Professional Documents

Culture Documents

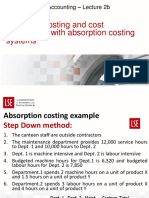

Absorption Costing by Example

Uploaded by

tiarawanroslanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absorption Costing by Example

Uploaded by

tiarawanroslanCopyright:

Available Formats

ABSORPTION COSTING BY

EXAMPLE

EXAMPLE 1

The following is a list of overheads. List down the basis that

they should be apportioned to various cost centres.

- Rent

- Depreciation

- Personnel

- Supervision

- Canteen

- Heat & Light

ACE 1a

- Rent Floor space occupied

- Depreciation Cost or book value of

equipment

- Personnel No. of employees

- Supervision No. of employees

supervised

- Canteen No. of employees

- Heat & Light Floor space occupied

ACE 1b

EXAMPLE 2

McIver plc has two department, M and N. All costs for these departments are indirect and related to

the year ended 31

st

December, 2011.

M N

Indirect materials 90,000 100,000

Indirect labour 200,000 30,000

Equipment and related costs 90,000 275,000

Supervisory salaries 70,000 10,000

450,000 415,000

The following information is available:

M N

Direct labour costs 200,000 50,000

Direct labour hours 150,000 hours 25,000 hours

Machine hours 100,000 hours 415,000 hours

a. Calculate the predetermined overhead recovery rates for the two departments by using the three

methods.

b. Which method would you recommend, and why?

ACE 2

EXAMPLE 2

Answer

a M N

DL costs (450) = 2.25 (415) = 8.30

(200) (50)

DL costs (450) = 3 (415) = 16.60

(150) (25)

Machine hours (450) = 4.50 (415) = 1

(100) (415)

b. Department M is clearly a labour-intensive department, so the method chosen

for the overhead recovery rate must be a labour base. Labour hours are probably

preferred to labour cost, which can vary with the seniority of staff, but that is a

debatable point. Whichever method is chosen, it must be seen to be fair.

Department N is, however, a machine-intensive department and therefore the

machine hour basis is the fairest.

ACE 3

EXAMPLE 3

Compute the cost of project B52 using the data

from Example 4, McIver plc.

Project B52

Direct material 1,000

Direct labour costs 2,500

Direct labour hours M 1,600 hours

N 1,000 hours

Machine hours M 800 hours

N 2,000 hours

ACE 4

Project B52

Direct costs 3,500

Indirect labour costs Department M 4,800

(1,600 x 3)

Department N 2,000

(2,000 x 1)

Cost of project 10,300

ACE5

EXAMPLE 4 Pricing policy

Fergus OBrian is a printer by trade and has been operating for a year from is shop in Belfast. He has a

rather haphazard pricing policy, charging people what he thinks they can afford and what he thinks is

reasonable. His first years accounts are as follows:

Income 25,000

Less expenditure

Salary 12,000

Materials 8,000

Overheads:

Rent and rates 1,000

Depreciation of equipment 2,500

Heat and light 700

Telephone 200

Machine maintenance 600

Other office expenses 2,000

27,000

Net loss 2,000

Fergus cannot think why he should have made a loss: after all, he has been very busy working 48 weeks

a year, five days a week (i.e. 240 days a year). He recons he works an eight-hour day and is fully

occupied. He pays himself 1,000 a month, which he doesnt think is unreasonable.

You are invited as a consultant to investigate the pricing

ACE 6

EXAMPLE 4

You highlight that the problem is simply this: Fergus has no proper pricing policy. You

report that:

i. Price should equal Direct labour + Direct material + Overheads + Profit margin.

ii. Overheads need to be allocated on a labour hour basis, and the trade profit

margin is 50%.

Required:

1. Calculate the overhead recovery rate on a labour hour basis.

2. Set the price for printing the Annual Report of Thomas Mitchell Ltd. given the

following information:

Material cost 200

Labour time 16 hours estimated of OBrians time (say 6.25 per hour)

Plus overheads

ACE 7

Answer

1. Overheads = 7,000

Labour hour (240 x 8) = 1,920

ORR = 7,000 = 3,65

1,920

2. Thomas Mitchell Ltd. Project

Direct materials 200

Direct labour (16 x 6.25) 100

Indirect labour (16 x 3.65) 58

358

Add profit margin (50% price) 179

Price 537

ACE 8

3. With hindsight, you recon that you should

charge a higher overhead rate to allow for

inflation.

When you look back at the accounts for the year

ended 31

st

January, 2011, business has

recovered 1,900 hours worth of time. Actual

overheads are 7,350 (the result of 5%

inflation).

You have priced the work too low (an under-

recovery). Why is this, and how much have you

under-recovered?

