Professional Documents

Culture Documents

The Instruments of Trade Policy: Slides Prepared by Thomas Bishop

Uploaded by

destiny710Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Instruments of Trade Policy: Slides Prepared by Thomas Bishop

Uploaded by

destiny710Copyright:

Available Formats

Slides prepared by Thomas Bishop

Chapter 8

The Instruments

of Trade Policy

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-2

Preview

Partial equilibrium analysis of tariffs: supply,

demand and trade in a single industry

Costs and benefits of tariffs

Export subsidies

Import quotas

Voluntary export restraints

Local content requirements

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-3

Types of Tariffs

A specific tariff is levied as a fixed charge for

each unit of imported goods.

For example, $1 per kg of cheese

An ad valorem tariff is levied as a fraction of

the value of imported goods.

For example, 25% tariff on the value of imported

cars.

Lets now analyze how tariffs affect the

economy.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-4

Supply, Demand and Trade

in a Single Industry

Lets construct a model measuring how a tariff

affects a single market, say that of wheat.

Suppose that in the absence of trade the price

of wheat in the foreign country is lower than

that in the domestic country.

With trade the foreign country will export: construct

an export supply curve

With trade the domestic country will import:

construct an import demand curve

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-5

Supply, Demand and Trade

in a Single Industry (cont.)

An export supply curve is the difference

between the quantity that foreign producers

supply minus the quantity that foreign

consumers demand, at each price.

An import demand curve is the difference

between the quantity that domestic

consumers demand minus the quantity that

domestic producers supply, at each price.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-6

Supply, Demand and Trade

in a Single Industry (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-7

Supply, Demand and Trade

in a Single Industry (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-8

Supply, Demand and Trade

in a Single Industry (cont.)

In equilibrium,

import demand = export supply

domestic demand domestic supply =

foreign supply foreign demand

In equilibrium,

world demand = world supply

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-9

Supply, Demand and Trade

in a Single Industry (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-10

The Effects of a Tariff

A tariff acts as an added cost of transportation,

making shippers unwilling to ship goods unless the

price difference between the domestic and foreign

markets exceeds the tariff.

If shippers are unwilling to ship wheat, there is excess

demand for wheat in the domestic market and excess

supply in the foreign market.

The price of wheat will tend to rise in the domestic market.

The price of wheat will tend to fall in the foreign market.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-11

The Effects of a Tariff (cont.)

Thus, a tariff will make the price of a good rise

in the domestic market and will make the price

of a good fall in the foreign market, until the

price difference equals the tariff.

P

T

P

*

T

= t

P

T

= P

*

T

+ t

The price of the good in foreign (world) markets

should fall if there is a significant drop in the

quantity demanded of the good caused by the

domestic tariff.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-12

The Effects of a Tariff (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-13

The Effects of a Tariff (cont.)

Because the price in domestic markets rises

(to P

T

), domestic producers should supply

more and domestic consumers should

demand less.

The quantity of imports falls from Q

W

to Q

T

Because the price in foreign markets falls

(to P

*

T

), foreign producers should supply less

and foreign consumers should demand more.

The quantity of exports falls from Q

W

to Q

T

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-14

The Effects of a Tariff (cont.)

The quantity of domestic import demand

equals the quantity of foreign export supply

when P

T

P

*

T

= t

In this case, the increase in the price of the

good in the domestic country is less than the

amount of the tariff.

Part of the tariff is reflected in a decline of the

foreign countrys export price, and thus is not

passed on to domestic consumers.

But this effect is often not very significant.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-15

The Effects of a Tariff in a Small Country

When a country is small, it has no effect on

the foreign (world) price of a good, because

its demand for the good is an insignificant part

of world demand.

Therefore, the foreign price will not fall, but will

remain at P

w

The price in the domestic market, however, will

rise to P

T

= P

w

+ t

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-16

The Effects

of a Tariff in a Small Country (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-17

Effective Rate of Protection

The effective rate of protection measures how

much protection a tariff or other trade policy provides

domestic producers.

It represents the change in value that an industry adds to the

production process when trade policy changes.

The change in value that an industry provides depends on

the change in prices when trade policies change.

Effective rates of protection often differ from tariff rates

because tariffs affect sectors other than the protected sector,

a fact which affects the prices and value added for the

protected sector.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-18

Effective Rate of Protection (cont.)

