Professional Documents

Culture Documents

Chapter 1 - Risk and Insurance - Insurance

Uploaded by

fatinathirah96Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Risk and Insurance - Insurance

Uploaded by

fatinathirah96Copyright:

Available Formats

CHAPTER 1:

RISK AND INSURANCE

(INSURANCE)

LEARNING OUTCOME

Define basic characteristics of insurance

Define characteristics of an insurable

risk

Explain differences between adverse

selection and insurance

Explain differences between insurance

and gambling compared

Explain differences between insurance

and hedging compared

Explain types of insurance

DEFINITION OF INSURANCE

Insurance is the pooling of fortuitous

losses by transfer of such risks to

insurers, who agree to indemnify

insureds for such losses, to provide

other pecuniary benefits on their

occurrence, or to render services

connected with the risk

BASIC CHARACTERISTICS OF

INSURANCE

Pooling of losses

Pooling involves spreading losses

incurred by the few over the entire

group

Risk reduction is based on the law of

large numbers

According to the law of large

numbers, the greater the number of

exposures, the more closely will the

actual results approach the probable

results that are expected from an

infinite number of exposures.

BASIC CHARACTERISTICS OF

INSURANCE

Example of pooling:

Two business owners own identical buildings

valued at $50,000

There is a 10 percent chance each building will be

destroyed by a peril in any year

Loss to either building is an independent event

Expected value and standard deviation of the loss

for each owner is:

000 , 5 $ 000 , 50 $ * 10 . 0 0 $ * 90 . 0 loss Expected

000 , 15 $

000 , 5 $ 000 , 50 $ 10 . 0 000 , 5 $ 0 90 . 0

2 2

deviation Standard

BASIC CHARACTERISTICS OF

INSURANCE

Example, continued:

If the owners instead pool (combine) their loss

exposures, and each agrees to pay an equal share

of any loss that might occur:

As additional individuals are added to the pool, the

standard deviation continues to decline while the

expected value of the loss remains unchanged

000 , 5 $

000 , 50 $ * 01 . 0 000 , 25 $ * 09 . 0 000 , 25 $ * 09 . 0 0 $ * 81 . 0

loss Expected

607 , 10 $

) 000 , 5 $ 000 , 50 ($ 01 . 0 000 , 5 $ 000 , 25 $ ) 09 . 0 )( 2 ( 000 , 5 $ 0 81 . 0

2

2 2

deviation Standard

BASIC CHARACTERISTICS OF

INSURANCE

Payment of fortuitous losses

A fortuitous loss is one that is unforeseen,

unexpected, and occur as a result of

chance

Risk transfer

A pure risk is transferred from the insured

to the insurer, who typically is in a stronger

financial position

Indemnification

The insured is restored to his or her

approximate financial position prior to the

occurrence of the loss

CHARACTERISTICS OF AN

INSURABLE RISK

Large number of exposure units

To predict average loss based on the law of

large numbers

Enable insurer to predict the losses if

homogeneous

Accidental and unintentional loss

To assure random occurrence of events

Determinable and measurable loss

To determine how much should be paid

CHARACTERISTICS OF AN IDEALLY

INSURABLE RISK

No catastrophic loss

To allow the pooling technique to work

Exposures to catastrophic loss can be

managed by using reinsurance, dispersing

coverage over a large geographic area, or

using financial instruments, such as

catastrophe bonds

Calculable chance of loss

To establish a premium that is sufficient to pay

all claims and expenses and yields a profit

during the policy period

CHARACTERISTICS OF AN IDEALLY

INSURABLE RISK

Economically feasible premium

So people can afford to purchase the policy

For insurance to be an attractive purchase,

the premiums paid must be substantially

less than the face value, or amount, of the

policy

Based on these requirements:

Most personal, property and liability risks

can be insured

Market risks, financial risks, production

risks and political risks are difficult to insure

ADVERSE SELECTION AND INSURANCE

Adverse selection is the tendency of persons

with a higher-than-average chance of loss to

seek insurance at standard rates

If not controlled by underwriting, adverse

selection results in higher-than-expected loss

levels

Adverse selection can be controlled by:

