Professional Documents

Culture Documents

Rating Methodology

Uploaded by

anandakr0 ratings0% found this document useful (0 votes)

13 views18 pagesAbout loan

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAbout loan

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views18 pagesRating Methodology

Uploaded by

anandakrAbout loan

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 18

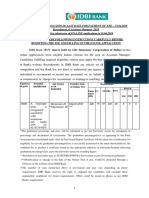

Rating methodology

Approach to Credit Rating

Company

Rating

Project Risk

Management

Risk

External

Risk

Financial

Risk

Business

Risk

Industry

Risk

Internal

Risk

Overall risk rating

Industry

Projected growth, demand - supply position

trends in consumption

anticipated addition of new capacities (Steel -

bunched capacities lead to over supply )

International competitiveness

increasingly becoming an important issue

leads to event risks such as drop in duties (duties

on Copper)

Industry (contd.)

Cyclicality

affects the stability of cash flows (Traffic on Toll Roads)

financial structure needs to be conservative

Level of consolidation of industry impacts amplitude of

cycle

Regulatory Uncertainty

Telecom industry

event risks

Identification of key success factors

Business Position

Objective is to determine the competitive position

of company in the industry

above EBIDTA level analysis

focus not on financial structure

Standing on key success factors

advantages should be sustainable

Focus on peer comparison

Financial Performance, Position

Financial ratio analysis (in addition to standard

ratios)

PBID/ Net Sales (peer comparison)

Debt/ Cash Accruals

Projected cash flows

free cash flow analysis

Financial flexibility

Debt equity ratio

Market standing

Financial Performance, Position (Contd)

Contingent liabilities (Guarantees,disputed

payments)

Amount

Likelihood of devolvement

Support to group companies

Low yield investments

Committed future investments

Ratings of quite a few flag ship companies are

lower due to the contingent liabilities

Management, Group

Past business, payment record

there is no better proxy than past payment/ credit

record

not just payments, overall credit discipline is

important

Strategic planning, project implementation record

Management structure, succession plans

Overall financial position of the group

Investment Plans

Nature of project

Size of the project (in relation to company

financials)

Financing plan

Implementation Risk

Approvals required

Financial closure

Implementation

Investment Plans

Post Implementation risks

Stabilisation risk, cash flow impact

Market risk

Projected cash flows

Framework similar to company rating

Blending of company, project risks

definition of projects

capping of project ratings

Need for structuring

Group rating concept

Strong linkages between group companies

flag ship gives guarantees/ advances etc

strong financial linkages between companies

Strong case for a group rating

merge financials of all companies

notching to obtain rating of each company

Other Issues

Single customer dependence (JFTC companies)

Strong linkage to another company/ project

EPC companies

bundle of contracts

order book position

receivables level

Parent company support (MNCs)

Other Issues

Importance of company to group/ flagship (group

finance companies)

Cyclicality - rate through the cycle

Other Issues (Contd)

Timely payment

Rating is an ongoing exercise

Incorporates information,expectations as on date

Consistency essential

Measurement of rating performance

Consistency in default rates across categories

Securitisation - Existing Receivables

Top down approach to rating

Start with obligor rating

Contract to be analysed for

Satisfaction of performance

Dilution risks (TDS, residual performance etc.)

Assignability

Set off risks

Legal confirmations

Bankruptcy remoteness

Ring fencing of assets

Approval of charge holders

Securitisation - Future Receivables

Bottom up approach

Start with company rating

Base debt servicing capacity is important

Enhancement based on the structure

Quality of cash flows

Sustainability of cash flows

Legal handle on the cash flows

Protective covenants

Key aspects of rating structured deals

Multi functional approach - credit, legal, taxation

and regulatory aspects

Covenanting is very important

Necessary covenants

Protective covenants

Rights in event of default

Monitoring/ exercise of triggers is very important

Thank You

You might also like

- 3-4 QuestionsDocument2 pages3-4 QuestionsanandakrNo ratings yet

- 3-4 QuestionsDocument2 pages3-4 QuestionsanandakrNo ratings yet

- Key Mock Test August 2021Document1 pageKey Mock Test August 2021anandakrNo ratings yet

- Recollected Questions II To III 08.08.2021Document3 pagesRecollected Questions II To III 08.08.2021anandakrNo ratings yet

