Professional Documents

Culture Documents

Introduction To Derivatives

Uploaded by

Supreet GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Derivatives

Uploaded by

Supreet GuptaCopyright:

Available Formats

Chapter 1

1

Introduction to

Derivatives

Options, Futures, and Other

Derivatives, 7th Edition, Copyright

John C. Hull 2008 2

Options, Futures, and Other

Derivatives, 7th Edition, Copyright

John C. Hull 2008 3

Options, Futures, and Other

Derivatives, 7th Edition, Copyright

John C. Hull 2008 4

5

Ways Derivatives are Used

To hedge risks

To speculate (take a view on the future direction of the market)

To lock in an arbitrage profit

To change the nature of a liability

To change the nature of an investment

A derivative instrument is a contract between two parties that

specifies conditions (especially the dates, resulting values of the

underlying variables, and notional amounts) under which

payments are to be made between the parties. Ex, An SBI stock

option is a derivative because its value depends on the price of

SBI stock

6

Forward Price

1. The forward price for a contract is the delivery

price that would be applicable to the contract if

were negotiated today

2. The forward price may be different for contracts

of different maturities

3. The party that has agreed to buy has what is

termed a long position

4. The party that has agreed to sell has what is

termed a short position

7

On July 20, 2007 the treasurer of a corporation enters into a long

forward contract to buy 1 million in six months at an exchange

rate of 2.0489

This obligates the corporation to pay $2,048,900 for 1 million on

January 20, 2008

What are the possible outcomes? If pound appreciate to 2.05 or

depreciate to 2.039

If you plan to grow 500 bushels of wheat next year, you could sell your

wheat for whatever the price is when you harvest it, or you could lock

in a price now by selling a forward contract that obligates you to sell

500 bushels of wheat to, say, Mr A after the harvest for a fixed price.

By locking in the price now, you eliminate the risk of falling wheat

prices. On the other hand, if prices rise later, you will get only what

your contract entitles you to.

8

Profit from a

Long Forward Position

Profit

Price of Underlying

at Maturity, S

T

K

9

Profit from a

Short Forward Position

Profit

Price of Underlying

at Maturity, S

T

K

10

Futures Contracts

Agreement to buy or sell an asset for a

certain price at a certain time

Similar to forward contract

Whereas a forward contract is traded OTC, a

futures contract is traded on an exchange.

Maturity date, contract size ,strike price all

are fixed in advance.

11

Exchanges Trading Futures

Chicago Board of Trade

Chicago Mercantile Exchange

LIFFE (London)

Eurex (Europe)

BM&F (Sao Paulo, Brazil)

TIFFE (Tokyo)

NSE/BSE(India)

12

13

Options

A call option is an option to buy a certain

asset by a certain date for a certain price

(the strike price)

A put option is an option to sell a certain

asset by a certain date for a certain price

(the strike price)

Buyers of Call

Sellers of Call

Buyers of Put

Sellers of Put

Options, Futures, and Other

Derivatives, 7th Edition, Copyright

John C. Hull 2008 14

15

American vs European Options

An American option can be exercised at any

time during its life

A European option can be exercised only at

maturity

Stock Price

Strike Price

Value of Option

Contract Lot

16

Exchanges Trading Options

Chicago Board Options Exchange

American Stock Exchange-NASDAQ

Philadelphia Stock Exchange

Pacific Exchange

LIFFE (London)

Eurex (Europe)

17

Options vs Futures/Forwards

A futures/forward contract gives the holder

the obligation to buy or sell at a certain

price

An option gives the holder the right to buy

or sell at a certain price

18

Types of Traders

Hedgers

Speculators

Arbitrageurs

Facts: Some of the largest trading losses in derivatives have

occurred because individuals who had a mandate to be

hedgers or arbitrageurs switched to being speculators

19

Hedging using future

Company A: must pay 1 million pound in Sept for

imports from Britain

Company B: will receive 3 million pound in Sept

from Exports to Britain

Quotes:

Current exchange Rate $1.6920= 1pound

September Future price $ 1.6850= 1 pound

Size of Future contract: pound 62,500

Company A hedging strategy?

