Professional Documents

Culture Documents

Management Principles & Practices: Done By, Preethi, Reecha Jain, Sowmya .R

Uploaded by

Jaya Preethi DoraisamyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management Principles & Practices: Done By, Preethi, Reecha Jain, Sowmya .R

Uploaded by

Jaya Preethi DoraisamyCopyright:

Available Formats

MANAGEMENT PRINCIPLES &

PRACTICES

Done by,

Preethi,

Reecha Jain,

Sowmya .R.

CONTENTS

Accounting Profit

Economic Profit

Difference between accounting profit &

economic profit

ACCOUNTING PROFIT

The accounting profit used by accountants to determine

a firm's taxable income.

The Formula for Accounting Profit is;

Accounting Profit = Total Revenue - Explicit Costs

Explicit costs are the actual cash payments for

resources purchased in resource markets.

These are the rent paid on land and plant and

equipment, wages to labor, interest on capital, cost of

raw material, transport charges etc., etc.

Thus, all these explicit costs are subtracted from the

firm's total revenue, we get accounting profit.

ECONOMIC PROFIT

Accounting profit ignores the opportunity cost of the firm's

own resources used in the production of goods.

The economist include these costs named as implicit costs

while determining the total cost of production.

A firm's Implicit costs are the opportunity costs of using its

self owned, self employed resources.

The Formula for Economic Profit is;

Economic Profit = Total revenue - (Explicit Cost + Implicit Cost)

Where,

Implicit cost refers to entrepreneurs wages, rental income on self

owned land and interest on self capital.

Explicit cost is expenses incurred in earning a revenue eg:

payment to employees, rent payment.

Economic profit takes into account the opportunity costs

of all resources used in production.

In simple words, the difference between the revenue

received from the sale of an output and the cost of the

inputs used.

Implicit costs also include normal profit earned by a firm

Normal profit is the minimum amount required to keep on

entrepreneur engaged in the present line of production.

THE DIFFERENCE BETWEEN ECONOMIC PROFIT

& ACCOUNTING PROFIT

Manager gives more important to Economic profit than

Accounting profit because;

Accounting profit is calculated only for a period of time but

Economic profit is calculated over long run.

Although, accounting profit involves non-cash

transactions/adjustments for depreciation, allowances,

provisions, capitalising development costs, leased

assets, etc.

It is calculated for whole of the entities business.

As economic profit is calculated for long run, the profit

is in real terms. .

Why manager prefer economic profit?

It indicates the true profitability position of an enterprise.

It is a tool for overall measurement of managements

performance.

Also ideal for setting corporate goals, management incentives

and payment of bonuses.

It can be readily communicated and understood by operational

management.

It focuses management on improving profit without making

additional investment.

It guides the owner whether to enter/stay in market or exit it.

You might also like

- Chapter 8 - Divisional Perfomance and BudgetingDocument34 pagesChapter 8 - Divisional Perfomance and BudgetingJeremiah NcubeNo ratings yet

- Accounting Basic TerminologiesDocument5 pagesAccounting Basic TerminologiesUsman Ali MashwaniNo ratings yet

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument3 pagesSegmented Reporting, Investment Center Evaluation, and Transfer Pricingeskelapamudah enakNo ratings yet

- CostDocument4 pagesCostChaahat S.No ratings yet

- MAS 2 Responsibility Accounting Part 1Document4 pagesMAS 2 Responsibility Accounting Part 1Jon garciaNo ratings yet

- Profit MGT & InflationDocument21 pagesProfit MGT & InflationParkhi AgarwalNo ratings yet

- Chapter 1Document2 pagesChapter 1Controller GujranwalaNo ratings yet

- Entrepreneur Chapter 18Document6 pagesEntrepreneur Chapter 18CaladhielNo ratings yet

- 08-LECTURE NOTES - Difference Between Economic and Accounting Profit - MANAGERIAL ECONOMICSDocument11 pages08-LECTURE NOTES - Difference Between Economic and Accounting Profit - MANAGERIAL ECONOMICSreagan blaireNo ratings yet

- Financial Statement PresentationDocument33 pagesFinancial Statement Presentationcyrene jamnagueNo ratings yet

- FinalDocument32 pagesFinalreegup0% (1)

- Alekya - Profit AnaDocument17 pagesAlekya - Profit AnaMOHAMMED KHAYYUMNo ratings yet

- Income Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Document47 pagesIncome Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Jenkins Jose Shirley100% (1)

- Statement of Comprehensive IncomeDocument8 pagesStatement of Comprehensive IncomeSalvie Angela Clarette UtanaNo ratings yet

- Maximizing EconomicsDocument5 pagesMaximizing EconomicsLaures RegidorNo ratings yet

- Work FinalDocument32 pagesWork FinalElhissin ElhissinnNo ratings yet

- Documents 4Document3 pagesDocuments 4Espoir BashNo ratings yet

- INTRODUCTION TO PROFIT MANAGEMENT M.E. NotesDocument25 pagesINTRODUCTION TO PROFIT MANAGEMENT M.E. NotesRita Alexa100% (3)