Careful underwriting (selection and classification

of applicants for insurance)

Policy provisions (e.G., Suicide clause in life

insurance)

INSURANCE VS. GAMBLING

INSURANCE

Insurance is a

technique for

handing an already

existing pure risk

Insurance is always

socially productive:

Both parties have a

common interest in

the prevention of a

loss

GAMBLING

Gambling creates a

new speculative risk

Gambling is not

socially productive

The winners gain

comes at the

expense of the loser

INSURANCE VS. HEDGING

INSURANCE

Risk is transferred by a

contract

Insurance involves the

transfer of pure

(insurable) risks

Insurance can reduce

the objective risk of an

insurer

Through the law of

large numbers

HEDGING

Risk is transferred by

a contract

Hedging involves

risks that are typically

uninsurable

Hedging does not

result in reduced risk

Types of

Insurance

Private

Insurance

Government

Insurance

PRIVATE INSURANCE

Life and health

Life insurance pays death

benefits to beneficiaries when the

insured dies

Health insurance covers medical

expenses because of sickness or

injury

Disability plans pay income

benefits

PRIVATE INSURANCE

Property and liability

Property insurance indemnifies property

owners against the loss or damage of real or

personal property

Liability insurance covers the insureds legal

liability arising out of property damage or

bodily injury to others

Casualty insurance refers to insurance that

covers whatever is not covered by fire, marine,

and life insurance

PRIVATE INSURANCE

Private insurance coverages can be

grouped into two major categories

Personal lines: coverages that insure the

real estate and personal property of

individuals and families or provide

protection against legal liability

Commercial lines: coverages for business

firms, nonprofit organizations, and

government agencies

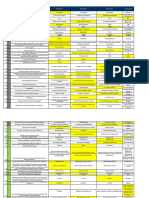

EXHIBIT 2.3

PROPERTY AND

CASUALTY

INSURANCE

COVERAGES

GOVERNMENT INSURANCE

Social insurance programs

Financed entirely or in large part by

contributions from employers and/or

employees

Benefits are heavily weighted in favor of

low-income groups

Eligibility and benefits are prescribed by

statute

Examples: social security, unemployment,

workers comp

Other government insurance programs

Found at both the federal and state level

Examples:federal flood insurance, state

health insurance pools

BENEFITS OF INSURANCE TO

SOCIETY

Indemnification for loss

Reduction of worry and fear

Source of investment funds

Loss prevention

Enhancement of credit

ACTIVITY

Discuss these questions (textbook page 54)

Q1: buildings in flood zones are difficult to insure by

private insurers because the ideal requirements of an

insurable risk are difficult to meet.

Identify the ideal requirements of an insurable risk

Which of the requirements of an insurable risk are

nit met by the flood peril?

Q2: what is the definition of insurance? Identify four

basic characteristics of insurance.

Q & A

REFERENCE

Redja, G.E. (2008). Principles of Risk

Management and Insurance, tenth edition,

Addison-Aesley

You might also like

- Staples Worklife Magazine - Winter 2019Document68 pagesStaples Worklife Magazine - Winter 2019Anonymous fq268KsS100% (1)

- Working Heights Fall Arrest Systems PDFDocument4 pagesWorking Heights Fall Arrest Systems PDFPraful E. PawarNo ratings yet

- Risk Management Solution Manual Chapter 04Document6 pagesRisk Management Solution Manual Chapter 04hawlkar100% (1)

- Chapter 8 Insurance PricingDocument17 pagesChapter 8 Insurance Pricingticen100% (1)

- Chuong 2 Forward and Futures 2013 SDocument120 pagesChuong 2 Forward and Futures 2013 Samericus_smile7474100% (1)

- Chapter 01 - Test Bank: Multiple Choice QuestionsDocument47 pagesChapter 01 - Test Bank: Multiple Choice QuestionsMark Angelo BustosNo ratings yet