- Dporuid Bquoo: Karnataka AuthorityDocument1 pageDporuid Bquoo: Karnataka AuthorityanandakrNo ratings yet

- Shri Rama Jayam Mukhund InvitationDocument1 pageShri Rama Jayam Mukhund InvitationanandakrNo ratings yet

- Recollected Questions II To III 08.08.2021Document3 pagesRecollected Questions II To III 08.08.2021anandakrNo ratings yet

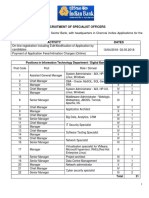

- IDBI Assistant Manager Recruitment 2019.PDF-92Document20 pagesIDBI Assistant Manager Recruitment 2019.PDF-92Subham GhoshNo ratings yet

- Draft TimetableDocument1 pageDraft TimetableanandakrNo ratings yet

- DIPSEV - 01 Jul 2019 - To - 31 Jul 2019 PDFDocument468 pagesDIPSEV - 01 Jul 2019 - To - 31 Jul 2019 PDFanandakr0% (1)

- IDBI Assistant Manager Recruitment 2019.PDF-92Document20 pagesIDBI Assistant Manager Recruitment 2019.PDF-92Subham GhoshNo ratings yet

- India Bank Recruitment of Specialist Officers EngDocument25 pagesIndia Bank Recruitment of Specialist Officers Engajay kumarNo ratings yet

- KycDocument3 pagesKycanandakrNo ratings yet

- IDBI Assistant Manager Recruitment 2019.PDF-92Document20 pagesIDBI Assistant Manager Recruitment 2019.PDF-92Subham GhoshNo ratings yet

- IDBI Assistant Manager Recruitment 2019.PDF-92Document20 pagesIDBI Assistant Manager Recruitment 2019.PDF-92Subham GhoshNo ratings yet

- DIPSEV - 01 Jul 2018 - To - 31 Jul 2018Document338 pagesDIPSEV - 01 Jul 2018 - To - 31 Jul 2018anandakr100% (1)

- IV - Requirement List & Uniform Distribution Details 2019-20Document2 pagesIV - Requirement List & Uniform Distribution Details 2019-20anandakrNo ratings yet

- Bhajan Book by Smt. Kunnakudy Bala RamakrishnanDocument142 pagesBhajan Book by Smt. Kunnakudy Bala Ramakrishnananandakr50% (4)

- DIPSEV - 01 Apr 2019Document463 pagesDIPSEV - 01 Apr 2019anandakrNo ratings yet

- DIPSEV - 01 Jan 2018to31 Jan 2018 PDFDocument308 pagesDIPSEV - 01 Jan 2018to31 Jan 2018 PDFpooja143100% (1)

- FAQ - ShriVaishnava Sampradaya Daily Sandhai ClassDocument30 pagesFAQ - ShriVaishnava Sampradaya Daily Sandhai Classanandakr100% (1)

- DIPSEV - 01 Sep 2018 - To - 30 Sep 2018Document358 pagesDIPSEV - 01 Sep 2018 - To - 30 Sep 2018anandakr50% (2)

- DIPSEV - 01 Sep 2018 - To - 30 Sep 2018Document358 pagesDIPSEV - 01 Sep 2018 - To - 30 Sep 2018anandakr50% (2)

- Class 7 Geography CH 2Document3 pagesClass 7 Geography CH 2anandakrNo ratings yet

- Class 8 Geography CH 3Document3 pagesClass 8 Geography CH 3anandakr100% (1)

- Earth Quake in RampurDocument2 pagesEarth Quake in RampuranandakrNo ratings yet

- Earth Quake in RampurDocument2 pagesEarth Quake in RampuranandakrNo ratings yet

- 2014 05 06 Nse EqDocument26 pages2014 05 06 Nse EqanandakrNo ratings yet

- LogjjsjsjsDocument4 pagesLogjjsjsjsanandakrNo ratings yet

- The Titan School Lesson Plan Class Subject Topic 1. Incorporation of Multiple IntelligencesDocument3 pagesThe Titan School Lesson Plan Class Subject Topic 1. Incorporation of Multiple IntelligencesanandakrNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assessment On Opportunities Gaps and Challenges On Land Based Investment in Oromia RegionDocument41 pagesAssessment On Opportunities Gaps and Challenges On Land Based Investment in Oromia RegionDejeneNo ratings yet