- Cost of ProdDocument2 pagesCost of ProdRoma Fe MabanagNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- A Study On Profitability Analysis atDocument13 pagesA Study On Profitability Analysis atAsishNo ratings yet

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (35)

- Dwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFmiltongoodwin2490i100% (15)

- SSF From LinnyDocument80 pagesSSF From Linnymanojpatel51No ratings yet

- Chapter 7 Decentralization and Transfer PricingDocument34 pagesChapter 7 Decentralization and Transfer Pricingtamirat tadeseNo ratings yet

- Responsibility CentreDocument5 pagesResponsibility CentreataulbariNo ratings yet

- Key Takeaways: Accountants' Gaap TimelinessDocument3 pagesKey Takeaways: Accountants' Gaap TimelinessMaria GarciaNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- SM 26Document8 pagesSM 26Qamar AbbasNo ratings yet

- Module VII Profit Mgmt.Document15 pagesModule VII Profit Mgmt.Apoorv BNo ratings yet

- Types of CostDocument11 pagesTypes of Cost009rohitsainiNo ratings yet

- An Overview of Business Finance-1Document24 pagesAn Overview of Business Finance-1HamzaNo ratings yet

- The Goal of A Maximum Profit Profit MaximizationDocument2 pagesThe Goal of A Maximum Profit Profit MaximizationKaila100% (1)

- Report - Basic Financial Statements-EriveDocument18 pagesReport - Basic Financial Statements-Eriveevita eriveNo ratings yet

- Assignment On SCMDocument5 pagesAssignment On SCMcattiger123No ratings yet

- MMPC-04 2022-23Document8 pagesMMPC-04 2022-23Rajni KumariNo ratings yet

- Solution Manual For Financial Management Theory and Practice 14th Edition by Brigham and Ehrhardt ISBN 1111972214 9781111972219Document36 pagesSolution Manual For Financial Management Theory and Practice 14th Edition by Brigham and Ehrhardt ISBN 1111972214 9781111972219caseywestfmjcgodkzr100% (23)

- Accounting Terminologies - Feb 2022Document7 pagesAccounting Terminologies - Feb 202210Mansi ManekNo ratings yet

- Segmented Reporting Investment Center Evaluation and Transfer PricingDocument42 pagesSegmented Reporting Investment Center Evaluation and Transfer PricingAyu Dian SetyaniNo ratings yet

- Income StatementsDocument5 pagesIncome StatementsAdetunbi TolulopeNo ratings yet

- APP2 Week 6 - Q2Document15 pagesAPP2 Week 6 - Q2Rhina MayNo ratings yet

- Meaning and Nature of ProfitDocument2 pagesMeaning and Nature of ProfitkigenNo ratings yet

- Financial Management Theory and Practice 13th Edition Brigham Solutions ManualDocument35 pagesFinancial Management Theory and Practice 13th Edition Brigham Solutions Manualartisticvinosezk57No ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- Residual Income and Business Unit Profitability AnalysisDocument7 pagesResidual Income and Business Unit Profitability AnalysisLealyn CuestaNo ratings yet

- Financial Management Theory and Practice 13th Edition Brigham Solutions ManualDocument35 pagesFinancial Management Theory and Practice 13th Edition Brigham Solutions Manualrappelpotherueo100% (17)

- Chapter III Lecture NoteDocument22 pagesChapter III Lecture NoteKalkidan NigussieNo ratings yet

- Chapter 3Document28 pagesChapter 3Kibrom EmbzaNo ratings yet

- Q1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDocument18 pagesQ1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDhaval LagwankarNo ratings yet

- Solution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108Document36 pagesSolution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108stephanievargasogimkdbxwn100% (26)

- Financial and Economic TermsDocument4 pagesFinancial and Economic TermsShaggy DuraiNo ratings yet

- FINFO Week 3 Learner GuideDocument14 pagesFINFO Week 3 Learner GuideAngelica Caballes TabaniaNo ratings yet

- Summary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSDocument9 pagesSummary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSliaNo ratings yet

- Solution Manual For Corporate Finance A Focused Approach 5th Edition by Ehrhardt Brigham ISBN 1133947530 9781133947530Document36 pagesSolution Manual For Corporate Finance A Focused Approach 5th Edition by Ehrhardt Brigham ISBN 1133947530 9781133947530heathernashdnjbczemra100% (24)

- 74601bos60479 FND cp1 U3Document13 pages74601bos60479 FND cp1 U3kingdksNo ratings yet

- Financial Statement: Why Do We Need Financial Information To Make Business Decision?Document19 pagesFinancial Statement: Why Do We Need Financial Information To Make Business Decision?steven johnNo ratings yet

- Income Statement: Profit and LossDocument7 pagesIncome Statement: Profit and LossNavya NarulaNo ratings yet