- Risks and Rewards For The Insurance Sector: The Big Issues, and How To Tackle ThemDocument26 pagesRisks and Rewards For The Insurance Sector: The Big Issues, and How To Tackle ThemPie DiverNo ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- Crisis ManagementDocument23 pagesCrisis ManagementLauren Gail75% (4)

- Audits, Gap Assessments, CAPA - 0Document230 pagesAudits, Gap Assessments, CAPA - 0mgvtertv100% (3)

- Employee Benefits: Qualified Retirement Plans: OverviewDocument14 pagesEmployee Benefits: Qualified Retirement Plans: OverviewAtticus SinNo ratings yet

- Chapter4 141022095335 Conversion Gate02Document40 pagesChapter4 141022095335 Conversion Gate02NarenBistaNo ratings yet

- Basic Principles of Cross-Examination: Claire F. RushDocument14 pagesBasic Principles of Cross-Examination: Claire F. RushSellappan RathinamNo ratings yet

- Coombs Clyde HDocument21 pagesCoombs Clyde HAlinde CostarNo ratings yet

- TOFPA: A Surgical Approach To Tetralogy of Fallot With Pulmonary AtresiaDocument24 pagesTOFPA: A Surgical Approach To Tetralogy of Fallot With Pulmonary AtresiaRedmond P. Burke MD100% (1)

- Electrical Safety Program Sample PDFDocument14 pagesElectrical Safety Program Sample PDFPeter GeorgeNo ratings yet

- The Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquesDocument26 pagesThe Correlation Structure of Security Returns: Multiindex Models and Grouping TechniquessaminbdNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Insurance AccountingDocument16 pagesInsurance Accountingssp2000No ratings yet

- Cognidox - A Complete Guide To Medical Device DevelopmentDocument38 pagesCognidox - A Complete Guide To Medical Device DevelopmentcivicbladeNo ratings yet

- Fundamentals of insurance terminology explainedDocument16 pagesFundamentals of insurance terminology explainedFaye Nandini SalinsNo ratings yet

- Generalized Linear ModelsDocument5 pagesGeneralized Linear Modelsplfs1974No ratings yet

- Role of Actuaries in Insurance Product Design and Risk ManagementDocument19 pagesRole of Actuaries in Insurance Product Design and Risk ManagementKunal KalraNo ratings yet

- AAU Community's Attitude Toward InsuranceDocument64 pagesAAU Community's Attitude Toward InsurancechuchuNo ratings yet

- Pooling Arrangements and Diversification of RiskDocument26 pagesPooling Arrangements and Diversification of RiskMaliha TribhuNo ratings yet

- Risk &insuranceDocument138 pagesRisk &insurancesabit hussenNo ratings yet

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiNo ratings yet

- Chapt 2 MICDocument13 pagesChapt 2 MICAkkamaNo ratings yet

- Chap003 Solution Manual Financial Institutions Management A Risk Management ApproachDocument15 pagesChap003 Solution Manual Financial Institutions Management A Risk Management ApproachFami Famz100% (1)

- Rejda Ch01Document22 pagesRejda Ch01Saiful Islam100% (1)

- Arbitrage Pricing TheoryDocument10 pagesArbitrage Pricing TheoryarmailgmNo ratings yet

- CT5: Key concepts in life insuranceDocument15 pagesCT5: Key concepts in life insurancePriyaNo ratings yet

- Comparative Advantage - The Basis For Exchange (Chapter 2)Document42 pagesComparative Advantage - The Basis For Exchange (Chapter 2)John Chan100% (1)

- Keown Perfin5 Im 10Document18 pagesKeown Perfin5 Im 10a_hslrNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- Answer 3Document7 pagesAnswer 3Quân LêNo ratings yet

- Cost Accounting and Management AccountingDocument11 pagesCost Accounting and Management AccountingCollins AbereNo ratings yet