Company B hedging strategy?

20

Hedging using options

An investor owns 500 IBM shares and wants

protection against possible decline in the share

price over the next two months.

Quotes:

Current IBM share= $52

IBM October 50 put= $4

Size of Put: 100 shares

The Investors strategy if price fall below or above

52?

Outcome?

21

Speculation using future

An investor feels that sterling with strengthen

relative to the US dollar over the next two months

and would like to take a speculative position

Quotes:

Current exchange Rate $1.6470= 1pound

April Future price $ 1.6410= 1 pound

Size of Future contract: pound 62,500

Investor speculative strategy if exchange rate is

1.7000 or 1.6000?

22

Speculation using options

A speculator with $7,800 to invest thinks that the

price of Exxon will increase in the next three

months and has obtained the following quotes:

Quotes:

Current stock price= $78

Exxon December call with an $80 strike price =

$3

The speculator has $ 7800 to invest

Investor speculative strategy of price $90 or $70?

23

Arbitration

A stock is traded on both the New York Stock

Exchange and LSE.

Quotes:

New York SE= $172 per share

LSE = pound 100 per share

Value of 1 pound= $1.7500

Investor arbitrage strategy?

24

Welcome to Derivatives

You might also like

- New Products and Brand ExtensionsDocument17 pagesNew Products and Brand ExtensionsSupreet GuptaNo ratings yet

- Strategy Analysis of ABC Consultants Pvt. LTD.: by Group - 4Document15 pagesStrategy Analysis of ABC Consultants Pvt. LTD.: by Group - 4Supreet GuptaNo ratings yet

- Customer Expectations ReportDocument29 pagesCustomer Expectations ReportSupreet GuptaNo ratings yet

- Capital Investments: Importance and DifficultiesDocument13 pagesCapital Investments: Importance and DifficultiesSupreet Gupta57% (7)

- IMC MixDocument21 pagesIMC MixSupreet GuptaNo ratings yet

- Hotel MarketingDocument61 pagesHotel MarketingSupreet GuptaNo ratings yet

- Introduction To Investing and ValuationDocument44 pagesIntroduction To Investing and ValuationSupreet GuptaNo ratings yet

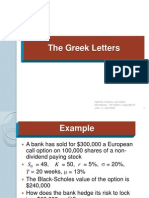

- The Greek LettersDocument18 pagesThe Greek LettersSupreet GuptaNo ratings yet

- Managing Bank CapitalDocument14 pagesManaging Bank CapitalSupreet GuptaNo ratings yet

- Managing Bank CapitalDocument14 pagesManaging Bank CapitalSupreet GuptaNo ratings yet

- Gateforum Test SeriesDocument22 pagesGateforum Test SeriesSupreet GuptaNo ratings yet

- Gateforum Test Series 2Document18 pagesGateforum Test Series 2Supreet GuptaNo ratings yet

- Services Marketing The Plaza Hotel NyDocument19 pagesServices Marketing The Plaza Hotel NySupreet GuptaNo ratings yet

- Presented by Group 9Document13 pagesPresented by Group 9Supreet GuptaNo ratings yet

- Summer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Document14 pagesSummer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Supreet GuptaNo ratings yet

- PrefaceDocument2 pagesPrefaceSupreet GuptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Seo PackagesDocument10 pagesSeo PackagesKareem GulfNo ratings yet

- Project Report On Consumer Behaviour Towards Goldpine Lemon Masti and Jeera Masti Soft DrinksDocument102 pagesProject Report On Consumer Behaviour Towards Goldpine Lemon Masti and Jeera Masti Soft DrinksAmritraj D.BangeraNo ratings yet

- FABM FS and Closing EntriesDocument18 pagesFABM FS and Closing EntriesMarchyrella Uoiea Olin Jovenir100% (1)

- FAR - Learning Assessment 2 - For PostingDocument6 pagesFAR - Learning Assessment 2 - For PostingDarlene JacaNo ratings yet

