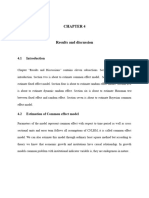

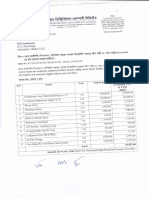

Professional Documents

Culture Documents

Welcome To The Presentation: Efficient Portfolio Construction

Uploaded by

Rafidul IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Welcome To The Presentation: Efficient Portfolio Construction

Uploaded by

Rafidul IslamCopyright:

Available Formats

Welcome to the

Presentation

Efficient Portfolio

Construction

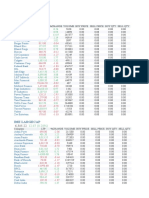

Selected Companies

Company Name

Industry

National Bank Limited (NBL)

Banking

Lankabangla Finance Ltd.

Non-Banking

Eastern Cables

Engineering

Atlas Bangladesh

Apex Foods

Food

Sonali Aansh

Jute

Pharma Aids

Pharmaceuticals

Reliance Insurance

Insurance

Aramit Cement

Cement

Tallu Spinning

Textile

Criteria for Security Selection

Must be listed in DSE before January, 2006

Must be A category stock

Must be the industry leader or closest competitor

to the industry leader

Company must be in the growth stage

P/E Ratio of Securities

From January 2007 to December 2011

Price & Dividend are encoded from

DSE Data Archive

Risk Free Rate

Calculation

year

Six month T-Bill

Monthly Yield

2011

0.0651

0.00542

2010

0.0485

0.00404

2009

0.0575

0.00479

2008

0.0583

0.00483

2007

0.0582

0.00485

Risk Free Rate

0.004778

Price and Dividend Adjustment

MS Excel

Return Calculation

Correlation Matrix

Company

Name

NBL

Eastern

Cables

Apex

Foods

Sonali

Aansh

Pharma

Aids

Reliance

Insurance

Lankabangla

Finance

Aramit

Cement

Atlas

Bangladesh

Tallu

Spinning

NBL 1.000

Eastern

Cables

0.207 1.000

Apex Foods -0.137 0.419 1.000

Sonali Aansh 0.095 0.196 0.306 1.000

Pharma Aids 0.099 0.149 0.188 0.203 1.000

Reliance

Insurance

0.128 0.304 0.283 0.206 0.407 1.000

Lankabangla

Finance

0.237 0.033 0.127 -0.061 0.011 0.215 1.000

Aramit

Cement

-0.029 0.215 0.578 0.482 0.141 0.412 0.176 1.000

Atlas

Bangladesh

-0.062 0.285 0.155 0.099 0.451 0.350 0.073 0.128 1.000

Tallu

Spinning

-0.057 0.157 0.265 0.379 0.419 0.476 -0.016 0.431 0.249 1.000

Return & Risk

Equally Weighted Portfolio

With SS

Excess Portfolio Return

5.75%

Portfolio Variance

0.0243

Portfolio Standard

Deviation

15.60%

Theta ()

0.3684

Portfolio Return

6.23%

Maximum Theta ()

With SS

No SS

Excess Portfolio

Return

7.96% 6.61%

Portfolio Variance

0.0292 0.0247

Portfolio Standard

Daviation

17.09% 15.73%

Theta ()

0.47 0.42

Portfolio Return

8.44% 7.08%

Asset

With

Short Sell

With

Short Sell

NBL

0.07 0.00

Eastern Cables

0.05 0.07

Apex Foods

-0.36 0.00

Sonali Aansh

0.06 0.06

Pharma Aids

0.01 0.06

Reliance

Insurance

0.08 0.01

Lankabangla

Finance Ltd.

0.39 0.41

Aramit Cement

0.37 0.29

Atlas

Bangladesh

0.24 0.00

Tallu Spinning

0.09 0.10

No SS

With SS

Excess Portfolio

Return

5.52% 5.52%

Portfolio Variance

0.0157 0.0157

Portfolio Standard

Daviation

12.51% 12.53%

Theta ()

0.4413 0.4407

Portfolio Return

(Given)

6.00% 6.00%

Asset

Without

Short Sell

With

Short Sell

NBL

0.12 0.12

Eastern Cables

0.10 0.09

Apex Foods

0.01 0.01

Sonali Aansh

0.02 0.02

Pharma Aids

0.00 -0.01

Reliance

Insurance

0.08 0.09

Lankabangla

Finance Ltd.