- Investment Analysis and Portfolio Management: Gareth MylesDocument26 pagesInvestment Analysis and Portfolio Management: Gareth MyleshoalongkiemNo ratings yet

- Unit 3 - Calculation of PremiumDocument21 pagesUnit 3 - Calculation of PremiumRahul Kumar JainNo ratings yet

- SOA Documents Actuary CredibilityDocument175 pagesSOA Documents Actuary Credibilitytayko177No ratings yet

- Homework 5Document4 pagesHomework 5Ngọc TrâmNo ratings yet

- Exam 1 LXTDocument31 pagesExam 1 LXTphongtrandangphongNo ratings yet

- Ruin Probability On Premium Pricing Using Pareto Distributed Claims On Policies With Benefit LimitDocument49 pagesRuin Probability On Premium Pricing Using Pareto Distributed Claims On Policies With Benefit Limitonly_AyrnandNo ratings yet

- Fire InsuranceDocument34 pagesFire InsuranceSaurav PandeyNo ratings yet

- Chapter 1 Audit Testbank AnswerDocument4 pagesChapter 1 Audit Testbank AnswerNgoc Truong Quang BaoNo ratings yet

- Insurance Intermediaries Roles RegulationsDocument45 pagesInsurance Intermediaries Roles RegulationsGracy100% (1)

- Risk Theory - Course Syllabus - As of Nov 22, 2014Document2 pagesRisk Theory - Course Syllabus - As of Nov 22, 2014ShaiTengcoNo ratings yet

- Introduction To Accounting and Business: Instructor Le Ngoc Anh KhoaDocument66 pagesIntroduction To Accounting and Business: Instructor Le Ngoc Anh KhoaThien TranNo ratings yet

- Principles of Insurance (Chapter - Unit 2) Solved MCQs (Set-1)Document5 pagesPrinciples of Insurance (Chapter - Unit 2) Solved MCQs (Set-1)ANURAGNo ratings yet

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- BFC5935 - Tutorial 10 SolutionsDocument8 pagesBFC5935 - Tutorial 10 SolutionsAlex YisnNo ratings yet

- Deeper Understanding, Faster Calculation - Exam P Insights & Shortcuts 20th EditionDocument28 pagesDeeper Understanding, Faster Calculation - Exam P Insights & Shortcuts 20th EditionJose Ramon VillatuyaNo ratings yet

- Risk and ReturnDocument3 pagesRisk and ReturnPiyush RathiNo ratings yet

- Chapter 12: Calculating Cost of Capital and Project RiskDocument29 pagesChapter 12: Calculating Cost of Capital and Project RiskazmiikptNo ratings yet

- Model Question Paper Business EconomicsDocument20 pagesModel Question Paper Business EconomicsDaniel VincentNo ratings yet

- Activity Based CostingDocument51 pagesActivity Based CostingAbdulyunus AmirNo ratings yet

- Chapter19 GeDocument15 pagesChapter19 Gebillurengin8590No ratings yet

- Chapter 19 - OptionsDocument23 pagesChapter 19 - OptionsSehrish Atta0% (1)

- Understanding Keynesian Cross Model and Fiscal Policy MultipliersDocument30 pagesUnderstanding Keynesian Cross Model and Fiscal Policy MultiplierswaysNo ratings yet

- Compound Interest, Present Value, Annuities and Finding The Interest RatesDocument41 pagesCompound Interest, Present Value, Annuities and Finding The Interest RatesCher Na100% (1)

- Crime Insurance and Surety BondsDocument17 pagesCrime Insurance and Surety Bondsmannajoe7No ratings yet

- Chapter 21Document13 pagesChapter 21kennyNo ratings yet

- Fins2624 Online Question Bank CH 15Document28 pagesFins2624 Online Question Bank CH 15AllenRuan100% (3)

- FINA 420 - Insurance RisksDocument30 pagesFINA 420 - Insurance RisksZiyi YinNo ratings yet