For example, suppose that an automobile

sells on the world market for $8000, and the

parts that made it are worth $6000.

The value added of the auto production is

$8000-$6000

Suppose that a country puts a 25% tariff on

imported autos so that domestic auto

assembly firms can now charge up to $10000

instead of $8000.

Now auto assembly will occur if the value

added is up to $10000-$6000.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-19

Effective Rate of Protection (cont.)

The effective rate of protection for domestic

auto assembly firms is the change in value

added:

($4000 - $2000)/$2000 = 100%

In this case, the effective rate of protection is

greater than the tariff rate.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-20

Costs and Benefits of Tariffs

A tariff raises the price of a good in the

importing country, so we expect it to hurt

consumers and benefit producers there.

In addition, the government gains tariff

revenue from a tariff.

How to measure these costs and benefits?

We use the concepts of consumer surplus

and producer surplus.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-21

Consumer Surplus

Consumer surplus measures the amount

that a consumer gains from a purchase by the

difference in the price he pays from the price

he would have been willing to pay.

The price he would have been willing to pay

is determined by a demand (willingness to

buy) curve.

When the price increases, the quantity demanded

decreases as well as the consumer surplus.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-22

Consumer Surplus (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-23

Producer Surplus

Producer surplus measures the amount that

a producer gains from a sale by the difference

in the price he receives from the price he

would have been willing to sell at.

The price he would have been willing to sell at is

determined by a supply (willingness to sell) curve.

When price increases, the quantity supplied

increases as well as the producer surplus.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-24

Producer Surplus (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-25

Costs and Benefits of Tariffs

A tariff raises the price of a good in the

importing country, making its consumer

surplus decrease (making its consumers

worse off) and making its producer surplus

increase (making its producers better off).

Also, government revenue will increase.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-26

Costs and Benefits of Tariffs (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-27

Costs and Benefits of Tariffs (cont.)

For a large country that can affect foreign (world)

prices, the welfare effect of a tariff is ambiguous.

The triangles b and d represent the efficiency loss.

The tariff distorts production and consumption decisions:

producers produce too much and consumers consume too

little compared to the market outcome.

The rectangle e represents the terms of trade gain.

The terms of trade increases because the tariff lowers foreign

export (domestic import) prices.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-28

Costs and Benefits of Tariffs (cont.)

Government revenue from the tariff equals the

tariff rate times the quantity of imports.

t = P

T

P

*

T

Q

T

= D

2

S

2

Government revenue = t x Q

T

= c + e

Part of government revenue (rectangle e)

represents the terms of trade gain, and part

(rectangle c) represents part of the value of

lost consumer surplus.

The government gains at the expense of

consumers and foreigners.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-29

Costs and Benefits of Tariffs (cont.)

If the terms of trade gain exceeds the

efficiency loss, then national welfare will

increase under a tariff, at the expense of

foreign countries.

However, this analysis assumes that the terms of

trade does not change due to tariff changes by

foreign countries (i.e., due to retaliation).

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-30

Costs and Benefits of Tariffs (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-31

Export Subsidy

An export subsidy can also be specific or ad valorem

A specific subsidy is a payment per unit exported.

An ad valorem subsidy is a payment as a proportion of the

value exported.

An export subsidy raises the price of a good in the

exporting country, making its consumer surplus

decrease (making its consumers worse off) and

making its producer surplus increase (making its

producers better off).

Also, government revenue will decrease.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-32

Export Subsidy (cont.)

An export subsidy raises the price of a good in

the exporting country, while lowering it in

foreign countries.

In contrast to a tariff, an export subsidy

worsens the terms of trade by lowering the

price of domestic products in world markets.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-33

Export

Subsidy

(cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-34

Export Subsidy (cont.)

An export subsidy unambiguously produces a

negative effect on national welfare.

The triangles b and d represent the efficiency loss.

The tariff distorts production and consumption decisions:

producers produce too much and consumers consume too

little compared to the market outcome.

The area b + c + d + f + g represents the cost of

government subsidy.

In addition, the terms of trade decreases, because the price

of exports falls in foreign markets to P

*

s

.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-35

Export Subsidy in Europe

The European Unions Common Agricultural Policy

sets high prices for agricultural products and

subsidizes exports to dispose of excess production.