0.25 0.25

Aramit Cement

0.19 0.18

Atlas

Bangladesh

0.17 0.18

Tallu Spinning

0.06 0.06

Manimum Risk

(Standard Deviation)

With SS

No SS

Excess Portfolio

Return

2.94% 3.16%

Portfolio Variance

0.0108 0.0112

Portfolio Standard

Daviation

10.38% 10.60%

Theta ()

0.2831 0.2987

Portfolio Return

3.42% 3.64%

Asset

With

Short Sell

With out

Short Sell

NBL

0.17 0.16

Eastern Cables

0.14 0.17

Apex Foods

0.41 0.38

Sonali Aansh

-0.02 0.00

Pharma Aids

-0.04 0.00

Reliance

Insurance

0.09 0.07

Lankabangla

Finance Ltd.

0.10 0.12

Aramit Cement

-0.01 0.00

Atlas

Bangladesh

0.11 0.08

Tallu Spinning

0.04 0.01

Manimum Risk

(Standard Deviation)

With Given Return 6%

With SS

No SS

Excess Portfolio Return

5.52% 5.52%

Portfolio Variance

0.0157 0.0157

Portfolio Standard

Daviation

12.51% 12.53%

Theta ()

0.4413 0.4407

Portfolio Return

6% 6%

Asset

With

Short Sell

With out

Short Sell

NBL

0.12 0.12

Eastern Cables

0.09 0.10

Apex Foods

0.01 0.01

Sonali Aansh

0.02 0.02

Pharma Aids

-0.01 0.00

Reliance

Insurance

0.09 0.08

Lankabangla

Finance Ltd.

0.25 0.25

Aramit Cement

0.18 0.19

Atlas

Bangladesh

0.18 0.17

Tallu Spinning

0.06 0.06

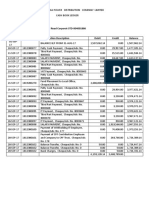

Performance

Given Return 6% Monthly

Max

No

SS

Max

with

SS

Min

Risk

SS

Min

Risk

No SS

Max

No

SS

Max

with

SS

Min

Risk

SS

Min

Risk

No SS

Portfolio

Return ()

0.8500 1.0125 0.4102 0.4371 0.7200 0.7200 0.7200 0.7200

portfolio

0.3294 0.1709 0.1038 0.1060 0.1253 0.1251 0.1251 0.1253

Rf

0.0573 0.0573 0.0573 0.0573 0.0573 0.0573 0.0573 0.0573

Market

Return

0.1157 0.1157 0.1157 0.1157 0.1157 0.1157 0.1157 0.1157

Market

Stdv

0.0972 0.0972 0.0972 0.0972 0.0972 0.0972 0.0972 0.0972

Performance

Given Return 6% Monthly

Max

No SS

Max

with SS

Min

Risk

SS

Min

Risk No

SS

Max

No SS

Max

with SS

Min

Risk

SS

Min

Risk No

SS

Overall

Performance

0.7926 0.9551 0.3528 0.3798 0.6627 0.6627 0.6627 0.6627

Selectivity

Return

0.7859 0.9551 0.3528 0.3798 0.6627 0.6627 0.6627 0.6627

Diversification

0.1910 0.1026 0.0624 0.0636 0.0752 0.0751 0.0751 0.0752

Net Selectivity

0.5948 0.8525 0.2905 0.3161 0.5874 0.5875 0.5875 0.5874

Performance

Given Return 6% Monthly

Max

No SS

Max

with SS

Min

Risk

SS

Min

Risk No

SS

Max

No SS

Max

with SS

Min

Risk

SS

Min

Risk No

SS

Treynor

6.8264 9.5512 3.5282 3.7977 6.6267 6.6267 6.6267 6.6267

Treynor's

Benchmark

0.0583 0.0583 0.0583 0.0583 0.0583 0.0583 0.0583 0.0583

Sharpe

2.4063 5.5901 3.3976 3.5844 5.2887 5.2962 5.2962 5.2887

Sharpe

Benchmark

0.6005 0.6005 0.6005 0.6005 0.6005 0.6005 0.6005 0.6005

Jensen

0.7859 0.9483 0.3460 0.3730 0.6559 0.6559 0.6559 0.6559

Thank You

You might also like

- Why Industrial Bearings Fail: Analysis, Maintenance, and PreventionFrom EverandWhy Industrial Bearings Fail: Analysis, Maintenance, and PreventionNo ratings yet

