument16 pagesFull Download:: Test BankRohan Dwivedi100% (1)

- Collaboration and InnovationDocument15 pagesCollaboration and InnovationRhea Ann DiazNo ratings yet

- City Bank Annual Report 2021Document478 pagesCity Bank Annual Report 2021Shadat Rahman 1731419No ratings yet

- Fi HR Integration PDFDocument2 pagesFi HR Integration PDFBrentNo ratings yet

- Implementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsDocument38 pagesImplementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsAdelina Elena OlogeanuNo ratings yet

- CIF ICPO To XXXXXXXXXXXXXXXXXXXXX TemplateDocument3 pagesCIF ICPO To XXXXXXXXXXXXXXXXXXXXX Templatevijaykumarbhattad100% (5)

- Private Organization Pension Amendment ProclamationDocument8 pagesPrivate Organization Pension Amendment ProclamationMulu DestaNo ratings yet

- Value Creation - The Source of Pricing AdvantageDocument23 pagesValue Creation - The Source of Pricing AdvantageReymark Mores50% (2)

- Corporate Social Responsibility EthicsDocument35 pagesCorporate Social Responsibility EthicsMaham ZahraNo ratings yet

- Ifb Agro Piku - Copy - 2Document20 pagesIfb Agro Piku - Copy - 2Ahmed KhanNo ratings yet

- Analyze Portfolio PerformanceDocument48 pagesAnalyze Portfolio PerformanceMd Zainuddin IbrahimNo ratings yet

- Xlfinplan Features SatishDocument7 pagesXlfinplan Features SatishrajsalgyanNo ratings yet

- Bandhan Bank Case Study: Transformation from MFI to Leading BankDocument14 pagesBandhan Bank Case Study: Transformation from MFI to Leading BankSOURAV GOYALNo ratings yet

- Chevron Attestation PDFDocument2 pagesChevron Attestation PDFedgarmerchanNo ratings yet