Professional Documents

Culture Documents

Review of The Accounting Process: Mcgraw-Hill /irwin

Uploaded by

MadchestervillainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review of The Accounting Process: Mcgraw-Hill /irwin

Uploaded by

MadchestervillainCopyright:

Available Formats

McGraw-Hill /Irwin 2009 The McGraw-Hill Companies, Inc.

REVIEW OF THE

ACCOUNTING PROCESS

Chapter 2

Slide 2

2-2

Accounting Equation for a Corporation

A = L + SE

+ Retained Earnings + Paid-in Capital

- Expenses

- Losses

+ Revenues

+ Gains

- Dividends

Slide 3

2-3

Account Relationships

Debits and credits affect the Balance Sheet

Model as follows:

A = L + PIC + RE

Assets

Dr.

+

Cr.

-

Liabilities

Dr.

-

Cr.

+

Paid-in

Capital

Dr.

-

Cr.

+

Retained

Earnings

Dr.

-

Cr.

+

Revenues

and Gains

Dr.

-

Cr.

+

Expenses

and Losses

Dr.

+

Cr.

-

Permanent Accounts

Temporary Accounts

Slide 4

2-4

Source

documents

Record in

Journal

Financial

Statements

Transaction

Analysis

Post to

Ledger

Unadjusted

Trial Balance

Record & Post

Adjusting

Entries

Adjusted

Trial Balance

Close Temporary

Accounts

Post-Closing

Trial Balance

The

Accounting

Processing

Cycle

During the Accounting Period

At the End of the Accounting Period

At the End

of the Year

Slide 5

2-5

Accounting Processing Cycle

On January 1, $40,000 was borrowed from a

bank and a note payable was signed.

Prepare the journal entry.

Two accounts are affected:

Cash (an asset) increases by $40,000.

Notes Payable (a liability) increases by $40,000.

GENERAL JOURNAL Page 1

Date Description

Post.

Ref. Debit Credit

Jan 1 Cash 40,000

Notes Payable 40,000

Slide 6

2-6

General Ledger

The T account is a shorthand format of an account

used by accountants to analyze transactions.

It is not part of the bookkeeping system.

GENERAL LEDGER

Account: Acct. No. ##

Balance

Date Item

Post.

Ref. Debit Credit DR (CR)

Slide 7

2-7

Posting Journal Entries

2-8

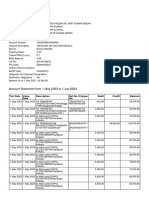

Account Title Debits Credits

Cash 68,500 $

Accounts receivable 2,000

Supplies 2,000

Prepaid rent 24,000

Inventory 38,000

Furniture and fixtures 12,000

Accounts payable 35,000 $

Notes payable 40,000

Unearned rent revenue 1,000

Common stock 60,000

Retained earnings 1,000

Sales revenue 38,500

Cost of goods sold 22,000

Salaries expense 5,000

Total 174,500 $ 174,500 $

Dress Right Clothing Corporation

Unadjusted Trial Balance

July 31, 2009

After recording all entries for the period, Dress Rights

Unadjusted Trial Balance would be as follows:

Debits = Credits

A Trial

Balance is a

listing of all

accounts

and their

balances at

a point in

time.

Slide 9

2-9

Transactions where

cash is paid or received

before a related

expense or revenue is

recognized.

Transactions where

cash is paid or received

after a related expense

or revenue is

recognized.

Adjusting Entries

Prepayments Accruals Estimates

Accountants must often

make estimates in order

to comply with the

accrual accounting

model.

At the end of the period, adjusting entries are

required to satisfy the realization principle and

the matching principle.

Slide 10

2-10

Asset

Expense

Unadjusted

Balance

Credit

Adjustment

Debit

Adjustment

Prepaid Expenses

Today, I will pay

for my first

6 months rent.

Prepaid Expenses

Items paid for in advance

of receiving their benefits

Slide 11

2-11

Depreciation is the process of computing

expense by allocating the cost of plant and

equipment over their expected useful lives.

Straight-Line

Depreciation

Expense

=

Asset Cost - Salvage Value

Useful Life

Depreciation

Slide 12

2-12

Liability

Revenue

Unadjusted

Balance

Credit

Adjustment

Debit

Adjustment

Unearned Revenues

Go Streaks

Buy your season tickets for

all home basketball games NOW!