- Portfoli Risk of 5 Major Steel Companies of IndiaDocument3 pagesPortfoli Risk of 5 Major Steel Companies of Indiamannu.abhimanyu3098No ratings yet

- Partners Healthcare (Tables and Exhibits)Document9 pagesPartners Healthcare (Tables and Exhibits)sahilkuNo ratings yet

- Essar SteelDocument10 pagesEssar Steelchin2dabgarNo ratings yet

- Kotak Mahindra Bank Balance Sheet of Last 5 YearsDocument10 pagesKotak Mahindra Bank Balance Sheet of Last 5 YearsManish MahajanNo ratings yet

- Market 1Document2 pagesMarket 1YatrikNo ratings yet

- Analysis of Autoline Industries Ltd.Document43 pagesAnalysis of Autoline Industries Ltd.Umang Katta0% (1)

- ASX Code Company Name LiquidityDocument36 pagesASX Code Company Name LiquidityHa LinhNo ratings yet

- Business Report ANDocument39 pagesBusiness Report ANKrishnaveni RajNo ratings yet

- Equity Portfolio ConstructionDocument15 pagesEquity Portfolio ConstructionSuyash PurohitNo ratings yet

- Daily Trade Journal - 06.08.2013Document6 pagesDaily Trade Journal - 06.08.2013Randora LkNo ratings yet

- PortfolioDocument1 pagePortfolioShakhawat RahmanNo ratings yet

- Cipla Ltd.Document25 pagesCipla Ltd.namithakb271480% (1)

- Submitted By: Parth D. DalalDocument43 pagesSubmitted By: Parth D. Dalalrahulshah86No ratings yet

- Table: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz Sumux Sumuy SumuzDocument4 pagesTable: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz Sumux Sumuy SumuzJuan David HernandezNo ratings yet

- 01.alco Bdsdev Chapter 1Document4 pages01.alco Bdsdev Chapter 1Animesh ChoubeyNo ratings yet

- VIFmodel 3Document2 pagesVIFmodel 3Van Joshua NunezNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Bse Midcap SelectDocument3 pagesBse Midcap SelectYatrikNo ratings yet

- Sri Vajra Financial ReportsDocument7 pagesSri Vajra Financial ReportsRamana VaitlaNo ratings yet

- Table: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz Sumuxsumuysumuz RXDocument2 pagesTable: Modal Participating Mass Ratios Case Mode Period Ux Uy Uz Sumuxsumuysumuz RXMuhammadFurqanMuhsininNo ratings yet

- Ashok Leyland Profit & Loss Account, Ashok Leyland Financial Statement & AccountsDocument3 pagesAshok Leyland Profit & Loss Account, Ashok Leyland Financial Statement & AccountsRaghaw MundhraNo ratings yet

- Lincoln Crowne Engineering Mining Services 12 July 2013Document2 pagesLincoln Crowne Engineering Mining Services 12 July 2013Lincoln Crowne & CompanyNo ratings yet

- Equity Analysis - DailyDocument7 pagesEquity Analysis - Dailyapi-198466611No ratings yet

- Kohat TextileDocument10 pagesKohat TextileHashim AfzalNo ratings yet

- Efficient Portfolio ConstructionDocument16 pagesEfficient Portfolio Construction2rmjNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-198466611No ratings yet

- TABLE: Modal Participating Mass Ratios Case Mode Period UX UY UZ Sum Ux Sum Uy Sum UZ Modal 1 Modal 2 Modal 3Document2 pagesTABLE: Modal Participating Mass Ratios Case Mode Period UX UY UZ Sum Ux Sum Uy Sum UZ Modal 1 Modal 2 Modal 3Juan Gabriel CaillaguaNo ratings yet