- Aec 001-Bacc 001 (Econ) - Week 15 ModuleDocument3 pagesAec 001-Bacc 001 (Econ) - Week 15 ModuleNicole ValentinoNo ratings yet

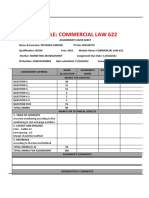

- Claw 622 2022Document24 pagesClaw 622 2022Priyanka GirdariNo ratings yet

- Lebogang Mononyane CV 2023Document3 pagesLebogang Mononyane CV 2023Mono MollyNo ratings yet

- G O Ms NoDocument2 pagesG O Ms NoMuralidhar MogalicherlaNo ratings yet

- Account StatementDocument12 pagesAccount StatementNarendra PNo ratings yet

- Angara V. Electoral Commission G.R. NO. L-45081. JULY 15, 1936 Laurel, JDocument7 pagesAngara V. Electoral Commission G.R. NO. L-45081. JULY 15, 1936 Laurel, JOppa KyuNo ratings yet

- ØÁ L Nu T Uz È: Federal Negarit GazetaDocument29 pagesØÁ L Nu T Uz È: Federal Negarit GazetaNurNo ratings yet

- Golden Rule of InterpretationDocument8 pagesGolden Rule of InterpretationPawanpreet SinghNo ratings yet

- Power of The Subconscious MindDocument200 pagesPower of The Subconscious Mindapi-26248282100% (2)

- The Role of A Citizen in Upholding Sovereignty, UnityDocument2 pagesThe Role of A Citizen in Upholding Sovereignty, Unityaditya .dNo ratings yet

- Lease Offer - Flavors - Eggsy PutoDocument7 pagesLease Offer - Flavors - Eggsy PutoThe Seafarer RamNo ratings yet

- 10 Biggest LiesDocument12 pages10 Biggest LiesJose RenteriaNo ratings yet

- Strategic Planning and Organization Performance: A Review On Conceptual and Practice PerspectivesDocument10 pagesStrategic Planning and Organization Performance: A Review On Conceptual and Practice PerspectivesIoana HalchinNo ratings yet

- Boston TV EEO Public File Report 2022-2023Document4 pagesBoston TV EEO Public File Report 2022-2023Boston 25 DeskNo ratings yet

- CLIFFORD PROCTOR'S NURSERIES LIMITED - Company Accounts From Level BusinessDocument7 pagesCLIFFORD PROCTOR'S NURSERIES LIMITED - Company Accounts From Level BusinessLevel BusinessNo ratings yet

- Ucsp Week 7Document10 pagesUcsp Week 7EikaSoriano100% (1)

- Ebook PDF Data Mining For Business Analytics Concepts Techniques and Applications With Xlminer 3rd Edition PDFDocument41 pagesEbook PDF Data Mining For Business Analytics Concepts Techniques and Applications With Xlminer 3rd Edition PDFpaula.stolte522100% (35)

- Sport in The Eastern Sudan - 1912Document308 pagesSport in The Eastern Sudan - 1912nevada desert ratNo ratings yet

- Cruttenden (2014) : (Summary)Document2 pagesCruttenden (2014) : (Summary)Emma PeelNo ratings yet

- Link Between Competitive Advantage and CSRDocument14 pagesLink Between Competitive Advantage and CSRManish DhamankarNo ratings yet

- Pakistan The Factories Act, 1934: CHAPTER I - PreliminaryDocument56 pagesPakistan The Factories Act, 1934: CHAPTER I - Preliminarydanni1No ratings yet

- New Banking Value ChainDocument10 pagesNew Banking Value Chainapi-276166864No ratings yet

- Group 1 KULOT RevisedDocument15 pagesGroup 1 KULOT RevisedFranchesca Mekila TuradoNo ratings yet

- Republic V Tanyag-San JoseDocument14 pagesRepublic V Tanyag-San Joseyannie11No ratings yet

- Group Session-Week 2 - Aldi Case StudyDocument8 pagesGroup Session-Week 2 - Aldi Case StudyJay DMNo ratings yet

- DowryDocument34 pagesDowryRashid ZubairNo ratings yet

- "Why Some Firms Outperform Others" Resource Possession & Exploitation Resources & CapabilitiesDocument1 page"Why Some Firms Outperform Others" Resource Possession & Exploitation Resources & CapabilitiesJordan ChizickNo ratings yet

- ALBAO - BSChE2A - MODULE 1 (RIZAL)Document11 pagesALBAO - BSChE2A - MODULE 1 (RIZAL)Shaun Patrick AlbaoNo ratings yet

- Gavin Walker, Fascism and The Metapolitics of ImperialismDocument9 pagesGavin Walker, Fascism and The Metapolitics of ImperialismakansrlNo ratings yet

- Classification of Malnutrition in ChildrenDocument2 pagesClassification of Malnutrition in ChildrenJai Jai MaharashtraNo ratings yet

- A Deal Making Strategy For New CEOsDocument4 pagesA Deal Making Strategy For New CEOsTirtha DasNo ratings yet