The subsidized exports reduce world prices of agricultural

products.

The direct cost of this policy for European taxpayers

is almost $50 billion.

But the EU has proposed that farmers receive direct

payments independent of the amount of production to help

lower EU prices and reduce production.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-36

Export Subsidy in Europe (cont.)

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-37

Import Quota

An import quota is a restriction on the quantity

of a good that may be imported.

This restriction is usually enforced by issuing

licenses to domestic firms that import, or in

some cases to foreign governments of

exporting countries.

A binding import quota will push up the price

of the import because the quantity demanded

will exceed the quantity supplied by domestic

producers and from imports.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-38

Import Quota (cont.)

When a quota instead of a tariff is used to

restrict imports, the government receives no

revenue.

Instead, the revenue from selling imports at high

prices goes to quota license holders: either

domestic firms or foreign governments.

These extra revenues are called quota rents.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-39

US Import

Quota

on Sugar

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-40

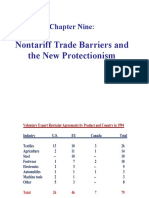

Voluntary Export Restraint

A voluntary export restraint works like an

import quota, except that the quota is imposed

by the exporting country rather than the

importing country.

However, these restraints are usually

requested by the importing country.

The profits or rents from this policy are earned

by foreign governments or foreign producers.

Foreigners sell a restricted quantity at an

increased price.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-41

Local Content Requirement

A local content requirement is a regulation

that requires a specified fraction of a final

good to be produced domestically.

It may be specified in value terms, by

requiring that some minimum share of the

value of a good represent domestic valued

added, or in physical units.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-42

Local Content Requirement (cont.)

From the viewpoint of domestic producers of

inputs, a local content requirement provides

protection in the same way that an import

quota would.

From the viewpoint of firms that must buy

domestic inputs, however, the requirement

does not place a strict limit on imports, but

allows firms to import more if they also use

more domestic parts.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-43

Local Content Requirement (cont.)

Local content requirement provides neither

government revenue (as a tariff would) nor

quota rents.

Instead the difference between the prices of

domestic goods and imports is averaged into

the price of the final good and is passed on to

consumers.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-44

Other Trade Policies

Export credit subsidies

A subsidized loan to exporters

US Export-Import Bank subsidizes loans to US exporters.

Government procurement

Government agencies are obligated to purchase from

domestic suppliers, even when they charge higher prices

(or have inferior quality) compared to foreign suppliers.

Bureaucratic regulations

Safety, health, quality or customs regulations can act as

a form of protection and trade restriction.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-45

Summary

Tariff Export

subsidy

Import

quota

Voluntary

export

restraint

Producer

surplus

Consumer

surplus

Government

net revenue

National

welfare

Increases Increases Increases Increases

No change:

rents to

license holders

Increases Decreases

Decreases Decreases Decreases Decreases

No change:

rents to

foreigners

Ambiguous,

falls for small

country

Ambiguous,

falls for small

country

Decreases

Decreases

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-46

Summary (cont.)

1. A tariff decreases the world price of the

imported good when a country is large,

increases the domestic price of the imported

good and reduces the quantity traded.

2. A quota does the same.

3. An export subsidy decreases the world

price of the exported good when a country

is large, increases the domestic price of

the exported good and increases the

quantity produced.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-47

Summary (cont.)

4. The welfare effect of a tariff, quota and export

subsidy can be measured by:

Efficiency loss from consumers and producers

Terms of trade gain or loss

5. With import quotas, voluntary export restraints and

local content requirements, the government of the

importing country receives no revenue.

6. With voluntary export restraints and occasionally

import quotas, quota rents go to foreigners.