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNo ratings yet

- Axis Bank Ltd. Performance AnalysisDocument11 pagesAxis Bank Ltd. Performance AnalysisSurbhî GuptaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- ASPI Rallied Crossing 6,000 Amidst Heavyweights Leading TurnoverDocument6 pagesASPI Rallied Crossing 6,000 Amidst Heavyweights Leading TurnoverRandora LkNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-160037995No ratings yet

- VV549Document7 pagesVV549Fred MillerNo ratings yet

- Financial StatementsDocument82 pagesFinancial Statementssamuel safoNo ratings yet

- Account Fund Position Ledger Balances: ClientsDocument96 pagesAccount Fund Position Ledger Balances: ClientsRP groupNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-146671334No ratings yet

- Special Report by Epic Reseach 08 August 2013Document4 pagesSpecial Report by Epic Reseach 08 August 2013EpicresearchNo ratings yet

- Libro 1Document4 pagesLibro 1Roy AlfaroNo ratings yet

- BSE Top 100 CompaniesDocument2 pagesBSE Top 100 CompaniesYatrikNo ratings yet

- Analyisis ResultsDocument11 pagesAnalyisis ResultsQasim ShahNo ratings yet

- Risk Management Through Derivative in Indian Stock MarketDocument29 pagesRisk Management Through Derivative in Indian Stock MarketHimanshu RastogiNo ratings yet

- Blue Bus485 FinalDocument13 pagesBlue Bus485 FinalTamzid Ahmed AnikNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-160037995No ratings yet

- Alcoholic Beverages-CH1Document5 pagesAlcoholic Beverages-CH1Prateek KhardNo ratings yet

- Synthetic and Rayon: DividendDocument3 pagesSynthetic and Rayon: DividendDo ItNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Archies Financial StatmentsDocument5 pagesArchies Financial StatmentsShitiz JainNo ratings yet

- PSA AssignmetDocument15 pagesPSA AssignmetFunTech BloggerNo ratings yet

- Parle Product FinanciaDocument14 pagesParle Product FinanciaAbinash Behera100% (1)

- HDFC by IshanDocument14 pagesHDFC by IshanIshan MalikNo ratings yet

- Daily News Letter 23nov2012Document7 pagesDaily News Letter 23nov2012Theequicom AdvisoryNo ratings yet

- Liberty - January 12 2017Document1 pageLiberty - January 12 2017Tiso Blackstar GroupNo ratings yet

- 11 - Chapter 5 PDFDocument48 pages11 - Chapter 5 PDFXyzNo ratings yet

- Tata Steel Ratio AnalysisDocument12 pagesTata Steel Ratio Analysisece_shreyas0% (2)

- Equity Market News and Tips For 24-Jan-2013Document7 pagesEquity Market News and Tips For 24-Jan-2013Theequicom AdvisoryNo ratings yet

- Indices Hinges On Positive Territory Amidst Strong TurnoverDocument6 pagesIndices Hinges On Positive Territory Amidst Strong TurnoverRandora LkNo ratings yet

- Income Statement: Altus Honda Cars Pakistan LimitedDocument23 pagesIncome Statement: Altus Honda Cars Pakistan LimitedTahir HussainNo ratings yet

- Li:Tftr: Flccrrdf$E-Ctp!$2NilnlDocument1 pageLi:Tftr: Flccrrdf$E-Ctp!$2NilnlRafidul IslamNo ratings yet

- ABB India - 001Document10 pagesABB India - 001Rafidul IslamNo ratings yet

- App RevisedDocument128 pagesApp RevisedRafidul IslamNo ratings yet

- ABB India - 001Document10 pagesABB India - 001Rafidul IslamNo ratings yet

- XVKV Cviqvi WWW÷ Wedkb KV Úvbx WJWG UwDocument3 pagesXVKV Cviqvi WWW÷ Wedkb KV Úvbx WJWG UwRafidul IslamNo ratings yet

- LD ReleaseDocument1 pageLD ReleaseRafidul IslamNo ratings yet

- S (Kcffilr: Q"irffii1 ( (1#:ii',i:fDocument2 pagesS (Kcffilr: Q"irffii1 ( (1#:ii',i:fRafidul IslamNo ratings yet

- Bill PaymentDocument2 pagesBill PaymentRafidul IslamNo ratings yet

- Dhaka Power Distribution Company LimitedDocument1 pageDhaka Power Distribution Company LimitedRafidul IslamNo ratings yet

