Professional Documents

Culture Documents

Welfare

Uploaded by

Vamsi Krishna BCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Welfare

Uploaded by

Vamsi Krishna BCopyright:

Available Formats

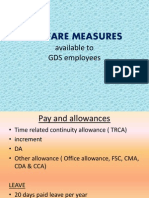

WELFARE MEASURES

available to

GDS employees

Pay and allowances

Time related continuity allowance ( TRCA)

increment

DA

Other allowance ( Office allowance, FSC, CMA,

CDA & CCA)

LEAVE

20 days paid leave per year

Maternity leave for 3 months for female GDS

Other benefits

Service discharge benefit scheme (SDBS)

Ex-Gratia Gratuity Rs.60,000/-

Severance amount- Rs.60,000/-

Productivity linked bonus

Group insurance scheme

Immediate relief to the family of an

employee who dies while in service

If an GDS employee dies while in service, his family will

be eligible for immediate monetary relief equal to two

months Basic pay of the deceased Government

servant subject to a maximum of Rs.7,000/-

No formal application from the bereaved family is

necessary.

The advance should be adjusted within six months

against the arrears of pay and allowances, death

gratuity or any other payment due in respect of the

deceased official.

Group Insurance Scheme

Twin benefits- Insurance coverage and Savings

30% -- Insurance Fund

70% Savings Fund

Rate of subscription & Amount of Insurance

cover are determined for GDS is

Rate of subscription is Rs.50/-

Insurance cover is Rs.50,000/-

Promotions

To MSE/ MTS based on seniority cum fitness

Through competitive departmental

examination for

MTS/ Postman/ PAs

Incentive/ Commission

1% commission on new TD accounts

SB annual incentive @ 2%

RPLI policy procurement @ Rs. 2.50/1000 or

10 % of the annual premium collected

1% on RPLI premium colection

Incentive/Commission for GDS

For the deposits made under SB/TD schemes

BPMs can earn Commission/Incentive

For SB, Commission may be claimed for each

financial year

Rate of commission is 2% on net deposit

Procedure to calculate net deposit is shown in

next slide

Calculation of net deposit

Deposits made from April to February should

be taken

Deposits made in March not to be counted

Withdrawals made from 1

st

April to 31

st

March should be taken into account

Withdrawals made from A.O. should be taken

in to account

Calculation of net deposit

Deposits made at A.O. should not be taken

into account

Amount of interest should not be treated as

deposit

2% of the net deposit arrived as said above

may be claimed as commission

Claim should be preferred in the month of

April every year

Payment of SB Commission

The Commission bill may be forwarded to

A.O.

A.O. will verify and sanction the bill

Commission amount can be charged at BO

with separate head in BODA as Payment of

Commission to BPM.

Rate of Commission - TD

Sl Type of A/c Rate of

Commission

01 1 year TD %

02 2 & 3 years TD 1%

03 5 years TD 2%

Procedure to claim TD commission

Claim may be preferred once in a month

Bill should be submitted to A.O. for the

accounts opened during the month on 1

st

of

next month

Accounts opened through agents are not

eligible to claim commission

No commission for TD re-deposits

Forward commission bill to A.O. duly invoiced

in BODA

Payment of TD Commission

A.O. will verify and sanction the bill

Commission amount can be charged at BO

with separate head in BODA as Payment of

Commission to BPM.

The charged bill should be sent back to A.O.

Payment of TD Commission

Need not wait up to the end of financial year

to claim commission on TD deposits

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Training and DevelopmentDocument23 pagesTraining and DevelopmentVamsi Krishna BNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Direct Operating Cost AircraftDocument44 pagesDirect Operating Cost AircraftusakalambaNo ratings yet

- Acquisitions and Restructuring StrategiesDocument31 pagesAcquisitions and Restructuring StrategiesYber LexNo ratings yet

- Garudapuranam TeluguDocument11 pagesGarudapuranam Teluguhimaece65% (17)

- Introduction To Human Resource ManagementDocument34 pagesIntroduction To Human Resource ManagementDhanush RaoNo ratings yet

- Checklist For AuditDocument22 pagesChecklist For Auditaishwarya raikar100% (2)

- Pedda BalashikshaDocument210 pagesPedda Balashikshaarun_soft189456100% (2)

- Role of FICCI in Indian ExDocument50 pagesRole of FICCI in Indian ExNitin BansalNo ratings yet

- ROF For Wireless CommDocument40 pagesROF For Wireless CommVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income PlanVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income PlanVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlusVamsi Krishna BNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageVamsi Krishna BNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- IllustrationDocument4 pagesIllustrationVamsi Krishna BNo ratings yet