ACE 9

3. Actual overheads 7,350

Overheads recovered (1,900 x 3.65) 6,935

Under-recovered 415

ACE10

EXAMPLE 5

A personnel department uses an overhead

recovery rate of 20 per hour. Estimated activity

is 40,000 hours. At the end of the year actual

overheads for the year are 840,000 and 45,000

hours.

ACE11

Overhead incurred (actual) 840,000

Overhead recovered (absorbed) (45,000 x 20) 900,000

Over-absorption of overhead 60,000

In this example, services are charged 60,000 more than was

actually spent.

ACE 12

PAUSE FOR THOUGHT

Q: Do you remember the last time you used a

painter/decorator to decorate your house? You

probably asked them for an estimate or

quotation. Did they use absorption costing

methodology?

A: Probably in many cases the answer is yes. They

estimated the cost of the materials (paint and

wallpaper) and labour time and added on

overheads and sometimes a margin. Others just

quote what they think is the market rate.

ACE 13

You might also like

- Week 9 - 10 - OverheadDocument44 pagesWeek 9 - 10 - OverheadMohammad EhsanNo ratings yet

- Product Costing PowerPointDocument20 pagesProduct Costing PowerPointPrincessFabulNo ratings yet

- Accounting For Manufacturing OverheadsDocument18 pagesAccounting For Manufacturing Overheadshi_monestyNo ratings yet

- Learning Guide No. 3 - AnswersDocument10 pagesLearning Guide No. 3 - AnswersXaivri Ylaina VrieseNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMalikwaheedNo ratings yet

- Week 5 - BUS 5431 - HomeworkDocument9 pagesWeek 5 - BUS 5431 - HomeworkSue Ming FeiNo ratings yet

- Cost Accounting/Series-3-2007 (Code3016)Document18 pagesCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- ABC Activity Based CostingDocument8 pagesABC Activity Based CostingAnn GelNo ratings yet

- 01d MCQ and A Intro To Man Acc and Cost ConceptsDocument8 pages01d MCQ and A Intro To Man Acc and Cost ConceptsK Lam LamNo ratings yet

- Ch09 TB Hoggetta8eDocument14 pagesCh09 TB Hoggetta8eAlex Schuldiner100% (1)

- CA IPCC Costing Guideline Answers May 2015 PDFDocument20 pagesCA IPCC Costing Guideline Answers May 2015 PDFanupNo ratings yet

- Clone Machinery Had The Following Experience Regarding Power CostsDocument10 pagesClone Machinery Had The Following Experience Regarding Power CostssatoukookieNo ratings yet

- Wk4 Seminar Abc & Overhead Absorption Methods S Workshop Problems Example 1Document8 pagesWk4 Seminar Abc & Overhead Absorption Methods S Workshop Problems Example 1FungaiNo ratings yet

- CA Course Work Take HomeDocument4 pagesCA Course Work Take HomeOgwang JoshuaNo ratings yet

- MI1 TestDocument9 pagesMI1 TestĐỗ Hoàng DungNo ratings yet

- Practice Questions 1Document5 pagesPractice Questions 1Div_nNo ratings yet

- Mock Test 2021 PMDocument5 pagesMock Test 2021 PMBao Thy PhoNo ratings yet

- Korarai 18181881Document4 pagesKorarai 18181881KyraraNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Managerial AccountingDocument23 pagesManagerial AccountingErum AnwerNo ratings yet

- Sample Problems Management AccountingDocument5 pagesSample Problems Management AccountingMarjun Segismundo Tugano IIINo ratings yet

- UntitledDocument9 pagesUntitledBipin Kumar JhaNo ratings yet

- Example: The Annual Overheads Are As FollowsDocument22 pagesExample: The Annual Overheads Are As FollowsmalingapereraNo ratings yet

- Acctba3 - Comprehensive ReviewerDocument10 pagesAcctba3 - Comprehensive ReviewerDarwyn MendozaNo ratings yet

- ACCA F 2 Managment Accountant Topic Wise Q A PDFDocument44 pagesACCA F 2 Managment Accountant Topic Wise Q A PDFSaurabh KaushikNo ratings yet

- Categories of Costing MethodsDocument9 pagesCategories of Costing Methodskitderoger_391648570No ratings yet

- Accounting for Factory Overhead ProblemsDocument29 pagesAccounting for Factory Overhead ProblemsKyrara70% (20)

- Miranda, Sweet (FactoryOverhead)Document5 pagesMiranda, Sweet (FactoryOverhead)Sweet Jenesie MirandaNo ratings yet

- Icaew Cfab Mi 2018 Sample Exam 1Document29 pagesIcaew Cfab Mi 2018 Sample Exam 1Anonymous ulFku1v100% (1)