Unearned Revenue

Cash received in

advance of performing

services

Slide 13

2-13

Alternative Approach to Record Prepayments

Unearned Revenue

Record initial cash receipts

as follows:

Cash $$$

Revenue $$$

Adjusting Entry

Record the amount for the

unearned liability as

follows:

Revenue $$$

Unearned revenue $$$

Prepaid Expenses

Record initial cash

payments as follows:

Expense $$$

Cash $$$

Adjusting Entry

Record the amount for the

prepaid expense as

follows:

Prepaid expense $$$

Expense $$$

Slide 14

2-14

Expense

Liability

Credit

Adjustment

Debit

Adjustment

Accrued Liabilities

I wont pay you

until the job is done!

Accrued Liabilities

Liabilities recorded when an

expense has been incurred

prior to cash payment.

Slide 15

2-15

Asset

Revenue

Credit

Adjustment

Debit

Adjustment

Accrued Receivables

Yes, you can pay me

in May for your April

15 tax return.

Accrued Receivables

Revenue earned in a

period prior to the cash

receipt.

Slide 16

2-16

Estimates

Uncollectible

accounts and

depreciation of fixed

assets are estimated.

An estimated item is

a function of future

events and

developments.

$

Slide 17

2-17

Estimates

Page 30

Date Description

Post.

Ref. Debit Credit

July 31 Bad Debt Expense 500

Allowance for Uncollectible

Accounts 500

GENERAL JOURNAL

2-18

DRESS RIGHT CLOTHING CORPORATION

Adjusted Trial Balance

July 31, 2009

Account Title Debits Credits

Cash 68,500 $

Accounts receivable 2,000

Allowance for uncollectible accounts 500 $

Supplies 1,200

Prepaid rent 22,000

Inventory 38,000

Furniture and fixtures 12,000

Accumulated depr.-furniture & fixtures 200

Accounts payable 35,000

Note payable 40,000

Unearned rent revenue 750

Salaries payable 5,500

Interest payable 333

Common stock 60,000

Retained earnings 1,000

Sales revenue 38,500

Rent revenue 250

Cost of goods sold 22,000

Salaries expense 10,500

Supplies expense 800

Rent expense 2,000

Depreciation expense 200

Interest expense 333

Bad debt expense 500

Totals 181,033 $ 181,033 $

This is the Adjusted

Trial Balance for

Dress Right after all

adjusting entries have

been recorded and

posted.

Dress Right will use

these balances to

prepare the financial

statements.

Slide 19

2-19

Dress Right Clothing Corporation

Income Statement

For Month Ended July 31, 2009

Sales revenue 38,500 $

Cost of goods sold 22,000

Gross profit 16,500

Other expenses:

Salaries 10,500 $

Supplies 800

Rent 2,000

Depreciation 200

Bad debt 500

Total operating expenses 14,000

Operating income 2,500

Other income (expense):

Rent revenue 250

Interest expense (333) (83)

Net income 2,417 $

The income statement summarizes the results

of operating activities of the company.

Slide 20

2-20

Current assets:

Cash 68,500 $

Accounts receivable 2,000 $

Less: Allowance for uncollectible accounts 500 1,500

Supplies 1,200

Inventory 38,000

Prepaid rent 22,000

Total current assets 131,200

Property and equipment:

Furniture and fixtures 12,000

Less: Accumulated depreciation 200 11,800

Total assets 143,000 $

Dress Right Clothing Corporation

Balance Sheet

At July 31, 2009

Assets

The balance sheet presents the financial

position of the company on a particular date.

Slide 21

2-21

Current liabilities:

Accounts payable 35,000 $

Salaries payable 5,500

Unearned rent revenue 750

Interest payable 333

Note payable 10,000

Total current liabilities 51,583

Long-term liabilities:

Note payable 30,000

Shareholders' equity:

Common stock 60,000 $

Retained earnings 1,417

Total shareholders' equity 61,417

Total liabilities and shareholders' equity 143,000 $

Dress Right Clothing Corporation

Balance Sheet

At July 31, 2009

Liabilities and Shareholders' Equity

Notice that assets of $143,000 equal total

liabilities plus shareholders equity of $143,000.