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-48

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-49

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-50

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-51

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-52

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-53

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-54

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-55

Copyright 2006 Pearson Addison-Wesley. All rights reserved. 8-56

You might also like

- The Instruments of Trade PolicyDocument43 pagesThe Instruments of Trade PolicyHarika HarikaNo ratings yet

- The Instruments of Trade PolicyDocument61 pagesThe Instruments of Trade PolicyRyan J AnwardNo ratings yet

- International Economics Theory and Policy Krugman 10th Edition Solutions ManualDocument8 pagesInternational Economics Theory and Policy Krugman 10th Edition Solutions ManualRobertSchmidttjcdw100% (79)

- Medtech Law Ra 5527Document12 pagesMedtech Law Ra 5527Aldwin Cantos100% (1)

- L1 Communication Processes, Principles, and EthicsDocument24 pagesL1 Communication Processes, Principles, and EthicsKaren mesina67% (3)

- The Theory of Tariffs and QuotasDocument68 pagesThe Theory of Tariffs and QuotasAda Teaches100% (1)

- Instruments of Trade PolicyDocument38 pagesInstruments of Trade PolicyADHADUK RONS MAHENDRABHAINo ratings yet

- English FestDocument3 pagesEnglish FestTelet Tolentino100% (2)

- Hoisting and Rigging - Basic Safety Training: Want To Receive A Wallet Card?Document36 pagesHoisting and Rigging - Basic Safety Training: Want To Receive A Wallet Card?xharpreetxNo ratings yet

- Lift & EscalatorsDocument19 pagesLift & EscalatorsINCREDIBLEInteriors& FURNITURES DECOR100% (1)

- Krugman Obstfeld CH 08Document55 pagesKrugman Obstfeld CH 08doctor khanNo ratings yet

- Afp (Pa) OrganizationDocument20 pagesAfp (Pa) OrganizationAcad Demics100% (3)

- Additional Materials From Learning Resource (LR) PortalDocument2 pagesAdditional Materials From Learning Resource (LR) PortalZile SmithNo ratings yet

- Chapter 8 - The Instruments of Trade PolicyDocument57 pagesChapter 8 - The Instruments of Trade Policyvintosh_pNo ratings yet

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- The Instruments of Trade PolicyDocument36 pagesThe Instruments of Trade PolicyFeyza DökmeciNo ratings yet

- Chapter 3 IEDocument50 pagesChapter 3 IETrâm NgọcNo ratings yet

- The Instruments of Trade Policy: Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDocument55 pagesThe Instruments of Trade Policy: Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldJuan TelloNo ratings yet

- The Instruments of Trade PolicyDocument57 pagesThe Instruments of Trade PolicyAlice AungNo ratings yet

- C09 Krugman425789 10e GEDocument57 pagesC09 Krugman425789 10e GEVu Van CuongNo ratings yet

- 1.4. Trade Restrictions TariffDocument48 pages1.4. Trade Restrictions TariffThu PhươngNo ratings yet

- The Instruments of Trade PolicyDocument55 pagesThe Instruments of Trade PolicyMadalina RaceaNo ratings yet

- Trade Restrictions TariffDocument46 pagesTrade Restrictions Tariff22070899No ratings yet

- Instruments of Trade PolicyDocument14 pagesInstruments of Trade PolicyKatrizia FauniNo ratings yet

- The Instruments of Trade PolicyDocument57 pagesThe Instruments of Trade PolicyChristofer VaarNo ratings yet

- International Economics TheoryDocument19 pagesInternational Economics TheorylukeNo ratings yet

- 7.instruments of Trade PolicyDocument38 pages7.instruments of Trade PolicyJennifer W.A.No ratings yet

- A Tariff Is A Tax Imposed by A Government On Goods and Services ImportedDocument9 pagesA Tariff Is A Tax Imposed by A Government On Goods and Services ImportedPranav SehgalNo ratings yet

- Lecture Slides Chapter 05Document22 pagesLecture Slides Chapter 05Nadeem JonaidNo ratings yet

- SubsidiesDocument9 pagesSubsidiesSanzida BegumNo ratings yet

- Trade Barriers 100031Document6 pagesTrade Barriers 100031Sreeparna duttaNo ratings yet

- 6 The Neoclassical Summary Free Trade As Economic GoalDocument4 pages6 The Neoclassical Summary Free Trade As Economic GoalOlga LiNo ratings yet

- International Trade Policy 08Document34 pagesInternational Trade Policy 08Arshad AbbasNo ratings yet

- 02 Internationaltradepolicy Chap2 - 150218235618Document33 pages02 Internationaltradepolicy Chap2 - 150218235618exams_sbsNo ratings yet