- (ZT.Z:.::' - RR :, OoooDocument4 pages(ZT.Z:.::' - RR :, OoooRafidul IslamNo ratings yet

- Ffi:ffit::::l:: ::":j::i :,R, TDocument3 pagesFfi:ffit::::l:: ::":j::i :,R, TRafidul IslamNo ratings yet

- ":":il.##'il:' "" "',: ii4-Il$S, TTLS, L.RNKDocument4 pages":":il.##'il:' "" "',: ii4-Il$S, TTLS, L.RNKRafidul IslamNo ratings yet

- Letter From VADocument1 pageLetter From VARafidul IslamNo ratings yet

- Rsrir - Fi MFLLT'G/S: Crsf91Rsp1)Document5 pagesRsrir - Fi MFLLT'G/S: Crsf91Rsp1)Rafidul IslamNo ratings yet

- R!af IDocument6 pagesR!af IRafidul IslamNo ratings yet

- CÇLL SH¡H J Fðj¡Ell BM¡L BF Š V Eöf ŠL P F¡ LN LL¡ QM¡ZDocument2 pagesCÇLL SH¡H J Fðj¡Ell BM¡L BF Š V Eöf ŠL P F¡ LN LL¡ QM¡ZRafidul IslamNo ratings yet

- F/s@ja TRDocument1 pageF/s@ja TRRafidul IslamNo ratings yet

- Dhaka Power Distribution Company Limited: Payment Voucher For Recording of Payment of CPF Contribution To CPF TrustDocument1 pageDhaka Power Distribution Company Limited: Payment Voucher For Recording of Payment of CPF Contribution To CPF TrustRafidul IslamNo ratings yet

- CÇLL SH¡H J Fðj¡Ell BM¡L BF Š V Eöf ŠL P F¡ LN LL¡ QM¡ZDocument2 pagesCÇLL SH¡H J Fðj¡Ell BM¡L BF Š V Eöf ŠL P F¡ LN LL¡ QM¡ZRafidul IslamNo ratings yet

- Cash BookDocument1 pageCash BookRafidul IslamNo ratings yet

- Dhaka Power Distribution Company LimitedDocument1 pageDhaka Power Distribution Company LimitedRafidul IslamNo ratings yet

- A¢Nëj Ae¤Μrc Ew Bf¢Šl ¢Nl¡E¡J S¢Sa V¡L¡Document6 pagesA¢Nëj Ae¤Μrc Ew Bf¢Šl ¢Nl¡E¡J S¢Sa V¡L¡Rafidul IslamNo ratings yet

- Dhaka Power Distribution Company LimitedDocument1 pageDhaka Power Distribution Company LimitedRafidul IslamNo ratings yet

- Dhaka Power Distribution Company LimitedDocument1 pageDhaka Power Distribution Company LimitedRafidul IslamNo ratings yet

- Dhaka Power Distribution Company LimitedDocument1 pageDhaka Power Distribution Company LimitedRafidul IslamNo ratings yet

- Cash BookDocument1 pageCash BookRafidul IslamNo ratings yet

- Budget Performance Report: Code Description Actual Budget VarianceDocument1 pageBudget Performance Report: Code Description Actual Budget VarianceRafidul IslamNo ratings yet

- PVJVB Dig: Wu. Avi Dig bs-6 (GM - Avi 37 ' Óe )Document4 pagesPVJVB Dig: Wu. Avi Dig bs-6 (GM - Avi 37 ' Óe )Rafidul IslamNo ratings yet

- Dhaka Power Distribution Company Limited: OFFICE: Superintending Engineer Contracts and ProcurementDocument1 pageDhaka Power Distribution Company Limited: OFFICE: Superintending Engineer Contracts and ProcurementRafidul IslamNo ratings yet

- Dhaka Power Distribution Company LimitedDocument1 pageDhaka Power Distribution Company LimitedRafidul IslamNo ratings yet

- Anatomia Del Pie en Insuficiencia VenosaDocument13 pagesAnatomia Del Pie en Insuficiencia VenosaDinOritha AtiLanoNo ratings yet