Slide 22

2-22

The statement of cash flows discloses the

changes in cash during a period.

Cash flows from operating activities:

Cash inflows:

From customers 36,500 $

From rent 1,000

Cash outflows:

For rent (24,000)

For supplies (2,000)

To suppliers for merchandise (25,000)

To employees (5,000)

Net cash used by operating activities (18,500) $

Cash flows from investing activities:

Purchase of furniture and fixtures (12,000)

Cash flows from financing activities:

Issue of capital stock 60,000 $

Increase in notes payable 40,000

Payment of cash dividend (1,000)

Net cash provided by financing activities 99,000

Net increase in cash 68,500 $

Dress Right Clothing Corporation

Statement of Cash Flows

For the Month of July 2009

Slide 23

2-23

The statement of shareholders equity

presents the changes in permanent

shareholder accounts.

Common

Stock

Retained

Earnings

Total

Shareholders'

Equity

Balance at July 1, 2009 - $ - $ - $

Issue of capital stock 60,000 60,000

Net income for July 2009 2,417 2,417

Less: Dividends (1,000) (1,000)

Balance at July 31, 2009 60,000 $ 1,417 $ 61,417 $

Dress Right Clothing Corporation

Statement of Shareholders' Equity

For the Month of July 2009

Slide 24

2-24

Temporary

Accounts

Revenues

Income

Summary

E

x

p

e

n

s

e

s

D

i

v

i

d

e

n

d

s

Permanent

Accounts

Assets

L

i

a

b

i

l

i

t

i

e

s

S

h

a

r

e

h

o

l

d

e

r

s

E

q

u

i

t

y

The closing process applies

only to temporary accounts.

Temporary and Permanent Accounts

Retained

Earnings

Slide 25

2-25

CLOSING ENTRIES

Two Objectives of Closing Entries:

1.Set the Temporary Accounts (Income Statement

accounts and Dividends) to zero.

2.Update the Retained Earnings account (include

current period earnings and dividends).

2-26

DRESS RIGHT CLOTHING CORPORATION

Adjusted Trial Balance

July 31, 2009

Account Title Debits Credits

Cash 68,500 $

Accounts receivable 2,000

Allowance for uncollectible accounts 500 $

Supplies 1,200

Prepaid rent 22,000

Inventory 38,000

Furniture and fixtures 12,000

Accumulated depr.-furniture & fixtures 200

Accounts payable 35,000

Note payable 40,000

Unearned rent revenue 750

Salaries payable 5,500

Interest payable 333

Common stock 60,000

Retained earnings 1,000

Sales revenue 38,500

Rent revenue 250

Cost of goods sold 22,000

Salaries expense 10,500

Supplies expense 800

Rent expense 2,000

Depreciation expense 200

Interest expense 333

Bad debt expense 500

Totals 181,033 $ 181,033 $

This is the Adjusted

Trial Balance for

Dress Right after all

adjusting entries have

been recorded and

posted.

Dress Right will use

these balances to

prepare the financial

statements.

2-27

Dress Right Closing Entries

Sales revenue 38,500

Rent revenue 250

Income Summary 38,750

Income Summary 36,333

Cost of goods sold 22,000

Salaries expense 10,500

Supplies expense 800

Rent expense 2,000

Depreciation expense 200

Interest expense 333

Bad debt expense 500

Income Summary 2,417

Retained Earnings 2,417

Slide 28

2-28

Post-Closing Trial Balance

Lists permanent

accounts and their

balances.

Total debits equal

total credits.

DRESS RIGHT CLOTHING CORPORATION

Post-Closing Trial Balance

July 31, 2009

Account Title Debits Credits

Cash 68,500 $

Accounts receivable 2,000

Allowance for uncollectible accounts 500 $

Supplies 1,200

Prepaid rent 22,000

Inventory 38,000

Furniture and fixtures 12,000

Accumulated depr.-furniture & fixtures 200

Accounts payable 35,000

Note payable 40,000

Unearned rent revenue 750

Salaries payable 5,500

Interest payable 333

Common stock 60,000

Retained earnings 1,417

Totals 143,700 $ 143,700 $

You might also like

- Governmental and Nonprofit Accounting: Environment and CharacteristicsDocument12 pagesGovernmental and Nonprofit Accounting: Environment and CharacteristicsMadchestervillainNo ratings yet