- F2 Mock1 AnsDocument8 pagesF2 Mock1 AnsHajra ZahraNo ratings yet

- Mock Exam Mac2Document3 pagesMock Exam Mac2Danny FranklinNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- Costing and Accounting MCQsDocument2 pagesCosting and Accounting MCQsmadhurialamuriNo ratings yet

- Acca f2 Management Accountant Topicwise Past PapersDocument44 pagesAcca f2 Management Accountant Topicwise Past PapersIkram Naguib100% (2)

- Cost Accounting 7 & 8Document26 pagesCost Accounting 7 & 8Kyrara79% (19)

- Athena LTD SolutionDocument4 pagesAthena LTD Solutionsurbhiaggarwal13No ratings yet

- AAADocument7 pagesAAAHamis Mohamed100% (1)

- UntitledDocument11 pagesUntitledBipin Kumar JhaNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- Che 319 Test 1-2011/2012 SessionDocument10 pagesChe 319 Test 1-2011/2012 SessionnelsonNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Cost Acctg. Problems 1Document8 pagesCost Acctg. Problems 1Cheese ButterNo ratings yet

- Exercises Lecture4Document3 pagesExercises Lecture4LizzyNo ratings yet

- Job-Order Costing and Cost Assignment With Absorption Costing SystemsDocument50 pagesJob-Order Costing and Cost Assignment With Absorption Costing SystemsAnh Quan NguyenNo ratings yet

- Ch.2 - Job CostingDocument26 pagesCh.2 - Job Costingahmedgalalabdalbaath2003No ratings yet

- Factory OverheadDocument2 pagesFactory Overheadenchantadia0% (1)

- Analyze Cost Allocation Methods and Overhead VariancesDocument73 pagesAnalyze Cost Allocation Methods and Overhead VariancesPiyal Hossain100% (1)

- Answers Toa Extra Questions Management AnDocument77 pagesAnswers Toa Extra Questions Management AnNhan ThaiNo ratings yet

- MSc FINANCE UoW PMC Marking SchemeDocument8 pagesMSc FINANCE UoW PMC Marking Schemepinkwine2001No ratings yet

- Management Accounting/Series-3-2007 (Code3023)Document15 pagesManagement Accounting/Series-3-2007 (Code3023)Hein Linn Kyaw100% (1)

- Accounting For Factory OverheadDocument29 pagesAccounting For Factory OverheadEmmanuel Hong100% (2)

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- NZ2 M 22 Types of Angles Display PostersDocument10 pagesNZ2 M 22 Types of Angles Display PostersMenna OmranNo ratings yet

- WORKSHEET - Coordinates Differentiated Worksheet PDFDocument4 pagesWORKSHEET - Coordinates Differentiated Worksheet PDFtiarawanroslanNo ratings yet

- Division WorksheetDocument2 pagesDivision WorksheettiarawanroslanNo ratings yet

- Living Things WorksheetDocument2 pagesLiving Things WorksheettiarawanroslanNo ratings yet

- Interviewing For Research and Analysing Qualitative Data - 3 PDFDocument8 pagesInterviewing For Research and Analysing Qualitative Data - 3 PDFtiarawanroslanNo ratings yet

- Result PSR 2018Document186 pagesResult PSR 2018tiarawanroslan33% (3)

- Introduction To Habitats PowerpointDocument16 pagesIntroduction To Habitats PowerpointtiarawanroslanNo ratings yet

- A Critical Component of Improving Education in Less-Developed Countries Assessment For Learning PDFDocument8 pagesA Critical Component of Improving Education in Less-Developed Countries Assessment For Learning PDFtiarawanroslanNo ratings yet

- Effects of Musical Expertise On The Early Right Anterior Negativity: An Event-Related Brain Potential StudyDocument7 pagesEffects of Musical Expertise On The Early Right Anterior Negativity: An Event-Related Brain Potential StudytiarawanroslanNo ratings yet

- Treasure HuntDocument11 pagesTreasure HunttiarawanroslanNo ratings yet

- Ethnographic InterviewDocument12 pagesEthnographic InterviewtiarawanroslanNo ratings yet

- BRRRRR Its Cold Here A Study of AntarcticaDocument15 pagesBRRRRR Its Cold Here A Study of AntarcticatiarawanroslanNo ratings yet

- Introduction To Marketing PlanDocument14 pagesIntroduction To Marketing PlantiarawanroslanNo ratings yet

- Misconceptions in Primary ScienceDocument23 pagesMisconceptions in Primary SciencetiarawanroslanNo ratings yet

- Abrsm Theory Grade 2Document3 pagesAbrsm Theory Grade 2tiarawanroslan0% (22)