- WelfareDocument16 pagesWelfareVamsi Krishna BNo ratings yet

- Energy Conservation in Wireless Sensor Networks: Giuseppe AnastasiDocument90 pagesEnergy Conservation in Wireless Sensor Networks: Giuseppe AnastasiVamsi Krishna BNo ratings yet

- Telugu Ugadi Panchangam 2015-2016. Raasi Phalalu and Fortunes and All.Document152 pagesTelugu Ugadi Panchangam 2015-2016. Raasi Phalalu and Fortunes and All.Vamsi Krishna BNo ratings yet

- Training DevelopmentDocument28 pagesTraining DevelopmentSarah EdwardsNo ratings yet

- Survey 1Document8 pagesSurvey 1Vamsi Krishna BNo ratings yet

- Human Resource AccountingDocument5 pagesHuman Resource AccountingVamsi Krishna BNo ratings yet

- Virtual KeyboardDocument24 pagesVirtual Keyboardid.arun526088% (8)

- Mobile Management Pdf1Document33 pagesMobile Management Pdf1Vamsi Krishna BNo ratings yet

- Vitual RealityDocument31 pagesVitual Realitybabamaa0709No ratings yet

- GLASKIDocument52 pagesGLASKIWARWICKJNo ratings yet

- English Written Test 2Document4 pagesEnglish Written Test 2Phí Thị MaiNo ratings yet

- Material Adverse Change Clauses: Decoding A Legal EnigmaDocument6 pagesMaterial Adverse Change Clauses: Decoding A Legal Enigmahariom bajpaiNo ratings yet

- CLI Components and Turning Points PDFDocument48 pagesCLI Components and Turning Points PDFMarcoJulioKolinskyNo ratings yet

- T AccountsDocument4 pagesT AccountsMaks MaksNo ratings yet

- FIN 516 Week 8 Final ExamDocument2 pagesFIN 516 Week 8 Final ExamCherylR0% (1)

- Multiple Deposit Creation by Euro BanksDocument20 pagesMultiple Deposit Creation by Euro BankshrishikeshkrojhaNo ratings yet

- Corporate Tax ProblemsDocument21 pagesCorporate Tax Problemsnavtej02No ratings yet

- Endnotes 3 (Gender, Race, Class and Other-Misfortunes) (Ed) by Jasper Bernes, Chris Chen (2013)Document249 pagesEndnotes 3 (Gender, Race, Class and Other-Misfortunes) (Ed) by Jasper Bernes, Chris Chen (2013)nemo nulaNo ratings yet

- KIM Cum Appln Form Reliance Fixed Horizon Fund XXXX Series 15 PDFDocument24 pagesKIM Cum Appln Form Reliance Fixed Horizon Fund XXXX Series 15 PDFarvind gaikwadNo ratings yet

- EMSI CCNY Economic Impact Report Executive SummaryDocument9 pagesEMSI CCNY Economic Impact Report Executive SummaryCCNY CommunicationsNo ratings yet

- ProjectDocument52 pagesProjectChithra ChithuNo ratings yet

- Transfer of Mortgage: Property")Document4 pagesTransfer of Mortgage: Property")vijhay_adsuleNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document16 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 17 03 80810 DDocument36 pages17 03 80810 D9137254No ratings yet

- Ask For DowryDocument18 pagesAsk For DowryMuhammad AhmedNo ratings yet

- ATTACHMENT 7 - CONTRACT - NON COMPLIANCE ALTERNATIVE - Final 4Document7 pagesATTACHMENT 7 - CONTRACT - NON COMPLIANCE ALTERNATIVE - Final 4shareyhouNo ratings yet

- IDFC BankDocument12 pagesIDFC Bankdrmadmax1963No ratings yet

- Securitization: Presented by Amit Jindal Deepak Bhardwaj Ramej Butt Presented To Pushkal Pandey SirDocument15 pagesSecuritization: Presented by Amit Jindal Deepak Bhardwaj Ramej Butt Presented To Pushkal Pandey SirshitijmalhotraNo ratings yet

- Reserve Bank of India Act 1934 FinalDocument19 pagesReserve Bank of India Act 1934 FinalBijal GohilNo ratings yet

- Chapter 2Document22 pagesChapter 2Tiến ĐứcNo ratings yet

- Standard Fidic IV Copa For Pwd-Nhai Jobs in IndiaDocument57 pagesStandard Fidic IV Copa For Pwd-Nhai Jobs in Indialittledragon0110100% (2)

- Intermediate Test 3Document4 pagesIntermediate Test 3Hao Phan100% (2)

- Cost of CapitalDocument12 pagesCost of CapitalAbdii DhufeeraNo ratings yet

- "Cash Management" at Indian Oil Corporation Ltd.Document49 pages"Cash Management" at Indian Oil Corporation Ltd.udpatel83% (6)

- FNMA Form 3269-44Document2 pagesFNMA Form 3269-44rapiddocsNo ratings yet