- (Seamgen) SOW Template ExampleDocument6 pages(Seamgen) SOW Template ExampleIon GîleaNo ratings yet

- Enterprise Resource Planning: MPC 6 Edition Chapter 1aDocument25 pagesEnterprise Resource Planning: MPC 6 Edition Chapter 1aKhaled ToffahaNo ratings yet

- ISO 14001-2015 Environmental Management Systems-Requirements With Guidance For UseDocument44 pagesISO 14001-2015 Environmental Management Systems-Requirements With Guidance For UseLeo Benzut B-fam 'istunink'100% (1)

- Start-Up IndiaDocument5 pagesStart-Up IndiaSanjay YadavNo ratings yet

- Accounting Principles and Procedures m001 PDFDocument2 pagesAccounting Principles and Procedures m001 PDFUmer BhuttaNo ratings yet

- Automated Payroll Processing: Risk and Procedures For Control McqsDocument18 pagesAutomated Payroll Processing: Risk and Procedures For Control McqsNicah AcojonNo ratings yet

- Radiant Semiconductor: Project Management Development Program - PMDPDocument74 pagesRadiant Semiconductor: Project Management Development Program - PMDPsravanNo ratings yet

- Innovation and Design Thinking PDFDocument20 pagesInnovation and Design Thinking PDFEnjoy ShesheNo ratings yet

- Building Brand Equity Via Product Quality: Andreas Herrmann, Frank Huber, Alan T. Shao & Yeqing BaoDocument16 pagesBuilding Brand Equity Via Product Quality: Andreas Herrmann, Frank Huber, Alan T. Shao & Yeqing BaoCiro Ribeiro RochaNo ratings yet

- Bafin CH01Document5 pagesBafin CH01Sharilyn CasisimanNo ratings yet

- CfroiDocument2 pagesCfroiPro Resources100% (1)

- Finance Account - ProjectDocument12 pagesFinance Account - ProjectSnigdha AgrawalNo ratings yet

- Functional StrategyDocument2 pagesFunctional StrategyChelsea Anne VidalloNo ratings yet

- BL 193-OI SNF IncDocument1 pageBL 193-OI SNF IncAlexander Santos Collantes TaquedaNo ratings yet

- Oracle 11g Audit Vault DatasheetDocument2 pagesOracle 11g Audit Vault Datasheetcarles_perezNo ratings yet

- Century IDBI Q2FY21 12nov20Document7 pagesCentury IDBI Q2FY21 12nov20Tai TranNo ratings yet

- Cisa PDFDocument71 pagesCisa PDFVierdy Sulfianto RahmadaniNo ratings yet

- Business Plan - Tour Company (JST)Document26 pagesBusiness Plan - Tour Company (JST)Adrian Keys81% (68)

- Dynamic Efficiency & Hotelling's RuleDocument48 pagesDynamic Efficiency & Hotelling's RuleJason McCoyNo ratings yet

- ICount and Its BenefitsDocument2 pagesICount and Its BenefitsVamshi Krishna100% (2)

- Act 20-AP 01 Coe, AP & AeDocument3 pagesAct 20-AP 01 Coe, AP & AeJomar VillenaNo ratings yet

- Research Proposal PaperDocument8 pagesResearch Proposal Paperunknown name67% (3)

- Industrial Relations & Labour Laws: ObjectivesDocument40 pagesIndustrial Relations & Labour Laws: ObjectivesAditya KulkarniNo ratings yet

- Forex Trading For Beginners Simple Strategies To Make Money WithDocument112 pagesForex Trading For Beginners Simple Strategies To Make Money WithProfessor Adilson MarquesNo ratings yet

- S4 Financial Projections Spreadsheet Feb2019Rev1Document36 pagesS4 Financial Projections Spreadsheet Feb2019Rev1Ruffa Mae MatiasNo ratings yet

- Balance Day AdjustmentsDocument15 pagesBalance Day AdjustmentsGimhan GodawatteNo ratings yet