- Chap 8,9Document17 pagesChap 8,9Trâm PhạmNo ratings yet

- Non-Tariff Trade BarriersDocument33 pagesNon-Tariff Trade Barriershangbg2k3No ratings yet

- Lecture 2 International Trade GraphsDocument44 pagesLecture 2 International Trade GraphsL SNo ratings yet

- Sample - HSC Economics NotesDocument3 pagesSample - HSC Economics NotesAndrew LeeNo ratings yet

- Team 3 ProjectDocument14 pagesTeam 3 ProjectGabriela LorenaNo ratings yet

- Non-Tariff Barriers & Protection (R)Document35 pagesNon-Tariff Barriers & Protection (R)Anand MauryaNo ratings yet

- Project Report On Tariff and Non TariffDocument38 pagesProject Report On Tariff and Non TariffAustin OliverNo ratings yet

- ECN102 World Economy: DR Rachel MaleDocument62 pagesECN102 World Economy: DR Rachel MaleJaja123y77No ratings yet

- Trade Restrictions: TariffsDocument22 pagesTrade Restrictions: TariffsVari GhumanNo ratings yet

- Taxation Efficiency and International TradeDocument14 pagesTaxation Efficiency and International TradeSamia Irshad ullahNo ratings yet

- Section 3 - International Economics Complete PackDocument19 pagesSection 3 - International Economics Complete PackBinh Minh DuongNo ratings yet

- Trade Policy 1 Tariff EffectDocument18 pagesTrade Policy 1 Tariff EffectRoite BeteroNo ratings yet

- Chapter Nine:: Nontariff Trade Barriers and The New ProtectionismDocument26 pagesChapter Nine:: Nontariff Trade Barriers and The New ProtectionismAhmad RonyNo ratings yet

- Trade Restrictions: Tariffs: Anhui University of Finance & Economics 1/21Document22 pagesTrade Restrictions: Tariffs: Anhui University of Finance & Economics 1/21pankhu_06No ratings yet

- Topic 2-Tariffs and QuotasDocument7 pagesTopic 2-Tariffs and QuotasJamesNo ratings yet

- International Econ Exam 2Document7 pagesInternational Econ Exam 2Colin QuinnNo ratings yet

- Itf 6Document26 pagesItf 6pandeyprakash9826No ratings yet

- International Business Environment 1Document8 pagesInternational Business Environment 1Sammir MalhotraNo ratings yet

- Chap 1 Extension of RicardoDocument21 pagesChap 1 Extension of RicardoK59 TRAN VY TRANo ratings yet

- Lecture 09Document39 pagesLecture 09ayladtlNo ratings yet

- Instruments of Trade PolicyDocument14 pagesInstruments of Trade Policydipsmech18No ratings yet

- He Political Economy of International TradeDocument13 pagesHe Political Economy of International TradeMd. Mehedi HasanNo ratings yet

- Chapt08 Krugman 46657 09 IE C08 FDocument63 pagesChapt08 Krugman 46657 09 IE C08 FMihai StoicaNo ratings yet

- Microeconomics-International Trade Notes 2Document17 pagesMicroeconomics-International Trade Notes 2Khasheena RobertsNo ratings yet

- Answer:: Chapter 5 Study QuestionDocument9 pagesAnswer:: Chapter 5 Study QuestionChi IuvianamoNo ratings yet

- Trade PolicyDocument16 pagesTrade PolicyDalvir ThakurNo ratings yet

- Week 14 Application International TradeDocument29 pagesWeek 14 Application International TradeTri Imam WicaksonoNo ratings yet

- QUIZDocument9 pagesQUIZChâu GiangNo ratings yet

- Lecture #1 Trade Policy (1) InstrumentsDocument14 pagesLecture #1 Trade Policy (1) InstrumentsAlexandra NeaguNo ratings yet

- Instrument of International Trade PolicyDocument13 pagesInstrument of International Trade PolicyayushbilaiyaNo ratings yet

- Zion Desamero - Module 6 Assignment #2 - Trade BarriersDocument7 pagesZion Desamero - Module 6 Assignment #2 - Trade BarriersZion EliNo ratings yet

- Advantages and Disadvantages of Trade BarriersDocument8 pagesAdvantages and Disadvantages of Trade BarriersNabila NordinNo ratings yet