- The Balance Sheet and Financial DisclosuresDocument20 pagesThe Balance Sheet and Financial DisclosuresMadchestervillainNo ratings yet

- AC303 CH1SlidesDocument25 pagesAC303 CH1SlidesMadchestervillainNo ratings yet

- Auditing and Assurance Solutions To QuestionsDocument79 pagesAuditing and Assurance Solutions To QuestionsMadchestervillain50% (8)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction to Supply Chain Management in 40 CharactersDocument7 pagesIntroduction to Supply Chain Management in 40 CharacterspraveenNo ratings yet

- (ASC) Accounting For Business CombinationDocument13 pages(ASC) Accounting For Business CombinationRENZ ALFRED ASTRERONo ratings yet

- December 2019 Salary SheetDocument62 pagesDecember 2019 Salary Sheetarooba abbasiNo ratings yet

- Wala 60 at 71Document18 pagesWala 60 at 71Pauline BiancaNo ratings yet

- Investing and Financing Decisions and The Balance Sheet: Answers To QuestionsDocument47 pagesInvesting and Financing Decisions and The Balance Sheet: Answers To QuestionsabraamNo ratings yet

- Toaz - Info Kashato Shirts Entries PRDocument64 pagesToaz - Info Kashato Shirts Entries PRTylerNo ratings yet

- CH 14Document4 pagesCH 14Hoàng HuyNo ratings yet

- Quizzer Cash - Solution Printed KoDocument119 pagesQuizzer Cash - Solution Printed Kogoerginamarquez80% (10)

- Accounting Practice SetDocument8 pagesAccounting Practice SetA100% (1)

- CH 6 Qaf 04Document8 pagesCH 6 Qaf 04MahmoudTahboubNo ratings yet

- BITS PILANI Operation Management SyllabusDocument12 pagesBITS PILANI Operation Management Syllabussap6370No ratings yet

- Chithambara College Past Students Association AccountsDocument61 pagesChithambara College Past Students Association Accountsapi-140426513No ratings yet

- uPV202017300632/P2 M/EURONE T@yb/SAJANLALDocument7 pagesuPV202017300632/P2 M/EURONE T@yb/SAJANLALAnkitNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- Comparing Merchandising and Manufakturing CompanyDocument3 pagesComparing Merchandising and Manufakturing CompanyHermanNo ratings yet

- 10 ACCT 1A&B MFGDocument14 pages10 ACCT 1A&B MFGShannon MojicaNo ratings yet

- Vendor Management NotesDocument11 pagesVendor Management NotesPrashant KunalNo ratings yet

- Financial Accounting Summer 2011 Chap 3 Homework - SP 3Document13 pagesFinancial Accounting Summer 2011 Chap 3 Homework - SP 3Samwashington14100% (4)

- Cost of Goods Sold CogsDocument29 pagesCost of Goods Sold CogsArzan Ali0% (1)

- Tai Lieu Ke Toan - Docx Khanh.Document20 pagesTai Lieu Ke Toan - Docx Khanh.copmuopNo ratings yet

- PA - T NG H P TestbankDocument86 pagesPA - T NG H P TestbankBích Phan Ngô NgọcNo ratings yet

- 1k Instacart DropDocument75 pages1k Instacart Dropdenoxjm620100% (2)

- Statement AmitDocument15 pagesStatement AmitAmit MeenaNo ratings yet

- SAP - SD TutorialDocument23 pagesSAP - SD TutorialVaibhav NaiduNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument4 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoAdnan JafarNo ratings yet

- Quiz September 1Document3 pagesQuiz September 1ANGIE BERNALNo ratings yet

- Financial Accounting Assignment 1 PDFDocument26 pagesFinancial Accounting Assignment 1 PDFUmair MughalNo ratings yet

- Supply Chain ManagementDocument6 pagesSupply Chain ManagementSheikh Saad Bin ZareefNo ratings yet

- ACC406 - Assignment 2 - Group ADocument30 pagesACC406 - Assignment 2 - Group ASiti Nur Nadya MokhtarNo ratings yet

- Lembar Kerja Salon CantikDocument26 pagesLembar Kerja Salon CantikFanisa CantickaNo ratings yet