- References and Bibliography: Journal, OctoberDocument3 pagesReferences and Bibliography: Journal, OctoberSatyajit MohantyNo ratings yet

- Insights of Mutual Funds For Retail InvestorsDocument11 pagesInsights of Mutual Funds For Retail InvestorsjayminashahNo ratings yet

- ACC 642 - CH 01 SolutionsDocument17 pagesACC 642 - CH 01 SolutionstboneuncwNo ratings yet

- Debhie Cesilia - 5213418072 - TugasDocument6 pagesDebhie Cesilia - 5213418072 - TugasFenita Yuni PratiwiNo ratings yet

- TSE Trading MethodologyDocument74 pagesTSE Trading Methodologyorenmax123No ratings yet

- Far 5Document9 pagesFar 5Sonu NayakNo ratings yet

- The Technical Analyst WWW - Technicalanalyst.co - UkDocument2 pagesThe Technical Analyst WWW - Technicalanalyst.co - UkTUAN NGUYỄNNo ratings yet

- Solution To Biological Assets ProblemsDocument9 pagesSolution To Biological Assets ProblemsBella De LiañoNo ratings yet

- QuestionsDocument9 pagesQuestionsShaheer BaigNo ratings yet

- FBF Final Project Report (Financial Plan)Document6 pagesFBF Final Project Report (Financial Plan)Afaq BhuttaNo ratings yet

- Harami: Gapped DownDocument2 pagesHarami: Gapped DownkosurugNo ratings yet

- HSBC Asian Local Bond Index (ALBI)Document17 pagesHSBC Asian Local Bond Index (ALBI)Areeys SyaheeraNo ratings yet

- Security and Trade AssignmentDocument10 pagesSecurity and Trade AssignmentMaarij KhanNo ratings yet

- With Ashwani GujralDocument6 pagesWith Ashwani Gujralprincekavalam2No ratings yet

- Applied Auditing by Asuncion 2018pdf PDF FreeDocument8 pagesApplied Auditing by Asuncion 2018pdf PDF FreePrincess Joanna OngNo ratings yet

- Assignment Due September 8Document9 pagesAssignment Due September 8Alexander UrvinaNo ratings yet

- Structured ProductDocument27 pagesStructured ProductParvesh AghiNo ratings yet

- Chapter 7Document36 pagesChapter 7Marwa HassanNo ratings yet

- Ch04 Beams10e TBDocument31 pagesCh04 Beams10e TBSteven Andrian Gunawan0% (1)

- JPM Fixed inDocument236 pagesJPM Fixed inMikhail ValkoNo ratings yet

- RobovidapekDocument2 pagesRobovidapekBELLO SAIFULLAHINo ratings yet

- Investors Perception Indian Stock Market 120102040143 Phpapp01Document95 pagesInvestors Perception Indian Stock Market 120102040143 Phpapp01Priya Ramanathan67% (3)

- Notes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Document10 pagesNotes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Karthikeyan PandiarasuNo ratings yet

- How To Find and Invest in Penny StocksDocument3 pagesHow To Find and Invest in Penny StocksJonhmark AniñonNo ratings yet

- Case Analysis - Cost of CapitalDocument5 pagesCase Analysis - Cost of CapitalHazraphine LinsoNo ratings yet

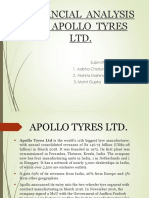

- Financial Analysis of Apollo Tyres LTDDocument11 pagesFinancial Analysis of Apollo Tyres LTDaabhaNo ratings yet

- The Five Key Players of AdvertisingDocument7 pagesThe Five Key Players of AdvertisingUmair ImranNo ratings yet

- Nepal Stock Exchange Ltd. Closing Price: Nepse Commercial Banks. PriceDocument15 pagesNepal Stock Exchange Ltd. Closing Price: Nepse Commercial Banks. PriceChakra DahalNo ratings yet

- Federal Funds Rate Series and History of The Federal Funds Market 1928-1954Document34 pagesFederal Funds Rate Series and History of The Federal Funds Market 1928-1954Daví José Nardy AntunesNo ratings yet