- Iannis XenakisDocument6 pagesIannis XenakistiarawanroslanNo ratings yet

- Suschitzky 398 448Document51 pagesSuschitzky 398 448tiarawanroslanNo ratings yet

- Fadel 414 8Document5 pagesFadel 414 8tiarawanroslanNo ratings yet

- Top 40 Pop Songs EverDocument9 pagesTop 40 Pop Songs EvertiarawanroslanNo ratings yet

- Learning Is NotDocument1 pageLearning Is NotShannon100% (10)

- Stravinsky ForcesDocument7 pagesStravinsky ForcestiarawanroslanNo ratings yet

- SLU Missalette 2016 Capping (Not-Final)Document18 pagesSLU Missalette 2016 Capping (Not-Final)Teanu Jose Gabrillo TamayoNo ratings yet

- 4900 DatasheetDocument2 pages4900 DatasheetMakam Raghu100% (1)

- CP R77.30 ReleaseNotesDocument18 pagesCP R77.30 ReleaseNotesnenjamsNo ratings yet

- Hematology NotesDocument3 pagesHematology NotesFarisa Jane BanggoNo ratings yet

- 8483724Document24 pages8483724ejkiranNo ratings yet

- Impact of Endurance Exercise Training in the Fasted State on Muscle Metabolism and Insulin SensitivityDocument14 pagesImpact of Endurance Exercise Training in the Fasted State on Muscle Metabolism and Insulin SensitivityYo Vivo Fit Pablo y KarlaNo ratings yet

- 1 CAT O&M Manual G3500 Engine 0Document126 pages1 CAT O&M Manual G3500 Engine 0Hassan100% (1)

- Njhs Application EssayDocument4 pagesNjhs Application Essaycjawrknbf100% (2)

- Philippine Politics and Constitution SyllabusDocument7 pagesPhilippine Politics and Constitution SyllabusIvy Karen C. Prado100% (1)

- Broom Manufacture Machine: StartDocument62 pagesBroom Manufacture Machine: StartHaziq PazliNo ratings yet

- Land-Use PlanningDocument15 pagesLand-Use PlanningCiara MaryNo ratings yet

- Anki Very Useful ManualDocument5 pagesAnki Very Useful ManualSoundaryaNo ratings yet

- PoiconverterDocument2 pagesPoiconvertertaco6541No ratings yet

- Soil Testing Lab Results SummaryDocument2 pagesSoil Testing Lab Results SummaryMd SohagNo ratings yet

- Cat IQ TestDocument3 pagesCat IQ TestBrendan Bowen100% (1)

- 4MB0 02R Que 20160609 PDFDocument32 pages4MB0 02R Que 20160609 PDFakashNo ratings yet

- Larong Lahi Week 15 18Document7 pagesLarong Lahi Week 15 18CJAY SOTELONo ratings yet

- PLC of MaggiDocument19 pagesPLC of Maggikrati agarwalNo ratings yet

- Informed Consent: Ghaiath M. A. HusseinDocument26 pagesInformed Consent: Ghaiath M. A. HusseinDocAxi Maximo Jr AxibalNo ratings yet

- Assessing Khazaria-Serpent PeopleDocument1 pageAssessing Khazaria-Serpent PeopleJoao JoseNo ratings yet

- ZJJ 3Document23 pagesZJJ 3jananiwimukthiNo ratings yet

- Rumi and ReligionDocument2 pagesRumi and ReligionJustin LiewNo ratings yet

- CPS Layoffs BreakdownDocument21 pagesCPS Layoffs BreakdownjroneillNo ratings yet

- BC Planning EvenDocument5 pagesBC Planning EvenRuth KeziaNo ratings yet

- Bhajan Songs PDFDocument36 pagesBhajan Songs PDFsilphansi67% (6)

- Clinical behavior analysis and RFT: Conceptualizing psychopathology and its treatmentDocument28 pagesClinical behavior analysis and RFT: Conceptualizing psychopathology and its treatmentAnne de AndradeNo ratings yet

- Chapter 1 - The Empirical Beginnings and Basic Contents of Educational PsychologyDocument9 pagesChapter 1 - The Empirical Beginnings and Basic Contents of Educational PsychologyJoshua Almuete71% (7)

- 2009 GCSE PE SpecificationsDocument225 pages2009 GCSE PE SpecificationsAdstasticNo ratings yet

- Liugong 938 Wheel Loader Parts ManualDocument20 pagesLiugong 938 Wheel Loader Parts Manualjonathan100% (49)

- Physics MCQ Solid State PhysicsDocument15 pagesPhysics MCQ Solid State PhysicsRams Chander88% (25)