- Rejda rmiGE ppt02Document21 pagesRejda rmiGE ppt02Fadi OsamaNo ratings yet

- Chapter-4-1Document32 pagesChapter-4-1JF FNo ratings yet

- Insurance and Risk Management - Section 3 Week 4Document18 pagesInsurance and Risk Management - Section 3 Week 4Yara AzizNo ratings yet

- DRRM Plan2020 2021Document5 pagesDRRM Plan2020 2021SheChanNo ratings yet

- Atls 1Document5 pagesAtls 1Mega MalyndaNo ratings yet

- ManeuversDocument16 pagesManeuversCezar-George BadaleNo ratings yet

- Hand Injuries & Their ManagementsDocument78 pagesHand Injuries & Their ManagementsKuruNo ratings yet

- Physio Ex Exercise 6 Activity 4Document5 pagesPhysio Ex Exercise 6 Activity 4Roland Calipayan Jr.No ratings yet

- Semi Solids PDFDocument3 pagesSemi Solids PDFAsif Hasan NiloyNo ratings yet

- Referralsystem 161202080450Document21 pagesReferralsystem 161202080450DRx Sonali Tarei100% (1)

- 15.1 - PH II - Leave Rules-2019Document40 pages15.1 - PH II - Leave Rules-2019Ranjeet SinghNo ratings yet

- Siddhant Fortis HealthCareDocument4 pagesSiddhant Fortis HealthCaresiddhant jainNo ratings yet

- 2017EffectofConsumptionKemuningsLeafMurrayaPaniculataL JackInfusetoReduceBodyMassIndexWaistCircumferenceandPelvisCircumferenceonObesePatientsDocument5 pages2017EffectofConsumptionKemuningsLeafMurrayaPaniculataL JackInfusetoReduceBodyMassIndexWaistCircumferenceandPelvisCircumferenceonObesePatientsvidianka rembulanNo ratings yet

- English in Nursing 1: Novi Noverawati, M.PDDocument11 pagesEnglish in Nursing 1: Novi Noverawati, M.PDTiara MahardikaNo ratings yet

- The Nature of Feeding and Swallowing Difficulties in PDFDocument118 pagesThe Nature of Feeding and Swallowing Difficulties in PDFLisa NurhasanahNo ratings yet

- Immunization WHODocument17 pagesImmunization WHOMuhammad Hardhantyo PuspowardoyoNo ratings yet

- Antiparkinsonian Drugs Pathophysiology and TreatmentDocument5 pagesAntiparkinsonian Drugs Pathophysiology and Treatmentkv 14No ratings yet

- 09022016att ComplaintDocument25 pages09022016att Complaintsarah_larimerNo ratings yet

- Sop Cleaning Rev 06 - 2018 Rev Baru (Repaired)Document20 pagesSop Cleaning Rev 06 - 2018 Rev Baru (Repaired)FajarRachmadiNo ratings yet

- Agile Project Management: Course 4. Agile Leadership Principles and Practices Module 3 of 4Document32 pagesAgile Project Management: Course 4. Agile Leadership Principles and Practices Module 3 of 4John BenderNo ratings yet

- PU Exam Cancellation Letter VC, PUDocument4 pagesPU Exam Cancellation Letter VC, PUSanjeevNo ratings yet

- LC (Lethal Concentration) : Uji Toksisitas KuantitatifDocument31 pagesLC (Lethal Concentration) : Uji Toksisitas Kuantitatifbagi_fileNo ratings yet

- Psihogeni Neepileptički Napadi Kao Dijagnostički Problem: AutoriDocument4 pagesPsihogeni Neepileptički Napadi Kao Dijagnostički Problem: AutorifhdhNo ratings yet

- Senior Counsel or Associate General Counsel or Assistant GeneralDocument3 pagesSenior Counsel or Associate General Counsel or Assistant Generalapi-76922317No ratings yet

- Civil Tender Volume-1Document85 pagesCivil Tender Volume-1Aditya RaghavNo ratings yet