- Thermal Radiation System: Instruction Manual and Experiment Guide For The PASCO Scientific Model TD-8553/8554A/8555Document28 pagesThermal Radiation System: Instruction Manual and Experiment Guide For The PASCO Scientific Model TD-8553/8554A/8555CoupeyNo ratings yet

- Concrete Mix DesignDocument36 pagesConcrete Mix Designamitbd80% (5)

- Python GUI Programming With Tkinter Deve-31-118 Job 1Document88 pagesPython GUI Programming With Tkinter Deve-31-118 Job 1Shafira LuthfiyahNo ratings yet

- CHAPTER 31 Faraday S LawDocument27 pagesCHAPTER 31 Faraday S LawSattishZeeNo ratings yet

- MATLAB AssignmentsDocument12 pagesMATLAB AssignmentsnilimaNo ratings yet

- Getting Started With Experion Software GuideDocument28 pagesGetting Started With Experion Software Guidebeerman81No ratings yet

- X2 ParametersDocument6 pagesX2 Parametersmanson_dataNo ratings yet

- 74LVC14APWDHDocument11 pages74LVC14APWDHIlie GrecuNo ratings yet

- Spreadsheet Practice Exercises-2016FDocument40 pagesSpreadsheet Practice Exercises-2016FDharneeshkarDandy92% (12)

- Mensuration & Calculation For Plumbing by Daleon PDFDocument101 pagesMensuration & Calculation For Plumbing by Daleon PDFmanny daleon100% (1)

- STHAMB or Pillars of The Hindu TemplesDocument31 pagesSTHAMB or Pillars of The Hindu TemplesudayNo ratings yet

- K-D Hawk: Manitou North America, IncDocument334 pagesK-D Hawk: Manitou North America, IncRazvan MitruNo ratings yet

- Linear Interpolation Equation Formula Calculator PDFDocument3 pagesLinear Interpolation Equation Formula Calculator PDFMatthew HaleNo ratings yet

- ch12 칼리스터 재료과학과 공학 답지Document71 pagesch12 칼리스터 재료과학과 공학 답지hayun9999999No ratings yet

- Bioinstrumentation III SemDocument2 pagesBioinstrumentation III SemAnonymous Jp9PvVkZNo ratings yet

- Characterization and Manufacture of Braided Composites For Large Commercial Aircraft StructuresDocument44 pagesCharacterization and Manufacture of Braided Composites For Large Commercial Aircraft StructuresnicolasNo ratings yet

- Midterm Exam Schedule-Summer 2022 Weekdays and WeekendDocument14 pagesMidterm Exam Schedule-Summer 2022 Weekdays and Weekendmansoor malikNo ratings yet

- Ziad Masri - Reality Unveiled The Hidden KeyDocument172 pagesZiad Masri - Reality Unveiled The Hidden KeyAivlys93% (15)

- MRM Assignment Written Analysis FormatDocument2 pagesMRM Assignment Written Analysis FormatMd AliNo ratings yet

- Numerical Analisis 2015Document357 pagesNumerical Analisis 2015mariaNo ratings yet

- Introduction To The Visual Basic Programming LanguageDocument24 pagesIntroduction To The Visual Basic Programming Languageapi-3749038100% (1)

- Power Semiconductor Applications - Philips-NXPDocument609 pagesPower Semiconductor Applications - Philips-NXPnanditonanaman100% (2)

- Chemistry Pupil Book 10 - 12Document260 pagesChemistry Pupil Book 10 - 12Mawolo WuolewuNo ratings yet

- Fem PDFDocument65 pagesFem PDFManda Ramesh BabuNo ratings yet

- Thesis PDFDocument115 pagesThesis PDFRavi KumarNo ratings yet

- Association Between Anxiety and DepressionDocument10 pagesAssociation Between Anxiety and Depressionoliffasalma atthahirohNo ratings yet

- Cisco HyperFlex Systems Technical DeckDocument81 pagesCisco HyperFlex Systems Technical Deckkinan_kazuki104No ratings yet

- Bone Specific Alkaline PhophataseDocument6 pagesBone Specific Alkaline PhophataseMohan DesaiNo ratings yet

- IMO Resuts - Science Olympiad FoundationDocument2 pagesIMO Resuts - Science Olympiad FoundationAbhinav SinghNo ratings yet