- Impulse ResponseDocument4 pagesImpulse Responsedestiny710No ratings yet

- CH 013Document23 pagesCH 013destiny710No ratings yet

- Change Storage Type in StataDocument2 pagesChange Storage Type in Statadestiny710No ratings yet

- MONSANTO, THE LEADING Producer of Genetically Modified Plant SeedDocument3 pagesMONSANTO, THE LEADING Producer of Genetically Modified Plant Seeddestiny710No ratings yet

- A Tariff Acts As An Added Cost of TransportationDocument3 pagesA Tariff Acts As An Added Cost of Transportationdestiny710No ratings yet

- Project Mangement AssignmentDocument7 pagesProject Mangement Assignmentdestiny710No ratings yet

- Atlantic Computer: A Bundle of Pricing OptionsDocument36 pagesAtlantic Computer: A Bundle of Pricing OptionsRohit GhoshNo ratings yet

- Internal Control SystemDocument27 pagesInternal Control SystemHaidee Flavier SabidoNo ratings yet

- Presentation PFA July2020 V5Document116 pagesPresentation PFA July2020 V5Karunamoorthy PeriasamyNo ratings yet

- Approaches To Discourse AnalysisDocument16 pagesApproaches To Discourse AnalysisSaadat Hussain Shahji PanjtaniNo ratings yet

- Zydus Wellnes AR 2019Document213 pagesZydus Wellnes AR 2019ravis1985No ratings yet

- Government Senior High School Profile FORM SY 2020-2021Document28 pagesGovernment Senior High School Profile FORM SY 2020-2021Liza MiraballesNo ratings yet

- Base Ten Lesson PlanDocument2 pagesBase Ten Lesson Planapi-573840381No ratings yet

- Adm 551 HRM Topic 1 HRM PerspectiveDocument39 pagesAdm 551 HRM Topic 1 HRM PerspectiveAirin SamuelNo ratings yet

- Identification and Management of Risks in Construction ProjectsDocument8 pagesIdentification and Management of Risks in Construction ProjectsPrasanthi KoneruNo ratings yet

- MCQ InfraDocument5 pagesMCQ InfraFarooq AhmedNo ratings yet

- CEED 2012 BrochureDocument14 pagesCEED 2012 Brochurehii_bhartiNo ratings yet

- Elsevier Journal FinderDocument4 pagesElsevier Journal FinderLuminita PopaNo ratings yet

- S2 2016 372985 Bibliography PDFDocument2 pagesS2 2016 372985 Bibliography PDFNanang AriesNo ratings yet

- Organisation Name: PESTLE AnalysisDocument3 pagesOrganisation Name: PESTLE AnalysisYogesh KamraNo ratings yet

- Industrial Assignment 1. Application Power ElectronicsDocument2 pagesIndustrial Assignment 1. Application Power ElectronicsLM BecinaNo ratings yet

- Value Chain Analysis1Document29 pagesValue Chain Analysis1ramyasathishNo ratings yet

- PresDraft 1Document38 pagesPresDraft 1Pradipta RohimoneNo ratings yet

- As 1386.5-1989 Clean Rooms and Clean Workstations Clean WorkstationsDocument5 pagesAs 1386.5-1989 Clean Rooms and Clean Workstations Clean WorkstationsSAI Global - APACNo ratings yet

- Residence and Travel Questionnaire: Tataaia/Nb/Dm/126Document2 pagesResidence and Travel Questionnaire: Tataaia/Nb/Dm/126Data CentrumNo ratings yet

- Powers and Limits of The CongressDocument3 pagesPowers and Limits of The Congressm zainNo ratings yet

- Driving Question: What If Teachers Lead The Transformation of Schools and School Districts For The 21st Century?Document7 pagesDriving Question: What If Teachers Lead The Transformation of Schools and School Districts For The 21st Century?jaycebelle berjuegaNo ratings yet

- Muhammad Luqman Hakimi Bin Mohd Zamri - October 2018 Set 1 Question PaperDocument15 pagesMuhammad Luqman Hakimi Bin Mohd Zamri - October 2018 Set 1 Question PaperLUQMAN DENGKILNo ratings yet

- OWWAFUNCTIONSDocument4 pagesOWWAFUNCTIONSDuay Guadalupe VillaestivaNo ratings yet